Professional Documents

Culture Documents

U.S. Federal Open Market Committee: Federal Funds Rate

Uploaded by

Eduardo PetazzeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

U.S. Federal Open Market Committee: Federal Funds Rate

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

U.S.

Federal Open Market Committee - Federal Funds Rate

by Eduardo Petazze

Update at December 16, 2015

The Fed has lifted its fed funds target to a range of 0.25 to 0.50 percent

Federal Open Market Committee statement

Implementation Note issued December 16, 2015

Projections Materials pdf, 5 pages

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgagebacked securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way

The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain,

for some time, below levels that are expected to prevail in the longer run (~ 3.5%)

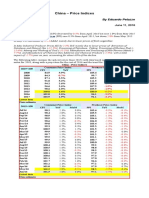

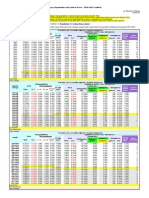

Summary of Economic Projections

FMOC Summary of

Economic Projections (%)

Change in real GDP

Dec15 projection

Sep15 projection

Jun15 projection

Mar15 projection

Dec14 projection

Sep14 projection

Jun14 projection

Mar14 projection

Dec13 projection

Sep13 projection

Unemployment rate

Dec15 projection

Sep15 projection

Jun15 projection

Mar15 projection

Dec14 projection

Sep14 projection

Jun14 projection

Mar14 projection

Dec13 projection

Sep13 projection

PCE inflation

Dec15 projection

Sep15 projection

Jun15 projection

Mar15 projection

Dec14 projection

Sep14 projection

Jun14 projection

Mar14 projection

Dec13 projection

Sep13 projection

Core PCE inflation

Dec15 projection

Sep15 projection

Jun15 projection

Mar15 projection

Dec14 projection

Sep14 projection

Jun14 projection

Mar14 projection

Dec13 projection

Sep13 projection

2015

Central tendency

2016

2017

2018

Longer run

FOMC participants' assessments of appropriate

monetary policy

2015

Range

2017

2016

2018

Longer run

2.1

2.0 2.3

1.8 2.0

2.3 2.7

2.6 3.0

2.6 3.0

3.0 3.2

3.0 3.2

3.0 3.4

3.0 3.5

2.3

2.2

2.4

2.3

2.5

2.6

2.5

2.5

2.5

2.5

2.5

2.6

2.7

2.7

3.0

2.9

3.0

3.0

3.2

3.3

2.0

2.0

2.1

2.0

2.3

2.3

2.3 1.8 2.2 1.8

2.4 1.8 2.2 1.8

2.5

2.0

2.4

2.0

2.5

2.0

2.5

2.0

2.1

2.2

2.2

2.2

2.2

2.2

2.3

2.3

2.3

2.3

2.3

2.3

2.4

2.5

2.0

1.9

1.7

2.1

2.1

2.1

2.2

2.2

2.2

2.2

2.2

2.5

2.3

3.1

3.2

3.2

3.6

3.5

3.6

3.7

2.0

2.1

2.3

2.2

2.1

2.1

2.2

2.2

2.1

2.2

2.7

2.8

3.0

3.0

3.0

3.0

3.2

3.4

3.5

3.5

1.8

1.9

2.0

1.8

2.0

2.0

2.5 1.7 2.4

2.6 1.6 2.4

2.5

2.5

2.7

2.6

1.8

1.8

1.8

1.8

1.8

1.8

1.8

1.8

1.8

2.1

2.3

2.7

2.5

2.5

2.7

2.6

2.5

2.4

2.5

2.5

5.0

5.0 5.1

5.2 5.3

5.0 5.2

5.2 5.3

5.4 5.6

5.4 5.7

5.8 5.9

5.8 6.1

5.9 6.2

4.6

4.7

