Professional Documents

Culture Documents

Student Loan Fact Sheet - NM

Uploaded by

Pat DavisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Student Loan Fact Sheet - NM

Uploaded by

Pat DavisCopyright:

Available Formats

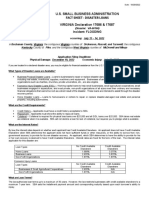

Refinancing Student Loans Fact Sheet

134,000 Student Loan Borrowers In New Mexico Would

Benefit From Refinancing

THE ISSUE

Students, families, and communities have all been affected by the

growing problem of student loan debt.

Nearly 1 in 5 U.S. households is affected by student debt.1

There are 43 million borrowers in the U.S. carrying $1.3 trillion2 in

student loan debt.

The average debt load for a 2013 bachelors degree recipient is

approximately $28,400.3

243,000 New Mexicans have student loan debt.

The total student loan debt for the state of New Mexico is

$6,141,828,000.4

Many student loan borrowers have high and unmanageable interest

rates. This not only impacts their ability to repay loans, but other life

decisions as well.

According to a report by the New York Fed, thirty-year-olds with

student loan debt were less likely to own a home than those without

student debtthe opposite of what happened pre-recession.3

For older borrowers, student loan debt may prevent parents from

contributing to their childrens college education or even delay their

own retirement.

While consumers with car and home loans have the option of lowering

their monthly payments by refinancing their loans, those with student

loans do not.

The ability to refinance student loans will help young people, families, and

seniors achieve a fair shot in this economy.

RELATED RESOURCES

Calculate Your

Refinancing Savings

Refinancing Student

Loans 101

Its Our Interest: The

Need to Reduce

Student Loan Interest

Rates

FOR MORE

INFORMATION

For more information

and to get

involved, check out

itsourinterest.org

THE SOLUTION

Earlier this year, Senator Elizabeth Warren (D-MA) and Congressman Joe

Courtney (D-CT-2) introduced the Bank on Students Emergency Loan

Refinancing Act (S. 793/H.R. 1434). This bill would allow student loan

borrowersincluding those with graduate and parent loansto refinance

their loans to a lower interest rate. For those with private loans, refinancing

student loans into the federal loan system would allow borrowers access

to programs like income-based repayment plans and public service loan

forgiveness.

1 Generation Progress

Refinancing Student Loans Fact Sheet

Allowing hardworking students and families to refinance their loans

would not only help borrowers, but also the entire economy.

A report by Generation Progress and the Center for American Progress

found that lowering student loan interest rates to 5 percent in 2013 would

have saved borrowers $14 billion and added $21 billion to the economy in

the first year alone.6

When the Congressional Budget Office analyzed similar legislation in 2014, it

determined that passing that bill would reduce the deficit by about $14 billion

during the 2015-2024 period. Estimates of the 2014 legislation also found that

refinancing student loans would have helped 25 million borrowers and saved

an average of $2,000 over the life of each loan.7

END NOTES

1. Richard Fry, A Record One-in Five

Households Now Owe Student Loan Debt:

Burden Greatest on Young, Poor (Pew

Research Center, 2012, available at http://

www.pewsocialtrends.org/2012/09/26/arecord-one-in-five-households-now-owestudent-loan-debt/

2. Meta Brown, Andrew Haughwout, Donghoon Lee, Joelle Scally, and Wilbert van der

Klaauw, The Student Loan Landscape, Liberty Street Economics, February 18, 2015,

available at http://libertystreeteconomics.

newyorkfed.org/2015/02/the_student_

loan-landscape.html#.VT6SXiTD--p

3. The Institute for College Access & Success,

Student Debt and the Class of 2013, available at http://ticas.org/sites/default/files/

legacy/fckfiles/pub/classof2013.pdf (2014)

4. The White House, Estimated Outstanding Balance and Number of Borrowers with

Outstanding Direct Loan or FFEL Loan as

of Jan. 2015, by State, available at https://

www.whitehouse.gov/sites/default/files/

docs/state_by_state_number_of_borrowers_and_outstanding_balance_final.pdf

2 Generation Progress

5. Natalie Kitroeff, Student Debt May Be

Sabotaging Your Shot at Buying a Home,

Bloomberg Business, February 18, 2015,

available at http://www.bloomberg.com/

news/articles/2015-02-18/student-debtmay-be-sabotaging-your-shot-at-buying-ahome

6. Ben Schwartz and Sarah Ayres Steinberg,

Why Millennials Arent Saving for Retirementand What We Can Do to Change

That, (Washington: Center for American

Progress, 2014), available at https://www.

