Professional Documents

Culture Documents

Financial Management - Chapter 2

Uploaded by

mechidreamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management - Chapter 2

Uploaded by

mechidreamCopyright:

Available Formats

Subject: Financial Management

Chapter: Two – Time Value of Money

Chapter No. 2 - Time Value of Money

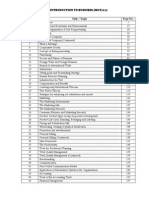

Contents

♦ Introduction to the concept of “inflation” – Wholesale Price Index and

Consumer Price Index

♦ Money losing value due to reduction in purchasing power

♦ Concept of interest as compensation in purchasing power of money

♦ Four tier structure for rates of interest in any economy

♦ Compounding and discounting processes

♦ Application of time value of money to business decisions

♦ Numerical exercises for practice

At the end of the chapter the student will be able to

♦ Determine - Future value of a present sum by compounding

♦ Determine - Present value of a future sum by discounting

♦ Determine - Present value of a bond investment

♦ Explain - the different tiers of interest structure in an economy

♦ Choose – the best project based on its “Net Present Value”

Concept of “Inflation” – Wholesale Price Index and Consumer Price Index

Inflation means to increase. In this context, it means increase in prices of commodities. The price

increase is due to the difference between “supply” and “demand” for a given commodity. If the supply

is more than demand, prices decline and if the demand is more, prices increase. In a developing

country like India, the demand for most of the commodities will always be more than the supply.

Hence “inflation” will always be experienced in developing markets.

The increase is constantly measured in all the countries. The items included for determining the prices

would be different from country to country. For example, in India, essential commodities like sugar,

kerosene, a loaf of bread etc. are included in the basket of commodities considered for calculation of

“inflation”. Different from this, in a developed country, items that are luxury items in a developing

country would also be included. For example, automobile could be included. The increase is expressed

in % terms. For example if the rate of inflation is 5%, this means that over a period of one year, the

prices have increased by 5%. The details of inflation are published regularly in all leading dailies in the

country.

Wholesale price and not the retail price

The prices of the selected commodities for determining the rate of inflation over a period of one year

could be on the wholesale or retail. The latter one is mostly referred to as “consumer price”. Thus we

have a “wholesale price index” and “consumer price index” for expressing rates of inflation.

Conventionally in India the rate of inflation has always been expressed in “wholesale price index” basis

Punjab Technical University, Online Virtual Campus 1

Subject: Financial Management

Chapter: Two – Time Value of Money

rather than “consumer price index” basis although the consumer price index increase is also published

regularly. At present the wholesale price index inflation is around 3%. We will explain this concept

through an example.

Example no. 1

I had spent Rs. 100/- in getting a basket of commodities one year ago. If the rate of inflation is say 3%,

now I will be required to spend Rs. 103/- to get the same basket of commodities. How do we get

Rs.103/-? Rs. 100/- x 1.03 = Rs. 103/-. This means that due to “inflation”, the purchasing power of the

local currency decreases with the passage of time. This is exactly the concept of “time value of

money”. In simple words, “time value of money” means that with the passage of time, money loses its

value.

Is there a situation in which the prices decrease over a period of time and

opposite of “inflation” takes place?

Usually in a developing country, such a situation does not arise, as the demand is always greater than

supply. However currently Japan is experiencing “deflation” in which current prices would be less than

the past prices. This is harmful to a developing economy, as units that save money would get very low

interest or no interest. Hence there will be no incentive for the units to invest money in bonds, fixed

deposits etc.

Concept of Interest as compensation for loss of purchasing power due to

“inflation”:

You keep money in a deposit with a bank. It could be a Savings Bank or a Fixed Deposit. What does the

bank pay to you? “Interest”. This is the “return” on your investment. Why should the bank pay interest

to you? Let us enumerate the possible reasons for the bank’s action.

♦ The bank does the business of lending. For this, it requires funds through deposits. It earns

interest on loans and pays interest on deposits;

♦ With the passage of time, the purchasing power of money reduces. The same thing will happen

to your deposit with the bank. The bank gives compensation to you for this loss in value of

money;

♦ In case the bank does not pay interest, it will not get funds for lending. You will not keep

deposits with it. You will choose other willing banks or avenues of investment.

While all of them are correct, we are more interested in the second reason. Value of money erodes due

to “inflation” as we have seen in the earlier paragraph. The rates of inflation would be different for

different countries. Further, it could be different for the same country at different times. Sometimes it

could be high while at some other times, it could be low.

Note:1

Would interest be less in case the rate of inflation comes down?

Absolutely. As an example, we have already seen what is happening in Japan. The Japanese banks are

practically not paying interest on deposits right now. The rate of inflation in the US is around 2% p.a.

and accordingly the rate of interest on investment would be around 3% to 3.5% p.a. Thus the rate of

inflation in a country and the rate of interest on investment are closely linked to each other. For further

details, please look at the “Tier structure” of rates of interest given below.

Consider Indian market conditions. Hypothetically if the inflation comes down to say 1%, the rat e of

interest on bank deposits and bank loans in turn would also come down. The banks would not pay the

current rate of interest. If the students may recall in India, the rates of interest on savings are

constantly coming down. This is the result of the rate of inflation coming down constantly at least till

the last year.

