Professional Documents

Culture Documents

Commsec: Home Prices Consolidate Inflation Contained

Uploaded by

Australian Property ForumOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commsec: Home Prices Consolidate Inflation Contained

Uploaded by

Australian Property ForumCopyright:

Available Formats

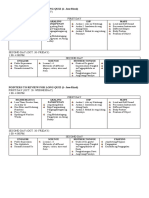

Economic Insights

Economics | June 1 2015

Home prices consolidate; Inflation contained

Home Value Index; Inflation gauge; Building approvals; PMI

Home prices fall: The CoreLogic RP Data Home Value Index of capital city home prices fell by 0.9 per cent

in May to stand 9 per cent higher over the year. Dwelling prices fell in six of the eight capital cities in May.

Total returns on capital city dwellings in the year to May rose by 13.3 per cent with houses up 13.7 per

cent on a year earlier and units up 10.2 per cent.

Dwelling approvals ease: Dwelling approvals fell by 4.4 per cent in April to be up 16.3 per cent on a year

ago. House approvals rose by 4.7 per cent in April while lumpy apartment approvals fell by 13.6 per cent.

Tame inflation: The TD Securities-Melbourne Institute monthly inflation gauge was up 0.3 per cent in May

to be up 1.4 per cent over the year. The trimmed mean measure was up 1.3 per cent over the year.

The Performance of Manufacturing index rose by 4.3 points to 52.3 in May. A reading above 50.0 indicates

that the sector is expanding.

China manufacturing: The official Chinese PMI lifted from 50.1 to 50.2 in May. The HSBC measure lifted

from 49.1 to 49.2.

The approvals data has implications for banks, building and building material companies. Inflation data is important for interest rate

settings. Home price data is important for retailers, especially those focussed on consumer durables.

What does it all mean?

A mixed bag of economic data, but for the most part, positive. A mild correction in property prices (particularly in

Sydney and Melbourne) is a good thing, tame inflation, a lift in private sector house approvals (apartment

approvals are generally volatile), and a healthy expansion in manufacturing activity.

The slide in capital city home prices in May marked the first fall in six months and is likely to be driven by the

tightening in lending criteria by the banking sector. In particular there has been a concerted effort to cool investor

demand or speculative home purchases. While it was encouraging that Sydney and Melbourne prices pulled

back, the perfect scenario would have been for a lift in prices

across other capital cities.

Dwelling prices fell in six of the eight capital cities, while

Rest of State prices were flat in May and only up 2.3 per

cent on a year ago. This highlights the issues facing

policymakers in attempting to manage a very diverse housing

market. What we would expect to see is the lift in capital city

house prices eventually filters out across the regional towns

over the next 12-24 months. Strength in home prices across

the nation will be more supportive of a lift in activity levels

over the medium term.

Inflation is well contained. All the key measures from the TD

Securities/Melbourne Institute monthly inflation report show

prices up 1.3-1.5 per cent over the year well below the

Reserve Banks 2-3 per cent target band. The Reserve Bank

Savanth Sebastian Economist (Author)

Twitter: @CommSec

Produced by Commonwealth Research based on information available at the time of publishing. We believe that the information in this report is correct and any opinions, conclusions or

recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither

Commonwealth Bank of Australia ABN 48 123 123 124 nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this report.

The report has been prepared without taking account of the objectives, financial situation or needs of any particular individual. For this reason, any individual should, before acting on the information

in this report, consider the appropriateness of the information, having regard to the individuals objectives, financial situation and needs and, if necessary, seek appropriate professional advice. In the

case of certain securities Commonwealth Bank of Australia is or may be the only market maker.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399 a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia.

This report is approved and distributed in the UK by Commonwealth Bank of Australia incorporated in Australia with limited liability. Registered in England No. BR250 and regulated in the UK by the

Financial Conduct Authority (FCA). This report does not purport to be a complete statement or summary. For the purpose of the FCA rules, this report and related services are not intended for

private customers and are not available to them.

Commonwealth Bank of Australia and its subsidiaries have effected or may effect transactions for their own account in any investments or related investments referred to in this report.

