Professional Documents

Culture Documents

Deloitte Consulting 401

Uploaded by

007003sCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deloitte Consulting 401

Uploaded by

007003sCopyright:

Available Formats

TBR

PROFESSIONAL SERVICES BUSINESS QUARTERLY

TT

DELOITTE CONSULTING

Ee

Cc

Hh

Nn

Oo

Ll

Oo

Gg

Yy

SM

Fourth Calendar Quarter 2001

Second Fiscal Half 2001 ended May 31, 2001

PSBQ is the comprehensive analysis of professional services, such as management consulting, strategy consulting, system

integrations, outsourcers and other IT consultants. PSBQ covers quarterly reports on IBM Global Services, EDS, CSC,

Accenture, Hewlett-Packard Services, Compaq Global Services, PwC, KPMG Consulting, Unisys Corp., Cap Gemini

Ernst & Young, Affiliated Computer Services, Deloitte Consulting and McKinsey & Co. The service also includes a

quarterly benchmark report, analyst access and custom consulting.

Publish Date: Jan. 30, 2002

TBR ANALYTICAL SUMMARY

( = negative, = neutral, = positive)

R

R

Ee

Ss

Ee

Aa

Rr

Cc

Hh

TBR POSITION

Deloitte Consulting is the consulting arm of worldwide accounting and auditing firm

Deloitte Touche Tohmatsu. DCs FY01 performance in the midst of a general

economic slowdown, as well as more substantial declines in the consulting and IT

services industries, speaks to the efforts to diversify its business model. DC posted

FY01 revenues of $3.49 billion, up 11.1% from $3.14 billion in FY00. While far from

the growth rates of 35% or more DC enjoyed prior to the deceleration in IT spending,

DC has managed to maintain positive revenue growth, beating the PSBQ average of

9% for the period. TBR believes this is due to the relative success of DCs efforts to

geographically diversify its business model, expand its portfolio of services and

strengthen its brand the next logical steps after establishing a global footprint.

While TBR certainly expects DC to continue its expansion into new geographies in the

future, it appears DC has curtailed its expansionist strategy in favor of diversifying its

range of services. This served to buffer DC against overexposure to the areas hardest

hit by the IT spending slump and enabled it to respond to clients demands for a

broader range of services from a single firm. DC may yet suffer a decline in revenues

as corporate IT spending is still soft and strategy consulting is weakening. However,

an even more serious threat to DC stems from the Enron debacle and its

corresponding effect on the auditing industry. TBR believes that despite DCs ardent

refusal to spin off from DTT, a disruptive separation will be inevitable.

B

B

Uu

Ss

Ii

Nn

Ee

Ss

Ss

Author: John Caucis, Contributing Analyst

Content Editor: Humberto Andrade (handrade@tbri.com), PSBQ Director

STRATEGIC OVERVIEW .............................................................. Page 5

DCs primary strategic objectives of establishing a global presence and serving the worlds

leading multinational corporations have remained intact in FY01 from FY00, though the

strategy seems to be evolving to its next stage. From DCs inaugural year in 1996 the

consulting company has grown from a handful of practices to 34 worldwide practices at the

beginning of FY00. This number has not grown since that time, and TBR believes DCs

corporate strategy has shifted from an expansionist strategy to focusing on growing and

strengthening its portfolio of global strategic alliances. However, TBR believes the

slowdown in the consulting industry in 2001, especially in the United States, also had an

impact on DCs efforts to expand its global footprint. FY01 revenues were $3.49 billion,

up 11.1% from $3.14 in FY00. These results are cause for some optimism for DC as its

11.1% year-to-year revenue growth in FY01 edged out the 10% year-to-year revenue

growth achieved in FY00. However, year-to-year revenue growth for FY01 and FY00 are

far from the spectacular growth rates of 35% or more during the height of the IT

infrastructure and services spending frenzy a few years back.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this

information is accurate or complete. Technology Business Research will not be held liable or responsible for any decisions that are made based on

this information. This report is not a recommendation to purchase securities. This report is copyright protected and supplied for the sole use of the

recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 2

MARKET STRATEGY............................................................................................ Page 10

It would seem DC has curtailed its efforts to expand its global footprint, as it has not increased its member

or subsidiary geographic practices since FY99. These practices numbered 34 in FY99 and that has

remained unchanged. Despite this, DCs overseas revenues have continued to grow and become a larger

portion of its worldwide revenues. In FY01, revenues from EMEA and Asia Pacific totaled $1.1 billion, up

19.4% from $926 million in FY00. Individually, EMEA revenues were $661 million, up 7% from

$619 million in FY00, while Asia Pacific revenues were $445 million, up 45% from $307 million in FY00.

Revenues from EMEA and Asia Pacific accounted for 31.7% of total revenue in FY01 versus 29.5% in

FY00. Revenue from Latin America has grown 33.8% to $210 million in FY01 from $157 million in FY00.

To supplement the Authentic Consultant branding and marketing campaign it launched in July 2001, DC

recently published the first two in its Straight Talk series of books. DC hopes this effort will further

distinguish itself from its consulting rivals in the eyes of current and potential clients. TBR believes this

represents an effort by DC to strengthen its brand recognition, which it admits has been weaker than its

consulting competitors. DC continues to target large enterprises, both as clients and strategic partners (the

consulting needs of midmarket or smaller firms are primarily served by DCs parent company DTT). In

FY01, DC established new or expanded relationships with Lucent, Siemens, BEA Systems and

Hewlett-Packard.

RESOURCE MANAGEMENT ............................................................................... Page 14

FY01 saw the virtual end of the war for talent DC and most other consultancies were fighting during the

heyday of the e-commerce and Internet frenzy. The mass exodus of consultants who left their positions

with consulting firms like DC, Accenture, McKinsey and the Boston Consulting Group to join or start new

e-commerce ventures intensified the competition for talent during the e-commerce and Internet boom. But

as IT spending on new projects dried up, so did the need for the architects and plumbers of the new

technology, the strategy and IT consultants. DCs globalization strategy led to substantial growth in its

worldwide staff and locations since 1998. Its worldwide staff has grown 49.4% from 8,220 in FY98 to

12,282 in FY01. However, most of this growth has been overseas, with staff in EMEA increasing 95.3%

from 1,469 in FY98 to 2,869 in FY01. DCs staff in the Asia Pacific/Africa region has grown 79.1% from

1,454 in FY98 to 2,605 in FY01. In FY01, Asia Pacific became the fastest-growing region for DC both in

terms of revenue and human resources directed to the area. An interesting development is DCs launch of

Passport, the firms Web-based alumni program established at the beginning of FY01. In its first year,

DC estimates the program already has more than 2,000 registrants on its Web site. DC also reports

receiving more than 7,000 hits in one month from alumni looking for firm news and information. DC also

has formed alliances with major placement firms to help track and place alumni. DC employs one full-time

global director, one full-time Web manager, has temporarily employed some staff to build its alumni Web

site and distributes a regular newsletter.

