Professional Documents

Culture Documents

28th May (Thursday), 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus Magazine

Uploaded by

Mujahid AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

28th May (Thursday), 2015 Daily Exclusive ORYZA Rice E-Newsletter by Riceplus Magazine

Uploaded by

Mujahid AliCopyright:

Available Formats

Daily Exclusive

ORYZA Rice E-Newsletter

Daily Exclusive ORYZA Rice E-Newsletter 2015

www.ricepluss.com

www.riceplusmagazine.blogspot.com

May 28 ,2015

Vol 5,Issue V

For Advertisement in daily Newsletter & Blog & Website

Contact: Mujahid Ali mujahid.riceplus@gmail.com

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 1

Daily Exclusive ORYZA Rice E-Newsletter 2015

India's Open Market Rice Auctions Receive

Lukewarm Response Due to High Prices

May 27, 2015

India's rice auctions under the Open Market Sale Scheme (OMSS) since their launch on April 1

this year have received a lukewarm response from traders and private purchasers, according to

local sources.With an intention to clear off the buffer stocks with the Food Corporation of India

(FCI, the government of India has allowed the FCI to offload excess rice stocks to the extent of

around 2 million tons to bulk buyers such as millers and traders. Any government agencies are

not allowed to participate in bidding, according to local sources.However, the FCI received bids

for only 350 tons so far.

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 2

Daily Exclusive ORYZA Rice E-Newsletter 2015

An official from Food Ministry told local sources that the demand was low as the prices of

Rs.2,300 per quintal (around $369 per ton) for common grade paddy and Rs.2,340 per quintal

(around $375 per ton) for Grade A paddy offered by the FCI are higher than the prevailing

market price.

The official added that the rice price was set based on the Minimum Support Price (MSP), at

which the government agencies procure rice from farmers. The minimum and maximum auction

quantities of rice for sale under OMSS are 50 tons and 3,500 tons per week respectively.He

noted that if the demand does not pick up, the government may decide to wind up the rice sales

under OMSS.Indias rice stocks in the central pool as of May 1, 2015 stood at around 22.23

million tons (including a milled equivalent of about 7.968 million tons of paddy), down about

22% from around 28.41 million tons recorded during the same period last year, according to data

from FCI. Current rice stocks are about 94% more than the required buffer and strategic reserve

norms of around 12.2 million tons for this time of the year.

IPAB to Hear Basmati GI Certification Case

in July 2015

May 27, 2015

The Chennai-based Intellectual Property Appellate Board (IPAB) will reportedly hear the claims

of parties involved in the basmati gegraphical indications (GI) certification case for three days

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 3

Daily Exclusive ORYZA Rice E-Newsletter 2015

starting from July 8, 2015, a move that could see legal protection granted to Indian basmati rice,

according to local sources.India's petition to grant a legal protection to basmati rice is being

delayed since 2009, when the the Agricultural and Processed Food Products Export

Development Authority (APEDA) applied for the GI protection for the first time. However,

based on complaints from the Madhya Pradesh department of farmer welfare and agriculture

development and some basmati exporters in the state, in December 2013, the GI Registry

directed the APEDA to file an amended GI application to include Madhya Pradesh as a basmati

growing area.

Not convinced by the GI Registry's directive, the APEDA approached the Intellectual Property

Appellate Board (IPAB) in February 2014 to decide over the inclusion of Madhya Pradesh in its

Geographical Indications (GI) application. The Madhya Pradesh state farmers' body also

appealed against the APEDA with the IPAB.The APEDA has been very keen on not including

other basmati growing states, other than those recognized by National Agricultural Research

System under the agriculture and co-operative department, in its application as it views the GI

status is critical in determining the genuine basmati rice cultivators.

The Commerce and Agriculture Ministries as well as some renowned agricultural scientists in

India are also opposed to the inclusion of Madhya Pradesh in the definition of traditionally

basmati-growing geography as it would undermine the rights of those farmers who have been

traditionally growing basmati in Indo-Gangetic plain.Meanwhile, Pakistan's Basmati Growers

Association (BGA) also appealed to the IPAB against granting legal protection to Indian basmati

rice.A GI certification label certifies the geographical origin of a product and confirms adherence

to some production standards. It also prevents producers who aren't covered by the tag from

using the same thereby providing a legal protection to the cultivation and use of the specific

product.

