Professional Documents

Culture Documents

TM Forum Business Benchmarking Mobile Services Q2 2007 Non-Participant Report

Uploaded by

Ronan CaseyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TM Forum Business Benchmarking Mobile Services Q2 2007 Non-Participant Report

Uploaded by

Ronan CaseyCopyright:

Available Formats

Business Benchmarking

Business Performance Report

Service Offering: Mobile Services

Period: Q2 2007 Q4 2006

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

This work is a copyrighted document of TeleManagement Forum (TM Forum).

The authorship of TM Forum of this work shall be displayed on any further

distribution of it.

While this work has been through strenuous review, due to the nature of the

work, errors may be present. No liability is accepted for any errors or omissions

or for consequences of any use made of this work.

Under no circumstances will TM Forum be liable for direct or indirect damages or

any costs or losses resulting from the use of this work. The risk of driving

business decisions in accordance with this work is borne solely by the user.

Companies in legitimate possession of this report may:

Distribute it internally in their company

Quote it with attribution to the TM Forum in their presentations/ documents

May not:

Distribute the full document or large extracts of it outside their companies

Use large extracts of the document in presentations outside their

companies

If in doubt, please contact Toni Graham at tgraham@tmforum.org

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

Table of Contents

\\KONA\Company\TM Forum\Round 3 Report Generation\Mobile\Mobile Example\R3

Mobile Example.doc - _Toc210394969

NOTE TO READER .............................................................................................. 4

SUMMARY RESULTS .......................................................................................... 5

Q2 07 OVERVIEW: ............................................................................................... 7

Q1 07 OVERVIEW: ............................................................................................... 8

Q4 06 OVERVIEW: ............................................................................................... 9

INDIVIDUAL METRIC RESULTS: ...................................................................... 10

REVENUE AND MARGIN: ..................................................................................... 10

CUSTOMER EXPERIENCE: ................................................................................... 31

OPERATIONAL EFFICIENCY: ................................................................................ 37

CORRELATIONS ............................................................................................... 40

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

Note to Reader

Welcome to the non-participant version of the Mobile Services Business

Performance Study Report.

This report has been specifically created for the use of non-participants; i.e.

companies that did not contribute data to this study. To better illustrate what a

participant receives this document contains both factual results of the study as

well as illustrative service provider scores. These scores were created to be

representative of what a participating service provider may receive without

disclosing the real scores of any of the participants.

To avoid confusion the following portions of the document are factual and have

been developed directly from the data provided by the participants:

Correlations

The statistics and graphs in the Individual Metric Results

Similarly, these areas of the document are illustrative and represent the service

provider specific information that would be provided to our fictional service

provider:

Executive Summary

Q2 2007 Overview

Q1 2007 Overview

Q4 2006 Overview

"Your Score" portion of the Individual Metrics Results

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

Summary Results

This Mobile Study included data from 12 participants on 11 metrics. There were

10 metrics with sufficient data to share. Your company contributed data to all 10

of those metrics. Data was collected for three quarters.

From the quarterly overviews on the following pages, it can be seen that your

strongest performance was for:

Operating Income/Revenue (G-RM-1)

OpEx/Revenue (G-RM-3)

Customer Acquisition (G-RM-5a Prepay)

Service Availability (A-CE-5)

The weakest performance was for:

Customer Loss (G-RM-5b)

Customer Acquisition (G-RM-5a Postpay)

Taking each separately, the following observations can be made:

Operating Income/Revenue (G-RM-1)

You have a strong score on this metric in the study. This means that

youre a operating more profitably than the majority of the participants.

This aligns well with your low OpEx/Revenue.

OpEx/CapEx (G-RM-2):

You have a higher than average score on this metric. This means that

your OpEx/CapEx ration is higher than most of the other participants. Note

your OpEx/CapEx increased sharply in Q1 2007 in line with a strong shift

in the industry average. A higher than average OpEx/CapEx score can

signify either a higher OpEx figure or a lower CapEx figure. Since you

have successfully driven OpEx down over the period of the study, your

score for this metric appears to derive from a lower CapEx investment in

relationship to your OpEx spending.

OpEx/Revenue (G-RM-3):

This is a strong score. Since there are participants with stronger positions

i.e. a lower OpEx/Revenue, improving this strength might be worth

consideration.

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

The decrease in your OpEx/Revenue over the period of the study is

especially important given the increasing OpEx/Revenue in the general

industry.

