Professional Documents

Culture Documents

2005-2006 (Sem2)

Uploaded by

anchgmCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2005-2006 (Sem2)

Uploaded by

anchgmCopyright:

Available Formats

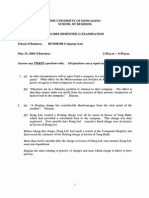

THE UNIVERSITY OF HONG KONG

SCHOOL OF BUSINESS

2005-2006 (SEMESTER 2) EXAMINATION

School of Business: BUSI0010B Company Law

Instructor: Mr. David Woods

9:30 a.m.- 11:30 a.m.

May 19,2006

Answer any THREE questions only. All questions carry equal marks.

1.

"A fundamental difference between partnership and company law is that the

Partnership Ordinance provides an optional, essentially contractual,

framework for conducting business operations through the medium of a

partnership whereas the Companies Ordinance imposes a mandatory

structure." Discuss.

2.

"It is becoming increasingly difficult to predict whether in any particular case

the courts will or will not adhere to the principle of separate corporate

personality as confirmed in Salomon v Salomon & Co Ltd. (1897)." Discuss.

3.

Edward, a director of Fine Coaches Ltd (a coach building company), learned

from George, his accountant, that Happy Travel Ltd., a company to which

George is also the accountant, was to be the subject of a takeover by Jet

Holidays Ltd. Edward immediately purchased $50,000 worth of shares in

Happy Travel Ltd. by means of a temporary loan from Fine Coaches Ltd

which was not formally disclosed in the accounts.

Edward' s shares increased substantially in value as a result of the takeover of

Happy Travel Ltd. by Jet Holidays Ltd. In addition, Edward received various

shareholder benefits, such as holidays and travel at reduced rates and discounts

on the purchase of his new car. He never informed Fine Coaches Ltd. of his

involvement with the other companies.

Advise Edward and George as to their liabilities.

4.

X, Y, and Z incorporate W. Ltd. All three become directors and they hold all

of its shares between themselves. X owns 30o/o of the shares with the

remainder divided equally between Y and Z. After disagreements Y and Z

combine to use their shareholdings to dismiss X from the board. After this

they pursue a policy of distributing profits largely in the form of directors'

fees, thereby reducing the scope for dividends. X has also discovered that Y

and Z are planning to increase the capital of W Ltd by means of a rights issue.

X cannot afford to take up his entitlement and therefore is concerned that his

minority shareholding will be diluted even further.

X therefore wishes to realise his investment in W Ltd but Y and Z have

indicated that they will only purchase his shares at a substantial discount.

Advise X and consider whether your answer would be affected by the fact that

X might have been to blame for the original dispute with Y and Z.

5.

6.

(a)

"The problem of ultra vires has now been solved by the Companies

(Amendment) Ordinance 1997." Discuss.

(b)

"Section 168A Companies Ordinance gives significant protection to

minority shareholders, though it does not supplant the common law."

Discuss.

(a)

"Romalpa clauses in contracts represent a grave danger to creditors

holding floating charges. However, other problems may also occur."

Discuss.

(b)

Hong Ltd. created a floating charge over all its assets in favour of

Heng Seng Bank, which had provided a substantial loan to the

company. This charge was duly registered. Four months later Hong

Ltd. created a fixed charge over its factory in favour of Tung Ltd.

Before taking this charge, Tung Ltd. had made a search at the

Companies Registry and discovered the existence of the floating

charge in favour of Heng Seng Bank.

More than twelve months after the charge in favour of Tung Ltd. was

created, Hong Ltd. went into liquidation.

Explain the rules relating to priority of charges and state which charge

is likely to have priority.

7.

(a)

Activon Ltd. is a manufacturer of washing machines. In 2003, Activon

Ltd. made a contract with Staleglow Ltd., a manufacturer of washing

powder, in which Activon, in return for a substantial payment,

undertook that for the next five years its directors would appear in

Staleglow's television commercials and recommend Staleglow's

products for use with their machines.

In 2005, Activon's directors decided that Staleglow's washing power

was an inferior product and that by recommending it they were in fact

seriously damaging Activon's own profitability.

Advise Activon's directors.

(b)

8.

Explain the "proper purposes" doctrine governing the exercise of

discretionary powers by the board of directors of a company. What is

the rationale of this doctrine?

