Professional Documents

Culture Documents

Good Sintext Report by DRE

Uploaded by

MLastTryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Good Sintext Report by DRE

Uploaded by

MLastTryCopyright:

Available Formats

4th Feb 2015

SINTEX INDUSTRIES LIMITED

BSE: 502742 | Sector: BUILDING MATERIALS

View - BUY

CMP

: Rs. 115

Target Price: Rs. 150 (In the next 6 mths)

BUSINESS BACKGROUND

SIntex Industries Limited (SIL) commenced manufacturing of plastic molded polyethylene

liquid storage tanks including water tanks and introduced new plastic products like doors,

window frames and pallets. The Sintex group has 36 manufacturing plants in India and

abroad. Sintex Industries commenced manufacturing of SMC molded products, undertook

modernization and expansion of the textile unit and commenced structured yarn dyed

business. SIL entered prefab structures business in 2001 and started monolithic business in

2005. SIL has made 4 acquisitions in India and overseas to enhance its presence in the

composites segment. SILs acquisitions in the composites segment include Wausaukee

Components and Nero Plastics in the US, Bright Autoplast in India, and NIEF Plastics in

France. These acquisitions have strengthened Sintexs position by giving it access to

technology and customers.

FACEDATA

VALUE Rs

KEY

1.00

DIVD YIELD %

0.64

52 WK HI/LOW

119/31

NSE CODE

SINTEX

BSE CODE

SINTEX

MARKET CAP

RS 4097 CRS

INVESTMENT HIGHLIGHTS

Strong Q3 FY15 Performance

During the third quarter of FY15, total revenues grew by 32% to Rs.1832 crs

largely driven by a strong volume with Q3FY2015, EBIDTA growing by 25%

totalling Rs 306.85 crs as compared to Rs 244.65. crs earned in Q3 last year

with reported profit after tax (PAT) growing by 83% to Rs 161 crs as compared

to Rs 83. crs earned in Q3 last year.

In the first 9 months of FY15 SIL has recorded a Topline of Rs 4858.crs (from

Rs 3881.4 crs in the first 9 mths of FY14) led by better product mix. Also this is

reflected in a higher EBIDTA growth of 30% at Rs 802.05 crs from Rs 617.74

crs in the first 9 mths of last year and a strong 62% increase in PAT. The PAT

for the first 9 mths of FY15 stood at Rs 331 crs as compared to Rs 204 crs in

the first 9 mths of last year.

vScore: vScore (Value Score) is our proprietary company rating system f

For FY14 SIL has recorded a topline of Rs 5864 crs, a EBIDTA of Rs 974.crs

while PAT is placed at Rs 364 crs. SIL paid a dividend of 70% for FY14.

Stable cash flow from the textile business

The Textile segment of SIL caters to a niche market by supplying only high end

structured dyed yarn fabrics to luxury brands such as Armani, Burberry, DKNY,

Zara, among others. Due to the global recession, there has been a slowdown in

demand for luxury products, particularly in Europe, which has led to a

consolidation in the business. In FY14, textiles constituted 10.5% of total

revenues, down from 15.5% in FY08.

During FY12-14, revenues have grown at a CAGR of 8.1%. In FY13, revenues

were more or less flat. However, with recovery in overseas demand, revenues in

Assured

FY14 grew 15.7% YoY to Rs 546.4 crore. Further, with the role out of the new

spinning business from FY17E, we expect revenue from this segment to grow at

a CAGR of 18% during FY14-17E.

SHAREHOLDING PATTERN

PROMOTERS

- 41%

BANKS, MFs & DIIs - 13 %

FIIs

- 8%

PUBLIC

- 38%

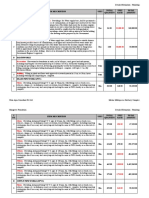

KEY FUNDAMENTALS

YE

FY15 FY16 FY17

Sales Gr%

19

15 15

PBT Gr%

29

19 25

PAT Gr%

30

23

20

EPS Gr%

-9

23

20

Roe %

11 11

12

Roce %

EPS (Rs)

P/E(x)

Precise

10.6

10

Advice

13.0 15.0

8 7

Greenfield spinning project minor delays expected

Commercial production of phase-1 spinning project has been deferred by a month (on account of

weather conditions and local delays), whereas trial runs will start in Mid-may. SIL has also marginally

lowered its revenue guidance from the project in FY16, as it expects a utilization rate of 20%/70% in

FY16/17, from 50%/90% earlier.

