Professional Documents

Culture Documents

Toa

Uploaded by

rain06021992Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Toa

Uploaded by

rain06021992Copyright:

Available Formats

ACCTG 421 GOVERNMENT ACCOUNTING

NONPROFIT ORGANIZATIONS

b. Annuity fund payments vary in amount

Multiple Choice (IAA)

and life income payments are fixed in

amount.

1. Nonprofit organizations include all of the

c. Both annuity fund payments and life

following, except

income payments are fixed in amount.

d. Both annuity fund payments and life

a. Professional associations

income payments vary in amount.

b. Schools, colleges and universities

c. Hospitals

8. The statement of financial position of a

d. Government-owned and controlled

private non-profit organization shall report the

corporations

net assets according to which of the following

classifications?

2. This fund include all the assets of a non-profit

organization that are available for use as

a. Unrestricted and permanently restricted

authorized by the governing board and are

b. Temporarily restricted and permanently

not restricted for specific purposes.

restricted

c. Unrestricted and temporarily restricted

a. Unrestricted fund

d. Unrestricted, temporarily restricted

b. Restricted fund

and restricted

c. Permanent endowment fund

d. Term endowment

9. Unrestricted net assets are typically the

assets in

3. The principal must be maintained indefinitely

in revenue producing investments and only

a. General fund

the revenue from the investments may be

b. Restricted fund

expended.

c. Permanent endowment fund

d. Loan fund, term endowment fund, annuity

a. Permanent endowment fund

fund, life income fund and plant fund

b. Term endowment fund

c. Quasi-endowment fund

10. Management and general expenses, fund

d. Annuity fund

raising and membership development

activities of a non-profit organization are

4. It is a fund for which the principal may be

classified in the statement of activities as

expended after the passage of a certain

period or the occurrence of an event specified

a. Program services

by the donor.

b. Support services

c. Both program services and support

a. Regular endowment

services

b. Term endowment

d. Neither program services nor support

c. Quasi-endowment

services

d. Both regular and term endowment

Multiple choice (AICPA Adapted)

5. The type of endowment fund that may be

established by the board of trustees of a

11. A non-profit college received during the

nonprofiit university is

current year a certain amount from a donor

with the stipulation that the contribution be

a. Permanent endowment fund

used to support faculty training during the

b. Term endowment fund

next fiscal year. In the early part of next year,

c. Quasi-endowment fund

the administrators of the college awarded

d. Trustee endowment fund

research grant equal to the contribution in

accordance with the instruction of the donor.

6. This fund is established for assets contributed

For the current year ended, the college shall

to a non-profit organization with the

report the contribution as

stipulation that the organization shall pay

specified fixed amount periodically to a

a. Temporarily restricted revenue in the

designated beneficiary for a specified period

statement of activities

of time.

b. Unrestricted revenue in the statement of

activities

a. Annuity fund

c. Temporarily restricted deferred revenue in

b. Life income fund

the statement of activities

c. Agency fund

d. An increase in the fund balance in the

d. Loan fund

statement of financial position

7. With respect to a non-profit organizations

payments to beneficiaries of annuity fund and

life income fund

a. Annuity fund payments are fixed in

amount and life income payments

vary in amount.

12. A voluntary health and welfare organization

received a contribution from a donor in the

current year. The donor did not specify any

use restriction but the donor specified that

the donation should be used in the next year.

The governing board of the organization spent

the contribution in the next year for fund

raising expenses. For the current year ended,

the organization shall report the contribution

in the

a. Statement of financial position as

deferred revenue

b. Statement of activities as unrestricted

revenue

c. Statement of financial position as

increase in fund balance

d. Statement of activities as

temporarily restricted

13. A nonprofit hospital received a cash donation

from a generous benefactor in the later part

of the current year. The donor requested that

the donation be used to acquire equipment

for the hospital. The hospital used the

donation to acquire equipment in early part of

next year. For the current year ended, the

hospital shall report the cash donation in the

a. Statement of activities as unrestricted

revenue

b. Statement of financial position as

temporarily restricted revenue

c. Statement of financial position as

unrestricted deferred revenue

d. Statement of activities as

temporarily restricted revenue

14. Save the planet Earth, a nonprofit research

organization received a cash contribution

from a generous donor. The donor stipulated

that the donation be used to purchase new

computers for the research staff of the

organization. The contribution was received in

the current year, and the computers were

acquired in the next year. For the current

year, the cash contribution shall be reported

by the organization in the

a. Statement of activities as unrestricted

revenue

b. Statement of activities as deferred

revenue

c. Statement of activities as

temporarily restricted revenue

d. Statement of financial position as

deferred revenue

15. A prominent art collector donated an art

collection to a private nonprofit museum with

the stipulation that the art collection be

shown to the public, that it should be

preserved and not be sold. On the date of

donation, what was the effect of the donation

on the museums financial statements?