Customer Acquisition (G-RM-5a Prepay)

Your strong performance in prepay customer acquisition for Q4 2006 and

Q1 2007 has eroded to only an above average position for Q2 2007. This

may be worth investigation.

Customer Acquisition (G-RM-5a Postpay)

Acquisition of Postpay customers is a below average for this study. Like

prepay your performance has declined over the period of the study.

Customer Loss (G-RM-5b Prepay)

You have a poor position on the percent of Customer Loss for both the

Prepay and Postpay segments. This means that you lose a larger % of

customers per month than the majority of the other participants in the

study.

Incident Resolution Time (A-CE-2a)

You have above average performance on this metric; performance has

improved slightly over the period of the study.

Service Availability (A-CE-5)

You have a strong position in the study for service availability. The trend

information shows that you have maintained this level of Service

Availability steadily throughout both this and the earlier study.

Service Problem Resolution (A-OE-2a)

You have an above average position on this metric which means you are

able to close your internally identified problems more quickly than

average. Please note: there is a large difference between the time to

resolve customer problems and the time required to resolve internally

identifies problems. Generally, communication service providers with the

best performance see closer alignment between the two metrics.

Mobile Services

Business Performance Report

Q2 07 Overview:

Revenue and Margin

G-RM-1

Profitability (expressed as Operating Income / Revenue)

G-RM-2

OpEx / CapEx

G-RM-3

OpEx/Revenue

G-RM-5a

Customers Acquired - Prepay

Customers Acquired - Postpay

G-RM-5b

Customers Lost - Prepay

Customers Lost - Postpay

Customer Experience

A-CE-2a

Incident Resolution Time

A-CE-5

Availability

Operational Efficiency

A-OE-2a

Service Problem Resolution Time

Q2 2007- Q4 2006

Mobile Services

Business Performance Report

Q1 07 Overview:

Revenue and Margin

G-RM-1

Profitability (expressed as Operating Income / Revenue)

G-RM-2

OpEx / CapEx

G-RM-3

OpEx/Revenue

G-RM-5a

Customers Acquired - Prepay

Customers Acquired - Postpay

G-RM-5b

Customers Lost - Prepay

Customers Lost - Postpay

Customer Experience

A-CE-2a

Incident Resolution Time

A-CE-5

Availability

Operational Efficiency

A-OE-2a

Service Problem Resolution Time

Q2 2007- Q4 2006

Mobile Services

Business Performance Report

Q4 06 Overview:

Revenue and Margin

G-RM-1

Profitability (expressed as Operating Income / Revenue)

G-RM-2

OpEx / CapEx

G-RM-3

OpEx/Revenue

G-RM-5a

Customers Acquired - Prepay

Customers Acquired - Postpay

G-RM-5b

Customers Lost - Prepay

Customers Lost - Postpay

Customer Experience

A-CE-2a

Incident Resolution Time

A-CE-5

Availability

Operational Efficiency

A-OE-2a

Service Problem Resolution Time

Q2 2007- Q4 2006

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

10

Individual Metric Results:

Revenue and Margin:

G-RM-1 Q2 07

Profitability (expressed as Operating Income / Revenue)

% 2DP

Units :

6

Participants:

77.00

55.65

Lead

45.95

Avg. Lead

43.21

Avg. Lag

42.73

Lag

G-RM-1

Max

Your Score:

76.00

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

11

G-RM-1 Q1 07

Profitability (expressed as Operating Income / Revenue)

% 2DP

Units :

6

Participants:

76.00

55.68

Lead

45.92

Avg. Lead

41.71

Avg. Lag

41.60

Lag

G-RM-1

Max

Your Score:

72.00

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

12

G-RM-1 Q4 06

Profitability (expressed as Operating Income / Revenue)

% 2DP

Units :

7

Participants:

75.00

55.17

Lead

42.53

Avg. Lead

40.26

Avg. Lag

31.73

Lag

G-RM-1

Max

Your Score:

70.63

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

13

G-RM-2 Q2 07

OpEx / CapEx

% 2DP

Units :

5

Participants:

1069.16

926.34

High

897.64

Avg. High

840.57

Avg. Low

768.41

Low

G-RM-2

Max

Your Score:

907.77

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

14

G-RM-2 Q1 07

OpEx / CapEx

% 2DP

Units :

