Professional Documents

Culture Documents

Pna Ar 2007

Uploaded by

reine1987Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pna Ar 2007

Uploaded by

reine1987Copyright:

Available Formats

delivering growth

Annual Report 2007

!"#$%&'(")*"#+,&-%(.,&/*0*',1

$3456755789587

:*(,.'-(&

9:"+/01;<-0=+601>

?:@,0))*+2;A010B=1B4=+.5,*+>

#:C:D=,-10EE

!:F:40E./

?:!:G012E./

;-02"#< =,.(,'"(<

C:A:@50++

+,>*&',(,1?@@*.,

H.I.E8

NNA.E7*O+1.@,+..,

@*O,-"+=P701.QRO..1PE012L$&$

S.E.T-*1.U'$%3$$%8&&&

V05P=6=E.U'$%3ML'LMNN

D.7P=,.WXXX:T010OP,+0E=01:5*6:0O

F60=EW=1)*YT010OP,+0E=01:5*6:0O

!-&'")$11(,&&

CJ"*K3L'M

@*O,-"+=P701.QRO..1PE012L$&$

='-.ABC.D"#>,/*&'*#>

C01!OP,+0E=019.P*O+5.PH=6=,.2

@-0+.P0+.E=P,.2*1,-.

!OP,+0E=01@.5O+=,=.PFK5-01B.

;G*6."+015-Z"+=P701.>

!@[<*2.WC#!

$%1*'-(&

$%&'(")*"

C+=5.X0,.+-*OP.<**T.+P

9=I.+P=2.<.1,+.

$83F0BE.@,+..,

"+=P701.QRO..1PE012L&&&

/"-&

C+=5.X0,.+-*OP.<**T.+P;H0*P>

\1=,$]3QL,-VE**+

33H01.[01B!I.1O.

^=.1,=01.QH0*C49

3"#A,(&

!#_"01`=1B?+*OTH=6=,.2

38LRO..1@,+..,

"+=P701.QRO..1PE012L&&&

=D"(,+,>*&'("(

<*6TO,.+P-0+.a1I.P,*+@.+I=5.PC,/H=6=,.2

H.I.E$N

3&%RO..1@,+..,

"+=P701.QRO..1PE012L&&&

S.E.T-*1.W$3&&M(&(&(

$##%")E,#,(")F,,'*#>

S-.!11O0E?.1.+0EA..,=1B*)C01!OP,+0E=019.P*O+5.PH=6=,.2X=EE7.-.E20,,-.

@*)=,.E"+=P701.Q8LNSO+7*,@,+..,Q"+=P701.QRO..1PE012!\@S9!Ha!Q*183A0/8&&M

0,$&0:6:

Pan Australian Resources Limited ABN 17 011 065 160

Annual Report - 31 December 2007

Contents

Directors' report

Corporate governance statement

Financial report

Directors' declaration

Shareholder information

Page

1

23

27

83

87

Pan Australian Resources Limited

Directors' report

31 December 2007

Directors' report

Your directors present their report on the consolidated entity consisting of Pan Australian Resources Limited (referred to

hereafter as the Company or PanAust) and the entities it controlled at the end of, or during, the year ended 31 December

2007 (Reporting Period).

Directors

The following persons were directors of PanAust during the whole of the financial year and up to the date of this report:

R. Bryan

G. Stafford

N.P. Withnall

A.E. Daley

G.A. Handley

(Chairman, Non-Executive Director)

(Managing Director)

(Non-Executive Director)

(Non-Executive Director)

(Non-Executive Director)

Information on directors

Robert Bryan BSc (Hons, Geology) FAusIMM. (Chairman, Non-Executive Director). Age 73.

Mr Bryan is a geologist who has wide experience in the mining industry. In 1984 Mr Bryan founded Pan Australian Mining

Limited and, while Managing Director from 1984 to 1989, oversaw the development of the major gold mine at Mt Leyshon.

After selling his controlling interest in Pan Australian Mining in 1989, Mr Bryan founded his own private company Leyshon

Pty Ltd. In 1994 Mr Bryan was appointed founding Chairman of the Company, which became PanAust in 1996.

Mr Bryan is an Honorary Life Member of the Queensland Resources Council, and a Director of the Sustainable Minerals

Institute within the University of Queensland. During the past three years, Mr Bryan has also served as a director of the

following listed companies:

Highlands Pacific Limited (chairman) appointed 1 July 1998*

Queensland Gas Company Limited (chairman) appointed 22 September 1999*

* denotes current directorship

Appointed Director and Chairman of the Company on 12 December 1994. Mr Bryan is also the Chairman of the

Remuneration Committee.

Interests in shares and options

Mr Bryan has a direct interest in 118,201 ordinary shares in PanAust.

Mr Bryan has an indirect interest in 24,059,514 ordinary shares in PanAust held by Leyshon Equities Pty Ltd, a company

in which Mr Bryan has a substantial shareholding. Mr Bryan also has an indirect interest in 4,178,767 ordinary shares in

PanAust held by Transmere Pty Ltd, a company in which Mr Bryan has a substantial shareholding.

