Professional Documents

Culture Documents

Schedule 1 Indiana Deductions

Uploaded by

kdaveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule 1 Indiana Deductions

Uploaded by

kdaveCopyright:

Available Formats

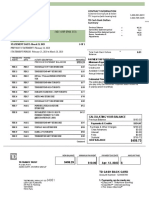

Schedules 1 & 2

Attachment

Sequence No. 01

Schedule 1: Indiana Deductions

Form IT-40, State Form 47908

R4 / 8-05

(Schedule 2 begins after line 12 below)

Enter your first name, middle initial and last name and spouses full name if filing a joint return

Your Social

Security Number

Instructions for Schedule 1 begin on page 9.

1. Renters deduction: Address where rented if different from the one on the front page (enter below)

Please round all entries to

the nearest whole dollar

(see instructions on page 6).

B

_________________________________________

Landlords name and address (enter on next line)

C

D

_________________________________________

Amount of rent paid $_________________

E

Number of months rented _____

Enter the lesser of $2,500 or amount of rent paid ...................

2. Homeowners residential property tax deduction: enter address where property tax was paid if

different from front page F

________________________________________________________

Number of months lived there G_________

Amount of property tax paid $ H

________________

3. State tax refund reported on federal return (see page 10) .............................................................

2

3

4. Interest on U.S. government obligations (see page 10) .................................................................

5. Taxable Social Security benefits (see page 10) .............................................................................

6. Taxable railroad retirement benefits (see page 10) ........................................................................

7. Military service deduction: $2,000 maximum for qualifying person (see page 10) .........................

8. Non-Indiana locality earnings deduction: $2,000 maximum per qualifying person (see page 11)

9. Insulation deduction: $1,000 maximum: attach verification (see page 11) .....................................

10. Nontaxable portion of unemployment compensation (see page 11) ..............................................

10

Enter the lesser of $2,500 or the actual amount of property tax paid ............................................

11. Other Deductions: See instructions beginning on page 12 (attach additional sheets if necessary)

a. Enter deduction name

code no.

11a

b. Enter deduction name

code no.

11b

code no.

11c

code no.

11d

c. Enter deduction name

d. Enter deduction name

12. Add lines 1 through 11 and enter total on line 8 of Form IT-40 ....................... Total Deductions

12

Schedule 2: Indiana Credits

Instructions for Schedule 2 begin on page 22.

1. Credit for local taxes paid outside Indiana (see page 22) ..............................................................

2. County credit for the elderly: attach federal Schedule R (see page 22) .........................................

3. Other Local Credits: See instructions on page 23 (attach additional sheets if necessary)

a. Enter credit name

b. Enter credit name

A

B

code no.

3a

code no.

3b

Important: Lines 1 through 3 cannot be greater than the county tax due on IT-40 line 17

(see page 24)

4. College credit: attach Schedule CC-40 (see page 24) ...................................................................

5. Credit for taxes paid to other states: attach other state's return (see page 25) ..............................

4

5

6. Other Credits: See instructions on page 26 (attach additional sheets if necessary)

6a

a. Enter credit name

b. Enter credit name

6b

c. Enter credit name

E code no.

F code no.

6c

d. Enter credit name

code no.

code no.

6d

Important: Lines 4 through 6 added together cannot be greater than the state adjusted gross

income tax due on IT-40 line 16 (see Additional Limitations on page 30)

7. Add lines 1 through 6 and enter total on line 28 of Form IT-40 ........................... Total Credits

You might also like

- Pages From Donald Trump's 1995 Income Tax ReturnsDocument3 pagesPages From Donald Trump's 1995 Income Tax ReturnsCirca NewsNo ratings yet

- IRS f982 Goes With The 1099-CDocument5 pagesIRS f982 Goes With The 1099-Cexousiallc100% (3)

- 2011 1040NR-EZ Form - SampleDocument2 pages2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- File 2011 NM Income Tax ReturnDocument3 pagesFile 2011 NM Income Tax ReturnPedro ChapaNo ratings yet

