Professional Documents

Culture Documents

Tax Reform Component

Uploaded by

Salman SahirCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Reform Component

Uploaded by

Salman SahirCopyright:

Available Formats

HRMWing(FBR)GIZ

TaxEvasionandTransferPricing

HRMWing(FBR)GIZ

Crossbordertransactions

andtaxtreaties

Tax Reform Component

Governance Programme

April 2012

Islamabad, Karachi, Lahore

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

Imprint

Published by:

Deutsche Gesellschaft fr

Internationale Zusammenarbeit (GIZ) GmbH

Support to Governance in Pakistan Programme

Tax Reform Component

House No. 4, Street No.14-A, F-7/2 Islamabad - Pakistan

T +92 (51) 260 8988 - 90

F +92 (51) 260 8987

I www.giz.de

GIZ was formed on the 1st of January 2011. It brings together the long-standing expertise of DED, GTZ and

InWEnt. For further information, go to www.giz.de.

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

National Law of Pakistan on Tax Treaties

Income Tax Ordinance 2001 on Tax Treaties

Section 107 deals with Agreements for the avoidance of double taxation and prevention

of fiscal evasion with respect to taxes on income imposed by this Ordinance and under

the corresponding laws in force in a foreign country.

The Federal Government is competent to make provisions by Gazette notification to

implement such agreements,

These agreements have overriding effect and no provision of the Ordinance will have

effect in so far as these agreements and notified provisions for implementation provide

for

a) Relief from the payable tax.

b) Determination of Pakistan-source income.

c) Determination of income in the hands of non-residents, including permanent

establishments in Pakistan.

d) Determination of income of resident persons having special relationship with nonresidents.

e) Exchange of information for the prevention of fiscal evasion or avoidance of taxes

on income between treaty partners.

MUTUAL AGREEMENT PROCEDURE

Rule 19D.- An aggrieved Pakistani national residing abroad or a resident taxpayer may

make an application to the Competent Authority (FBR) in the prescribed form for taking

up his matter with the Competent Authority of the relevant tax treaty partner who would

endeavour to resolve it through consultative measures.

However, the taxpayer can withdraw from the mutual agreement procedure and pursue

his right of appeal under the normal course, if the terms and conditions of the impending

resolution are not satisfactory to him.

Note: The same procedure would apply for an application received in Pakistan through

the Competent Authority of the other treaty partner.

EXEMPTIONS FROM TAX

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

Section 44 provides for exemptions under international agreements. Its sub-section (1)

states(1) Any Pakistan-source income which Pakistan is not permitted to tax under a

tax treaty shall be exempt from tax under this Ordinance.

Sub-section (3) states that any income received by a person (not being a citizen of

Pakistan) engaged as a contractor, consultant or expert on a project in Pakistan shall be

exempt from tax under this Ordinance to the extent provided for in a bilateral or

multilateral technical assistance agreement between the Federal Government and a

foreign government or public international organization.

Section 53 provides for exemptions and tax concessions in the Second Schedule to the

Ordinance. The income or classes of income, or persons or classes of persons specified in

the Second Schedule may be exempted from tax, taxed at lower rates, allowed reduction

in tax liability or exempted from the operation of any provision of this Ordinance.

1980 UN MODEL CONVENTION

EXEMPTION METHOD

Article 23A provides that where a resident of a Contracting State derives income which,

in accordance with the provisions of this Convention, may be taxed in the other

Contracting State, the first-mentioned State shall exempt such income from tax.

However, where income derived by a resident of a Contracting State is exempt from tax

in that State, such State may nevertheless, in calculating the amount of tax, on the

remaining income of such resident, take into account the exempted income.

0o0

INCOME TAX ORDINANCE, 2001

PAKISTAN-SOURCE BUSINESS INCOME

Section 101(3) states that Business Income of a non-resident person is to be treated as

Pakistan-source income to the extent it is directly or indirectly attributable to(a) Permanent establishment in Pakistan of the non-resident.

(b) Sales of goods merchandise of the kind sold by the person through a

permanent establishment in Pakistan.

Other business activities of the kind as those effected by a

4

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

non-resident through a permanent establishment in Pakistan.

