Professional Documents

Culture Documents

Mainland China - Interest Rates and Inflation

Uploaded by

Eduardo PetazzeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mainland China - Interest Rates and Inflation

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

Mainland China - Interest rates and inflation

by Eduardo Petazze

Last Updated: August 25, 2015

Interest rates remain strongly positive on industrial prices

With effect from August 26, 2015, the People's Bank of China (PBC) decided to cut the RMB deposit reserve ratio (RRR), combined with further reduction in the

benchmark interest rate by 25 basis points, placing the one-year deposits at 1.75% per annum and the one-year loan interest rate at 4.60%, in order to

encourage consumption and investment.

Announcements made since the end of 2014 to date fail to establish a Quantitative Easing (QE) program, so effectiveness in terms of encouraging consumption

and investment will be limited

The Central Bank of China has reduced by 25 basis points its benchmark interest rates. China's price level is still running low, so the real interest rate is higher

than the historical average

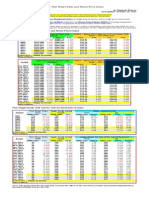

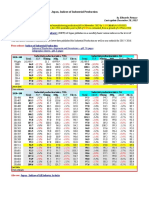

The following table shows the main rates benchmark interest.

People's Bank of China RMB benchmark deposit and lending interest rates

06 Apr 11 07 Jul 11 08 Jun 12 06 Jul 12 22 Nov 14 01 Mar 15 11 May 15 28 Jun 15

Adjusted rates, %

Deposits

(A) Demand deposits

0.50

(B) Time deposits

Three months

2.85

Half of the year

3.05

One year

3.25

Two years

4.15

Three years

4.75

Five years

5.25

Lending

Six months

5.85

One year

6.31

One to three years

6.40

Three to five years

6.65

More than five years

6.80

Individual housing provident fund loans

Five years (including five years)

4.20

More than five years

4.70

Latest data

26 Aug 15

change

0.50

0.40

0.35

0.35

0.35

0.35

0.35

0.35

0.00

3.10

3.30

3.50

4.40

5.00

5.50

2.85

3.05

3.25

4.10

4.65

5.10

2.60

2.80

3.00

3.75

4.25

4.75

2.35

2.55

2.75

3.35

4.00

2.10

2.30

2.50

3.10

3.75

1.85

2.05

2.25

2.85

3.50

1.60

1.80

2.00

2.60

3.25

1.35

1.55

1.75

2.35

3.00

-0.25

-0.25

-0.25

-0.25

-0.25

6.10

6.56

6.65

6.90

7.05

5.85

6.31

6.40

6.65

6.80

5.60

6.00

6.15

6.40

6.55

5.60

5.60

5.60

6.00

6.15

5.35

5.35

5.35

5.75

5.90

5.10

5.10

5.10

5.50

5.65

4.85

4.85

4.85

5.25

5.40

4.60

4.60

4.60

5.00

5.15

-0.25

-0.25

-0.25

-0.25

-0.25

4.45

4.90

4.20

4.70

4.00

4.50

3.75

4.25

3.50

4.00

3.25

3.75

3.00

3.50

2.75

3.25

-0.25

-0.25

Note:

From March 1, 2015 the upper limit of the floating range for deposit interest rates was raised from 1.2 to 1.3 times the benchmark level.

Since the middle of the 1st. quarter of 2015 the Standing Lending Facility Operations (SLF) was widespread throughout the country, to improve the

liquidity provision channels to small and medium-sized financial institutions

On August 26, 2015, the PBC lowered the RMB deposit reserve requirement ratio (RRR) of all financial institutions by 0.5 percentage points, from

18.5%, and additional reductions for rural, micro and small enterprises, financial leasing and auto finance companies, to encourage it to play a good role

in the expansion of consumption

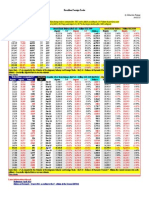

The following table shows the interest rates actually agree financial institutions in the interbank market and the evolution of purchase prices of industrial

producers.

