Professional Documents

Culture Documents

HKICPA QP Exam (Module A) Sep2006 Question Paper

Uploaded by

cynthia tsuiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HKICPA QP Exam (Module A) Sep2006 Question Paper

Uploaded by

cynthia tsuiCopyright:

Available Formats

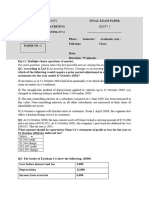

SECTION A – CASE QUESTIONS (Total: 50 marks)

Answer the following ONE compulsory question which relates to the Case below. Marks

will be awarded for logical argumentation and appropriate presentation of the answers.

CASE

Assume that you are Mr. David Lee, the accounting manager of Ultimate Holdings Limited

(“UHL”). UHL is a company incorporated in Hong Kong and is principally engaged in the

trading of toys in Hong Kong.

On 31 March 2005, UHL acquired 20 per cent of the issued share capital of Successful Toys

Limited (“STL”), a retail chain store incorporated in Hong Kong. The cost of the investment

was seven million Hong Kong Dollars (HKD7,000,000), which UHL paid all in cash. This

20 per cent shareholding enables UHL to exercise significant influence on STL. On

31 March 2005, the fair value of STL’s identifiable assets was HKD20,000,000, and the

carrying amount of those assets was HKD15,200,000. STL had no liabilities or contingent

liabilities at that date. The following shows STL’s balance sheet at 31 March 2005 together

with the fair values of the identifiable assets:

Carrying Fair

amounts values

HKD’000 HKD’000

Plant and equipment (net) 11,200 16,000

Net current assets 4,000 4,000

15,200 20,000

Issued equity:

1,000,000 ordinary shares 10,000

Retained earnings 5,200

15,200

During the year ended 31 March 2006, STL reported a profit of HKD12,000,000 but did not

pay any dividends. In addition, the fair value of STL’s plant and equipment further

increased to HKD20,000,000.

On 31 March 2006, UHL acquired a further 50 per cent of the issued share capital of STL

thereby obtaining control. The cost of investment was thirty million Hong Kong Dollars

(HKD30,000,000), which UHL paid all in cash. At 31 March 2006, STL had a contingent

liability of HK$1,000,000 regarding a lawsuit with a supplier. STL expects to settle the case

by March 2007.

Module A (September 2006 Session) Page 1 of 7

The following shows the balance sheets of UHL and STL at 31 March 2006 together with the

fair values of STL’s identifiable assets at that date:

UHL STL STL

Carrying Fair

amounts values

HKD’000 HKD’000 HKD’000

Land lease premium 10,000 - -

Property, plant and equipment (net) 21,000 9,800 20,000

Investment in a subsidiary 37,000 - -

Net current assets 9,000 17,400 17,400

77,000 27,200 37,400

Issued equity:

Ordinary shares 65,000 10,000

Retained earnings 12,000 17,200

77,000 27,200

UHL has adopted an accounting policy to depreciate and amortise plant and equipment

using the straight-line method over a 10-year life with no residual value.

UHL has no investment other than STL.

The fair values of STL’s assets at 31 March 2005 and subsequent changes in the fair values

have not been reflected in STL’s financial statements.

Module A (September 2006 Session) Page 2 of 7

You have a draft consolidated financial statements of UHL for the year ended 31 March 2006.

After you have sent them to UHL’s directors for review, one of the directors, who is not a

certified public accountant, sends you an e-mail as follows:

To: David LEE, Accounting Manager, UHL

From: Danielle WONG (Director)

c.c.: Crystal HO, Stephen LEE, Christopher YUNG (Directors)

Date: 18 May 2006

Consolidated financial statements of UHL as at 31 March 2006

Could you please clarify the following points relating to UHL’s draft consolidated balance

sheets which I have just reviewed.

(A) So far as I understand, the company owns a warehouse in the New Territories and an

office in Kowloon. I am not aware that we have purchased or leased any land.

Why is there an item “Land lease premium” in the consolidated balance sheet?