- Form 12CDocument2 pagesForm 12CAllahBaksh100% (2)

- Individual Income Tax ReturnDocument2 pagesIndividual Income Tax ReturnMNCOOhioNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- Tax Exemptions and Deductions QuizDocument25 pagesTax Exemptions and Deductions QuizDanica VetuzNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- TD Cash Back Card: 256 Rue Du Faubourg Saint-Martin 75010 ParisDocument2 pagesTD Cash Back Card: 256 Rue Du Faubourg Saint-Martin 75010 ParisIPTV NumberOneNo ratings yet

- Lance Dean 2013 Tax Return - T13 - For - RecordsDocument57 pagesLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDocument69 pagesBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- Mercantile Reviewer UP 2016 NEGO PDFDocument48 pagesMercantile Reviewer UP 2016 NEGO PDFAnonymousNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

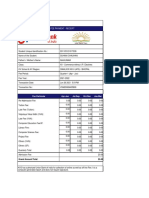

- Income Analysis WorksheetDocument11 pagesIncome Analysis WorksheetRajasekhar Reddy AnekalluNo ratings yet

- UUID For Vendor InvoicesDocument5 pagesUUID For Vendor Invoiceskdave100% (1)

- Genal ListDocument4 pagesGenal ListErik FarrNo ratings yet

- Tax Invoice: Savita Indane Gas Services (0000118201)Document1 pageTax Invoice: Savita Indane Gas Services (0000118201)veeresh100% (1)

- Andre FladellDocument26 pagesAndre FladellMy-Acts Of-SeditionNo ratings yet

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- A Practical Guide to the NEC4 Engineering and Construction ContractFrom EverandA Practical Guide to the NEC4 Engineering and Construction ContractNo ratings yet

- Income Taxation - Win Ballada 19th EditionDocument11 pagesIncome Taxation - Win Ballada 19th EditionAshley GomezNo ratings yet

- Monese Statement 01 May 2023 - 23 August 2023Document12 pagesMonese Statement 01 May 2023 - 23 August 2023Andrea SarocoNo ratings yet

- Income TaxationDocument124 pagesIncome TaxationGWENN JYTSY BAFLORNo ratings yet

- Emergent Payments India Private Limited Tax InvoiceDocument1 pageEmergent Payments India Private Limited Tax InvoiceSuganthan SundharamNo ratings yet

- Engagement Letter Business Clients NEW PDFDocument9 pagesEngagement Letter Business Clients NEW PDFMark TorresNo ratings yet

- Schedule CB For Tax Year 2012Document2 pagesSchedule CB For Tax Year 2012Scott LieberNo ratings yet

- MM DD YY MM DD YY: State of New Jersey Income Tax-Resident ReturnDocument3 pagesMM DD YY MM DD YY: State of New Jersey Income Tax-Resident ReturnNirali ShahNo ratings yet

- A Dulce Base Security Officer Speaks OutDocument2 pagesA Dulce Base Security Officer Speaks OutSteven SchoferNo ratings yet

- Indiana Full-Year Resident Individual Income Tax Return: State Form 154 (R9 / 9-10)Document2 pagesIndiana Full-Year Resident Individual Income Tax Return: State Form 154 (R9 / 9-10)surferdude1888No ratings yet

- M 1 PRDocument2 pagesM 1 PRAndy KrogstadNo ratings yet

- Chapter 4Document6 pagesChapter 4Ashanti T Swan0% (1)

- Senior Circuit Breaker 2014Document2 pagesSenior Circuit Breaker 2014Scott LieberNo ratings yet

- Drake State Refund As Taxable Worksheet (2018)Document1 pageDrake State Refund As Taxable Worksheet (2018)TaxGuyNo ratings yet

- North Dakota Tax Form ND-S1Document2 pagesNorth Dakota Tax Form ND-S1Rob PortNo ratings yet