5

Participants:

1069.16

926.34

High

897.64

Avg. High

894.59

Avg. Low

768.41

Low

G-RM-2

Max

Your Score:

903.64

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

15

G-RM-2 Q4 06

OpEx / CapEx

% 2DP

Units :

6

Participants:

512.06

510.51

High

448.89

Avg. High

421.19

Avg. Low

293.06

Low

G-RM-2

Max

Your Score:

489.00

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

16

G-RM-3 Q2 07

OpEx / Revenue

% 2DP

Units :

6

Participants:

31.00

57.27

Lead

64.78

Avg. Lead

70.83

Avg. Lag

75.61

Lag

G-RM-3

Min

Your Score:

38.47

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

17

G-RM-3 Q1 07

OpEx / Revenue

% 2DP

Units :

6

Participants:

33.00

56.83

Lead

64.78

Avg. Lead

70.83

Avg. Lag

75.61

Lag

G-RM-3

Min

Your Score:

39.26

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

18

G-RM-3 Q4 06

OpEx / Revenue

% 2DP

Units :

7

Participants:

34.00

45.96

Lead

59.72

Avg. Lead

61.04

Avg. Lag

69.25

Lag

G-RM-3

Min

Your Score:

41.58

Average

Max

Mobile Services

G-RM-5a Q2 07

Business Performance Report

Q2 2007- Q4 2006

19

Prepay

Customers Acquired - Prepay

% 2DP

Units :

6

Participants:

6.17

3.21

Lead

2.51

Avg. Lead

1.84

Avg. Lag

1.33

Lag

G-RM-5a

Max

Your Score:

2.95

Average

Min

Mobile Services

G-RM-5a Q1 07

Business Performance Report

Q2 2007- Q4 2006

20

Prepay

Customers Acquired - Prepay

% 2DP

Units :

6

Participants:

6.70

2.71

Lead

2.19

Avg. Lead

1.58

Avg. Lag

1.31

Lag

G-RM-5a

Max

Your Score:

5.97

Average

Min

Mobile Services

G-RM-5a Q4 06

Business Performance Report

Q2 2007- Q4 2006

21

Prepay

Customers Acquired - Prepay

% 2DP

Units :

7

Participants:

6.62

4.68

Lead

3.71

Avg. Lead

2.65

Avg. Lag

1.51

Lag

G-RM-5a

Max

Your Score:

6.44

Average

Min

Mobile Services

G-RM-5a Q2 07

Business Performance Report

Q2 2007- Q4 2006

22

Postpay

Customers Acquired - Postpay

% 2DP

Units :

6

Participants:

11.16

2.91

Lead

1.73

Avg. Lead

1.31

Avg. Lag

1.12

Lag

G-RM-5a

Max

Your Score:

1.59

Average

Min

Mobile Services

G-RM-5a Q1 07

Business Performance Report

Q2 2007- Q4 2006

23

Postpay

Customers Acquired - Postpay

% 2DP

Units :

6

Participants:

4.09

2.61

Lead

1.79

Avg. Lead

1.30

Avg. Lag

1.11

Lag

G-RM-5a

Max

Your Score:

1.70

Average

Min

Mobile Services

G-RM-5a Q4 06

Business Performance Report

Q2 2007- Q4 2006

24

Postpay

Customers Acquired - Postpay

% 2DP

Units :

7

Participants:

5.85

3.53

Lead

2.67

Avg. Lead

1.87

Avg. Lag

1.46

Lag

G-RM-5a

Max

Your Score:

2.07

Average

Min

Mobile Services

Business Performance Report

G-RM-5b Q2 07

Q2 2007- Q4 2006

25

Prepay

Customers Lost - Prepay

% 2DP

Units :

6

Participants:

1.26

1.69

Lead

2.23

Avg. Lead

3.09

Avg. Lag

4.13

Lag

G-RM-5b

Min

Your Score:

3.89

Average

Max

Mobile Services

Business Performance Report

G-RM-5b Q1 07

Q2 2007- Q4 2006

26

Prepay

Customers Lost - Prepay

% 2DP

Units :

6

Participants:

1.04

1.44

Lead

2.10

Avg. Lead

2.89

Avg. Lag

4.11

Lag

G-RM-5b

Min

Your Score:

3.96

Average

Max

Mobile Services

Business Performance Report

G-RM-5b Q4 06

Q2 2007- Q4 2006

27

Prepay

Customers Lost - Prepay

% 2DP

Units :

