Professional Documents

Culture Documents

Part II Formula

Uploaded by

Kushagra GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part II Formula

Uploaded by

Kushagra GuptaCopyright:

Available Formats

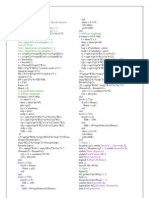

1.

1. Arithmetic Return= (Pt+Dt-Pt-1)/Pt-1 where Pt and Pt-1 are prices at

time t and t-1 resp. and Dt is the dividends flow between time t-1 and t

2. Geometric Return= ln([Pt+Dt]/Pt-1)

3. delta normal VaR(alpha%)= [-mean(returns)

+stdDev(returns)*z(alpha%)]*Pt-1 where Pt-1 is initial portfolio

position ...remember this is absolute Var

4. Lognormal VaR(alpha%)= [1-exp[mean(returns)stdDev(returns)*z(alpha%)]]*Pt-1

5. Standard error of Quantile se(q)= sqrt[p(1-p)/n]/f(q)

6. Generalized Extreme Value Distribution(GEV) :

F(X|E,mean,stdDev)= exp[-[1+E*((x-mean)/stdDev)]^(-1/E)] ;E=shape

parameter of tail !=0

F(X|E,mean,stdDev)= exp[-exp((x-mean)/stdDev)] ;E=shape parameter

of tail =0

7. Generalized Pareto Distribution(GPD):

1-[1+(E*x/beta)]^(-1/E) ;E=shape parameter of tail !=0

1-[exp(-x/beta)] ;E=shape parameter of tail =0

8. Var Using PoT VaR= u+(beta/E)[[(n/Nu)*(1-CL)]^-E - 1] where u is the

upper limit for losses. CL is confidence level, Nu no of losses above u

and total no of observations is n

9. Expected Shortfall Using POT parameters

ES= VaR/(1-E) + (Beta-E*u)/(1-E)

10. Yield based DV01= (1/10000)*[(Sum of PV(weighted time) of Bond's

Cash flows)/(1+periodic yield)]

11. Modified Duration= 1/P*(1/1+periodic yield)*(Sum of PV(weighted

time) of Bond's Cash flows)

12. Macualay duration= (1+periodic yield)* Modified Duration

13.Mortgage payment(monthly)= MB0*[r/1-(1+r)^-T] where r is

monthly interest rate and MB0 is original loan balance ,T is loan

maturity

14. Loan to Value ratio= Current Mortgage Amount/Current Apprised

Value

15. Single monthly Mortality Rate, SMM= 1-(1-CPR)^1/12 where CPR is

current prepayment rate

16. Bond Equivalent yield=2*[(1+monthly CF yield)^6-1]

17.option Cost= Zero Volatility Spread- Option Adjusted Spread

18. Put call parity: p+S=c+X*e^(-Rf*T)

19.Information ratio= [Rp-Rb]/std Dev(Rp-b) where Rp is portfolio

return, Rb is benchmark return, std Dev(Rp-b) is active risk and Rp-Rb is

active return

20. Risk Aversion= Information Ratio/2*Active risk

thats the first half wait for more

thanks

ShaktiRathore, May 11, 2013

#3

2.

ShaktiRathoreActive Member

Here are the rest of the lot for the part II,

21.Marginal Contribution to value added= Alpha of asset- 2*Risk Aversion* Active

Risk*Marginal contribution to active risk

22.Average Log Return= ln(1+r1)+ln(1+r2)+ln(1+r3)+................ln(1+rT)/T

23. Alpha and IR test: t(alpha%)= alpha-0/SE(alpha) and t(IR)= IR-0/S.E.(IR)

24. Sharpe Ratio t-Test; t=[MERp/stdDev(p)]-[MERb/stdDev(b)]/sqrt(2/N) where MER is mean

excess return

25. Active portfolio return= Rpa= beta(pa)*Rb+[Xpa1*Rf1+Xpa2*Rf2....Xpan*Rfn]+Spar

where beta(pa) is sensitivity to benchmark,X are factors sensitivities to portfolio and s is

unsystematic risk

26. Fama French three factor model: Ri,t= Rf,t + alphai + Betai,m*[E(Rm)-Rf,t]+

Betai,smb*[E(SMBt)]+ Betai,hml*[E(HMLt)]