- Please Print or Type All AnswersDocument2 pagesPlease Print or Type All AnswerselktonclerkNo ratings yet

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocument2 pages1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- 2015 Two BrothersDocument43 pages2015 Two BrothersAnonymous Wu0bxv6p7No ratings yet

- Report of Receipts and Disbursements: FEC Form 3Document9 pagesReport of Receipts and Disbursements: FEC Form 3Bobby CogginsNo ratings yet

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173No ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- Form 2220 Underpayment Penalty CalculatorDocument4 pagesForm 2220 Underpayment Penalty Calculatorkushaal subramonyNo ratings yet

- State Tax FormDocument2 pagesState Tax FormSaintjinx21No ratings yet

- F1040se DFTDocument3 pagesF1040se DFTjyoti06ranjanNo ratings yet

- Form 1040nrez 2010Document2 pagesForm 1040nrez 2010David A. VestNo ratings yet

- Mortgage Recording Tax Return: General InformationDocument4 pagesMortgage Recording Tax Return: General Informationshubik1No ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- U.S. Information Return Trust Accumulation of Charitable AmountsDocument4 pagesU.S. Information Return Trust Accumulation of Charitable AmountspdizypdizyNo ratings yet

- Maine Individual Income Tax: FORM 1040ME 2 0 1 3Document3 pagesMaine Individual Income Tax: FORM 1040ME 2 0 1 3Daniel DillNo ratings yet

- 10 1041sbDocument9 pages10 1041sbTham DangNo ratings yet

- Peabody BankruptcyDocument30 pagesPeabody BankruptcyZerohedgeNo ratings yet

- 2011 Pa-40Document2 pages2011 Pa-40Hesam AhmadiNo ratings yet

- LCGS 2011 941Document2 pagesLCGS 2011 941Timothy Rampage RushNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changessud_hotlineNo ratings yet

- Column No.1:: The Length of The Name Should Not Be Greater Than 99 CharactersDocument3 pagesColumn No.1:: The Length of The Name Should Not Be Greater Than 99 Charactersdjmd007No ratings yet

- RITA 32 Form-Quarterly TaxDocument2 pagesRITA 32 Form-Quarterly Taxjtu3834No ratings yet

- Form_1040N_Schedules_I_II_and_III_8-418-2022_finalDocument3 pagesForm_1040N_Schedules_I_II_and_III_8-418-2022_finaldammydave4No ratings yet

- By The Numbers, Inc.Document51 pagesBy The Numbers, Inc.mailfrmajithNo ratings yet

- Saral: ITS-2D Form No. 2DDocument2 pagesSaral: ITS-2D Form No. 2DPrasanta KarmakarNo ratings yet

- Untitled PDFDocument2 pagesUntitled PDFjenny abbottNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- 195211 Form M1PR Homestead Credit RefundDocument2 pages195211 Form M1PR Homestead Credit RefundMichelle Ann WasanNo ratings yet

- MO-1040A Fillable Calculating - 2015 PDFDocument3 pagesMO-1040A Fillable Calculating - 2015 PDFAnonymous 3RVba19mNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- U.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019From EverandU.S Economy, Construction Industry, and Residential Market Crisis and Recovery, 2000-2019No ratings yet

- China's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeFrom EverandChina's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeNo ratings yet

- Unit Test TemplateDocument3 pagesUnit Test TemplatekdaveNo ratings yet

- Ipfw by The NumbersDocument2 pagesIpfw by The NumberskdaveNo ratings yet

- New SAP Learning Hub: A Complete, Cloud-Based Learning Experience For Customers and PartnersDocument1 pageNew SAP Learning Hub: A Complete, Cloud-Based Learning Experience For Customers and PartnerskdaveNo ratings yet

- Chap 017 SchedulingDocument4 pagesChap 017 SchedulingkdaveNo ratings yet

- Guidelines For Course Assignments and ProjectsDocument1 pageGuidelines For Course Assignments and ProjectskdaveNo ratings yet