(d) Any business connection in Pakistan.

WHERE business of a non-resident comprises rendering of independent services

(including professional and services of entertainers and sports persons) any remuneration

paid by a resident person or borne by permanent establishment is also treated as business

income in Pakistan.

0o0

1980 UN MODEL CONVENTION

BUSINESS PROFITS

Article 7, among other provisions, states that the profits derived from the sales of goods

or merchandise of the kind sold by the person through a permanent establishment or other

business activities of the kind as those effected by a non-resident through a permanent

establishment SHALL NOT BE TAXABLE if the enterprise demonstrates that such sales

or business activities have been carried out for reasons other than obtaining a benefit

under the Convention.

Likewise, no profits shall be attributed to a permanent establishment by reason of the

mere purchase by the permanent establishment of the goods or merchandise for the

enterprise.

0o0

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

INCOME TAX ORDINANCE, 2001

COMPUTATION OF INCOME

Section 11 (8) provides that the income of a non-resident person under any classified

head i.e. salary, property income, business income, capital gains and income from Other

Sources, shall be computed by taking into account only amounts that are Pakistan-source

income.

Section 11 (5) provides that the income of a resident person under any classified head

shall be computed by taking into account amounts that are Pakistan-source income and

amounts that are foreign-source income.

The term income includes any amount chargeable to tax under the Income Tax

Ordinance, any amount subject to collection or deduction of tax under various provisions

of the Ordinance, any amount treated as income under any provision of this Ordinance

and any loss of income.

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

0o0

INCOME TAX ORDINANCE, 2001

PERMANENT ESTABLISHMENT

Section 2 (41) defines permanent establishment to mean a fixed place of business

through which the business is wholly or partly carried on-including:

(a) a place of management, branch, office, factory, workshop, premises, warehouse,

permanent sales exhibition or outlet and a liaison office where contracts (not being

purchase-contracts) are negotiated;

(b) a mine, oil or gas well, quarry or any other place of extracting natural resources;

c) an agricultural, pastoral or forestry property;

(d) a building site, a construction, assembly or installation project together with

supervisory activities continuing for more than 90 days in a 12-month period;

(e) the furnishing of consultancy or other services through employees/personnel;

(f) an agent (not being of independent status) habitually exercising an authority to

conclude contracts or habitually maintaining stock-in-trade or other merchandise for

delivery on behalf of the other person; and

(g) any substantial equipment, other asset or property capable of giving rise to income.

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

1980 UN MODEL CONVENTION

PERMANENT ESTABLISHMENT

Article 5 provides more or less the same definition as in the Income Tax Ordinance,

except as follows:

(a) Para 3(a) provides for a period of more than 6 months and not 90 days for the

activities to continue in respect of a building site, a construction, assembly or installation

project.

(b) Para 3(b) provides for an aggregate period of 6 months within a 12-month period for

furnishing of services for the same or a connected project.

The term Permanent establishment does not include

(i) use of facilities for stock or storage and display of goods only

(ii) solely for purchase of goods, etc. and

(iii) activity of preparatory or auxiliary character.

(d) Agents of independent status would include a broker and a general commission

agent, acting in ordinary course of their business with many enterprises.

0o0

INCOME TAX RULES, 2002

FOREIGN INCOME TAX

Rule 15 made u/s 102 and 103 of the Ordinance provides relief to the resident person

from international double taxation but any penalty, fine, interest, etc. is not treated as a

foreign tax.

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

However, withholding taxes imposed on dividends, salary and gross receipts of nonresident persons as final tax are treated as substantially equivalent to the income tax

imposed under the Income Tax Ordinance, 2001.

Section 102 of the Ordinance provides exemption to the foreign source salary of resident

individuals if they have paid foreign income tax or tax was withheld at source and paid to

the revenue authority of the foreign country.

Section 103 of the Ordinance states that where a taxpayer resident in Pakistan has paid

foreign income tax, he shall be allowed a tax credit equal to or lesser of

(a) foreign tax paid, or

(b) Pakistan tax payable in respect of that income.

This will be done by applying average rate of Pakistan income tax applicable to the

taxpayer against his net foreign source income.