FINANCIAL METRICS........................................................................................... Page 19

DC sustained top-line growth during the recent slowdown in the consulting and IT services industries.

Revenues for FY01 grew 11.1% to $3.49 billion from $3.14 billion in FY00. Revenue growth, while still

positive, has flattened since FY99, corresponding to the decline in IT spending. FY99 revenue growth was

an impressive 37% from FY98, but the aforementioned slowdown has pushed revenue growth rates down in

the two years since. FY00 revenue grew 9.9% from FY99 revenue of $2.9 billion, with slightly better

growth achieved in FY01. TBR estimates DCs net income was $559 million in FY01, up 11.1% from FY00

net income of $503 million. DCs net income growth rate kept pace with its revenue growth rate,

illustrating TBRs belief that it has succeeded in controlling operating and other expenses in the face of the

slowdown in its business. DCs net margin of 16% in both FY01 and FY00 declined from the 19% net

margin of FY99. The stabilization of DCs net margin in FY01 corresponds to DCs efforts to curtail

recruiting and hiring, among other expenses. TBR believes the slowdown in FY00 caught DC somewhat by

surprise, evidenced by the sharp decline in net margin from FY99 to FY00, but the company may have

responded quickly enough to preserve its net margin and net income for FY01.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 3

HIGHLIGHTS OF THE QUARTER

( = negative, = neutral, = positive)

NEW SERVICES AND PRODUCTS

DC Announces Support for Siebel 7

10/15/01 DC announced its support for Siebel 7, the seventh major release of Siebel eBusiness

Applications from Siebel Systems Inc. Through its Global Strategic Alliance with Siebel Systems, DC

will now be able to incorporate Siebel 7 into its CRM technology service offering. During CY01, DC has

solidified its position as a Siebel Systems partner with joint wins at major insurance, computer

manufacturing and consumer good companies.

DC Research Finds PC Market to be Stable in 2002

10/5/01 According to recent DC research, all indicators point to a lackluster comeback in 2002 for the PC

industry. The PC Critical Industry Trend Evaluator, an analysis tool developed by DC to track the health

of the PC industry, provided the data for the DC study. PC-CITE is based on financial data from PC

manufacturers, component and peripheral suppliers. It also collected data from distributors and retailers, as

well as stock market indicators through calendar 2Q01.

NEW CLIENTS AND CONTRACTS

DC Withdraws from U.K. Job Center Projects

12/10/01 DC has withdrawn from its contract to manage two flagship job center projects in Leeds and

Suffolk, England because of business reasons. The announcement will come as a blow to the U.K.

government, which has been seeking to bring private sector knowledge into the public sector. Under the

agreement, job seekers in Leeds and Suffolk are able to visit one office for their benefit and employment

requirements. Recently the Public Commercial Services Union claimed private sector companies managing

job centers faced a high level of staff turnover because of poor levels of pay.

DC Partners with Lucent to Implement Billing System for U.K. Utility Company

11/7/01 Lucent is working with DC to implement its Arbor/BP billing platform for U.K. utility company

npower. npower will use the Arbor/BP billing platform to support the introduction of new telephony

services to its expanding customer base across the United Kingdom.

DC Assists Launch of Web Site for California Technology, Trade and Commerce Agency

11/5/01 The California Technology, Trade and Commerce Agency unveiled its new one-stop Web site,

providing dynamic access for business attraction and development, job retention, and international trade

and investment services online. DC worked with the TTCA to integrate and execute its agency-wide

Internet strategy for the site. The firms services included redesigning the look and navigation of the TTCA

Web site and building the new site using the My California portal technology.

ALLIANCES AND ACQUISITIONS

HP and DC Establish Global Alliance

1/14/02 DC and Hewlett-Packard announced a global alliance to jointly develop and deliver collaborative

solutions for customers in the manufacturing sector. The alliance will combine HPs technologies and

complementary services with DCs business consulting and solution delivery. The alliances initial focus

and solution development will center on product lifecycle collaboration, a framework to support

collaborative product development and lifecycle management.

BEA Partners with DC

1/9/02 Software maker BEA Systems has entered a partnership agreement with DC, capping its strategy

to compete against its No. 1 rival IBM. The partnership network is designed to give BEA access to

customers around the globe and compete with IBM Global Services. The accord completes BEAs full

sweep of computer service providers, Cap Gemini Ernst & Young, Computer Sciences Corp., EDS,

Accenture, PricewaterhouseCoopers, Andersen and KPMG Consulting.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 4

Siemens and DC Announce Agreement

11/29/01 Siemens and DC announced they have signed a teaming agreement to pursue potential business

opportunities in the security and CRM marketplace. The agreement formalizes the existing relationship the

two global companies have developed in security and CRM services since earlier this year. Under the

agreement, Siemens and DC will jointly respond to project opportunities with clients that focus on the

deployment and management of security and CRM solutions.

Asia Logistics Forms Strategic Alliance with DC

11/6/01 Asia Logistics Technologies has formed a strategic alliance with DC to provide ERP and SCM

services and solutions to local and international clients.

DC Partners with Digital Detroit

10/24/01 DC is joining hands with Digital Detroit, a nonprofit technology association, to promote

Southeast Michigan as a technology center and an area specializing in more than just automotive

manufacturing. Digital Detroit is a high-tech networking association for business leaders in Michigan. The

association provides educational resources to its members and the high-tech community via events, print

and broadcast news and an online forum, as well as various networking functions. DC will work on the

promotion with its parent company, DTT LLP.

DC Signs Services Provider Agreement with SupplySolution Inc.

10/15/01 DC has signed an agreement with SupplySolution, a provider of supply chain execution

applications, to provide project management, implementation, support, maintenance and other services to

SupplySolutions customers. DC will serve as an implementation ally for SupplySolutions fulfillment

application, i-Supply, to automotive and manufacturing companies worldwide.

Nucleus Financial and DC Announce Alliance

10/1/01 Nucleus Financial Network and DC have announced an agreement to work together to market

software and professional services for strategic processing environments to global financial institutions.

Nucleus Financial and DC will provide financial institutions with a comprehensive technology solution for

strategic processing and an outsourcing alternative for the onerous task of security master maintenance.

These services will be backed by DCs enterprise-level integration services.

ORGANIZATIONAL CHANGES

DC Deploys Saba e-Learning Solution

11/12/01 California-based Saba Software Inc. has supplied its Saba Learning, Enterprise Edition

e-learning system to the professional services provider DC. DC will use Sabas system to deliver selfservice electronic learning to its consulting professionals worldwide. The Internet-based Saba solution

offers support for multilingual content and environments, as well as the ability to support business rules

that are appropriate for the local business practices at each of the consulting firms worldwide offices.