Gary Stafford BSc (Hons, Mining Engineering) MAusIMM. (Managing Director). Age 47.

Mr Stafford is a mining engineer with 26 years experience in the mining industry, initially in engineering and management

positions at coal and gold mines with CRA, BHP and Barrack Mine Management before moving into company

management with Saracen Minerals Limited (a subsidiary of Crusader Limited) and then PanAust. Mr Stafford is also a

Director of Puthep Company Limited (Thailand).

Appointed Managing Director on 7 March 1996. Mr Stafford is also a member of the Finance Committee.

Interests in shares and options

Mr Stafford has a direct interest in 11,080,334 ordinary shares in PanAust.

7,500,000 options over ordinary shares in PanAust.

4,400,000 options over ordinary shares in PanAust to be issued in 2008 subject to shareholder approval.

Mr Stafford has an indirect interest in 3,495,314 ordinary shares in PanAust held by The Spellbrook Superannuation Fund.

-1-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Information on directors (continued)

Nerolie Phyllis Withnall BA, LLB. (Non-Executive Director). Age 64.

Mrs Withnall is a former commercial lawyer with specialist skills in the areas of corporate advice, capital raisings,

securities and corporate trusts. Mrs Withnall is a former partner of the national law firm Minter Ellison and is a member of a

number of government and community organisations, including the Takeovers Panel and the Corporations and Markets

Advisory Committee. Mrs Withnall is Chairman of the Brisbane Institute and is a member of the Council of the Australian

National Maritime Museum.

During the past three years Mrs Withnall has also served as a director of the following listed companies:

Campbell Brothers Limited appointed 1994*

Alchemia Limited appointed October 2003*

QM Technologies Limited Chairman appointed September 2003*

Hedley Gaming and Leisure Property Partners Limited - appointed 2007*

* denotes current directorship

Appointed Director on 21 May 1996. Mrs Withnall is also a member of the Remuneration Committee and is Chairman of

the Audit Committee.

Interests in shares and options

Mrs Withnall has a direct interest in 448,507 ordinary shares in PanAust.

Andrew Edward Daley BSc (Hons, Mining Engineering) FAusIMM. (Non-Executive Director). Age 59.

Mr Daley is a Chartered Engineer, a Member of IOM3 and a director of Investor Resources Finance Pty Ltd, a company

based in Melbourne that provides financial and corporate advisory services to the resource industry. Mr Daley commenced

his career on the Zambian Copper Belt with Anglo American and subsequently worked with Rio Tinto and Conoco

Minerals, before relocating to Australia with Fluor Australia in early 1981. Since late 1983, Mr Daley has primarily worked

in the resource finance sector, initially with National Australia Bank, then Chase Manhattan and more recently, as a

Director of Barclays Capital mining team in London and Sydney.

During the past three years, Mr Daley has also served as a director of the following listed companies:

Kentor Gold Limited appointed 12 November 2004*

Gladstone Pacific Nickel Limited appointed 11 February 2005 and resigned on 7 December 2007

Dragon Mining Ltd appointed director 23 March 2005 and Chairman 20 March 2006*

Minerva Resources plc - appointed as director and Chairman 7 July 2007*

Uranex NL - appointed 30 November 2007*

* denotes current directorship

Appointed Director on 3 August 2004. Mr Daley is also Chairman of the Finance Committee and is a member of the Audit

Committee.

Interests in shares and options

Mr Daley has an indirect interest in 311,861 ordinary shares in PanAust held by The Motherlode Superannuation Fund.

Geoffrey Arthur Handley BSc (Hons, Geology and Chemistry) MAusIMM. (Non-Executive Director). Age 58.

Mr Handley is a geologist with over 30 years experience in the mining industry. Mr Handley worked as a geologist for BHP

Exploration Ltd., as a chemist and geologist for Placer Exploration Ltd. and as an analyst for the AMP Society. In 1981, he

joined Placer Pacific Ltd. as a Senior Geologist and was responsible for the exploration and feasibility work at the Porgera,

Granny Smith, Osborne and Big Bell mines. Most recently, Mr Handley was Executive Vice President, Strategic

Development with Placer Dome where he was responsible for global exploration, acquisitions, research and development

and strategic planning.

During the past three years, Mr Handley has also served as a director of the following companies listed on the Toronto and

AMEX Stock Exchanges:

Eldorado Gold Corp. appointed 29 August 2006 *

Endeavour Silver Corp. appointed 14 June 2006*

Mr Handley is also a director of the following Australian company, which listed on the Australian Securities Exchange on

5 April 2007:

-2-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Information on directors (continued)

Boart Longyear Limited appointed 21 February 2007*

* denotes current directorship

Appointed Director on 29 September 2006. Mr Handley is also a member of the Audit Committee.