4.9

4.9

5.0

5.1

5.1

5.2

5.3

5.4

4.8

4.9

5.1

5.1

5.2

5.4

5.5

5.6

5.8

5.9

4.6

4.7

4.9

4.8

4.9

4.9

4.8 4.6 5.0 4.8

4.9 4.7 5.0 4.9

5.1

5.0

5.1

5.0

5.3

5.2

5.3

5.2

5.2

5.2

5.2

5.2

5.0

5.2

5.2

5.2

5.5

5.5

5.5

5.8

5.8

5.8

5.0

4.9 5.2

5.0 5.3

4.8 5.3

5.0 5.5

5.2 5.7

5.2 5.9

5.4 5.9

5.5 6.2

5.3 6.3

4.3

4.5

4.6

4.5

4.9

4.9

5.0

5.1

5.0

5.2

4.9

5.0

5.2

5.2

5.4

5.6

5.6

5.8

6.0

6.0

4.5

4.5

4.8

4.8

4.7

4.7

5.0 4.5 5.3

5.0 4.6 5.3

5.5

5.5

5.7

5.8

4.7

4.7

5.0

4.9

5.0

5.0

5.0

5.2

5.2

5.2

5.8

5.8

5.8

5.8

5.8

6.0

6.0

6.0

6.0

6.0

0.4

0.3 0.5

0.6 0.8

0.6 0.8

1.0 1.6

1.6 1.9

1.5 2.0

1.5 2.0

1.5 2.0

1.6 2.0

1.2

1.5

1.6

1.7

1.7

1.7

1.6

1.7

1.7

1.7

1.7

1.8

1.9

1.9

2.0

2.0

2.0

2.0

2.0

2.0

1.8

1.8

1.9

1.9

1.8

1.9

2.0 1.9 2.0

2.0

2.0

2.0

2.0

2.0

2.0

0.3

0.3

0.6

0.6

1.0

1.5

1.4

1.5

1.4

1.4

0.5

1.0

1.0

1.5

2.2

2.4

2.4

2.4

2.3

2.3

1.2

1.5

1.5

1.6

1.6

1.6

1.5

1.6

1.6

1.5

2.1

2.4

2.4

2.4

2.1

2.1

2.0

2.0

2.2

2.3

1.7

1.7

1.7

1.7

1.8

1.7

2.0 1.7 2.1

2.2 1.8 2.1

2.2

2.2

2.2

2.2

1.3

1.3 1.4

1.3 1.4

1.3 1.4

1.5 1.8

1.6 1.9

1.6 2.0

1.7 2.0

1.6 2.0

1.7 2.0

1.5

1.5

1.6

1.5

1.7

1.8

1.8

1.8

1.8

1.9

1.7

1.8

1.9

1.9

2.0

2.0

2.0

2.0

2.0

2.0

1.7

1.8

1.9

1.8

1.8

1.9

2.0 1.9 2.0

2.0 1.9 2.0

2.0

2.0

2.0

2.0

1.2

1.2

1.2

1.2

1.5

1.6

1.5

1.5

1.5

1.6

1.4

1.7

1.6

1.6

2.2

2.4

2.4

2.4

2.3

2.3

1.4

1.5

1.5

1.5

1.6

1.7

1.6

1.6

1.6

1.7

2.1

2.4

2.4

2.4

2.1

2.2

2.0

2.0

2.2

2.3

1.6

1.7

1.7

1.7

1.8

1.8

2.0 1.7 2.1

2.2 1.8 2.1

2.2

2.2

2.2

2.2

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

2.0

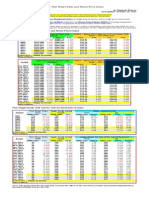

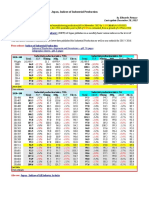

Appropriate pace of policy firming

Midpoint federal funds

rate

2015 2016 2017

2018

Longer Run

0.125

2

0.250

0.375

15

0.500

0.625

0.750

0.875

4

1.000

1.125

3

1.250

1.375

7

1.500

1.625

2

1.750

1.875

5

2.000

2.125

1

2

1

2.250

2.375

4

2.500

1

2.625

2

2.750

2.875

4

3.000

1

1

2

3.125

2

1

3.250

1

6

3.375

1

3

3.500

2

6

3.625

2

3.750

2

3.875

1

4.000

1

Number of participants

17

17

17

17

17

weighted rate

0.3456 1.2868 2.4118

3.1618

3.4118

Sep15 weighted rate 0.4044 1.4779 2.6397

3.3382

3.4632

See our projection of the employment situation for 2016 at the bottom of this document

Update at October 5, 2015

On average for 2015, the labor market conditions index (LMCI) will have a slightly positive value, noting that the expansion of labor market conditions are soon to end.

See details updated at the bottom of this document

Addendum - Update at September 17, 2015

Policy remained unchanged.

