Professional Documents

Culture Documents

3 - Payroll Reimbursement Form 1-05-113998 7

Uploaded by

falleppaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 - Payroll Reimbursement Form 1-05-113998 7

Uploaded by

falleppaCopyright:

Available Formats

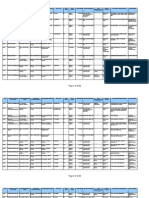

EMD-055 (1/2008)

MICHIGAN STATE POLICE

PAYROLL REIMBURSEMENT DETAIL

Reference the attached instruction sheet before completing this detail

Contact and Activity Information (a)

Local Emergency Management Program / Fiduciary

Year and Title of Grant from Grant Agreement

Primary Agent's Phone

Primary Agent's Name

Page _____ of _____

Primary Agent's Fax

Type of Activity or Event

Agency's Name and Phone # completing this form if different than the local EM Program (Sub-Recipient)

Employee's Name

(Last, First, M.I.)

Date and Hours Worked Each Day (d)

Emp.

Code *

(c)

(b)

Date of Activity or Event

)

Regular Over time

Total Regular Total Overtime

Rate Per Rate Per Per Diem

Total Per

Wages

Wages

Hour

Hour

Rate

Diem

(i)

(j)

(f)

(g)

(h)

(k)

Date

Total

Hours

(e)

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

Hours

0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

(2)

(3)

(4)

Totals =

Please enter the fringe benefit percentage rates on the instruction sheet before completing the Payroll Reimbursement Detail.

Total Regular Wage (2) =

$0.00

Total Overtime Wage (3) =

$0.00

x Fringe Benefit Rate =

0.00%

x Fringe Benefit Rate =

0.00%

Total Benefits (1) =

$0.00

Regular Benefits (1) =

$0.00

Overtime Benefits (1) =

$0.00

Grand Total (this page only)

$0.00

EMPLOYEE CODE * ( C )

Full Time Existing (FE)

Part Time Existing (PE)

Total Per Diem (4) =

Full Time New (FN)

Part Time New (PN)

$0.00

Backfill (B)

Total Wages (2,3,4) =

Total

Wages

$0.00

Volunteer (V)

Sub-grantee's Authorized Financial Representative (m)

Print Name and Title

Phone Number

Signature

Date

I certify that the above information is true and accurate, that payment has been made to the employees

identified, and documentation of these transactions is available for audit.

)

X

Authority:

1976 PA 390, as amended

Completion: Voluntary, but completion

necessary to be considered for

assistance.

Return detail (attached to the Reimbursement Request Coversheet) to:

Michigan State Police, Emergency Management and Homeland Security Division, Attn: Financial Section, 4000 Collins Rd., Lansing, MI 48910

(l)

EMD-055i (1/2008)

INSTRUCTIONS FOR COMPLETION OF PAYROLL REIMBURSEMENT DETAIL (EMD-055)

Fringe Benefit Rate Calculation

Worksheet Instructions

General Information:

A separate Payroll Reimbursement Detail (EMD-055) must be completed for each grant solution

area and individual exercise.

A Payroll Reimbursement Detail (EMD-055) must be completed whenever requesting payroll

reimbursement. No Exceptions.

Calculated fields on the Payroll Reimbursement Detail (EMD-055) are protected

and cannot be accessed electronically.

Each change in an employee's wage rate requires completion of an additional line, even

if it is the same employee.

The Payroll Reimbursement Detail (EMD-055) is considered documentation and must be submitted

with the corresponding Reimbursement Request Coversheet.

Mail completed forms to: Michigan State Police, Emergency Management Division and Homeland

Security Division, Attn:Financial Section, 4000 Collins Rd., Lansing, MI 48910.

a. Contact and Activity Information:

- All applicable Contact and Activity Information must be completed.

- Primary Agent is the locally designated contact for the grant.

- Agency is a Sub-recipient receiving funds through the Local Emergency Management

Program.

- Type of grant Activity or Event, e.g., TT Exercise, Flood Disaster, Mitigation Project,

Training, Conference, etc.

b. Employee Name:

- Enter employee's last name, first name, and middle initial.

c. Employee Code: *

- Enter employee code from legend on the front bottom of form.

- If the employee is performing backfill, add Code "B" to the employee code.

- Volunteer (V) includes paid-for-call, paid-on-call, and paid-per-call, and non-paid volunteer

personnel.

d. Date & Hours Worked Each Day:

- Enter the date(s) worked on the top line of this section.

- Enter each employee's hours worked under the corresponding date.

