Professional Documents

Culture Documents

Managing Growth Assignment

Uploaded by

Chitrakalpa SenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managing Growth Assignment

Uploaded by

Chitrakalpa SenCopyright:

Available Formats

Running head: MANAGING GROWTH ASSIGNMENT

Managing Growth Assignment

FIN/571

June 16, 2014

Gurpreet Atwal

MANAGING GROWTH ASSIGNMENT

Managing Growth Assignment

Throughout the past six weeks, this class has given the tools to analyze all the financial

statements for Sunflower Nutraceuticals with accuracy and use them to make educated decisions

in the working capital simulation. The following are decisions that were made during each phase

and how they influenced the final outcome. Along with how they affected SNCs working capital

and what general effects are associated with limited access to financing.

Background information of Sunflower Nutraceuticals (SNC)

Sunflower Nutraceutical (SNC) is a privately owned company. They are wide distributor

of all the vital supplements such as herbs for womans vitamins and minerals for all consumers

(mainly womens), distributors and retailers (Harvard Business School Publishing, 2014). The

business was started after 2006, where SNC expanded their operations and opened various

outlets. They have been overly successful in producing their own brands of sports drinks,

vitamins for teenagers, metabolism-boosting powders, and other products that enhance the

metabolism system of humans. SNC is open to the potential of growing into a major

nutraceutical distributor, but they have been struggling to breakeven which have forced them to

exceed the companys credit line to $300,000. They are only able to use a small percentage 12%

to evaluate and invest in new opportunities that could result in a good return.

Phase 1 Years 2013-2015

The first phase presented four opportunities that could be helpful in growing the

company.

1. Acquiring a new client SNC acquired Atlantic Wellness a health food giant to their

product line. This decision increased the companies EBIT approximately $260,000

MANAGING GROWTH ASSIGNMENT

and their sales figures by $4 million. Even through SNCs sales and EBIT figures

increased, the net working capital and profit margins remained the same.

Acquiring Atlantic Wellness as a new client would help SNC increase their sales, but that

will come with a cost of more inventory and accounts receivable. That could cause an issue

because SNCs currently had to keep a minimum cash amount $300,000 on hand for any

company operational needs. However, this could be solved by making a good deal with Ayurveda

Naturals.

2. Leveraging their supplier discount- The company is considering adding Atlantic

Wellness to their product line that would double their sales for $2 million. Also, SNC

is considered signing a contract with Ayurveda Naturals which have favorable

payment terms that reflect a net gain of approximately 60 days.

3. Limiting their receivable accounts- Super Sports Centers account for 20% of the

companys sales figures. That receivables account takes about 200 days to pay, and

that is a way over the 90 day average. To resolve this issue, SNC could drop Super

Sports Centers but they would take a sales hit of $2 million.

4. Discontinuing their poor selling nutraceutical products- SNC has more than 100

products, some of which could be dropped because they are outdated. Decreasing or

discounting the items would allow the company to :

a. reduce its DSI to approximately 86 days

b.

cuts its EBIT to $65,000

c. drop sales by $1 million

d. make more space for other products

MANAGING GROWTH ASSIGNMENT

Phase 2 Years 2016- 2018

Phase two presented SNC with three more opportunities and those opportunities are as

follows:

1. Take up Big Box contributions The company partnered up with a sales giant MegaMart, and that decision increased sales 25% in 2016, 10% in 2017, and 5% in 2018.

This decision is a good idea but will drop profit margins and EBIT.

2. Expansion of SNCs online presence SNC is looking into expanding their

operations into new retail markets. They were presented with an opportunity to

become partners with Golden Years Nutraceuticals, where they could reach a larger

more diverse market. This decision reduced SNCs DSO figures because the web

sales being collected began quicker from 7 days to 3 days during the duration of 2016

to 2018 and another 2 days in 2018 ending at 12 days lowest than the start. SNC also

saw a 10% increase in sales which was ideal because it would allow them to increase

their sales with having no effect on the companys working capital.