Economic Insights: Home prices consolidate; Inflation contained

can cut rates without fears of inflation exceeding the target band over the next year.

The latest manufacturing reading was encouraging, but it still has a long way to go. While the headline reading

recorded a slight expansion, the highlight is the lift in the exports component of the PMI survey, which rose by

10.9 points to 58.3 in May. The fall in the Aussie dollar may finally be having the desired impact on exports.

The Reserve Bank Board has a relatively easy decision at its meeting tomorrow. Monetary is ultra-stimulatory,

fiscal policy is providing modest stimulus and it is now more about allowing the economy a few months to adjust

to conditions. Interestingly policymakers are likely to feel more optimistic about the economic landscape following

the slide in the Australian dollar in the past fortnight.

What do the figures show?

Home prices

The CoreLogic RP Data Hedonic Australian Home Value index of capital city home prices fell by 0.9 per

cent in May after lifting by 0.8 per cent in April. Home prices are up by 9.0 per cent on a year ago, after recording

7.9 per cent annual growth to April.

House prices fell by 0.7 per cent in May while apartments fell by 2.3 per cent. House prices were up 9.6 per cent

on a year ago and apartments were up by 5.3 per cent.

The average Australian capital city house price (median price based on settled sales over quarter) was $600,000

and the average unit price was $504,000.

Dwelling prices fell in six of the eight capital cities in May: Hobart (down 2.7 per cent), Melbourne (down 1.7

per cent), Brisbane (down 0.8 per cent), Sydney (down 0.7 per cent), Darwin (up 0.6 per cent), Perth (down 0.5

per cent), and Adelaide (down 0.2 per cent). Prices rose in Canberra (up 1.4 per cent) and Darwin (up 0.6 per

cent).

Home prices were higher than a year ago in six of the eight capital cities. Prices rose most in Sydney (up

15.0 per cent), followed by Melbourne (up 9.0 per cent), Brisbane (up 3.1 per cent), Adelaide (up 3.4 per cent),

Canberra (up 2.4 per cent) and Perth (up 0.7 per cent). Price fell in Darwin (down 2.0 per cent) and Hobart (down

1.0 per cent).

Total returns on capital city dwellings in the year to May rose by 13.3 per cent with houses up 13.7 per cent on

a year earlier and units up 10.2 per cent.

RP Data report: Over the past three years, dwelling values have risen more than three times as fast as rents.

Dwelling values are 24.2 per cent higher across the combined capitals over the past three years while weekly

rents have risen by only 7.2 per cent. The net result is that gross rental yields have been compressed from 4.3

per cent back in 2012 to the current average gross yield of 3.7 per cent across the combined capital city index.

Rental yields are currently the lowest in Melbourne. A typical house is returning a gross yield of 3.2 per cent

while units are providing a higher gross yield, averaging 4.3 per cent. Sydney follows closely behind, recording a

gross yield of 3.4 per cent for houses and 4.5 per cent for units.

Building Approvals:

Dwelling approvals fell by 4.4 per cent in April to be up 16.3 per cent on a year ago. In trend terms, approvals

are down 0.4 per cent, after lifting for the prior 10 months.

House approvals rose by 4.7 per cent in April (private sector up 4.7 per cent). Meanwhile lumpy apartment

approvals fell by 13.6 per cent in April (private sector down 15.0 per cent).

In trend terms dwelling approvals are up 16.5 per cent on a year ago with house approvals up 4.0 per cent while

apartments are up by 34.4 per cent.

Across states in April: NSW approvals fell by 14.6 per cent; Victoria fell by 2.2 per cent; Queensland down by

June 1 2015

Economic Insights: Home prices consolidate; Inflation contained

14.2 per cent; South Australia fell by 10.3 per cent; Western Australia fell by 3.0 per cent; Tasmania rose by 29.8

per cent. In trend terms, approvals fell 6.2 per cent in the Northern Territory and rose 8.4 per cent in the ACT.

The value of all commercial and residential building approvals fell by 4.1 per cent in April after rising by 4.8

per cent in March. Residential approvals fell by 3.5 per cent with new building down by 5.1 per cent while

alterations & additions rose by 10.8 per cent. Commercial building fell by 5.4 per cent in April, but was still up 14.5

per cent on a year ago.

