Professional Documents

Culture Documents

1601E - August 2008

Uploaded by

lovesresearchCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1601E - August 2008

Uploaded by

lovesresearchCopyright:

Available Formats

(To be filled up by the BIR)

DLN:

PSIC:

Monthly Remittance Return

of Creditable Income Taxes

Withheld (Expanded)

(Except for transactions involving onerous transfer

BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

1601-E

August 2008 (ENCS)

of real property classified as ordinary asset)

Fill in all applicable spaces. Mark all appropriate boxes with an X.

1 For the Month

2 Amended Return?

3 No. of Sheets Attached

4 Any Taxes Withheld?

(MM / YYYY)

Yes

Yes

No

Part I

Background Information

5 TIN

6 RDO Code

7 Line of Business

8

Withholding Agent's Name

(Last Name, First Name, Middle Name for Individuals)/(Registered Name for Non-Individuals)

10 Registered Address

Telephone Number

11 Zip Code

12 Category of Withholding Agent

Private

Government

13 Are there payees availing of tax relief under Special Law or International Tax Treaty?

No

If yes, specify

Yes

Part II

Computation of Tax

NATURE OF INCOME PAYMENT

AT C

TAX

RATE

TAX BASE

14 Total Tax Required to be Withheld and Remitted

15 Less: Tax Credits/Payments

15A Tax Remitted in Return Previously Filed, if this is an Amended Return

15A

15B

15C Total Tax Credits/Payments (Sum of Items 15A & 15B)

15C

Add: Penalties

16

Surcharge

17B

Compromise

Interest

17A

TAX REQUIRED

TO BE WITHHELD

14

15B Advance Payments Made (please attach proof of payments - BIR Form No. 0605)

16 Tax Still Due/(Overremittance) (Item 14 less Item 15C)

17

No

17C

17D

18 Total Amount Still Due/(Overremittance) (Sum of Items 16 & 17D)

18

If overremittance, mark one box only:

To be Refunded

To be issued a Tax Credit Certificate

We declare, under the penalties of perjury, that this return has been made in good faith, verified by us, and to the best of our knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

19

Title/Position of Signatory

Tax Agent Acc. No./Atty's Roll No. (if applicable)

Part III

Drawee Bank/

Agency

Particulars

21 Cash/Bank 21A

Debit Memo

22 Check

22A

23 Others

20

President/Vice President/Principal Officer/Accredited Tax Agent/

Authorized Representative/Taxpayer

(Signature over printed name)

23A

Number

_______

TIN of Signatory

Date of Issuance

Treasurer/Assistant Treasurer

(Signature Over Printed Name)

Title/Position of Signatory

TIN of Signatory

Date of Expiry

Details of Payment

Date

MM

DD

YYYY

Stamp of Receiving Office/

AAB and Date of Receipt

Amount

21B

21C

21D

22B

22C

22D

23B

23C

23D

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

(RO's Signature/

Bank Teller's Initial)

SCHEDULES OF ALPHANUMERIC TAX CODES

NATURE OF INCOME PAYMENT

EWT- professionals (lawyers, CPAs, engineers, etc)/talent fees paid

to juridical persons

- if the current year's gross income is P720,000 and below

- if the current year's gross income exceeds P720,000

EWT- professional entertainers- if the current year's gross income does not exceed P720,000.00

- if the current year's gross income exceeds P720,000.00

EWT- professional athletes- if the current year's gross income does not exceed P720,000.00

- if the current year's gross income exceeds P720,000.00

EWT- movie, stage, radio, television and musical directors- if the current year's gross income does not exceed P720,000.00

- if the current year's gross income exceeds P720,000.00

EWT- management and technical consultants

- if the current year's gross income is P720,000 and below

- if the current year's gross income exceeds P720,000

EWT- business and bookkeeping agents and agencies

- if the current year's gross income is P720,000 and below

- if the current year's gross income exceeds P720,000

EWT- insurance agents and insurance adjusters

- if the current year's gross income is P720,000 and below

- if the current year's gross income exceeds P720,000

EWT- other recipient of talent fees- if the current year's gross income does not exceed P720,000.00