Building materials to see some slowdown in near term

While execution in monolithic business will continue to be at a slower pace, revenue growth in prefab

business continues to surprise us positively. Sintex expects revenue CAGR of 20-25% growth in

prefab over the next 2 years, led by increased social spending on education and healthcare, coupled

with new governments focus on low cost housing. However, a systematic execution in Monolithic will

lead to a 15-20% yoy de-growth in revenues (guidance of Rs6.5-7.5bn in FY15).

Clean India programme a big opportunity, no near term benefits

Sintex is extremely bullish on recent initiatives on Swacch Bharat Mission, clean India campaign,

which would cover 1.04crore households, provide 0.25m seats of community toilets, and solid waste

management for 4041 towns. The total cost of the program me is estimated at Rs 620 bn over the

next 5 years, where Sintex will be the biggest beneficiary, given its 90- 95% market share of

prefabricated toilets. However in the near term, Sintex envisages no benefits and expects atleast 9-12

months for meaningful orders to come by.

Custom molding overseas acquisition yielding results

While revenue growth in domestic business came at 13% (in line), overseas custom molding grew at

55% (Rs5.8bn) which is attributable to contribution from SIMONINN acquisition. The company

expects SIMONINN revenues at EUR50m with likely Ebitda margins at 8-9%.

Solid financial performance - topline growth and margin expansion

We estimate SILs earnings to witness a CAGR of 20-25% over FY13-16E. This will be driven by

strong revenue growth (15-20% CAGR over FY13-16E) and a steady EBITDA margin expansion over

the same period.

Over the years, the company has improved its operational performance significantly with its operating

margins having remained in a range between 15. to 16% since last 3 years. Also, considering that the

company is a domestic Textiles & Building materials player, the net leverage at 1.08x as on FY14

seems high but this is expected to come down to 0.62:1 by Mar 2017. .

Business Outlook & Stock Valuation

On a rough cut basis, in FY15, Topline will see a steady rise wherein Topline is expected to touch Rs 6960.

crs. On the bottomline level we expect the company to record a PAT of Rs 475 crs in FY15E. Thus on a

conservative basis, SIL should record a EPS of Rs 10.5.. for FY15E. For FY16E and FY17E our expectation

is that earnings traction for SIL would continue to be robust wherein we expect a EPS of Rs 13 and Rs 16.

A macroeconomic turnaround, improving trajectory of businesses linked to government spending and easing

working capital cycle would drive a 34% PAT CAGR over FY14-17E. Further the SIL management is

targeting a 25% topline growth from new products and a strong 300 to 400 bp increase in its ROCE by 201718

Sintex enjoys early-mover advantage in businesses that are levered to social sector spending in India

(schools/low cost housing/ healthcare centers), funded almost entirely by government. It is believed this

spending will continue, given the socio economic context. Sintexs India construction (monolithic and prefab)

business (40% of revenue) is geared to social sector spending in India by the central and state governments

on low-cost housing, slum rehabilitation, schools and rural healthcare center construction in remote areas.

Though the monolithic business, which has been suffering due to sluggishness from government activity and

consequent delays in execution and receivables pulled down overall performance, things are expected to get

better as Sintex has reduced the number of slow moving sites from seven to five and this will soon come

down to three in the near future

The recent spate of reforms from the government will help gradually revive the domestic economy and

augurs well for SIL as a buoyant social spending and an improved Capex from the private sector will ensure

a strong revival in SILs fortunes.

Hence we believe that the SIL stock should be purchased at the current price for a price target of around Rs

150 keeping a financial stop loss of Rs 95.

FINANCIALS

For the Year Ended March RsCrs

Net Sales

EBIDTA

EBIDTA %

Interest

Depreciation

Non Operational Other Income

Profit Before Tax

Profit After Tax

Diluted EPS (Rs)

Equity Capital

Reserves

Borrowings

GrossBlock

Investments

FY14A

5864.8

975.4

16.63

274.4

254.8

52.4

482.5

364.6

11.72

FY15E

6960.1

1150.1

16.52

273.1

286.0

30.0

621.0

475.0

10.63

FY16E

7998.1

1330.0

16.63

310.0

310.0

30.0

740.0

582.0

13.02

FY17E

9200.1

1530

16.63

300.0

340.0

35.0

925.0

700.0

15.66

31.11

3484.4

3819.0

5003.8

305.8

44.7

4834.9

3987.0

5780

305.8

44.7

5416.9

3887.0

5980.0

305.8

44.7

6116.9

3837.0

6230.0

305.8

KEY CONCERNS

Sharp increase in intesrest rates

Downturn in Goverment spending and any negative impact on the Textles sectors would also

impact SILs operations negatively.