Churchgate Ltd. is a building company whose directors are Leopold, Rex and

Victoria. Church gate's Articles of Association include a provision that "any

transaction involving expenditure of $500,000 or more must first be approved

at a board meeting". In 2003, Churchgate acquired a site for development in

W anchai and the board appointed Marina to be the manager of the W anchai

project.

Marina asked Edward, an office junior, to order $300,000 worth of bricks for

the Wanchai project from Apollo Ltd. Edward telephoned the order and

Apollo Ltd. delivered the bricks.

Bunder & Co. were anxious to be appointed architects for the Wanchai project

and their senior partner telephoned Leopold to discuss the matter. Leopold

said that they should speak to Marina since she was "in charge of the project".

Marina appointed Bunder & Co. architects for the Wanchai project on terms

which included the payment of an "up-front" fee of$600,000.

Edward also ordered carpets and interior fittings worth $800,000 from Shelley

Ltd.

Shelley Ltd's Sales Manager telephoned Marina who confirmed

Edward's authority and Shelley Ltd. have now delivered the carpets and

fittings.

Rex and Victoria, who are dissatisfied with Marina's handling of the Wanchai

project, have summoned a board meeting claiming that Churchgate is not

liable to pay anything to Apollo Ltd., Bunder & Co. or Shelley Ltd.

Advise Apollo Ltd., Bunder & Co. and Shelley Ltd.

<<<End of Paper>>>

You might also like

- BUSI 0010 Company Laxw Draft Final Exam Paper v2Document7 pagesBUSI 0010 Company Laxw Draft Final Exam Paper v2anchgmNo ratings yet

- 2010-2011 (Sem2)Document6 pages2010-2011 (Sem2)anchgmNo ratings yet

- 2008-2009 (Sem2)Document4 pages2008-2009 (Sem2)anchgmNo ratings yet

- 2009-2010 (Sem2)Document4 pages2009-2010 (Sem2)anchgmNo ratings yet

- 2008-2009 (Sem1)Document4 pages2008-2009 (Sem1)anchgmNo ratings yet

- 2007-2008 (Sem1)Document3 pages2007-2008 (Sem1)anchgmNo ratings yet

- 2007-2008 (Sem2)Document4 pages2007-2008 (Sem2)anchgmNo ratings yet

- The University of Hong Kong School of Business 2006-2007 (SEMESTER 2) EXAMINATIONDocument4 pagesThe University of Hong Kong School of Business 2006-2007 (SEMESTER 2) EXAMINATIONanchgmNo ratings yet

- 2001-2002 (Sem1)Document2 pages2001-2002 (Sem1)anchgmNo ratings yet

- The University of Hong Kong School of BusinessDocument2 pagesThe University of Hong Kong School of BusinessanchgmNo ratings yet

- 2006-2007 (Sem1)Document5 pages2006-2007 (Sem1)anchgmNo ratings yet

- 2002-2003 (Sem2)Document3 pages2002-2003 (Sem2)anchgmNo ratings yet

- 2002-2003 (Sem1)Document3 pages2002-2003 (Sem1)anchgmNo ratings yet

- The University of Hong Kong School of Business 2003-2004 (SEMESTER 1) EXAMINATIONDocument3 pagesThe University of Hong Kong School of Business 2003-2004 (SEMESTER 1) EXAMINATIONanchgmNo ratings yet

- 2000-2001 (Sem2)Document3 pages2000-2001 (Sem2)anchgmNo ratings yet

- 2003-2004 (Sem2)Document3 pages2003-2004 (Sem2)anchgmNo ratings yet

- 2004-2005 (Sem1)Document3 pages2004-2005 (Sem1)anchgmNo ratings yet

- 2005-2006 (Sem1)Document2 pages2005-2006 (Sem1)anchgmNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LLM Company Law Course Outline 2020-2021 MNLUADocument6 pagesLLM Company Law Course Outline 2020-2021 MNLUAKatyayaniNo ratings yet

- Company Law: Maruti Suzuki India Ltd. Vs Meghna Automotives Pvt. LTDDocument24 pagesCompany Law: Maruti Suzuki India Ltd. Vs Meghna Automotives Pvt. LTDAjrocks02100% (1)