a. Temporarily restricted net assets

increased

b. Unrestricted net assets increased

c. Permanently restricted net assets

increased

d. No effect on net assets

16. A nonprofit college received a building with no

donor stipulation as to its use. The college

does not have an accounting policy implying a

time restriction on the donated building. What

type of net assets should be increased when

the building is received?

a. Unrestricted

b. Temporarily restricted

c. Permanently restricted

d. Temporarily restricted and permanently

restricted

17. Which of the following would result in an

increase in unrestricted net assets for the

current year?

I.

A private nonprofit hospital earned interest

on investments that were boarddesignated.

II.

A private nonprofit organization received

unconditional promises to give which will

not be received until January of next year.

The donors placed no restrictions on the

donations.

a.

b.

c.

d.

I only

II only

Both I and II

Neither I nor II

18. For a private nonprofit organization, when is a

donor of conditional promise to give

considered unconditional?

a. Only when the condition is substantially

met.

b. When the possibility that the

condition will not be met is remote.

c. When the conditional promise is made.

d. When the cash or other asset promised is

received.

19. United Hope, a private not-for-profit voluntary

health and welfare organization, received the

following contribution during the current year:

I.

From donors who stipulated that the

money should not be spent until next year.

II.

From donors who stipulated that the

contributions should be used for the

acquisition of equipment, none of which

was acquired in the current year.

a.

b.

c.

d.

I only

Both I and II

II only

Neither I nor II

20. Rosary Gardens, a private not-for-profit

organization, established a quasi-endowment

during the current year. At year-end, the

assets in the quasi-endowment shall be

included in which of the following

classifications?

a.

b.

c.

d.

Temporarily restricted net assets

Unrestricted net assets

Permanently restricted net assets

Either temporarily or permanently

restricted net assets, depending on the

expected term of the quasi-endowment.

21. An alumnus donated securities to a nonprofit

college and stipulated that the principal be

held in perpetuity and revenue be used for

faculty travel. Dividends received from the

securities shall be recognized as revenue in

a. Endowment fund

b. Quasi-endowment fund

c. Restricted current fund

d. Unrestricted current fund

22. For a nonprofit organization, net assets which

can be expended in accordance with the

wishes of the governing board shall be

reported as

a.

b.

c.

d.

Unrestricted

Temporarily restricted

Permanently restricted

Appropriated

d. Both I and II

26. Which of the following conditions is required

for the recognition of contributed services?

I.

The contributed serves create or enhance

nonfinancial assets.

II.

The contributed services require

specialized skills, are provided by

individuals possessing those skills, and

would typically need to be purchased if

not provided by donation.

23. Philippine Museum has both regular and term

endowment. In the museums statement of

financial position, how should the net assets

of each type of endowment be reported?

a. Term endowment as temporarily

restricted and regular endowment as

permanently restricted.

b. Term endowment as permanently

restricted and regular endowment as

temporarily restricted.

c. Both term and regular endowments as

permanently restricted.

d. Both term and regular endowments as

temporarily restricted.

24. During the current year, a nonprofit private

college received a promise from a donor to

provide 80% of the funds needed to construct

a new building if the college could get the

remaining 20% of the funds from other donors

by the middle of next year. At the current-year

end, the governing board of the college had

received donations from other donors for

approximately 15% of the cost of the new

building and believed that the probability of

not getting the remaining 5% was remote.

How would the college report the promise of

the donor for the current year?

a. Increase in permanently restricted net

assets.

b. Not reported.

c. Increase in deferred support in the

statement of financial position.

d. Increase in temporarily restricted net

assets in the statement of activities.

25. Which of the following transactions or events

would cause an increase in unrestricted net

assets for the current year?

I.

II.

A private not-for-profit voluntary health and

welfare organization spent a restricted

donation that was received in the prior

year. In accordance with the donors

wishes, the donation was spent on public

health education during the current year.

