Professional Documents

Culture Documents

Week1 Basel3 Slides PDF

Uploaded by

Manas KotruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week1 Basel3 Slides PDF

Uploaded by

Manas KotruCopyright:

Available Formats

TW3421x - An Introduction to Credit Risk Management

Introduction

The Basel Accords: Basel III

Dr. Pasquale Cirillo

Week 1

Lesson 3

2007-2008: The Crisis

The flaws of Basel II

The flaws of Basel II

Insufficient Capital Reserve

The flaws of Basel II

Insufficient Capital Reserve

No uniform definition

of capital

The flaws of Basel II

Insufficient Capital Reserve

No uniform definition

of capital

Inadequate risk

management approach

The flaws of Basel II

Insufficient Capital Reserve

No uniform definition

of capital

Underestimation of

liquidity risk and

excessive leverage

Inadequate risk

management approach

The flaws of Basel II

Insufficient Capital Reserve

Pro-cyclicality

Underestimation of

liquidity risk and

excessive leverage

No uniform definition

of capital

Inadequate risk

management approach

Basel III

(Basel 2.5 in 2011)

First Basel III proposals in 2009.

First version in 2011.

Many amendments.

The implementation is now

ongoing.

Fully operative in 2018/2019.

The key points

Capital definitions and requirements.

Capital conservation buffer.

Countercyclical buffer.

Leverage ratio.

Liquidity risk.

Counterparty Credit Risk.

The key points

Capital definitions and requirements.

Capital conservation buffer.

Countercyclical buffer.

Leverage ratio.

Liquidity risk.

Counterparty Credit Risk.

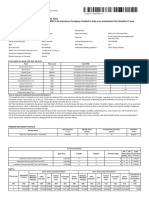

Capital Definitions &

Requirements

TIER 1

Core capital:

Share Capital

Retained Earnings

Does not include

goodwill or

deferred tax assets.

At least 4.5% of

RWA at all times!

Capital Definitions &

Requirements

TIER 1

ADDITIONAL TIER 1

Core capital:

Items like noncumulative

Share Capital

Retained Earnings preferred stocks.

Does not include

goodwill or

deferred tax assets.

At least 4.5% of

RWA at all times!

At least 6%

of RWA

Capital Definitions &

Requirements

TIER 1

ADDITIONAL TIER 1

Core capital:

Items like noncumulative

Share Capital

Retained Earnings preferred stocks.

Does not include

goodwill or

deferred tax assets.

At least 4.5% of

RWA at all times!

TOTAL

CAPITAL

at least 8%

of RWA at

all times

TIER 2

Supplementary

capital, e.g. debt

subordinated to

depositors, with an

original maturity of

5 years.

Capital Definitions &

Requirements

TIER 1

ADDITIONAL TIER 1

Core capital:

Items like noncumulative

Share Capital

Retained Earnings preferred stocks.

Does not include

goodwill or

deferred tax assets.

At least 4.5% of

RWA at all times!

TOTAL

CAPITAL

at least 8%

of RWA at

all times

TIER 2

Supplementary

capital, e.g. debt

subordinated to

depositors, with an

original maturity of

5 years.

TIER 3

Capital Buffers

Basel III asks banks to have additional capital buffers, in order to hedge risk.

They must be met with Tier 1 capital.

CONSERVATION

BUFFER

COUNTERCYCLICAL

BUFFER

2.5%

of RWA

0-2.5%

of RWA

Capital Buffers

Basel III asks banks to have additional capital buffers, in order to hedge risk.

They must be met with Tier 1 capital.

CONSERVATION

BUFFER

COUNTERCYCLICAL

BUFFER

2.5%

of RWA

0-2.5%

of RWA

Compulsory

To the discretion of

national authorities

Capital Buffers

Basel III asks banks to have additional capital buffers, in order to hedge risk.

They must be met with Tier 1 capital.

TOTAL

CAPITAL

at least

10.5%

of RWA at

all times

CONSERVATION

BUFFER

COUNTERCYCLICAL

BUFFER

2.5%

of RWA

0-2.5%

of RWA

Compulsory

To the discretion of

national authorities

Leverage

In addition to the capital requirements based on RWA, banks are supposed to keep

a minimum leverage ratio of 3%.

The leverage ratio is the ratio of capital to total exposure.

Regulators may impose stricter regulations.

In the US, for some Systemically Important Financial Institution (SIFI) the

leverage ratio is at least 6%.

Liquidity Risk

Liquidity risk is the risk that manifests itself in situations in which a party

interested in trading an asset cannot actually do it because nobody in the

market wants to trade for that asset.

For banks it generally arises because banks have the tendency to finance longterm needs with short-term funding.

In good times, this is not generally a problem.

In bad times, it can lead a bank to the impossibility of rolling over and

financing itself.