Now 13 of 17 members see the fedrrral funds rate hike coming by year end by, average, +25 bps to 0.250%~0.375%

Federal Open Market Committee statement

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal

funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of

maximum employment and 2 percent inflation.

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is

reasonably confident that inflation will move back to its 2 percent objective over the medium term.

Addendum - Update at June 17, 2015

At least 10 of the 17 participants in the FOMC want to place the federal funds rate above its own expectations of inflation (PCE) for the current year.

Raising rates too soon (and at high level too) could trigger a greater-than-expected tightening of financial conditions or a bout of financial instability, causing the economy to stall. This

would likely force the Fed to reverse direction, moving rates back down toward zero with potential costs to credibility. (IMF)

Federal Open Market Committee statement

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably

confident that inflation will move back to its 2 percent objective over the medium term.

Also see: 2015 Article IV Consultation with the United States of America Concluding Statement of the IMF Mission

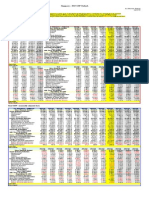

Projection of the employment situation for 2016

In 2016 average unemployment rate of 4.4% is projected

Population data (000)

Total population (000)

Noninstitutional population (%)

Civilian noninstitutional population (+16 y)

Not in Labor force (+16 y), NSA

Civilian Labor Force Level, NSA

Participation rate, NSA

Labor force & Employment situation (000)

Employment Level

Total nonfarm

Farmers and self-employed

Unemployment Level (+16 yr)

NSA

Civilian Labor Force Level

Memo:

Unemployment rate

Nonfarm Payrolls Y/Y change

Oct-15

322,243

78.1%

251,541

94,228

157,313

62.5%

Nov-15

322,450

78.1%

251,747

94,408

157,339

62.5%

Dec-15

322,640

78.1%

251,924

95,169

156,755

62.2%

Jan-16

322,809

78.2%

252,367

95,763

156,604

62.1%

Feb-16

322,969

78.2%

252,665

95,525

157,140

62.2%

Mar-16

323,132

78.3%

252,909

95,561

157,348

62.2%

Apr-16

323,304

78.3%

253,127

95,642

157,485

62.2%

May-16

323,487

78.3%

253,330

94,801

158,529

62.6%

Jun-16

323,686

78.3%

253,543

94,072

159,471

62.9%

Jul-16

323,900

78.3%

253,761

94,126

159,635

62.9%

Aug-16

324,127

78.4%

253,981

95,498

158,483

62.4%

Sep-16

324,360

78.4%

254,199

96,330

157,869

62.1%

Oct-16

324,586

78.4%

254,413

96,104

158,309

62.2%

Nov-16

324,803

78.4%

254,625

96,457

158,168

62.1%

Dec-16

325,009

78.4%

254,818

97,062

157,756

61.9%

Oct-15

149,716

143,784

5,932

7,597

157,313

Nov-15

149,766

144,128

5,638

7,573

157,339

Dec-15

149,412

144,056

5,356

7,343

156,755

Jan-16

148,577

141,463

7,114

8,027

156,604

Feb-16

149,312

142,331

6,981

7,828

157,140

Mar-16

149,900

143,204

6,696

7,448

157,348

Apr-16

150,749

144,313

6,436

6,736

157,485

May-16

151,538

145,217

6,321

6,991

158,529

Jun-16

152,056

145,690

6,366

7,415

159,471

Jul-16

152,121

144,675

7,446

7,514

159,635

Aug-16

151,487

144,943

6,544

6,996

158,483

Sep-16

151,411

145,496

5,915

6,458

157,869

Oct-16

151,964

146,594

5,370

6,345

158,309

Nov-16

151,919

146,941

4,978

6,249

158,168

Dec-16

151,584

146,782

4,802

6,172

157,756

4.83%

2,784

4.81%

2,650

4.68%

2,572

5.13%

2,792

4.98%

2,812

4.73%

2,907

4.28%

2,876

4.41%

2,853

4.65%

2,854

4.71%

2,804

4.41%

2,882

4.09%

2,892

4.01%

2,810

3.95%

2,813

3.91%

2,726

Employment Level

Total nonfarm

Farmers and self-employed

Unemployment Level (+16 yr)

Civilian Labor Force Level

Memo:

Unemployment rate

Nonfarm Payrolls M/M change

149,120 149,364 149,668 150,147 150,406 150,579 150,845 151,063 151,061 151,079 151,237 151,222 151,395 151,665 151,919