FINANCIALS

DC Reports FY01 Revenues of $3.49 Billion, Up 11% from FY00

5/31/01 FY01 revenues for DC were $3.49 billion, up 11%, or $350 million, from FY00 revenue of

$3.14 billion. (Note: DC restated revenue amounts reported in prior annual reports for FY00 to include all

revenues of DC instead of revenues only from professional fees in FY00. DC also restated FY00 revenues

in U.S. dollars using FY01 exchange rates.)

For complete press releases, see TBRs Web site.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 5

STRATEGIC OVERVIEW

DCs primary strategic objectives of establishing a global presence and serving the worlds leading multinational

corporations have remained intact in FY01 from FY00, though the strategy seems to be evolving to its next stage.

From DCs inaugural year in 1996 the consulting company has grown from a handful of practices to 34 worldwide

practices at the beginning of FY00. This number has not grown since that time, and TBR believes DCs corporate

strategy has shifted from an expansionist strategy to focusing on growing and strengthening its portfolio of global

strategic alliances. However, TBR believes the slowdown in the consulting industry in 2001, especially in the

United States, also had an impact on DCs efforts to expand its global footprint. FY01 revenues were $3.49 billion,

up 11.1% from $3.14 in FY00. These results are cause for some optimism for DC as its 11.1% year-to-year revenue

growth in FY01 edged out the 10% year-to-year revenue growth achieved in FY00. However, year-to-year revenue

growth for FY01 and FY00 are far from the spectacular growth rates of 35% or more during the height of the IT

infrastructure and services spending frenzy a few years back.

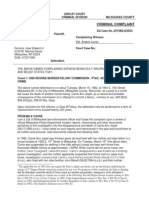

Deloitte's Four-Year Annual Revenues

$4,000

$3,500

$ in Millions

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$FY98

FY99

FY00

FY01

Fiscal Year

STRATEGIC OBJECTIVES

l

l

l

l

l

Expand its portfolio of services through alliances

Serve Global 2000 companies

Leverage relationship with parent company DTT to expand client base

Grow e-government practice

Grow its strategy consulting practice

Relating Strategic Objectives to Actions

In the sections below, TBR relates recent actions taken by the company to the strategic objectives listed above.

EXPAND ITS PORTFOLIO OF SERVICES THROUGH ALLIANCES

l HP and DC formed an alliance to jointly deliver solutions to the manufacturing sector.

l

DC partnered with BEA with to better compete with IBMs Global Services and Software groups.

Siemens and DC formed an alliance to pursue potential business opportunities in the security and CRM

marketplaces.

Asia Logistics Technologies formed a strategic alliance with DC to provide ERP and SCM services.

Lucent is working with DC to implement its Arbor/BP billing platform for U.K. utility company npower.

Nucleus Financial Network and DC have announced an agreement to work together to market software

and professional services for strategic processing environments to global financial institutions.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 6

SERVE GLOBAL 2000 COMPANIES

l BEA Systems counts the majority of the Fortune Global 500 among its clients and its newly established

partnership gives DC access to this clientele.

l

Clients include General Motors, Hewlett-Packard, Cargill, Philip Morris and Microsoft.

Largest 40 clients represent nearly 50% of total revenues.

GROW E-GOVERNMENT PRACTICE

l DC worked with the California Technology, Trade and Commerce Agency to integrate and execute its

agency-wide Internet strategy for its new Web site.

Changes and Developments to Strategic Objectives

TBR will comment on a strategic objective only if there is some change in its status, such as its addition or removal,

or if there is some development concerning it.

EXPAND ITS PORTFOLIO OF SERVICES THROUGH ALLIANCES

TBR believes the decline in the consulting industry has highlighted the benefits of global diversification as well as

having a diverse portfolio of services. Now that DC has completed its global footprint, at least for now, it is

focusing on broadening its range of services. A corollary to this is the need to build a strong portfolio of strategic

alliances by cultivating new relationships with hardware, software, infrastructure and services providers from a

diverse range of industries and geographies. DC has the advantage of having a large multinational parent company

with an extensive clientele as a source for new clients and strategic partners.

GROW ITS STRATEGY CONSULTING PRACTICE

DC has recognized clients are increasingly expecting a broad range of services from their consulting and IT services

companies. For example, CRM clients are demanding that services companies bridge the design and build phases

of an IT project with the latter implement and operate phases. Furthermore, clients are no longer agreeing to invest

in cutting-edge technology with unproven or uncertain returns on investment. Identifying the quantitative and

qualitative elements of a return on an investment is a core competency of the strategy and management consulting

discipline a discipline DC in which recognized its weakness just a few years ago. Since that time, DC has been

aggressively building its strategy practice. In FY00, DCs strategy practice was among the fastest growing in the

industry; TBR estimates it generated $1.4 billion in FY00, achieving a 26% year-to-year growth from FY99

revenues of $1.1 billion. DCs strategy practice is also accounting for a larger share of total revenue. In FY99,

strategy consulting generated 39% of total revenue, while in FY00 it generated 45% of total revenue. While DC did

not report strategy-consulting revenue in its FY01 annual report, TBR is skeptical DCs strategy consulting practice

will be able to replicate its performance of FY99 and FY00 in FY01, though DC has a stronger position against the

pure-play strategy shops and IT services rivals it competes against. For example, McKinsey & Company, long

regarded as the consulting industrys most prestigious firm, has been criticized for its unwillingness to help clients

implement its recommendations. DC has recognized the hyper-cerebral, pie-in-the-sky musings of strategy

consulting elitists like McKinsey are less likely to leave clients awestruck by their prima facie brilliance, especially

if not accompanied by a commitment to assist in their execution. Clients are still seeking strategic counsel to guide

any project and insure there is a solid business reason for its initiation. But clients are increasingly demanding

consultants work with clients to put the ideas generated into action. An example on the other end of the spectrum is

ZAMBA Solutions, a small systems integration and implementation company credited with solid implementation

expertise but lacking a meaningful consulting component in its service offerings. DC must continue to expand its

portfolio of services along with its strategy consulting practice if it expects to compete with IGS, EDS and

Accenture in IT services, as well as strategy consulting leaders like McKinsey, Boston Consulting and Booz-Allen

& Hamilton.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 7

CORPORATE STRENGTHS AND WEAKNESSES

Strengths

l

l

l

Owned by DTT

Privately held

Strong CRM practice

Weaknesses

l

l

l

l

Owned by DTT

Privately held

Weak in outsourcing

Overexposure to IT implementation

Changes and Developments to Strengths and Weaknesses

TBR will comment on a strength or weakness only if there is some change in its status, such as its addition or

removal, or if there is some development concerning it.