During the current year, a private not-forprofit college earned dividends and interest

on term endowments. Donors placed no

restrictions on the earnings of term

endowments. The governing board of the

college intends to use this investment

income to fund undergraduate scholarships

for next year.

a. II only

b. I only

c. Neither I nor II

a.

b.

c.

d.

II only

Either I or II

I only

Neither I nor II

27. During the current year, a foundation received

the following contributed services:

I.

A reputable law firm contributed services

which involve advice related to the

foundations regular endowments.

II.

Senior citizens participated in a telethon

to raise money for a new building.

Which of these contributed services shall be

included in unrestricted revenue for the

current year?

a.

b.

c.

d.

I only

II only

Both I and II

Neither I nor II

28. A nonprofit private elementary school

occupies the school building rent-free as

permitted by the building owner. The

existence of rent-free facilities is recognized in

the schools Unrestricted Fund as

a. Financial aid expense and other operating

support

b. Rent expense and an increase in fund

balance

c. Rent expense and contribution

revenue

d. An item requiring disclosure in the note to

financial statements

29. A storm broke the glass windows in the

building of a religious organization. A member

of the organization replaced the windows at

no charge. In the statement of activities of the

religious organization, the breakage and

replacement of the windows shall

a. Not be reported

b. Be reported by note disclosure only

c. Be reported as an increase n

expenses and contribution revenue

d. Be reported as an increase in net assets

and contribution revenue

30. During the current year, a service entity

repaired the heating system in the building

occupied by a nonprofit organization. An

invoice for a certain amount was received by

the nonprofit organization for the service

charge but at year-end, the service entity

notified the nonprofit organization that the

repairs are being donated without charge.

How should the nonprofit organization report

these contributed services during the current

year?

a. Only in the notes to financial statements.

b. No disclosure is required.

c. As an increase in expenses and

increase in unrestricted revenue in

the statement of activities.

d. As an increase in temporarily restricted

net assets in the statement of activities.

b. A shelter for the homeless

c. A private foundation

d. A public golf course

37. How should a nonprofit organization report

depreciation in the statement of activities?

a. It should not b included.

b. It should be included as a decrease

in unrestricted net assets.

c. It should be included as an increase in

temporarily restricted net assets.

d. It should be reclassified from unrestricted

net assets to temporarily restricted net

assets.

31. A fraternal organization shall prepare a

statement of financial position and which of

the following financial statements?

I.

II.

III.

Statement of activities

Statement of changes in fund balance

Statement of cash flows

a.

b.

c.

d.

I, II and III

III only

II and III

I and III

38. An entity is a nongovernmental not-for-profit

organization involved in research. The

statement of functional expenses should

classify which of the following as support

services?

a. Salaries of staff researchers involved in

research.

b. Salaries of fund-raisers for fund used

in research.

c. Cost of equipment involved in research.

d. Cost of laboratory supplies used in

research.

32. A statement of functional expenses is required

for which of the following nonprofit

organization?

a. College

b. Hospital

c. Voluntary health and welfare

organization

d. Performing arts organization

33. Which of the following private nonprofit

entities is required to report expenses both by

function and by natural classification?

a. Hospital

b. University

c. Voluntary health and welfare

organization

d. Performing arts organization

34. Which classification is required for reporting of

expenses by nonprofit organization?

a. Natural classification in the statement of

activities or notes to FS.

b. Functional classification in the

statement of activities or notes to

FS.

c. Functional classification in the statement

of activities in a matrix format in a

separate statement.

d. Functional classification in the statement

of activities and natural classification in

the notes to FS.

35. If private not-for-profit health care entities do

not use the expense classification in the

operating statement, such entities must

provide it in the notes.

a.

b.

c.

d.

Natural

Character

Functional

Object

36. Which of the following is required to prepare a

statement of functional expenses?

a. An art museum

39. In the statement of activities for nonprofit

performing arts center, expenses shall be

deducted from

I.

II.

III.

Unrestricted revenue

Temporarily restricted revenue

Permanently restricted revenue

a.

b.

c.

d.

I, II and III

Both I and II

I only

II only

40. What is an arrangement where a donor makes

an initial gift to a trust or directly to the notfor-profit organization in which the not-forprofit organization has a beneficial interest

but is not the sole beneficiary?

a.

b.

c.

d.

Donor-imposed condition

Donor-imposed restriction

Share-the-wealth agreement

Split-interest agreement

41. Which of the following is prepared by private

nonprofit hospital but not prepared by other

nonprofit organization?

a.

b.

c.

d.