- For per diem rate, enter a "1" in the hours cell below the corresponding date worked.

e. Total Hours:

- No entry required, this is a calculated field.

f. Regular Wage Rate Per Hour: (Do not include fringe benefits with this rate)

- Complete a separate line for each different wage rate, even for the same employee.

g. Overtime Wage Rate Per Hour: (Do not include fringe benefits with this rate)

- Complete a separate line for each different wage rate, even for the same employee.

Fringe benefits for force account labor are eligible. Fringe benefits for

overtime will be significantly less than regular time. A different rate is

charged for regular time and overtime.

Only FICA (social security & Medicare), unemployment insurance,

worker's compensation, and retirement are eligible fringe benefits for

overtime.

If fringe benefit percentages vary from person to person, fill

out a separate payroll form for each person. Do not mix

employees with different fringe benefit rates on the same form.

Complete a different form each time the fringe benefit rate

changes.

The following steps will assist in calculating the percentage of fringe benefits paid

on an employees salary. Note: items and percentages will vary from one entity to

another.

1. The normal year consists of 2080 hours (52 weeks x 5

workdays/week x 8 hours/day). This does not include holidays and

vacations.

2. Determine the employees basic hourly pay rate (annual salary/2080

hours).

3. Fringe benefit percentage for vacation time: Divide number of hours

of annual vacation provided to the employee by 2080 (80 hours (2

weeks)/2080 = 3.85%).

4. Fringe

for paid

holidays:

Divide the number

of paid benefit

holidaypercentage

hours by 2080

(64 hours

(8 holidays)/2080

=

3.07%).

5. Retirement pay : Because this measure varies widely, use only

the percentage of salary matched by the employer.

h. Per Diem Rate Per Activity, Function or Event:

- Complete a separate line for each different per diem rate, even for the same employee.

- Enter the per diem rate for each activity, function, event or call.

- Per diem rate applies when no hourly wage rate has been established, e.g., paid-per-call, etc.

6. Social Security, Medicare, and Unemployment Insurance: All three

are standard percentages of salary.

i. Total Regular Wages:

- No entry required, this is a calculated field.

7. Insurance: This benefit varies by employee. Divide the amount

paid by the employer by the basic pay rate determined in step two.

j. Total Overtime Wages:

- No entry required, this is a calculated field.

k. Total Per Diem:

- No entry required, this is a calculated field.

8. Workers Compensation: This benefit also varies by employee.

Divide the amount paid by the employer by the basic pay rate

determined in step two. Use the rate per $100 to determine

the correct percentage.

l. Total Wages:

- No entry required, this is a calculated field.

m. Sub-grantee's Authorized Financial Representative:

- An authorized financial representative (person who can certify each employee was paid wages

and benefits listed) must print his or her name, title, date and phone number, and sign this detail.

Fringe Benefits (%)

Holidays

Vacation Leave

Sick Leave

Social Security

Medicare

Unemployment

Worker's Comp.

Retirement

Health Benefits

Life Ins. Benefits

Other

Total % of annual

salary

Regular Time

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

Overtime

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

IMPORTANT: The Instruction Sheet with fringe benefit calculations

MUST be submitted with the Payroll Reimbursement Detail (EMD-055).

Revised 01/2009

EMD-055i (1/2008)

Revised 01/2009

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SC4622 (CX) G3-399-04 - Ship Structural Access ManualDocument40 pagesSC4622 (CX) G3-399-04 - Ship Structural Access ManualBen TanNo ratings yet

- Vendor Reporting TemplateDocument85 pagesVendor Reporting TemplatefalleppaNo ratings yet

- Price and Accuracy of Selected Stereo Speakers (N 27)Document1 pagePrice and Accuracy of Selected Stereo Speakers (N 27)falleppaNo ratings yet

- Crosswalk Winter Weather Event 0322014Document1,328 pagesCrosswalk Winter Weather Event 0322014falleppaNo ratings yet

- Od 2019Document1,179 pagesOd 2019falleppa0% (1)

- 421 B Rehabilitation Cost Detail SheetDocument4 pages421 B Rehabilitation Cost Detail SheetfalleppaNo ratings yet

- Sales Purchase InvoiceDocument8 pagesSales Purchase InvoicefalleppaNo ratings yet

- 86427Document12 pages86427falleppaNo ratings yet

- DOSFY2011 Service Contract Inventory Detailed ReportDocument897 pagesDOSFY2011 Service Contract Inventory Detailed ReportfalleppaNo ratings yet

- 2011 Detail Service Contract Inventory12212011Document2,162 pages2011 Detail Service Contract Inventory12212011falleppaNo ratings yet

- New Resource Implementation ChecklistDocument2 pagesNew Resource Implementation ChecklistfalleppaNo ratings yet