STRENGTH: OWNED BY DTT

DC benefits from having a large multinational company as its corporate parent; DTT operates in 140 countries,

employs more than 95,000 people and generated $12.4 billion in revenue in FY01. In the United States, DTT

operates as Deloitte & Touche. Once the smallest of the Big Five accounting firms, DTT is now surpassed by only

PricewaterhouseCoopers, which generated $24 billion in revenue in FY01 and employs 160,000 people. DC has

leveraged this association and its extensive client base to build its own client base. Certainly, DCs role as a DTT

subsidiary has strengthened its brand recognition. But DC has done its part to build a reputation for itself as well.

For example, DC has been one of the fastest-growing segments of DTT since its launch, especially overseas. For

example, in the United Kingdom in FY01, DCs revenue grew 30% to $289 million from $221 million in FY00,

while DTT revenue grew 19.3% year-to-year. For example, the continued growth of DCs strategy consulting

practice will enable it to offer a more comprehensive range of services and further strengthen its brand.

WEAKNESS: OWNED BY DTT

DCs relationship with DTT represents a weakness as well as a strength. The impact of the Enron collapse on the

accounting industry makes the future of this parent-subsidiary relationship unclear as DTT may be forced to divest

its consulting practice on short notice. Senator Barbara Boxer of California introduced legislation in January that

would ultimately ban U.S. accounting and auditing firms from providing consulting services to audit clients. In

addition, the SEC is expected to tighten the regulations regarding auditor independence. The impact of such a

separation on DC is unclear as the recent separations of KPMG Consulting and Accenture from their former auditing

parents have had contrary impacts on both consultancies. KPMG has struggled through the early stages of its

existence as an independent company. It is struggling to rebrand and expand its global footprint, but lacks the cash

to fund these efforts and is still subject to the restrictions of the non-compete agreement with its former parent.

KPMG suffered a 10.4% year-to-year decline in revenues in 1Q02 (calendar 3Q01), and KPMGs management

expects a best-case scenario of a 13% year-to-year decline in revenues in 2Q02 (calendar 4Q01). On the contrary,

Accenture has quickly become a leader in the consulting and IT services industries since becoming an independent

company. It has successfully rebranded and completed the separation from Arthur Andersen LLP, and has enjoyed

two consecutive quarters of year-to-year revenue growth since its IPO, achieving record revenues of $2.99 billion in

its most recent quarter. Should the expected restrictions on auditing firms prevent DTT from upselling auditing and

accounting services, DCs client base of shared patrons may shrink and the availability of potential new clients may

disappear. This is assuming that DTT does not divest its consulting services. Should the two companies separate,

the transition to an independent company may be financially and culturally disruptive.

WEAKNESS: WEAK IN OUTSOURCING

Though they boast an outsourcing capability, DC does not posses the extensive outsourcing infrastructure of ACS,

IGS or EDS (ACS, for example, has more than 500 locations worldwide while DC has but 19 outsourcing-capable

locations). TBR believes DC poses no threat to these leading companies, and will only realize marginal financial

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 8

benefits from being a minor outsourcing player. DC must expand its outsourcing services if it seriously expects to

gain a meaningful share of this growing market.

OPPORTUNITIES AND THREATS

Opportunities

l

l

l

l

Growing outsourcing market

Growing CRM market

Expand into Russia, Eastern Europe and other developing markets

Grow strategy practice

Threats

l

l

l

Fallout from Enron collapse

Decline in systems integration and IT implementation services

Consulting industry maturing

Changes and Developments to Opportunities and Threats

TBR will comment on an opportunity or threat only if there is some change in its status, such as its addition or

removal, or if there is some development concerning it.

OPPORTUNITY: GROWING OUTSOURCING MARKET

In the face of a slowing economy, many companies have implemented cost-cutting measures such as outsourcing

their IT departments or other business processes. IGS, EDS, Accenture and ACS have all reaped the financial

benefits of this trend. DC operates seven Client Support Centers in the United States and Canada, and 12 other

centers throughout EMEA and the Asia Pacific region from which they provide business process outsourcing,

application management and remote development services. The potential client base available to DC through its

subsidiary relationship to DTT is an opportunity for DC to capitalize on the growing outsourcing market, though it

must first expand its outsourcing capabilities.

OPPORTUNITY: GROWING CRM MARKET

IDC expects the CRM services market to total $148 billion by 2005, growing at a compounded annual growth rate

of 25.2% between 2001 and 2005. In FY01, TBR estimates CRM services accounted for 13% of DCs total

revenues, or about $454 million. DC has also been advertising its CRM capabilities through its Straight Talk

series of books and was recognized by Gartner three times in 2000 and 2001 as a leader in CRM services. TBR

believes DC is positioned to capture a share of this growing market.

THREAT: FALLOUT FROM ENRON COLLAPSE

The Enron collapse is likely to lead to sweeping changes in the accounting and consulting professions. In fact, the

very business model of accounting firms that cross-sell consulting services to their client bases may be challenged.

DCs relationship with its professional services parent DTT may be at risk if regulators or governmental agencies

tighten the restrictions on accounting firms. Though DC has vigorously denied any intention to split from DTT, it

may have no choice but to pursue a greater degree of independence from its parent company. TBR believes the

Enron failure and DCs peer review of Enron auditor Arthur Andersen LLP may impact DCs relationship with its

parent company as well as its image. DC has leveraged its relationship to DTT to reach new clients, especially

during its infancy as a consultancy. TBR certainly expects a stringent review of auditing firms that offer businessconsulting services with their accounting and assurance services. TBR also expects the investigation to re-examine

the value of the triennial peer review process among and between these firms, a process in place since 1978.

Ultimately, this may impact DCs ability to share clients with its parent company, and may eventually force DC to

reconsider its options as a subsidiary of DTT despite its ardent refusal to consider a spinoff or IPO. Furthermore,

DCs current clientele may perceive the current uncertainty surrounding the auditing industry as a potential threat to

the continuity and quality of their current relationships with DC, and they may migrate to DCs competitors.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 9

THREAT: DECLINE IN SYSTEMS INTEGRATION AND IT IMPLEMENTATION SERVICES

Systems integration and third-party implementation services have been hard hit by the slowdown in IT spending in

2001. These services comprise a substantial portion of DCs services portfolio, dangerously exposing DC to this

decline.

