Professional Documents

Culture Documents

International Business Exam - SET1

Uploaded by

Joanne PanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Business Exam - SET1

Uploaded by

Joanne PanCopyright:

Available Formats

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

Section A (50 marks)

This section contains TWENTY (20) questions. You are required to answer ALL

questions in the answer sheets given.

Objective

1. There are 3 basic decisions that a firm contemplating foreign expansion must make :

A. Cost, Accessibility and Timing

B. Entrance, Timing and Scale

C. Liability, Partnering and Competition

D. Location, Licensing and Distribution

2. Which of the following is NOT one of the advantages of a joint venture?

A. Firms can benefit from a local partners knowledge of the host country

B. In some countries, political considerations may make this the only feasible entry

mode.

C. It is one of the least risky forms of entry

D. High development costs can be shared with a partner

3. Whole own subsidiaries in foreign countries usually take one or two forms- an

acquisition or ____

A. Selective franchising

B. Greenfield Investment

C. Equity partnership

D. Exclusive licensing agreements.

4. An acquisition has 3 main points in its favour: its quick to execute, to may pre-empt

competitors, and _______________.

A. It has a solid record of successes

B. It is less capital intensive than other modes.

C. It is relatively easy to end if profits do not meet expectations

D. It may be less risky than a greenfield venture

5. If a firm is considering to enter a country where there are no current competitors or

where the competitive advantage of the firm is based on the transfer of

organizationally embedded competencies, skills, routines and cultures, it is probably

preferable to use _____ entry mode.

A. Franchising

B. Greenfield investment

C. Exporting

D. Acquisition.

CONFIDENTIAL

6.

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

_____ refers to the systematic reduction in production costs over the life of a product

based on the learning effects and economies of scale.

A. Location economy

B. Sustainable Competitive Advantage

C. Experience Curve

D. Total Quality Control

7. Products that serve_____ when tastes and preferences of consumers in different

nations are similar if not identical

A. Core needs

B. Transnational needs

C. Universal Needs

D. Local responsive

8. A localization strategy seeks to increase profitability by :

A. Customizing the firms products to match local tastes

B. Marketing local goods instead of imported ones

C. Brokering through strategic alliances with local partners

D. Offering Discounts and promotions to match local needs.

9. The firm must ________ to maximize the learning benefits of an alliance.

A. Shield inside knowledge as proprietary unless necessary

B. Make use of new knowledge within its own organization

C. Apply knowledge transferences carefully

D. Seek 3rd party protections against industrial espionage.

10. When the growth in the countrys money supply is faster than the growth in its output

(GDP), _____ is fuelled.

A. Trade creation

B. Money supply

C. De-flation

D. Inflation

11. Research suggests that when FDI takes the form in acquisition, employment in the

host country would

A. Fall first then tends to grow faster than domestic rivals

B. Falls off rapidly and rarely recovers

C. Increase

D. Unaffected

12. Government will ________when foreign imports flood a domestic market to attract

customers or threated local firms.

A. Declare war

B. Begin boosting exports

C. Impose countervailing duties

D. Seize foreign goods

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

13. The extra profit that producers/ manufactures make when supply is artificially limited

by an import quota is referred to as _____.

A. A windfall profit

B. An import surcharge

C. A subsidy

D. A quota rent.

14. IMF rescued efforts for trouble economies may involve enabling week governments a

way out of their management financial messes created by reckless behaviour. This is

known to the economists as :

A. Loan Hazard

B. Monetary Hazard

C. Moral Hazard

D. Debt Hazard

15. Which of the following is not a business strategy for dealing with risks in exchange

rate movements?

A. Contracting out manufacturing

B. Insisting payments to be made in gold certificates

C. Insurance coverage

D. Dispersing productions to around the world

16. An extensive 20 year old study of the relationship between economic growth and

economic growth demonstrated _____.

A. No significant relationship between the two

B. Despite more economic freedom, economic growth in fact slows down.

C. More economic freedom, more economic growth

D. Less economic freedom, more economic growth

17. Which of the following is NOT one of the steps in a shift toward a market-based

economic system?

A. Privatization

B. Deregulation

C. A stable price of petroleum and other natural resources

D. The creation of a legal system to safeguard property rights.

18. _______ risk is defined as the likelihood that political forces will cause drastic

changes in a countrys business environment that adversely affect the profit and goals

of a business enterprise.