Foreign tax credit u/s 103 is allowed first before any other tax credit admissible u/s 147

(advance tax paid) or section 168 (credit for tax collected or deducted in Pakistan) is

applied.

Rule 16 requires the resident person to submit an application with return of income,

accompanied by supporting documents, to claim credit for foreign tax. However,

Commissioner is authorized to accept secondary evidence of tax deductions abroad.

0o0

INCOME TAX ORDINANCE, 2001

ROYALTIES

Rule 18 of the Income Tax Rules, 2002, deals with income from royalties and states that

the income of a non-resident person by way or royalty received from a resident person or

a permanent establishment in Pakistan of a non-resident person shall be determined in the

light of agreements made before or after 08 March, 1980, by allowing certain

expenditures incurred in Pakistan or outside Pakistan in earning royalty which would not

exceed 10 per cent of the gross amount of royalty.

However, this provision does not apply where royalty is covered u/s 169 of the Income

Tax Ordinance and the tax thereon (presently 15% unless fixed at a lower rate under a tax

treaty) is treated as a final tax. Besides, any royalty relating to a permanent establishment

is treated as income from Business u/s 6(4) of the Ordinance.

9

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

The term royalty has been defined in section 2(54) of the Ordinance which, in short,

may be taken to mean any amount paid or payable, as consideration for the use of or right

to use any patent, invention, design, model, secret formula or process, trade mark,

copyright (including films or video tapes) and receipt or right to receive any visual

images or sounds in connection with television, radio or internet broadcasting or for the

supply of any technical, industrial, commercial or scientific knowledge, experience or

skill; or for the use of any industrial, commercial or scientific equipment; for the supply

of any assistance for these properties or rights and the disposal of any property or right so

mentioned.

1980 UN MODEL CONVENTION

ARTICLE 12-ROYALTIES

As a general rule, the Convention treats royalties as taxable in the recipients country of

residence. The payers country is entitled to only a limited taxation right by way of

charging tax at an amount not exceeding the agreed percentage of the gross amount of

royalties, mostly through withholding taxes.

It is further provided that where the recipient of royalties is not a beneficial owner or the

royalties are attributable to a permanent establishment or a fixed base maintained by the

recipient in the payers country, full taxation will be allowed to the source country, but

the taxpayer would be entitled to deduction of relevant expenditures as are applicable to

Business Profits and Independent Personal Services.

10

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

0o0

INCOME TAX ORDINANCE, 2001

FEES FOR TECHICAL SERVICES

Rule 19 of the Income Tax Rules, 2002, states that, except where fee for technical

services is treated as a final tax u/s 169 of the Ordinance, deductions will be allowed,

according to the agreements, for the expenditure admissible u/s 40 being Income from

other sources generally applying maximum total deduction @ 20% of the gross mount

of such fees.

If the tax rate is not settled in the relevant tax treaty, normal tax @ 15% will be levied on

gross amount of the fee for technical services u/s 6 of the Ordinance, which is the final

tax.

The term fee for technical services has been defined in section 2 (23) of the Ordinance

to mean any consideration, whether periodical or lump sum, for the rendering of any

managerial, technical or consultancy services, including the services of technical or other

personnel (not being salary income)but excluding consideration for services rendered in

relation to a construction, assembly or like project undertaken by the recipient.

Under section 101(12) of the Ordinance, income from technical fee is treated as Pakistansource income, if it is borne by a permanent establishment of a non-resident or paid by a

resident for services utilized in Pakistan.

0o0

INCOME TAX ORDINANCE, 2001

Salary Income for Dependant Personal Services

11

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

Section 101(1) provides that Salary shall be Pakistansource income to the extent to

which it is received from any employment exercised in Pakistan (wherever paid) or is

paid by our Governments in Pakistan, wherever the employment is exercised.

For this purpose, an individual who is not present in Pakistan for 183 days, in the

aggregate, in a tax year, is treated as a non-resident person u/s 81(2) of the Ordinance.

Dependant personal services need to be distinguished from Independent Services which

are not treated as Salary but are taken as Business Income of a non-resident rendering

independent services (including professional and services of entertainers and sports

persons) for which remunerations are paid by a resident person or borne by a permanent

establishment of the non-resident in Pakistan.