Interests in shares and options

Mr Handleys spouse, a related party of the Company for the purposes of the Corporations Act 2001, holds 155,000

ordinary shares in PanAust.

Company secretary

David Hairsine MFTA (Senior), for the period 1 January 2007 to 23 February 2007.

Mr Hairsine was appointed the Company Secretary on 25 November 2004. After an extensive career with MIM Holdings

Limited in a number of senior commercial, project development and treasury roles, he joined the Company in September

2004 and continues in the role of Chief Financial Officer.

Resigned as Company Secretary on 23 February 2007.

Paul Martin Scarr B Comm, LLB (Hons) for the period after 23 February 2007.

Paul Scarr is a lawyer with 16 years experience. He has particular expertise in advising clients in the mining industry in

Australia, Papua New Guinea and South East Asia. Prior to joining PanAust, he worked in private practice with both Allens

Arthur Robinson and Mallesons Stephen Jacques. During that period, he advised publicly listed companies in relation to

their obligations under the Corporations Act and the ASX Listing Rules. Mr Scarr is responsible for the company secretarial

function, corporate governance issues and the legal function of the Company.

Appointed Company Secretary on 23 February 2007.

Meetings of directors

The numbers of meetings of the Companys board of directors and of each board committee held during the year ended

31 December 2007, and the numbers of meetings attended by each director were:

Meetings of committees

Full meetings

of directors

A

B

R. Bryan

G. Stafford

N.P. Withnall

A.E. Daley

G.A. Handley

4

4

3

4

4

4

4

4

4

4

Ad hoc

A

B

Finance

A

B

1

**

1

1

1

**

**

2

3

3

**

**

3

3

3

**

5

**

5

**

1

**

1

1

1

Audit

**

5

**

5

**

Remuneration

A

B

1

**

1

**

**

1

**

1

**

**

A = Number of meetings attended

B = Number of meetings held during the time the director held office or was a member of the committee during the year

** = Not a member of the relevant committee

Earnings per share

31 December

2007

Cents

Basic loss per share

Diluted loss per share

(0.92)

(0.92)

-3-

31 December

2006

Cents

(0.39)

(0.39)

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Dividends

Since the end of the previous financial year, no amounts were paid or declared by way of dividend by the Company. The

Directors do not recommend a final dividend in respect of the year ended 31 December 2007.

Review of operations

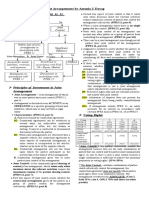

Group Corporate Structure

PanAust is a company limited by shares that is incorporated and domiciled in Australia. The Companys operating assets

and associated commitments are in Laos and Thailand. PanAust has prepared a consolidated financial report

incorporating the entities it controlled during the financial year, which are outlined in the following illustration of the Groups

corporate structure:

Corporate Structure in Laos

PanAust owns a 90% interest (2006: 100%) in the Lao-registered company, Phu Bia Mining Limited (Phu Bia Mining),

through the Companys wholly owned subsidiary Pan Mekong Exploration Pty Limited. Phu Bia Mining has a Mineral

Exploration and Production Agreement (MEPA) with the Government of Laos. This agreement regulates exploration and

mining within a contract area of 2,636 square kilometres (the Phu Bia Contract Area) in Laos.

The Government of Laos has exercised its option to acquire a 10% interest in Phu Bia Mining, so that PanAusts interest

has reduced to 90%. The Government interest can be funded through future dividends payable to the Government as

declared by Phu Bia Mining.

-4-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Review of operations (continued)

Corporate Structure in Thailand

PanAust holds a shareholding right of 33.17% (2006: 20.66%) (the legal formalities to complete the increase in the

shareholding are currently being completed) in the Thai-registered company Puthep Company Limited (Puthep) through

the Companys wholly owned subsidiary PNA (Puthep) Pty Limited. Padaeng Industry Public Company Limited (Padaeng)

owns the other 66.83% (2006: 79.34%) interest in Puthep. Puthep has a concession agreement with the Government of

Thailand. The concession covers the two deposits (the PUT1 and PUT2 deposits) that comprise the Puthep Copper

Project.

PanAust can earn a 51% interest in Puthep by completing a feasibility study on the Puthep Copper Project in accordance

with the Participation Agreement between the parties dated 21 August 2000 (as amended). The Government of Thailand

has an option to acquire a 10% interest. If the Government of Thailand exercises its option to acquire a 10% interest, each

of Padaeng and the Company must transfer half of the shares required to be transferred to the Government of Thailand

provided that Padaeng's interest is not to fall below 26%. Under the Participation Agreement, the Company has further

options to acquire a 60% or 70% interest in Puthep (if the Government of Thailand exercised its option the interest would

be diluted to 55% or 64% respectively).

Under the Thailand - Australia Free Trade Agreement, the Company can acquire a 60% interest without any further

approvals from the Government of Thailand. The Company can acquire an interest above 60% with government approval.