27. Total Active Systematic Return=Expected Active beta return+ Active beta surprise+

Active benchmark timing return

28. Liquidity Duration= Q/.1*V where Q is no of shares of security, V is volume of security

29. Diversified VaR= z*stdDev(p)*P ;P is portfolio value

30. Individual VaR=z*stdDev(i)*wi*P ;wi is weight of individual security i

31. VaR of Two Asset Portfolio=

z*P*sqrt[w1^2*stdDev1^2+w2^2*stdDev2^2+2w1w2*stdDev1*stdDev2*correlation(1,2)]

for securities 1 and 2

32. Covariance(1,2)=stdDev1*stdDev2*correlation(1,2)

33. Undiversified VaRp=VaR1+VaR2

34. std Deviation of equally weighted portfolio of n securities with equal stdDeviation stdDev

and correlation rho

stdDeviation of portfolio= stdDev *sqrt[1/n+(1-1/n)*rho]

35.Marginal VaRi= (VaR/P)*Betai

36. Component VaR= VaR*Betai*wi

37.Return on surplus=change in surplus/Assets=(change in Assets- change in

Liabilities)/Assets=Rasset-Rliabs.*(Liabs/Assets) where Surplus = Assets- Liabilities

38. Probability of Default, PD= CS/1-RR where CS is spread of corporate bond wrt Rf and RR

is expected recovery rate

39. Risk neutral probability of default= 1-[(1+Rf)/(1+y)] where Rf is risk free rate and y is

yield on Bond

40. Cumulative probability of default(2yrs)= 1-{(1-PD1)*(1-P(Default in yr2|no default in yr

1))}

41. Merton Model, Payment to Debtholder= Dm- max(Dm-Vm,0) and Payment to

Stockholder= max(Vm-Dm,0)

42. Distance to default= [expected Asset return-default threshold]/stdDev(exp asset returns)

43. Distance to Default(lognormal Distribution)= [log(V/defaultThreshold)+

[E(ROA)-.5*stdDev^2]*Maturity]/stdDev*sqrt(Maturity) where V is value of firm assests,

stdDev is stdDeviation of firm assets, E(ROA) is expected return on assets

44. Portfolio Unexpected Loss of two asset portfolio ULp=

sqrt[UL1^2+UL2^2+2*UL1*UL2*correlation(1,2)]

45. Risk Contribution=RC1= UL1*[UL1+UL2*corr(1,2)]/ULp ;RC2=

UL2*[UL2+UL1*corr(1,2)]/ULp so that RC1+RC2=ULp

46.Mean Loss Rate=PD(1-RR)= PD*LGD

47. Credit spread= -[(1/T-t)*ln(D/F)]-Rf where T-t is remaining maturity, D is current value of

debt, F face value of debt and Rf is risk free rate

48. Vasicek Model: change in interest rate r= speed of reversion of r*(k-r(t))*small change in

time t+ stdDev of r* random error term

ShaktiRathore, May 11, 2013

#4

o

3.

Like x 1

ShaktiRathoreActive Member

here are rest to

49. Merton Models: PD=N{[ln(F/V)-mean*(T-t)+.5*stdDev^2*(T-t)]/stdDev*sqrt(T-t)}

50. LGD= F*PD-V*exp(mean*(T-t))*N(d)

51. Vulnerable option= (1-PD)*c +PD*RR*c

52. CDS Spread; PV of payoff =s* PV of payments => s=PV of payoff/PV of payments

53. RAROC= [Revenues-Expected Loss-Expenses+Return on Economic capital+/-transfer

price]/Economic Capital

54. Economic Capital= Operation VaR-EL=Unexpected Loss

55. Adjusted RAROC= ARAROC= RAROC-Rf/Beta(eqty)

56. spread= (Ask price-Bid Price)/.5*(Ask price+Bid Price)