A. Legal

B. De-regulation

C. Regulation

D. Political

19. The role of the government in a market economy is to ____.

A. Allocate resources for the good of society

B. Re-distribute income to create equitable access to the market

C. Plan the production of goods and services in that country

D. Encourage vigorous free and fair competition between private producers

3

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

20. The objective of a command economy is to ____.

A. Mobilize resources for the public good

B. Take over troubled industries

C. Open up markets both at home and abroad

D. Ensure free supply of products.

Section B (20 marks)

This section contains FIVE (5) questions. You are required to answer ALL questions in

the answer sheets given.

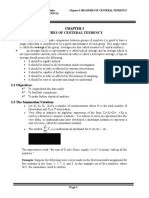

One of the strategic objective shared by production and logistics is to increase product quality

by eliminating defective products from both the supply chain and the manufacturing process.

In this context, quality means reliability, implying that the products has no defects and

performs well.

Please fill in the figure below that shows the relationship between quality and costs. Write

your answers in the answer sheet. (not in this paper)

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

a)

d)

Improve

Performance

Reliability

Increases

Profits

b)

e)

c)

Part C : Case Study (30 marks)

This section contains FIVE (5) questions. You are required to answer ALL questions in

the answer sheets given.

General Electrics Joint VentureGeneral Electric formerly entered a foreign market by either

acquiring an established firm or establishing a greenfield subsidiary. Joint ventures with a

local company were almost never considered. The prevailing philosophy was that without full

control, the company didnt do the deal. However, times have changed. Since the early 2000s

joint ventures have become one of the most powerful strategic tools in GEs arsenal.To enter

the South Korean market, for example, GE Money, the retail lending arm of GEs financial

services business, formed joint ventures with Hyundai to offer auto loans, mortgages,and

credit cards.

GE has a 43 percent stake in these ventures. Similarly, in Spain it has formed several joint

ventures with local banks to provide consumer loans and credit cards to Spanish residents,

and in Central America it has a joint venture with BAC-Credomatic, the largest bank in the

5

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

region.There are several reasons for the switch in strategy. For one thing, GE used to be able

to buy its way into majority ownership in almost any business, but prices for acquisitions

have been bid so high that GE is reluctant to acquire for fear of overpaying. Better to form a

joint venture, so the thinking goes, than risk paying too much for a company that turns out to

have problems that are discovered only after the acquisition.Just as importantly, GE now sees

joint ventures as a great way to dip its toe into foreign markets where it lacks local

knowledge. Moreover, in certain nations, China being a case in point, economic, political,

legal, and cultural considerations make joint ventures an easier option than either

acquisitionsor greenfield ventures. GE believes it can often benefit from the political

contacts, local expertise, and business relationships that the local partner brings to the

table,plus in certain sectors of the Chinese economy and some others,local laws prohibit other

entry modes. GE also sees joint ventures as a good way to share the risk of building a

business in a nation where it lacks local knowledge.

Finally, under the leadership of CEO Jeffrey Immelt, GE has adopted aggressive growth

goals, and it believes that entering via joint ventures into nations where it lacks a presence is

the only way of attaining these goals. Fueled by its large number of joint ventures, GE has

rapidly expanded its international presence over the past decade. For the first time, in 2007

the company derived the majority of its revenue from foreign operations. Of course, General

Electric has done joint ventures in the past. For example, it has a long standing 50/50 joint

venture with the French company Snecma to make engines for commercial jet aircraft,

another with Fanuc of Japan to make controls for electrical equipment, and a third with Sea

Containers of the United Kingdom, which has become one of the worlds largest companies

leasing shipping containers.But all of these ventures came about only after GE had explored

other ways to gain access to particular markets or technology. Once the last option for GE,

establishing joint ventures is now often the preferred entry strategy.GE managers also note

there is no shortage of partners willing to enter into a joint venture with the company. The

company has a well-earned reputation for being a good partner. GE also is well known for its

innovative management techniques and excellent management development programs. Many

partners are happy to team up with GE to get access to this know-how. The knowledge flow

goes both ways, with GE acquiring access to knowledge about local markets, and partners

earning cutting-edge management techniques from GE that can be used to boost their own

productivity.