South Korea Buys 55,378 Tons of NonGlutinous Brown Rice from U.S. and China

in Tender

May 27, 2015

South Korea's state run Agro Fisheries & Food Trade Corporation (KAFTC) has purchased

55,378 tons of non-glutinous brown rice of the U.S. and Chinese origins, according to a

statement on its website.The tonnage and price details of the various varieties of rice purchased

are as below.KAFTC originally sought to purchase about 75,378 tons of non-glutinous rice via

eight tenders but will announce the results for 10,000 tons of non-glutinous short-grain brown

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 4

Daily Exclusive ORYZA Rice E-Newsletter 2015

rice, 9,000 tons 10,000 tons of non-glutinous medium-grain brown rice after sample tests are

complete, according to the website. Results for 10,352 tons of non-glutinous medium-grain rice

are also not specified by the KAFTC.

Oryza Overnight Recap Chicago Rough

Rice Futures Remain Under Pressure from

Lack of Demand

May 27, 2015

Chicago rough rice futures for Jul delivery are currently seen paused 1.5 cents per cwt (about

$0.33 per ton) lower at $9.405 per cwt (about $207 per ton) during early floor trading in

Chicago. The other grains are seen trading with mixed results; soybeans are currently seen about

0.2% higher, wheat is listed about 1.3% lower and corn is currently noted about 0.9% lower.U.S.

stocks traded higher on Wednesday, recovering some of Tuesday's sharp decline, as investors

eyed Greece headlines amid continued rise in the dollar and bond yields. The Dow Jones

industrial average traded about 105 points higher. The blue chip index fell as much as 242 points

on Tuesday before closing 190 points lower. European stocks opened higher and rallied on

encouraging reports out of Greece.

The German DAX gained more than 1 percent, while Greece's ATHEX Composite traded 3.5%

higher. No major data is expected Wednesday. Weekly mortgage applications dropped 1.6% as

higher rates put a pause on refinancing. Investors will continue to watch the Dow transports,

which attempted to trade about half a percent higher. The index extended its recent selloff on

Tuesday, with its 50-day moving average falling below its 200-day moving average. Gold is

currently trading slightly higher, crude oil is seen trading about 0.4% lower, and the U.S. dollar

is currently trading about 0.1% higher at 8:30am Chicago time.

Thailand Rice Sellers Lower Some of Their

Quotes Today; Other Asia Quotes Unchanged

May 27, 2015

Thailand rice sellers lowered their quotes for Hommali rice by about $10 per ton to around $850

- $860 per ton today. Other Asia rice sellers kept their quotes mostly unchanged today.

5% Broken Rice

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 5

Daily Exclusive ORYZA Rice E-Newsletter 2015

Thailand 5% rice is indicated at around $370 - $380 per ton, about a $20 per ton premium on

Vietnam 5% rice shown at around $350 - $360 per ton. India 5% rice is indicated at around $370

- $380 per ton, about a $35 per ton discount to Pakistan 5% rice shown at around $405 - $415 per

ton.

25% Broken Rice

Thailand 25% rice is shown at around $350 - $360 per ton, about a $25 per ton premium on

Vietnam 25% rice shown at around $325- $335 per ton. India 25% rice is indicated at around

$345 - $355, about a $15 per ton discount to Pakistan 25% rice shown at around $360 - $370 per

ton.

Parboiled Rice

Thailand parboiled rice is indicated at around $370 - $380 per ton. India parboiled rice is

indicated at around $360 - $370 per ton, about a $45 per ton discount to Pakistan parboiled rice

shown at around $405 - $415 per ton.

100% Broken Rice

Thailand broken rice, A1 Super, is indicated at around $315 - $325 per ton, about a $5 per ton

premium on Vietnam 100% broken rice shown at around $310 - $320 per ton. India's 100%

broken rice is shown at around $275 - $285 per ton, about a $30 per ton discount to Pakistan

broken sortexed rice shown at around $305 - $315 per ton.