1

“Rate of inflation coming down” - What does it mean? Does it mean that the prices of commodities are coming

down or the increase in prices of commodities is coming down? – Answer is: The increase in prices of commodities

is coming down; in actual terms, the prices of commodities are not reducing.

Punjab Technical University, Online Virtual Campus 2

Subject: Financial Management

Chapter: Two – Time Value of Money

Four tier structure for rates of interest in any economy

The starting point for any interest is the rate of inflation in the economy. Like for example, in India at

present, it is around 3% now. We have seen earlier that interest is the compensation for loss of

purchasing power of Indian Rupee. This loss is due to the phenomenon of “inflation”. We have also

learnt that the banks would normally offer a rate of interest higher than the rate of inflation. Based on

this, let us construct a 4-tier system of interest rates. This would build up stage-wise rates of interest

till investment in a project.

Tier 1 – Rate of inflation, say 3%

Tier 2 – Rate of interest on investment say in bank deposit

Rate of inflation + some compensation from the acceptor of deposits, say banks. = 3% + 4% = 7%,

that is the lowest interest offered by a public sector bank now on fixed deposits. The exact premium

paid to the depositor depends on the following:

♦ The duration of the deposit – the longer the duration, the higher the premium and vice-versa.

That is why the longer duration deposits would attract higher rates of interest and shorter

duration deposits would have a lower rate of interest.

♦ The need for deposits by the banking company for a specific period. The bank would offer a

higher rate for that period. Suppose a bank wants more deposits for six months rather than

one year. It will attract deposits for six months by offering higher rate of interest than the

market.

Tier 3 – What does the bank do with the deposits that it accepts? It gives loans. The rate of interest on

loans becomes the next tier, Tier 3.

What are the factors that a bank would consider to determine its lending rate?

Average interest paid out on deposits and expenses

Minimum expected profit from lending operations

Degree of risk in lending – specific to a borrower, depending upon his business

Continuing discussion on Tier 3, we see that the minimum rate of interest on loans would be 7% + 3%

+ 1% = 11%. This is the lowest interest that any bank offers now in India on loans. There is a specific

name for this rate. It is referred to as “Prime Lending Rate” or PLR. The bank would add further to this

rate depending upon risk etc., which is called “risk premium”2. This would again be different from

borrower to borrower.

Why discuss about a loan here?

Who takes loans in a big way from the banks? This does not refer to the housing or consumer loans

taken by salaried persons. Obviously, business enterprises. It is for investment in their

business/projects. Hence the rate of return on a project would be the last Tier, called “Tier 4”.

Can you determine this rate? Yes and no. Yes, as you will be able to determine a formula for this. No,

because, it is not always possible to evaluate risk associated with a project correctly.

The formula is:

Rate of interest on loans, say 11% + compensation for the additional risk taken by the project owner.

For an outsider, it will not be possible to put a figure on this. This will depend upon the risk associated

with the specific project.

2

This is the reason that for different activities, the same bank charges different rates of interest at the

same time. Similarly for different borrowers pursuing the same activity, the rates of interest would be

different as per perception of risk associated with them.

Punjab Technical University, Online Virtual Campus 3

Subject: Financial Management

Chapter: Two – Time Value of Money

From whose point of view? - Both from the points of view of the owner and the lender/investor. This

compensation is referred to as “risk premium” of the project.

The question that could come to one’s mind while reading these lines is:

Why should a project owner expect a higher rate of return than the rate of interest on loans?

Consider the following and learn the risk associated with a project.

♦ The project owner’s investment does not have the backing of assets. A lender, on the contrary,

has backing of assets for his loan.

♦ The enterprise pays the lender interest periodically. The owners on the contrary, get return in

the form of dividend. This is not certain.

♦ Besides interest, the enterprise should also have sufficient surplus after paying interest to

repay the loan amount

♦ Risk of project failure affects the owners more than the lenders for the same reason as

mentioned in the first bullet point

Example No. 2

Let us summarise the above as under:

Rate of inflation = Tier no. 1 = 3% p.a.

Rate of interest on investment = Tier no. 2 = 7% p.a.

Rate of interest on loans = Tier no. 3 = 11% p.a.

Rate of return from investment in projects = Tier no. 4 = 15% p.a. (This is just an example. The rate of

return expected from a project would actually depend upon the degree of risk associated with the

project in the perception of the project owners primarily and project lenders secondarily)

Future value of Re.1 - Process of compounding

Refer to Example no. 1. We found out that we would require Rs.103/- to purchase a basket of

commodities that we could purchase at Rs.100/- a year ago and the rate of inflation works out to 3%

p.a. Can we give another name for the value after one year? Yes. It is called the “future value”, while

Rs.100/- is called the present value. The other name for the future value is “compounded value” as

this is obtained by a process called “compounding”.

Can we have a formula for this process of compounding?

n

Future value (F.V.) at T1 = PV at T0 x (1+r/100) , wherein T1 is the end of year 1 and T 0 is the

beginning of year 1.

n

(1 + r/100) is known as compounding factor.

Let us apply this formula to another investment example and determine the future value.

Example no. 3

You have a fixed deposit for Rs.10,000/- in a bank. Terms of deposit are:

Period – Two years

Rate of interest = 10% p.a.

The bank does not pay interest periodically. Interest gets accumulated to the principal amount; it gets

paid at the end of the period along with principal amount.