Nevertheless, joint ventures are no panacea. GEs agreements normally give even the

minority partner in a joint venture veto power over major strategic decisions, and control

issues can scuttle some ventures. In January 2007, for example,GE announced it would enter

into a venture with Britains Smiths Group to make aerospace equipment. However, in

September of the same year, GE ended talks aimed at establishing the venture, stating it could

not reach an agreement over the vision for the joint venture. GE has also found that as

much as it would like majority ownership, or even a 50/50 split, sometimes it has to settle for

a minority stake to gain access to a foreign market. In 2003, when GE entered into a joint

venture with Hyundai Motor to offer auto loans, it did soas a minority partner even though it

would have preferred a majority position. Hyundai had refused to cede control to GE.

Sources: C. H. Deutsch, The Venturesome Giant, The New York

Times , October 5, 2007, pp. C1, C8; Odd Couple: Jet Engines, The

Economist , May 5, 2007, p. 72; and GE, BAC Joint Venture to Buy

Banco Mercantil, Financial Wire , January 11, 2007, p. 1.

CONFIDENTIAL

IBM 1143 INTERNATIONAL BUSINESS

FINAL EXAMINATION

Questions

1. GE used to prefer acquistions or greenfield ventures as an entry mode, rather than

joint ventures. Why do you think this was the case?

(6 marks)

2. Why do you think GE has come to favour joint ventures in recent years? (6 marks)

3. What are the risks that GE must assume when it enters into a joint venture? Is ther any

way for GE to reduce these risks

( 6 marks)

4. The case mentions about GE has a well-earned reputation for being a good partner.

What are the likely benefits for this reputation to GE? If GE were to tarnish its

reputation by, for example, opportunistically taking advantage of a partner, how might

this impact the company going forward?

( 6marks)

5. In addition to its reputation for being a good partner, what other assets do you think

GE brings to the table that make it an attractive joint-venture partner

( 6 marks)

You might also like

- Rift Valley University: Department of Marketing Management Strategic Management Final Exam Based Assignments 60%Document9 pagesRift Valley University: Department of Marketing Management Strategic Management Final Exam Based Assignments 60%Abdulaziz MohammedNo ratings yet

- Entry Strategy & Strategic Alliances: C. Pioneering CostsDocument12 pagesEntry Strategy & Strategic Alliances: C. Pioneering CostsBusiness BlueNo ratings yet

- International Marketing Question BankDocument1 pageInternational Marketing Question BankKiara Mp50% (2)

- Chapter 6 Pricing in International Markets AbitiDocument18 pagesChapter 6 Pricing in International Markets AbitiKidu Yabe100% (1)

- Strategy SolutionsDocument2 pagesStrategy SolutionsIbrahim OsmanNo ratings yet

- L5M15 Advanced Negotiation Questions No AnswersDocument23 pagesL5M15 Advanced Negotiation Questions No AnswersjaneNo ratings yet

- Chapter 1: Globalization and International BusinessDocument14 pagesChapter 1: Globalization and International BusinessMeggie NguyenNo ratings yet

- Market Structures AssignmentDocument3 pagesMarket Structures AssignmentDilantha ShaluthaNo ratings yet

- MCQ - Economies of ScaleDocument6 pagesMCQ - Economies of Scaleiacharjee100% (1)

- Chap005 International Trade TheoryDocument15 pagesChap005 International Trade TheoryDavid Navarro Cárdenas0% (1)

- XDocument6 pagesXBoogii EnkhboldNo ratings yet

- International Product Policy-SlidesDocument12 pagesInternational Product Policy-SlidesRAVINDRA Pr. SHUKLANo ratings yet

- Chapter 8: Foreign Direct Investment: True / False QuestionsDocument41 pagesChapter 8: Foreign Direct Investment: True / False QuestionsQuốc Phú100% (1)

- P2 November 2014 Question Paper PDFDocument20 pagesP2 November 2014 Question Paper PDFAnu MauryaNo ratings yet

- Multiple Choice Questions Chapter 4 ElasticityDocument22 pagesMultiple Choice Questions Chapter 4 ElasticityAfrose Khan100% (2)

- International Business Module 1Document22 pagesInternational Business Module 1Ajesh Mukundan P0% (1)