7

Participants:

1.14

2.07

Lead

2.59

Avg. Lead

3.06

Avg. Lag

6.02

Lag

G-RM-5b

Min

Your Score:

3.31

Average

Max

Mobile Services

Business Performance Report

G-RM-5b Q2 07

Q2 2007- Q4 2006

28

Postpay

Customers Lost - Postpay

% 2DP

Units :

6

Participants:

0.22

0.82

Lead

1.01

Avg. Lead

1.59

Avg. Lag

2.25

Lag

G-RM-5b

Min

Your Score:

1.81

Average

Max

Mobile Services

Business Performance Report

G-RM-5b Q1 07

Q2 2007- Q4 2006

29

Postpay

Customers Lost - Postpay

% 2DP

Units :

6

Participants:

0.57

0.79

Lead

0.96

Avg. Lead

1.69

Avg. Lag

2.33

Lag

G-RM-5b

Min

Your Score:

1.30

Average

Max

Mobile Services

Business Performance Report

G-RM-5b Q4 06

Q2 2007- Q4 2006

30

Postpay

Customers Lost - Postpay

% 2DP

Units :

7

Participants:

0.35

0.74

Lead

0.83

Avg. Lead

1.37

Avg. Lag

3.27

Lag

G-RM-5b

Min

Your Score:

1.73

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

31

Customer Experience:

A-CE-2a Q2 07

Customer Incident Resolution Time

minutes 2DP

Units :

6

Participants:

218.00

965.28

Lead

3338.57

Avg. Lead

7991

Avg. Lag

14315.36

Lag

A-CE-2a

Min

Your Score:

3308.75

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

32

A-CE-2a Q1 07

Customer Incident Resolution Time

minutes 2DP

Units :

6

Participants:

274.82

357.2

Lead

1647.31

Avg. Lead

4538.81

Avg. Lag

14209.58

Lag

A-CE-2a

Min

Your Score:

3479.54

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

33

A-CE-2a Q4 06

Customer Incident Resolution Time

minutes 2DP

Units :

6

Participants:

109.25

807.56

Lead

3592.90

Avg. Lead

11957.62

Avg. Lag

29822.67

Lag

A-CE-2a

Min

Your Score:

3511.80

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

34

A-CE-5 Q2 07

Availability of Service to Customer

%3DP

Units :

11

Participants:

99.98

99.94

Lead

99.91

Avg. Lead

99.87

Avg. Lag

99.69

Lag

A-CE-5

Max

Your Score:

99.95

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

35

A-CE-5 Q1 07

Availability of Service to Customer

% 3DP

Units :

11

Participants:

99.98

99.95

Lead

99.92

Avg. Lead

99.87

Avg. Lag

99.73

Lag

A-CE-5

Max

Your Score:

99.96

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

36

A-CE-5 Q4 06

Availability of Service to Customer

% 3DP

Units :

11

Participants:

99.98

99.95

Lead

99.92

Avg. Lead

99.88

Avg. Lag

99.73

Lag

A-CE-5

Max

Your Score:

99.96

Average

Min

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

37

Operational Efficiency:

A-OE-2a Q2 07

Service Problem Resolution Time

minutes 2DP

Units :

6

Participants:

2796.63

Lead

42897.78

42986.67

45910.19

Avg. Lead

Avg. Lag

45910.19

Lag

A-OE-2a

Min

Your Score:

42905.76

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

38

A-OE-2a Q1 07

Service Problem Resolution Time

minutes 2DP

Units :

6

Participants:

3752.07

Lead

44413.53

49038.42

62987.37

Avg. Lead

Avg. Lag

62987.37

Lag

A-OE-2a

Min

Your Score:

49071.93

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

39

A-OE-2a Q4 06

Service Problem Resolution Time

minutes 2DP

Units :

6

Participants:

3156.81

Lead

46260.00

63681.88

86416.00

Avg. Lead

Avg. Lag

86416.00

Lag

A-OE-2a

Min

Your Score:

48607.98

Average

Max

Mobile Services

Business Performance Report

Q2 2007- Q4 2006

40

Correlations

Visual correlations are used to spot potential interactions or insights from the

data. Visual correlations track the leading and lagging positions of all the

participants across 2-3 metrics. (Anonymity is preserved)

In this case correlations were conducted for a number of metrics. The most

interesting are shown below. Additional correlations may be developed as

needed on the web-portal.