Statement of financial position

Statement of cash flows

Statement of changed in net assets

Notes to financial statements

42. Which of the following statements of a private

nonprofit hospital reports the changes in

unrestricted, temporarily restricted and

permanently restricted net assets for a

period?

I.

II.

III.

Statement of financial position

Statement of operations

Statement of changes in net assets

a. I and II only

b. I and III only

c. II and III only

d. III only

43. The contractual adjustment account of a

nonprofit hospital is

a.

b.

c.

d.

An expense account

A revenue offset account

A loss account

An asset account

44. For a private health organization, which of the

following is included in patient service

revenue?

a.

b.

c.

d.

Contractual adjustment

Charity care

Restricted contribution

Unrestricted contribution

45. How is charity care accounted for in the

financial statements of a nonprofit health care

organization?

a.

b.

c.

d.

As patient service revenue

As bad debt expense

As a separate component of revenue

Not included in the financial

statements

46. Depending on the extent of discretion that the

nonprofit recipient has over the use or

subsequent disposition of the assets, gifts in

kind may be treated as

a. Agency transaction only

b. Contribution only

c. Either agency transaction or

contribution

d. Neither agency transaction or

contribution

47. When a nonprofit organization receives an

asset for which it has little or no discretion

over the use of the asset, the organization

should report the asset as

a.

b.

c.

d.

Contribution

Agency transaction

Conditional transfer

Either contribution or agency transaction

48. How are non-refundable advance fees

representing payments for future services

accounted for by nonprofit continuing care

retirement communities?

a.

b.

c.

d.

As revenue

As a liability

As other financing source

In a trust fund

49. A family lost a home in a recent fire. At the

current year-end, a philanthropist sent money

to a nonprofit benevolent organization to

purchase furniture for the family. In early part

of next year, the organization purchased the

furniture for the family. How should the

receipt of money be reported in the current

year?

a. As an unrestricted contribution

b. As a temporarily restricted contribution

c. As a permanently restricted contribution

d. As a liability

50. A successful alumnus of a private university

has recently donated a certain amount to the

university for the purpose of funding a center

for the study of sports ethics. This donation

is conditional upon the university raising an

amount matching the donation within twelve

months. The university administrators

estimate that they have a 50% chance of

raising the additional money. How should this

donation be accounted for?

a.

b.

c.

d.

As a temporarily restricted support

As an unrestricted support

As refundable advance

As memorandum entry reported in the

notes

51. A nongovernmental nonprofit organization is

preparing the year-end financial statements.

Which of the following statements is required?

a.

b.

c.

d.

Statement of changes in financial position

Statement of cash flows

Statement of changes in fund balance

Statement of revenue, expenses and

changes in fund balance

52. The statement of cash flows for a nonprofit

organization shall report cash flows according

to which of the following classifications?

I.

II.

III.

a.

b.

c.

d.

Operating activities

Investing activities

Financial activities

I, II and III

II and III

I only

I and III

53. A nonprofit university had the following cash

inflows during the current year:

I.

II.

III.

From tuition fees

From a donor who stipulated that the

money be invested indefinitely

From a donor who stipulated that the

money be spent in accordance with

the wishes of the universitys

governing board.

In the statement of cash flows for the current

year, what cash inflows shall be reported as

operating activities?

a.

b.

c.

d.

I, II and III

I only

I and II only

I and III only

54. A nonprofit foundation had the following cash

contributions and expenditures in the current

year:

I.

II.

III.

Unrestricted cash contribution

Cash contribution restricted by the

donor for the acquisition of equipment

Cash expenditure for an equipment

from the restricted cash contribution

What cash flows should be reported in the

statement of cash flows under investing

activities?

a.

b.

c.

d.

I, II and III

I only

II and III only

III only

55. During the current year, a nonprofit

organization received the following donorrestricted contribution and investment

income.

I.

II.

a.

b.

c.

d.

Cash contribution to bepermanently

invested.

Cash dividend and interest to be used

for the acquisition of theatre

equipment.

I only

II only

Both I and II

Neither I nor II

56. During the current year, a nonprofit

organization received a donation of

equipment from a local computer retailer. The

equipment is expected to have a useful life of

3 years. The donor placed no restriction on

how long the computer equipment was to be

used and the nonprofit organization has an

accounting policy which does not imply a time

restriction on gift o flong-lived asset. In the

statement of activities for the current year,

the donation of computer equipment should

be reported

a. As an increase in temporarily restricted

net assets

b. Only in the notes to financial statements

c. As an increase in unrestricted net

assets

d. As either increase in temporarily restricted

or unrestricted net assets

57. In the prior year, an alumnus of a private

nonprofit high school made a contribution

with the stipulation that the donation be used

for faculty travel during the current year.