Punjab Technical University, Online Virtual Campus 4

Subject: Financial Management

Chapter: Two – Time Value of Money

What is the future value of this investment?

The future value is Rs.12,100/-. In the compounding formula, by substituting 10% for “r” and 2 for “n”,

we get this value. The break-up of principal and interest amount for the period of investment, i.e., two

years is as under:

Principal – Rs.10,000/-

Interest – Rs.2,100/-

Does the future value alter with the change in the frequency of compounding?

In the above example, we have assumed that the bank pays interest at the frequency of one year.

Suppose the bank pays interest at a higher frequency, would the future value turn out to be different?

Let us see the following example.

Example no. 4

Suppose the bank increases the frequency of compounding from yearly to half-yearly. What will be the

future value? We can use the same formula with an amendment. The amended formula would be:

nx2

Future value = Present investment x (1 + r/200)

As interest gets compounded twice as frequently, r is divided by 200. Similarly the number of periods

for compounding also gets doubled and hence it is 2 x n instead of “n”. Accordingly, in our formula,

what would be the values of “r” and “n”?

r = 5% and n = 4

4

With these values, the future value FV at T2 works out to 10,000 x (1.05) = Rs.12,155/-.

Similarly we can see that in case the frequency of compounding increases to quarterly from half-

yearly, the future value works out to Rs. 12,184/-.

Let us summarise what we have learnt so far on “compounding and future value”:

♦ The amount that you get back at the end is called “future value”

♦ Future value is determined by “compounding”

♦ Future value depends upon:

♦ Rate of interest and

♦ Frequency of compounding

♦ The multiplying factor is known as “compounding factor”

♦ The more the frequency, the higher the amount of interest

Doubling period

A frequent question posed by an investor is: “How much time it will take for my investment to double

in value”? This question can be answered by a rule known as “Rule of 72”. It is an approximate way of

finding out the doubling period. Suppose the rate of interest is 12%. The doubling period is 6 years.

A more accurate answer can be had by a better formula like:

0.35 + 69/interest rate in % terms. Employing the same rate of 12%, we find that the doubling period

is 6.10 years instead of 6 years. This is more accurate than the Rule of 72 formula.

Punjab Technical University, Online Virtual Campus 5

Subject: Financial Management

Chapter: Two – Time Value of Money

Present value of a future rupee – Process of discounting

So far we have seen “future value”. We are now going to see “present value” of a future sum. Suppose

we want to have Rs.10,000/- after say two years (T2). We want to know how much we should save now

(T0). This situation is exactly the opposite of the earlier future value situation. The investment at T0

should increase to the desired future value at a desired rate of interest. The process of determining

the present value from future value is known as “discounting”. “Discounting” is converse of

“compounding”.

Example no. 5

We want to get Rs.108/- at the end of T1. The desired rate of interest is 8% per annum. What is the

amount that we should invest at T0?

Can we use the “future value” formula here?

Yes – with necessary modification as under:

n

Future value = Present investment x (1 + r/100)

Future value at T1, Rs.108/- = PV at T0 (to be determined) x (1.08)

PV at T0 = Rs. 108/1.08 = Rs.100/-.

Thus the formula for present value is as under:

n

Present value = Future value = Future value x [1/(1 + r/100) ]

--------------------

n

(1 + r/100)

The reciprocal of compounding factor is referred to as “discounting factor. We need to multiply the

n

future value by this discounting factor and not divide. In the above formula, 1/(1+r/100) is referred

to as “discounting factor”.

Discounting factor = 1/compounding factor; discounting factor x compounding factor = 1.

Discounting factor would always be less than 1.

Example no. 6

We want to get Rs.10,000/- after two years. The desired rate of interest is 12% p.a. The frequency of is

yearly.

What is the present value of this future sum of Rs.10,000/-?

Present value = Rs. 7,971/-

The two-step process in determining present value is:

Step 1 = determine the discounting factor = 1/[1 + 12/200] 4 = 0.7924

Step 2 = multiply the future value by this factor to get the present value

Present value of Rs.10,000/- = Rs.7,924/-

Punjab Technical University, Online Virtual Campus 6

Subject: Financial Management

Chapter: Two – Time Value of Money

We have already seen under “future value” that higher frequency of compounding increases the future

value. Conversely, higher frequency of discounting decreases the present value. The students are

advised to take the following exercise and verify for themselves.

Exercise No. 1

After three years we are likely to get a windfall of Rs.1,00,000/-. What will be the present value of this

windfall, in case the expected rate of return is 15% p.a.?

Answer – Rs.65,751/-

Let us summarise what you have learnt so far on “discounting and present value”:

♦ Discounting is the converse of compounding

♦ It is used when you want to determine the present value of a future sum

♦ Just as there is a compounding factor, there is a discounting factor

♦ In case you determine the discounting factor, you should multiply the future value by this

factor to get the present value

♦ The more the frequency the of discounting, the less will be the value of present value

♦ Present value will always be less than future value by the same token of inflation.

Application of concepts of future value and present value in business

Where does one apply the future value and present value in business?

As discussed earlier, future value is helpful in determining the compounded return of an investment

and hence is more useful in the case of personal investment.

However, in the case of discounted value, the relevance is more to business. The following example

illustrates this.

Example no. 6 - Application 1

We want to start an Industrial project at T0 with an investment of Rs.100 lacs.

We expect to get a return of 20% from the project.