- Marketing Mnanagement Final Exam Answer SheetDocument8 pagesMarketing Mnanagement Final Exam Answer SheetJemal YayaNo ratings yet

- Past Paper IIDocument16 pagesPast Paper IIWasim OmarshahNo ratings yet

- Market Research MidtermDocument18 pagesMarket Research MidtermGene's100% (1)

- IM All in OneDocument45 pagesIM All in OneMujahid AliNo ratings yet

- Ratio Analysis: Profitability RatiosDocument10 pagesRatio Analysis: Profitability RatiosREHANRAJNo ratings yet

- Financial Market & Institution WorksheetDocument5 pagesFinancial Market & Institution WorksheetBobasa S Ahmed100% (1)

- IBUS 321 Forum Q and ADocument3 pagesIBUS 321 Forum Q and Amarina belmonte100% (1)

- Examveda MCQ 1,2,3 SectionDocument131 pagesExamveda MCQ 1,2,3 SectionVipulNo ratings yet

- Multiple Choice Questions-MacroDocument21 pagesMultiple Choice Questions-MacroSravan Kumar100% (1)

- Multiple Choice 1Document5 pagesMultiple Choice 1віра сіркаNo ratings yet

- Elms Quiz: Oligopoly I. MULTIPLE CHOICE (10 Items X 2 Points)Document2 pagesElms Quiz: Oligopoly I. MULTIPLE CHOICE (10 Items X 2 Points)Thirdy SuarezNo ratings yet

- International Entrepreneurship OpportunitiesDocument11 pagesInternational Entrepreneurship OpportunitiesanitikaNo ratings yet

- GST MCQ Are in Question Bank - Chapter WISE .. Custom MCQ'SDocument26 pagesGST MCQ Are in Question Bank - Chapter WISE .. Custom MCQ'SAman jainNo ratings yet

- International Marketing Chapter 2Document42 pagesInternational Marketing Chapter 2wubeNo ratings yet

- Unit 1 McqsDocument5 pagesUnit 1 McqsArun Soman0% (4)

- CHAPTER 3 Measure of Centeral TendencyDocument20 pagesCHAPTER 3 Measure of Centeral TendencyyonasNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementBharat BhojwaniNo ratings yet

- MCQs On Capital StructureDocument7 pagesMCQs On Capital Structuremercy100% (1)

- Insurance: 1 Lesson 1 Introduction To InsuranceDocument14 pagesInsurance: 1 Lesson 1 Introduction To Insurancevipul sutharNo ratings yet

- Chapter 2Document18 pagesChapter 2Hk100% (1)

- Modes of International Market EntryDocument45 pagesModes of International Market EntryNeelam KambleNo ratings yet

- MQPs of Consumer Behaviour For AKTU MBA StudentsDocument3 pagesMQPs of Consumer Behaviour For AKTU MBA Studentsazam49No ratings yet

- International Marketing Quiz ExamDocument2 pagesInternational Marketing Quiz ExamJu Lee Ann50% (2)

- AdmasDocument170 pagesAdmasHMichael AbeNo ratings yet

- Global Marketing Important Questions Unit WiseDocument5 pagesGlobal Marketing Important Questions Unit Wisevaidyam rahulNo ratings yet

- Strategic Management 1Document9 pagesStrategic Management 1Weldu GebruNo ratings yet

- MM Chapter 1 Test BankDocument13 pagesMM Chapter 1 Test BankkarimNo ratings yet

- Theories of RetailDocument24 pagesTheories of RetailSiddhartha DeshmukhNo ratings yet

- International Martketing Practice Questions: Keegan 8e Ch08Document7 pagesInternational Martketing Practice Questions: Keegan 8e Ch08PandaNo ratings yet

- Cravens Strategic Marketing 9eDocument13 pagesCravens Strategic Marketing 9eumair baigNo ratings yet

- Chapter 01 Multinational Financial Management An OverviewDocument45 pagesChapter 01 Multinational Financial Management An OverviewGunawan Adi Saputra0% (1)

- 812-MARKETING (2) PracticalDocument9 pages812-MARKETING (2) Practicaltushar kapoorNo ratings yet

- Business Law ExamDocument3 pagesBusiness Law ExamBarzala CarcarNo ratings yet

- Answers To End-of-Chapter Questions - Part 2: SolutionDocument2 pagesAnswers To End-of-Chapter Questions - Part 2: Solutionpakhijuli100% (1)