57. Liquidity Adjusted VaR=LVaR= V*z*stdDev+ .5*V*spread where V is asset value

58. LVaR/VaR= 1+[spread/2*(1-exp(-stdDev*z)]

59. Elasticity=E= (change in P/P)/(change in N/N)

60. LVaR= VaR*(1-change in P/P)=VaR*(1-E*change in N/N)

61. LVaR/VaR|comb.=LVaR/VaR|exog. *LVaR/VaR|endo.

62. Capital Ratio= Total Capital/Total Risk weighted Assets

63. Capital Requirement(K)= [Conditional EL-EL]*maturity Adjustment

64. Liquidity Coverage ratio= Stock of highly Liquid Assets/Total net cash outflow over next

30 days

65. net stable funding ratio= Available amount of stable funding/Required amount of stable

funding

66. Stressed VaR= max(SVaRt-1, m*SVaRavg.) where m is a factor

67. EL= PD*LGD

You might also like

- Cash Flow AnalysisDocument38 pagesCash Flow AnalysisDragan100% (5)

- Private Equity E Book V4Document141 pagesPrivate Equity E Book V4gasbbound1No ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CORP Finals 9.5 16 PDFDocument270 pagesCORP Finals 9.5 16 PDFAlleine TupazNo ratings yet

- Financial Management Formula SheetDocument2 pagesFinancial Management Formula SheetSantosh Kumar100% (2)

- Naseer SwiftDocument67 pagesNaseer SwiftNaseeruddin MohdNo ratings yet

- % Bsformula.mDocument30 pages% Bsformula.mapi-616455436No ratings yet

- HDFC BankDocument239 pagesHDFC BankGagandeep SinghNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- 5 Lease of Bank Instrument - Bank Statement As Pof 005aDocument1 page5 Lease of Bank Instrument - Bank Statement As Pof 005aapi-255857738No ratings yet

- BA Final PrepDocument136 pagesBA Final PrepRonald AlexanderNo ratings yet

- G.R. No. 167519. THE WELLEX GROUP, INC., Petitioner, vs. U-LAND AIRLINES, CO., LTD., RespondentDocument77 pagesG.R. No. 167519. THE WELLEX GROUP, INC., Petitioner, vs. U-LAND AIRLINES, CO., LTD., RespondentMa. Christian RamosNo ratings yet

- MFE FormulasDocument7 pagesMFE FormulasahpohyNo ratings yet

- Comparative Study of Mutual Fund Returns and Insurance ReturnsDocument3 pagesComparative Study of Mutual Fund Returns and Insurance Returnskkdeepak sal0% (1)

- Chapter 2: Statistics and Data Analysis For Financial Engineering: With R ExamplesDocument15 pagesChapter 2: Statistics and Data Analysis For Financial Engineering: With R ExamplesJesus ValenciaNo ratings yet

- FORMULASDocument5 pagesFORMULASNurul AsyiqinNo ratings yet

- Vector Processing MatlabDocument11 pagesVector Processing Matlabbero199450% (2)

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Cse 90Document4 pagesCse 90Sharan magaNo ratings yet

- Maths (Polar)Document2 pagesMaths (Polar)karthikcrv4No ratings yet

- Formula Sheet 301 Common Exam - 1Document2 pagesFormula Sheet 301 Common Exam - 1siputvwNo ratings yet

- Power Spectrum: To Compute PSDDocument8 pagesPower Spectrum: To Compute PSDKiran KumarNo ratings yet

- %pembankitan Kanal Rayleigh: All AllDocument6 pages%pembankitan Kanal Rayleigh: All AllnataliiadesiiNo ratings yet

- Corporate Finance Theory: Formula SheetDocument6 pagesCorporate Finance Theory: Formula SheetteratakbalqisNo ratings yet

- Formula SheetDocument7 pagesFormula SheetAbraham RodriguezNo ratings yet

- MOS 3330: Operations Management Formula Sheet: O H O HDocument1 pageMOS 3330: Operations Management Formula Sheet: O H O HVivek NnrrNo ratings yet