Nature of operations and principal activities

The principal activities during the reporting period of entities within the consolidated entity were mine development, gold

mining operations, precious and base metal project evaluation and mineral exploration.

Employees

The consolidated entity had 1,261 permanent employees, including staff on fixed term contracts, as at 31 December 2007

(2006: 404 employees).

Operating Review for the Year

Laos

The major focus for the year was development of the Phu Kham Copper-Gold Operation. At the end of the year,

construction was approaching completion and commissioning had commenced. Construction of the project was running

significantly ahead of the previously scheduled mid-2008 start up of concentrate production and within the US$241 million

capital budget. Production of copper-gold-silver concentrate is scheduled to commence in March 2008 with first

concentrate sales expected during the June quarter 2008. Initially, the mine is designed to process 12 million dry metric

tonnes ore per annum to produce more than 200,000 tonnes of concentrate containing, on average, 50,000 tonnes of

copper, 50,000 ounces of gold and 400,000 ounces of silver. In September 2007, PanAust announced that it would

expand mine throughput by 33% to 16 million tonnes per annum for annual production of 65,000 tonnes of copper, 60,000

ounces of gold and 550,000 ounces of silver. The expansion is scheduled to be completed by the end of 2009.

Record annual gold production of 31,380 oz (21,557 oz for 2006) was achieved at the Phu Kham Heap Leach Gold

Operation (formerly known as Phu Bia Gold Mine). During the year, a seasonal operating strategy was successfully

implemented whereby irrigation of the heap leach pads takes place only during the dry season months (October to April).

For the balance of the year, irrigation is suspended and the pads are covered with plastic. Mining and stockpiling of gold

ore continues through the wet season.

During the year, exploration progressed at several projects. Advanced exploration was undertaken and a pre-feasibility

study commenced at the Ban Houayxai Gold-Silver Project approximately 25km west of the Phu Kham Copper-Gold

Operation, and advanced exploration at the Phonsavan Copper Project in the northern part of the Contract Area. Early

exploration was underway at several prospects including the Pha Nai Copper Prospect, Phu He Gold Prospect and the

Triple N Gold Prospect. The Phu Bia Contract Area covers 2,636 square kilometres of highly prospective ground and

remains very much under-explored. A major aerial geophysical survey is scheduled to be completed during the first half of

2008 and will provide base-line data to assist in the targeting of ongoing exploration activities.

Thailand

PanAust is undertaking a feasibility study on the Puthep Copper Project. The feasibility study will be conducted in two

phases. The first phase commenced in the March 2007 quarter and will test the overall economics and potential of the

PUT 1 deposit and allow planning for a second, more detailed phase. Drilling being undertaken as part of the feasibility

study is focused on the establishment of a primary copper-gold resource. The second phase of the feasibility study, which

is subject to a positive outcome to the first phase, is currently scheduled to be completed by the end of 2008.

-5-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Review of operations (continued)

Australia

During the financial year, the Company held a 16% interest in the tenements comprising the Darlot South Gold Exploration

Project located in Western Australia. Sundowner Minerals N.L., part of the Barrick Gold Group, is the operator and has

earned its majority interest under a farm-in arrangement. The Company incurred no expenditure in relation to this project

during the financial year.

Funding for growth

Syndication of funding for the development of the Phu Kham Copper-Gold Operation was completed in June 2007.

PanAust entered into loan agreements for debt facilities with a syndicate of ten banks and underwritten by ANZ Investment

Bank. The facilities included a US$160 million construction facility over a seven-year term for the completion of the

construction of the Phu Kham Copper-Gold Operation; a US$35 million lease facility for the mining fleet (split into two

tranches); and working capital, letter of credit and cost overrun facilities totalling US$47 million. The debt facilities are fully

covered by political risk insurance (PRI) provided by a range of commercial PRI providers. First drawdown of the US$160

million construction facility occurred in July 2007.

In December 2007, PanAust agreed terms for a US$80 million subordinated debt facility with Goldman Sachs JBWere.

The funds will be used to finance initial expenditure on the US$40 million capital works for the expansion of the Phu Kham

Copper-Gold Operation and the substantially increased exploration and evaluation budget of US$30 million (includes

Thailand) for 2008. The facility will also provide the Company with funding flexibility through the first year of copper-gold

production at Phu Kham.

Operating Results for the Year

The consolidated operating loss for the financial year of the consolidated entity after providing for income tax amounted to

(US$13,054,830) compared to a consolidated operating loss of (US$4,522,338) for the year ended 31 December 2006.