142,689 142,900 143,419 143,712 143,971 144,124 144,296 144,491 144,675 144,914 145,075 145,225 145,459 145,693 146,017

6,431

6,464

6,249

6,435

6,435

6,455

6,549

6,572

6,386

6,165

6,162

5,997

5,936

5,972

5,902

7,908

7,937

7,521

7,597

7,485

7,354

7,223

7,245

7,110

7,048

6,869

6,692

6,597

6,572

6,385

157,028 157,301 157,189 157,744 157,891 157,933 158,068 158,308 158,171 158,127 158,106 157,914 157,992 158,237 158,304

Personal Consumption Expenditure

PCE Bn of chained (2009) dollars; SAAR

per Civilian labor force ($)

MoM

YoY

per Employee ($)

MoM

YoY

Latest Update

Estimate

Oct-15 Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16 Nov-16 Dec-16

11,292.8 11,337.0 11,365.0 11,394.0 11,369.0 11,371.0 11,391.0 11,418.0 11,434.0 11,462.0 11,501.0 11,526.0 11,536.0 11,529.0 11,562.0

71,916 72,072 72,301 72,231 72,005 71,999 72,064 72,125 72,289 72,486 72,742 72,989 73,016 72,859 73,037

-0.14% 0.22% 0.32% -0.10% -0.31% -0.01% 0.09% 0.09% 0.23% 0.27% 0.35% 0.34% 0.04% -0.22% 0.24%

1.86% 1.73% 2.68% 2.43% 1.74% 1.56% 1.35% 1.08% 1.12% 1.02% 1.01% 1.49% 1.31% 0.77% 1.12%

75,730 75,902 75,935 75,886 75,589 75,515 75,515 75,584 75,691 75,868 76,046 76,219 76,198 76,016 76,106

-0.16% 0.23% 0.04% -0.06% -0.39% -0.10% -0.00% 0.09% 0.14% 0.23% 0.24% 0.23% -0.03% -0.24% 0.12%

1.04% 1.18% 1.68% 1.64% 0.97% 0.72% 0.35% 0.33% 0.30% 0.32% 0.26% 0.65% 0.39% 0.11% 0.29%

SA

5.04%

299

5.05%

211

4.78%

519

4.82%

293

4.74%

259

4.66%

153

4.57%

172

4.58%

195

4.50%

184

4.46%

239

4.34%

161

4.24%

150

4.18%

234

4.15%

234

4.03%

324

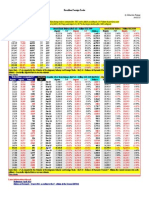

Assessing the Change in Labor Market Conditions

On average for 2015, the labor market conditions index (LMCI) will have a slightly positive value, noting that the expansion of labor market conditions are soon to end.

The following table is an updated monthly report from the Fed staff, summarizing a single indicator of labor market conditions in the US

US Federal Reserve Labor market conditions index (LMCI)

