Professional Documents

Culture Documents

Asistensi Akuntansi Keuangan 2 - Basic& Diluted EPS

Uploaded by

Jordy TangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asistensi Akuntansi Keuangan 2 - Basic& Diluted EPS

Uploaded by

Jordy TangCopyright:

Available Formats

Asistensi AK2

Pertemuan ke -4 (Basic and Dilluted EPS)

Asisten : Kinta Khristina

Problem 1

Commander Corporation had $900.000 net income in 2012. On january 1,2012 there were

220.000 ordinary shares outstanding. On April 1, 2012, 20.000 shares were issued and on

September 1,2012, Commander Corporation bought 30.000 treasury shares. There are 30.000

options to buy ordinary share at $40 per share outstanding. The market price of the ordinary

share averaged $50 during 2012. The tax rate for the year is 25%.

During 2012, there were 20.000 shares of convertible preference share outstanding. The

preference share is $100 par, pays $7 a year dividend, and is convertile into 3 shares of

ordinary shares. Commander Corporation issued $2.000.000 of 8% convertible bonds at face

value during 2010. Each $1.000 bond is convertible into 20 shares of ordinary shares.

Compute the Commander Corporation diluted EPS!

Problem 2

Presented below are Axis Incs Balance Sheet as of december 31,2012

Account

Cash

Account Receivable

Inventory

Land

Building

Accumulated Depreciation

Investment in Centro Co.

Total

Axis Incs

$470.000

300.000

780.000

467.500

750.000

(330.000)

262.500

2.700.000

Accounts Payable

Bonds Payable

Share capital Preference ($10 par value,

10%)

Share capital Ordinary ( $10 Par value )

Retained earnings

Total

120.000

900.000

600.000

450.000

630.000

2.700.000

Additional Information:

Axiss 8% bonds can be converted into 20.000 ordinary shares

Axiss preference shares can be converted into 36.000 ordinary shares

The average market price of Axiss ordinary shares is $60

Axis reported 2012 net income of $900.000 from its own operation and paid $300.000

of cash dividend

The company is subject to 30% income tax rate

Based on the above information , you are required to calculate Basic and Diluted EPS!

Problem 3

On January 1,2010 PT Sekawan Securities issued 10-year Rp 3,000,000,000 face value,6%

bonds, at par. Each Rp 1,000,000 bond is convertible into 15 shares of PT Sekawan Securities

common stock. PT Sekawan Securitiess net income in 2010 is Rp240,000,000 and its tax

rate is 30%. PT Sekawan Securities had 100,000 shares of common stock outstanding

throughout 2010. None of the bonds were converted in 2010.

Instructions

a. Compute diluted EPS for 2010

b. Assuming the fact as above, except that Rp 1,000,000,000 of 6% convertible

preferred stock was issued instead of the bonds. Each Rp 100,000 preferred share

is convertible into 5 shares of PT Sekawan Securities common stock

Problem 4 ( Homework)

PT Sahabat Securities Tbk, a sister company of PT Sekawan Securities, earned Rp

260,000,000 during a period when it had an average of 100,000 shares of common

stockoutstanding. The common stock sold at an average market price of Rp 15,000 per share

during the period. Also outstanding were 30,000 warrants that could be exercised to purchase

one share of common stock for Rp 10,000 for each warrant exercised.

Instructions

a.Are the warrants dilutive?

b.Compute basic and diluted EPS

( Hint : penerapan untuk warrant mirip dengan option )

You might also like

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Ak 2Document12 pagesAk 2nikenapNo ratings yet

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolNo ratings yet

- FAR2 Quiz On CorpDocument16 pagesFAR2 Quiz On CorpYami Sukehiro100% (1)

- Investments Handouts MCDocument14 pagesInvestments Handouts MCSnow TurnerNo ratings yet

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- Assessment Test 1 - Without KeyDocument7 pagesAssessment Test 1 - Without KeyNicolas ErnestoNo ratings yet

- Working 7Document5 pagesWorking 7Hà Lê DuyNo ratings yet

- Long Term Financing ExercisesDocument3 pagesLong Term Financing ExercisesMaryJoyBernalesNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- Earning Per ShareDocument6 pagesEarning Per ShareArianne LlorenteNo ratings yet

- Modul Lab. Akuntansi Menengah 2 - P 20.21Document54 pagesModul Lab. Akuntansi Menengah 2 - P 20.21Ivonie NursalimNo ratings yet

- Intermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Document1 pageIntermediate Accounting 3 Basic and Diluted Earnings Per Share: Quiz 11Airon BendañaNo ratings yet