3. Create a private label product- SNC has partnered with Fountain of Youth Spas to

make a private label where they can expand their product line and increase sales and

consumer base. Doing this would increase sales by 5% in 2016, 4% in 2017, and 3%

in 2018. It will also increase profit margin by 2% as well as DSOs and DSI. This

decision will allow SNC to increase the EBIT while slightly increasing accounts

receivable.

Phase 3 Years 2019-2021

The last phase there are three opportunities that were presented to SNC, those

opportunities are:

MANAGING GROWTH ASSIGNMENT

1. Acquire a high-risk client- SNC is looking into Midwest Miracles that are a potential

high risk client because of their excessive debt and risky financial position. Acquiring

this client would increase sales by 30% in 2019 for future prospects. They are a

potential risk because their company has a lesser chance of going bankrupt compared

to recovering. Other issues include an increase in DSO by 190 days and higher fees

with and longer than normal invoice payment periods.

2. Renegotiate current supplier credit terms- SNC wants to renegotiate its current terms

with its suppliers, so they used their main vendor Dynasty Enterprises as leverage.

They want a 3% discount for payment in 10 days. They want to use this same tactic

with other suppliers because Dynasty offered SNC terms of 2/10 net 30 which

reduces the cost of sales by $200,000 and accounts receivable by $812,000.

3. Adopt a global expansion plan SNC attained a client from Latin America named

Viva Famila, they have helped expand SNC into another country. This allowed SNC

decrease their DSO for a couple days because the client is covering the delivery

charges. This new decision has increased DSI by two days and increased sales by 3%

with profit margins remaining the same.

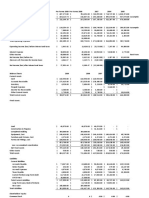

Final Outcome Metrics of SNC Years 2013-2021

The following numbers are estimated values and are in the thousands:

Sales

$13,000 to $23,430 an increase of 80%

EBIT

$882 to $2500 an increase of 183%

Net Income

$393 to $1346 an increase of 242%

Free Cash Flow

$264 to 1500 an increase of 468%

MANAGING GROWTH ASSIGNMENT

Total Firm Value

$3248 to $5407 an increase of 66%

Effects of Limited Access to Financing

A firm with limited or no access to external capital may be seriously constrained in its

ability to pursue an optimal investment policy which, in turn, may hinder the firms growth

(Access to financing and firm growth, 2011). There are other effects such as higher interest

rates on loans and credit fees, force the company to face a complicated and expensive entry

(registration costs, policies, equipment fees and etc.) and exit procedures (Parrino, Kidwell &

Bates, 2014). This could make it challenging for companies to acquire property and the rights to

products.

Conclusion

After completing this simulation and this paper, there is now a newly found appreciation

for business owners. Handling competitors and looking at all the opportunities to acquire new

clients and businesses is a challenge. The position is a difficult task and is not for the faint of

heart. The simulation really showed the challenging ways companies have to deal with managing

growth and capital.

References

Access to financing and firm growth. (2011, March). Journal of Banking & Finance, 35(3), 709.

MANAGING GROWTH ASSIGNMENT

Retrieved from http://www.sciencedirect.com.ezproxy.apollolibrary.com/science/article/p

ii/S0378426610003377

Harvard Business Publishing. (2014). Working Capital Simulation: Managing Growth. Retrieved

June 15, 2014 from

Parrino, R., Kidwell, D. S., & Bates, T. (2014). Fundamentals of Corporate Finance. Retrieved

from The University of Phoenix eBook Collection database.