The estimated future earnings are:

T1 – Rs.30 lacs

T2 – Rs.35 lacs

T3 – Rs.40 lacs

T4 – Rs.45 lacs

We want to evaluate our investment decision in the project. How do we do this? By applying

discounting factor for 20% to the future earnings.

Present value of T1 = Value at T0 = Rs. 30lacs/1.20 = Rs.25 lacs

Present value of T2 = Value at T0 = Rs.35 lacs/(1.20)2 = Rs.24.30 lacs

Present value of T3 = Value at T0 = Rs.40 lacs/(1.20)3 = Rs.23.14 lacs

Punjab Technical University, Online Virtual Campus 7

Subject: Financial Management

Chapter: Two – Time Value of Money

And Present value of T4 = Value atT0 = Rs.45 lacs/(1.20)4 = Rs.21.69 lacs

The “sum total” of all the T0 values = Rs.94.13 lacs = Present value of future earnings for a period of

four years.

What does this mean? It means that at 20% expected return the project has given back only Rs.94.13

lacs. This is against Rs.100 lacs that have been invested in it. That is, the present value of future

earnings is less than original investment. Hence we will not invest in the project. The difference

between the present value of future earnings and the investment at T 0 is called the “Net present

value” or NPV. This is one of the fundamental methods of selecting a project.

Here is how we can use it for selecting a project:

♦ Determine the amount we need to invest in a project.

♦ Estimate future earnings from the project on certain working assumptions.

♦ Discount the future earnings by a suitable rate of discount. This depends upon the market rate

for borrowing and our perception of risk in the project. This gives the present value of all future

earnings.

♦ Compare this with the present value of investment. We invest in the project if the present

value of the future earnings is more than present value of investment.

♦ In the above example, suppose the present value is greater than Rs.100 lacs. Then we would

select the project for investment.

Exercise No. 2

We are investing in a project Rs. 1000 lacs. The rate of return that we expect from the project is 18%

p.a. The estimated future earnings for three years are:

T1 = Rs.450 lacs

T2 = Rs.500 lacs

T3 = Rs.550 lacs

The above are also referred to as cash flows 3(in this case cash inflows)

Examine as to whether it is worthwhile investing in the project. Find out the Net Present Value of the

project.

Answer:

Present value of future earnings = Rs.1071 lacs

Net Present Value = Rs.71 lacs

We can invest in the project

Example No. 7 - Application 2

Suppose there is a bond that has been floated in the market with face value of Rs.1000/-. The interest

per year is Rs.100/-. The period is 5 years. The expected rate of return is 8% p.a. What is the price at

which an investor will be willing to purchase the bond from the market now?

3

Cash flow could either be cash inflow or cash outflow. When an investment is made at T0 it is called “cash out

flow”. Similarly when returns are received they are called “cash in flows. Cash out flow is denoted by mentioning

the figure within bracket like (50 lacs)

Punjab Technical University, Online Virtual Campus 8

Subject: Financial Management

Chapter: Two – Time Value of Money

Step 1 = to construct the future returns including the principal amount

Year from now Payment expected (cash inflow)

1 Rs.100/-

2 Rs.100/-

3 Rs.100/-

4 Rs.100/-

5 Rs.1100/-

Step 2 = discounting the payment expected by the rate of return, i.e., 8% p.a., we can determine the

present value of the future cash flows. It is Rs.1080.30. This means that an investor will be willing to

purchase this bond now from the market provided the market price of this bond is less than

Rs.1080.30.

Exercise No. 3

We have a bond with the face value of Rs.5,000/-. The interest on the bond is Rs.600/- per year. We

are supposed to get a premium on the bond of Rs.250/- at the end of the maturity period. Expected

rate of return by us = 10% p.a. Suppose the maturity is after 5 years, what is the price at which an

investor would be willing to purchase it from us?

(Note – please add the premium amount to the face value. You will get Rs.5,250/- on maturity)

Answer: Present value of future returns = Rs.5534/-. An investor will be willing to pay

anything less than this value for purchasing the bond from you.

Example no. 8 - Application 3

Evaluation of opening of a branch office by discounting the expected future returns at a suitable rate

of discount and comparing the present value with the investment required in capital assets to open a

branch office.

As you will have realised by now, the investment in a branch office is very similar to investment in a

project. You are investing in a project to get returns from it. Similarly, you invest in a branch office

based on expectation of additional returns.

As it is very similar to a project, separate example or exercise is not given here.

Example No. 9 - Application 4

Suppose we develop a product by spending say Rs.10 lacs. This amount will be recovered along with

profit through sales of a number of units over a period of time. Suppose we project sales in unit terms

as well as value terms over a period of time. Let us assume this period to be three years. Suppose the

expected rate of return is 15% p.a. Further, assume projected sales for the next three years to be as

under:

No. of units expected to be sold Unit Rate Expected sales in lacs of Rupees

2000 Rs.250/- Rs.5 lacs

2200 Rs.250/- Rs.5.5 lacs

2500 Rs.250/- Rs.6.25 lacs

This is similar to finding out the net present value in the case of projects. We discount the expected

sales by the expected rate of return of 15% p.a. This determines the present value of the expected

sales. Let us compare this with the total product development expenses.

Punjab Technical University, Online Virtual Campus 9

Subject: Financial Management

Chapter: Two – Time Value of Money

Exercise No. 4

Find out the net present value in the above example. Also confirm that the total product development

costs stand fully recovered at T3.

