Professional Documents

Culture Documents

Account Answers Utar Tutorial

Uploaded by

sadyehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account Answers Utar Tutorial

Uploaded by

sadyehCopyright:

Available Formats

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 1

1.

2. Accounting equation

Assets = Capital + Liabilities

AL=C

-

depicts the relationship between assets, liabilities and owners equity.

shows the financial position of a business entity at a particular date.

can be presented in the form of balance sheet.

the total of one part is always equal to the total of the other part.

Statement of Financial Position as at XXX

Assets

Liabilities

Capital

3.

4.Fatimah

UKAF 1033 Business Accounting 1

Jan 2011

5. Johari

6.Kok Heng

Tutorial 2

Q.1

Debited

Credited

Debited

Credited

(a) Lorry

(c) Loan from

(e) Machinery

(g) Bank

(i) Cash

Cash

Cash

Amal

Siva

Bala

(b) Siti

(d) Cash

(f) Cash

(h) Bank

(j) Lam

Bank

Van

Ho

Capital

Cash

UKAF 1033 Business Accounting 1

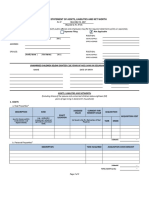

Q.2

Date

Mar 1

Mar 2

Mar 3

Mar 5

Mar 8

Mar 15

Mar 17

Mar 24

Mar 31

Q.3

Jan 2011

Particulars

Dr Cash

Dr Bank

Cr Capital

Dr

750

9,000

Dr Bank

Cr Dala (Loan creditor)

2,000

Dr Equipment (Computer)

Cr Cash

600

Dr Equipment (display equipment)

Cr Chin Enterprise

420

Dr Cash

Cr Bank

200

Dr Dala

Cr Bank

500

Dr Chin Enterprise

Cr Bank

420

Dr Dala

Cr Cash

250

Dr Equipment (Printer)

Cr Lim

200

Cr

9,750

2,000

600

420

200

500

420

250

200

Fendy

1

24

28

Capital

Wong

Biz rates

28

bank

28

bank

10

28

returns out

bank

11000

250

45

830

6100

195

415

Bank

5 Stationery

16 biz rates

19 rent

28 ben

28 mardi

28 betty

62

970

75

830

415

6100

Ben

2 Purchases

830

betty

20 motor vehi

6100

mardi

2 purchases

610

capital

1600

Cash

3 purchases

4 rent

7 wages

11 rent

18 insurance

21 motor exp

23 wages

370

75

160

75

280

24

170

Sales

6 tam

6 husin

6 wong

15 lee

15 sharee

15 rashid

370

290

410

205

280

426

UKAF 1033 Business Accounting 1

lam

2 purchases

Jan 2011

13

husin

590

Returns outwards

10 mardi

tam

6

Sales

Returns Inwards

35

195

370

rent

sales

290

husin

13 returns in

4

11

19

cash

cash

cash

Sales

410

wong

24 bank

16

Bank

biz rates

970 28 bank

sharee

7

23

cash

cash

wages

160

170

rashid

Bank

stationery

62

18

cash

insurance

280

21

cash

motor exp

24

20

betty

35

250

75

75

75

45

lee

15

15

15

sales

Sales

sales

205

280

426

Capital

1 Bank

1 cash

2

2

2

3

ben

mardi

lam

cash

purchases

830

610

590

370

11000

1600

motor vehicle

6100

Tutorial 3

1. Joe Trading

UKAF 1033 Business Accounting 1

Jan 2011

2. Kim

3. Gary

UKAF 1033 Business Accounting 1

Jan 2011

4.

5. (a) Purpose of day books

- segregation of duties different bookeepers

- provides a means of internal control to prevent fraud

- facilitates the location of errors and ensuring accuracy of ledgers

(b) Sales day book: Invoice

Purchases day book: Suppliers Invoice

Sales return day book: Credit note

Purchases return day book: Debit note

Contents:- Date on which each transaction took place

- Name and contact information of the addressee

- Details or description relating to the sales/purchases/returns

transaction (e.g: name of the goods, no. of items).