You might also like

- FIN571 Working Capital Simulation WK6Document7 pagesFIN571 Working Capital Simulation WK6Dina100% (3)

- SNC Growth Through Working Capital DecisionsDocument6 pagesSNC Growth Through Working Capital DecisionsDebra Rogers100% (3)

- Working Capital Simulation Managing Growth Key Metrics and Strategic DecisionsDocument5 pagesWorking Capital Simulation Managing Growth Key Metrics and Strategic DecisionsAvinashDeshpande1989100% (1)

- Working Capital Simulation: Managing Growth V2Document5 pagesWorking Capital Simulation: Managing Growth V2Abdul Qader100% (6)

- Working Capital Simulation - Managing Growth AssignmentDocument9 pagesWorking Capital Simulation - Managing Growth AssignmentMySpam100% (1)

- SNCDocument10 pagesSNCdev_90100% (2)

- Working Capital Simulation - Managing Growth - Sunflower Nutraceuticals Harvard Case StudyDocument4 pagesWorking Capital Simulation - Managing Growth - Sunflower Nutraceuticals Harvard Case Studyalka murarka67% (3)

- MEG CV 2 CaseDocument10 pagesMEG CV 2 Casegabal_m50% (2)

- Hill Country Snack Foods CompanyDocument14 pagesHill Country Snack Foods CompanyVeni GuptaNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Winfieldpresentationfinal 130212133845 Phpapp02Document26 pagesWinfieldpresentationfinal 130212133845 Phpapp02Sukanta JanaNo ratings yet

- Answer 1Document4 pagesAnswer 1steveNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Hampton Machine Tool CompanyDocument5 pagesHampton Machine Tool Companydownloadsking100% (1)

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- Assess Two Doll Projects' NPV, IRR for RecommendationDocument4 pagesAssess Two Doll Projects' NPV, IRR for RecommendationTushar Gupta100% (1)

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- Pillsbury Case AnalysisDocument7 pagesPillsbury Case AnalysisKanishk GuptaNo ratings yet

- MidlandDocument9 pagesMidlandvenom_ftw100% (1)

- Oliver's DinnerDocument8 pagesOliver's DinnerAkash MathewsNo ratings yet

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Session 10 Simulation Questions PDFDocument6 pagesSession 10 Simulation Questions PDFVAIBHAV WADHWA0% (1)

- Case Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityDocument5 pagesCase Study 4 Winfield Refuse Management, Inc.: Raising Debt vs. EquityAditya DashNo ratings yet

- Ben & Jerry's Financial PerformanceDocument9 pagesBen & Jerry's Financial Performancemark gally reboton0% (1)

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Druthers Forming Answer KeyDocument3 pagesDruthers Forming Answer KeyDesventes AdrienNo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Stuart Daw questions costing approach transaction basisDocument2 pagesStuart Daw questions costing approach transaction basisMike ChhabraNo ratings yet

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDocument5 pagesNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniNo ratings yet

- StrykerDocument10 pagesStrykerVeer SahaniNo ratings yet

- Winfield CaseDocument8 pagesWinfield CaseAbhinandan Singh67% (3)

- Group Ariel StudentsDocument8 pagesGroup Ariel Studentsbaashii4No ratings yet

- Letter From PrisonDocument10 pagesLetter From PrisonNur Sakinah MustafaNo ratings yet

- Example MidlandDocument5 pagesExample Midlandtdavis1234No ratings yet

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Rockboro CaseDocument4 pagesRockboro CaseVan Arloe YuNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Case Study 1 Anadam MFG Instructions and NotesDocument1 pageCase Study 1 Anadam MFG Instructions and NotesSaifuddin Mohammed Tarek0% (1)

- DYOD Financial AnalysisDocument13 pagesDYOD Financial AnalysisSabyasachi Sahu100% (1)

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Document13 pagesMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaNo ratings yet

- Group 5 PresentationDocument73 pagesGroup 5 PresentationSourabh Arora100% (4)

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Deluxe's Restructuring and Capital StructureDocument4 pagesDeluxe's Restructuring and Capital StructureshielamaeNo ratings yet