LMCI As Reported

Base 50

Month

NSA

SA Trend NSA

SA Trend

Jan-14

2.5

6.0

5.7 52.5 56.0

55.7

Feb-14

2.9

7.6

5.7 52.9 57.6

55.7

Mar-14

5.9

6.7

5.6 55.9 56.7

55.6

Apr-14

8.1

5.5

5.4 58.1 55.5

55.4

May-14

7.0

5.1

5.3 57.0 55.1

55.3

Jun-14

5.5

5.2

5.3 55.5 55.2

55.3

Jul-14

3.2

5.1

5.3 53.2 55.1

55.3

Aug-14

2.8

5.9

5.2 52.8 55.9

55.2

Sep-14

4.9

5.5

5.1 54.9 55.5

55.1

Oct-14

6.2

4.0

5.0 56.2 54.0

55.0

Nov-14

7.2

3.1

4.8 57.2 53.1

54.8

Dec-14

7.0

3.4

4.6 57.0 53.4

54.6

Jan-15

3.4

3.9

3.0 53.4 53.9

53.0

Feb-15

1.5

4.2

2.8 51.5 54.2

52.8

Mar-15

-0.8

4.0

2.5 49.2 54.0

52.5

Apr-15

-0.5

2.4

2.1 49.5 52.4

52.1

May-15

1.6

1.3

1.7 51.6 51.3

51.7

Jun-15

1.7

1.3

1.4 51.7 51.3

51.4

Jul-15

1.5

1.6

1.1 51.5 51.6

51.1

Aug-15

1.7

1.2

0.9 51.7 51.2

50.9

Sep-15

1.5

0.2

0.6 51.5 50.2

50.6

Oct-15

2.2

-1.1

0.3 52.2 48.9

50.3

Nov-15

0.5

-1.1

-0.1 50.5 48.9

49.9

Dec-15

1.3

-2.2

-0.6 51.3 47.8

49.4

Latest data, change

NSA

SA Trend NSA

SA Trend

Monthly

-1.7

-0.0

-0.4 -1.7

-0.0

-0.4

Annual

-6.7

-4.2

-5.0 -6.7

-4.2

-5.0

Year Avg.

NSA

SA Trend NSA

SA Trend

2004

7.2

7.2

7.2 57.2 57.2

57.2

2005

6.9

6.9

6.9 56.9 56.9

56.9

2006

4.1

4.1

4.1 54.1 54.1

54.1

2007

-1.5

-1.5

-1.5 48.5 48.5

48.5

2008

-19.2 -19.2 -19.2 30.8 30.8

30.8

2009

-10.1 -10.1 -10.1 39.9 39.9

39.9

2010

6.1

6.1

6.1 56.1 56.1

56.1

2011

5.9

5.9

5.9 55.9 55.9

55.9

2012

3.7

3.7

3.7 53.7 53.7

53.7

2013

4.0

4.0

4.0 54.0 54.0

54.0

2014

5.3

5.3

5.3 55.3 55.3

55.3

2015

1.3

1.3

1.3 51.3 51.3

51.3

2016

-2.4

-2.4

-2.4 47.6 47.6

47.6

1977~2016 Average

0.3

0.3

0.3 50.3 50.3

50.3

St. Deviation

9.6

8.2

7.7

9.6

8.2

7.7

Max

28.7

27.6

22.4 78.7 77.6

72.4

Min

-43.0 -24.2 -20.4

7.0 25.8

29.6

Own estimate SA and Trend is our own estimate

Last data Note: Fed Working paper

Note: On average, from February 1980 until April 2014, under conditions of expanding the estimate issued by the Fed it has had an average of +4, while in terms of contraction of the labor

market conditions indicator has a value of -20

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- South Africa - 2015 GDP OutlookDocument1 pageSouth Africa - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- India - Index of Industrial ProductionDocument1 pageIndia - Index of Industrial ProductionEduardo PetazzeNo ratings yet

- Turkey - Gross Domestic Product, Outlook 2016-2017Document1 pageTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Document1 pageCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNo ratings yet

- Analysis and Estimation of The US Oil ProductionDocument1 pageAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNo ratings yet

- Germany - Renewable Energies ActDocument1 pageGermany - Renewable Energies ActEduardo PetazzeNo ratings yet

- Highlights, Wednesday June 8, 2016Document1 pageHighlights, Wednesday June 8, 2016Eduardo PetazzeNo ratings yet

- U.S. Employment Situation - 2015 / 2017 OutlookDocument1 pageU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNo ratings yet

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocument1 pageChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNo ratings yet

- US Mining Production IndexDocument1 pageUS Mining Production IndexEduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- Reflections On The Greek Crisis and The Level of EmploymentDocument1 pageReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNo ratings yet

- India 2015 GDPDocument1 pageIndia 2015 GDPEduardo PetazzeNo ratings yet

- U.S. New Home Sales and House Price IndexDocument1 pageU.S. New Home Sales and House Price IndexEduardo PetazzeNo ratings yet

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocument1 pageEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNo ratings yet

- China - Power GenerationDocument1 pageChina - Power GenerationEduardo PetazzeNo ratings yet

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocument1 pageUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNo ratings yet

- Chile, Monthly Index of Economic Activity, IMACECDocument2 pagesChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNo ratings yet

- Singapore - 2015 GDP OutlookDocument1 pageSingapore - 2015 GDP OutlookEduardo PetazzeNo ratings yet

- Mainland China - Interest Rates and InflationDocument1 pageMainland China - Interest Rates and InflationEduardo PetazzeNo ratings yet

- Highlights in Scribd, Updated in April 2015Document1 pageHighlights in Scribd, Updated in April 2015Eduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- Japan, Population and Labour Force - 2015-2017 OutlookDocument1 pageJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNo ratings yet