- Exercise Chapter 16Document4 pagesExercise Chapter 16hangbg2k3No ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Tugas Latihan Soal EPSDocument4 pagesTugas Latihan Soal EPSNaoya FaldinyNo ratings yet

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- Toaz - Info Far Vol 2 Chapter 22 25docx PRDocument22 pagesToaz - Info Far Vol 2 Chapter 22 25docx PRVivialyn PalimpingNo ratings yet

- Illustrative Examples - Earnings Per Share (EPS)Document6 pagesIllustrative Examples - Earnings Per Share (EPS)Ms QuiambaoNo ratings yet

- SFM CA Final Mutual FundDocument7 pagesSFM CA Final Mutual FundShrey KunjNo ratings yet

- Bab 3 - Soal-Soal No. 4 SD 10Document4 pagesBab 3 - Soal-Soal No. 4 SD 10Vanni LimNo ratings yet

- FAR-06 Earnings Per ShareDocument4 pagesFAR-06 Earnings Per ShareKim Cristian Maaño50% (2)

- A1c - SW#3 PDFDocument3 pagesA1c - SW#3 PDFLemuel ReñaNo ratings yet

- MID - Test N03Document2 pagesMID - Test N03Vân Nhi PhạmNo ratings yet

- Assignment 5Document2 pagesAssignment 5Esther LiuNo ratings yet

- Quiiz 1Document4 pagesQuiiz 1max pNo ratings yet

- Applied AuditingDocument3 pagesApplied AuditingJessicaNo ratings yet

- Week 6 Basic Earnings Per ShareDocument4 pagesWeek 6 Basic Earnings Per SharePearlle Ivana TavarroNo ratings yet

- Soal Kiesio Chapter 16Document4 pagesSoal Kiesio Chapter 16helfiani putri100% (1)

- ACCT101 Sample Paper - With SolutionDocument24 pagesACCT101 Sample Paper - With SolutionBryan Seow100% (1)

- Bonds Payable Sample ProblemsDocument2 pagesBonds Payable Sample ProblemsErin LumogdangNo ratings yet

- Chapter 16 (Dilutive and Earning Per Share)Document2 pagesChapter 16 (Dilutive and Earning Per Share)dinar100% (1)

- Practice Exam: TEXT: PART A - Multiple Choice QuestionsDocument12 pagesPractice Exam: TEXT: PART A - Multiple Choice QuestionsMelissa WhiteNo ratings yet

- MBA-5107, Short QuestionsDocument2 pagesMBA-5107, Short QuestionsShajib GaziNo ratings yet

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Soal Kuis Uas - AklDocument3 pagesSoal Kuis Uas - AklBastian Nugraha SiraitNo ratings yet

- Audit Prob InvestmentDocument5 pagesAudit Prob InvestmentANGIE BERNAL100% (1)

- CIMA Masters Gateway F2 MCQDocument27 pagesCIMA Masters Gateway F2 MCQObaidul Hoque NomanNo ratings yet

- PL Financial Accounting and Reporting Sample Paper 1Document11 pagesPL Financial Accounting and Reporting Sample Paper 1karlr9No ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Week 11 - CH 11 QuestionsDocument2 pagesWeek 11 - CH 11 QuestionslizaNo ratings yet

- Earnings Per Share DiscussionDocument2 pagesEarnings Per Share DiscussionSpongebob SquarepantsNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Sem V AssignmentDocument4 pagesSem V Assignmentpritika mishraNo ratings yet

- Bus - Valuation - StudentDocument5 pagesBus - Valuation - StudentMilan TilvaNo ratings yet

- EPS SlidesDocument8 pagesEPS SlidesAHSAN IQBALNo ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- What We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingDocument39 pagesWhat We Will Study and Learn in This Chapter:: Corporations: Dividends, Retained Earnings, and Income ReportingSunil Kumar SahooNo ratings yet

- P2Document20 pagesP2Jemson YandugNo ratings yet

- Part IIDocument11 pagesPart IINCTNo ratings yet

- Chapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8Document2 pagesChapter 10 Reporting and Analysing Equity (Companies: Lecture Notes Solutions - Lecture 8 Topic 8aaronNo ratings yet

- Act Part5Document1 pageAct Part5Moe ChannelNo ratings yet

- FABM 2 Lesson3Document7 pagesFABM 2 Lesson3---0% (2)

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- She QuizDocument2 pagesShe QuizRonnelson PascualNo ratings yet

- The RE Formula Is As Follows:: ProfitsDocument4 pagesThe RE Formula Is As Follows:: Profitserica lamsenNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Soal Pert 6 - Merchandising Business - JordyDocument1 pageSoal Pert 6 - Merchandising Business - JordyJordy Tang100% (1)