- Folio column entry for cross referencing back to the original source

documents

- Monetary amounts of the goods

Tutorial 4

1.

UKAF 1033 Business Accounting 1

Jan 2011

2. Kedai Runcit Shaari

3. Purpose of trial balance

(a) to ascertain whether the total of the accounts with debit balances equals the

total of the accounts with credit balances (matching credit entry for every debit

entry).

(b) to prove arithmetic accuracy of the ledger accounts.

(c) to assist in the preparation of financial statements.

UKAF 1033 Business Accounting 1

Jan 2011

4.

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 5

1.

Trial Balance as at 31 Dec 2007

RM

Capital

Drawings

Loan- Public Bank

Leasehold premises

Motor vehicles

Investment

Trade debtors

Trade creditors

Cash

Bank overdraft

Sales

Purchases

Returns outwards

Returns inwards

Carriage

Wages and salaries

Rent and rates

Light and heat

Telephone and postage

Printing and stationery

Bank interest

Interest received

RM

39,980

14,760

20,000

52,500

13,650

4,980

2,630

1,910

460

3,620

81,640

49,870

960

840

390

5,610

1,420

710

540

230

140

148,730

620

148,730

UKAF 1033 Business Accounting 1

Jan 2011

2

.

10

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 6

1.

Balance b/d

Beh

2,740

201

Cash Book

Bank charges

Gina

Balance c/d

2,941

Bank Reconciliation statement as on 31 March 2008

Balance as per cash book

Add: Unpresented cheque

Less: Lodgements not yet credited

Balance as per bank statement

32

93

2816

2,941

2816

131

2947

410

2537

2.Hogan

11

UKAF 1033 Business Accounting 1

Jan 2011

3. Thomas Lee

4. King

12

UKAF 1033 Business Accounting 1

5. Han Chung Trading

(a)

Balance b/f

Receipts (15,073-47-18)

(b)

Jan 2011

Cash Book

RM

1,470 Payments (15,520+47)

15,008 Bank charges

Balance c/f

16,478

RM

15,567

35

876

16,478

Bank Reconciliation Statement as on 31 Oct 2007

RM

Balance as per cash book

Add

Unpresented cheques (214+370+30)

614

Less

Uncredited lodgements

Bank error in debiting account

Balance as per bank statement

1,542

72

RM

876

614

1,490

1,614

(124)

6. Factors causing the differences:(a) Timing differences

Uncredited lodgements and unpresented cheques

(b) Omissions and errors

Omissions of transactions such as bank charges, standing order, direct debit,

credit transfer, dishonoured cheque of third parties; and errors in cash book.

13

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 7

1.

2.

14

UKAF 1033 Business Accounting 1

Jan 2011

3.

15

UKAF 1033 Business Accounting 1

Jan 2011

4.

16

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 8

1.

2.

17

UKAF 1033 Business Accounting 1

Jan 2011

3.Didi

4.

(a)

Journal

Bank

Thong

(Being receipt of RM500 towards debt previously written off)

Thong

Bad debts recovered account

(Being reversal of debt previously written off)

Debit Credit

RM

RM

500

500

500

500

18

UKAF 1033 Business Accounting 1

(b)

(c)

Provision for doubtful debts

RM

Balance c/d

1,045

Balance b/d

(22,000-800-300)*5%

P+L

1,045

Jan 2011

RM

900

145

1,045

Balance Sheet as at 30 Nov 2007

RM

Current Asset

Trade Debtors (22,000-1,100)

Less: Provision for doubtful debts

20,900

1,045

19,855

5.