A summary of consolidated revenues and results by significant industry segments is set out below:

Segment revenues

31 December 31 December

2007

2006

US$'000

US$'000

Geographic Segments

Australia

Southeast Asia

2,440

22,536

24,976

11,012

12,670

23,682

Segment results

31 December 31 December

2007

2006

US$'000

US$'000

(3,636)

(9,419)

(13,055)

7,018

(11,476)

(4,458)

Non-segment unallocated revenues and results

Profit before income tax expense

(13,055)

(64)

(4,522)

Consolidated entity loss from ordinary activities before

income tax expense

(13,055)

(4,522)

The results were affected by the following significant gains and expenses:

Gains:

Foreign exchange gains

Expenses

Hedging expenses

Write off of uneconomically recoverable gold in heaps

-6-

31 December

2007

US$'000

31 December

2006

US$'000

1,057

7,379

(2,687)

-

(5,212)

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Significant changes in the state of affairs

Significant changes in the state of affairs of the Company during the financial year were as follows:

31 December

2007

US$'000

(a)

An increase in contributed equity of $8,129,098 (from $207,855,937 to $215,985,035) as a

result of:

Issue of 11,661,649 fully paid ordinary shares @ A$0.64 each on exercise of unlisted options

6,565

Issue of 10,000,000 fully paid ordinary shares @ A$0.12 each on exercise of options granted

under the Company's Executive Option Plan

977

Issue of 3,900,000 fully paid ordinary shares @ A$0.18 each on exercise of options granted

under the Company's Executive Option Plan

587

8,129

(b)

(c)

An increase in debt as a result of project financing for Phu Kham Copper-Gold Operation

development

Expenses:

Hedging expenses

173,998

(2,687)

Matters subsequent to the end of the financial year

Since the end of the financial year, the syndicate of lenders involved in the project debt facilities for the development of the

Phu Kham Copper-Gold Operation approved the US$80 million subordinated debt facility between PanAust and Goldman

Sachs JBWere (GSJBW). The agreement was executed on 5 March 2008, with the first drawdown of funds from this

facility occurring on 10 March 2008.

In conjunction with entry into the debt facility on 5 March 2008, 5 million options were issued to GSJBW with an exercise

price of A$1.145 per option, a term of 12 months and an expiry date of 5 March 2009. The options are unlisted. The holder

of the options is only entitled to participate in future share issues if the options are first exercised.

Options and share rights have been issued to senior executives, and share rights have been issued to other employees

subsequent to the end of the financial year.

Likely developments and expected results of operations

Additional comments on expected results of certain operations of the Group are included in this annual report under the

review of operations and activities on pages 4 - 6.

Future developments and business strategies of the Company are as follows:

Commencement of copper-gold concentrate production at the Phu Kham Copper-Gold Operation in Laos;

Commencement of the expansion of production capacity at the Phu Kham Copper-Gold Operation in Laos;

New reserve estimate for Phu Kham following extensive infill and step-out drilling program;

Ongoing exploration evaluation activities in Laos and Thailand;

Completion of a pre-feasibility study on the Ban Houayxai Project in Laos; and

Ongoing identification, evaluation and possible acquisition of new projects and evaluation and development of corporate

initiatives.

-7-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Environmental regulation

Under the Corporations Act 2001, the Company is required to report on its performance in relation to Australian

environmental laws.

The Company owns a minority interest in the Darlot South Gold Exploration Project in Western Australia. The Project is

subject to the environmental laws of Western Australia and the Commonwealth of Australia. Sundowner Minerals N.L., part

of the Barrick Gold Group, is the operator of the Project. Under the farm-in arrangements, the operator is required to

comply with all relevant environmental laws and regulations. The Company is not aware of any breach of any

environmental laws by the operator and has fully complied with its obligations as a minority holder of tenements.

The Companys policies with respect to compliance with environmental laws in all countries in which it operates will be

more fully discussed in the Sustainability Report to be released in the second quarter 2008 (first released in the second

quarter 2007).

Insurance of officers

During the financial year, PanAust paid a premium of US$52,346 (2006: US$39,742) to insure the officers of the Company

and its controlled entities.

The liabilities insured include legal costs that may be incurred in defending civil or criminal proceedings that may be

brought against the officers in their capacity as officers of entities in the Group, and any other payments arising from

liabilities incurred by the officers in connection with such proceedings. This does not include such liabilities that arise from

conduct involving a wilful breach of duty by the officers or the improper use by the officers of their position or of information

to gain advantage for themselves or someone else or to cause detriment to the Company. It is not possible to apportion

the premium between amounts relating to the insurance against legal costs and those relating to other liabilities.

Proceedings on behalf of the Company

No person has applied to the Court under section 237 of the Corporations Act 2001 for leave to bring proceedings on

behalf of the Company, or to intervene in any proceedings to which the Company is a party, for the purpose of taking

responsibility on behalf of the Company for all or part of those proceedings.

No proceedings have been brought or intervened in on behalf of the Company with leave of the Court under section 237 of

the Corporations Act 2001.

Non-audit services

The Company may decide to employ the auditor on assignments additional to their statutory audit duties where the

auditor's expertise and experience with the Company are important.

Details of the amounts paid or payable to the auditor (PricewaterhouseCoopers) for audit and non-audit services provided

during the year are set out below.