- Detail Engagement ReportDocument9 pagesDetail Engagement ReportfalleppaNo ratings yet

- U.S. International Trade in Goods and Services, 1992 - PresentDocument12 pagesU.S. International Trade in Goods and Services, 1992 - PresentfalleppaNo ratings yet

- VN Detail Fy14Document786 pagesVN Detail Fy14falleppaNo ratings yet

- CTP Teaching Details in TimetableDocument1 pageCTP Teaching Details in TimetablefalleppaNo ratings yet

- Intl Consumer PricesDocument118 pagesIntl Consumer PricesfalleppaNo ratings yet

- OxygendemandDocument12 pagesOxygendemandAllenNo ratings yet

- Bakery Business PlanDocument15 pagesBakery Business PlanGayu AishuNo ratings yet

- Tests Conducted On Under Water Battery - YaduDocument15 pagesTests Conducted On Under Water Battery - YadushuklahouseNo ratings yet

- Bradycardia AlgorithmDocument1 pageBradycardia AlgorithmGideon BahuleNo ratings yet

- Chan vs. ChanDocument2 pagesChan vs. ChanMmm GggNo ratings yet

- Nama Anggota: Dede Wiyanto Endri Murni Hati Rukhi Hasibah Tugas: Bahasa Inggris (Narrative Text)Document3 pagesNama Anggota: Dede Wiyanto Endri Murni Hati Rukhi Hasibah Tugas: Bahasa Inggris (Narrative Text)Wiyan Alwaysfans CheLseaNo ratings yet

- Tutorial Slides - Internal Forced Convection & Natural ConvectionDocument31 pagesTutorial Slides - Internal Forced Convection & Natural ConvectionVivaan Sharma75% (4)

- Draw-Through or Blow-Through: Components of Air Handling UnitDocument23 pagesDraw-Through or Blow-Through: Components of Air Handling Unityousuff0% (1)

- Brooklyn Hops BreweryDocument24 pagesBrooklyn Hops BrewerynyairsunsetNo ratings yet

- Measurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiaDocument9 pagesMeasurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiariskhawatiNo ratings yet

- Eliasmith2012-Large-scale Model of The BrainDocument5 pagesEliasmith2012-Large-scale Model of The Brainiulia andreeaNo ratings yet

- KQ2H M1 InchDocument5 pagesKQ2H M1 Inch林林爸爸No ratings yet

- DexaDocument36 pagesDexaVioleta Naghiu100% (1)

- AJINOMOTO 2013 Ideal Amino Acid Profile For PigletsDocument28 pagesAJINOMOTO 2013 Ideal Amino Acid Profile For PigletsFreddy Alexander Horna Morillo100% (1)

- Module 3 Passive Heating 8.3.18Document63 pagesModule 3 Passive Heating 8.3.18Aman KashyapNo ratings yet

- Me22 M1a1Document2 pagesMe22 M1a1Jihoo JungNo ratings yet

- Clase No. 24 Nouns and Their Modifiers ExercisesDocument2 pagesClase No. 24 Nouns and Their Modifiers ExercisesenriquefisicoNo ratings yet

- Disease PreventionDocument14 pagesDisease PreventionJoan InsonNo ratings yet

- Granulation Process Basic UnderstandingDocument3 pagesGranulation Process Basic UnderstandingRainMan75No ratings yet

- 3 Growing in FaithDocument5 pages3 Growing in FaithJohnny PadernalNo ratings yet

- NWMP Data 2018Document56 pagesNWMP Data 2018Copper xNo ratings yet

- Specification and Maintenance Manual: Sequence Flashing Lights (SFL)Document13 pagesSpecification and Maintenance Manual: Sequence Flashing Lights (SFL)Javier Eduardo Alzate BogotaNo ratings yet

- Form No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )Document2 pagesForm No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )NeethinathanNo ratings yet

- En CafDocument1 pageEn Caffareedee0% (1)

- Parle G ReportDocument7 pagesParle G ReportnikhilNo ratings yet

- Principles in Biochemistry (SBK3013)Document3 pagesPrinciples in Biochemistry (SBK3013)Leena MuniandyNo ratings yet

- Achai, Sydney Jill S. GE 15 - SIM - ULOcDocument13 pagesAchai, Sydney Jill S. GE 15 - SIM - ULOcSydney AchaiNo ratings yet

- TOCDocument14 pagesTOCAthirah HattaNo ratings yet

- Jepretan Layar 2022-11-30 Pada 11.29.09Document1 pageJepretan Layar 2022-11-30 Pada 11.29.09Muhamad yasinNo ratings yet