During the current year, the school spent all

the donation for faculty travel expenses. What

was the effect of the donation on unrestricted

and temporarily restricted net assets for the

current year?

a. Increase in unrestricted net assets and

decrease in temporarily restricted net

assets

b. No effect on unrestricted net assets

and decrease in temporarily restricted

net assets

c. Increase in unrestricted net assets and no

effect on temporarily restricted net assets

d. No effect on both unrestricted and

temporarily restricted net assets

58. Which of the following would result to

reclassification of net assets of a nonprofit

organization?

I.

II.

a.

b.

c.

d.

Expiration of donor-imposed condition

Expiration of donor-imposed restriction

I only

II only

Both I and II

Neither I nor II

59. At the end of the current year, the Board of

Trustees of the nonprofit museum designated

a certain amount of unrestricted net assets

for the construction of an addition to a

building. What effect does this designation

have on the unrestricted and temporarily

restricted net assets?

a. No effect on unrestricted net assets and

increase to temporarily restricted net

assets

b. Decrease in unrestricted net assets and

increase in temporarily restricted net

assets

c. Decrease in unrestricted net assets and no

effect on temporarily restricted net assets

d. No effect on both unrestricted and

temporarily restricted net assets

60. A voluntary health and welfare organization

received a cash donation in the prior year

which contained a donor-imposed restriction

which stipulated that the donation could not

be spent until the current year. The

organization spent the donation in the current

year for fund raising activities. In the current

year, the expiration of the time restriction

wold result in reporting

a. Increase in temporarily restricted net

assets

b. Reclassification which decreased

temporarily restricted net assets

c. Increase in unrestricted net assets

d. Expense which decreased temporarily

restricted net assets

You might also like

- AFAR - Gov and NPODocument3 pagesAFAR - Gov and NPOJoanna Rose Deciar100% (1)

- 1718 2nds FX Govt AcctgDocument8 pages1718 2nds FX Govt AcctgAveryl Lei Sta.Ana100% (1)

- IR 2 Mod 11 Non For ProfitDocument7 pagesIR 2 Mod 11 Non For ProfitAndrea LanuzaNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Preweek Drill2Document7 pagesPreweek Drill2Grave KnightNo ratings yet

- Year1 Year3 Year3Document3 pagesYear1 Year3 Year3Kyla de SilvaNo ratings yet

- Advanced Acounting QizDocument3 pagesAdvanced Acounting QizJamhel MarquezNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- Government Accounting ReviewDocument6 pagesGovernment Accounting ReviewErwinPaulM.SaritaNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- AfarDocument18 pagesAfarFleo GardivoNo ratings yet

- ACC401 Quiz2Document7 pagesACC401 Quiz287StudentNo ratings yet

- Module 7 NPO Colleges and Universities - Ngovacc PDFDocument8 pagesModule 7 NPO Colleges and Universities - Ngovacc PDFvum preeNo ratings yet

- Quiz Accounting For VHWODocument7 pagesQuiz Accounting For VHWOCarol PagalNo ratings yet

- Quizzer Answers KeyDocument4 pagesQuizzer Answers KeyDaneen GastarNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- Prelim Exam - Doc2Document16 pagesPrelim Exam - Doc2alellie100% (1)

- Midterm SheDocument5 pagesMidterm SheKaye Delos SantosNo ratings yet

- Test2 AfarDocument24 pagesTest2 AfarZyrelle DelgadoNo ratings yet

- Taxation Final Pre Board Oct 2016Document13 pagesTaxation Final Pre Board Oct 2016Maryane AngelaNo ratings yet

- Chapter 14 Multiple Choices: PROB. 14 - 1 (IAS)Document12 pagesChapter 14 Multiple Choices: PROB. 14 - 1 (IAS)jek vinNo ratings yet

- AFAR8722 - Nonprofit Organizations PDFDocument2 pagesAFAR8722 - Nonprofit Organizations PDFSid Tuazon100% (1)

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- Chapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashDocument35 pagesChapter 2: Audit of Cash and Cash Equivalents: Internal Control Over CashEmey CalbayNo ratings yet