- Burton SensorsDocument4 pagesBurton SensorsAbhishek BaratamNo ratings yet

- Case: Blaine Kitchenware, IncDocument5 pagesCase: Blaine Kitchenware, IncWilliam NgNo ratings yet

- Case 2 - Question 1Document8 pagesCase 2 - Question 1justin_zelin100% (1)

- Purinex Case StudyDocument9 pagesPurinex Case Studylucy007No ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Marriott Corporation Case SolutionDocument6 pagesMarriott Corporation Case Solutionanon_671448363No ratings yet

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Planter Nut Case Analysis PDF FreeDocument2 pagesPlanter Nut Case Analysis PDF Freesidra imtiazNo ratings yet

- Case3 KKDDocument4 pagesCase3 KKDvrenhays_xia039267No ratings yet

- Gainsboro CorporationDocument3 pagesGainsboro Corporationarshdeep1990No ratings yet

- Circular Flow of IncomeDocument6 pagesCircular Flow of IncomeRafsunIslamNo ratings yet

- Bsbcrt611 Apply Critical Thinking For Complex Problem Solving Assessment Task 2Document9 pagesBsbcrt611 Apply Critical Thinking For Complex Problem Solving Assessment Task 2Ana Martinez75% (8)

- Strategic Managment AssignmentDocument6 pagesStrategic Managment Assignmentsharad jainNo ratings yet

- Case 2 Karan Makhecha IndividualSubmissionDocument10 pagesCase 2 Karan Makhecha IndividualSubmission2ffdsh4g9wNo ratings yet

- Marketing Options Viability ReportDocument6 pagesMarketing Options Viability ReportCath HalimNo ratings yet

- Case Econ08 PPT 21Document38 pagesCase Econ08 PPT 21Chitrakalpa SenNo ratings yet

- The Big Mac IndexDocument12 pagesThe Big Mac IndexChitrakalpa SenNo ratings yet

- Practice 3 SLNDocument24 pagesPractice 3 SLNChitrakalpa SenNo ratings yet

- Mishkin Keynote Dec08Document17 pagesMishkin Keynote Dec08Chitrakalpa SenNo ratings yet

- Problem Set #7 Solutions Econ 2106H, J. L.Turner: AVC AC Q Q Q Q Q QDocument3 pagesProblem Set #7 Solutions Econ 2106H, J. L.Turner: AVC AC Q Q Q Q Q QChitrakalpa SenNo ratings yet

- Managerial Economics 1Document6 pagesManagerial Economics 1Chitrakalpa SenNo ratings yet

- Elasticity Practice QuestionsDocument11 pagesElasticity Practice QuestionsidentifierNo ratings yet

- Elasticity Practice QuestionsDocument11 pagesElasticity Practice QuestionsidentifierNo ratings yet

- ps1 Eco110Document9 pagesps1 Eco110Chitrakalpa SenNo ratings yet

- S3 DualDocument17 pagesS3 DualChitrakalpa SenNo ratings yet

- Central Bank InterventionDocument31 pagesCentral Bank InterventionmilktraderNo ratings yet

- Econometrics I 1Document24 pagesEconometrics I 1Chitrakalpa SenNo ratings yet

- Hutch Working PaperDocument25 pagesHutch Working PaperChitrakalpa SenNo ratings yet

- Starvedrock TrailmapDocument1 pageStarvedrock TrailmapChitrakalpa SenNo ratings yet

- Understanding Service Sector RevolutionDocument34 pagesUnderstanding Service Sector RevolutionsatomarNo ratings yet

- Classical 1Document40 pagesClassical 1Chitrakalpa SenNo ratings yet

- The Essential SeafoodDocument217 pagesThe Essential SeafoodAnonymous DTEWiCa9No ratings yet

- NHC Invites Bids for Housing ConstructionDocument2 pagesNHC Invites Bids for Housing ConstructionGladys Bernabe de VeraNo ratings yet

