Professional Documents

Culture Documents

Valuation Methods (DDM, EVA and DCF)

Uploaded by

Angelo TorresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Methods (DDM, EVA and DCF)

Uploaded by

Angelo TorresCopyright:

Available Formats

Valuation Methods

You can estimate market values of companies using

DCF, Economic Value Added or Residual Income

Em via DCF = [FCFi/(1+Rwacc)i] Dm

Em via EVA = IK0 + [EBITix(1-T)-IKixRwacc] - Dm

____________________(1+Rwacc)I

Em via Residual Income = EB0+[(NIi-EBixRe)/(1+Re)i

Dividend Discount Model also works!!!

Although less often used, the Dividend

Discount Model can help you find Em

Em = Divi/(1+Re)I

It is a deceivingly simple method, but may

not work well in real sector companies as

these may not pay regular dividends

Is there a way to check DDM ~ DCF et al?

Valuing Coke using DDM

Question to ask when valuing Coke with the DDM

method is What is the maximum dividend Coke

can afford to pay while still allowing it to grow at

its trend growth of 1.5% without new equity?

To answer the above question, we know this:

SGR = RxROE/(1-RxROE), where R=[NI-Divs]/NI

Set SGR=2%, and take ROEKO=25%. If we know

that last 12 mos of NI = $8.37B, then Div=$7.7B

Note: SGR stands for sustainable growth rate (the maximum growth level a company can self-fund without additional equity issues). This SGR can be found by either of the

following two equations: SGR = RxROE/(1-RxROE) or SGR = ROICxFLx(1-d)/(1-ROICxFLx(1-d)), where ROIC=EBITx(1-T)/IK, FL = (Eb+Db)/Eb and d=1-(NI-Divs)/(EBIT(1-T))

Valuing Coke using DDM

If we assume Dividends grow at 1.5% and that Re,

based on current data, is 6% (from Rf+Be x (Rm-Rf) =

2.4%+0.6x6%), then:

Em = $7.7Bx(1+1.5%)/(6%-1.5%)+Excess Cash

Em = $187.65B (Ps=$42)

As of Aug 7th, 14, Cokes MarketCap = $173B (Ps=$39)

Note that Cokes 12mo trailing DIVs are $5.27B but

we used $7.7B (from SGR formula). Why?

Because $7.7B is the highest Coke can pay and still be able to grow

at its trend of 1.5% without requiring additional equity

If we had used $5.27B, we wouldve undervalued Coke using DDM

Valuing Coke using DDM

How did we find the expected growth? We assumed it would be the growth priced in the stock price

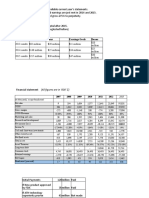

EBIT

Dep

CAPex

-Inc WK

$

$

$

$

FCF

Rdx(1-T)

Re

Rwacc

EC

Em

gimp

Ps

7,000,200

1,997,000

(2,511,000)

(352,000)

6,134,200

1.56% $ 18.64

6.00% $ 173.00

5.57%

$

9,307,000

$ 173,000,000

1.61%

39.41

ROE

R

g*

25%

7.994%

2.04%

NI

DIV

R

$

$

EC

Em

$ 9,307,000

$ 187,655,228

Ps

Note: See Appendix for an expanded view of this exercise

8.37

7.70

7.994%

42.75

DDM needs some tweaks, so why use it?

Is best to use DCF or EVA before relying on DDM,

specially for Real Sector companies that dont pay

dividends

Whether companies pay or not pay dividends, we must find

a level of dividends based on growth trends and SGR. This is

due to the fact that even what companies pay might not be

suited for use in DDM valuations (as was the case with Coke)

However, DDM is most helpful to value commercial

and investment banks. For these type of companies

(Financial Institutions), DDM works like a charm

More on why DDM is good for FIs

DDM is well suited to value banks because:

Banks operate under very tight regulations

Banks have stable dividend policies. That allows us to look

back and, just as easy, project dividends forward

Unlike real sector companies (which buy raw inputs to

manufacture products which then are sold for money), banks

raw inputs are money. Banks then use that capital to create

money-like products and sell these, again, for money.

Concepts of working capital needs are thus very different.

Banks also invest more on IT technology than on CAPex and

those IT investments are expensed as they occur. As such, Net

Income (from which Divs come) includes good info about it.

Banks pool all funds (a dollar from deposits might end up

exactly where another dollar in Long Term Debt ended up) to

invest in various projects (whether it be lending to people or

investing in companies). As a result, as Banks even use its

Deposits (a short term liability), is not as easy to estimate a

reasonable Em% and Dm% to weigh Rd and Re in WACC

Using DDM to value Banks

See Damodaran article on valuing Banks using DDM

http://tinyurl.com/d9gghzo

What is the alternative to DDM in FIs?