(B) In last year’s financial statements, I see an item “Investment in an associate” of an

amount of HK$7,000,000 in the balance sheet. This item disappeared in the current

year’s “consolidated” balance sheet as at 31 March 2006. Interestingly, I find an item

“Share of profit of an associate” in the “consolidated” income statement for the current

year. Is there something wrong with the financial statements? What does the term

“consolidated” mean?

(C) In your notes to the consolidated cash flow statement describing assets and liabilities

acquired in business combination, there is an item “Provision for contingent liabilities”

of HK$1,000,000 under current liabilities assumed. I recall that in the financial

statements of some listed companies I have read, contingent liabilities are in fact not

liabilities. They are only disclosed in the notes. Why do we treat them as a liability

in our accounts?

(D) What is “Goodwill”?

I would appreciate your clarification in time for the upcoming board meeting.

Best regards,

Danielle

Module A (September 2006 Session) Page 3 of 7

Required:

Question 1 (50 marks – approximately 90 minutes)

(a) Prepare a memorandum in response to the issues raised by

Ms. Danielle WONG. In your memorandum, you should:

(i) discuss the reasons for the item “Land lease premium” in the

consolidated balance sheet;

(5 marks)

(ii) discuss how UHL should account for its interest in STL from

31 March 2005 to 31 March 2006. For this purpose, you should explain

(1) the treatments of the 20% interest in STL in UHL’s balance sheet at

31 March 2005; (2) the effect of the 50% interest acquired at

31 March 2006 on the status of STL and (3) the meaning of

“consolidated” financial statements;

(10 marks)

(iii) determine the carrying amount of the 20% interest in STL at

31 March 2006 (i.e. before the acquisition of the 50% interest at

31 March 2006);

(5 marks)

(iv) discuss why the “contingent liability” is recognised as a liability in

UHL’s consolidated balance sheet; and

(5 marks)

(v) why goodwill is recognised in UHL’s consolidated balance sheet and its

implications for financial statements in future. You should also

demonstrate the calculation of the carrying amount of the goodwill as at

31 March 2006.

(10 marks)

(b) Prepare an annex to your memorandum showing the consolidated balance

sheet as at 31 March 2006. Ignore deferred taxation. [Alternatively, you may

list the consolidation journals necessary for the purpose of drafting the

consolidated balance sheet.]

(15 marks)

* * * END OF SECTION A * * *

(QUESTIONS)

Module A (September 2006 Session) Page 4 of 7

SECTION B – ESSAY / SHORT QUESTIONS (Total: 50 marks)

Answer ALL of the following questions. Marks will be awarded for logical argumentation

and appropriate presentation of the answers.

Question 2 (10 marks – approximately 18 minutes)

Discuss the following statement:

“All errors in prior years’ financial statements must be corrected in the current year’s

financial statements.”

(10 marks)

Question 3 (14 marks – approximately 25 minutes)

Sloan Limited (“Sloan”) is considering the following three alternatives in obtaining external

funds:

(a) The issue of a financial instrument for a principal amount of HK$500,000,000. The

interest rate would be 16% per annum for the first ten years payable in arrears and

zero per cent in subsequent periods. Sloan would have no obligation to repay the

principal amount.

(b) The issue of redeemable convertible preference shares (“PS”) with a principal amount

of HK$500,000,000. By the end of the fourth year from the date of issue of the PS,

Sloan would have to redeem the PS. Sloan would pay a fixed dividend at 8% per

annum cumulative. At any time during the four years, the PS could be converted into

100,000,000 ordinary shares of Sloan if the holders exercised the conversion option,

without which Sloan would have to pay a dividend at 10% per annum cumulative.

(c) The issue of 100,000,000 ordinary shares for HK$500,000,000. At the same time,

Sloan would write a put option to repurchase the 100,000,000 ordinary shares at

HK$6.6 per share at the end of the fourth year from the date of issue of the ordinary

shares. The put option would necessitate gross physical settlement. The fair value

of the put option at the contract date is estimated at HK$15,000,000.

Required:

Determine how Sloan should account for the financial instruments to be issued under

these three investment options. Explain your answer by reference to relevant

accounting standards.