19

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 9

1. Hikmat Trading

20

UKAF 1033 Business Accounting 1

Jan 2011

2. Bakti Enterprise

3. Ori Sdn Bhd

2006

1-Jun

1-Jul

30-Sep

1-Oct

2007

1-Jan

1-Apr

1-Jun

Prepaid rent b/d

Bank- Q3

Bank- Rates

Bank- Q4

Bank- Q1

Bank- Q2

Accrual rates c/d

Prepaid b/d

Rent and Rates

RM

2006

200

1-Jun

600

2,040

600

750

750

380

5,320

250

Accrual rates b/d

31-May

31-May

31-May

P+L (Rates)

P+L (Rent)

Prepaid rent c/d

1-Jun

Accrual rates b/d

RM

340

2,080

2,650

250

5,320

380

Workings: P+L (Rent) = 7*200 (Jun-Dec'06) +

5*250 (Jan-May'07)

= 2,650

P+L (Rates) = 10*170 (Jun'06-Mar'07) +

2*190 (Apr'07-May'07)

= 2,080

b) Matching principles refers to the assumption that in the measurement of profit,

costs should be set against the revenue which they generate at the point in time

when this arises.

In this case, the rent and rates expenses are matched according to the

accounting period. Expenses give rise to certain effects which take the form of

revenue. Matching is thus the determination of profit by attributing specific

causes to particular effects at the point in time at which the effects occur.

21

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 10

1. Soon

Statement of Comprehensive Income for the year ended 31 Dec 2008

RM

Sales (1000+250+8+3-200)

Less: Cost of sales

Opening stock

Purchases (700+160-180)

200

680

880

230

less: Closing stock

Gross profit

Less: Expenditure

Rent (8+30-10)

Insurance (12+20+6)

Electricity (25+7-9)

Telephone (10-2-1)

Wages

Discounts allowed

Bad debts written off

Depreciation

28

38

23

7

100

8

3

50

Statement of Financial Position as at 31 Dec 2008

RM

RM

Fixed assets (350-50)

Current Assets

Trade debtors

Stock

Bank (20+1000-700-185-50)

Prepayments (10+2)

Less: Current Liabilities

Accruals (7+6)

Trade creditors

Net current assets

Capital

Balance as at 1 Jan 2008

Add: Net profit

Less: Drawings

RM

1,061

650

411

257

154

RM

300

250

230

85

12

577

13

160

173

404

704

600

154

754

50

704

22

UKAF 1033 Business Accounting 1

Jan 2011

2.

23

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 11

1.

2.

3.

24

UKAF 1033 Business Accounting 1

Jan 2011

4. Types of error that do not affect the trial balance agreement

(a) Error of omission

A transaction is completely omitted from the books.

(b) Error of principle

An entry is made in the wrong class of account.

(c) Error of commission

An entry is posted to the wrong persons account.

(d) Error of original entry

The double entry principle is correct but error occurs in the original documents

where the figure is incorrect.

(e) Complete reversal of entry

An account that should be credited is debited and vice versa.

(f) Compensating error

Errors occur and cancel each other out.

Tutorial 12

1. Regent Sdn Bhd

a)

i) Bank Charges

Cash

RM

56

56

ii) Creditors control

Purchases

400

iii) Debtors control

Sales

100

400

100

iv) Creditors control/ Amin Trading

Purchases

90

v) Bad debts

Debtors control/ Shanie

88

vi) Motor expenses

Motor Vehicle

vii) Accumulated Depreciation

Depreciation

RM

90

88

550

550

55

55

25

UKAF 1033 Business Accounting 1

b)

Jan 2011

Statement of Corrected Net Profit for the year ended 31 May 2008

RM

Net profit as per draft final account

305,660

Add: Purchases overcast

400

Sales undercast

100

Error in purchases journal

90

Wrongly accounted depreciation

55

645

Less: Bank charges

Bad debts

Repair and maintenance

56

88

550

694

305,611

2.

3. Gail Dawson

26

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 13

1.

2.

27

UKAF 1033 Business Accounting 1

Jan 2011

3.

4.

