Professional Documents

Culture Documents

Final Uft CD

Uploaded by

Tere YpilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Uft CD

Uploaded by

Tere YpilCopyright:

Available Formats

Ref.

: A2

Understand the Flows of Significant Classes of

Transactions, including Walkthrough Cash

Disbursements

Client:

Period End:

Global Home Depot, Inc.,

December 2014

Prepared By:

Reviewed By:

Ma. Teresa Ypil

Nathallie

Cabaluna

Professional standards require us to obtain an understanding of the flows of transactions sufficient to identify and

understand a) major classes of transactions in the entitys operations; b) how such transactions are initiated; c)

significant accounting records, supporting documents and accounts in the financial statements; and d) the accounting

and financial reporting process, from the initiation of significant transactions and other events to their inclusion in the

financial statements.

Related Accounts

Cash disbursements typically have a significant effect on the following accounts (modify account names as appropriate

and list other accounts not pre-populated below):

Cash

Accounts payable

Accrued Expenses

Purchases

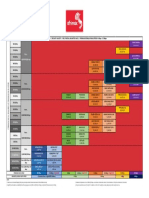

Principal Steps in the Cash Disbursements Flow of Transactions

Document below the job title(s) of the individual(s) responsible for each of the steps in the cash disbursements flow of

transactions. To help ensure that we properly consider the effects of computer processing in making our risk assessments

and developing our audit plan, indicate those steps where computer processing is involved by placing an X in the

column for the appropriate step.

Whenever a certain inventory level goes below the reorder point, the Inventory Clerk will report to the

Purchaser for requisitioning. The Purchaser will determine the supplier and will send copy of the purchase

order to the supplier (via e-mail or by fax), to the Accounting Office and to the one who will receive the goods

(a copy with no details as to the quantity). Upon receipt of the goods, the one who receives will count them and

will notify the Accounting Office of such receipt by providing a receiving report. The Accounting Office will

compare the receiving report with the purchase order and the suppliers invoice, and will record the related

liability. The Accounting Office will send the necessary documents for payment to the President. The President

will review the accuracy and authenticity of the documents prior to the approval of the vouchers for payment.

Then the check will be prepared and mailed to the supplier and the source documents will be stamped PAID.

The Accounting Office will then update the Accounts Payable general and subsidiary ledger.

Process Step

1.

2.

3.

4.

5.

6.

7.

When inventory runs lower than the reorder point, a report for

requisitioning will be sent

Supplier will be chosen and will be sent with a copy of the

purchase order.

Upon receipt of goods, receiver will count them and input

them in a blind receiving report and will notify the Accounting

Office of such receipt by providing receiving report.

Receiving report, purchase order and the suppliers invoice

will be compared and the liability will be recorded.

Necessary documents will be sent to the President for

payment. The President will review the accuracy and

authenticity of the documents prior to the approval of the

vouchers for payment.

Check will be prepared and mailed to the supplier and the

source documents will be stamped, PAID

Update the Accounts Payable general and subsidiary ledger

Performed By (Job Title Only)

Inventory Clerk

Purchaser

Receiving

personnel

department

Accountant

Payable)

President

(Accounts

Treasurer

Accountant

(Accounts

Ref.:

Understand the Flows of Significant Classes of

Transactions, including Walkthrough Cash

Disbursements

Payable)

Provide any other details that are necessary to understand the initiation, processing, and recording of cash

disbursements:

What Could Go Wrongs (WCGW)

What if the company issued a check for payment

without receiving any request for payment?

What if there is a material discrepancy between the

quantities in the receiving report and purchase order

whereby understating inventory, and the company

has already issued the check to be paid to the

supplier.?

What makes sure that all checks issued corresponds

to any payables that are valid?

What makes sure that all purchase order are

properly approved?

What makes sure no double payment occurred?

What makes sure that purchases are valid?

Consideration

Accounts and Assertions Affected by WCGW

Balance Sheet

Income Statement

Cash may be understated due Only balance sheet accounts

to double payment; occurrence are affected

Cash may be understated, Cost of goods sold will be

inventory

understated, overstated

and

thus

disbursements are overstated- understating Net Incomeoccurrence

Completeness and Existence

Cash may be understated,

disbursements

overstatedoccurrence

Payables may be overstatedauthorization

Overstatement

of

disbursement- Occurrence

Overstatement of PayablesOccurrence

of

Rights and obligation

Rights and obligation

Only balance sheet accounts

are affected

Overstating Net Income- right

and obligation

Control

Procedures

Professional standards require us to obtain an understanding of a clients control procedures sufficient to develop the

audit plan. Document below the control procedures that the client has put in place to prevent or detect errors in

processing and recording transactions for this accounting process. It is not necessary to perform walkthroughs of these

controls unless we intend to assess control risk below the maximum. The absence of control procedures may require

additional audit procedures relating to one or more financial statement assertions for the account(s) affected.