americanprogress.org/issues/economy/

news/2014/07/31/94933/why-millennials-arent-saving-for-retirement-and-whatwe-can-do-to-change-that/

7. Anne Johnson and Tobin Van Ostern,

Its Our Interest: The Need to Reduce

Student Loan Interest Rates, (Washington: Center for American Progress, 2013)

available at https://www.americanprogress.org/issues/higher-education/

report/2013/02/13/53061/its-ourinterest-the-need-to-reduce-student-loaninterest-rates/

Refinancing Student Loans Fact Sheet

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- ProgressNowNM / Progressive Champions - 2016 New Mexico Progressive Voter GuideDocument11 pagesProgressNowNM / Progressive Champions - 2016 New Mexico Progressive Voter GuidePat DavisNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Nunez Complaint, Citizen Watchdog To Sec of StateDocument4 pagesNunez Complaint, Citizen Watchdog To Sec of StatePat DavisNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- "Standards For Evaluating 'Right To Work' Laws - Harvard Univ.Document4 pages"Standards For Evaluating 'Right To Work' Laws - Harvard Univ.Pat DavisNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Pablo Padilla Information/ ChargesDocument4 pagesPablo Padilla Information/ ChargesPat DavisNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Court Documents, Rebecca DowDocument42 pagesCourt Documents, Rebecca DowPat DavisNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- NM Supreme Court Order: ChandlerDocument101 pagesNM Supreme Court Order: ChandlerPat DavisNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 2016 Poll Memo: Food TaxDocument2 pages2016 Poll Memo: Food TaxPat DavisNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Andy Nunez - Sec of State ComplaintDocument44 pagesAndy Nunez - Sec of State ComplaintPat DavisNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Nate Gentry Corporate TransactionsDocument3 pagesNate Gentry Corporate TransactionsPat DavisNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- "Standards For Evaluating 'Right To Work' Laws - Harvard Univ.Document4 pages"Standards For Evaluating 'Right To Work' Laws - Harvard Univ.Pat DavisNo ratings yet

- Albuquerque Workforce Data BriefDocument9 pagesAlbuquerque Workforce Data BriefPat DavisNo ratings yet

- 2016 Poll Memo: Crime IssuesDocument2 pages2016 Poll Memo: Crime IssuesPat DavisNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Money On The SidelinesDocument25 pagesMoney On The SidelinesPat DavisNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- NM Supreme Court Order: ChandlerDocument101 pagesNM Supreme Court Order: ChandlerPat DavisNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Emails: Drafting of PNM-sponsored Resolution by Santa Fe City Councilor Patti BusheeDocument80 pagesEmails: Drafting of PNM-sponsored Resolution by Santa Fe City Councilor Patti BusheePat DavisNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- NMHIX Board Meeting, Jan 9, 2015Document50 pagesNMHIX Board Meeting, Jan 9, 2015Pat DavisNo ratings yet

- Transcript of Former PNM Plant ManagerDocument66 pagesTranscript of Former PNM Plant ManagerPat DavisNo ratings yet

- New Mexico Health Exchange Application, November 2014Document121 pagesNew Mexico Health Exchange Application, November 2014Pat DavisNo ratings yet

- ProgressNowNM 2014 Progressive's Voter GuideDocument3 pagesProgressNowNM 2014 Progressive's Voter GuidePat DavisNo ratings yet

- Talking About DecrimNM CampaignDocument1 pageTalking About DecrimNM CampaignPat DavisNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Travel Expenses - Rep. Sandra JeffDocument1 pageTravel Expenses - Rep. Sandra JeffPat DavisNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Final Administrative Investigative ReportDocument19 pagesFinal Administrative Investigative ReportPat DavisNo ratings yet

- Santa Fe Petition Packet - Reducing Marijuana Penalties CampaignDocument4 pagesSanta Fe Petition Packet - Reducing Marijuana Penalties CampaignPat DavisNo ratings yet

- Press Release: Investigation Into Deleted EmailsDocument1 pagePress Release: Investigation Into Deleted EmailsPat DavisNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Voter Registration Fraud Investigation - Amy Orlando & Jay McCleskeyDocument13 pagesVoter Registration Fraud Investigation - Amy Orlando & Jay McCleskeyPat Davis100% (1)

- Albuquerque Petition Packet - Reducing MJ Penalties CampaignDocument4 pagesAlbuquerque Petition Packet - Reducing MJ Penalties CampaignPat DavisNo ratings yet