Balance b/d

Sales

Cash

Interest on overdue account

Balance c/d

Balance b/d

Debtors' Ledger Control

RM

7,182 Cash

69,104 Discounts allowed

66 Returns inwards

10 Bills receivable

42 Bad debts

Creditors ledger control

Balance c/d

76,404

RM

59,129

1,846

983

3,243

593

303

10,307

76,404

10,307

5. Purpose of Control Accounts

- to provide a check on the accuracy of the ledger

- to facilitate the location of erros higlighted in the trial balance by pinpointing

the personal ledger

- deter fraud and ensure proper segregation of duties

- facilitate the extraction of balances on creditors and debtors, whereby

information is obtained immediately from control accounts

28

UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 14

1. Balan

2. Othman

29

UKAF 1033 Business Accounting 1

Jan 2011

3. Amal

Sales

Statement of Comprehensive Income for the year ended 31 May 2008

RM

RM

405,000

Less: Cost of sales

Opening stock

Purchases (259,600-1,040)

less: Closing stock

Gross profit

Add: Discounts received

Reduction in provision of doubtful debts ([0.5%*46,200]-280)

Less: Expenditure

Discounts allowed

Wages and salaries (52,360+140)

Bad debts

Loan interest

Carriage outwards

Other operating expenses (38,800-500+200)

Depreciation on property (90,000*1%)

Depreciation on equipment (57,500*15%)

27,400

258,560

285,960

25,900

260,060

144,940

4,420

49

149,409

3,370

52,500

1,720

1,560

5,310

38,500

900

8,625

112,485

36,924

Net profit

Statement of Financial Position as at 31 May 2008

RM

RM

Cost

Acc. Depn

Fixed Assets

Property

Equipment

90,000

57,500

Current Assets

Stock

Trade debtors

Less: Provision of bad debts

Cash on hand

Prepayment

46,200

231

Less: Current Liabilities

Bank overdraft

Accruals (140+200)

Trade creditors

Net current assets

14,500

340

33,600

13,400

41,125

RM

NBV

76,600

16,375

92,975

25,900

45,969

151

500

72,520

48,440

24,080

117,055

30

UKAF 1033 Business Accounting 1

Jan 2011

Less: Long term liability

13% loan

Net assets

12,000

105,055

Capital

Balance at 1 June 2007

Add: Net profit

98,101

36,924

135,025

29,970

105,055

Less: Drawings (28,930+1,040)

4. Tim

Sales

Statement of Comprehensive Income for the year ended 30 Sep 2007

RM

RM

203,845

Less: Cost of sales

Opening stock

Purchases (167,760-112)

less: Closing stock

Gross profit

Add: Discounts received

Less: Expenditure

Rent (1,350+450)

Light and heat (475+136)

Insurance

Salaries

Stationery and printing

Telephone and postage

General Expenses (2,044+252)

Travellers commission and expenses (9,925+806)

Discounts allowed

Bad debts written off

Provision for doubtful debts

Depreciation on office furniture and equipment (1,440*10%)

Net profit

14,972

167,648

182,620

12,972

169,648

34,197

955

35,152

1,800

611

304

6,352

737

517

2,296

10,731

517

331

430

144

24,770

10,382

31

UKAF 1033 Business Accounting 1

Jan 2011

Statement of Financial Position as at 30 Sep 2007

RM

RM

Fixed Assets

Office furniture and equipment (1,440-144)

Current Assets

Stock

Debtors

Less: Provision of bad debts

Bank

Petty cash in hand

Less: Current Liabilities

Accruals (450+136+806+252)

Trade creditors

Net current assets

RM

1,296

12,972

19,100

573

1,644

8,162

18,527

6,603

29

38,131

9,806

28,325

29,621

Capital

Balance at 1 June 2007

Add: Net profit

24,239

10,382

34,621

5,000

29,621

Less: Drawings (4,888+112)

5.