- Paper 12 - Company Accounts and Audit Syl2012Document116 pagesPaper 12 - Company Accounts and Audit Syl2012sumit4up6rNo ratings yet

- The Economy and Housing Continue To Tread Water: Two-Year Yields On Greek Debt SurgeDocument6 pagesThe Economy and Housing Continue To Tread Water: Two-Year Yields On Greek Debt SurgeRossy JonesNo ratings yet

- Nayak Committee On SSIs IndiaDocument3 pagesNayak Committee On SSIs IndiaSiddhu AroraNo ratings yet

- Commerce Is The Branch of Production That Deals WiDocument6 pagesCommerce Is The Branch of Production That Deals WiAli SalehNo ratings yet

- Business Communication Project-NBP Gomal University Branch DiKhanDocument10 pagesBusiness Communication Project-NBP Gomal University Branch DiKhan✬ SHANZA MALIK ✬No ratings yet

- HSBC Customer Base AnalysisDocument51 pagesHSBC Customer Base AnalysisHusnain A AliNo ratings yet

- Akhuwat Foundation Services BreakdownDocument30 pagesAkhuwat Foundation Services BreakdownAdeel KhanNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- ECB European Central BankDocument12 pagesECB European Central BankHiral SoniNo ratings yet

- Cebu International Finance Corporation V CA AlegreDocument4 pagesCebu International Finance Corporation V CA AlegreJANE MARIE DOROMALNo ratings yet

- Sbi - Salary Account - DetailsDocument9 pagesSbi - Salary Account - Detailsgaurav8tcsNo ratings yet

- Garcia v. VillarDocument3 pagesGarcia v. VillarKDNo ratings yet

- Bancassurance PDFDocument251 pagesBancassurance PDFdivyansh singh33% (3)

- Annual Report 2011Document56 pagesAnnual Report 2011Mark EpersonNo ratings yet

- FITJEE 10th Class Quiz 24-10-2021 Q.PDocument8 pagesFITJEE 10th Class Quiz 24-10-2021 Q.PSurya RaoNo ratings yet

- MI 400 Questions IB GuideDocument6 pagesMI 400 Questions IB GuideMulugeta AshangoNo ratings yet

- Atm Using FingerprintDocument5 pagesAtm Using FingerprintShivaNo ratings yet

- G.R. No. 126152Document1 pageG.R. No. 126152sherwincincoNo ratings yet

- Books Prime of EntryDocument2 pagesBooks Prime of EntryAdriana FilzahNo ratings yet

- Credit Risk Assessment of A BankDocument3 pagesCredit Risk Assessment of A BankRajpreet KaurNo ratings yet

- Developing A Strategic Plan For Brac Bank Ltd. For 2020. - PPTDocument40 pagesDeveloping A Strategic Plan For Brac Bank Ltd. For 2020. - PPTOmayerNo ratings yet

- Solved in The Documentary Movie Expelled No Intelligence Allowed TherDocument1 pageSolved in The Documentary Movie Expelled No Intelligence Allowed TherAnbu jaromiaNo ratings yet

- 2010 FirstRand Annual Report 1Document450 pages2010 FirstRand Annual Report 1Sathya SeelanNo ratings yet

- Retail Lending Policy 2010-11Document25 pagesRetail Lending Policy 2010-11Bhandup YadavNo ratings yet

- 7 P's of Service Marketing MixDocument22 pages7 P's of Service Marketing MixAlekha MittalNo ratings yet

- Ce Digital Banking Maturity Study EmeaDocument30 pagesCe Digital Banking Maturity Study EmeaRajeevNo ratings yet

- Bookshoppe Jan 2013Document23 pagesBookshoppe Jan 2013ibnusina2013No ratings yet

- September StatementDocument4 pagesSeptember Statementdonbabich8No ratings yet

- Manana Mobile International SIM CardDocument9 pagesManana Mobile International SIM CardManana Mobile International SIMNo ratings yet