- M.S.D.C. Radharamanan Vs M.S.D. Chandrasekara Raja and ... On 14 March, 2008Document10 pagesM.S.D.C. Radharamanan Vs M.S.D. Chandrasekara Raja and ... On 14 March, 2008Knowledge GuruNo ratings yet

- Assignment Company CompleteDocument24 pagesAssignment Company CompleteIzman Rozaidi75% (4)

- Company Law NotesDocument67 pagesCompany Law NotesBrian Okuku OwinohNo ratings yet

- Ministry of Company AffairsDocument12 pagesMinistry of Company AffairsDeepak ChauhanNo ratings yet

- Meaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2Document21 pagesMeaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2smsmbaNo ratings yet

- Retrenchment Under Industrial Dispute Act, 1947Document3 pagesRetrenchment Under Industrial Dispute Act, 1947gauravNo ratings yet

- The Concept of Oppression and MismanagementDocument3 pagesThe Concept of Oppression and MismanagementKaushikNo ratings yet

- Corporate and Business Law (Zimbabwe) : Monday 9 June 2014Document4 pagesCorporate and Business Law (Zimbabwe) : Monday 9 June 2014Phebieon MukwenhaNo ratings yet

- Unit 2 Company Law - Part IIDocument25 pagesUnit 2 Company Law - Part IIDeborahNo ratings yet

- Company Law (Core) PDFDocument7 pagesCompany Law (Core) PDFsonu guptaNo ratings yet

- Share Capital and Creditor Protection Efficient Rules For A Modern Company LawDocument54 pagesShare Capital and Creditor Protection Efficient Rules For A Modern Company LawMichelle T.No ratings yet

- 2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFDocument3 pages2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFbdsrl0% (1)

- Nota Terkini Company LawDocument154 pagesNota Terkini Company LawPeter LuaNo ratings yet

- Firms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Document13 pagesFirms - Entry Tests and Interviews Guidelines (WWW - Gcaofficial.tk)Munira SheraliNo ratings yet

- Sbec Summary NotesDocument107 pagesSbec Summary NotesShobhit ShuklaNo ratings yet

- 2013 Study Analysis enDocument427 pages2013 Study Analysis enmanjuashokNo ratings yet

- 1 Corporate LawDocument63 pages1 Corporate LawYash AgarwalNo ratings yet

- Important Q and A - Company Law ICSI Ele PDFDocument143 pagesImportant Q and A - Company Law ICSI Ele PDFRashi ViRdiNo ratings yet

- Company Law Reform in Malaysia: The Role and Duties of DirectorsDocument15 pagesCompany Law Reform in Malaysia: The Role and Duties of DirectorsBenjamin Goo KWNo ratings yet

- Compounding of OffencesDocument49 pagesCompounding of Offenceskumar_anil6660% (1)

- Rule in Solomon CaseDocument18 pagesRule in Solomon CaseNurizati Jamil100% (1)

- The Evolution of The Separate Legal Personality Doctrine..., Comp. Law. 2011,..Document21 pagesThe Evolution of The Separate Legal Personality Doctrine..., Comp. Law. 2011,..Kartik RameshNo ratings yet

- 09 06 15 IDEFF Seminars AFrada CartesioDocument71 pages09 06 15 IDEFF Seminars AFrada CartesioManuelNo ratings yet

- Meetings of A Company: University Businees School, Panjab University ChandigarhDocument24 pagesMeetings of A Company: University Businees School, Panjab University ChandigarhRamneet ParmarNo ratings yet

- Promoting Employees' Interests Through Corporate Law in The New Knowledge-Based EconomyDocument28 pagesPromoting Employees' Interests Through Corporate Law in The New Knowledge-Based EconomyGareth ZhaoNo ratings yet

- Mercantile Law Cases: Siddhant Sarup 400907027Document112 pagesMercantile Law Cases: Siddhant Sarup 400907027Siddhant SarupNo ratings yet

- Corporate and Business Law (LW) - EnglishDocument16 pagesCorporate and Business Law (LW) - EnglishEnkhbold Damdinsuren100% (1)

- White Paper On Modernising Company LawDocument58 pagesWhite Paper On Modernising Company LawUnderstandableMeNo ratings yet