The Board of Directors has considered the position and, in accordance with advice received from the Audit Committee, is

satisfied that the provision of the non-audit services is compatible with the general standard of independence for auditors

imposed by the Corporations Act 2001. The Directors are satisfied that the provision of non-audit services by the auditor,

as set out below, did not compromise the auditor independence requirements of the Corporations Act 2001 for the

following reasons:

all non-audit services have been reviewed by the Audit Committee to ensure they did not impact the impartiality

and objectivity of the auditor; and

none of the services undermine the general principles relating to auditor independence as set out in APES 110

Code of Ethics for Professional Accountants.

-8-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Non-audit services (continued)

During the year the following fees were paid or payable for services provided by the auditor of the parent entity, its related

practices and non-related audit firms:

Consolidated

31 December 31 December

2007

2006

$

$

1. Audit services

PricewaterhouseCoopers Australian firm:

Audit and review of financial reports and other audit work under the Corporations Act

2001

Related practices of PricewaterhouseCoopers Australian firm:

PricewaterhouseCoopers Laos firm

Total remuneration for audit services

2. Other assurance services

PricewaterhouseCoopers Australian firm:

Due diligence services

Controls assurance services

AIFRS accounting services

Other services

Total remuneration for other assurance services

Taxation services

PricewaterhouseCoopers Australian firm:

Tax compliance services

Related practices of PricewaterhouseCoopers Australian firm:

PricewaterhouseCoopers Laos firm

Tax compliance services

Tax advice

Total remuneration for taxation services

-9-

174,598

86,187

90,541

265,139

49,000

135,187

5,327

14,833

20,160

81,506

18,606

100,112

7,704

16,400

16,400

33,598

41,302

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report

The remuneration report is set out under the following main headings:

A

B

C

D

E

Principles used to determine the nature and amount of remuneration

Details of remuneration

Service agreements

Share-based compensation

Additional information

The information provided under headings A-D includes remuneration disclosures that are required under Accounting

Standard AASB 124 Related Party Disclosures. These disclosures have been transferred from the financial report and

have been audited. The disclosures in Section E are additional disclosures required by the Corporations Act 2001 and the

Corporations Regulations 2001 not otherwise dealt with in sections A-D and which have not been audited.

A Principles used to determine the nature and amount of remuneration (audited)

This report outlines the remuneration agreements in place for directors and executives of PanAust.

Remuneration philosophy

The performance of the Company depends upon the quality of its directors and executives. To prosper, the Company must

attract, motivate and retain highly skilled directors and executives.

To this end, the Company embodies the following principles in its remuneration framework:

Provide competitive rewards to attract high calibre executives;

Link executive rewards to shareholder value;

Significant portion of executive remuneration is at risk", dependent upon meeting pre-determined performance

benchmarks; and

Establish appropriate, demanding performance hurdles in relation to variable executive remuneration.

Remuneration Committee

The Remuneration Committee of the Board of Directors of the Company comprises Mr R. Bryan (Chairman) and Mrs N.

Withnall, both independent directors. It is responsible for determining and reviewing compensation arrangements for the

Chairman, the Directors, the Managing Director and the senior management team.

The Remuneration Committee assesses the appropriateness of the nature and amount of remuneration of directors and

executives on a periodic basis by reference to relevant employment market conditions. The overall objective is to ensure

maximum stakeholder benefit from the retention of a high quality Board and executive team.

Remuneration structure

In accordance with "best practice" corporate governance, the structure of non-executive director and senior manager

remuneration is separate and distinct.

Non-executive director remuneration

Objective

The Board seeks to set aggregate remuneration at a level which provides the Company with the ability to attract and retain

directors of the highest calibre, whilst incurring a cost which is acceptable to shareholders.

Structure

The Constitution and the ASX Listing Rules specify that the aggregate remuneration of non-executive directors shall be

determined from time to time by a general meeting. An amount not exceeding the amount determined is then divided

between the directors as agreed by the directors. The latest determination was at the Annual General Meeting held on 25

May 2007 when shareholders approved an aggregate remuneration cap of A$500,000 per year.

The amount of aggregate remuneration sought to be approved by shareholders, and the manner in which it is apportioned

amongst directors, is reviewed annually. The Board considers the fees paid to non-executive directors of comparable

companies when undertaking the annual review process. Each director receives a fee for being a director of the Company.

Membership of a board committee entitles directors to an additional fee. The fee for membership by a non-executive

director of a board committee was A$7,500 and the fee for chairing a committee was A$15,000.

In April 2007, the Company discontinued a scheme under which non-executive directors of the Company were able to

acquire shares in the Company in lieu of fees under the Director Share Incentive Plan. No shares had been issued under

the scheme since December 2003.

The remuneration of non-executive directors for the year ending 31 December 2007 is detailed in the table on page 14.

-10-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

A Principles used to determine the nature and amount of remuneration (audited) (continued)

Executive director and senior executive remuneration

Objective

The Company aims to reward executives with a level and mix of remuneration commensurate with their position and

responsibilities within the Company.