Counterparty Credit Risk

Under Basel III, for each of its derivatives counterparties, a bank has to

compute a quantity known as credit value adjustment, or CVA.

CVA can vary because of changes in the market variables influencing the

value of the derivatives, or because of variations in the credit spreads

applicable to the counterparty.

If you are interested, this can be the topic of Week 7.

Thank You

You might also like

- Case 7Document2 pagesCase 7Manas Kotru100% (1)

- Unit 8: Imperfect Competition II - Oligopoly and Monopolistic CompetitionDocument7 pagesUnit 8: Imperfect Competition II - Oligopoly and Monopolistic CompetitionManas KotruNo ratings yet

- Barriers and Gateways To CommunicationDocument8 pagesBarriers and Gateways To CommunicationNidhi Nikhil GoyalNo ratings yet

- Unit 2: Consumer TheoryDocument11 pagesUnit 2: Consumer TheoryManas KotruNo ratings yet

- SN DiagramDocument7 pagesSN DiagramManas Kotru100% (1)

- Pipe DesignDocument16 pagesPipe DesignManas KotruNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Corona Kavach Policy-Oriental Insurance - Rate ChartDocument3 pagesCorona Kavach Policy-Oriental Insurance - Rate ChartAnand KesarkarNo ratings yet

- SAMPLE EXAM 1aDocument12 pagesSAMPLE EXAM 1abasquesheep60% (5)

- Compliance Risk SalaryDocument31 pagesCompliance Risk SalaryHer HuwNo ratings yet

- Test BankDocument12 pagesTest BankJanine BordarioNo ratings yet

- Group 3: Anggun Nurul HayatiDocument21 pagesGroup 3: Anggun Nurul HayatiAndiGunturPratomoNo ratings yet

- Risk Return ConceptDocument34 pagesRisk Return Conceptriddhi agrawalNo ratings yet

- Synergy 2.0 609Document91 pagesSynergy 2.0 609menascime100% (3)

- BEC Study GuideDocument111 pagesBEC Study GuideWan Yu HuangNo ratings yet

- A Study On Marine Insurance With Reference To New India Assurance Company LTDDocument58 pagesA Study On Marine Insurance With Reference To New India Assurance Company LTDnandiniNo ratings yet

- Types of Insurance Lesson PlanDocument8 pagesTypes of Insurance Lesson PlanpcsgdnwuNo ratings yet

- d076 Study GuideDocument15 pagesd076 Study GuideMonique CruzNo ratings yet

- Wahed FTSE USA Shariah ETF: FactsheetDocument4 pagesWahed FTSE USA Shariah ETF: FactsheetNajmi IshakNo ratings yet

- Notes For Financial Management ... RiyaDocument49 pagesNotes For Financial Management ... RiyaAbhay YadavNo ratings yet

- Data AnanysisDocument14 pagesData AnanysisDrishty BishtNo ratings yet

- Jeevan Labh - 936: Mr. SushantDocument4 pagesJeevan Labh - 936: Mr. SushantSushant PattanayakNo ratings yet

- 01-311 LLPQ LifeDocument12 pages01-311 LLPQ Lifeeric andersonNo ratings yet

- Summary of IFRS 17Document10 pagesSummary of IFRS 17Micaella DanoNo ratings yet

- Insurance Market ChapterDocument33 pagesInsurance Market ChapterShuvro RahmanNo ratings yet

- Violeta Vs Insular LifeDocument2 pagesVioleta Vs Insular LifeajdgafjsdgaNo ratings yet

- TemplateDocument36 pagesTemplateSubhan Imran100% (1)

- MSC Finance BGSE PresentationDocument13 pagesMSC Finance BGSE PresentationJ MouritzNo ratings yet

- Term Life Insurance - Compare & Buy Life Insurance OnlineDocument3 pagesTerm Life Insurance - Compare & Buy Life Insurance OnlinevinaagrwalNo ratings yet

- IA English Health QPDocument41 pagesIA English Health QPMAHESH BABU YALAVARTHINo ratings yet

- Poi T4Document4 pagesPoi T4JennieNo ratings yet

- Commercial Vehicle InsuranceDocument124 pagesCommercial Vehicle InsurancePratik SapkotaNo ratings yet

- Jeevan Surabhi - 106 - 107 - 108Document3 pagesJeevan Surabhi - 106 - 107 - 108Vinay KumarNo ratings yet

- ALM Coursework Feedback 2013Document3 pagesALM Coursework Feedback 2013Stanislav LazarovNo ratings yet

- Chapter 11 - Life Insurance in Estate PlanningDocument18 pagesChapter 11 - Life Insurance in Estate PlanningAkshya ChoudharyNo ratings yet

- Tata Value Fund Series 1 SidDocument44 pagesTata Value Fund Series 1 SidAbdul Qadir SaifiNo ratings yet

- IllustrationDocument3 pagesIllustrationFuse BulbNo ratings yet