Answer – The product development costs stand fully recovered at T3.

Let us summarise what we have learnt on application of “Time value of money” to business

♦ Compounding and discounting have a number of applications to Finance decisions.

♦ Compounding has greater application to personal investment while discounting has greater

application to business.

♦ Discounting is useful in a number of decisions like project, product development, opening a

branch office etc.

♦ Bond valuation is also done through discounting.

Let us look at one more example for reinforcing our learning. Let us select the

best project out of the three projects proposed.

Consider the following 3 alternative projects. Assumptions are also given below:

Investment at T0 for all the projects is Rs.500 lacs.

Future cash flows are considered for T1 to T5.

Although the scale of operations for all the projects is the same, the projects have different future

earnings or returns.

The promoters expect a rate of return of 15% p.a. hence; this is the rate by which the future returns

are discounted.

(Rupees in Lacs)

Project 1 Project 2 Project 3

Year Future Future Disc. Future

Disc. Value Disc. Value

No. Earnings Earnings Value Earnings

1 100 150 130.44 175

86.96 152.18

2 120 150 113.42 150

90.73 113.42

3 200 150 98.63 180

131.5 118.35

4 250 200 114.36 225

142.95 128.66

5 250 200 99.44 250

124.3 124.3

Total 556.29

576.4 636.91

Punjab Technical University, Online Virtual Campus 10

Subject: Financial Management

Chapter: Two – Time Value of Money

As Project 3 has the highest NPV it would be selected. NPV = PV of future earnings (-) original

investment. Accordingly, the net present values for the three projects would be:

Project 1 76.44 lacs

Project 2 56.29 lacs

Project 3 136.91 lacs

On the basis of net present value, project 3 would get selected.

Concept of annuity

So far we have seen the following in respect of application of time value of money:

Investment lump sum at T0 and get lump sum at Tn = Future value; process is “compounding”. This is

called future value of a single stream.

Suppose we are given a future value and want to know how much should be invested at present. We

use the process that is converse of compounding and this is called “discounting”. In order to get lump

sum after a given period, we should invest the present value at the beginning, again a lump sum. This

is called the present value of a single stream.

Invest lump sum at T0 in a project and get annual returns. The returns will not be equal to each other.

To determine the present value of the future returns to determine Net Present Value = Present value;

process is “discounting”. This is the example of present value of multiple streams.

Annuity refers to “multiple stream” of cash flows but which are equal to each other and

occurring annually. The cash flows could either be in flows or out flows. This means that the following

alternatives are available to us when we are talking of “annuity”.

♦ We invest at the beginning one lump sum amount and get returns over a period of time

that are equal to each other. The cash in flows that are equal to each other are called

“annuity”. Herein we use what is known as Present Value Interest Factor Annuity

(PVIFA). We multiply the Annuity by this factor and get the present value of the future

cash flows in one shot. Then we compare this present value with our proposed investment

at T0 taking decision on investment. We invest provided the Present value of future

annuities is at least equal to our investment at T0.

♦ We invest in equal instalments over a period of time and get one lump sum at the end of

the period. The cash outflows that are equal to each other are called “annuity”. Herein

we use what is known as Future Value Interest Factor Annuity (FVIFA) .We multiply

the Annuity by this factor and get the future value of the cash out flows in one shot.

Let us study the following examples to understand the concept of “annuity”.

Example no. 10

Punjab Technical University, Online Virtual Campus 11

Subject: Financial Management

Chapter: Two – Time Value of Money

We are able to invest every year Rs.1000/- for a period of 5 years. We expect a return of 10% p.a.

What will be the value of this investment at the end of 5 years?

Let us represent this by way of a timeline

At T0 T1 T2 T3 T4

T5

Investment = zero 1,000/- 1,000/- 1,000/- 1,000/- 1,000/-

Can we use the future value formula, find out the future value of each stream of Rs.1000/- and add

them up? Thus T1 investment would earn interest for 4 years, the 2 nd year investment would earn

interest for 3 years, the 3rd year investment would earn interest for 2 years, the 4 th year investment

would earn interest for 1 year and the last year investment would not earn any interest. Instead of

doing such an elaborate exercise, we use the alternative “FVIFA”.

Practical applications of “Annuity”4 for future value

♦ Life Insurance policy premium

♦ Recurring deposit account with a bank

Example no. 11

Similar in concept to Example no. 10, we can think of investment lump sum at T0 and getting returns

over a period of time, the returns being equal in value. Example is investment in bank deposit floated

by competitive banking industry at present. Each return will be partly principal amount and partly

interest amount. Our aim is to determine the present value of the future returns by discounting them

and comparing the present value with our investment value.

Can we use PVIF and find out the present value of future cash flows? Yes. The cash flow at T 1 is

discounted for one year, the cash flow at the end of the second year is discounted for two years, the

cash flow at the end of the third year is discounted for three years and so on and so forth. Instead of

repeating the discounting process so many times, we have the easy alternative of Present Value

Interest Factor Annuity.

It is okay for discussion. However the students will be interested in knowing as to where he will get the

PVIFA and FVIFA values. These will be available as annexure with any standard textbook on “Financial

Management” and multiply with the annuity to arrive at the Present Value or Future value as the case

may be.