Statement of Comprehensive Income for the year ended 31 Jan 2006

RM

RM

Sales (50,240-300)

Less: Return inwards

Less: Cost of sales

Opening stock

Purchases

less: Return outwards

13,630

42,400

348

less: Closing stock (15,450+240)

Gross profit

Add: Gain on sales of motor vehicle

Less: Expenditure

Salaries and wages

Rent, rates and insurance (860+36-60-10)

Sundry expenses (750+90)

Provision for doubtful debts (340-280)

Bad debts

Depreciation on fixtures and fittings (1400*10%+240*4/12*10%)

Depreciation on motor vehicles ([920-80]*25%)

Net profit

RM

49,940

136

49,804

42,052

55,682

15,690

39,992

9,812

40

9,852

4,100

826

840

60

134

148

210

6,318

3,534

32

UKAF 1033 Business Accounting 1

Jan 2011

Statement of Financial Position as at 31 Jan 2006

RM

Fixed Assets

Fixture and fittings

Motor Vehicle

1,640

840

Current Assets

Stock

Sundry debtors (4,610-300)

Less: Provision of bad debts

Prepayments (60+10)

Cash at bank and in hand

4,310

340

Less: Current Liabilities

Accruals (36+90)

Sundry creditors

Net current assets

126

3,852

Capital

Balance at 1 June 2007

Add: Net profit

Less: Drawings

RM

148

210

RM

1,492

630

2,122

15,690

3,970

70

3,820

23,550

3,978

19,572

21,694

20,760

3,534

24,294

2,600

21,694

Workings: Profit of 20% on sales price

x

100

=

240

80

x

=

RM300

33

You might also like

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622No ratings yet

- Venture Capital ValuationDocument8 pagesVenture Capital Valuationgnachev_4100% (4)

- Accounting Grade 8 MemorandumDocument5 pagesAccounting Grade 8 MemorandumTasniem Stemmet Boltman29% (14)

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- CHP 12 - Practice Question List (By Sir Hasan Dossani)Document7 pagesCHP 12 - Practice Question List (By Sir Hasan Dossani)aditi shenoyNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Solution Past Paper Higher-Series4-08hkDocument16 pagesSolution Past Paper Higher-Series4-08hkJoyce LimNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Week 6 - Solutions (Some Revision Questions)Document13 pagesWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- Analyzing accounting transactions and journal entriesDocument7 pagesAnalyzing accounting transactions and journal entriesThirdyOjela0% (1)

- Reply - EPFO Apex Court Contempt Petition - HPTDC Union PDFDocument22 pagesReply - EPFO Apex Court Contempt Petition - HPTDC Union PDFSudhaNo ratings yet

- Legal Data for Banking: Business Optimisation and Regulatory ComplianceFrom EverandLegal Data for Banking: Business Optimisation and Regulatory ComplianceNo ratings yet

- Pricing Model For Infosys BPO LimitedDocument4 pagesPricing Model For Infosys BPO LimitedAdil JahangeerNo ratings yet

- Diamond Paint ReportDocument21 pagesDiamond Paint Reportialimughal100% (4)

- Brief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceDocument6 pagesBrief Exercises BE2 - 1: No. Account (A) Debit Effect (B) Credit Effect (C) Normal BalanceRakibul Islam Khan83% (6)

- The Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaFrom EverandThe Red Dream: The Chinese Communist Party and the Financial Deterioration of ChinaNo ratings yet

- Book-Keeping and Accounts/Series-4-2011 (Code2007)Document16 pagesBook-Keeping and Accounts/Series-4-2011 (Code2007)Hein Linn Kyaw100% (1)

- 2010 Papers and Memos PDFDocument29 pages2010 Papers and Memos PDFTshegofatso NtsimeNo ratings yet

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- CH 02Document7 pagesCH 02Arian MorinaNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- ACCA Dec 2011 F7 Mock PaperDocument10 pagesACCA Dec 2011 F7 Mock PaperCharles AdontengNo ratings yet

- Hacp130 1 Jul Dec2021 Fa1 GT V3 02082021Document8 pagesHacp130 1 Jul Dec2021 Fa1 GT V3 02082021vanessa.ryder15No ratings yet

- Accounting For Managers GTU Question PaperDocument3 pagesAccounting For Managers GTU Question PaperbhfunNo ratings yet