1980 UN MODEL CONVENTION

Dependant Personal Services

Article 15, inter alia, provides that salaries, wages, etc. of a non-resident shall be taxed

only if the employment is exercised and remuneration is derived in that Contracting State.

However, remuneration derived by a resident of a Contracting State in respect of an

employment exercised in the other Contracting State shall be taxable only in the first

mentioned State if (a) the recipient is present in the other State for a period or periods not

exceeding in the aggregate 183 days in the fiscal year concerned and (b) the remuneration

is paid by or on behalf of any employer who is not a resident of the other State and (c) the

remuneration is not borne by a permanent establishment or fixed base which the

employer has in the other State.

0o0

INCOME TAX ORDINANCE, 2001

Shipping and Air Transport Income of non-residents.

Section 7 of the Income Tax Ordinance, 2001, provides for taxation on the business of

operating ships or aircrafts by the owner or charterer in respect of(a) gross amount (whether in or out of Pakistan) for the carriage of passengers, livestock,

mail or goods embarked in Pakistan; and

(b) gross amount received/receivable in Pakistan for carriage of passengers, livestock,

mail or goods embarked outside Pakistan.

The following rates of tax have been prescribed:(i)

8% in case of shipping income (gross amount)

12

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

(ii) 3% in case of air transport income (gross amount)

UN MODEL CONVENTION

(Article 8 Alternate A & B )

Main criteria: Profits are taxable only in the contracting state where the place of effective

management of the enterprise operating ships or aircrafts in international traffic is

situated;

UNLESS

The activities arising from such operations in the other contacting state are more than

casual.

o0o

INCOME TAX ORDINANCE, 2001

Independent services

Section 101 (4) provides that where the business of a non-resident person comprises the

rendering of independent services (including professional services and the services of

entertainers and sports persons) any remuneration derived by that person which is paid by

a resident person or borne by a permanent establishment of that non-resident person will

be taxed in Pakistan.

1980 UN MODEL CONVENTION

Independent personal services

Article 14 contains provisions similar to the provisions made in section 101(4) of the

Ordinance, except that the period of non-residents stay is 183 days (in the aggregate) or

more in a fiscal year. Besides, the term professional services specifically includes

13

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

independent scientific, literary, artistic, educational or teaching activities as well as the

independent activities of physicians, lawyers, engineers, architects, dentists and

accountants.

0o0

INCOME TAX ORDINANCE, 2001

CAPITAL GAINS

Section 101(5) of the Income Tax Ordinance treats gains on disposal of assets or

properties used in deriving business income by a non-resident person or his permanent

establishment in Pakistan and from rendering independent services as Pakistan-source

income.

1980 UN MODEL CONVENTION

(Capital Gains)

Article 13, inter alia, provides that gains derived from the alienation of immovable

property situated in a Contracting State may be taxed in that State. (Such tax in Pakistan

is treated as a Provincial subject).

Gains from the alienation of movable property belonging to business of a permanent

establishment or pertaining to a fixed base of a non-resident for performing independent

personal services may be taxed in that State (as done in Pakistan).

0o0

14

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

INCOME TAX ORDINANCE, 2001

DIVIDENDS

Section 101 (6) provides that a dividend paid by a resident company shall be treated as

Pakistan-source income. Resident company is one which is incorporated or formed by or

under any law in force in Pakistan and the control and management of its affairs is

situated wholly in Pakistan at any time in the year.

As regards tax on dividends, section 5 of the Ordinance imposes tax at the prescribed rate

(presently 10%) on the gross amount of dividend received by shareholder of a any person

from any company. Similarly, advance or loan given to a private company is also treated

as dividend by virtue of its broad definition given in section 2 (19) of the Ordinance.

1980 UN MODEL CONVENTION

DIVIDENDS

Article 10 provides that dividends paid by a company which is a resident of a Contracting

State to a resident of the other Contracting State may be taxed in that other State.

However, such dividends may also be taxed in the Contracting State of which the

company paying the dividends is a resident.