Global Rice Quotes

May 28th, 2015

Long grain white rice - high quality

Thailand 100% B grade 375-385

Vietnam 5% broken

350-360

India 5% broken

370-380

Pakistan 5% broken

405-415

Myanmar 5% broken

420-430

Cambodia 5% broken

430-440

U.S. 4% broken 465-475

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 6

Daily Exclusive ORYZA Rice E-Newsletter 2015

Uruguay 5% broken

565-575

Argentina 5% broken

555-565

Long grain white rice - low quality

Thailand 25% broken

350-360

Vietnam 25% broken

325-335

Pakistan 25% broken

360-370

Cambodia 25% broken

410-420

India 25% broken

345-355

U.S. 15% broken

455-465

Long grain parboiled rice

Thailand parboiled 100% stxd

365-375

Pakistan parboiled 5% broken stxd

405-415

India parboiled 5% broken stxd

350-360

U.S. parboiled 4% broken

555-565

Brazil parboiled 5% broken

570-580

Uruguay parboiled 5% broken

NQ

Long grain fragrant rice

Thailand Hommali 92% 845-855

Vietnam Jasmine

470-480

India basmati 2% broken NQ

Pakistan basmati 2% broken

NQ

Cambodia Phka Mails 815-825

Brokens

Thailand A1 Super

315-325

Vietnam 100% broken 310-320

Pakistan 100% broken stxd

305-315

Cambodia A1 Super

350-360

India 100% broken stxd 275-285

Egypt medium grain brokens

NQ

U.S. pet food

365-375

Brazil half grain NQ

All prices USD per ton, FOB vessel, oryza.com

www.ricepluss.com & www.riceplusmagazine.blogspot.com

Page 7

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Ahwal e Buzurgan e DeenDocument83 pagesAhwal e Buzurgan e DeenMujahid AliNo ratings yet

- Allah Ko Yaad Rakhayn by Shaykh Abdur Rauf SakharviDocument41 pagesAllah Ko Yaad Rakhayn by Shaykh Abdur Rauf SakharviArsalanKhanNo ratings yet

- Rice News DailyDocument132 pagesRice News DailyMujahid AliNo ratings yet

- Raising Young Entrepreneurs, Cultivating An Entrepreneurial Mindset in Early ChildhoodDocument4 pagesRaising Young Entrepreneurs, Cultivating An Entrepreneurial Mindset in Early ChildhoodMujahid Ali100% (1)

- Rice News DailyDocument132 pagesRice News DailyMujahid AliNo ratings yet

- Hukmaay Alam حکمائے عالمDocument648 pagesHukmaay Alam حکمائے عالمMujahid AliNo ratings yet

- Asmaye e AzamDocument76 pagesAsmaye e AzamKhaleeq Ahmad BegNo ratings yet

- Rice News - 2-6 Sep 2017Document259 pagesRice News - 2-6 Sep 2017Mujahid AliNo ratings yet

- 6th November, 2017 Daily Global Regional Local Rice E-NewsletterDocument3 pages6th November, 2017 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- Kabeera Gunaah by Sheikh Shamsuddin Al ZahbiDocument378 pagesKabeera Gunaah by Sheikh Shamsuddin Al ZahbiMujahid AliNo ratings yet

- Rice NewsDocument1 pageRice NewsMujahid AliNo ratings yet

- The Key To Unlocking Sales Performance 2621Document54 pagesThe Key To Unlocking Sales Performance 2621nik achikNo ratings yet

- Rice Ideas 3Document3 pagesRice Ideas 3Mujahid AliNo ratings yet

- Drama Sabaat - Hum TV - Research Article Drama Review & AnalysisDocument54 pagesDrama Sabaat - Hum TV - Research Article Drama Review & AnalysisMujahid AliNo ratings yet

- Tick Tock Culture and Impact On Youth and SocietyDocument4 pagesTick Tock Culture and Impact On Youth and SocietyMujahid AliNo ratings yet

- June, 2017 Daily Global Regional & Local Rice E-Newsletter by Riceplus MagazineDocument34 pagesJune, 2017 Daily Global Regional & Local Rice E-Newsletter by Riceplus MagazineMujahid AliNo ratings yet

- Parenting in 21st CenturyDocument2 pagesParenting in 21st CenturyMujahid AliNo ratings yet

- Growing Demands of Content WritersDocument4 pagesGrowing Demands of Content WritersMujahid AliNo ratings yet

- Possible Winning of PTI in SialakotDocument5 pagesPossible Winning of PTI in SialakotMujahid AliNo ratings yet

- Why STEM Eduction Is Must For KidsDocument2 pagesWhy STEM Eduction Is Must For KidsMujahid AliNo ratings yet

- Writers Recomend - RecommendedDocument177 pagesWriters Recomend - RecommendedMujahid AliNo ratings yet

- Drama Sabaat - Hum TV - Research Article Drama Review & AnalysisDocument54 pagesDrama Sabaat - Hum TV - Research Article Drama Review & AnalysisMujahid AliNo ratings yet

- Museebat Preshani Ka Door Hona - Tasbeeh DeekDocument4 pagesMuseebat Preshani Ka Door Hona - Tasbeeh DeekMujahid AliNo ratings yet

- UseFullness of Miswak (Twig) in The Light of Modern Science and ResearchDocument61 pagesUseFullness of Miswak (Twig) in The Light of Modern Science and ResearchMujahid AliNo ratings yet