- UKMM1043 Basic Economics, Accounting and Management Tutorial 4 (Suggested Answer)Document2 pagesUKMM1043 Basic Economics, Accounting and Management Tutorial 4 (Suggested Answer)kenneth lohNo ratings yet

- 0452 s11 QP 22Document20 pages0452 s11 QP 22Athul TomyNo ratings yet

- Accounts PGDMDocument48 pagesAccounts PGDMMeghali BarmanNo ratings yet

- Project Account Form 5 (Senior Year) Amira AthirahDocument26 pagesProject Account Form 5 (Senior Year) Amira AthirahRoselynna MusleemNo ratings yet

- Paper 11Document51 pagesPaper 11eshwarsapNo ratings yet

- Pac Ver Finalans KeyDocument10 pagesPac Ver Finalans KeyArun LalNo ratings yet

- 2.recording ProcessDocument30 pages2.recording Processwpar815No ratings yet

- Ectangle Harmaceuticals TD: Prepared byDocument8 pagesEctangle Harmaceuticals TD: Prepared byOndhotara AkasheNo ratings yet

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocument12 pagesBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11No ratings yet

- Acct1501 Tut 4 HWDocument5 pagesAcct1501 Tut 4 HWjroflcopterNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- QUESTION 1 - Multiple Choice (15 Marks)Document24 pagesQUESTION 1 - Multiple Choice (15 Marks)Juanita AddinallNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Accounting Mechanics: DR Amit Kumar SinhaDocument11 pagesAccounting Mechanics: DR Amit Kumar SinhaAmit SinhaNo ratings yet

- Final Done Assigment (Account) MokDocument14 pagesFinal Done Assigment (Account) MokMRSUNGSUNGNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelDocument8 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Subsidiary Level and Advanced LevelSherjeel AhmedNo ratings yet

- Exercise Chap 7Document16 pagesExercise Chap 7JF FNo ratings yet

- Arya Bima Putra - 215020300111071 - CH - Tugas1Document3 pagesArya Bima Putra - 215020300111071 - CH - Tugas1Arya Bima PutraNo ratings yet

- Financial Accounting Adjustments Trial BalanceDocument5 pagesFinancial Accounting Adjustments Trial BalanceMohamed ThabithNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- FAC1503 Lecture 1Document14 pagesFAC1503 Lecture 1Beverly JohnNo ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- ACC1006 EOY Essay DrillDocument13 pagesACC1006 EOY Essay DrillTiffany Tan Suet YiNo ratings yet

- Faculty of Management: Financial Accounting and AnalysisDocument11 pagesFaculty of Management: Financial Accounting and AnalysisHari KrishnaNo ratings yet

- Auditor's responsibilities for subsequent eventsDocument3 pagesAuditor's responsibilities for subsequent eventsVenniah MusundaNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- 0452 s11 Ms 22Document9 pages0452 s11 Ms 22Athul TomyNo ratings yet

- Libby Financial Accounting Chapter2Document12 pagesLibby Financial Accounting Chapter2Jie Bo TiNo ratings yet

- 046334c2-eae8-4012-9bf0-5cad15fb28b3Document14 pages046334c2-eae8-4012-9bf0-5cad15fb28b3Nici VanderwaltNo ratings yet

- Account PaperDocument3 pagesAccount PaperJay WilliamsNo ratings yet

- Financial Accounting Suggested AnswersDocument6 pagesFinancial Accounting Suggested Answersaqsa_22inNo ratings yet

- 0452 s11 QP 21Document24 pages0452 s11 QP 21Athul TomyNo ratings yet

- Bankard's Quarterly Report for 3rd Quarter 2011Document16 pagesBankard's Quarterly Report for 3rd Quarter 2011Ryan Samuel C. CervasNo ratings yet

- 2010 LCCI Bookkeeping and Accounts Series 3Document8 pages2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- CAP-III Advanced Financial ReportingDocument17 pagesCAP-III Advanced Financial ReportingcasarokarNo ratings yet

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksFrom EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNo ratings yet