Where the recipient is the beneficial owner of the dividends, the tax so charged shall not

exceed a certain agreed percentage of the gross amount of the dividends.

In all other cases, percentage of tax can be established through bilateral negotiations.

0o0

INCOME TAX ORDINANCE, 2001

15

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

PROFIT ON DEBT

Section 101 (7) states that profit on debt shall be Pakistan-source income if it is borne by

a permanent establishment of a non-resident person or paid by a resident person.

Profit on debt whether payable or receivable, is defined in section 2(46) to mean

(a) any profit, yield, interest, discount, premium or other amount owing under a debt,

other than a return on capital, or

(b) any service fee or other charge in respect of a debt, including any fee or charge

incurred in respect of a credit facility which has not been utilized.

Section 152(2) requires every person paying an amount ( profit on debt ) to a nonresident to deduct tax @ 30% of the gross amount of such payment. However, this

provision will not apply if the Commissioner accords approval that it is taxable to a

permanent establishment in Pakistan of a non-resident person. It will also not apply

where the amount is payable by a person who is liable to pay tax on that amount s

representative of the non-resident person.

UN MODEL CONVENTION

Interest

Article 11 provides that Interest arising in a Contracting State and paid to a resident of the

other Contracting State may be taxed in that other State.

However, such Interest may also be taxed in the Contracting State in which it arises and

according to the laws of that State, but if the recipient is the beneficial owner of the

Interest the tax so charged shall not exceed the mutually agreed percentage of the gross

amount of the Interest.

Note: Where debt-claim in respect of which the interest is paid is effectively connected

with the permanent establishment, fixed base for independent personal services or

business activities for not obtaining any benefit under the Convention, the above

provisions will not apply.

0o0

INCOME TAX RULES, 2002

Foreign Income Tax

Rule 15 made u/s 102 and 103 of the Ordinance provides relief to the resident person

from international double taxation but any penalty, fine, interest, etc. is not treated as a

foreign tax.

However, withholding taxes imposed on dividends, salary and gross receipts of nonresident persons as final tax are treated as substantially equivalent to the income tax

imposed under the Income Tax Ordinance, 2001.

16

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

Section 102 of the Ordinance provides exemption to the foreign source salary of resident

individuals if they have paid foreign income tax or tax was withheld at source and paid to

the revenue authority of the foreign country.

Section 103 of the Ordinance states that where a taxpayer resident in Pakistan has paid

foreign income tax, he shall be allowed a tax credit equal to or lesser of

(a) foreign tax paid, or

(b) Pakistan tax payable in respect of that income.

This will be done by applying average rate of Pakistan income tax applicable to the

taxpayer against his net foreign source income.

Foreign tax credit u/s 103 is allowed first before any other tax credit admissible u/s 147

(advance tax paid) or section 168 (credit for tax collected or deducted in Pakistan) is

applied.

Rule 16 requires the resident person to submit an application with return of income,

accompanied by supporting documents, to claim credit for foreign tax. However,

Commissioner is authorized to accept secondary evidence of tax deductions abroad.

0o0

INCOME TAX RULES, 2002

Transfer Pricing

Chapter VI of the Income Tax Rules applies for the purposes of section 108

(Transactions between associates).

It mainly provides for the exercise of the Commissioners power to distribute, apportion

or allocate income, expenditure or tax credit, between associates in respect of transactions

not made according to the arms length principle.

Such transactions cover sales, assignments, leases, licenses, loans, contributions and

rights to use property or performance of services.

Among other provisions, the Commissioner is to be guided by international standards,

case law and guidelines issued by various tax-related internationally recognized

organizations.

He may also use any method consistent with the comparable uncontrolled transactions, if

other methods viz (a) comparable uncontrolled price method (b) re-sale price method (c)

17

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

cost plus method or (d) profit-split method would not readily determine the arms length

result.

UN MODEL CONVENTION

Associated Enterprises

Article 9 states that where conditions are made or imposed between the two enterprises in

their commercial or financial relations which differ from those which would be made

between independent enterprises, then any profits which would, but for those conditions,

have not so accrued, may be included in the profits of that enterprise and taxed

accordingly.

