Professional Documents

Culture Documents

Chile Cards and Payments Market Is Expected To Grow at A Healthy Rate PDF

Uploaded by

Corey0 ratings0% found this document useful (0 votes)

27 views6 pagesChile Cards and Payments Market is expected to grow at a healthy rate. Debit cards dominate the card payments market in terms of number of cards in circulation. The value of debit card transactions at ATMs remained significantly higher than the value of transactions at POS terminals in 2014.

Original Description:

Original Title

Chile Cards and Payments Market is expected to grow at a healthy rate.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChile Cards and Payments Market is expected to grow at a healthy rate. Debit cards dominate the card payments market in terms of number of cards in circulation. The value of debit card transactions at ATMs remained significantly higher than the value of transactions at POS terminals in 2014.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views6 pagesChile Cards and Payments Market Is Expected To Grow at A Healthy Rate PDF

Uploaded by

CoreyChile Cards and Payments Market is expected to grow at a healthy rate. Debit cards dominate the card payments market in terms of number of cards in circulation. The value of debit card transactions at ATMs remained significantly higher than the value of transactions at POS terminals in 2014.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Chile Cards and Payments Market is expected to grow at

a healthy rate

Published: March 2015

Available Format: Excel

Write to: enquiry@psmarketresearch.com

(or)

Call US/ Canada toll-free:1-888-778-7886

https://www.psmarketresearch.com

Chile Cards and Payments Market is expected to

grow at a healthy rate

P&S Market Research releases a new research on cards and payments market. The

databook :

Chile Databook: Cards & Payments Market Size and Forecast to 2020

Explore Description and Scope of the Databook:

https://www.psmarketresearch.com/market-analysis/chile-databook-cards-paymentsmarket

Chile Card and Payments market databook includes market size and forecast for the

period 2010 to 2020 in terms of number of cards, number and value of transactions

processed through these cards. The databook also includes competitive landscape

(card issuers in the country) for both debit cards and credit cards.

The card payments market in Chile grew at a healthy pace during the period 2010 2014, both in terms of volume and value. The growth of the Chile card payments

market will continue in future, driven by the growth of retail sector, increasing market

for online and mobile commerce, and new product offerings. Also branchless banking

model implemented by banks in Chile is expected to further boost the growth of cardbased payments.

https://www.psmarketresearch.com

Chile Cards and Payments Market is expected to

grow at a healthy rate

In Chile, debit cards dominate the card payments market in terms of number of

cards in circulation. The increase in number of debit cards during the period can

be attributed to increasing volume of basic bank accounts cuentas a la vista,

as debit cards are offered along with these accounts. In 2014, debit cards

accounted for 50.5% of total cards in circulation. Debit card also dominated

the Chilean card payments in terms of number of transactions and value of

transactions. Debit cards are used by consumers to shop at retail outlets,

withdraw cash from ATMs and make online payments. Debit card penetration per

100 inhabitants increased from 88 in 2012 to 104 in 2014. The penetration is

further expected to increase to 127 cards per 100 inhabitants by 2020. The

growth in the number of the debit card transactions was fueled by consumer

perceptions that they provide control on spending, and is safe to use. The value

of debit card transactions at ATMs remained significantly higher than the value of

transactions at POS terminals in 2014. Debit card transactions at ATM terminals

accounted for 72.7% of the total debit card transactions in 2014.

Request for Databook Sample: https://www.psmarketresearch.com/enquiryform.php?enqid=89&title=Report%20sample

https://www.psmarketresearch.com

Chile Cards and Payments Market is expected to

grow at a healthy rate

The credit card penetration in Chile per 100 inhabitants increased from 33 in 2012 to

38 in 2014. The penetration is further expected to increase to 45 cards per 100

inhabitants by 2020. The transaction value of credit cards reported at POS terminals

was greater than at ATMs. The credit card transaction value at POS terminals

amounted to CLP8.7 trillion in 2014, representing 85% of the total credit card

transactions, compared to CLP1.5 trillion at ATMs in the same year.

The number of ATM terminals increased from 9,238 in 2012 to 10,283 in 2014. The

number of POS terminals increased from 82,264 in 2012 to 91,159 in 2014. The

number of POS terminals is expected to grow significantly over the forecast period

due to the expansion of retail sector

By scheme, the number of debit cards in circulation was dominated by CuentaRut, a

domestic player, with market share of 44.6%, followed by Visa with 34.5% market

share in 2014. Visa was also a leading scheme in credit card segment with a market

share of 50% of the total credit cards in circulation.

https://www.psmarketresearch.com

Chile Cards and Payments Market is expected to

grow at a healthy rate

Some of the key players in the debit cards market include Banco BBVA Chile, Banco

de Chile and Banco de Crdito e Inversiones. Banco del Estado de Chile was the leading bank

in terms of number of debit cards issued in 2014, accounting for 44% of the total number of

debit cards. Some of the key players in the credit card market in the Chilean card

payments include Banco Santander Chile, Banco de Chile and Banco de Crdito e Inversiones.