Each column represents the position from the single operator against the metrics

in the rows.

SPa

SPb

SPc

SPd

G-RM-3

OpEx/Revenue

G-RM-1

Profitability

This correlation highlights the relationship between low OpEx and good

profitability.

SPe

Mobile Services

Business Performance Report

SPa

SPb

Q2 2007- Q4 2006

SPc

SPd

SPe

41

SPf

G-RM-5b

Customers Lost - Postpay

G-RM-5b

Customers Lost - Prepay

This correlation suggests that operators who are effective at retaining existing

customers have similar results between Postpay and Prepay customers. The

implication is that the stickiness is more to do with shared service attributes than

with special handling due to payment method.

Mobile Services

Business Performance Report

SPa

SPb

Q2 2007- Q4 2006

SPc

SPd

SPe

42

SPf

G-RM-5a

Customers Acquired - Postpay

G-RM-5a

Customers Acquired - Prepay

G-RM-3

OpEx/Revenue

This correlation indicates that operators with strong profitability generally lead in

either prepay or post pay customer acquisition, but are typically at least average

in the other category

Mobile Services

Business Performance Report

SPa

SPb

Q2 2007- Q4 2006

SPc

SPd

43

SPe

A-CE-5

Availability

G-RM-5b

Customers Lost - Postpay

G-RM-5b

Customers Lost - Prepay

This correlation shows that once availability reaches 99% there is little

relationship between increased service availability and customer retention,

implying that customers may not be able to discern the difference and other

criteria become more important to the decision to remain with a provider.

You might also like

- EY Top 10 Risks in Telecommunications 2014Document32 pagesEY Top 10 Risks in Telecommunications 2014mamunurrahmanNo ratings yet

- UCD Open Days Booklet 2017 40pg A5 WebDocument40 pagesUCD Open Days Booklet 2017 40pg A5 WebRonan CaseyNo ratings yet

- JHDSS CourseDependenciesDocument2 pagesJHDSS CourseDependenciesif05041736No ratings yet

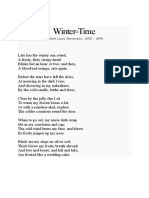

- Winter-Time: Robert Louis Stevenson, 1850 - 1894Document1 pageWinter-Time: Robert Louis Stevenson, 1850 - 1894Ronan CaseyNo ratings yet

- Lecture Slides Week2-2Document11 pagesLecture Slides Week2-2mcraciunNo ratings yet

- Goat Cheese TartDocument1 pageGoat Cheese TartRonan CaseyNo ratings yet

- JHDSS CourseDependenciesDocument2 pagesJHDSS CourseDependenciesif05041736No ratings yet

- Week1 6Document12 pagesWeek1 6Ronan CaseyNo ratings yet

- SNA 8: Network Resilience: Lada AdamicDocument35 pagesSNA 8: Network Resilience: Lada AdamicRonan CaseyNo ratings yet

- Week1 1 PDFDocument17 pagesWeek1 1 PDF김택수No ratings yet

- Lecture Slides Week1-2Document35 pagesLecture Slides Week1-2LastingNo ratings yet

- NG Roadm WP Final2Document0 pagesNG Roadm WP Final2Ronan CaseyNo ratings yet

- Nexus Product Names Chart 2012 V4-1Document1 pageNexus Product Names Chart 2012 V4-1Ronan CaseyNo ratings yet

- PDF 14Q2 Forrester-Report Social MarketingDocument24 pagesPDF 14Q2 Forrester-Report Social MarketingRonan CaseyNo ratings yet

- Forester - Future of Mobile App DevelopmentDocument22 pagesForester - Future of Mobile App DevelopmentRonan CaseyNo ratings yet

- 900Document18 pages900Ronan CaseyNo ratings yet

- Web Browser Caching TutorialDocument4 pagesWeb Browser Caching TutorialDeepak MishraNo ratings yet

- ATM Pocket Guide: For Your ATM Testing Needs Call 800.TEKELEC Visit Our Web Site atDocument14 pagesATM Pocket Guide: For Your ATM Testing Needs Call 800.TEKELEC Visit Our Web Site athemusairamNo ratings yet

- Policy Control and LTEDocument10 pagesPolicy Control and LTERonan CaseyNo ratings yet