0o0

INCOME TAX ORDINANCE, 2001

CONCEPT OF RESIDENCE

Section 82 provides that a resident individual is one who is present in Pakistan for 183

days, or more, in the aggregate, in a tax year or is a government official of Pakistan

posted abroad in the tax year.

Section 83 provides that a resident company is one which is incorporated or formed by or

under any law in force in Pakistan and the control and management of its affairs is

situated wholly in Pakistan at any time in the tax year.

Section 84 provides that a resident association of persons is the one for a tax year if the

control and management of its affairs is situated wholly or partly in Pakistan at any time

in the year.

18

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

The term association of persons includes a firm, a Hindu undivided family, any

artificial juridical person and any body of persons formed under a foreign law, but does

not include a company.

NOTE: If a person is not resident for a tax year, such person would be treated as a nonresident.

0o0

INCOME TAX ORDINANCE, 2001

TAX RATES FOR NON-RESIDENTS

Section 152.-Payments to non-residents: Unless a tax treaty otherwise provides, the

following payments to non-residents attract tax rates, as follows:

(1) Royalties and fees for technical services: Every person paying an amount of royalty or

fees for technical services to a non-resident is required to deduct final tax @ 15% from

the gross amount paid to the non-resident

(1A) Contracts for construction and services: Every person making a payment in full or

part to a non-resident person on the execution of any specified contract for construction

or services is required to deduct final tax @ 6% from the gross amount payable under the

contract.

(1AA) Insurance premium, etc: Every person making a payment of insurance or reinsurance premium to a non-resident person is required to deduct final tax @ 5% from the

gross amount paid to the non-resident.

Sub-section(2) General rate @ 30%: Except for the amounts subjected to deduction of tax

under sections 149 (salary) 150 (Dividends) 153 (supply of goods and services) 155

(property income) 156 (Prizes and winnings) 233 (Brokerage and Commission) and the

amounts of royalty or fees for technical services and contracts for construction and

services, every person paying any other amount to a non-resident person (other than

permanent establishment) is required to deduct tax @ 30% from the gross amount paid to

the non-resident.

19

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

Section 152(5) provides that where a person intends to make a normal payment to a nonresident person (other than permanent establishment) without deduction of tax, a notice

will be furnished to the Commissioner who is empowered to accept the persons

contention or order deduction of tax @ 30%. This provision, however, does not apply

where any payment is liable to reduced rate of tax under the relevant agreement for

avoidance of double taxation).

Section 153A.-Payments to non-resident media persons: Every person making a payment

for advertisement services to a non-resident media person relaying from outside Pakistan

is required to deduct final tax @ 10% from the gross amount paid to the non-resident

0o0

20

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

INCOME TAX ORDINANCE, 2001

INDEPENDENT SERVICES

Section 101 (4) provides that where the business of a non-resident person comprises the

rendering of independent services (including professional services and the services of

entertainers and sports persons) any remuneration derived by that person which is paid by

a resident person or borne by a permanent establishment of that non-resident person will

be taxed in Pakistan.

1980 UN MODEL CONVENTION

INDEPENDENT PERSONAL SERVICES

Article 14 contains provisions similar to the provisions made in section 101(4) of the

Ordinance, except that the period of non-residents stay is 183 days (in the aggregate) or

more in a fiscal year. Besides, the term professional services specifically includes

independent scientific, literary, artistic, educational or teaching activities as well as the

independent activities of physicians, lawyers, engineers, architects, dentists and

accountants.

0o0

21

HRMWing(FBR)GIZ

Crossbordertransactionsandtaxtreaties

22

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Income Taxation Reviewer : With TRAIN Law UpdatesDocument25 pagesIncome Taxation Reviewer : With TRAIN Law UpdatesTristanMaglinaoCanta75% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Atty. Gerald Yu (Taxation I)Document13 pagesAtty. Gerald Yu (Taxation I)pkdg1995No ratings yet

- Pilot Transfer Arrangements BrochureDocument5 pagesPilot Transfer Arrangements BrochureMats Karlsson100% (1)

- Payslip 2023 2024 6 200000000029454 IGSLDocument1 pagePayslip 2023 2024 6 200000000029454 IGSLMohit SagarNo ratings yet