CONCLUSION

DCs FY01 performance in the midst of a general economic slowdown, as well as more substantial declines in the

consulting and IT services industries, speaks to the efforts to diversify its business model. DC posted FY01

revenues of $3.49 billion, up 11.1% from $3.14 billion in FY00. While far from the growth rates of 35% or more

DC enjoyed prior to the deceleration in IT spending, DC has managed to maintain positive revenue growth, beating

the PSBQ average of 9% for the period. TBR believes this is due to the relative success of DCs efforts to

geographically diversify its business model, expand its portfolio of services and strengthen its brand the next

logical steps after establishing a global footprint. While TBR certainly expects DC to continue its expansion into

new geographies in the future, it appears DC has curtailed its expansionist strategy in favor of diversifying its range

of services. This served to buffer DC against overexposure to the areas hardest hit by the IT spending slump and

enabled it to respond to clients demands for a broader range of services from a single firm. DC may yet suffer a

decline in revenues as corporate IT spending is still soft and strategy consulting is weakening. However, an even

more serious threat to DC stems from the Enron debacle and its corresponding effect on the auditing industry. TBR

believes that despite DCs ardent refusal to spin off from DTT, a disruptive separation will be inevitable.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 10

MARKET STRATEGY

It would seem DC has curtailed its efforts to expand its global footprint, as it has not increased its member or

subsidiary geographic practices since FY99. These practices numbered 34 in FY99 and that has remained

unchanged. Despite this, DCs overseas revenues have continued to grow and become a larger portion of its

worldwide revenues. In FY01, revenues from EMEA and Asia Pacific totaled $1.1 billion, up 19.4% from

$926 million in FY00. Individually, EMEA revenues were $661 million, up 7% from $619 million in FY00, while

Asia Pacific revenues were $445 million, up 45% from $307 million in FY00. Revenue from EMEA and Asia

Pacific accounted for 31.7% of total revenues in FY01, versus 29.5% in FY00. Revenue from Latin America has

grown 33.8% to $210 million in FY01 from $157 million in FY00.

To supplement the Authentic Consultant branding and marketing campaign it launched in July 2001, DC recently

published the first two in its Straight Talk series of books. The first, titled Your Secret Weapon: How to Get the

Most Out of Your Consultant, is intended to guide clients in deciding whether or not to hire a consultant. The

second book, How to Eat the CRM Elephant, explores CRM from a customer service perspective, warning against

becoming infatuated with CRM technology and losing touch with ones customers. This book series will detail the

results of DCs research into what consulting clients are demanding in the current climate of cynicism toward the

consulting industry. DC hopes this effort will further distinguish itself from its consulting rivals in the eyes of

current and potential clients. DC also hopes this will lend credence to its claim that it has remained focused on its

clients rather than on distractions such as talent wars and IPOs, distractions it claims have preoccupied many of its

rivals at the expense of their clients. TBR believes this represents an effort by DC to strengthen its brand

recognition, which it admits has been weaker than its consulting competitors.

DC continues to target large enterprises, both as clients and strategic partners (the consulting needs of midmarket or

smaller firms are primarily served outside of DC by parent company DTT). In FY01, DC established new or

expanded current relationships with Lucent, Siemens, BEA Systems and Hewlett-Packard. The recently established

marketing alliance with HP grew out of HPs relationship with DC as a client, and represents a common evolution

among DCs web of partners and clients.

TBR believes the publication of DCs How to Eat the CRM Elephant and its recent alliances with Siebel and

Siemens illustrate its faith in the CRM market. In FY01, TBR estimates CRM services accounted for 13% of DCs

total revenues, or about $454 million. DC has engaged in a number of marketing events to promote its presence in

the CRM services market, such as its sponsorship of Davos and its sponsorship of Siebel Systems User Week in

Europe. DC also sponsored Siebel Worldwide User Week 2001 in Chicago during September 2001. TBR expects

DC to continue to pursue CRM-related partnerships and clients, as well as continuing to market itself as a leader in

the development and implementation of CRM services.

In response to increasing client demand that a quantifiable ROI be established prior to the initiation of a technology

project, DC has developed software tools to be used in conjunction with the CRM applications of its partners like

Siebel Systems. Quantifying ROI has become an integral part of the selling stage of technology projects and TBR

believes DC recognized this before several of its rivals. Another crucial part of the project-selling process is the

establishment of project milestones to specify frequent ROI reviews for clients. Part of DCs CRM services

includes a series of regular deliverables to clients, sometimes every three months, to provide clients with quick

wins through frequent ROI updates. TBR believes this is part of a larger effort to broaden the range of services

included under the CRM umbrella.

GEOGRAPHIES

Asia Pacific revenue is becoming a larger portion of DCs total revenue, as illustrated in the above chart. Thanks to

a 45% increase in revenue from FY00 in DCs Asia Pacific business, revenue generated outside North America

grew to 37.7% of total revenue from 34.5% in FY00. TBR also believes DCs Latin American business is growing,

as evidenced by its increase to 6% of total revenue in FY01 from 5% in FY00. Growth in EMEA has slowed as the

slowdown in the United States has migrated across the Atlantic. In FY01, DCs EMEA business grew 7% from

FY00 versus 20% year-to-year growth achieved in FY00 from FY99 and a phenomenal 56% growth rate in FY99

from FY98. TBR is not surprised to see DCs rates of non-North American revenue growth slowing as DC shifts the

focus of its expansionist strategy from geographies to services.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 11

Geographic Revenues

80.0%

Total Revenue

70.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

FY99

North America

FY00

EMEA

Asia Pacific

FY01

Latin America

Source: DC 2001 Annual Report and TBR estimates.

SERVICES STRATEGY

In FY01, DC claimed to have merged its industry and services practices to illustrate its stated commitment to and

focus on meeting its clients needs. The reorganization resulted in the formation of the Markets and Services

organization. While TBR believes this change to be more symbolic than an actual reorganization of its corporate

structure, it further illustrates DCs efforts to distinguish itself from its rivals. TBR does not believe this represents a

departure from the strategy of offering industry-specific expertise that DC and many other consultancies pursued in

response to increasingly specialized client demands. Instead, TBR believes DC is enhancing its vertical and

horizontal integration among its industry and services groups. Simply put, the reorganization may represent nothing

more than increased collaboration among industry groups to more quickly identify and respond to cross-industry

needs and trends.

It is important to note that DC recognized a lack of business process expertise among its services and industry

groups and attributed this to the admitted weakness of its brand image against some of its rivals. TBR believes

increasing business process expertise along each of DCs industry and services lines is, and will continue to be, a

part of its overall services strategy.

DC retains the alignment of its service areas into 14 comprehensive and complementary units as follows.

Customer Relationship Management

Services include: business solutions, technology integration and process improvement; transformation and

integration of customer interaction channels including Web, wireless, e-mail, chat, contact centers, field sales, field

services, customer portals and indirect channels; customer data consolidation; and integration of technologies related

to marketing analytics, personalization, campaign management and marketing effectiveness into customer

operations.