- HW 6Document13 pagesHW 6api-465474049No ratings yet

- % Plotting The Given Question With CoordinatesDocument10 pages% Plotting The Given Question With CoordinatesNishan GajurelNo ratings yet

- % Plotting The Given Question With CoordinatesDocument10 pages% Plotting The Given Question With CoordinatesNishan GajurelNo ratings yet

- Formula ListDocument2 pagesFormula ListKarin Leunis GarciaNo ratings yet

- 6 F 193483165 D 13 F 6255 ADocument15 pages6 F 193483165 D 13 F 6255 Aapi-616455436No ratings yet

- Code MatlabDocument18 pagesCode Matlabvanlinh leNo ratings yet

- NA Assignment2 171465551 Sabbir Ahmed KIE180713Document30 pagesNA Assignment2 171465551 Sabbir Ahmed KIE180713Sabbir Ahmed NirobNo ratings yet

- L2-Formula SheetDocument4 pagesL2-Formula SheetShumaila FurqanNo ratings yet

- CT 303 Digital Communications Lab 9: Heer Gohil 201901135Document25 pagesCT 303 Digital Communications Lab 9: Heer Gohil 201901135H GNo ratings yet

- MatcodesDocument5 pagesMatcodesAcet AldehydeNo ratings yet

- HW 5Document12 pagesHW 5api-289065336No ratings yet

- Simulation of Antenna Radiation Pattern-HornDocument5 pagesSimulation of Antenna Radiation Pattern-Hornbenny_181163% (8)

- HW 9Document11 pagesHW 9api-289065336No ratings yet

- Experiment Number 13: Laplace Transform 13.1 OBJECTIVEDocument4 pagesExperiment Number 13: Laplace Transform 13.1 OBJECTIVEUsama TufailNo ratings yet

- Fin All Formula - Docx 1Document9 pagesFin All Formula - Docx 1Marcus HollowayNo ratings yet

- 18 Vector Valued FunctionsDocument14 pages18 Vector Valued FunctionsJasmine Bianca CastilloNo ratings yet

- Financial Economic Theory and Engineering Formula Sheet 2011Document22 pagesFinancial Economic Theory and Engineering Formula Sheet 2011cass700No ratings yet

- A General Result On The Smarandache Star FunctionDocument13 pagesA General Result On The Smarandache Star FunctionDon HassNo ratings yet

- Codo2D MatlabDocument2 pagesCodo2D Matlabargenis bonillaNo ratings yet

- Extension of Forex Example To Include An Igarch (1,1) Fitted Model and Var Using Riskmetrics MethodologyDocument2 pagesExtension of Forex Example To Include An Igarch (1,1) Fitted Model and Var Using Riskmetrics Methodologyapi-223061586No ratings yet

- HW 7Document9 pagesHW 7api-516646274No ratings yet

- YaDocument44 pagesYaapi-361356322No ratings yet

- Matlab CompiledDocument34 pagesMatlab CompiledAyanNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- Solution To Exercises 1.1: Answers: X 2.5375 + 1.9080i R 0.8161 - 0.0000iDocument8 pagesSolution To Exercises 1.1: Answers: X 2.5375 + 1.9080i R 0.8161 - 0.0000iGera VillaNo ratings yet

- Precision Measurement & Control RevisionDocument8 pagesPrecision Measurement & Control RevisionEleanor McCutcheonNo ratings yet

- Formula Sheet: 1. FV PV (1 + R) 2. Present Value of An Annuity PV CF X A.FDocument4 pagesFormula Sheet: 1. FV PV (1 + R) 2. Present Value of An Annuity PV CF X A.FKlaus MikaelsonNo ratings yet

- Frame Example 1Document4 pagesFrame Example 1gajula pavanNo ratings yet

- Exam Formula SheetDocument2 pagesExam Formula SheetYeji KimNo ratings yet

- Formula Sheet (Handed Out On Exam)Document5 pagesFormula Sheet (Handed Out On Exam)cheif sNo ratings yet