- Formula List ProgressionDocument1 pageFormula List ProgressionyindichonNo ratings yet

- Formula List ProgressionDocument1 pageFormula List ProgressionsadyehNo ratings yet

- 170S1Document22 pages170S1sadyeh100% (1)

- Modul 1 - Bab 1-5 - Ting 2Document20 pagesModul 1 - Bab 1-5 - Ting 2sadyehNo ratings yet

- EXERCISE CHAPTER 6: Land & Its Resources: Latihan Bab 6: Tanah & SumbernyaDocument20 pagesEXERCISE CHAPTER 6: Land & Its Resources: Latihan Bab 6: Tanah & SumbernyasadyehNo ratings yet

- Modul 2.2Document14 pagesModul 2.2sadyehNo ratings yet

- QuadraticDocument22 pagesQuadraticsadyehNo ratings yet

- Chapter 6: Land & Its Resources: Bab 6: Tanah & SumbernyaDocument13 pagesChapter 6: Land & Its Resources: Bab 6: Tanah & SumbernyasadyehNo ratings yet

- 2.1 The Importance of Nutrition & Good Eating HabitsDocument22 pages2.1 The Importance of Nutrition & Good Eating HabitssadyehNo ratings yet

- NO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan JawapanDocument1 pageNO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan Jawapan NO. Soalan JawapansadyehNo ratings yet

- Modul 2.3Document10 pagesModul 2.3sadyehNo ratings yet

- Microorganisms & Their Effects On Living Things: Science Form 5Document14 pagesMicroorganisms & Their Effects On Living Things: Science Form 5sadyehNo ratings yet

- Chapter 3: Preservation & Conservationof Environment: By: MR Sathya SeelanDocument26 pagesChapter 3: Preservation & Conservationof Environment: By: MR Sathya SeelansadyehNo ratings yet

- Ujian Bab 3Document12 pagesUjian Bab 3sadyehNo ratings yet

- Exercise Chapter 4: Reproduction (Part 1) : Latihan Bab 4: Pembiakan (BHG 1)Document20 pagesExercise Chapter 4: Reproduction (Part 1) : Latihan Bab 4: Pembiakan (BHG 1)sadyehNo ratings yet

- Exercise Chapter 4: Reproduction (Part 2) : Latihan Bab 4: Pembiakan (BHG 2)Document12 pagesExercise Chapter 4: Reproduction (Part 2) : Latihan Bab 4: Pembiakan (BHG 2)sadyehNo ratings yet

- Science / Sains Form 3 Chapter 1: Respiration (Respirasi) : By: MR Sathya Seelan 1Document7 pagesScience / Sains Form 3 Chapter 1: Respiration (Respirasi) : By: MR Sathya Seelan 1sadyehNo ratings yet

- Nota Bab 4 - Part 1Document16 pagesNota Bab 4 - Part 1sadyehNo ratings yet

- Ujian Bab 2Document21 pagesUjian Bab 2sadyehNo ratings yet

- Sains / Science Form 3: By: MR Sathya SeelanDocument5 pagesSains / Science Form 3: By: MR Sathya SeelansadyehNo ratings yet

- Bab 3: Perkumuhan: Sains/Science Form 3Document4 pagesBab 3: Perkumuhan: Sains/Science Form 3sadyehNo ratings yet

- Diagnostic Test 1: Home Tuition With Tutor SathyaDocument9 pagesDiagnostic Test 1: Home Tuition With Tutor SathyasadyehNo ratings yet

- Mathematics Form 5: By: MR Sathya Seelan 1Document12 pagesMathematics Form 5: By: MR Sathya Seelan 1sadyehNo ratings yet

- Latihan Bab 3Document19 pagesLatihan Bab 3sadyehNo ratings yet

- Nota - Bab 2Document11 pagesNota - Bab 2sadyehNo ratings yet

- Chapter 1 Respiration Doc1Document6 pagesChapter 1 Respiration Doc1api-248021925No ratings yet