Supply Chain Management

Services include: supply chain planning, collaboration and optimization technologies such as i2 and Manugistics;

supplier relationship management technologies, including sourcing and e-procurement solutions such as Atlas

Commerce, Ariba and i2; collaborative commerce/business-to-business/public and private e-marketplaces; product

innovation and lifecycle management, including collaborative product commerce solutions such as Agile Software,

PTC, Unigraphics, i2; and logistics operations technologies, including warehouse management systems,

transportation management systems and e-fulfillment solutions such as Manhattan Associates, Exe, i2 and Nistevo.

Integrated Enterprise Solutions

Services include: business solutions, technology integration and process improvement related to enterprise resource

planning and related technologies/solutions; all ERP, CRM, supply chain management, business-to-business, human

resource dynamics, SEM, financial management, business warehouse and portal solutions for Oracle, PeopleSoft

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 12

and SAP (also includes SAP/Commerce One); and all industry-specific solutions developed around Oracle,

PeopleSoft and SAP.

eTI (e-Technology Integration)

Provides technology solutions and services with primary capabilities in information dynamics, development

services, enterprise connection services, enterprise systems management and security, technology architecture

services, internetworking services and IT transformation; solutions and service offerings that package the

capabilities into cross-industry, package-specific and industry-specific points of view; and includes all non-ERP

industry specific package solutions such as FTI, Keenan and Amarta.

Emerging Business Solutions

Services developed with vendor partners include Web design and development, creative/interactive eStudio services,

Web presence and branding, user-centered design and personalization, enterprise portals (Viador, Plumtree,

DataChannel, Epicentric), content management (Vignette, Interwoven), digital asset management, mobile

commerce/wireless (724, WareNet, Nuance), e-commerce integration (ATG, BroadVision), collaborative commerce

integration, e-payment integration services, e-transformation services, and innovative technology assessment and

deployment.

Offshore Development

Focused on providing offshore development capability with appropriate on-site development support in

engagements across DCs services; skills include Java, C, C++ development, UNIX and Microsoft platform

development, database administration, Web development, and selected software configuration skills; and leverages

SEI CMM Level 5 development expertise to support development-oriented projects.

IT and Business Process Outsourcing

Services include application management outsourcing; application services running on DCs servers; hosting

services supporting some or all of a clients technology infrastructure, including servers, networks, desktops,

computer operations and helpdesk support; IT outsourcing combining application management with hosting services

to effectively become a clients IT department; remote development of ERP interfaces, conversions, reports,

enhancements and functional configurations at DCs Application Support Centers; and business process outsourcing

for functions such as payroll or human resources applications.

Performance, Learning and Change

Services focus on issues of human performance such as organizational alignment, organizational design, culture,

strategic transformation planning, leadership, communication, enterprise and initiative-related learning, and

collaborative knowledge management.

Customer/Product/Market

Services include analysis, strategy and implementation associated with the sales, marketing and service processes;

customer-driven business strategies, including multi-channel strategies and channel conflict; marketing, branding

and pricing analysis and strategies; customer value/performance metrics; customer-centric processes, organization

and decision making; and transformation of an enterprises brand, customer service, sales and marketing

capabilities.

Operations/Supply Chain

Services include analysis, strategy and implementation related to areas such as supply chain, both within an

enterprise and across enterprises; supplier relationship management, including procurement and strategic sourcing;

collaborative commerce/business-to-business/public and private e-marketplaces; product innovation and lifecycle

management, including new product development and collaborative product commerce; logistics operations,

including inventory management, warehousing and logistics management; reconfiguration of work through the

application of lean operations principles across an enterprises entire value stream (enterprise-level lean principles);

merger and acquisition integration; operations improvement not categorized elsewhere.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 13

Financial and Performance Management

Services include analysis, strategy and implementation related to the financial and performance management

business processes, including business planning, financial reporting, closing/consolidation, financial planning and

budgeting, performance measurement and treasury management; business requirements and performance

improvement strategies related to the CFOs arena; financial analysis and modeling; merger and acquisition

analysis; value-based management and strategic enterprise management; activity-based costing and strategic cost

management; and turnaround management.

Business IT Strategy

Services include strategic use of information technology to impact basis of competition, performance, economics,

and value creation; e-business strategy; digital strategy; IT organization and processes transformation; IT value

analytics; and links to IT strategy in DCs technology competency.

Corporate Strategy

Services include industry, market, and competitive research; alternative business models; complexity, scenarios and

real options; market entry and operations strategy; links to organization strategy; and e-business.

Program Leadership

Services include the alignment of programs with corporate and operations strategies; program and project

prioritization (against strategy); portfolio and program benefits realization; portfolio and program management;

program office management for major change programs; and links to M&A and all competencies.

PRICING

DCs project revenue is directly related to the hourly rate charged to its customers. This hourly rate can differ due to

size of project, different tasks, individual negotiations and status of customer, such as private sector or government.

In addition to time, DC bills for out-of-pocket expenses such as travel, lodging, meals, report production and

specialized software/hardware products. DCs out-of-pocket expenses typically average about 20% of fees. The

company also is willing to propose fixed expenses on a project-by-project basis. The following chart details DCs

billing rates for its labor categories.

DC Hourly Wages for Various Labor Categories

Labor Category

Partner/Principal

Director

Senior Manager

Manager

Senior Consultant

Consultant

Source: www.state.fl.us/st_contracts.

TECHNOLOGY BUSINESS RESEARCH, I NC.

Estimated Hourly Rate

$395-$475

$315-$445

$290-$395

$265-$370

$180-$270

$85-$150

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 14

RESOURCE MANAGEMENT

FY01 saw the virtual end of the war for talent DC and most other consultancies were fighting during the heyday of

the e-commerce and Internet frenzy. The mass exodus of consultants who left their positions with consulting firms

like DC, Accenture, McKinsey and the Boston Consulting Group to join or start new e-commerce ventures

intensified the competition for talent during the e-commerce and Internet boom. But as IT spending on new projects

dried up, so did the need for the architects and plumbers of the new technology, the strategy and IT consultants.

Rival KPMG Consulting slashed jobs three times during 2001. McKinsey scaled back its recruiting efforts, froze its

hiring, and released 210 support staff during the year. Even Accenture, despite recently concluding four straight

quarters of year-to-year revenue growth during 2001, implemented measures to match workforce size with business

trends (though in calendar 4Q01 Accenture actually hired 2,400 professionals, illustrating the momentum of its

business relative to its rivals).

