Professional Documents

Culture Documents

Berkshire Hathaway Equity Research

Uploaded by

InvestingSidekickCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Berkshire Hathaway Equity Research

Uploaded by

InvestingSidekickCopyright:

Available Formats

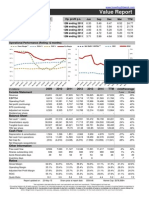

Berkshire Hathaway Inc.

www.InvestingSidekick.com

BRKA

######

I.S.Q. Score:

TTM EPS: 12276.32

Next year EPS estimate:

Net cash* / (debt) p.s: (10310.41)

Net debt EBITDA:

0.5

Net debt Equity:

0.1

Value Report

Op. profit p.s.

Mar

Jun

Sep

Dec

TTM

12M ending 2014

12M ending 2013

12M ending 2012

12M ending 2011

12M ending 2010

4012.68

4438.98

2986.32

1355.03

3095.12

5428.86

4192.26

2793.72

3188.45

1783.45

4108.80

4488.28

3592.38

2036.76

2751.30

3555.08

4399.15

4110.91

2696.86

3932.36

17105.42

17518.67

13483.32

9277.10

11562.23

Operational Performance (Rolling 12 months)

Gross Margin**

SG&A %

R&D %

Net Debt / EBITDA**

Op Margin

18%

120%

16%

100%

ROE

ROIC

10%

1.4

9%

1.2

8%

14%

1.0

7%

12%

80%

10%

0.8

8%

0.6

6%

5%

60%

6%

40%

4%

3%

0.4

4%

20%

2%

0%

0%

2009

$ millions

2010

2011

2%

0.2

1%

0%

2012

2013

2014

TTM

Income Statement

Revenue

EBITDA

Operating Profit

Net profit (continuing)

EPS (continuing)

Adjusted net income

Dividend per share

CAGR/average

5 year

10 year

112,493 136,185 143,688 162,463 182,150 194,673 194,673

12%

14,679

23,330

19,997

27,382

35,304

35,475

35,475

19%

11,552

19,051

15,314

22,236

28,796

28,105

28,105

19%

8,441

13,494

10,746

15,312

19,845

20,170

20,170

19%

5,439.67 8,187.51 6,509.55 9,319.85 12,071.51 12,277.00 12,276.32

18%

8,441

13,494

10,746

15,312

19,845

20,170

20,170

19%

- #DIV/0!

10%

12%

10%

11%

10%

11%

#DIV/0!

Balance Sheet

Net cash* / (debt)

Shareholders equity

Tangible book value

TBV per share

(7,351) (20,347) (23,085) (15,744) (24,038) (16,940) (16,940)

131,102 157,318 164,850 187,647 221,890 240,170 240,170

97,130 108,312 111,637 133,124 164,879 179,456 179,456

62,593.93 65,718.52 67,625.75 81,027.67 100,294.17 109,230.64 109,224.59

18%

13%

13%

12%

#NUM!

11%

11%

10%

19%

15%

25%

114%

23%

16%

16%

28%

9%

1%

#DIV/0!

10%

1%

#DIV/0!

Cash Flow

Depreciation & amortization

Net cash from operations

Net Cap Ex

Net Disposals (acquisitions)

3,127

4,279

15,846

17,895

(4,937)

(5,980)

(108) (15,924)

4,683

20,476

(8,191)

(8,685)

5,146

6,508

7,370

7,370

20,950

27,704

32,010

32,010

(9,775) (11,087) (15,185) (15,185)

(3,188)

(6,431)

(4,824)

(4,824)

10,909

1,552

-

12,285

1,651

-

11,175

1,643

-

Other Information

Free cash flow

Shares outstanding (000s)

Accts Receivable days

Inventory days

11,915

1,648

-

16,617

1,644

-

16,825

1,643

-

16,825

1,643

-

Ratios

Gross Margin

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

10.3%

14.0%

10.7%

13.7%

15.8%

14.4%

14.4%

13.7%

13.5%

Adjusted Net Profit Margin

7.5%

9.9%

7.5%

9.4%

10.9%

10.4%

10.4%

9.6%

9.3%

ROIC

5.9%

7.4%

5.6%

7.4%

8.0%

7.8%

7.8%

7.2%

8.2%

Operating Margin

Quick Ratio

#DIV/0!