- Latihan Bab 2Document19 pagesLatihan Bab 2sadyehNo ratings yet

- Topics & ImportanceDocument1 pageTopics & ImportancesadyehNo ratings yet

- Pusat Tuisyen Meka Bestari & Indera: Bab 3: Daya & Tekanan Chapter 3: Force & PressureDocument11 pagesPusat Tuisyen Meka Bestari & Indera: Bab 3: Daya & Tekanan Chapter 3: Force & PressuresadyehNo ratings yet

- Analisis 2017Document5 pagesAnalisis 2017sadyehNo ratings yet

- IAS 36 - Presentation PDFDocument17 pagesIAS 36 - Presentation PDFRizwanChowdhuryNo ratings yet

- Module+5 1Document10 pagesModule+5 1Franco James SanpedroNo ratings yet

- Chapter 3ADocument27 pagesChapter 3AYeabkal BelegeNo ratings yet

- Bank Officer Resume SampleDocument8 pagesBank Officer Resume Sampleafdlxeqbk100% (1)

- Sport Zone Shoe Sourcing & Profit MaximizationDocument2 pagesSport Zone Shoe Sourcing & Profit MaximizationJotham HensenNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemAmieMatira50% (2)

- Beware 13122019-2Document19 pagesBeware 13122019-2nnadoziekenneth5No ratings yet

- Philippine Accountancy ActDocument9 pagesPhilippine Accountancy ActPrince DoomedNo ratings yet

- Movie Gallery growth by focusing on rural marketsDocument10 pagesMovie Gallery growth by focusing on rural marketsVageesh KumarNo ratings yet

- Chriyha, Adil, Zitouni Beidouri, and Otmane Bouksour. 2012. Proposal of A Performance Model Based On The Balanced Scorecard ForDocument8 pagesChriyha, Adil, Zitouni Beidouri, and Otmane Bouksour. 2012. Proposal of A Performance Model Based On The Balanced Scorecard Forkamel.jNo ratings yet

- Amul and India's National Dairy Development Board: Group T2Document12 pagesAmul and India's National Dairy Development Board: Group T2Sameep LuthraNo ratings yet

- Statement of Cash FlowsDocument11 pagesStatement of Cash FlowsBri CorpuzNo ratings yet

- Case Study 3 - Pepsi 2009Document6 pagesCase Study 3 - Pepsi 2009AHMAD EIZATT BIN IDLANA -No ratings yet

- Dwnload Full Advanced Accounting 12th Edition Fischer Solutions Manual PDFDocument35 pagesDwnload Full Advanced Accounting 12th Edition Fischer Solutions Manual PDFunrudesquirtjghzl100% (15)

- Financial Management Practice Questions... 2021Document33 pagesFinancial Management Practice Questions... 2021obed nkansahNo ratings yet

- Copie de Solution Problem IncomeDocument7 pagesCopie de Solution Problem IncomeInfinity NinjaaNo ratings yet

- Saln TemplateDocument6 pagesSaln TemplateAllan TomasNo ratings yet

- Environmental Auditing Its Benefits and Counter AnceDocument6 pagesEnvironmental Auditing Its Benefits and Counter AnceAziz Ibn MusahNo ratings yet

- Analytical Study of European Carpet Company's Carpet ExportsDocument73 pagesAnalytical Study of European Carpet Company's Carpet ExportsJamal ShanNo ratings yet

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Food Safety Audit Benefits & ObjectivesDocument10 pagesFood Safety Audit Benefits & ObjectivesCatherine Jane CallangaNo ratings yet

- Resume Kelly TranDocument1 pageResume Kelly Tranapi-447167643No ratings yet

- Developing A Wage StructureDocument1 pageDeveloping A Wage StructureChristina StellaNo ratings yet

- Privatization of Railways: A Comparative AnalysisDocument16 pagesPrivatization of Railways: A Comparative AnalysisKUSHAL PAWARNo ratings yet

- SOP For DSC ManagementDocument3 pagesSOP For DSC Managementyamuna popparthiNo ratings yet