DCs globalization strategy led to substantial growth in its worldwide staff and locations from the companys launch

in 1996 until FY00, but has slowed since. Its worldwide staff has grown 1.4% from 12,116 in FY00 to 12,282 in

FY01. This was following 9.4% year-to-year growth in FY00 and 34.7% year-to-year growth in FY99, which

certainly illustrates how DCs hiring trends corresponded to the decline in its business. DC reported staff in the

Americas decreased 1.6% from 6,916 in FY00 to 6,808 in FY01. DC includes Latin America in this figure, and

TBR believes headcount in Latin America actually increased as business in the region did as well. Given this, TBR

believes the bulk of the decline in staff took place in the United States. Staff in EMEA increased 1.3% from 2,832

in FY00 to 2,869 in FY01, illustrating the corresponding slowdown in DCs business in EMEA. Business in Asia

Pacific has continued to grow, as has DCs staff in the region. In FY01, Asia Pacific became the fastest-growing

region for DC both in terms of revenue and human resources DC directed to the area. Asia Pacific staff has grown

10% from 2,368 in FY00 to 2,605 in FY01.

An interesting development is DCs launch of Passport, the firms Web-based alumni program established at the

beginning of FY01. In its first year, DC estimates the program already has more than 2,000 registrants on its Web

site. DC also reports receiving more than 7,000 hits in one month from alumni looking for firm news and

information. DC also has formed alliances with major placement firms to help track and place alumni. While DC

seems to be just acknowledging the value of alumni relations, it is certainly a step in the right direction. A strong

alumni network can also serve to boost DCs prestige as a consultancy, and consequently its brand strength.

McKinseys alumni network is considered perhaps the most extensive and well managed in the consulting industry

and is perhaps the most powerful sales building resource leveraged by any consultancy. DC has recognized the

value of alumni networks as a way to cut costs by curbing headhunter and search fees, estimating that each alumni

rehire can cost as much as $50,000 in such fees. DC employs one full-time global director, one full-time Web

manager, has temporarily employed some staff to build its alumni Web site and distributes a regular newsletter.

DC Revenue and Net Income

FY99

FY00

FY01

$2,861

$3,144

$3,493

Net Income (in $ Millions)

$544

$503

$559

Revenue Year-to-Year Change

37%

10%

11%

Net Income Year-to-Year Change

42%

-8%

11%

19%

16%

Total Revenue (in $ Millions)

16%

Net Income Margin

Source: DC FY01 Annual Report and TBR estimates.

Note: DC restated revenue figures for FY99 and FY00 in its FY01 annual

report from those reported in its FY00 annual report.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 15

OPERATING UNITS AND ORGANIZATIONAL STRUCTURE

DCs geographic emphasis is global and it claims to be able to serve clients in any industry, with a strong focus on

e-business consulting. Although DC claims to have merged its industry groups with its services practices in FY01 to

form the Markets and Services group, DC has retained its industry focus within the following seven industry groups.

Company Segments/Global Market Groups

Manufacturing

Energy

Financial Services

Public Sector

Health Care

Communications/Media

Consumer Business

Manufacturing

Assesses current operations, recommending transformation strategies, implementing initiatives and coaching staff to

become in-house change agents. Addresses issues like process reengineering, application development, technology

selection and implementation, and improving the retail environment. Serves automotive, aerospace, high-tech and

process industries, and life sciences manufacturing sectors.

Financial Services

Provides enterprise transformation, ERP, CRM, mergers/acquisition/integration, strategy/financial management and

systems integration services to financial service firms.

Health Care

Works in conjunction with the tax, auditing, and accounting services of DTT to provide services in strategic

transformation, mergers/integration, as well as service to improve clients market positions, service execution and

market strength. Also provides services through Total Health Management, an integrated set of services and

capabilities related to the management of clinical care across health care organizations.

Consumer Business

Addresses issues of consumer relations, multichannel marketing, supply-chain management and business process

management. Services focus on enterprise transformation and include strategic enterprise management, CRM,

process enhancement, supply chain integration, ERP and systems integration, e-business consulting, and mergers

and acquisitions.

Energy

Serves clients in oil, gas and utility companies. Services include CRM, energy systems integration, mergers and

acquisitions, and ERP.

Public Sector

Offers services to enhance the access to and delivery of government services to citizens, business partners and

government employees. Services include enterprise transformation, ERP, CRM and change leadership.

Communications/Media

Provides communication companies with services, including scenario planning, increasing customer focus,

operational efficiency, revenue stream architecture, e-transformation strategies and other IT services.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 16

Revenue Growth by Global Market Unit

$900

$800

Revenues in Millions

$700

$600

$500

$400

$300

$200

$100

$0

Manufacturing Financial Services

Health Care Consumer Business

FY99

Energy

FY00

Public Sector

Communications/

Media

Other

FY01

Source: TBR estimates.

Five of DCs seven global market units have grown since FY99, the two exceptions being the Manufacturing and

Financial Services groups. TBR estimates revenues for these segments continued to shrink in FY01 thanks to

continued weakness in the U.S. financial services and manufacturing markets. However, TBR believes these groups

performed better in EMEA and Asia Pacific. Revenue in DCs Consumer Business segment grew in FY01, but only

slightly. TBR expects continued erosion of revenues in DCs Financial Services, Manufacturing and Consumer

Business segments. DC has enjoyed strong growth in its Energy, Public Sector and Communications segments since

FY98, trends TBR expects will likely slow with the declining economy and consulting industry, although TBR

expects DCs increased focus on the public sector will produce continued growth. DCs Health Care unit posted

impressive growth in FY01, driven mostly by strong U.S. business.

DC Organizational Structure

Martin Shaw

Chairman

Douglas McCracken

CEO

John M. Sullivan

Deputy CEO

Robert A. Go

Deputy CEO

Robert J. Glatz

CFO

Richard H. Murray

General Counsel

Tom Friedman

Global Director Deloitte Ventures

Brian Fugere

Chief Marketing Officer

Graham Baragwanath

Managing Director, Asia Pacific

Manoj Singh

Managing Director, Americas

Ken Clinchy

Managing Director, Europe

SALES FORCE AND DISTRIBUTION CHANNELS

TBR believes DC relies primarily on the efforts of its more than 850 worldwide partners to generate new and repeat

business. The rapidly increasing number of partners worldwide since FY99 illustrates this, and this has generally

coincided with DCs revenue growth. As revenue growth slowed in FY01, so did the number admitted to the partner

ranks. DC reported 690 worldwide partners in FY99, which jumped by 128 to 818 in FY00, but then grew by 34 in

FY01. Partners proactively establish contact with targeted prospects to identify potential sales opportunities and

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 17

work to establish awareness and preference for their services. DC also employs telemarketing, joint marketing

relationships, seminars, direct mailings, advertising and client referrals. In addition, consultants are taking an

increasing role in sales building as part of DCs recent Authentic Consultant marketing and advertising initiative.