- Multiple Choice QuestionsDocument13 pagesMultiple Choice QuestionsVictor CharlesNo ratings yet

- Consumer Behavior Mid-Term Examination Spring 2021 SMCHSDocument2 pagesConsumer Behavior Mid-Term Examination Spring 2021 SMCHSMaaz RaheelNo ratings yet

- Strategic Management Multiple Choice Questions and Answers Chapter 1-17Document58 pagesStrategic Management Multiple Choice Questions and Answers Chapter 1-17sonia khatibNo ratings yet

- Marketing MCQDocument37 pagesMarketing MCQRabiaSaleemNo ratings yet

- COMMERCE WEEK TopicsDocument8 pagesCOMMERCE WEEK TopicsPaadana Telugu PaataNo ratings yet

- Exam Principle ManagementDocument9 pagesExam Principle Managementapi-381739470% (10)

- Mathematics For Mgt-Converted (1) - MinDocument4 pagesMathematics For Mgt-Converted (1) - Minsamuel zelaelm100% (1)

- Balance of Payments Format and NumericalsDocument10 pagesBalance of Payments Format and NumericalsSarthak Gupta100% (2)

- Chapters 1 7 Practice No AnswersDocument57 pagesChapters 1 7 Practice No AnswersYoyo HihiNo ratings yet

- Ebook Crafting and Executing Strategy Concepts and Readings The Quest For Competitive Advantage 20Th Edition Thompson Test Bank Full Chapter PDFDocument68 pagesEbook Crafting and Executing Strategy Concepts and Readings The Quest For Competitive Advantage 20Th Edition Thompson Test Bank Full Chapter PDFclasticsipperw8g0100% (12)

- Determinants of Chinese Consumers Green Purchase BehaviorDocument25 pagesDeterminants of Chinese Consumers Green Purchase BehaviorAnitya HelsaNo ratings yet

- SPM Project 2014 - Version2Document47 pagesSPM Project 2014 - Version2Joanne PanNo ratings yet

- Business Law NotesDocument134 pagesBusiness Law NotesNadeem Sharif96% (24)

- Ethics & Business Part 1 of 5Document5 pagesEthics & Business Part 1 of 5Joanne PanNo ratings yet

- Zoomer Hold Me TightDocument2 pagesZoomer Hold Me TightJoanne PanNo ratings yet

- Brain ChemistryDocument9 pagesBrain ChemistryJoanne PanNo ratings yet

- Law 1063 Introduction To Legalframework Assignment 1 Question 1 (10 Marks)Document1 pageLaw 1063 Introduction To Legalframework Assignment 1 Question 1 (10 Marks)Joanne PanNo ratings yet

- Contract - OfferDocument86 pagesContract - OfferJoanne PanNo ratings yet

- Ohsa 1994 JPDocument29 pagesOhsa 1994 JPJoanne PanNo ratings yet

- Chapter 8Document14 pagesChapter 8Joanne PanNo ratings yet

- Assignment 1 Mini Case Law Analysis and CritiqueDocument1 pageAssignment 1 Mini Case Law Analysis and CritiqueJoanne PanNo ratings yet

- MoaDocument5 pagesMoaJoanne PanNo ratings yet

- Chapter 1 Introduction 2 Legal FrameworkDocument30 pagesChapter 1 Introduction 2 Legal FrameworkJoanne PanNo ratings yet

- Chap 3 WIPDocument31 pagesChap 3 WIPJoanne PanNo ratings yet

- English Grammar SecretsDocument66 pagesEnglish Grammar SecretsJoanne PanNo ratings yet

- Communication Skills OverviewDocument2 pagesCommunication Skills OverviewJoanne PanNo ratings yet

- Assignment 2Document2 pagesAssignment 2Joanne PanNo ratings yet

- Self Mastery Through Conscious by Eìmile Coueì 1Document52 pagesSelf Mastery Through Conscious by Eìmile Coueì 1Joanne PanNo ratings yet

- AYS2 07.2013 - Bonus - Arielle Ford - The Love Letters of ArielleDocument45 pagesAYS2 07.2013 - Bonus - Arielle Ford - The Love Letters of ArielleDolcevita2No ratings yet