(14 marks)

Module A (September 2006 Session) Page 5 of 7

Question 4 (12 marks – approximately 22 minutes)

Phoenix Real Estate Limited (“Phoenix”) is a property developer in China. In 2003, Phoenix

acquired the land use rights of two pieces of land in Beijing for hotel development:

Property One - Since the date of the acquisition of the land, the board of Phoenix has

decided to run the hotel on its own and commenced the pre-operating activities of the hotel

on 1 January 2005 when the development is completed and the hotel is available for its

intended use. The hotel’s grand opening took place on 1 July 2005.

Property Two - Since the date of the acquisition of the land, the board of Phoenix decided to

lease the whole property to earn rental. A lease agreement was entered into to lease the

whole property to its holding company (the “Tenant”) for a period of eighteen years for the

operation of a hotel. According to the lease agreement, in addition to the minimum annual

rental, Phoenix is entitled to receive a turnover rent which represents the excess of 5%

annual revenue of the hotel operation over the minimum rental. The monthly revenue

amount of the hotel operation is provided by the Tenant at the close of business of each

month-end date.

Other information on these two properties:

Property One Property Two

RMB’000 RMB’000

Cost of land use right 45,000 48,000

Cost of construction (excluding the

amortisation of land use right) 303,000 267,000

Fair value of the land use right as at

31 December 2005 60,000 100,000

Fair value of the building at existing

status as at 31 December 2005 560,000 340,000

Date of purchase of land use right 1 July 2003 1 October 2003

Term of land use right (from date of 75 years 60 years

purchase by Phoenix)

Estimated useful life of the property 50 years 40 years

Completion of construction of the December 2004 June 2005

building

Phoenix has adopted the cost model under HKAS 16 for property, plant and equipment and

the fair value model under HKAS 40 for investment property (buildings only). Depreciation

is provided to write off the cost of property, plant and equipment using the straight-line

method. The land use right is considered as a lease and accounted for in accordance with

the requirements under HKAS 17. Amortisation of the cost of the land during the

construction period is capitalised as part of the development cost of the property.

Required:

(a) Calculate the amount of (1) land use right and (2) carrying amount of the building

for each property to be reflected in Phoenix’s balance sheet as at

31 December 2005.

(9 marks)

(b) Explain the accounting treatment for the turnover rent under the lease

agreement entered into with the Tenant for Property Two in Phoenix’s financial

statements.

(3 marks)

Module A (September 2006 Session) Page 6 of 7

Question 5 (14 marks – approximately 25 minutes)

Mini Automobile Limited (“MAL”) signed a firm sales contract with Car Trading Inc. (“CTI”) on

1 May 2006. The contract specifies that 300 units of Mini Wagon II (“MW II”) have to be

delivered before 28 February 2007 at a fixed price of HK$380,000 per unit. If the delivery is

more than one month late, MAL will grant CTI a discount of 30 per cent on each delayed unit.

The costs of production are HK$288,000 per unit. Up to 31 December 2006, MAL was only

able to deliver 260 units. MAL will only be able to deliver another 20 units before

28 February 2007. The unexpected delay is due to a strike in one of the production plants.

MAL signed an agreement to lease premises for its show room for three years. According

to the lease agreement, MAL is responsible for restoration of the premises to the original

condition at the expiry of the lease term. As at 31 December 2006, MAL had already

incurred HK$10,000,000 in renovating and decorating the showroom. MAL estimates that it

will incur HK$800,000 to restore the premises to the original condition.

As at 31 December 2006, MAL was a defendant in a patent infringement lawsuit of its driving

control system (“DCS”) that has a high probability of making a loss of HK$120,000,000. If

MAL loses the case, the management will take legal action to claim the loss from the DCS

developer. The Company’s lawyers advise that it is also highly probable that MAL will be

successful in recovery of HK$100,000,000 from the DCS developer.

Required:

For each of the above situations, determine (i) whether a provision should be made; (ii)

the amount of the provision, if any, in MAL’s balance sheet at 31 December 2006; and

(iii) the required disclosure by reference to the relevant accounting standards.