Structure

In determining the level and make-up of executive remuneration, the Remuneration Committee researches market levels

of remuneration for comparable executive roles from which the Committee makes its recommendations to the Board.

Remuneration consists of the following key elements:

Fixed Remuneration;

Short Term Incentive (STI); and

Long Term Incentive (LTI).

The proportion of Fixed Remuneration, STI and LTI is established for each senior executive by the Remuneration

Committee. Remuneration for the most highly remunerated senior executives is detailed in the table on page 14.

Fixed Remuneration

Objective

The level of Fixed Remuneration is set so as to provide a base level of remuneration which is both appropriate to the

position and competitive in the market.

Fixed Remuneration is reviewed annually by the Remuneration Committee. The process consists of a review of relevant

comparative remuneration in the market and internal and, where appropriate, external advice on policies and practices.

Structure

Senior executives (or key management personnel) are given the opportunity to receive their Fixed Remuneration as either

base salary or base salary and superannuation.

Short Term Incentives

Objective

The objective of awarding STI is to link the achievement of the Companys strategic targets with the remuneration received

by the executives charged with meeting those targets. The total potential remuneration available is set at a level so as to

provide sufficient incentive to the senior executive to achieve the strategic targets, and such that the cost to the Company

is reasonable in the circumstances.

Structure

Actual payments or bonuses granted to each senior executive depend on the extent to which specific strategic targets set

at the beginning of the financial year are met. The strategic targets consist of a number of critical tasks covering both

financial and non-financial measures of performance. Typically included are measures such as reaching project

development milestones, safety, performance against budget or agreed operational targets.

For 2007, payment of the STI was linked to:

The Company's performance compared with the S&P/ASX 300 Metals and Mining Index on a Total Shareholder Return

(TSR) basis for the period commencing 1 April 2007 and ending 31 December 2007 (the TSR Performance Hurdle); and

As at 31 December 2007, the Phu Kham Copper-Gold Operation being ahead of schedule for first concentrate production

in the June 2008 quarter and being within construction budget (the Construction Performance Hurdle).

The TSR Performance Hurdle was chosen on the basis of its link to the creation of shareholder value. The proportion of

this STI component to be paid correlated to TSR performance. The Company had to perform at the 51st percentile of the

S&P/ASX 300 Metals and Mining Index prior to any amount being paid (50% payable at the 51st percentile increasing on a

straight line basis with 100% payable if the Company performed at the 75th percentile or above). Given the Company's

performance over the relevant period, 100% of this component of the STI was payable. This assessment was based on

publicly available information in relation to the TSR performance of the Company and the S&P/ASX 300 Metals and Mining

Index.

The Construction Performance Hurdle was chosen on the basis of its key strategic and financial importance to the

Company. This hurdle was achieved . Accordingly, 100% of this component of the STI was payable. This was confirmed

by reference to reports prepared by the Company and its contractors.

-11-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

A Principles used to determine the nature and amount of remuneration (audited) (continued)

On an annual basis, after consideration of the individual performance against critical tasks, an overall assessment of each

senior executives performance, as a participant in the management team for the Company, is approved by the

Remuneration Committee.

Company performance

The table below shows the outperformance of the Company as measured by the increase in its share price and growth in

market capitalisation over the last five years:

Year

A$ Cents per share

A$ Market Capitalisation

US$ Profit/(Loss)

30-Jun-03

4.3

12,475,520

(1,437,914)

30-Jun-04

17

70,723,474

(1,206,962)

30-Jun-05

24.5

155,619,734

(2,502,114)

31-Dec-05

21

158,438,625

(4,990,915)

31-Dec-06

31.5

443,459,891

(4,522,338)

31-Dec-07

99.0

1,419,037,120

(13,054,830)

Long Term Incentives

Objective

The objective of the Executives Option Plan (EOP) and Share Rights Plan (SRP) is to reward executives in a manner

which aligns this element of remuneration with the creation of shareholder wealth. The issue of share rights and

executives' options also forms part of the Company's retention strategy.

Options are granted under the EOP that was approved by the shareholders at the 1996 Annual General Meeting (as

amended by subsequent Board resolutions). EOP issues are only made to the Managing Director and his senior

executives as they are able to influence and have the prime responsibility for the generation of shareholder wealth, and

thus have a direct impact on the Companys performance against the relevant long term performance hurdle.

Share rights are granted under the Company's Share Rights Plan (SRP).

Commencing in 2007, the Managing Director and senior executives were offered a choice of options issued under the

EOP, share rights issued under the SRP or a combination of both.