In June 2015, the monthly weighted average interbank lending rate stood at 1.44%, up 0.02 percentage points from the previous month but down 1.41

percentage points from the same period last year. The monthly weighted average interest rate on bond pledged repo was 1.41%, up 0.11 percentage points from

the previous month but down 1.48 percentage points from the same period last year.

Link: Financial Statistics, H1 2015

Interbank Maket

Lending

Pledged Repo (*)

100 Million

Yuan and % Volume 1Volume

Volume 1Volume

Int. Rate

Int. Rate

Int. Rate

Int. Rate

Day

7-Day

Day

7-Day

2010

244,862

1.69 24,269

2.31

676,983

1.69 120,619

2.29

2011

273,200

3.17 42,401

4.02

728,667

3.17 157,023

4.10

2012

402,814

2.70 41,934

3.54 1,109,323

2.73 172,165

3.48

2013

289,636

3.01 44,024

4.17 1,201,733

3.28 196,621

4.32

2014

294,981

2.71 61,059

3.73 1,669,080

2.73 300,413

3.62

Purchaser Price Indices 2010=100

Industrial Producers (#)

Index

YoY

100.00

9.57%

109.13

9.13%

107.10

-1.86%

104.97

-2.00%

102.69

-2.17%

(#) From January 2011 the purchasing price

(*) RMB bond pledge-style repo business means a short-term RMB financing transaction with bonds as pledge index for raw materials, fuel and power

changed to the purchasing price index for

of rights, and trading amount is calculated by certain discount rate of the pledged bonds.

industrial producers

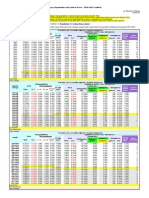

Interbank Maket

Purchaser Price Indices 2010=100

Lending

Pledged Repo (*)

Industrial Producers (#)