- Locker PPT Module01Document10 pagesLocker PPT Module01Joanne PanNo ratings yet

- Group Work - Design A SystemDocument3 pagesGroup Work - Design A SystemJoanne PanNo ratings yet

- Study SkillsDocument43 pagesStudy SkillsJoanne PanNo ratings yet

- Assertiveness Skills: Simran K. SangheraDocument41 pagesAssertiveness Skills: Simran K. SangheraBuried_ChildNo ratings yet

- India - Report ManuscriptDocument21 pagesIndia - Report ManuscriptAJ BlazaNo ratings yet

- Presentation On Skills Development in BangladeshDocument37 pagesPresentation On Skills Development in BangladeshMd. Anwarul HoqueNo ratings yet

- 453 CCS Competitive Advantage TataDocument67 pages453 CCS Competitive Advantage TataLOVE CHAWLA0% (1)

- Berkhout Foresight PDFDocument16 pagesBerkhout Foresight PDFMiranda081No ratings yet

- Jadhav 2012Document9 pagesJadhav 2012salman samirNo ratings yet

- M652 Spring2010 RenDocument15 pagesM652 Spring2010 RenshriniramNo ratings yet

- Question Bank For TYBCom Sem VIDocument1 pageQuestion Bank For TYBCom Sem VIKhan SanaNo ratings yet

- Macrec2 Problem Set 1 PDFDocument2 pagesMacrec2 Problem Set 1 PDFBrian TakataNo ratings yet

- Reading 6 Economic GrowthDocument16 pagesReading 6 Economic Growthtristan.riolsNo ratings yet

- The Entry On The Smartphones Market in MexicoDocument15 pagesThe Entry On The Smartphones Market in MexicoMartin SentisNo ratings yet

- 3 North South DivideDocument16 pages3 North South DivideAminahSolomon100% (1)

- 11th Malaysia Plan Six Strategic Thrusts in Moving Towards Vision 2020 - Astro AwaniDocument9 pages11th Malaysia Plan Six Strategic Thrusts in Moving Towards Vision 2020 - Astro AwaniZati TyNo ratings yet

- Tourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDocument12 pagesTourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDIPIN PNo ratings yet

- Marketing PlanDocument29 pagesMarketing PlanYousra MariumNo ratings yet

- Apple Project BearDocument882 pagesApple Project BearZachery EanesNo ratings yet

- Pols 3334Document10 pagesPols 3334ZhelinNo ratings yet

- Research Review Health AssamDocument11 pagesResearch Review Health AssamWilderness AssamNo ratings yet

- National SecurityDocument37 pagesNational SecurityJAIMERIE NAVAJANo ratings yet

- Jharkhand Public Service Commission (JPSC) SyllabusDocument7 pagesJharkhand Public Service Commission (JPSC) SyllabusSamish SrivastavaNo ratings yet

- Ged 104 Assignment 7Document8 pagesGed 104 Assignment 7Juan MiguelNo ratings yet

- Buddhist EconomyDocument262 pagesBuddhist EconomyFábio Stern100% (1)

- Growth Curriculum PDFDocument5 pagesGrowth Curriculum PDFArjun AgarwalNo ratings yet

- 2.global Environmental ConcernDocument11 pages2.global Environmental ConcernBenji JenNo ratings yet

- Trejo Nieto - Economic Development MetropolitanDocument46 pagesTrejo Nieto - Economic Development MetropolitanAriana MendozaNo ratings yet

- 2022report GREN FUTURE INDEXDocument43 pages2022report GREN FUTURE INDEXPablo KaiserNo ratings yet

- Sample - HSC Economics NotesDocument3 pagesSample - HSC Economics NotesAndrew LeeNo ratings yet

- AFORE 2014-Abstrack Book PDFDocument430 pagesAFORE 2014-Abstrack Book PDFxman4243No ratings yet

- Mindmap-First ChapterDocument6 pagesMindmap-First ChapterHeer Sirwani100% (1)

- Need For Public ExpenditureDocument3 pagesNeed For Public ExpenditureumamaheswariNo ratings yet

- British Imperialism Revisited The Costs and Benefits of 'Anglobalization'Document29 pagesBritish Imperialism Revisited The Costs and Benefits of 'Anglobalization'thunderdomeNo ratings yet