Inflation gauge

The monthly inflation gauge was up 0.3 per cent in May after a similar increase in April. The annual rate of

inflation held steady at 1.4 per cent.

Tradable good prices rose by 0.4 cent over the year to May, up from 0.2 per cent. And the annual growth rate of

non-tradable inflation rose from a decade low of 1.8 per cent to 2.0 per cent in April.

The underlying rate (trimmed mean) rose by 0.4 per cent in May after a 0.2 per cent lift in April. The annual rate

eased from 1.4 per cent to 1.3 per cent.

Excluding volatile items like petrol and fruit & vegetables, the inflation gauge rose by 0.2 per cent in May after

rising 0.3 per cent in April. The annual rate of inflation rose from 1.4 per cent to 1.5 per cent.

TD Securities noted that: Contributing to the overall change in May were price rises for automotive fuel (+4.3

per cent), tobacco (+1.1 per cent) and rent (+0.6 per cent). These were offset by falls in holiday travel and

accommodation (-0.5 per cent), newspapers, books and stationery (-1.3 per cent), and non-alcoholic beverages (2.2 per cent).

Performance of Manufacturing

The Performance of Manufacturing index rose by 4.3 points to 52.3 in May. A reading above 50.0 indicates that

the sector is expanding. The highlight of the report was the lift in the exports component of the PMI survey, which

rose by 10.9 points to 58.3 in May.

What is the importance of the economic data?

The CoreLogic RP Data Hedonic Australian Home Value Index is based on Australias biggest property

database. Unlike the ABS Index, which excludes terraces, semi-detached homes and apartments, the CoreLogicRP Data Hedonic Index includes all properties. Home prices are an important driver of wealth and spending.

The Australian Industry Group and PricewaterhouseCoopers compile the Performance of Manufacturing Index

(PMI) each month. The Australian PMI is the Australian equivalent of the US ISM manufacturing gauge. The PMI

is one of the timeliest economic indicators released in Australia. The PMI is useful not just in showing how the

manufacturing sector is performing but in providing some sense about where it is heading. The key forward

looking components are orders and employment.

The Bureau of Statistics' monthly Building Approvals release contains figures on local council approvals to build

residential structures such as homes and units as well as commercial premises such as offices and shops.

Approval is one of the first stages of the construction pipeline and is thus a key leading indicator of future activity.

An increase in approvals would point to stronger future activity for construction-related companies.

The TD Securities/Melbourne Institute Monthly Inflation Gauge is designed to provide a timely and accurate

monthly measure of inflation in Australia. The Bureau of Statistics only releases the Consumer Price Index on a

quarterly basis.

What are the implications for interest rates and investors?

In the next 12-18 months a record amount of new dwellings

will come onto the market, serving to restrain growth of

established home prices. Sydney and Melbourne home

prices are hot now, but it may be a different question in

2016.

Certainly there are few risks with cutting rates again, but it

gets down to a tactical decision. When is the best time to cut

rates? Are rate cuts losing their effectiveness? Do we risk

using up all our ammunition by cutting rates now? There are

no right or wrong answers, just a strategic decision by the

Board. Understandably financial markets and economists

are expecting no change to interest rates over the next few

months.

Savanth Sebastian, Economist, CommSec

Twitter: @CommSec

June 1 2015

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 1 To 23 Ques-AnswersDocument13 pagesChapter 1 To 23 Ques-AnswersRasha83% (12)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- True West - April 2016Document149 pagesTrue West - April 2016Rodrigo Moya100% (4)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Social Engineering FundamentalsDocument13 pagesSocial Engineering FundamentalsPonmanian100% (1)