$4.3

900

$4.2

800

$4.1

700

$4.0

600

$3.9

500

$3.8

400

$3.7

300

$3.6

200

$3.5

100

$3.4

Revenue per Partner

($ Millions)

Partners

Deloitte Worldwide Partners and Revenue per Partner

1,000

$3.3

FY00

FY01

Partners

Revenue per Partner

Source: DC 2001 Annual Report and TBR estimates.

DCs revenue per partner has grown as the number of partners in the firm has grown each year except FY00, when

DCs revenue growth declined sharply while its number of partners continued to grow. Revenue per partner in

FY01 rebounded to levels approaching those in FY99 as revenue growth outpaced the number of new partners

admitted.

Deloitte Revenue per Employee and Growth

$290,000

14.5%

$270,000

10.5%

$260,000

Growth

Revenues per Employee

($ Millions)

18.5%

$280,000

6.5%

$250,000

2.5%

$240,000

$230,000

-1.5%

FY99

Revenue per Employee

FY00

FY01

Revenue per Employee Year-to-Year Grow th

Source: DC 2001 Annual Report and TBR estimates.

DCs revenue per employee grew to $284,400 in FY01 from $259,492 in FY00. Year-to-year revenue per employee

growth rebounded to 9.6% in FY01 from 0.5% in FY00 as DC scaled back its hiring while revenues continued to

grow; employee ranks grew 1.4% from FY00 to FY01 while revenues grew 11.1%. This followed a 9% growth in

full-time personnel from 11,076 in FY99. TBR expects this trend to continue, though FY02 revenue growth may

not be sufficient to produce a jump in revenue per employee similar to FY01.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801

This report is based on information made available to the public by the vendor and other public sources. No representation is made that this information is accurate or complete. Technology

Business Research will not be held liable or responsible for any decisions that are made based on this information. This report is not a recommendation to purchase securities. This report is

copyright protected and supplied for the sole use of the recipient. Contact Technology Business Research, Inc. for permission to reproduce.

SM

PROFESSIONAL SERVICES BUSINESS QUARTERLY

Fourth Calendar Quarter 2001

DELOITTE CONSULTING

Page 18

RECRUITING AND RETENTION

While DC has not openly admitted to joining the ranks of consulting firms releasing, or counseling out,

consultants in droves, TBR believes that at least in North America DC has been reducing its headcount. TBR

estimates DCs North American headcount has declined 2% to 3% since FY00. (DC provided headcount by region

for its operations in the Americas in its annual report. However, DC did not distinguish between North America, the

United States, or Latin America, but TBR believes because the slowdown in IT services and consulting was most

acute in the United States, headcount reductions took place mostly in that region and not in the growing Latin

American market.) However, DC has openly stated it has moved groups of consultants between various

geographies, mostly from the United States to EMEA and Asia Pacific where business was stronger. Given this, and

given DC excluded support personnel in the worldwide headcount figures it reported in its annual report (which may

in fact show an actual worldwide headcount reduction), TBR believes DC may be mimicking McKinsey and

Accenture in managing its human resources. McKinsey and Accenture have been reluctant to dismiss consultants

outright. Their preference has been to offer temporary workforce alternatives such as leaves of absence, in the case

of Accenture, or to dismiss support staff, in the case of McKinsey. This practice in lieu of an outright layoff of

consultants demonstrates a belief that the industry will rebound and the company should be prepared to respond

quickly when the rebound occurs. Finally, TBR believes DC has also curtailed hiring and recruiting efforts again

like McKinsey, which has also cut back hiring, suspended summer internships and associate programs, postponed

start dates for new hires and even withdrawn employment offers.

DC has conceded a shift in its hiring focus, which may correspond with the aforementioned shift away from its

corporate strategy of geographic expansion. Where hiring was once more focused on building general practices

simply by increasing personnel, hiring is now focusing on meeting more specific strategic needs. DC continues to

emphasize diversity in hiring, claiming that its diverse workforce enables it to better serve international clients with

consultants acclimated to local culture and local issues.

PHYSICAL INFRASTRUCTURE AND WORLDWIDE LOCATIONS

DCs aforementioned globalization strategy has resulted in substantial international expansion since FY97. In

FY97, DC had offices in five nations, including the United States and Canada. It has since grown to include

locations or subsidiary practices in 34 nations worldwide.

Africa

Pretoria, South Africa; and Johannesburg, South Africa.

Americas

Buenos Aires, Argentina; Sao Paulo, Brazil; Calgary, Alberta, Canada; Montreal, Quebec, Canada; Ottawa, Ontario,

Canada; Toronto, Ontario, Canada; Vancouver, British Columbia, Canada; Santiago, Chile; Mexico City, Mexico;

Monterrey, Mexico; New York, N.Y.; Boston, Mass.; Chadds Ford, Pa.; East Brunswick; N.J.; Parsippany, N.J.;

Philadelphia, Pa.; Stamford, Conn.; Atlanta, Ga.; Marietta, Ga.; Washington, D.C.; West Palm Beach, Fla.; Austin,

Texas; Irving, Texas; Houston, Texas; Chicago, Ill.; Cincinnati, Ohio; Cleveland, Ohio; Detroit, Mich.; Downers

Grove, Ill.; Kansas City, Mo.; Minneapolis, Minn.; Pittsburgh, Pa.; Bellevue, Wash.; Foster City, Calif.; Los

Angeles, Calif.; Phoenix, Ariz.; Sacramento, Calif.; San Francisco, Calif.; San Ramon, Calif.; Santa Ana, Calif.; and

Seattle, Wash.

Asia Pacific

Brisbane, Australia; Canberra, Australia; Melbourne, Australia; Perth, Australia; Sydney, Australia; Shanghai,

China; Hong Kong; Jakarta, Indonesia; Osaka, Japan; Fukuoka, Japan; Tokyo, Japan; Kuala Lumpur, Malaysia;

Auckland, New Zealand; Wellington, New Zealand; Makati City, Philippines; Singapore; Seoul, South Korea;

Taipei, Taiwan; and Bangkok, Thailand.

Europe

Vienna, Austria; Brussels, Belgium; Zaventem, Belgium; Copenhagen, Denmark; Helsinki, Finland; Paris, France;

Berlin, Germany; Dusseldorf, Germany; Frankfurt, Germany; Hamburg, Germany; Hannover, Germany; Munich,

Germany; Milan, Italy; Rome, Italy; Strassen, Luxembourg; Amsterdam, Netherlands; s Hertogenbosch,

Netherlands; Oslo, Norway; Lisbon, Portugal; Madrid, Spain; Barcelona, Spain; Stockholm, Sweden; Zurich,

Switzerland; Basel, Switzerland; Bath, England; Warwick, England; and London, England.

TECHNOLOGY BUSINESS RESEARCH, I NC.

11 Merrill Drive, Hampton, NH 03842

Phone: (603) 929-1166 Fax: (603) 926-9801