In credit card market, Banco Santander Chile was the leading bank in 2014 with a market

share of 27.4% in total number of cards in circulation.

https://www.psmarketresearch.com

Chile Cards and Payments Market is expected to

grow at a healthy rate

About Us

P&S Market Research is a global market research and consulting company. We

provide market research reports, industry reports, business intelligence and research

based consulting services across a range of industries.

With the help of our professional corporate relations with various companies, our

market research offers the most accurate market forecasting. Our analysts and

consultants interact with leading companies of the concerned domain to substantiate

every single data presented in our publication. Our research assists our client in

identifying new and different windows of opportunity and frame informed and

customized strategies for expansion in different regions.

Contact:

Ms Somya

347, 5th Ave. #1402

New York City, NY - 10016

Email: enquiry@psmarketresearch.com

US/ Canada Toll-Free: 1-888-778-7886

Web: https://www.psmarketresearch.com

https://www.psmarketresearch.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounting Principles and Financial Statements ExplainedDocument23 pagesAccounting Principles and Financial Statements ExplainedAnonymous LC5kFdtcNo ratings yet

- 1 ReviewDocument98 pages1 ReviewMuhammad UsmanNo ratings yet

- ATM Withdrawal SpecificationDocument3 pagesATM Withdrawal SpecificationOswald_Alving100% (1)

- Kajoli Baxla Sbi StatementDocument5 pagesKajoli Baxla Sbi StatementShúbhám ChoúnipurgéNo ratings yet

- User rights and permissions reportDocument27 pagesUser rights and permissions reportanandsoggyNo ratings yet

- Different Kinds of Obligation: Pure and ConditionalDocument25 pagesDifferent Kinds of Obligation: Pure and ConditionalMikMik UyNo ratings yet

- Buyers CreditDocument8 pagesBuyers Creditsudhir.kochhar3530No ratings yet

- Sample IIM Essays Topics GD PI 2013Document9 pagesSample IIM Essays Topics GD PI 2013iimb_alumNo ratings yet

- Electronic Payment System Report by HDFC Bank InternDocument34 pagesElectronic Payment System Report by HDFC Bank InternChhaya sharma0% (1)

- Link Bank Account Application FormDocument4 pagesLink Bank Account Application FormJames Bond100% (1)

- Oracle Receivables Golden Tax AdaptorDocument112 pagesOracle Receivables Golden Tax AdaptorSatya Srinivas GonnabattulaNo ratings yet

- Dissertation Project On HDFC BankDocument43 pagesDissertation Project On HDFC BankMAHENDRA SHIVAJI DHENAK100% (6)

- UAB Aug 24-Oct 02,2011Document2 pagesUAB Aug 24-Oct 02,2011Danngee XeyNo ratings yet

- Target Redcards Target Credit Card AgreementDocument5 pagesTarget Redcards Target Credit Card Agreementapi-285771275No ratings yet

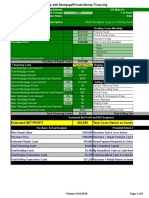

- Deal Analyzer For FlipsDocument8 pagesDeal Analyzer For FlipsAnonymous i1oQibwTjsNo ratings yet

- Advanced SAP SD Interview Questions and AnswersDocument31 pagesAdvanced SAP SD Interview Questions and AnswersBharath Kumar88% (8)

- Welcome To The Presentation of The: Group 4Document126 pagesWelcome To The Presentation of The: Group 4Ronald Jason RomeroNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementRajesh MgNo ratings yet

- IFRS 15 Summary PDFDocument8 pagesIFRS 15 Summary PDFAshraf ValappilNo ratings yet

- Final Individual ProjectDocument46 pagesFinal Individual ProjectSurbhi SinghalNo ratings yet

- Revised RFP-Core Banking System PDFDocument84 pagesRevised RFP-Core Banking System PDFAjay KhapNo ratings yet

- Shoreline Equity Partners Finder Fee EngagementDocument5 pagesShoreline Equity Partners Finder Fee EngagementMarius AngaraNo ratings yet

- Order in Respect of Directors, Promoters and Other Entities in The Matter of GDR Issue of Cals Refineries Ltd.Document53 pagesOrder in Respect of Directors, Promoters and Other Entities in The Matter of GDR Issue of Cals Refineries Ltd.Shyam SunderNo ratings yet

- User's Guide For Multicompany StructuresDocument240 pagesUser's Guide For Multicompany StructuresSanjit Kumar ShuklaNo ratings yet

- Assignment For Strategic Challenge ModuleDocument11 pagesAssignment For Strategic Challenge ModuleahmedNo ratings yet

- Who Meets There? 2. What Do They Do There? 3. Do They Help You in Any Way?Document63 pagesWho Meets There? 2. What Do They Do There? 3. Do They Help You in Any Way?Andrewcaesar97% (30)

- Demo Data Overview For Dynamics Ax 2009Document38 pagesDemo Data Overview For Dynamics Ax 2009Mohammed BouhoumNo ratings yet

- Equine Investigation ReportDocument46 pagesEquine Investigation ReportCourier JournalNo ratings yet

- Project 6 - Thera BankDocument13 pagesProject 6 - Thera BankFrancisco GuízarNo ratings yet

- Orion POS - Guide - User Guide PDFDocument252 pagesOrion POS - Guide - User Guide PDFcaplusinc100% (3)