- PRTC Signed An AgreementDocument2 pagesPRTC Signed An AgreementhersheyNo ratings yet

- AP - TestbankDocument22 pagesAP - TestbankRamon Jonathan SapalaranNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Additional Income Tax QuizzerDocument2 pagesAdditional Income Tax QuizzerJohn Brian D. Soriano100% (1)

- Multiple Choice - TheoreticalDocument8 pagesMultiple Choice - TheoreticalCharry Divine Dimen100% (3)

- p2 - Guerrero Ch12Document17 pagesp2 - Guerrero Ch12JerichoPedragosa100% (2)

- Ap105 InvestmentsDocument5 pagesAp105 InvestmentsVandix100% (1)

- HOBADocument4 pagesHOBAHannah YnciertoNo ratings yet

- Accounting For SMEs Illustrative ProblemsDocument5 pagesAccounting For SMEs Illustrative ProblemsKate AlvarezNo ratings yet

- QuestionsDocument16 pagesQuestionsLian GarlNo ratings yet

- Forex - Transaction and TranslationDocument13 pagesForex - Transaction and TranslationJoyce Anne MananquilNo ratings yet

- Drill Problems - Community Tax:: Mr. Lafa Mrs. LafaDocument2 pagesDrill Problems - Community Tax:: Mr. Lafa Mrs. LafaRealEXcellenceNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- Apllied Auditing Q&ADocument10 pagesApllied Auditing Q&APeterJorgeVillarante100% (2)

- Ap-5907q Cash PDFDocument5 pagesAp-5907q Cash PDFnikkaaaNo ratings yet

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocument47 pagesInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- Accounting For Legal Reorganizations and Liquidations: Multiple Choice QuestionsDocument121 pagesAccounting For Legal Reorganizations and Liquidations: Multiple Choice Questionsjana ayoubNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- AP 5904Q InvestmentsDocument4 pagesAP 5904Q Investmentskristine319No ratings yet

- COMPREHENSIVE QUIZ ON NPO ACCOUNTING StudentsDocument7 pagesCOMPREHENSIVE QUIZ ON NPO ACCOUNTING StudentsmahilomferNo ratings yet

- Tugas Chapter 22Document14 pagesTugas Chapter 22hayyu rachma annisaNo ratings yet

- NAME: Joven, Al Vincent M. Acc316/413: Assigned Quiz 1Document2 pagesNAME: Joven, Al Vincent M. Acc316/413: Assigned Quiz 1beeeeeeNo ratings yet

- Activity 1 Private Npo 2021Document2 pagesActivity 1 Private Npo 2021Ma Teresa B. CerezoNo ratings yet

- NPO Accounting Activity May 26 2021Document5 pagesNPO Accounting Activity May 26 2021Cassie PeiaNo ratings yet

- GOVACT QuizzerDocument6 pagesGOVACT QuizzerCaha OroNo ratings yet

- Accounting 61 (Government Accounting & Npngo) : Jose Rizal UniversityDocument4 pagesAccounting 61 (Government Accounting & Npngo) : Jose Rizal UniversityGreg DomingoNo ratings yet

- 1 ST Quiz NGODocument5 pages1 ST Quiz NGOfrancesNo ratings yet

- Npo ARC Review Questions 2Document6 pagesNpo ARC Review Questions 2janineNo ratings yet

- NPO AssignmentDocument4 pagesNPO AssignmentZyrah Mae SaezNo ratings yet

- Chapter 21 Accounting For Non-Profit OrganizationsDocument21 pagesChapter 21 Accounting For Non-Profit OrganizationsMarvin ClementeNo ratings yet

- CH 13Document16 pagesCH 13April Lynn Horn33% (3)

- FfdsDocument6 pagesFfdsNico evansNo ratings yet

- AndiDocument27 pagesAndiEllen MNo ratings yet

- Fiduciary Funds and Permanent Funds: True/False (Chapter 10)Document25 pagesFiduciary Funds and Permanent Funds: True/False (Chapter 10)Holban AndreiNo ratings yet

- II. Trade and Investment Policy Regime (1) O: Brazil WT/TPR/S/212Document13 pagesII. Trade and Investment Policy Regime (1) O: Brazil WT/TPR/S/212rain06021992No ratings yet