An alternative to DDM is to value Banks via their

fundamentals

Valuing the bank via its fundamentals requires

another set of tools that is different to those used

for real sector companies

Well expand more on banks fundamental

valuation towards the end of the course because

DDM is only a rough approximation. For ex, what

would we say are the right dividends when

projected growth >> SGR? Or, what would we do

if Net Income is biased by accounting gimmicks?

But lets return to Divs for Real Sector companies

We can still ask Why should companies return capital to their

shareholders? Why not keep Excess Capital for extreme situations?

Well lets start by saying that such Excess Capital belongs to

shareholders if they so like (Managers have to convince shareholders

that they have good use for the Excess Cash, or else dividend it out)

Excess Cash in a company belongs to those who invested in the company

assets that generated it, not to agents managing these assets. By contrast,

your parents earned excess cash by way of labor and own the rights to it.

They are simultaneously shareholders and managers of their assets.

That said (that Shareholders, not managers, own the rights to the

Excess Cash), there is also a value-conservation rationale to divesting

Excess Cash when good corporate opportunities are hard to come by

If IKi (invested capital on ith year) is larger than needed (as when

Excess Cash is there), the right side term of IKi x Rwacc (a.k.a. capital

charge) will make the value in between brackets smaller!!!

But lets return to Divs for Real Sector companies

Moreover, paying dividends to shareholders

provides some added benefit to stock owners:

Shareholders pay lower capital gain tax on dividends

Shareholders can then reinvest cash where they want

So when do companies accumulate Excess Cash?

Cash increases when projected growth (gp) <<< SGR

Growing below SGR is not so bad (i.e. Cokes SGR=11% but

youd be happy with a 0%-2% growth due to saturation)

When gp <<< SGR, company consumes less than its

invested capital

When gp >>> SGR, it consumes more than its invested

capital (so the company either can issue new equity, can

improve its SGR by levering itself and/or improving its

ROIC or it can grow below SGR to avoid funds shortage)

But, I hear that Cash is King

We wrap up by questioning the wisdom of the Cash is King

idiom in corporate settings

Is not that Cash does not serve us well at times of need, but

rather that if it can not be invested above the companys

opportunity cost (Rwacc), too much of it destroys value

In spite of the above, there may be times when you, as a

manager, convince shareholders to hold some or most of the

Excess Cash for valid purposes (i.e. buy a competitor using cash,

guarantee solvency during potential bank system crisis )

Lastly, think of it this way: Would you prefer holding cash at the

expense of growth, even when economically profitable growth

can be attained by putting that Excess Cash to work?

Returning to valuing Banks

(2) Now, to have a more

precise valuation (closer to the

real sector company technique

DCF but for banks), we need a

new valuation paradigm for FIs

Fundamental

Valuation

Valuation

shortcuts

(3) An interesting thing on valuation

shortcuts: What works for real sector

companies does NOT work for FIs

(1) Damiodarans article

proposes DDM as way to value

banks but that is somewhere

between a valuation shortcut

and a fundamental valuation

To understand the FIs Fundamental

Valuation model, we need to delve

deeper into the topology of banks

The FIs Fundamental Valuation model

- Separates FIs into fee and Fin Instrs side

- Values fee side discounting FCFEs by Re

- Values Financial Instruments side using:

PVLiquidationValue + PVFranchise Value -PVOPEX-PVTaxpenalty

This technique is sometimes referred to as the Balance Sheet approach

Lets focus on the traditional side, the least understood

The FIs Fundamental Valuation model

Liabs+Equity

DIVi = NIi-(TEi-TEi-1) because: NIi+Tei-1 DIVi =TEi

Value of Taxable Bond

Single Component

Value of Taxable Bond

Two Components

TB

ETFB

TB

ETFB

PV taxable bond = PV tax-free bond + (Addnl Cap Gains on taxable bond) x T

ETFB

TB

You might also like

- When Does Restructuring Improve Economic PerformanceDocument23 pagesWhen Does Restructuring Improve Economic PerformanceKashif KidwaiNo ratings yet

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- Tugas 1 - Tuff Wheels - Net Present ValueDocument5 pagesTugas 1 - Tuff Wheels - Net Present ValueClark JagiringNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- FIN526 Financial Statement Analysis Template JeffDocument5 pagesFIN526 Financial Statement Analysis Template Jeffjeffff woodsNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Conjoint Analysis PDFDocument15 pagesConjoint Analysis PDFSumit Kumar Awkash100% (1)

- Managerial Finance - Final ExamDocument3 pagesManagerial Finance - Final Examiqbal78651No ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Mba 7300Document2 pagesMba 7300Naman NepalNo ratings yet