Report updated on:

20-May-15

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Share price at report date: $219,900.00

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Market Cap: $361,296m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments. **Plotted against Left hand axis

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Berkshire Hathaway Inc.

www.InvestingSidekick.com

BRKA

Value Report

EV/OP trading range

Conservative model value

Aggressive model value

Current EV/OP (TTM)

Current EV/OP 13.5

(Enterprise Value / Operating Profit)

7.2%

6.2%

Return on Invested Capital

Free Cash ROIC

22.6

(5 year average)

20.6

Free Cash Flow Operating Profit

64%

15 years

58%

10 years

61%

5 years

18.6

16.6

14.6

12.6

% spending of FCF on

10.6

Net Acquisitions/(divestitures)

Dividends

8.6

Share buybacks / (issues)

6.6

Decrease/(increase) of net debt

4.6

Other spending/(asset sales)

57%

0%

1%

(50%)

92%

(cumulative last 10 years)

P/B trading range

P/B = 1

Book value p.s.

Current P/B

146177.72

Tangible Book (TBV) p.s. 109224.59

0.00

Net Net Curr. Assets p.s.

Net cash* / (debt) p.s. (10310.41)

2.1

1.9

Average annual change in

Book Value p.s.

TBV p.s.

9.7%

10.8%

15 years

15 years

10.4%

11.0%

10 years

10 years

11.7%

12.1%

5 years

5 years

1.7

1.5

1.3

Compounded annual growth in

Book Value p.s.

TBV p.s.

9.6%

10.2%

15 years

15 years

10.5%

10.6%

10 years

10 years

11.2%

13.5%

5 years

5 years

0.9

0.7

Free Cash Flow

Tangible Book Value per share

Book Value per share

100%

1.0

90%

0.9

80%

0.8

70%

0.7

60%

0.6

50%

0.5

40%

0.4

30%

0.3

20%

0.2

10%

0.1

0%

0.0

140000

30,000

120000

25,000

100000

20,000

80000

15,000

60000

10,000

40000

5,000

20000

Inventory days

160000

Quick Ratio

Operating Profit / FCF ($mil)

35,000

Quick Ratio (Acid test)

Accounts receivable days

Book Value per share ($)

Operating Income

Inventory/Accounts receivable days

1.1

(Seasonally adjusted data)

Report updated on: 20-May-15

Share price at report date:

$219,900.00

Market Cap: $361,296m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments.

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Literature - Part I: Group InterventionsDocument14 pagesLiterature - Part I: Group InterventionsDanielNo ratings yet

- 600 2 Sub-Zero Built-In Series Refrigerator Service ManualDocument188 pages600 2 Sub-Zero Built-In Series Refrigerator Service Manual911servicetechNo ratings yet

- Skellig - Chapters 16-20 QuestionsDocument1 pageSkellig - Chapters 16-20 Questionselishasantos0% (1)

- QuizDocument3 pagesQuizInvestingSidekickNo ratings yet

- Johnson Johnson Stock Analysis ReportDocument2 pagesJohnson Johnson Stock Analysis ReportInvestingSidekickNo ratings yet

- IBM Stock Analysis ReportDocument2 pagesIBM Stock Analysis ReportInvestingSidekick100% (1)

- Netflix Stock Analysis ReportDocument2 pagesNetflix Stock Analysis ReportInvestingSidekickNo ratings yet

- Oracle Stock Analysis ReportDocument2 pagesOracle Stock Analysis ReportInvestingSidekickNo ratings yet

- Apple Stock Analysis ReportDocument2 pagesApple Stock Analysis ReportInvestingSidekickNo ratings yet

- Cisco Stock Analysis ReportDocument2 pagesCisco Stock Analysis ReportInvestingSidekickNo ratings yet

- Verizon Stock Analysis ReportDocument2 pagesVerizon Stock Analysis ReportInvestingSidekickNo ratings yet

- Microsoft Stock Analysis ReportDocument2 pagesMicrosoft Stock Analysis ReportInvestingSidekickNo ratings yet

- Google Stock Analysis ReportDocument2 pagesGoogle Stock Analysis ReportInvestingSidekickNo ratings yet

- Customer Solutions ModelDocument8 pagesCustomer Solutions ModelInvestingSidekick0% (1)

- Boeing Stock Analysis ReportDocument2 pagesBoeing Stock Analysis ReportInvestingSidekick100% (1)

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickNo ratings yet

- House Buying Vs RentingDocument14 pagesHouse Buying Vs RentingInvestingSidekickNo ratings yet

- Gencorp Annual Report 2013Document177 pagesGencorp Annual Report 2013InvestingSidekickNo ratings yet