(14 marks)

* * * END OF EXAMINATION PAPER * * *

(QUESTIONS)

Module A (September 2006 Session) Page 7 of 7

You might also like

- Example: Currency Forward ContractsDocument23 pagesExample: Currency Forward ContractsRenjul ParavurNo ratings yet

- Swing Trading MasteryDocument120 pagesSwing Trading MasterySandro Pinna100% (5)

- Cfa L1 Topicwise Questions - Solutions Book FinalDocument216 pagesCfa L1 Topicwise Questions - Solutions Book Final848 Anirudh ChaudheriNo ratings yet

- Booklist 10-11Document20 pagesBooklist 10-11Chloe YeeNo ratings yet

- Indian Banks - CLSADocument4 pagesIndian Banks - CLSAPranjayNo ratings yet

- Bloomsburg University of Pennsylvania Bloomberg Navigation GuideDocument71 pagesBloomsburg University of Pennsylvania Bloomberg Navigation Guideseng086100% (1)

- HKICPA QP Exam (Module A) Sep2004 AnswerDocument14 pagesHKICPA QP Exam (Module A) Sep2004 Answercynthia tsuiNo ratings yet

- 盈科外服菲律宾简介2022年版本Document33 pages盈科外服菲律宾简介2022年版本Lordrey NonatoNo ratings yet

- Anti Money Laundering PolicyDocument8 pagesAnti Money Laundering PolicysonilaNo ratings yet

- Stock Valuation Spreadsheet TemplateDocument5 pagesStock Valuation Spreadsheet TemplatebgmanNo ratings yet

- Biotech Valuation ModelDocument8 pagesBiotech Valuation ModelsachinmatpalNo ratings yet

- Computational Finance: Fixed Income Securities: BondsDocument40 pagesComputational Finance: Fixed Income Securities: BondsJing HuangNo ratings yet

- C39CA 1617 Sample PaperDocument6 pagesC39CA 1617 Sample Paperdoba1000No ratings yet

- SFM New Sums Added in Study Material by CA Mayank KothariDocument112 pagesSFM New Sums Added in Study Material by CA Mayank KothariSNo ratings yet

- Askin CapitalDocument1 pageAskin CapitalPoorvaNo ratings yet

- Chapter 6 Self Test Taxation Discussion Questions PDF FreeDocument9 pagesChapter 6 Self Test Taxation Discussion Questions PDF FreeJanjan RiveraNo ratings yet

- IKEADocument22 pagesIKEAKurt MarshallNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 Question PaperDocument7 pagesHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2005 Question PaperDocument6 pagesHKICPA QP Exam (Module A) May2005 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2004 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Sep2004 Question Papercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2005 AnswerDocument12 pagesHKICPA QP Exam (Module A) May2005 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 AnswerDocument13 pagesHKICPA QP Exam (Module A) May2007 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 AnswerDocument12 pagesHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 AnswerDocument10 pagesHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- 2CEXAM Mock Question Licensing Examination Paper 8Document9 pages2CEXAM Mock Question Licensing Examination Paper 8Tsz Ngong KoNo ratings yet

- 道德、经济、数量、组合、固收、衍生Document170 pages道德、经济、数量、组合、固收、衍生Ariel MengNo ratings yet

- Weixin Official Account Registration and Verification Application FormDocument1 pageWeixin Official Account Registration and Verification Application Form叶桂清No ratings yet

- Bloomberg L.P., (2012), FWCV Forward Analysis Matching Output. Bloomberg L.P PDFDocument11 pagesBloomberg L.P., (2012), FWCV Forward Analysis Matching Output. Bloomberg L.P PDFAbdurahman JumaNo ratings yet

- Ed - 16wchap07sln For 30 Jan 2018Document7 pagesEd - 16wchap07sln For 30 Jan 2018MarinaNo ratings yet

- Management Accounting Autumn 2009Document18 pagesManagement Accounting Autumn 2009MahmozNo ratings yet

- Quantitative Finance PDFDocument2 pagesQuantitative Finance PDFaishNo ratings yet

- HKAL Applied Mathematics Syllabus 1994Document76 pagesHKAL Applied Mathematics Syllabus 1994Zimai ChangNo ratings yet