Concept of perpetuity

This is the concept applicable in the case of pension. Pension is taken to be perpetual. Can we find out

the lump sum amount in case the pension amount is given?

Example no. 12

Suppose the pension amount is Rs. 1000/-. The expected rate of return is 10% p.a. What is the core

amount out of which interest is paid? The annual payment is Rs.12,000/-. Hence the lump sum amount

is Annual payment/rate of interest expressed in decimals.

Accordingly the lump sum amount is Rs. 12,000/0.1 = Rs. 1,20,000/-.

Questions for reinforcement of learning and numerical exercises for practice

4

Annuity could be at a frequency more than one year. In fact in the case of recurring deposit, the annuity is

monthly.

Punjab Technical University, Online Virtual Campus 12

Subject: Financial Management

Chapter: Two – Time Value of Money

1. Why should return from a project be the highest in the 4-tier interest rate structure?

2. Future value interest factor x Present value interest factor = -----------------------

3. Can you find out the present value of a stream of annuity without using PVIFA? Explain the

process.

4. Find out the present value of a sum of Rs. 10 lacs at the end of five years in case the expected rate

of return is 12% and the compounding is done on half-yearly basis.

5. Suppose you open a recurring deposit account with annual interest of 6%. You open it for a period

of 12 months. The annuity is Rs.500/-. What will be the value at the end of one year?

6. Mr. George is about to retire. The employer places before him two alternatives. Mr. George has to

choose between them. Lump sum Rs. 12 lacs or half-yearly pension of Rs. 79,000/-. Which one

should he choose in case the annual expected return is 10%?

7. What is the present value of an income stream that provides Rs. 2,000/- at the end of year one, Rs.

5000/- at the end of year two and Rs.10,000/- for the next 5 years? Assume the rate of interest to

be 8% p.a.

8. What is the present value of Rs. 5,000/- receivable annually for 30 years if the first receipt occurs

after 5 years and the rate of interest is 10% p.a?

Punjab Technical University, Online Virtual Campus 13

You might also like

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioFrom EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioRating: 4.5 out of 5 stars4.5/5 (38)

- Interest RateDocument19 pagesInterest RatenzlNo ratings yet

- Definitions of InflationDocument4 pagesDefinitions of Inflationjiyaahuja578No ratings yet

- Time Value of Money (TVM)Document30 pagesTime Value of Money (TVM)thomasderz1961No ratings yet

- Nis AFMDocument19 pagesNis AFMnyshanairNo ratings yet

- Assignment of Note 3:: 1. What Do You Understand by The Term Interest Rate'?Document4 pagesAssignment of Note 3:: 1. What Do You Understand by The Term Interest Rate'?Sonu TandukarNo ratings yet

- FIM Term ReportDocument8 pagesFIM Term ReportYousuf ShabbirNo ratings yet

- 10 Things You Should Know About EconomicsDocument16 pages10 Things You Should Know About EconomicsLine RingcodanNo ratings yet

- Carry Trade Lesson 2: Carry Trades: An Opportunity To Profit From International Changes in Supply and DemandDocument15 pagesCarry Trade Lesson 2: Carry Trades: An Opportunity To Profit From International Changes in Supply and Demandsaied jaberNo ratings yet

- Nominal and Real Interest RatesDocument6 pagesNominal and Real Interest RatesGeromeNo ratings yet

- Financial MarketsDocument6 pagesFinancial MarketsRudella LizardoNo ratings yet

- UNIT 2: Time Value of Money: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument6 pagesUNIT 2: Time Value of Money: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- Monetary Policy' - : Savings AccountsDocument4 pagesMonetary Policy' - : Savings AccountsElvie Abulencia-BagsicNo ratings yet

- The Demand For Money: Nominal Interest Rate Real Interest RateDocument8 pagesThe Demand For Money: Nominal Interest Rate Real Interest RateHani AmirNo ratings yet

- Why We Need Transparent Pricing in Microfinance November 2008Document62 pagesWhy We Need Transparent Pricing in Microfinance November 2008Vivek ReddyNo ratings yet

- Thesis On Determinants of Money SupplyDocument5 pagesThesis On Determinants of Money Supplyrebeccariveranewhaven100% (1)

- Fi CHAPTER THREE Edited FFDocument10 pagesFi CHAPTER THREE Edited FFLencho MusaNo ratings yet

- January 2020 Banking CHPT 2Document18 pagesJanuary 2020 Banking CHPT 2Bonolo MphaNo ratings yet

- Ch. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument11 pagesCh. 34 - Notes - The Influence of Monetary and Fiscal Policy On Aggregate DemandBing TinsleyNo ratings yet

- What Is InflationDocument5 pagesWhat Is InflationSachin SahooNo ratings yet

- EditedDocument12 pagesEditedKeii blackhoodNo ratings yet

- Economics Lecture Notes - Chapter 10Document13 pagesEconomics Lecture Notes - Chapter 10Aydin Rahman6666No ratings yet

- Economic Report of The President, Show Recent Variations in Rates For High-Quality orDocument6 pagesEconomic Report of The President, Show Recent Variations in Rates For High-Quality orAida FitrianaNo ratings yet

- Money Market and Nominal Interest RateDocument2 pagesMoney Market and Nominal Interest RateMario SarayarNo ratings yet

- Glenn 3.odt Int RatesDocument2 pagesGlenn 3.odt Int RatesAbhishek SuranaNo ratings yet