- BAM 208 - P2 Quiz #2Document4 pagesBAM 208 - P2 Quiz #2trishaNo ratings yet

- Cel Ebrati On! Rental Pri Ci NG & Event Gui De: Wave Room (5, 000 Sq. FT.)Document1 pageCel Ebrati On! Rental Pri Ci NG & Event Gui De: Wave Room (5, 000 Sq. FT.)Salman SahirNo ratings yet

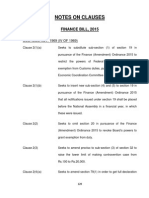

- Notes On Clauses FinalDocument29 pagesNotes On Clauses FinalSalman SahirNo ratings yet

- Rule9 (4) Ofincometaxrules2002 Oct. 22, 2005Document1 pageRule9 (4) Ofincometaxrules2002 Oct. 22, 2005Salman SahirNo ratings yet

- Circular No 20 of 1950 Dated Oct 10, 1950 PDFDocument1 pageCircular No 20 of 1950 Dated Oct 10, 1950 PDFSalman SahirNo ratings yet

- Admission CriteriaDocument1 pageAdmission CriteriaSalman SahirNo ratings yet

- Concept of TaxDocument18 pagesConcept of TaxSalmanSahirNo ratings yet

- Admission CriteriaDocument1 pageAdmission CriteriaSalman SahirNo ratings yet

- 40 quotes from Benjamin Button filmDocument5 pages40 quotes from Benjamin Button filmSalman SahirNo ratings yet

- Withholding Tax Regime (Rates Card) Guidelines For The Taxpayers, Tax Collectors & Withholding Agents (Updated Up To 1 July, 2014)Document31 pagesWithholding Tax Regime (Rates Card) Guidelines For The Taxpayers, Tax Collectors & Withholding Agents (Updated Up To 1 July, 2014)charismaticimranNo ratings yet

- CVT On Bank With Power of Attorneyor Not Sep. 14, 2006Document1 pageCVT On Bank With Power of Attorneyor Not Sep. 14, 2006Salman SahirNo ratings yet

- Mobilink 3G Prepaid - Mobilink - Har Dil. Har DinDocument7 pagesMobilink 3G Prepaid - Mobilink - Har Dil. Har DinSalman SahirNo ratings yet

- DjuiceDocument1 pageDjuiceSalman SahirNo ratings yet

- ExemptionsDocument16 pagesExemptionsmsadhanani3922No ratings yet

- Mathematical Functions Have Real SolutionsDocument1 pageMathematical Functions Have Real SolutionsSalman SahirNo ratings yet

- BH Nestings FP-RiverBankDocument1 pageBH Nestings FP-RiverBankSalman SahirNo ratings yet

- Application Guide AC Pilot Wire Relaying System SPD and SPA RelaysDocument24 pagesApplication Guide AC Pilot Wire Relaying System SPD and SPA RelaysSalman SahirNo ratings yet

- Shipping Industry Guidance On Pilot Transfer Arrangements2Document5 pagesShipping Industry Guidance On Pilot Transfer Arrangements2Salman SahirNo ratings yet

- (Chords) America - Horse With No NameDocument1 page(Chords) America - Horse With No NameSalman SahirNo ratings yet

- RSM100 Chapter 1 & 2 Notes on Business FundamentalsDocument44 pagesRSM100 Chapter 1 & 2 Notes on Business FundamentalsSalman SahirNo ratings yet

- TestDocument1 pageTestSalman SahirNo ratings yet

- UC Offshore CatalogueDocument49 pagesUC Offshore CatalogueSalman SahirNo ratings yet

- WWW - Prc.gov - PH Uploaded Documents RD Board Certificate DuplicateDocument2 pagesWWW - Prc.gov - PH Uploaded Documents RD Board Certificate DuplicateSalman SahirNo ratings yet

- Okmn Nature and LegendsDocument1 pageOkmn Nature and LegendsSalman SahirNo ratings yet

- America - Horse With No Name (Chords)Document1 pageAmerica - Horse With No Name (Chords)Salman SahirNo ratings yet