- Soal Asis 3 - Jordy - AJPDocument1 pageSoal Asis 3 - Jordy - AJPJordy TangNo ratings yet

- Soal Asis Pert 2 - Jordy - PA1Document1 pageSoal Asis Pert 2 - Jordy - PA1Jordy TangNo ratings yet

- Soal Asistensi Master BudgetDocument4 pagesSoal Asistensi Master BudgetJordy Tang100% (1)

- Aldehyde and Ketone ReactionsDocument21 pagesAldehyde and Ketone ReactionsChelsea MartinezNo ratings yet

- Carbonyl Compounds Aldehyde and KetonesDocument7 pagesCarbonyl Compounds Aldehyde and KetonesJason Raquin Roque100% (1)

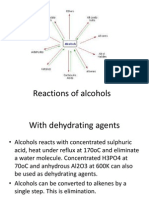

- Reactions of AlcoholsDocument10 pagesReactions of AlcoholsNeen NaazNo ratings yet

- Electrophilic Addition of Hydrogen HalidesDocument16 pagesElectrophilic Addition of Hydrogen HalidesDk Hazra HadzryaNo ratings yet

- 2013 23524Document332 pages2013 23524MarketsWikiNo ratings yet

- Aromaticity: Aliphatic Alicyclic AromaticDocument14 pagesAromaticity: Aliphatic Alicyclic AromaticSourav DasNo ratings yet

- Hom WworkDocument29 pagesHom WworkAshish BhallaNo ratings yet

- FundFinancialAcc Ch10 OLCDocument5 pagesFundFinancialAcc Ch10 OLCAmy WatcharaNo ratings yet

- Nitro ReviewDocument16 pagesNitro ReviewLarry PierceNo ratings yet

- Dhiraj TiwariDocument193 pagesDhiraj TiwariDharmender KumarNo ratings yet

- Multiple ChoiceDocument6 pagesMultiple ChoicelllllNo ratings yet

- H1 ChemDocument757 pagesH1 ChemCheng Shiang0% (1)

- January 2014 - Question Paper - Chemistry U2Document20 pagesJanuary 2014 - Question Paper - Chemistry U2lolomg90No ratings yet

- Chemistry Glossary For A2Document21 pagesChemistry Glossary For A2s_s_i_hassaanNo ratings yet

- C10 Molecular Geometry and Bonding TheoryDocument67 pagesC10 Molecular Geometry and Bonding Theoryaramki1100% (1)

- B. An Introduction To (Bio) Inorganic Chemistry: The Metal-Ligand InteractionDocument9 pagesB. An Introduction To (Bio) Inorganic Chemistry: The Metal-Ligand Interactionsalinips3No ratings yet

- Stability of Minerals PDFDocument380 pagesStability of Minerals PDFcemalbalciNo ratings yet

- Sulfonated Asphalt CCCDocument7 pagesSulfonated Asphalt CCCwynneralphNo ratings yet

- Bonds PayableDocument34 pagesBonds PayableArgem Jay PorioNo ratings yet

- Chemistry 16 Comprehensive Samplex (ANSWER KEY For Non-PSolv)Document5 pagesChemistry 16 Comprehensive Samplex (ANSWER KEY For Non-PSolv)Laia Valencia100% (1)

- 0620 w12 QP 63Document12 pages0620 w12 QP 63nicole1003No ratings yet

- Chapter 12 QDocument4 pagesChapter 12 QRebecca Lau100% (1)

- 6241 01 Que 20060118Document12 pages6241 01 Que 20060118UncleBulgariaNo ratings yet

- 0 Fixed IncomeDocument445 pages0 Fixed IncomeFeekoNo ratings yet

- HJM ModelsDocument12 pagesHJM ModelsPrateek SabharwalNo ratings yet

- Philippine Export and Foreign Loan Guarantee Corp Vs Eusebio DigestDocument3 pagesPhilippine Export and Foreign Loan Guarantee Corp Vs Eusebio DigestAzrael CassielNo ratings yet

- 2005 - Meenakumary - Doctorial Thesis - Lewis-Base Mediated Fragmentation of Polymeric Transition Metal DicarboxylatesDocument469 pages2005 - Meenakumary - Doctorial Thesis - Lewis-Base Mediated Fragmentation of Polymeric Transition Metal DicarboxylatesymiyazyNo ratings yet

- AP Bonding Questions Answer KeyDocument4 pagesAP Bonding Questions Answer KeyMysticNo ratings yet

- CJS On BondsDocument178 pagesCJS On BondsgoldilucksNo ratings yet