- EconomicsDocument3 pagesEconomicsbsnsNo ratings yet

- Quantitative Methods For FinanceDocument86 pagesQuantitative Methods For Financefusion2000100% (1)

- CompileDocument12 pagesCompileJoyluxxiNo ratings yet

- Engaging Activity A Financial MarketsDocument2 pagesEngaging Activity A Financial MarketsMary Justine ManaloNo ratings yet

- Types of InterestDocument4 pagesTypes of InterestUmar SheikhNo ratings yet

- Task 17Document7 pagesTask 17Medha SinghNo ratings yet

- Topic 3 Mas 2Document12 pagesTopic 3 Mas 2Jamaica DavidNo ratings yet

- Factsheet Ton How Do Inflation and The Rise in Interest Rates Affect My MoneyDocument8 pagesFactsheet Ton How Do Inflation and The Rise in Interest Rates Affect My Moneyimhidayat2021No ratings yet

- Champter Three InterestDocument14 pagesChampter Three InteresttemedebereNo ratings yet

- Interest Rates and The Loanable Funds FrameworkDocument4 pagesInterest Rates and The Loanable Funds FrameworkIvy RosalesNo ratings yet

- InflationDocument4 pagesInflationJyoti NarainNo ratings yet

- Lall Interest Rate ProjectDocument19 pagesLall Interest Rate ProjectSourav SsinghNo ratings yet

- Final Exam Microeconomics: AssignmentDocument10 pagesFinal Exam Microeconomics: AssignmentLưu Ngọc Anh ThưNo ratings yet

- AdmasDocument11 pagesAdmasAbdellah TeshomeNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Financial DecisionsDocument45 pagesFinancial DecisionsLumumba KuyelaNo ratings yet

- This Line Is Only For CommerceDocument23 pagesThis Line Is Only For CommerceSourav SsinghNo ratings yet

- Interest Rate DissertationDocument6 pagesInterest Rate DissertationCheapCustomWrittenPapersColumbia100% (1)

- Central BankingDocument8 pagesCentral BankingNoel Salazar JrNo ratings yet

- TheoryDocument3 pagesTheorysachinNo ratings yet

- Tam Keat Ying Test FIN320Document2 pagesTam Keat Ying Test FIN320JasmineNo ratings yet

- Macroeconomics: Unit 15 Monetary Policy and Theory The Top Five ConceptsDocument28 pagesMacroeconomics: Unit 15 Monetary Policy and Theory The Top Five ConceptsAsma Ul Husna MumuNo ratings yet

- Economics ProjectDocument21 pagesEconomics ProjectMalvika SoodNo ratings yet

- Lesson 7 - Monetary PolicyDocument8 pagesLesson 7 - Monetary PolicyJojoNo ratings yet

- Bank Rate, Also Referred To As The Discount Rate, Is TheDocument47 pagesBank Rate, Also Referred To As The Discount Rate, Is ThenajumussabaNo ratings yet

- How Interest Rates Affect The Stock MarketDocument7 pagesHow Interest Rates Affect The Stock MarketSandeep BabajiNo ratings yet

- Fin 480 Exam2Document14 pagesFin 480 Exam2OpheliaNiuNo ratings yet

- Inflation Gross Domestic ProductDocument4 pagesInflation Gross Domestic ProductKashish BangaloreNo ratings yet

- Com Net CollectionDocument6 pagesCom Net CollectionHussein MubasshirNo ratings yet

- Interest Rates and BondsDocument7 pagesInterest Rates and BondsMarlon A. RodriguezNo ratings yet

- Factors Affecting Interest RatesDocument1 pageFactors Affecting Interest RatesJasielle Leigh Ulangkaya100% (1)

- Time Value of Money-Financial Management: AbstractDocument6 pagesTime Value of Money-Financial Management: AbstractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- NSE - Equity Research Module 1Document143 pagesNSE - Equity Research Module 1Amit Kumar67% (12)

- Recent Trends in Operations ManagementDocument5 pagesRecent Trends in Operations Managementmechidream100% (13)

- Contributions of Management Gurus To Total Quality ManagementDocument6 pagesContributions of Management Gurus To Total Quality Managementmechidream95% (19)

- Purchase Committee Certificate Format Required For Purchase Orders in ERP SAPDocument1 pagePurchase Committee Certificate Format Required For Purchase Orders in ERP SAPmechidreamNo ratings yet

- JIT Techniques Practiced in Service IndustryDocument4 pagesJIT Techniques Practiced in Service IndustrymechidreamNo ratings yet

- International Business Environment Assignment 1Document5 pagesInternational Business Environment Assignment 1mechidream0% (2)

- E1 E2 Syllabus Nov 09Document4 pagesE1 E2 Syllabus Nov 09mechidreamNo ratings yet

- International Business Environment Assignment 2Document4 pagesInternational Business Environment Assignment 2mechidreamNo ratings yet

- Financial Management - Chapter 7Document19 pagesFinancial Management - Chapter 7rksp99999No ratings yet

- Human Resource Management NotesDocument34 pagesHuman Resource Management Notesmechidream88% (32)

- Irr and NPVDocument13 pagesIrr and NPVAbin VargheseNo ratings yet

- Chapter No. 10 Â " Dividend PolicyDocument9 pagesChapter No. 10 Â " Dividend PolicyToaster97No ratings yet