- Court Filing - Serving Subpoena at Sandra Jeff's 'Crownpoint' HomeDocument2 pagesCourt Filing - Serving Subpoena at Sandra Jeff's 'Crownpoint' HomePat DavisNo ratings yet

- ABQ Petition Sheet (See Instructions Before Printing)Document1 pageABQ Petition Sheet (See Instructions Before Printing)Pat DavisNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Albuquerque Petition Packet - Reducing MJ Penalties CampaignDocument4 pagesAlbuquerque Petition Packet - Reducing MJ Penalties CampaignPat DavisNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Scribd 8.29Document16 pagesScribd 8.29liz6085No ratings yet

- Santa Cruz Sentinel 02142022Document12 pagesSanta Cruz Sentinel 02142022Thomas WrightNo ratings yet

- Tax avoidance linked to higher corporate debt levelsDocument20 pagesTax avoidance linked to higher corporate debt levelsRisa Nadya SafrizalNo ratings yet

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- LATEST Finalized - Report TIDDocument25 pagesLATEST Finalized - Report TIDIyLiaorohimaru SamaNo ratings yet

- Financial Modeling and ForecastingDocument59 pagesFinancial Modeling and ForecastingYamini Divya KavetiNo ratings yet

- Microfinance and Entrepreneurship Development in Idia 1Document12 pagesMicrofinance and Entrepreneurship Development in Idia 1ram praveshNo ratings yet

- Kim Hoff PAR 117 JDF 1115 Separation AgreementDocument9 pagesKim Hoff PAR 117 JDF 1115 Separation AgreementlegalparaeagleNo ratings yet

- Hold vs. Dispose Analysis Full Book 2413Document50 pagesHold vs. Dispose Analysis Full Book 2413Shawn Salimian100% (1)

- How Money Works BookDocument44 pagesHow Money Works Bookjanemoraa2005No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Book of Home Finance: David L. HershmanDocument142 pagesBook of Home Finance: David L. Hershmanmm7ymasNo ratings yet

- Home Buying Case StudyDocument8 pagesHome Buying Case Studyapi-319606475No ratings yet

- What Is A Deed of ReconveyanceDocument12 pagesWhat Is A Deed of ReconveyanceBadronDimangadapNo ratings yet

- SEC v. Morgan Case 1:19-cv-00661Document31 pagesSEC v. Morgan Case 1:19-cv-00661Rochester For AllNo ratings yet

- 20130208Document40 pages20130208philline2009No ratings yet

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Document33 pagesPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNo ratings yet

- Dark Side of Universal BankingDocument89 pagesDark Side of Universal BankingTrương Nguyễn Quốc HuyNo ratings yet

- USA v. Michael Cohen - Criminal Information 8-21-2018Document22 pagesUSA v. Michael Cohen - Criminal Information 8-21-2018Legal InsurrectionNo ratings yet

- Classify Liabilities as Current or NoncurrentDocument5 pagesClassify Liabilities as Current or NoncurrentGirl lang0% (1)

- Financial Analysis of Banks in BangladeshDocument21 pagesFinancial Analysis of Banks in Bangladeshjobayer al-mahmudNo ratings yet

- Zach DeGregorio Civil Complaint Filed 01-03-2022Document261 pagesZach DeGregorio Civil Complaint Filed 01-03-2022DamienWillisNo ratings yet

- JM Financial Home - CRISIL - CleanedDocument8 pagesJM Financial Home - CRISIL - CleanedSrinivasNo ratings yet

- Scooping and Tossing Puerto Rico's FutureDocument8 pagesScooping and Tossing Puerto Rico's FutureRoosevelt Institute100% (2)

- Current Liab Trade and Other PayablesDocument6 pagesCurrent Liab Trade and Other PayablesRamainne Chalsea RonquilloNo ratings yet

- Expert Finance and IT Project Manager with 12+ Years ExperienceDocument4 pagesExpert Finance and IT Project Manager with 12+ Years ExperienceLtr ItvNo ratings yet

- Mar 102022 Smespd 02 eDocument83 pagesMar 102022 Smespd 02 esalam ahmedNo ratings yet

- Property Assessed Clean EnerDocument41 pagesProperty Assessed Clean Enermd shoebNo ratings yet

- MGMT E-2037 - Syllabus - 15.09.13Document11 pagesMGMT E-2037 - Syllabus - 15.09.13abondadaNo ratings yet

- Module 6 - LiabilitiesDocument11 pagesModule 6 - LiabilitiesLuiNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Rich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouFrom EverandRich Nurse Poor Nurses The Critical Stuff Nursing School Forgot To Teach YouNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)