- US - Personal Income and Outlays - 2015-2016 OutlookDocument1 pageUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNo ratings yet

- South Korea, Monthly Industrial StatisticsDocument1 pageSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNo ratings yet

- United States - Gross Domestic Product by IndustryDocument1 pageUnited States - Gross Domestic Product by IndustryEduardo PetazzeNo ratings yet

- Japan, Indices of Industrial ProductionDocument1 pageJapan, Indices of Industrial ProductionEduardo PetazzeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Institutional Framework For Small Business DevelopmentDocument59 pagesInstitutional Framework For Small Business DevelopmentNishantpiyooshNo ratings yet

- Orange Book 2nd Edition 2011 AddendumDocument4 pagesOrange Book 2nd Edition 2011 AddendumAlex JeavonsNo ratings yet

- Introduction to India's Oil and Gas IndustryDocument15 pagesIntroduction to India's Oil and Gas IndustryMeena HarryNo ratings yet

- Summary of Newell'S Corporate AdvantageDocument3 pagesSummary of Newell'S Corporate AdvantageMay Angeline CurbiNo ratings yet

- Benefits of MYOB Accounting SoftwareDocument13 pagesBenefits of MYOB Accounting SoftwareTuba MirzaNo ratings yet

- Questionnaire On Influence of Role of Packaging On ConsumerDocument5 pagesQuestionnaire On Influence of Role of Packaging On ConsumerMicheal Jones85% (13)

- Lkas 27Document15 pagesLkas 27nithyNo ratings yet

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument21 pagesFlexible Budgets, Direct-Cost Variances, and Management Control2mrbunbunsNo ratings yet

- Going: ForwrdDocument340 pagesGoing: ForwrdAngel MaNo ratings yet

- Report On Non Performing Assets of BankDocument53 pagesReport On Non Performing Assets of Bankhemali chovatiya75% (4)

- Investment and Portfolio AnalysisDocument6 pagesInvestment and Portfolio AnalysisMuhammad HaiderNo ratings yet

- ISM - PrimarkDocument17 pagesISM - PrimarkRatri Ika PratiwiNo ratings yet

- Team 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0Document7 pagesTeam 6 - Pricing Assignment 2 - Cambridge Software Corporation V 1.0SJ100% (1)

- S.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingDocument34 pagesS.N. Arts, D.J. Malpani Commerce and B.N. Sarda Science College, Sangamner T.Y. B. Com. Notes: Advanced AccountingAnant DivekarNo ratings yet

- ALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Document125 pagesALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Habeeb ShaikNo ratings yet

- Financial Services CICDocument19 pagesFinancial Services CICAashan Paul100% (1)

- Assignment 1: Marketing ManagementDocument37 pagesAssignment 1: Marketing ManagementHimanshu Verma100% (2)

- Owners EquityDocument8 pagesOwners Equityumer sheikhNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- Accenture Service Design Tale Two Coffee Shops TranscriptDocument2 pagesAccenture Service Design Tale Two Coffee Shops TranscriptAmilcar Alvarez de LeonNo ratings yet

- 20 Important Uses of PLR Rights Material PDFDocument21 pages20 Important Uses of PLR Rights Material PDFRavitNo ratings yet

- Bio Pharma Case StudyDocument2 pagesBio Pharma Case StudyAshish Shadija100% (2)

- The Trap Sir James Goldsmith PDFDocument189 pagesThe Trap Sir James Goldsmith PDFBob L100% (1)

- HR Practices in Automobile IndustryDocument13 pagesHR Practices in Automobile IndustryNEENDI AKSHAY THILAKNo ratings yet

- SunstarDocument189 pagesSunstarSarvesh Chandra SaxenaNo ratings yet

- Taxation Reviewer - SAN BEDADocument128 pagesTaxation Reviewer - SAN BEDAMark Lawrence Guzman93% (28)

- Case Study On Citizens' Band RadioDocument7 pagesCase Study On Citizens' Band RadioরাসেলআহমেদNo ratings yet

- Number of Months Number of Brownouts Per Month: Correct!Document6 pagesNumber of Months Number of Brownouts Per Month: Correct!Hey BeshywapNo ratings yet

- Brand Management Assignment (Project)Document9 pagesBrand Management Assignment (Project)Haider AliNo ratings yet