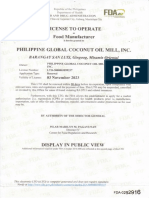

- FDA License 1Document1 pageFDA License 1rain06021992No ratings yet

- PDF Delgado Notes On Civil Procedure Rule 6 21 As Amended DDDocument60 pagesPDF Delgado Notes On Civil Procedure Rule 6 21 As Amended DDrain06021992No ratings yet

- FDA License 1Document1 pageFDA License 1rain06021992No ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149Document40 pagesIii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149rain06021992No ratings yet

- FDA License 1Document1 pageFDA License 1rain06021992No ratings yet

- PH Econ UpdateDocument68 pagesPH Econ Updaterain06021992No ratings yet

- I. A. Background: IEE Checklist For PLTU Projects of 30Document38 pagesI. A. Background: IEE Checklist For PLTU Projects of 30rain06021992No ratings yet

- Rules 64 65 DigestsDocument25 pagesRules 64 65 Digestsrain06021992No ratings yet

- Philippine Economic Zone AuthorityDocument26 pagesPhilippine Economic Zone Authorityrain06021992No ratings yet

- Definition of Product Groups Used in Part A.2: Agricultural Products (Ag)Document3 pagesDefinition of Product Groups Used in Part A.2: Agricultural Products (Ag)rain06021992No ratings yet

- World Trade Organization: CriticismDocument44 pagesWorld Trade Organization: Criticismrain06021992No ratings yet

- TerminalDocument38 pagesTerminalrain06021992No ratings yet

- Philippines Economic OutlookDocument9 pagesPhilippines Economic Outlookrain06021992No ratings yet

- ICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleDocument22 pagesICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleNash A. Dugasan100% (3)

- Module 3 Mainstreaming Framework Jan29 2014 LRDocument78 pagesModule 3 Mainstreaming Framework Jan29 2014 LRrain06021992No ratings yet

- Module 1b SJ Mainstreaming Framewok Part 1Document49 pagesModule 1b SJ Mainstreaming Framewok Part 1rain06021992No ratings yet

- LLR (LPart I)Document12 pagesLLR (LPart I)rain06021992No ratings yet

- Technical Bulletin 2013-01 - List of Protected Areas Under NIPAS PDFDocument24 pagesTechnical Bulletin 2013-01 - List of Protected Areas Under NIPAS PDFLiezl Bohol100% (1)

- EnP Mock Exam CleanDocument25 pagesEnP Mock Exam CleanCedric Recato DyNo ratings yet

- Iclte-b.6-Blgfpresentation NDSC BC 2017Document19 pagesIclte-b.6-Blgfpresentation NDSC BC 2017rain06021992No ratings yet

- Ra - 7718 - PPPDocument8 pagesRa - 7718 - PPPMaykaDSNo ratings yet

- Humanitarian Law and Human Rights Law - The Politics of DistinctioDocument110 pagesHumanitarian Law and Human Rights Law - The Politics of Distinctiorain06021992No ratings yet

- Module 1a Tibig VA May27Document86 pagesModule 1a Tibig VA May27rain06021992No ratings yet

- ICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleDocument22 pagesICLTE-C.1-Public Expenditure MGT & Financial Accountability - Local Budget CycleNash A. Dugasan100% (3)

- Projected Population Population in Single-Year: Table 1 Table 2Document2 pagesProjected Population Population in Single-Year: Table 1 Table 2rain06021992No ratings yet

- WEF VisionManagingNaturalDisaster Proposal 2011Document127 pagesWEF VisionManagingNaturalDisaster Proposal 2011rain06021992No ratings yet

- Singco NotesDocument85 pagesSingco Notesrain06021992No ratings yet

- Site & Area Planning (Full)Document167 pagesSite & Area Planning (Full)rain06021992No ratings yet

- Initial Environmental Examination (Iee) Checklist For Small Water Impounding ProjectDocument17 pagesInitial Environmental Examination (Iee) Checklist For Small Water Impounding Projectrain06021992No ratings yet

- Extending Criminal LiabilityDocument14 pagesExtending Criminal LiabilitymaustroNo ratings yet

- Semiconductor FundamentalsDocument18 pagesSemiconductor FundamentalsromfernNo ratings yet

- Women Under The Gun: How Gun Violence Affects Women and 4 Policy Solutions To Better Protect ThemDocument52 pagesWomen Under The Gun: How Gun Violence Affects Women and 4 Policy Solutions To Better Protect ThemCenter for American ProgressNo ratings yet