- 2022 Taiwan MP Salary ReportDocument38 pages2022 Taiwan MP Salary ReportVicky100% (1)

- Daily Trading Stance - 2009-08-06Document3 pagesDaily Trading Stance - 2009-08-06Trading Floor100% (2)

- Total Cost of Trading 120418Document28 pagesTotal Cost of Trading 120418tabbforumNo ratings yet

- CFA III-Performance Evaluation关键词清单Document9 pagesCFA III-Performance Evaluation关键词清单Thanh NguyenNo ratings yet

- FINS3630: Bank Financial ManagementDocument46 pagesFINS3630: Bank Financial ManagementKelvin ChenNo ratings yet

- Hkcee Economics - 8 National Income - P.1Document9 pagesHkcee Economics - 8 National Income - P.1peter wongNo ratings yet

- Nov Dec2002cookrepDocument118 pagesNov Dec2002cookrepDigito DunkeyNo ratings yet

- Sage UBS - Guide On Transitioning From GST To SST and Non-SST - V1.0Document27 pagesSage UBS - Guide On Transitioning From GST To SST and Non-SST - V1.0CTLNo ratings yet

- Course Outline ENG 101Document5 pagesCourse Outline ENG 101Zarin Chowdhury100% (2)

- CFA Level III Mock Exam 2 - Questions (AM)Document39 pagesCFA Level III Mock Exam 2 - Questions (AM)Munkhbaatar SanjaasurenNo ratings yet

- IIIrd Sem 2012 All Questionpapers in This Word FileDocument16 pagesIIIrd Sem 2012 All Questionpapers in This Word FileAkhil RupaniNo ratings yet

- CFA Level I - Timetable (August 2021 Exam) (V2)Document1 pageCFA Level I - Timetable (August 2021 Exam) (V2)Via Commerce Sdn BhdNo ratings yet

- Bosphorus CLO II Designated Activity CompanyDocument18 pagesBosphorus CLO II Designated Activity Companyeimg20041333No ratings yet

- Sample Midterm For Risk Management (MGFD30)Document21 pagesSample Midterm For Risk Management (MGFD30)somebodyNo ratings yet

- Answer ALL of The Following Questions. Marks Will Be Awarded For Logical Argumentation and Appropriate Presentation of The AnswersDocument7 pagesAnswer ALL of The Following Questions. Marks Will Be Awarded For Logical Argumentation and Appropriate Presentation of The AnswersVong Yu Kwan EdwinNo ratings yet

- Section A - CASE QUESTIONS (Total: 50 Marks)Document9 pagesSection A - CASE QUESTIONS (Total: 50 Marks)Vong Yu Kwan EdwinNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- Financial Reporting and Corporate Finance: (11BSB660) CourseworkDocument4 pagesFinancial Reporting and Corporate Finance: (11BSB660) CourseworkRicky SweeNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 AnswerDocument15 pagesHKICPA QP Exam (Module A) Sep2006 Answercynthia tsui100% (2)

- Finance QP 2017Document3 pagesFinance QP 2017Yeswanth rajaNo ratings yet

- MBA 1654 Question PaperDocument49 pagesMBA 1654 Question PaperkedrabeydoNo ratings yet

- Fsa 2Document2 pagesFsa 2Ciptawan CenNo ratings yet

- Valuation AssignmentDocument9 pagesValuation AssignmentNicole TaylorNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Pilot Paper F7Document6 pagesPilot Paper F7Dorian CaruanaNo ratings yet

- BAC 322 Advanced AccountingDocument9 pagesBAC 322 Advanced AccountingLawrence jnr MwapeNo ratings yet

- Financial & Corporate Reporting: RequirementDocument6 pagesFinancial & Corporate Reporting: RequirementTawsif HasanNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- F2 Questions November 2010Document20 pagesF2 Questions November 2010Robert MunyaradziNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- Bengal CorporationDocument2 pagesBengal CorporationTowhidul IslamNo ratings yet