- Student Instruction Masters Cand 2014Document2 pagesStudent Instruction Masters Cand 2014kdaveNo ratings yet

- Recommended Portfolio May 13Document4 pagesRecommended Portfolio May 13kdaveNo ratings yet

- Interesting Modi ArticleDocument5 pagesInteresting Modi ArticlekdaveNo ratings yet

- Chap 017-Operation SchedulingDocument4 pagesChap 017-Operation SchedulingkdaveNo ratings yet

- Shouldice Hospital Part1Document2 pagesShouldice Hospital Part1kdaveNo ratings yet

- Zfiint08 Upload100Document6 pagesZfiint08 Upload100kdaveNo ratings yet

- Chap 017Document8 pagesChap 017Nikhil BhilavadeNo ratings yet

- Chap 017Document8 pagesChap 017Nikhil BhilavadeNo ratings yet

- GITA MAHATMYAM-The Glory of the GitaDocument3 pagesGITA MAHATMYAM-The Glory of the Gitakdave100% (3)

- Unicredit vs. IngDocument3 pagesUnicredit vs. IngAlina AndrioaeNo ratings yet

- Income Tax 214C 2017Document52 pagesIncome Tax 214C 2017A JOKHIONo ratings yet

- Super ForgingsDocument2 pagesSuper Forgingsbikkumalla shivaprasadNo ratings yet

- Eight Methods To Pay Vendor in SapDocument7 pagesEight Methods To Pay Vendor in Sapadit1435No ratings yet

- Fredrickson v. Starbucks CorporationDocument51 pagesFredrickson v. Starbucks Corporationmary engNo ratings yet

- Revenue Regulations No. 01-99: Rule 1.coverageDocument24 pagesRevenue Regulations No. 01-99: Rule 1.coveragesaintkarriNo ratings yet

- Part II. Chapter 5 Collection of Real Property TaxDocument39 pagesPart II. Chapter 5 Collection of Real Property TaxRuiz, CherryjaneNo ratings yet

- IndusInd Bank Legend Credit Card - Dec 2017Document15 pagesIndusInd Bank Legend Credit Card - Dec 2017rithbaan basuNo ratings yet

- Paper 8: Indirect Tax Laws Statutory Update For May 2022 ExaminationDocument25 pagesPaper 8: Indirect Tax Laws Statutory Update For May 2022 Examinationparam.ginniNo ratings yet

- Quotation.782 Juniper v2.5 HardwareDocument1 pageQuotation.782 Juniper v2.5 HardwareFAVE ONENo ratings yet

- PayPal 2Document9 pagesPayPal 2Lucy Marie RamirezNo ratings yet

- Policy Statement - U010146572Document1 pagePolicy Statement - U010146572Dipak ChandwaniNo ratings yet

- Resume Vikas Kumar OmarDocument2 pagesResume Vikas Kumar OmarVikas Kumar OmarNo ratings yet

- Penalties Under The Income Tax Act 1961Document10 pagesPenalties Under The Income Tax Act 1961Ram IyerNo ratings yet

- Challan Form For Written Test Fee Payment (POLICE CONSTABLE)Document1 pageChallan Form For Written Test Fee Payment (POLICE CONSTABLE)Rashid Abbas0% (1)

- Scripts StatusDocument6 pagesScripts StatusGanesh ChimmaniNo ratings yet

- Receipt - 8 - 13 - 2021 12 - 00 - 00 AMDocument1 pageReceipt - 8 - 13 - 2021 12 - 00 - 00 AMSuhani ChauhanNo ratings yet

- Impact of Plastic Money On Paper MoneyDocument7 pagesImpact of Plastic Money On Paper Moneymustafeez88% (8)

- Engineering EconomyDocument47 pagesEngineering EconomyChris Thel MayNo ratings yet

- Project On Pan Card and Its BenefitsDocument22 pagesProject On Pan Card and Its BenefitsShambhavi SharmaNo ratings yet