Yes

Are bank reconciliations performed and reviewed by supervisory personnel, with reconciling

items followed-up on and resolved in a timely manner?

Is someone responsible for ensuring a proper cut-off (i.e., all cash disbursements are recorded in

the period made)?

Are cash disbursement journals reviewed both for unusual items and gaps in the numerical

sequence of disbursements?

Is appropriate documentation (e.g. voucher package) included when cheques are prepared and

signed?

Are all electronic transfers of funds properly approved?

/

/

/

/

/

Are there only a few authorized cheque signers?

Are limits established for cheque signing authority or are cheques over a certain amount required

Understand the Flows of Transactions

Cash disbursements - SBDP

No

(R12-07)

/

Page 2/3

Ref.: A2

Understand the Flows of Significant Classes of

Transactions, including Walkthrough Cash

Disbursements

Client:

Period End:

Global Home Depot, Inc.,

December 2014

Prepared By:

Reviewed By:

to be counter-signed?

Is access to blank cheques and signature plates controlled?

Ma. Teresa Ypil

Nathallie

Cabaluna

Walkthrough

Describe the walkthrough tests performed on the flow of transactions. In so doing determine that the walkthrough

encompasses the entire flow of initiating, authorizing, recording, processing and reporting individual transactions and,

to the extent necessary, related controls. Use original source documentation and information technology that the client

personnel typically would use in the flow of transactions:

Performance Considerations

a. Inquire of personnel about their understanding of what is required by the prescribed

procedures and, to the extent necessary, controls to determine whether the processing

procedures are performed as originally understood and on a timely basis.

Yes/No/

N/A

YES

Inquired of: Understanding the required procedures Date: 9/30/14

Initials &

Date

MTDY

9/30/14

NC

11/30/14

Key findings : Some employees has different opinions to the prescribed procedures yet, they

all have he same gist. Employees has the proper understanding on how to do the process and

procedures on the timely basis.

b. Note any exceptions to the prescribed procedures and, to the extent necessary, controls

identified and the impact this has on the audit.

YES

c. In instances where we have identified a significant risk and are required to assess control

risk, did the walkthrough procedures include an appropriate evaluation of the controls

sufficient to determine the effectiveness of the design of the controls and whether controls

have been implemented?

d. Did our inquiries of company personnel include follow-up questions about what company

personnel do when they encounter errors, the types of errors they have encountered, what

happened as a result of finding errors, and how the errors were corrected?

YES

e. In instances where we identified significant changes in the flow of transactions did we

evaluate the nature of the change to determine whether to walkthrough transactions

processed both before and after the change?

YES

YES

MTDY

9/30/14

NC

11/30/14

MTDY

9/30/14

NC

11/30/14

MTDY

9/30/14

NC

11/30/14

MTDY

9/30/14

NC

11/30/14

Conclusion (Check box to confirm conclusion)

Our walkthrough procedures have confirmed our understanding of the cash disbursements flow of transactions as

evidenced by our system documentation.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- A SfadfsdfDocument1 pageA SfadfsdfTere YpilNo ratings yet

- Research EnvironmentDocument1 pageResearch EnvironmentTere YpilNo ratings yet

- Ypil, Ma Teresa D Bsa-04 MWF 3-4Pm Assignment in AitDocument1 pageYpil, Ma Teresa D Bsa-04 MWF 3-4Pm Assignment in AitTere YpilNo ratings yet

- BookkeeperDocument1 pageBookkeeperTere YpilNo ratings yet

- Output Controls SumaryDocument3 pagesOutput Controls SumaryTere YpilNo ratings yet

- Time Table: DateDocument4 pagesTime Table: DateTere YpilNo ratings yet

- Practices of Entomophagy and Entomotherapy in Baranggay Alambijud, Argao and Baranggay Lusaran, Cebu City, PhilippinesDocument1 pagePractices of Entomophagy and Entomotherapy in Baranggay Alambijud, Argao and Baranggay Lusaran, Cebu City, PhilippinesTere YpilNo ratings yet

- Banana Peel Flour ProceduresDocument2 pagesBanana Peel Flour ProceduresTere YpilNo ratings yet

- 20 Success Secrets To Live byDocument9 pages20 Success Secrets To Live byTere YpilNo ratings yet

- How To Compute VAT Payable in The PhilippinesDocument5 pagesHow To Compute VAT Payable in The PhilippinesTere Ypil100% (1)

- Out Put Input Input: L A B O RDocument11 pagesOut Put Input Input: L A B O RTere YpilNo ratings yet