- Advanced Financial Reporting 1.PDF Nov 2011 1Document12 pagesAdvanced Financial Reporting 1.PDF Nov 2011 1Prof. OBESENo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- HKICPA QP Exam (Module A) Sep2008 AnswerDocument12 pagesHKICPA QP Exam (Module A) Sep2008 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 AnswerDocument13 pagesHKICPA QP Exam (Module A) May2007 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 AnswerDocument15 pagesHKICPA QP Exam (Module A) Sep2006 Answercynthia tsui100% (2)

- HKICPA QP Exam (Module A) May2005 AnswerDocument12 pagesHKICPA QP Exam (Module A) May2005 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) May2007 AnswerDocument13 pagesHKICPA QP Exam (Module A) May2007 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Feb2008 AnswerDocument10 pagesHKICPA QP Exam (Module A) Feb2008 Answercynthia tsui100% (1)

- HKICPA QP Exam (Module A) Feb2006 AnswerDocument12 pagesHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2008 Question PaperDocument9 pagesHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- CORRECTION OF ERRORS Theories PDFDocument7 pagesCORRECTION OF ERRORS Theories PDFJoy Miraflor AlinoodNo ratings yet

- Affidavit of Loss - Lavina AksakjsDocument1 pageAffidavit of Loss - Lavina AksakjsAnjo AlbaNo ratings yet

- Chapter 04Document8 pagesChapter 04Mominul MominNo ratings yet

- Financial News - FN 40 Under 40 Rising Stars in Investment Banking - 12 Dec 2011Document14 pagesFinancial News - FN 40 Under 40 Rising Stars in Investment Banking - 12 Dec 2011Edna ConceiçãoNo ratings yet

- IIBF MembershipDocument2 pagesIIBF MembershipUjjwal BaghelNo ratings yet

- Chapter 11 - Allocation of Joint Costs and Accounting For By-ProductsDocument27 pagesChapter 11 - Allocation of Joint Costs and Accounting For By-ProductsJoann CaneteNo ratings yet

- HDFC Repaired 22222Document124 pagesHDFC Repaired 22222rahulsogani123No ratings yet

- The Beginnings of FDI in E-CommerceDocument16 pagesThe Beginnings of FDI in E-CommerceAbhinavNo ratings yet

- RTD Pension DocumentsDocument53 pagesRTD Pension Documentsangel_aaahNo ratings yet

- PNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesDocument5 pagesPNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesKhayzee AsesorNo ratings yet

- ID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanDocument8 pagesID Analisis Rantai Nilai Dan Nilai Tambah Kakao Petani Di Kecamatan Paya Bakong DanLinda UtariNo ratings yet

- My Affidavit For LawyerDocument4 pagesMy Affidavit For LawyerJohn GuillermoNo ratings yet

- Case Digest in Insurance LawDocument8 pagesCase Digest in Insurance LawdenevoNo ratings yet

- Investment Analysis 1Document48 pagesInvestment Analysis 1yonasteweldebrhan87No ratings yet

- Smart ConsensusDocument1 pageSmart ConsensusKarthikKrishnanNo ratings yet

- Regd Office: Unit No. 2, First Floor, 3A Pollock Street, Kolkata: 700 001, West BengalDocument6 pagesRegd Office: Unit No. 2, First Floor, 3A Pollock Street, Kolkata: 700 001, West BengalCA Pallavi KNo ratings yet

- Question Bank (Repaired)Document7 pagesQuestion Bank (Repaired)jayeshNo ratings yet

- Budgetcircular2010 11Document109 pagesBudgetcircular2010 11Vikas AnandNo ratings yet

- Ch.1 Overview of Financial Management and Financial EnvironmentDocument37 pagesCh.1 Overview of Financial Management and Financial EnvironmentNguyễn ThảoNo ratings yet

- Chit Fund CompaniesDocument179 pagesChit Fund CompaniesMIKE4U4No ratings yet

- IBM Final PDFDocument4 pagesIBM Final PDFpohweijunNo ratings yet

- Terminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFDocument2 pagesTerminology in Product Cost Controlling (SAP Library - Cost Object Controlling (CO-PC-OBJ) ) PDFkkka TtNo ratings yet

- Investment Chapter 7Document3 pagesInvestment Chapter 7Bakpao CoklatNo ratings yet