Disclaimer

This document is not for public distribution and has been furnished to the recipient solely for information and must not be reproduced or

redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. This

material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it.

This report is not to be construed as an offer to sell or the solicitation of an offer to buy or sell any security. This report is not directed or

intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other

jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Joindre Group

and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible

for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform

themselves of and to observe such restriction.

This report is for the general information of clients of Joindre Group and does not provide individually tailored investment advice. It has been

prepared without regard to the individual financial circumstances, needs of individual clients and objectives of persons who receive it. Though

disseminated to all the customers simultaneously, not all customers may receive this report at the same time. Joindre Group will not treat

recipients as customers by virtue of their receiving this report. We have reviewed the report, and in so far as it includes current or historical

information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. The investment discussed or views

expressed may not be suitable for all investors. The user assumes the entire risk of any use made of this information. Neither Joindre Group,

nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their

own investigations and should consult their own advisors to determine merit and risks of such investments.

Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance.

Certain transactions including those involving futures, options and other derivatives as well as non-investment grade securities involve

substantial risk and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price

movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a

company's fundamentals. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to

change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the

recommendations expressed herein. We and our affiliates, officers, directors, and employees world wide : (a) may on / before or from time to

time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other

transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with

respect to any recommendation and related information and opinions.

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about

the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or

indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in

any form and/or redistributed without Joindre Groups written consent addressed at Botawala Building, 2nd Floor, 11/13,

Horniman Circle, Fort, Mumbai- 400 023.

You might also like

- 48 - 1997 SummerDocument42 pages48 - 1997 SummerLinda ZwaneNo ratings yet

- NPV CalculationDocument14 pagesNPV CalculationMLastTryNo ratings yet

- Sfa 5.22 PDFDocument36 pagesSfa 5.22 PDFLuis Evangelista Moura PachecoNo ratings yet

- Hydrostatic Pressure Test Safety ChecklistDocument3 pagesHydrostatic Pressure Test Safety ChecklistJerry Faria60% (5)

- 6.2 Incident Management Process Purpose / ObjectivesDocument7 pages6.2 Incident Management Process Purpose / ObjectivesMpho MbonaniNo ratings yet

- Info - Iec62443 2 1 (Ed1.0) enDocument9 pagesInfo - Iec62443 2 1 (Ed1.0) enMLastTryNo ratings yet

- Iso 27001Document100 pagesIso 27001Marek Sulich100% (1)

- 1.SITXWHS003 Student Assessment Tasks 1Document58 pages1.SITXWHS003 Student Assessment Tasks 1Yashaswi GhimireNo ratings yet

- SPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGDocument3 pagesSPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGRengie GaloNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- IDirect SintexInds Q2FY14Document7 pagesIDirect SintexInds Q2FY14MLastTryNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research TeamPooja AgarwalNo ratings yet

- Sinindus 20110913Document9 pagesSinindus 20110913red cornerNo ratings yet

- Press Release Q2fy1415Document6 pagesPress Release Q2fy1415MLastTryNo ratings yet

- 153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015Document33 pages153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015vishald4No ratings yet

- 2013 Apr 2 - ATDocument13 pages2013 Apr 2 - ATalan_s1No ratings yet

- Visaka Industries Annual Report FY11Document60 pagesVisaka Industries Annual Report FY11rajan10_kumar_805053No ratings yet

- Sintex Industries: CMP: Inr87 TP: INR115 BuyDocument8 pagesSintex Industries: CMP: Inr87 TP: INR115 BuyMLastTryNo ratings yet

- IEA Report 19th JanuaryDocument28 pagesIEA Report 19th JanuarynarnoliaNo ratings yet

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuNo ratings yet

- Technocraft Industries (India) : Crafting Value Global Leader at Attractive PriceDocument8 pagesTechnocraft Industries (India) : Crafting Value Global Leader at Attractive PricesanjeevpandaNo ratings yet

- Premium Textile MillDocument12 pagesPremium Textile MillBushra KhursheedNo ratings yet

- SintexInd Sunidhi 211014Document7 pagesSintexInd Sunidhi 211014MLastTryNo ratings yet