100 Million

Yuan and % Volume 1Volume

Volume 1Volume

Int. Rate

Int. Rate

Int. Rate

Int. Rate

Index

YoY

MoM

Day

7-Day

Day

7-Day

2012.01

15,741

4.21

3,305

4.55

48,422

4.41 10,295

4.45

108.19

2.01%

-0.31%

2012.02

27,771

3.22

3,543

4.06

72,380

3.33 17,716

4.16

108.33

0.97%

0.13%

2012.03

42,524

2.47

4,191

3.20

105,577

2.48 17,411

3.19

108.44

0.10%

0.10%

2012.04

37,186

3.18

2,986

3.86

91,594

3.17 13,320

3.85

108.47

-0.83%

0.03%

2012.05

50,007

2.13

2,276

2.98

122,484

2.12 12,068

2.94

108.15

-1.60%

-0.30%

2012.06

36,646

2.65

3,573

3.26

107,780

2.70 17,399

3.23

107.31

-2.53%

-0.77%

2012.07

42,053

2.68

3,840

3.52

103,900

2.69 17,990

3.49

106.45

-3.40%

-0.80%

2012.08

34,303

2.72

3,631

3.54

100,953

2.73 15,740

3.48

105.91

-4.09%

-0.51%

2012.09

30,994

2.79

3,538

3.54

90,382

2.87 10,886

3.42

106.02

-4.10%

0.10%

2012.10

22,345

2.73

3,658

3.17

77,801

2.69 14,025

3.17

106.14

-3.31%

0.11%

2012.11

32,078

2.41

3,502

3.26

96,692

2.40 13,214

3.19

105.94

-2.81%

-0.19%

2012.12

31,167

2.36

3,891

3.50

91,360

2.35 12,102

3.34

105.88

-2.44%

-0.06%

2013.01

33,896

2.13

3,047

3.27

115,470

2.09 12,420

3.09

106.17

-1.87%

0.27%

2013.02

23,010

2.59

3,102

3.44

78,500

2.68

9,366

3.46

106.32

-1.85%

0.15%

2013.03

30,720

2.31

4,302

3.22

109,238

2.29 15,329

3.15

106.24

-2.02%

-0.08%

2013.04

37,911

2.38

3,160

3.37

119,262

2.37 15,178

3.35

105.57

-2.67%

-0.63%

2013.05

38,622

2.80

3,953

3.71

118,167

2.87 15,101

3.65

104.92

-2.98%

-0.62%

2013.06

11,324

6.43

3,125

6.98

86,198

6.72 20,223

7.02

104.46

-2.66%

-0.44%

2013.07

18,775

3.34

3,759

4.10

93,484

3.36 18,285

4.18

104.07

-2.23%

-0.37%

2013.08

19,592

3.23

3,911

4.10

96,834

3.23 17,372

4.07

104.20

-1.62%

0.12%

2013.09

22,371

3.22

3,892

3.87

89,685

3.17 13,421

3.76

104.36

-1.56%

0.16%

2013.10

16,880

3.62

3,311

4.39

83,391

3.63 16,272

4.35

104.46

-1.59%

0.09%

2013.11

20,190

3.88

4,623

4.53

108,396

3.92 19,986

4.52

104.40

-1.45%

-0.05%

2013.12

16,345

3.71

3,839

5.17

103,108

3.84 23,668

5.26

104.40

-1.40%

-0.00%

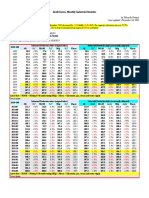

2014.01

16,783

3.36

3,864

4.84

83,561

3.41 17,244

4.71

104.33

-1.73%

-0.07%

2014.02

12,863

2.49

3,036

4.40

76,900

2.59 11,263

4.30

104.05

-2.14%

-0.26%

2014.03

26,694

2.30

3,079

3.47

130,716

2.25 17,239

3.39

103.56

-2.53%

-0.47%

2014.04

24,816

2.47

4,190

3.62

134,817

2.46 19,795

3.58

103.15

-2.30%

-0.40%

2014.05

34,823

2.44

3,316

3.31

150,891

2.41 16,070

3.23

103.04

-1.79%

-0.11%

2014.06

31,107

2.72

4,171

3.45

152,398

2.70 24,116

3.40

102.91

-1.48%

-0.12%

2014.07

26,053

3.23

5,104

3.98

152,221

3.23 32,401

3.83

102.92

-1.11%

0.01%

2014.08

19,470

2.97

6,185

3.61

144,248

2.95 30,644

3.48

102.78

-1.36%

-0.14%

2014.09

27,646

2.81

6,762

3.41

161,429

2.78 25,842

3.27

102.37

-1.91%

-0.39%

2014.10

30,502

2.52

6,456

3.18

167,028

2.51 29,220

3.08

101.80

-2.54%

-0.56%

2014.11

24,463

2.59

7,456

3.33

155,200

2.57 36,855

3.24

101.08

-3.19%

-0.71%

2014.12

19,761

2.97

7,440

4.46

159,671

3.02 39,724

4.31

100.25

-3.98%

-0.82%

2015.01

19,544

2.81

5,736

4.11

164,935

2.78 36,426

3.99

98.92

-5.18%

-1.32%

2015.02

13,448

3.07

4,569

4.73

109,735

3.05 30,336

4.65

97.92

-5.89%

-1.01%

2015.03

27,839

3.37

6,294

4.74

197,047

3.33 35,688

4.49

97.64

-5.71%

-0.29%

2015.04

34,246

2.26

6,334

3.20

241,346

2.23 30,044

2.94

97.46

-5.51%

-0.19%

2015.05

49,143

1.24

7,053

2.35

307,682

1.19 29,354

2.12

97.42

-5.46%

-0.05%

2015.06

97.19

-5.57%

-0.24%

2015.07

96.62

-6.12%

-0.58%

(#) From January 2011 the purchasing price

(*) RMB bond pledge-style repo business means a short-term RMB financing transaction with bonds as pledge index for raw materials, fuel and power

of rights, and trading amount is calculated by certain discount rate of the pledged bonds.

changed to the purchasing price index for

industrial producers

The above table is not regularly updated.

It is understood that the measures announced by the Central Bank of China do not amount to a program of Quantitative Easing (QE), which are not intended to

reduce the current deflationary process and its effectiveness in terms of encouraging consumption and investment will be limited .