- if the current year's gross income exceeds P720,000.00

EWT- fees of directors who are not employees of the company

- if the current year's gross income is P720,000 and below

- if the current year's gross income exceeds P720,000

EWT- rentals : real/personal properties, poles,satellites & transmission

facilities, billboards

TAX

RATE

10%

15%

AT C

IND

CORP

NATURE OF INCOME PAYMENT

EWT- payments to medical practitioners by a duly registered professional partnership

-if the current year's income payments for the medical practitioner is P720,000 and below

WI 010 WC 010

-if the current year's income payments for the medical practitioner exceed P720,000

15%

WI 011 WC 011 EWT- payments for medical/dental /veterinary services thru hospitals/clinics/

health maintenance organizations, including direct payments to

service providers

- if the current year's income payments for the medical/dental/veterinary services

WI 021

10%

WI 030

10%

15%

10%

15%

10%

15%

10%

15%

10%

15%

10%

15%

10%

15%

5%

EWT- cinematographic film rentals

5%

EWT- prime contractors/sub-contractors

2%

EWT- income distribution to beneficiaries of estates & trusts

15%

EWT- gross commission or service fees of customs, insurance,

stocks, real estate, immigration & commercial brokers &

fees of agents of professional entertainers

10%

TAX

RATE

AT C

IND

CORP

10%

15%

WI 141

WI 142

10%

WI 151

15%

WI 150

10%

WI 152

15%

WI 153

WI 020

WI 031

is P720,000 and below

- if the current year's income payments for the medical/dental/veterinary services

exceeds P720,000

EWT- payment by the general professional partnership (GPP) to its partners

WI 040

-if the current year's income payments for the partner is P720,000 and below

WI 041

-if the current year's income payments for the partner exceed P720,000

EWT- payments made by credit card companies

WI 050 WC 050

EWT- income payments made by the government to its local/resident suppliers

WI 051 WC 051

of Goods

EWT- income payments made by the government to its local/resident suppliers

WI 060

of Services

WI 061

EWT- income payments made by top 10,000 private corporations to

their local/resident supplier of goods

WI 070

EWT- income payments made by top 10,000 private corporations to

WI 071

their local/resident supplier of services

EWT- additional payments to government personnel from importers, shipping

WI 080

and airline companies or their agents for overtime services

WI 081

EWT- commission,rebates, discounts and other similar considerations

paid/granted to independent and exclusive distributors, medical/technical

WI 090

and sales representatives and marketing agents and sub-agents

of multi-level marketing companies

WI 091

EWT- gross payments to embalmers by funeral companies

WI 100 WC 100

EWT- payments made by pre-need companies to funeral parlors

EWT- tolling fee paid to refineries

WI 110 WC 110

EWT- income payments made to suppliers of agricultural products

EWT- income payments on purchases of minerals, mineral products & quarry resources

WI 120 WC 120

EWT - income payments on purchases of gold by Bangko Sentral ng Pilipinas (BSP)

from gold miners/suppliers under PD 1899, as amended by RA No. 7076

WI 130

EWT- on gross amount of refund given by MERALCO to customers with active

contracts as classified by MERALCO

WI 140 WC 140 EWT- on gross amount of refund given by MERALCO to customers with terminated

contracts as classified by MERALCO

1% of 1/2 WI 156 WC 156

1%

WI 640 WC 640

2%

WI 157 WC 157

1%

WI 158 WC 158

2%

WI 160 WC 160

15%

WI 159

10%

WI 515 WC 515

1%

1%

5%

1%

10%

WI 530

WI 535

WI 540

WI 610

WI 630

10%

WI 632 WC 632

25%

WI 650 WC 650

32%

WI 651 WC 651

WC 535

WC 540

WC 610

WC 630

You might also like

- BIR From 1601E - August 2008Document4 pagesBIR From 1601E - August 2008mba_roxascapiz50% (4)

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- 1601e PDFDocument2 pages1601e PDFJanKhyrelFloresNo ratings yet

- 2551MDocument3 pages2551MButch Pogi100% (2)

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- 2551QDocument2 pages2551QCris David Moreno79% (14)