- Infosys Result Update Q4FY12Document9 pagesInfosys Result Update Q4FY12Revivallife CounsellingNo ratings yet

- ProfitabilityDocument9 pagesProfitabilityNaheed AdeelNo ratings yet

- Wijaya Karya: Facing HeadwindsDocument5 pagesWijaya Karya: Facing HeadwindsDediNo ratings yet

- Results Press Release (Company Update)Document6 pagesResults Press Release (Company Update)Shyam SunderNo ratings yet

- Name - Anup Sharma UID - 19BBA1299: Analysis of Prime Securities LTDDocument14 pagesName - Anup Sharma UID - 19BBA1299: Analysis of Prime Securities LTDKartik GuleriaNo ratings yet

- Sintex Industries (SININD) : Growth To Moderate FurtherDocument7 pagesSintex Industries (SININD) : Growth To Moderate Furtherred cornerNo ratings yet

- Annual Report - Hyderabad Industries - 2009-2010Document24 pagesAnnual Report - Hyderabad Industries - 2009-2010siruslara6491No ratings yet

- Simplex Infra ICDocument7 pagesSimplex Infra ICAyush KillaNo ratings yet

- Top 10 Stocks Motilal OswalDocument74 pagesTop 10 Stocks Motilal OswalAbhiroop DasNo ratings yet

- Name - Anup Sharma UID - 19BBA1302: Analysis of Rain Industries LTDDocument14 pagesName - Anup Sharma UID - 19BBA1302: Analysis of Rain Industries LTDKartik GuleriaNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- IEA Report 31st JanuaryDocument24 pagesIEA Report 31st JanuarynarnoliaNo ratings yet

- q4 Ceo Remarks - FinalDocument11 pagesq4 Ceo Remarks - Finalakshay kumarNo ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Managerial Accounting Assignment: Company Chosen: SAILDocument11 pagesManagerial Accounting Assignment: Company Chosen: SAILBloomy devasiaNo ratings yet

- Name - Ashu Sharma Class/Section - UID - 19BBA1299: Analysis of Prime Securities LTDDocument14 pagesName - Ashu Sharma Class/Section - UID - 19BBA1299: Analysis of Prime Securities LTDKartik GuleriaNo ratings yet

- Finolex Cables-Initiating Coverage 22 Apr 2014Document9 pagesFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaNo ratings yet

- Balkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?Document9 pagesBalkrishna Industries (BALIND) : Margins vs. Guidance! What Do You Prefer?drsivaprasad7No ratings yet

- FIN 3224 - PensonicDocument8 pagesFIN 3224 - PensonicjuliahuiniNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research Team3bandhuNo ratings yet

- Wim Plast (WIMPLA) : Expansion in New Geographies To Drive VolumeDocument7 pagesWim Plast (WIMPLA) : Expansion in New Geographies To Drive VolumeDhawan SandeepNo ratings yet

- Tata Motors (TELCO) : Domestic Business Reports Positive Margins!Document12 pagesTata Motors (TELCO) : Domestic Business Reports Positive Margins!pgp28289No ratings yet

- PI Industries DolatCap 141111Document6 pagesPI Industries DolatCap 141111equityanalystinvestorNo ratings yet

- Dixon Technologies Q4FY21: Financial Results & HighlightsDocument4 pagesDixon Technologies Q4FY21: Financial Results & HighlightsabhiNo ratings yet

- Microsoft Word - IDirect - SolarInds - Q1FY17Document12 pagesMicrosoft Word - IDirect - SolarInds - Q1FY17anjugaduNo ratings yet

- ProfitabilityDocument3 pagesProfitabilityNaheed AdeelNo ratings yet

- panacAR 2016 2017Document116 pagespanacAR 2016 2017sharkl123No ratings yet

- Sintex-Industries-Limited 827 InitiatingCoverageDocument10 pagesSintex-Industries-Limited 827 InitiatingCoverageMLastTryNo ratings yet

- Sintex Industries: Topline Beats, Margins in Line - BuyDocument6 pagesSintex Industries: Topline Beats, Margins in Line - Buyred cornerNo ratings yet

- Continuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcDocument12 pagesContinuing On Its Strong Growth Trajectory, The Electronics Industry Posted A Growth of 7.8pcFaria AlamNo ratings yet

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Document23 pagesIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedNo ratings yet