- HTTP PostDocument2 pagesHTTP PostAbraham Chacón LandoisNo ratings yet

- Policy Control and LTEDocument10 pagesPolicy Control and LTERonan CaseyNo ratings yet

- Carrier Ethernet: Managing The Service LifecycleDocument20 pagesCarrier Ethernet: Managing The Service Lifecycleav8r_txNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Strategic Management EssentialsDocument29 pagesStrategic Management EssentialsKristine TiuNo ratings yet

- 18bba63c U4Document11 pages18bba63c U4Thangamani.R ManiNo ratings yet

- A.1 A.2 Frenchise Started in 1995. A.3 Resent No of Frenchise Is 51Document3 pagesA.1 A.2 Frenchise Started in 1995. A.3 Resent No of Frenchise Is 51Quausain JafriNo ratings yet

- Rogue Trader Profit FactorDocument9 pagesRogue Trader Profit FactorMorkizgaNo ratings yet

- Asean IntegrationDocument25 pagesAsean IntegrationCzarina Cid100% (1)

- Marketing Plan Group 5Document29 pagesMarketing Plan Group 5Neri La Luna100% (1)

- Corporate Social Responsibility and Tax AggressivenessDocument28 pagesCorporate Social Responsibility and Tax AggressivenessAdella WulandariNo ratings yet

- Economic Theory Business Management: Module-1 Introduction: Managerial EconomicsDocument6 pagesEconomic Theory Business Management: Module-1 Introduction: Managerial EconomicsDivya SNo ratings yet

- Synthesising Supply Chain Processes Based On GSCF FrameworkDocument17 pagesSynthesising Supply Chain Processes Based On GSCF FrameworkManuel RuizNo ratings yet

- RetailDocument20 pagesRetailAdarsh KumarNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Types of Bank AccountsDocument20 pagesTypes of Bank AccountsNisarg Khamar73% (11)

- International Marketing: - Czinkota & Ronkainen - Fall 2009 - Web Slides - Ch1-5, 8-10Document127 pagesInternational Marketing: - Czinkota & Ronkainen - Fall 2009 - Web Slides - Ch1-5, 8-10Star RaghuNo ratings yet

- Toate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreDocument2 pagesToate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreOliviu ArsenieNo ratings yet

- SUV Program BrochureDocument4 pagesSUV Program BrochurerahuNo ratings yet

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- 5WLA Based On Business Process ModelDocument50 pages5WLA Based On Business Process Modeldyah ika100% (3)

- Broker Commission Schedule-EDocument19 pagesBroker Commission Schedule-EErvin Fong ObilloNo ratings yet

- Subcontractor Default InsuranceDocument18 pagesSubcontractor Default InsurancebdiitNo ratings yet

- Superdry Assignment 2-FINALDocument31 pagesSuperdry Assignment 2-FINALHuong Khanh LeNo ratings yet

- Cap2 Sfma Summer Paper 2013 - FinalDocument6 pagesCap2 Sfma Summer Paper 2013 - FinalXiaojie LiuNo ratings yet

- Cornell NotesDocument1 pageCornell NotesEustass RellyyNo ratings yet

- 2008 IOMA Derivatives Market Survey - For WCDocument83 pages2008 IOMA Derivatives Market Survey - For WCrush2arthiNo ratings yet

- Torex Gold - Corporate Presentation - January 2023 202Document49 pagesTorex Gold - Corporate Presentation - January 2023 202Gustavo Rosales GutierrezNo ratings yet

- European Green Deal Commission Proposes Transformation of EU Economy and Society To Meet Climate AmbitionsDocument5 pagesEuropean Green Deal Commission Proposes Transformation of EU Economy and Society To Meet Climate AmbitionsclarencegirlNo ratings yet

- Sample Question PaperDocument16 pagesSample Question PaperAmit GhodekarNo ratings yet

- 2 Final Accounts - Sole Proprietor - Format - AdjustmentsDocument14 pages2 Final Accounts - Sole Proprietor - Format - AdjustmentsSudha Agarwal100% (1)

- Case Studies EdM404 - TecsonNoesonB.Document15 pagesCase Studies EdM404 - TecsonNoesonB.Noeson TecsonNo ratings yet

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Unit 15 Store Audit: StructureDocument24 pagesUnit 15 Store Audit: StructureCherry BlondNo ratings yet