- CoreLogic Weekly Market Update Week Ending 2017 November 19Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 November 19Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 December 3Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 December 3Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 December 10Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 December 10Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 November 26Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 November 26Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 November 5Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 November 5Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 October 29Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 October 29Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 November 12Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 November 12Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 August 13Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 August 13Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 April 30Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 April 30Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 October 15Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 October 15Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 September 17Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 September 17Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 October 8Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 October 8Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 October 22Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 October 22Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 August 20Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 August 20Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 August 27Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 August 27Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 July 16Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 July 16Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 July 23Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 July 23Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 May 21Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 May 21Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 July 2Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 July 2Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 April 16Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 April 16Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 May 14Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 May 14Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 May 28Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 May 28Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 April 23Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 April 23Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 October 30Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 October 30Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 October 23Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 October 23Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 December 4Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 December 4Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2017 March 26Document6 pagesCoreLogic Weekly Market Update Week Ending 2017 March 26Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 November 20Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 November 20Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 November 6Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 November 6Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 October 16Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 October 16Australian Property ForumNo ratings yet

- IRA Green BookDocument26 pagesIRA Green BookJosafat RodriguezNo ratings yet

- Concrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailDocument12 pagesConcrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailAnil sainiNo ratings yet

- Competition Law Final NotesDocument7 pagesCompetition Law Final NotesShubham PrakashNo ratings yet

- Scout-Handbook Eng PDFDocument11 pagesScout-Handbook Eng PDFTai Nguyen DucNo ratings yet

- Shopping For A Surprise! - Barney Wiki - FandomDocument5 pagesShopping For A Surprise! - Barney Wiki - FandomchefchadsmithNo ratings yet

- Created Ruby & Diamond Stackable Ring in Sterling Silver 9T69000 BevillesDocument1 pageCreated Ruby & Diamond Stackable Ring in Sterling Silver 9T69000 Bevillesnick leeNo ratings yet

- Molina V Pacific PlansDocument31 pagesMolina V Pacific Planscmv mendozaNo ratings yet

- Pointers To Review For Long QuizDocument1 pagePointers To Review For Long QuizJoice Ann PolinarNo ratings yet

- Business PlanDocument36 pagesBusiness PlanArun NarayananNo ratings yet

- Gerund Infinitive ParticipleDocument4 pagesGerund Infinitive ParticiplemertNo ratings yet

- Strategic Management CompleteDocument20 pagesStrategic Management Completeأبو ليلىNo ratings yet

- The IS - LM CurveDocument28 pagesThe IS - LM CurveVikku AgarwalNo ratings yet

- ACCA - Generation Next - Managing Talent in Large Accountancy FirmsDocument34 pagesACCA - Generation Next - Managing Talent in Large Accountancy FirmsIoana RotaruNo ratings yet

- Surat At-TaubahDocument14 pagesSurat At-TaubahAbbasNo ratings yet

- HR 2977 - Space Preservation Act of 2001Document6 pagesHR 2977 - Space Preservation Act of 2001Georg ElserNo ratings yet

- AsdsaDocument47 pagesAsdsaColin McCulloughNo ratings yet

- Tes Sharing Agreement 1Document2 pagesTes Sharing Agreement 1Chesca UrietaNo ratings yet

- Ilm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabDocument5 pagesIlm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabSalman KhanNo ratings yet

- Yasser ArafatDocument4 pagesYasser ArafatTanveer AhmadNo ratings yet

- Bajrang Lal Sharma SCCDocument15 pagesBajrang Lal Sharma SCCdevanshi jainNo ratings yet

- Jayant CVDocument2 pagesJayant CVjayanttiwariNo ratings yet

- CHAPTER 6 (2) - Theory of Cost - Lecture in ClassDocument44 pagesCHAPTER 6 (2) - Theory of Cost - Lecture in ClassMUHAMMAD ZAIM HAMZI MUHAMMAD ZINNo ratings yet

- Thought Expression Activity 1) Communication As Tool For Global Competitiveness Among Religion, Business, Social InteractionDocument2 pagesThought Expression Activity 1) Communication As Tool For Global Competitiveness Among Religion, Business, Social InteractionHover Olaso BonifacioNo ratings yet

- Handout Round Table On South Asian Ritua PDFDocument13 pagesHandout Round Table On South Asian Ritua PDFVictor GanNo ratings yet

- Practical TaskDocument3 pagesPractical TaskAAAAAAANo ratings yet

- Consejos y Recomendaciones para Viajar A Perú INGLESDocument3 pagesConsejos y Recomendaciones para Viajar A Perú INGLESvannia23No ratings yet

- Eugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Document2 pagesEugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Scribd Government DocsNo ratings yet