- ICICI SecuritiesDocument37 pagesICICI SecuritiesDipak ChandwaniNo ratings yet

- Bluedart Express (Bludar) : Best Financial Year Momentum Remains KeyDocument12 pagesBluedart Express (Bludar) : Best Financial Year Momentum Remains KeyAnkur MittalNo ratings yet

- SharekhanTopPicks 31082016Document7 pagesSharekhanTopPicks 31082016Jigar ShahNo ratings yet

- Star Ferro & Cement (STAFER) : Volume Growth To Drive RevenuesDocument14 pagesStar Ferro & Cement (STAFER) : Volume Growth To Drive RevenuesKirtikumar ShindeNo ratings yet

- accretech 年報2020Document45 pagesaccretech 年報2020Brian WuNo ratings yet

- Finolex Industries Limited: Q2FY14 ResultsDocument17 pagesFinolex Industries Limited: Q2FY14 ResultsSwamiNo ratings yet

- Market Outlook Market Outlook: I-Direct Top PicksDocument9 pagesMarket Outlook Market Outlook: I-Direct Top PicksJleodennis RajNo ratings yet

- FY16 Mid CapDocument5 pagesFY16 Mid CapAnonymous W7lVR9qs25No ratings yet

- IPS-Industry, Trade & Business Statistics - MillsDocument5 pagesIPS-Industry, Trade & Business Statistics - MillsAndrei ItemNo ratings yet

- Stylam IDBI Capital 200516Document20 pagesStylam IDBI Capital 200516Vikas AggarwalNo ratings yet

- Top Picks Sep 2012Document15 pagesTop Picks Sep 2012kulvir singNo ratings yet

- Dolat PreferredDocument45 pagesDolat PreferredAnonymous W7lVR9qs25No ratings yet

- Sharekhan Top PicksDocument7 pagesSharekhan Top PicksLaharii MerugumallaNo ratings yet

- 47 Women As Equal PartnersDocument60 pages47 Women As Equal PartnersMLastTryNo ratings yet

- 13-Disaster Guide For ConstructionnDocument24 pages13-Disaster Guide For ConstructionnMLastTryNo ratings yet

- IPCE New Guidance November2020Document22 pagesIPCE New Guidance November2020MLastTryNo ratings yet

- 71-Safty Fish Catch For FishermenDocument35 pages71-Safty Fish Catch For FishermenMLastTryNo ratings yet

- Vileparle 2019Document10 pagesVileparle 2019MLastTryNo ratings yet

- Healthy Diet FoodsDocument2 pagesHealthy Diet FoodsMLastTryNo ratings yet

- Guidelines - For - Retrofitting - of - BuildingsDocument45 pagesGuidelines - For - Retrofitting - of - BuildingsGautam PaulNo ratings yet

- HC Order On Mumbai Metro PDFDocument100 pagesHC Order On Mumbai Metro PDFMLastTryNo ratings yet

- Request For Proposal For Information Systems Audit: Central Bank of SeychellesDocument32 pagesRequest For Proposal For Information Systems Audit: Central Bank of SeychellesHasan OzturkNo ratings yet

- IR 71.3 Visitor RegisterDocument2 pagesIR 71.3 Visitor RegisterMLastTryNo ratings yet

- R P (R P) I S A 2009-10: Equest For Roposal F FOR Nformation Ystems UditDocument32 pagesR P (R P) I S A 2009-10: Equest For Roposal F FOR Nformation Ystems UditMLastTryNo ratings yet

- Draft Contract Agreement For TCDocument36 pagesDraft Contract Agreement For TCar15t0tleNo ratings yet

- RFP For ISO 27001 26 Jan 2013Document23 pagesRFP For ISO 27001 26 Jan 2013MLastTryNo ratings yet

- RKH Qitarat RFP Is Prog Assur 01mar18Document8 pagesRKH Qitarat RFP Is Prog Assur 01mar18MLastTryNo ratings yet

- 3.6 A-2 Dept File Retention ScheduleDocument10 pages3.6 A-2 Dept File Retention ScheduleMLastTryNo ratings yet

- Kwality 2nd CoC PDFDocument1 pageKwality 2nd CoC PDFMLastTryNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- NPV CalculationDocument11 pagesNPV CalculationMLastTryNo ratings yet

- Uco Bank AUDITDocument5 pagesUco Bank AUDITMLastTryNo ratings yet

- Heart Attack Prevention TipsDocument1 pageHeart Attack Prevention TipsMLastTryNo ratings yet

- Somaiya Timetable Annual Exam 18Document1 pageSomaiya Timetable Annual Exam 18MLastTryNo ratings yet