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasglydelNo ratings yet

- (2018) New BIR Income Tax Rates andDocument31 pages(2018) New BIR Income Tax Rates andGlenn Cacho Garce100% (1)

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- DLSU Grad Activities 2018Document4 pagesDLSU Grad Activities 2018Darren Goldwin DavidNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldJM HernandezNo ratings yet

- New Income Tax Return BIR Form 1702 - November 2011 RevisedDocument6 pagesNew Income Tax Return BIR Form 1702 - November 2011 RevisedBusinessTips.Ph100% (4)

- Bir Forms PDFDocument4 pagesBir Forms PDFgaryNo ratings yet

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- Bir Form 1901Document2 pagesBir Form 1901jaciemNo ratings yet

- Ayala Corporation SEC17Q June 2019 PDFDocument78 pagesAyala Corporation SEC17Q June 2019 PDFKeziah YpilNo ratings yet

- How To Use BIR FormsDocument52 pagesHow To Use BIR Formsbalinghoy#hotmail_com2147No ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- SSS R-5 Employer Payment ReturnDocument2 pagesSSS R-5 Employer Payment ReturnJimzon Kristian JimenezNo ratings yet

- Container Deposit (Wallem)Document2 pagesContainer Deposit (Wallem)Mr Im'NotNo ratings yet

- BIR Ruling DA-469-07Document5 pagesBIR Ruling DA-469-07liz kawiNo ratings yet

- Tax Exemption For Nonprofit Schools: Artemio V. Panganiban @inquirerdotnetDocument3 pagesTax Exemption For Nonprofit Schools: Artemio V. Panganiban @inquirerdotnetKenneth Bryan Tegerero TegioNo ratings yet

- Sec Cover SheetDocument32 pagesSec Cover SheetMeow MeowNo ratings yet

- BIR Form 1701QDocument2 pagesBIR Form 1701QfileksNo ratings yet

- Registration Data Sheet For Domestic Partnership ExampleDocument2 pagesRegistration Data Sheet For Domestic Partnership ExampleMark Angelo R. Arceo50% (2)

- Revenue Regulations on Minimum Corporate Income TaxDocument5 pagesRevenue Regulations on Minimum Corporate Income TaxKayzer SabaNo ratings yet

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- Bir Ruling (Da 146 04)Document4 pagesBir Ruling (Da 146 04)cool_peachNo ratings yet

- 2316Document13 pages2316Ariel BarkerNo ratings yet

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- AIA Philam Life Policy Fund Withdrawal FormDocument2 pagesAIA Philam Life Policy Fund Withdrawal Formippon_osotoNo ratings yet

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- BIR ESales Application For Account Enrollment - NarvacanDocument1 pageBIR ESales Application For Account Enrollment - NarvacanCherrylyn CacholaNo ratings yet

- Registration Update Sheet: Taxpayer InformationDocument1 pageRegistration Update Sheet: Taxpayer InformationRCVZ BKNo ratings yet

- TaxDocument6 pagesTaxChristian GonzalesNo ratings yet

- Waiving inheritance share donor's tax computationDocument2 pagesWaiving inheritance share donor's tax computationJelaineNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- SEC FormsDocument4 pagesSEC FormsZen Catolico ErumNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- HGC 2015 - Notes To Financial StatementsDocument34 pagesHGC 2015 - Notes To Financial StatementsDeborah DelfinNo ratings yet

- What Are The Corporations Exempt From Taxation?Document3 pagesWhat Are The Corporations Exempt From Taxation?ANGEL MAE LINABAN GONGOBNo ratings yet

- Bir Ruling (Da 561 07)Document10 pagesBir Ruling (Da 561 07)cool_peachNo ratings yet

- Bir Ruling (Da-031-07)Document2 pagesBir Ruling (Da-031-07)Stacy Liong BloggerAccountNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- FMF Pawnshop Financial StatementDocument123 pagesFMF Pawnshop Financial Statementaldred pera100% (1)

- Governance of CEOs in GOCCsDocument13 pagesGovernance of CEOs in GOCCseg_abadNo ratings yet

- Establishment of Retirement PlanDocument3 pagesEstablishment of Retirement PlanVioleta StancuNo ratings yet