- Financial Management - Chapter 9Document17 pagesFinancial Management - Chapter 9mechidreamNo ratings yet

- Financial Management - Chapter 8Document23 pagesFinancial Management - Chapter 8rksp99999No ratings yet

- Financial Management - Chapter 4Document17 pagesFinancial Management - Chapter 4mechidreamNo ratings yet

- Advantages and Disadvantages of Grapevine CommunicationDocument4 pagesAdvantages and Disadvantages of Grapevine Communicationmechidream89% (18)

- Financial Management:Techniques of Capital BudgetingDocument10 pagesFinancial Management:Techniques of Capital Budgetingmechidream0% (1)

- Monetary Policies by Rbi in RecessionDocument21 pagesMonetary Policies by Rbi in Recessionsamruddhi_khaleNo ratings yet

- Module 10 Q1 Challengesto HRMDocument8 pagesModule 10 Q1 Challengesto HRMprabodhNo ratings yet

- MGT211 Handouts 1 45Document200 pagesMGT211 Handouts 1 45aneebaNo ratings yet

- 2023 Oshkosh Business Outlook SurveyDocument3 pages2023 Oshkosh Business Outlook SurveyFOX 11 NewsNo ratings yet

- Final Sample Econ 141Document2 pagesFinal Sample Econ 141Elliot NounouNo ratings yet

- CHP 22 (Monitoring Jobs and Price Level)Document47 pagesCHP 22 (Monitoring Jobs and Price Level)Tahir Naeem JattNo ratings yet

- TCHE 303 - Tutorial 10Document4 pagesTCHE 303 - Tutorial 10Bách Nguyễn XuânNo ratings yet

- Keck Seng (Malaysia) Berhad - Annual Report 2022Document187 pagesKeck Seng (Malaysia) Berhad - Annual Report 2022Hew Jhet NungNo ratings yet

- NISMVAImportant QuestionsDocument396 pagesNISMVAImportant QuestionsKartheek Chandra100% (1)

- Asian Paints AnalysisDocument5 pagesAsian Paints AnalysisAnimesh SalhotraNo ratings yet

- Nature & Scope of Invt MGMTDocument65 pagesNature & Scope of Invt MGMTAishwarya ChoodamaniNo ratings yet

- Journal of Business Economics and ManagementDocument21 pagesJournal of Business Economics and Managementsajid bhattiNo ratings yet

- Online Class in Economic DevelopmentDocument1 pageOnline Class in Economic DevelopmentAdoree RamosNo ratings yet

- Capitalistic MusingsDocument443 pagesCapitalistic MusingsSam Vaknin100% (1)

- Fourth National PlanDocument266 pagesFourth National PlanRamesh PokharelNo ratings yet

- Joint Venture and AlliancesDocument10 pagesJoint Venture and AlliancesLaiq KhanNo ratings yet

- William J. Baumol, David de Ferranti, Monte Malach, Ariel Pablos-Méndez, Hilary Tabish, Lilian Gomory Wu - The Cost Disease_ Why Computers Get Cheaper and Health Care Doesn't-Yale University Press (20Document272 pagesWilliam J. Baumol, David de Ferranti, Monte Malach, Ariel Pablos-Méndez, Hilary Tabish, Lilian Gomory Wu - The Cost Disease_ Why Computers Get Cheaper and Health Care Doesn't-Yale University Press (20rfsgaspar5372No ratings yet

- Government Influence On Exchange RatesDocument65 pagesGovernment Influence On Exchange RatesAmmara NawazNo ratings yet

- Curriculum and Syllabi of MBA Programme With PEO POs COsDocument66 pagesCurriculum and Syllabi of MBA Programme With PEO POs COsDibya 'divino' MishraNo ratings yet

- Part Two Chapter 2 - Risk and ReturnDocument26 pagesPart Two Chapter 2 - Risk and ReturnbubuhomeNo ratings yet

- A Debate About Prohibition ofDocument3 pagesA Debate About Prohibition ofLance Kelly P. ManlangitNo ratings yet

- Office of The Economic Adviser-VibratorDocument1 pageOffice of The Economic Adviser-VibratorSandip PurohitNo ratings yet

- Inflation AccountingDocument9 pagesInflation AccountingyasheshgaglaniNo ratings yet

- 2020 ECO Topic 1 International Economic Integration Notes HannahDocument23 pages2020 ECO Topic 1 International Economic Integration Notes HannahJimmyNo ratings yet

- Financial Ratios in ContractsDocument2 pagesFinancial Ratios in ContractsDeyeck VergaNo ratings yet

- Fidelity Model Worksheet Mar 2019Document25 pagesFidelity Model Worksheet Mar 2019Bobby ChristiantoNo ratings yet

- Securities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTDocument10 pagesSecurities Market in India: References: Ramesh Singh, Mishra and Puri, NCERTridhiNo ratings yet

- Competition Assessment of FertilizerDocument98 pagesCompetition Assessment of Fertilizertyba_munirNo ratings yet

- Chap 1 Economics of Money and BankingDocument25 pagesChap 1 Economics of Money and BankingJason YoungNo ratings yet

- Briefing Notes On Key Political Questions For SA's Economic RecoveryDocument122 pagesBriefing Notes On Key Political Questions For SA's Economic RecoveryDocumentsZA100% (4)