- ECAP Learning - Vijay KumarDocument7 pagesECAP Learning - Vijay KumarVijayNo ratings yet

- Tata Motors ValuationDocument38 pagesTata Motors ValuationAkshat JainNo ratings yet

- Vijaya Diagnostic Centre LimitedDocument7 pagesVijaya Diagnostic Centre LimitedRavi KNo ratings yet

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Practice Questions MGT 632: Business Research Methods/ MGB 114: Research MethodsDocument9 pagesPractice Questions MGT 632: Business Research Methods/ MGB 114: Research MethodsVishal SharmaNo ratings yet

- Metropolis Investment NoteDocument10 pagesMetropolis Investment NoteYash BNo ratings yet

- MAC Cheat SheetDocument18 pagesMAC Cheat SheetAmariah ShairNo ratings yet

- QMM Assignment May2021Document2 pagesQMM Assignment May2021Anupam GuptaNo ratings yet

- Corporate Finance Practice ExamDocument11 pagesCorporate Finance Practice ExamPeng Jin100% (1)

- EVA Vs ROIDocument5 pagesEVA Vs ROINikhil KhobragadeNo ratings yet

- Strategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldFrom EverandStrategic Cost Cutting After COVID: How to Improve Profitability in a Post-Pandemic WorldNo ratings yet

- Strategic Management AccountingDocument27 pagesStrategic Management AccountingCvetozar MilanovNo ratings yet

- Portfolio Analysis BCG and AnsoffDocument22 pagesPortfolio Analysis BCG and AnsoffV.J. NagyNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- Management Control System: DR Rashmi SoniDocument35 pagesManagement Control System: DR Rashmi SoniPriyanka ReddyNo ratings yet

- Interpretation of Ratio Analysis of Novartis PharmaceuticalsDocument28 pagesInterpretation of Ratio Analysis of Novartis PharmaceuticalsumerhameedNo ratings yet

- Clo Rex Case Study Teaching NoteDocument5 pagesClo Rex Case Study Teaching Noteismun nadhifahNo ratings yet

- Caux Principles 1Document4 pagesCaux Principles 1Kirti DadheechNo ratings yet

- The Balanced Scorecard - SummaryDocument10 pagesThe Balanced Scorecard - SummaryGuest HouseNo ratings yet

- Present ValueDocument8 pagesPresent ValueFarrukhsgNo ratings yet

- The Number of Heart Surgeries Performed at Hartville General HosDocument1 pageThe Number of Heart Surgeries Performed at Hartville General HosAmit PandeyNo ratings yet

- MCQDocument9 pagesMCQsk_lovNo ratings yet

- Renault-Nissan Alliance Perspective: Thierry MOULONGUETDocument11 pagesRenault-Nissan Alliance Perspective: Thierry MOULONGUETSathish KumarNo ratings yet

- Project On Parag MilkDocument74 pagesProject On Parag MilkraisNo ratings yet

- Tata MotorsDocument2 pagesTata MotorsTanvi SharmaNo ratings yet

- Rough Assignment MarketingDocument11 pagesRough Assignment MarketingYared DemissieNo ratings yet

- Hero Honda FinanceDocument11 pagesHero Honda FinanceNavneet Lalit GoyalNo ratings yet

- Evaluating Project Economics and Capital Rationing: Learning ObjectivesDocument53 pagesEvaluating Project Economics and Capital Rationing: Learning ObjectivesShoniqua JohnsonNo ratings yet

- Strategy and Competitive Advantage in Diversified CompaniesDocument61 pagesStrategy and Competitive Advantage in Diversified CompaniesAnum ImranNo ratings yet

- Earn Pay-Outs: Sales Goals Bonus Earnings Goals BonusDocument5 pagesEarn Pay-Outs: Sales Goals Bonus Earnings Goals BonusUjjwal BhardwajNo ratings yet

- Security Valuation PriciplesDocument69 pagesSecurity Valuation PriciplesvacinadNo ratings yet

- Financial Management at Bajaj AutoDocument8 pagesFinancial Management at Bajaj AutoNavin KumarNo ratings yet

- Ch01 SolutionsDocument4 pagesCh01 SolutionshunkieNo ratings yet

- Nash EquilibriumDocument156 pagesNash EquilibriumfuriouNo ratings yet

- Homework 6Document7 pagesHomework 6Izzy RamirezNo ratings yet

- Business Policy and Strategy Bba Study NotesDocument60 pagesBusiness Policy and Strategy Bba Study NotessneelamNo ratings yet

- 0.17812100 1464363675 Investor Presentation For The Quarter and Year Ended March 2016 Original OptDocument35 pages0.17812100 1464363675 Investor Presentation For The Quarter and Year Ended March 2016 Original OptMattNo ratings yet