- BIR's New Invoicing Requirements Effective June 30, 2013Document2 pagesBIR's New Invoicing Requirements Effective June 30, 2013lito77No ratings yet

- Euv 1ST 2011 1701QDocument6 pagesEuv 1ST 2011 1701QAdrian Raymnd EspirituNo ratings yet

- 1601E - August 2008Document4 pages1601E - August 2008HarryNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- BIR Form 2307 Tax CodesDocument16 pagesBIR Form 2307 Tax CodesAnalyn Velasco Matibag100% (1)

- 3 FijiDocument33 pages3 FijilovesresearchNo ratings yet

- Annual Information Return of Creditable Income Taxes WithheldDocument2 pagesAnnual Information Return of Creditable Income Taxes WithheldAngela ArleneNo ratings yet

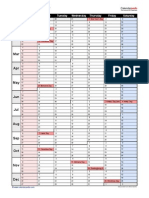

- 2015 Calendar Landscape 4 PagesDocument8 pages2015 Calendar Landscape 4 PageslovesresearchNo ratings yet

- A.F. Sanchez BrokerageDocument13 pagesA.F. Sanchez BrokeragelovesresearchNo ratings yet

- 2015 Calendar Landscape 2 Pages LinearDocument2 pages2015 Calendar Landscape 2 Pages LinearEdmir AsllaniNo ratings yet

- 31 CathayPacific2003 - Invol UpgradingDocument13 pages31 CathayPacific2003 - Invol UpgradinglovesresearchNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- 2015 Calendar Portrait RollingDocument1 page2015 Calendar Portrait RollinglovesresearchNo ratings yet

- 2015 Calendar Portrait 2 PagesDocument2 pages2015 Calendar Portrait 2 PageslovesresearchNo ratings yet

- Calvo V UCPBDocument9 pagesCalvo V UCPBlovesresearchNo ratings yet

- First Phil Industrial CorpDocument10 pagesFirst Phil Industrial CorplovesresearchNo ratings yet

- 2015 Calendar Landscape 4 PagesDocument8 pages2015 Calendar Landscape 4 PageslovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- De GuzmanDocument7 pagesDe GuzmanlovesresearchNo ratings yet

- Legal Primer On Foreign InvestmentDocument9 pagesLegal Primer On Foreign InvestmentleslansanganNo ratings yet

- Further, That The Right To Import The Drugs: Wretz Musni Page 1 of 5Document5 pagesFurther, That The Right To Import The Drugs: Wretz Musni Page 1 of 5lovesresearchNo ratings yet

- De GuzmanDocument7 pagesDe GuzmanlovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- RA 10607 Part4 (Reins, Settlement)Document3 pagesRA 10607 Part4 (Reins, Settlement)lovesresearchNo ratings yet

- RA 10607 Part4A (Settl-Prescription)Document2 pagesRA 10607 Part4A (Settl-Prescription)lovesresearchNo ratings yet

- RA 10607 Part1 (Gen)Document10 pagesRA 10607 Part1 (Gen)lovesresearchNo ratings yet

- RA 10607 Part4 (Reins, Settlement)Document3 pagesRA 10607 Part4 (Reins, Settlement)lovesresearchNo ratings yet

- 60 SB V MartinezDocument4 pages60 SB V MartinezlovesresearchNo ratings yet

- Villanueva V Quisumbing PDFDocument7 pagesVillanueva V Quisumbing PDFlovesresearchNo ratings yet

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Document226 pages10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchNo ratings yet

- 10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5Document226 pages10.1 Manual Gen Sm-p600 Galaxy Note 10 English JB User Manual Mie f5lovesresearchNo ratings yet

- Dulay V Dulay PDFDocument8 pagesDulay V Dulay PDFlovesresearchNo ratings yet

- Percentage TaxDocument7 pagesPercentage Taxyatot carbonelNo ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- Bir Ruling No. 1243-18 - JvsDocument3 pagesBir Ruling No. 1243-18 - Jvsjohn allen MarillaNo ratings yet

- Module 2 - CAT Level 3 (Material #1)Document4 pagesModule 2 - CAT Level 3 (Material #1)UFO CatcherNo ratings yet