- Rice News10march22Document57 pagesRice News10march22Mujahid AliNo ratings yet

- Rice News 17may2022Document62 pagesRice News 17may2022Mujahid AliNo ratings yet

- Rice News-21 April 22Document1 pageRice News-21 April 22Mujahid AliNo ratings yet

- Possible Winning of PTI in SialakotDocument5 pagesPossible Winning of PTI in SialakotMujahid AliNo ratings yet

- Rice News 21feb22Document153 pagesRice News 21feb22Mujahid AliNo ratings yet

- Rice News - 13 April 2022Document25 pagesRice News - 13 April 2022Mujahid AliNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Theoretical Study of The Constitutional Amendment Process of BangladeshDocument58 pagesA Theoretical Study of The Constitutional Amendment Process of BangladeshMohammad Safirul HasanNo ratings yet

- Tcode GTSDocument28 pagesTcode GTSKishor BodaNo ratings yet

- Fault (Culpa) : Accountability (121-123)Document4 pagesFault (Culpa) : Accountability (121-123)kevior2No ratings yet

- Review - Phippine Arch Post WarDocument34 pagesReview - Phippine Arch Post WariloilocityNo ratings yet

- The Nature of LoveDocument97 pagesThe Nature of LoveMiguel Garcia Herrera100% (1)

- National Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDocument13 pagesNational Law Institute University, Bhopal: Enforceability of Share Transfer RestrictionsDeepak KaneriyaNo ratings yet

- 06 - StreamUP & Umap User ManualDocument98 pages06 - StreamUP & Umap User ManualRené RuaultNo ratings yet

- Faithfulness A Fruit of The Holy SpiritDocument3 pagesFaithfulness A Fruit of The Holy SpiritImmanuel VictorNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument4 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancepavans25No ratings yet

- Mariño y AgoncilloDocument3 pagesMariño y AgoncilloAriel OgabangNo ratings yet

- Sandra Revolut Statement 2023Document9 pagesSandra Revolut Statement 2023Sandra MillerNo ratings yet

- BATCH 2023 Graduation SongsDocument2 pagesBATCH 2023 Graduation SongsJov AprisNo ratings yet

- SullivanDocument7 pagesSullivanHtaed TnawiNo ratings yet

- Republic Vs HerbietoDocument2 pagesRepublic Vs HerbietoMichelle Vale CruzNo ratings yet

- Questions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationDocument2 pagesQuestions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationMark MlsNo ratings yet

- CS-Fin Mkts-Buyback of Shares by MNCs in IndiaDocument9 pagesCS-Fin Mkts-Buyback of Shares by MNCs in IndiaPramod Kumar MitraNo ratings yet

- Certified Patent Valuation Analyst - TrainingDocument8 pagesCertified Patent Valuation Analyst - TrainingDavid WanetickNo ratings yet

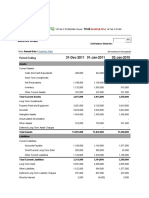

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- CIDB Contract FormDocument36 pagesCIDB Contract FormF3008 Dalili Damia Binti AmranNo ratings yet

- Online Declaration Form 1516Document2 pagesOnline Declaration Form 1516AlcaNo ratings yet

- Regional Ethics Bowl Cases: FALL 2018Document2 pagesRegional Ethics Bowl Cases: FALL 2018alyssaNo ratings yet

- Valeriano v. Employees Compensation CommissionDocument2 pagesValeriano v. Employees Compensation CommissionSherry Jane GaspayNo ratings yet

- Retraction of Dr. Jose Rizal (UNIT 4 WEEK 12)Document2 pagesRetraction of Dr. Jose Rizal (UNIT 4 WEEK 12)Marestel SivesindNo ratings yet

- Cfa Blank ContractDocument4 pagesCfa Blank Contractconcepcion riveraNo ratings yet

- Call CenterDocument25 pagesCall Centerbonika08No ratings yet

- Scheulin Email Thread BRENT ROSEDocument3 pagesScheulin Email Thread BRENT ROSEtpepperman100% (1)

- Eou FTZ EpzDocument18 pagesEou FTZ EpzNaveen Kumar0% (1)

- FullStmt 1706022124583 3310248148699 Ibtisam922Document3 pagesFullStmt 1706022124583 3310248148699 Ibtisam922محمدابتسام الحقNo ratings yet

- Petron Corporation and Peter Milagro v. National Labor Relations Commission and Chito MantosDocument2 pagesPetron Corporation and Peter Milagro v. National Labor Relations Commission and Chito MantosRafaelNo ratings yet

- Letter To JP Morgan ChaseDocument5 pagesLetter To JP Morgan ChaseBreitbart NewsNo ratings yet