- Ma 6Document32 pagesMa 6Tausif Narmawala0% (1)

- Simulado 5 (PREP) - BC 1Document7 pagesSimulado 5 (PREP) - BC 1Maria Clara OliveiraNo ratings yet

- GM588 - Practice Quiz 1Document4 pagesGM588 - Practice Quiz 1Chooy100% (1)

- Financial Analysis For Strategy Case StudyDocument11 pagesFinancial Analysis For Strategy Case StudyRahmat M JayaatmadjaNo ratings yet

- A Further Look at Financial Statements: Financial Accounting, Seventh EditionDocument64 pagesA Further Look at Financial Statements: Financial Accounting, Seventh Editionayesha125865No ratings yet

- Yunivarsiitii Naannoo Oromiyaa: Oromia State UniversityDocument287 pagesYunivarsiitii Naannoo Oromiyaa: Oromia State UniversityMola MogeseNo ratings yet

- Chapter 8 Cost ConceptsDocument28 pagesChapter 8 Cost ConceptsRajveer SinghNo ratings yet

- Ifrs 1Document10 pagesIfrs 1kadermaho456No ratings yet

- 01 Assignment CVP Basics AnswerDocument8 pages01 Assignment CVP Basics AnswerKSNo ratings yet

- Bai Tap KTQT 2Document12 pagesBai Tap KTQT 2Tram NguyenNo ratings yet

- Difference Between Financial and Managerial AccountingDocument10 pagesDifference Between Financial and Managerial AccountingRahman Sankai KaharuddinNo ratings yet

- Ilovepdf MergedDocument76 pagesIlovepdf MergedNitin KumarNo ratings yet

- Chapter 1: Session 1 Introduction To Financial AccountingDocument161 pagesChapter 1: Session 1 Introduction To Financial AccountingHarshini Akilandan100% (1)

- 12 Ch3. 12 - Investments PowerPointsDocument24 pages12 Ch3. 12 - Investments PowerPointsShawn Lynette Bray100% (2)

- Im Acco 20213 Accounting Principles 3Document107 pagesIm Acco 20213 Accounting Principles 3magua deceiNo ratings yet

- Core 10Document194 pagesCore 10Ashutosh Patro100% (1)

- Property and Assets: AB Bank Balance SheetDocument17 pagesProperty and Assets: AB Bank Balance SheetRafiul IslamNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- Accounts Must Do Questions by Vinit Mishra SirDocument137 pagesAccounts Must Do Questions by Vinit Mishra SirCan I Get 1000 SubscribersNo ratings yet

- KPI RepositoryDocument33 pagesKPI RepositoryBONo ratings yet

- Accounting 102 Final Exam Review - StudentsDocument7 pagesAccounting 102 Final Exam Review - StudentsYesha Mae CabungasonNo ratings yet

- Assignment Marriot Case SolutiionDocument6 pagesAssignment Marriot Case SolutiionRaheel AhmedNo ratings yet

- Forecasting RevenueDocument55 pagesForecasting RevenueHyacinth Alban100% (2)

- Chapter 6 InventoriesDocument10 pagesChapter 6 InventoriesShaheer Khurram100% (1)

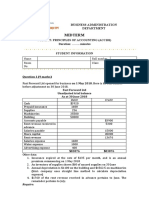

- Midterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationDocument2 pagesMidterm: Hoa Lac Subject: Principles of Accounting (Acc101) Duration: .. Minutes Student InformationNguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Module 3 Adjusting Journal EntriesDocument25 pagesModule 3 Adjusting Journal EntriesThriztan Andrei BaluyutNo ratings yet

- FCF Ch02 Excel Master StudentDocument24 pagesFCF Ch02 Excel Master Studentannu technologyNo ratings yet

- 5 MF Only - 230123 - 184709Document44 pages5 MF Only - 230123 - 184709vageesha namdeoNo ratings yet

- QuestionDocument12 pagesQuestionnmdl123No ratings yet

- As A Recent Graduate You Have Been Hired by CanadianDocument2 pagesAs A Recent Graduate You Have Been Hired by CanadianAmit PandeyNo ratings yet

- Quiz 1 Answers PDFDocument4 pagesQuiz 1 Answers PDFMariamiNo ratings yet

- FM W10a 1902Document9 pagesFM W10a 1902jonathanchristiandri2258No ratings yet

- Accounting Mid-Term Exam Acct.Document3 pagesAccounting Mid-Term Exam Acct.Ann ButlerNo ratings yet

- Sample Reports Guide For The Financial EdgeDocument404 pagesSample Reports Guide For The Financial EdgeAdi PermanaNo ratings yet