- America - Horse With No NameDocument1 pageAmerica - Horse With No NameSalman SahirNo ratings yet

- America - Horse With No NameDocument1 pageAmerica - Horse With No NameSalman SahirNo ratings yet

- Masinski Projekat Instalacija, Presek Cevi, Broj Kolena Elektroprojekt - Uticnice Atlas Krovne Gradje Predemer Predracun RadovaDocument1 pageMasinski Projekat Instalacija, Presek Cevi, Broj Kolena Elektroprojekt - Uticnice Atlas Krovne Gradje Predemer Predracun RadovaSalman SahirNo ratings yet

- Waiting in VainDocument1 pageWaiting in VainSalman SahirNo ratings yet

- Module 11 - Fringe Benefit TaxDocument18 pagesModule 11 - Fringe Benefit TaxJANELLE NUEZNo ratings yet

- Tax Invoice for R K Steels YadgirDocument1 pageTax Invoice for R K Steels Yadgirsudheer kulkarniNo ratings yet

- Isu PDF Gen 1 EmailDocument2 pagesIsu PDF Gen 1 EmailMandlakayise MabizelaNo ratings yet

- Affidavit Declaration FormDocument1 pageAffidavit Declaration FormGolden LightphNo ratings yet

- .Apr 2022Document10 pages.Apr 2022SWAPNIL JADHAVNo ratings yet

- Worldwide Corporate Tax Guide 2017Document1,756 pagesWorldwide Corporate Tax Guide 2017rotuaNo ratings yet

- Condition TypeDocument18 pagesCondition TypeDeepak SangramsinghNo ratings yet

- STATEMENT OF COMPARISON OF BUDGET AND ACTUAL AMOUNT June302017Document3 pagesSTATEMENT OF COMPARISON OF BUDGET AND ACTUAL AMOUNT June302017Reginald ValenciaNo ratings yet

- Individual TaxationDocument38 pagesIndividual TaxationannyeongchinguNo ratings yet

- National Officer SalaryDocument6 pagesNational Officer SalarytaolawaleNo ratings yet

- Sales GST 285Document2 pagesSales GST 285ashish.asati1No ratings yet

- AFF's Tax Memorandum On Finance Bill, 2021Document47 pagesAFF's Tax Memorandum On Finance Bill, 2021ahmad muzaffarNo ratings yet

- Guide To The Completion of The EMPLOYEE Income Tax FormDocument5 pagesGuide To The Completion of The EMPLOYEE Income Tax FormMarz CuculNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Personal Budget Tracker with Monthly Income and Expense EstimatesDocument4 pagesPersonal Budget Tracker with Monthly Income and Expense EstimatesAitor AguadoNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Document33 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoNo ratings yet

- Applying for a UK National Insurance NumberDocument2 pagesApplying for a UK National Insurance NumbergrungeshoesNo ratings yet

- 15989521209051213ADocument2 pages15989521209051213ATribhuvan RathoreNo ratings yet

- 10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010Document13 pages10 CIR v. Far East Bank - Trust Company GR No. 173854 March 15, 2010AlexandraSoledadNo ratings yet

- MODADV3 Quiz 3 - 12062021Document6 pagesMODADV3 Quiz 3 - 12062021Maha Bianca Charisma CastroNo ratings yet

- Answers To Concept ChecksDocument5 pagesAnswers To Concept ChecksSuhaybAhmed100% (1)

- Financial Aid Reflection Lesson 14Document2 pagesFinancial Aid Reflection Lesson 14api-287801256No ratings yet

- OnlyIAS - UPSC Essence GS 3 MainsDocument51 pagesOnlyIAS - UPSC Essence GS 3 MainsDivyansh JainNo ratings yet

- Tax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityDocument2 pagesTax Payment Compliance Monitoring System (TPCMS) of Top Withholding Agents (TWA) Registered Within BIR RDO 103 - Butuan CityJessa MaeNo ratings yet

- F6uk 2012 Dec QDocument13 pagesF6uk 2012 Dec QSaad HassanNo ratings yet

- Introduction To Federal Taxation in CanadaDocument64 pagesIntroduction To Federal Taxation in CanadaengarbangarNo ratings yet