- State Common Entrance Test Cell, Maharashtra: Provisional Selection Letter (CAP 2)Document1 pageState Common Entrance Test Cell, Maharashtra: Provisional Selection Letter (CAP 2)Vrushali ShirsathNo ratings yet

- Grade 11 Entreprenuership Module 1Document24 pagesGrade 11 Entreprenuership Module 1raymart fajiculayNo ratings yet

- Franca Aix Marseille UniversityDocument4 pagesFranca Aix Marseille UniversityArthur MograbiNo ratings yet

- Partnership Deed Day of February Two Thousand Nineteen in BetweenDocument6 pagesPartnership Deed Day of February Two Thousand Nineteen in Betweenradha83% (6)

- Diamond Service SoftwareDocument42 pagesDiamond Service Softwareqweqwe50% (2)

- Ethics AssignmentDocument10 pagesEthics AssignmentRiyad HossainNo ratings yet

- The Box - 1st and 2nd ConditionalsDocument3 pagesThe Box - 1st and 2nd Conditionalsshanay afshar50% (2)

- Internship ReportDocument48 pagesInternship Reportansar67% (3)

- Moz PROCUREMENT COORDINATOR JOB DESCRIPTIONDocument2 pagesMoz PROCUREMENT COORDINATOR JOB DESCRIPTIONTsholofeloNo ratings yet

- Cat Forklift v225b Spare Parts ManualDocument23 pagesCat Forklift v225b Spare Parts Manualethanmann190786ikm100% (81)

- Open 20 The Populist ImaginationDocument67 pagesOpen 20 The Populist ImaginationanthrofilmsNo ratings yet

- The Acquisition and Requisition of Immovable Property Manual by Muhammad Mahbubur Rahman PDFDocument246 pagesThe Acquisition and Requisition of Immovable Property Manual by Muhammad Mahbubur Rahman PDFMd. Shiraz JinnathNo ratings yet

- Case 14 G.R. No. 170672Document6 pagesCase 14 G.R. No. 170672Love UmpaNo ratings yet

- Ting Vs Central Bank of The PhilippinesDocument6 pagesTing Vs Central Bank of The PhilippinesRelmie TaasanNo ratings yet

- Wilbert Eugene Proffitt v. United States Parole Commission, 846 F.2d 73, 4th Cir. (1988)Document1 pageWilbert Eugene Proffitt v. United States Parole Commission, 846 F.2d 73, 4th Cir. (1988)Scribd Government DocsNo ratings yet

- Reyes v. CA 216 SCRA 25 (1993)Document7 pagesReyes v. CA 216 SCRA 25 (1993)Karla KanashiiNo ratings yet

- Rr310106 Managerial Economics and Financial AnalysisDocument9 pagesRr310106 Managerial Economics and Financial AnalysisSRINIVASA RAO GANTANo ratings yet

- TCS 10 Year Financial Statement FinalDocument14 pagesTCS 10 Year Financial Statement Finalgaurav sahuNo ratings yet

- Culasi, AntiqueDocument10 pagesCulasi, AntiquegeobscribdNo ratings yet

- Land and Agrarian Reform in The PhilippinesDocument36 pagesLand and Agrarian Reform in The PhilippinesPrix John EstaresNo ratings yet

- School AllotDocument1 pageSchool Allotamishameena294No ratings yet

- Gyptone Brochure (03 - 04)Document16 pagesGyptone Brochure (03 - 04)dan_horneaNo ratings yet

- Philippine Bus Rabbot V PeopleDocument3 pagesPhilippine Bus Rabbot V PeopleRostum AgapitoNo ratings yet

- Caoibes V Caoibes-PantojaDocument1 pageCaoibes V Caoibes-PantojaJames Evan I. ObnamiaNo ratings yet

- US Internal Revenue Service: f2106 - 2004Document2 pagesUS Internal Revenue Service: f2106 - 2004IRSNo ratings yet

- Glosario JurídicaDocument56 pagesGlosario JurídicaMaría Cristina MartínezNo ratings yet

- Manual Survey Pro For RangerDocument337 pagesManual Survey Pro For RangerIni ChitozNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyFrom EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyRating: 4 out of 5 stars4/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesFrom EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesRating: 5 out of 5 stars5/5 (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestFrom EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestRating: 5 out of 5 stars5/5 (1)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasFrom EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasRating: 3 out of 5 stars3/5 (1)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeFrom EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNo ratings yet

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)