- Why WorryDocument1 pageWhy WorryTere YpilNo ratings yet

- Simple Things 2Document12 pagesSimple Things 2Tere YpilNo ratings yet

- Xmas TreeDocument1 pageXmas TreeTere YpilNo ratings yet

- Issues Addressed General Controls Possible Effects 1.: An Impossible Work ScheduleDocument6 pagesIssues Addressed General Controls Possible Effects 1.: An Impossible Work ScheduleTere YpilNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tutorial 5 UpdatedDocument2 pagesTutorial 5 UpdatedChiraag ChiruNo ratings yet

- Geodesic Hub Connectors Domerama PDFDocument8 pagesGeodesic Hub Connectors Domerama PDFmoiseelenaNo ratings yet

- Boston Matrix of CokeDocument11 pagesBoston Matrix of CokeIrvin A. OsnayaNo ratings yet

- 5th Lecture - PhotojournDocument35 pages5th Lecture - PhotojournMis Dee50% (2)

- Recycled Concrete Roadbase Swis 4003Document45 pagesRecycled Concrete Roadbase Swis 4003Mircea BobarNo ratings yet

- Annual Report 2010-11Document188 pagesAnnual Report 2010-11Suryanath Gupta100% (1)

- C1506 16bDocument4 pagesC1506 16bmasoud132No ratings yet

- David Wright Thesis (PDF 1MB) - QUT EPrintsDocument360 pagesDavid Wright Thesis (PDF 1MB) - QUT EPrintsruin_2832No ratings yet

- ATB Riva Calzoni Gianluca RaseniDocument35 pagesATB Riva Calzoni Gianluca RaseniDiana QuinteroNo ratings yet

- Corning SMF-28 DatasheetDocument2 pagesCorning SMF-28 DatasheetsusyheunaNo ratings yet

- Volvo Ec35D: Parts CatalogDocument461 pagesVolvo Ec35D: Parts Cataloggiselle100% (1)

- Afrimax Pricing Table Feb23 Rel BDocument1 pageAfrimax Pricing Table Feb23 Rel BPhadia ShavaNo ratings yet

- Fire Alarm Sys Nec 760Document10 pagesFire Alarm Sys Nec 760nadeem Uddin100% (1)

- AASHTO - LRFD (Design Example For Steel Girder Superstructure Bridge - 2003)Document698 pagesAASHTO - LRFD (Design Example For Steel Girder Superstructure Bridge - 2003)Ridwan Kris50% (2)

- Whitepaper InstallScape InternalsDocument4 pagesWhitepaper InstallScape InternalsKostas KalogeropoulosNo ratings yet

- Understand Digital Marketing and Role of Twitter and Content Marketing in Digital MarketingDocument64 pagesUnderstand Digital Marketing and Role of Twitter and Content Marketing in Digital MarketingJoy SahaNo ratings yet

- Microreactor P.4-19Document22 pagesMicroreactor P.4-19dheannisrNo ratings yet

- Second Edition Handbook of PE Pipe - HDPE HandbookDocument3 pagesSecond Edition Handbook of PE Pipe - HDPE HandbooklucianoNo ratings yet

- Chiller: Asian Paints Khandala PlantDocument19 pagesChiller: Asian Paints Khandala PlantAditiNo ratings yet

- Atlas Copco ZT55 Instruction ManualDocument90 pagesAtlas Copco ZT55 Instruction ManualRafael Martin Anaya Figueroa100% (4)

- Differential Pressure Switch RH3Document2 pagesDifferential Pressure Switch RH3Jairo ColeccionistaNo ratings yet

- Warehouse OK 19 JuniDocument85 pagesWarehouse OK 19 JunihalyNo ratings yet

- TECDCT-2145 Cisco FabricPathDocument156 pagesTECDCT-2145 Cisco FabricPathWeiboraoNo ratings yet

- Ahmed Zaiba's CV SalehDocument6 pagesAhmed Zaiba's CV SalehSarah ZaibaNo ratings yet

- SP25Y English PDFDocument2 pagesSP25Y English PDFGarcia CruzNo ratings yet

- 460 Mr. Abhijit GadekarDocument4 pages460 Mr. Abhijit GadekarAbhishekSengaokarNo ratings yet

- Anothr System Definition FacilityDocument90 pagesAnothr System Definition FacilityllllllluisNo ratings yet

- VIOTEK Monitor ManualDocument11 pagesVIOTEK Monitor ManualJohn Michael V. LegasteNo ratings yet

- lTRF+IEC 61215-23A2 Part 1 of 2-Solar PanelDocument42 pageslTRF+IEC 61215-23A2 Part 1 of 2-Solar PanelGrupo CardogalNo ratings yet

- Corea 2016 Cost HandbookDocument70 pagesCorea 2016 Cost HandbookEdutamNo ratings yet