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickNo ratings yet

- The Washington Post Company 1971 Annual ReportDocument33 pagesThe Washington Post Company 1971 Annual ReportInvestingSidekickNo ratings yet

- IBM 10 Year FinancialsDocument1 pageIBM 10 Year FinancialsInvestingSidekickNo ratings yet

- Forms and Types of Business OrganizationDocument2 pagesForms and Types of Business Organizationjune hetreNo ratings yet

- Discuss in Details With Appropriate Examples What Factors Could Lead To Sympatric and Allopatric SpeciationDocument5 pagesDiscuss in Details With Appropriate Examples What Factors Could Lead To Sympatric and Allopatric SpeciationKhairul ShahmiNo ratings yet

- A Cautionary Tale of Psychoanalysis and SchizophreniaDocument30 pagesA Cautionary Tale of Psychoanalysis and SchizophreniaJona JoyNo ratings yet

- The Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerDocument6 pagesThe Perfect Prayer by by Jon Courson - Matthew 6 9-13 The Lords PrayerRobert Beaupre100% (1)

- My Manifesto - Huma 1100Document2 pagesMy Manifesto - Huma 1100api-490833029No ratings yet

- EY The Cfo Perspective at A Glance Profit or LoseDocument2 pagesEY The Cfo Perspective at A Glance Profit or LoseAayushi AroraNo ratings yet

- CHEST 6. Chest Trauma 2022 YismawDocument61 pagesCHEST 6. Chest Trauma 2022 YismawrobelNo ratings yet

- Row 1Document122 pagesRow 1abraha gebruNo ratings yet

- Summary Basis For Regulatory Action TemplateDocument23 pagesSummary Basis For Regulatory Action TemplateAviseka AcharyaNo ratings yet

- The Republic of LOMAR Sovereignty and International LawDocument13 pagesThe Republic of LOMAR Sovereignty and International LawRoyalHouseofRA UruguayNo ratings yet

- Testing Your Understanding: The Dash, Slash, Ellipses & BracketsDocument2 pagesTesting Your Understanding: The Dash, Slash, Ellipses & BracketsBatsaikhan DashdondogNo ratings yet

- Paul Daugerdas IndictmentDocument79 pagesPaul Daugerdas IndictmentBrian Willingham100% (2)

- Grade 10 To 12 English Amplified PamphletDocument59 pagesGrade 10 To 12 English Amplified PamphletChikuta ShingaliliNo ratings yet

- Connectors/Conjunctions: Intermediate English GrammarDocument9 pagesConnectors/Conjunctions: Intermediate English GrammarExe Nif EnsteinNo ratings yet

- 3B Adverbial PhrasesDocument1 page3B Adverbial PhrasesSarah INo ratings yet

- Leading a Community Through Integrity and CourageDocument2 pagesLeading a Community Through Integrity and CourageGretchen VenturaNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTPanchdev KumarNo ratings yet

- Why Narcissists Need You To Feel Bad About Yourself - Psychology TodayDocument51 pagesWhy Narcissists Need You To Feel Bad About Yourself - Psychology Todaytigerlo75No ratings yet

- Ch.24.2 Animal Evolution and DiversityDocument34 pagesCh.24.2 Animal Evolution and DiversityweldeenytNo ratings yet

- St. Louis ChemicalDocument8 pagesSt. Louis ChemicalNaomi Alberg-BlijdNo ratings yet

- Are Moral Principles Determined by SocietyDocument2 pagesAre Moral Principles Determined by SocietyKeye HiterozaNo ratings yet

- Discrete Mathematics - Logical EquivalenceDocument9 pagesDiscrete Mathematics - Logical EquivalenceEisha IslamNo ratings yet

- Modelling of Induction Motor PDFDocument42 pagesModelling of Induction Motor PDFsureshNo ratings yet

- Kung Fu MedicinesDocument9 pagesKung Fu MedicinesDavid HewittNo ratings yet

- Scent of Apples: Does The Author Make Us Think Seriously of Life? Why Do You Say So?Document2 pagesScent of Apples: Does The Author Make Us Think Seriously of Life? Why Do You Say So?carl tom BondiNo ratings yet

- Life Convict Laxman Naskar Vs State of West Bengal & Anr On 1 September, 2000Document6 pagesLife Convict Laxman Naskar Vs State of West Bengal & Anr On 1 September, 2000Kimberly HardyNo ratings yet

- ASBMR 14 Onsite Program Book FINALDocument362 pagesASBMR 14 Onsite Program Book FINALm419703No ratings yet