- Malta TINDocument4 pagesMalta TINMelvin ScorfnaNo ratings yet

- Chen Wholesalers LTD Incurred The Following Transactions Related To CurrentDocument1 pageChen Wholesalers LTD Incurred The Following Transactions Related To CurrentMiroslav GegoskiNo ratings yet

- 117237-2007-Systra Philippines Inc. v. Commissioner ofDocument8 pages117237-2007-Systra Philippines Inc. v. Commissioner ofEmary GutierrezNo ratings yet

- BRITANICO - Republic v. Heirs of Jalandoni PDFDocument1 pageBRITANICO - Republic v. Heirs of Jalandoni PDFNin BritanucciNo ratings yet

- Managerial Accounting ExerciseDocument2 pagesManagerial Accounting Exerciseivan_ferdian_1No ratings yet

- Form 1040NR-EZ Tax Return for Nonresident AliensDocument2 pagesForm 1040NR-EZ Tax Return for Nonresident AliensElena Alexandra CărăvanNo ratings yet

- Taxation TSN 3 Exam Coverage SummaryDocument33 pagesTaxation TSN 3 Exam Coverage SummaryPearl Angeli Quisido CanadaNo ratings yet

- Summary & Career Objective:: Curriculum VitaeDocument3 pagesSummary & Career Objective:: Curriculum VitaeJnanamNo ratings yet

- Department of Labor: lm3 BlankformDocument5 pagesDepartment of Labor: lm3 BlankformUSA_DepartmentOfLabor100% (6)

- Monde Nissin Corporation Del Monde Pacific LimitedDocument11 pagesMonde Nissin Corporation Del Monde Pacific LimitedJamaica RamosNo ratings yet

- NYS-45 quarterly tax filingDocument2 pagesNYS-45 quarterly tax filingMichael WalkerNo ratings yet

- Tax 2 Syllabus - DDL - 2019 PartA 11jan2019Document7 pagesTax 2 Syllabus - DDL - 2019 PartA 11jan2019ebernardo19No ratings yet

- Cold Milling Rate AnalysisDocument8 pagesCold Milling Rate AnalysisJahanzeb KhanNo ratings yet

- Haryana CST Return Format Form - 1Document2 pagesHaryana CST Return Format Form - 1Virender SainiNo ratings yet

- TX-ZWE 2021 Study GuideDocument26 pagesTX-ZWE 2021 Study Guidefarai murumbiNo ratings yet

- Section 136 137 139 of Finance Act 2007Document3 pagesSection 136 137 139 of Finance Act 2007Jitendra VernekarNo ratings yet

- DepreciationDocument27 pagesDepreciationraj10420No ratings yet

- Income Tax SlabsDocument2 pagesIncome Tax SlabsGhulam AwaisNo ratings yet

- BAJAJ HEALTH CARE LTD. (Formulation Division) : March - 2022 Ashesh Kumar Pandya QC Jr. OfficerDocument1 pageBAJAJ HEALTH CARE LTD. (Formulation Division) : March - 2022 Ashesh Kumar Pandya QC Jr. Officerdarshil thakkerNo ratings yet

- 25.2 MR of TOLENTINO V Secretary of FinanceDocument2 pages25.2 MR of TOLENTINO V Secretary of FinanceTelle MarieNo ratings yet

- Analysis of Pakistan's 7th National Finance Commission AwardDocument24 pagesAnalysis of Pakistan's 7th National Finance Commission Awardfaw03No ratings yet

- Govt BudgetDocument3 pagesGovt BudgettrishirNo ratings yet

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Document1 pageSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNo ratings yet

- Invoice Baby Cart LLP: GST No:27ADXFS4779C1ZBDocument8 pagesInvoice Baby Cart LLP: GST No:27ADXFS4779C1ZBSuryapratap Singh SikarwarNo ratings yet

- Tax Final Part 5Document37 pagesTax Final Part 5Angelica Jane AradoNo ratings yet

- UP Taxation Law Pre Week 2017Document28 pagesUP Taxation Law Pre Week 2017Robert Manto67% (3)