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzeNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- U.S. Federal Open Market Committee: Federal Funds RateDocument1 pageU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzeNo ratings yet

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzeNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzeNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzeNo ratings yet

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNo ratings yet

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNo ratings yet

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzeNo ratings yet

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNo ratings yet

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNo ratings yet

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNo ratings yet

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzeNo ratings yet

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzeNo ratings yet

- COHR321 Module Guide S2 2019Document14 pagesCOHR321 Module Guide S2 2019Tsakane SibuyiNo ratings yet

- Marketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseDocument2 pagesMarketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseKeJuanDuBoseNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Rotisserie Affair Deli Marketing PlanDocument41 pagesRotisserie Affair Deli Marketing PlanAri EngberNo ratings yet

- Viner Cost Curves and Supply CurvesDocument25 pagesViner Cost Curves and Supply CurvesZenobio FarfNo ratings yet

- Case StudyDocument7 pagesCase StudynarenderNo ratings yet

- Fundamental RulesDocument18 pagesFundamental RulesrakeshNo ratings yet

- Astro and CosmoDocument5 pagesAstro and CosmoGerson SchafferNo ratings yet

- A Project Report: Kurukshetra University, KurukshetraDocument74 pagesA Project Report: Kurukshetra University, KurukshetrasudhirNo ratings yet

- Some Information About The Exam (Version 2023-2024 Groep T)Document17 pagesSome Information About The Exam (Version 2023-2024 Groep T)mawiya1535No ratings yet

- Resume PDFDocument1 pageResume PDFAlejandro LopezNo ratings yet

- Microeconomics Principles and Policy 13Th Edition Baumol Test Bank Full Chapter PDFDocument67 pagesMicroeconomics Principles and Policy 13Th Edition Baumol Test Bank Full Chapter PDFVeronicaKellykcqb100% (8)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Product Manager and The ProductDocument24 pagesThe Product Manager and The ProductRohitkumariluNo ratings yet

- Ennwsoct 20020Document2 pagesEnnwsoct 20020aryanNo ratings yet

- Platinum Gazette 29 July 2011Document12 pagesPlatinum Gazette 29 July 2011Anonymous w8NEyXNo ratings yet

- Adrian MittermayrDocument2 pagesAdrian Mittermayrapi-258981850No ratings yet

- MCQDocument19 pagesMCQk_Dashy846580% (5)

- Management Accounting Tutorial QuestionsDocument2 pagesManagement Accounting Tutorial Questionskanasai1992No ratings yet

- Stock Valuation and Required Rate of Return ConceptsDocument3 pagesStock Valuation and Required Rate of Return ConceptsAntonette YapNo ratings yet

- Profit & Loss: Velka Engineering LTDDocument10 pagesProfit & Loss: Velka Engineering LTDparthsavaniNo ratings yet

- Q9 HazopDocument7 pagesQ9 HazophemendraNo ratings yet

- Leads Vs ReferralsDocument1 pageLeads Vs ReferralsDhanalakshmi chandramohanNo ratings yet

- FM11 CH 10 Capital BudgetingDocument56 pagesFM11 CH 10 Capital Budgetingm.idrisNo ratings yet

- H2 EconomicsDocument6 pagesH2 EconomicsDeclan Raj0% (1)

- NIL Case Outline DigestDocument44 pagesNIL Case Outline DigestCid Benedict PabalanNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- Book of RecordsDocument395 pagesBook of RecordsareyoubeefinNo ratings yet

- Carriage and Insurance Paid To CIPDocument16 pagesCarriage and Insurance Paid To CIParun arunNo ratings yet

- Journal 1: The Role of Digital and Social Media Marketing in Consumer Behaviour I. Executive SummaryDocument10 pagesJournal 1: The Role of Digital and Social Media Marketing in Consumer Behaviour I. Executive SummaryN.SNo ratings yet

- Strengthen PECs in DressmakingDocument1 pageStrengthen PECs in DressmakingLeticia AgustinNo ratings yet

- All about Shezan's marketing strategyDocument2 pagesAll about Shezan's marketing strategySam HeartsNo ratings yet