- Data Flow ModelDocument5 pagesData Flow ModelsuddddddNo ratings yet

- Gas PLDocument7 pagesGas PLAly Hassan WalyNo ratings yet

- Chapter 2. Returns: Let P Be The of An Asset at Time TDocument40 pagesChapter 2. Returns: Let P Be The of An Asset at Time TWOONGCHAE YOONo ratings yet

- p4 j13 FormulaeDocument5 pagesp4 j13 FormulaeaamirNo ratings yet

- 'E-Plane and H-Plane Horn Specifications': Function EndDocument2 pages'E-Plane and H-Plane Horn Specifications': Function EndBenny MtmNo ratings yet

- DSP Lab4Document19 pagesDSP Lab4Debashish KalitaNo ratings yet

- As 310Document9 pagesAs 310Ghetu MbiseNo ratings yet

- Worksheet3 SolDocument4 pagesWorksheet3 Solicelon NNo ratings yet

- Important FormulasDocument5 pagesImportant FormulasKhalil AkramNo ratings yet

- Computer Vision Project - ReportDocument28 pagesComputer Vision Project - ReportPRANAV KAKKARNo ratings yet

- Formulas For QuizzesDocument3 pagesFormulas For QuizzesSufyan KhanNo ratings yet

- Matlab Code:: Global GlobalDocument5 pagesMatlab Code:: Global GlobalPrajwal B NaikNo ratings yet

- Jet EngineDocument2 pagesJet EngineEbubechim Chiburikem Ogunka-NnokaNo ratings yet

- Pfa0064 - Topic 9Document18 pagesPfa0064 - Topic 9Jeyaletchumy Nava RatinamNo ratings yet

- Winter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"Document79 pagesWinter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"ShubhampratapsNo ratings yet

- Special Issues in Corporate FinanceDocument6 pagesSpecial Issues in Corporate FinanceMD Hafizul Islam HafizNo ratings yet

- Business in Canada ComsatsDocument17 pagesBusiness in Canada Comsatsfarhan harcho100% (1)

- Reduce: Bharti Infratel Bhin inDocument11 pagesReduce: Bharti Infratel Bhin inashok yadavNo ratings yet

- Qualifying Exam Review Qs Final Answers2Document32 pagesQualifying Exam Review Qs Final Answers2JD DLNo ratings yet

- Mutual Fund Internal Audit PresentationDocument80 pagesMutual Fund Internal Audit PresentationRam MutkuleNo ratings yet

- ARN Transfer FormDocument2 pagesARN Transfer FormSaurav PrakashNo ratings yet

- MF0002 Mergers Acquisition Model PaperDocument8 pagesMF0002 Mergers Acquisition Model PaperJhorapaata67% (3)

- 2009 PDFDocument140 pages2009 PDFAgung Wicaksono100% (1)

- Guided Notes - Roaring 20s and Great DepressionDocument3 pagesGuided Notes - Roaring 20s and Great DepressionBradley GriffinNo ratings yet

- RPS Manajemen Keuangan IIDocument2 pagesRPS Manajemen Keuangan IIaulia endiniNo ratings yet

- Certificate of Merger Instructions For FilingDocument6 pagesCertificate of Merger Instructions For FilingMark ReinhardtNo ratings yet

- Asset TablesDocument2 pagesAsset Tablessyp_18No ratings yet

- Scholes and Williams (1977)Document19 pagesScholes and Williams (1977)DewiRatihYunusNo ratings yet

- Change in State of DeliveryDocument1 pageChange in State of DeliverybrdmonteiroNo ratings yet

- Factor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertDocument16 pagesFactor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertJuan Manuel VeronNo ratings yet

- AkmenDocument7 pagesAkmenNovhy HaryaniNo ratings yet

- JLL Research ReportDocument10 pagesJLL Research Reportkrishnachaitanya_888No ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- CH005Document52 pagesCH005Lana LoaiNo ratings yet