- M. L. Dahanukar College of Commerce B. Com. (Accounting & Finance) Fees Details For The Year 2017-2018Document1 pageM. L. Dahanukar College of Commerce B. Com. (Accounting & Finance) Fees Details For The Year 2017-2018MLastTryNo ratings yet

- FYBBIDocument69 pagesFYBBIMLastTryNo ratings yet

- 521 - Download - Prof Murli Annual 2015Document5 pages521 - Download - Prof Murli Annual 2015MLastTryNo ratings yet

- List of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateDocument10 pagesList of Participating Organisations For Campus Placement Programme Aug-Sept 2018 Center Interview DateMLastTryNo ratings yet

- Time Table of FYJC Science & Commerce Annual Exam 2017 - 18Document6 pagesTime Table of FYJC Science & Commerce Annual Exam 2017 - 18MLastTryNo ratings yet

- 03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019Document52 pages03 Marine Multispecies Hatchery Complex Plumbing Detailed BOQ - 23.10.2019samir bendreNo ratings yet

- DL5/DL6 With CBD6S: User ManualDocument32 pagesDL5/DL6 With CBD6S: User ManualMeOminGNo ratings yet

- Part - A (Short Answer Questions) : S. No. Questions Bloom's Taxonomy Level Course OutcomeDocument11 pagesPart - A (Short Answer Questions) : S. No. Questions Bloom's Taxonomy Level Course OutcomeDevendra BhavsarNo ratings yet

- Venezuela's Gold Heist - Ebus & MartinelliDocument18 pagesVenezuela's Gold Heist - Ebus & MartinelliBram EbusNo ratings yet

- NV 2Document2 pagesNV 2Joshua ApongolNo ratings yet

- Gr7 3rd PeriodicalDocument2 pagesGr7 3rd PeriodicalElle GonzagaNo ratings yet

- 20091216-153551-APC Smart-UPS 1500VA USB SUA1500IDocument4 pages20091216-153551-APC Smart-UPS 1500VA USB SUA1500Ifietola1No ratings yet

- 1654403-1 Press Fit ConnectorsDocument40 pages1654403-1 Press Fit ConnectorsRafael CastroNo ratings yet

- FairyDocument1 pageFairyprojekti.jasminNo ratings yet

- G6Document14 pagesG6Arinah RdhNo ratings yet

- BNBC 2017 Volume 1 DraftDocument378 pagesBNBC 2017 Volume 1 Draftsiddharth gautamNo ratings yet

- Mcqs Ethics and CSR)Document9 pagesMcqs Ethics and CSR)Maida TanweerNo ratings yet

- MCQ (Chapter 6)Document4 pagesMCQ (Chapter 6)trail meNo ratings yet

- Logcat 1676535419488Document174 pagesLogcat 1676535419488Mungkin SayaNo ratings yet

- HTTP ProtocolDocument16 pagesHTTP ProtocolHao NguyenNo ratings yet

- Dell PowerEdge M1000e Spec SheetDocument2 pagesDell PowerEdge M1000e Spec SheetRochdi BouzaienNo ratings yet

- ATH SR5BT DatasheetDocument1 pageATH SR5BT DatasheetspeedbeatNo ratings yet

- Philippine Forest Facts and Figures PDFDocument34 pagesPhilippine Forest Facts and Figures PDFPamela L. FallerNo ratings yet

- Program 7Document6 pagesProgram 7Khushi GuptaNo ratings yet

- SYLVANIA W6413tc - SMDocument46 pagesSYLVANIA W6413tc - SMdreamyson1983100% (1)

- Which Among The Following Statement Is INCORRECTDocument7 pagesWhich Among The Following Statement Is INCORRECTJyoti SinghNo ratings yet

- New CVLRDocument2 pagesNew CVLRanahata2014No ratings yet

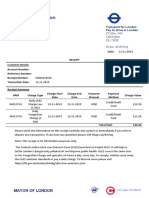

- Transport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingDocument1 pageTransport For London Pay To Drive in London: PO Box 344 Darlington Dl1 9qe TFL - Gov.uk/drivingDanyy MaciucNo ratings yet

- Hukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Document2 pagesHukbalahap: March 16, 2019 Godwin M. Rarama Readings in The Philippine History Seat No. 35Godwin RaramaNo ratings yet

- Calculate PostageDocument4 pagesCalculate PostageShivam ThakurNo ratings yet