Vesting of options and share rights issued in 2007 is subject to PanAusts total return to shareholders (TSR), including

share price growth, dividends and capital returns, compared to the TSR of the S&P/ASX 300 Metals and Mining Index over

a three-year period. Vesting will occur after a non-vesting period of three years and subject to the Companys ranking

within the Index, as follows:

TSR rank

Less than or at 50th percentile

Between 51st and 75th percentile

At or above 75th percentile

Proportion of options and share rights that vest

0%

th

50% increasing linearly to 100% at 75 percentile

100%

Once vested, the options remain exercisable for a period of up to two years and the share rights remain exercisable for a

period of up to ten years from the grant date. Options are granted under the EOP with cash consideration due on exercise

of the options at the relevant exercise price. Share rights are granted under the plan with no cash consideration due on

exercise of the share rights.

It should be noted that share rights under the SRP are also issued to other employees and contractors, but without

performance conditions. The vesting of such share rights is only subject to the employees or contractors being employed

or providing services as at the relevant vesting date. This reflects the retention objective of such issues.

Structure

The Remuneration Committee recommends to the Board the number and terms of options and share rights offered to

executives. Options and/or share rights recommended by the Board for the Managing Director are submitted for approval

by shareholders at the annual general meeting.

The tables on pages 17 - 19 provide details of options and share rights granted, the value of options and share rights,

vesting periods and lapsed options under the EOP and SRP.

-12-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

A Principles used to determine the nature and amount of remuneration (audited) (continued)

Under the terms of the present EOP and SRP:

The Board may invite a person who is an executive in permanent full time or permanent part time employment with the

Company or on a fixed term contract with the Company to participate in the EOP. A participant may nominate an

associate (such as a personal superannuation fund) to hold the options. An executive director of the Company is eligible

to participate in the EOP.

The Board may invite a person who is an employee of the Company or a contractor or an employee of a contractor to

participate in the SRP. A participant may nominate an associate (such as a personal superannuation fund) to hold the

share rights. An executive director of the Company is eligible to participate in the SRP.

Participation in both the EOP and SRP is voluntary. The Board has the discretion to determine (a) the number of options

and share rights to be issued under the EOP and SRP; (b) the exercise price (if any); and (c) other terms of issue of the

options and share rights. The Board has the discretion to impose performance hurdles which must be satisfied before the

options and share rights can be exercised.

Where the employment of a participant in the EOP is terminated for any reason other than retirement, retrenchment or

death, any unexercised options which have outstanding performance or other conditions will immediately lapse. Any

unexercised options which have satisfied all conditions are not affected.

Where the employment of a participant in the SRP is terminated for any reason other than retirement, retrenchment or

death, any unvested share rights will immediately lapse. Any vested share rights are not affected.

Where the employment of a participant in the EOP is terminated by reason of retirement, retrenchment or death, any

unexercised options which have outstanding conditions will immediately lapse unless the Board exercises its discretion to

the contrary. Any unexercised options which do not have any outstanding conditions are not affected.

Where the employment of a participant in the SRP is terminated by reason of retirement, retrenchment or death, any

unvested share rights will immediately lapse unless the Board exercises its discretion to the contrary. Any vested share

rights are not affected.

In the case of options or share rights, a participant will not be taken to have retired until they reach the age of 60 or such

other age as the Board may approve in a particular case.

Upon exercise of an option and payment of the exercise price, each option will convert into one ordinary fully paid share

in the Company. Options must be exercised within the exercise period determined by the Board. The exercise period for

an option must not exceed 5 years.

Upon exercise of a share right, each share right will convert into one ordinary fully paid share in the Company. There is

no exercise price payable. Share rights must be exercised within the exercise period determined by the Board. The

exercise period for a share right must not exceed 10 years.

Holders of options and share rights are not thereby entitled to participate in new pro rata or bonus issues of securities

made by the Company. Upon a new pro rata or bonus issue of securities, adjustments are made to the number of shares

over which the options and share rights exist and/or the exercise price (if any). The relevant formula to reflect changes to

the capital structure that occur by way of pro rata and bonus issues is set out in the EOP and SRP. The formula is

consistent with the ASX Listing Rules. In any reconstruction, options and share rights will be similarly reconstructed in

accordance with the ASX Listing Rules.

Options and share rights may not be transferred. In addition, the Board may impose disposal restrictions upon shares

acquired through the exercise of share rights. The disposal restrictions on such shares may restrict disposal of the shares

until the earlier of the nominated period (up to 10 years) after the acceptance of an offer by the participant to take share

rights, the cessation of the participants employment with the Group, the occurrence of a change in control in the

Company, or the receipt of the consent of the Board. There are no disposal restrictions on options issued under the EOP.

Upon a change in the control of the Company (for example, a takeover) or a demerger, all unvested options and share

rights will immediately vest and become exercisable. Immediately prior to the change in control or demerger, the Board

must make appropriate arrangements to ensure that the holders of options and share rights are able to exercise the option

or share right on or prior to the relevant event.

Participation in both the EOP and SRP does not confer any right upon the participant to future issues of options or share

rights.

-13-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

B Details of remuneration (audited)

Amounts of remuneration

Details of the remuneration of the directors and the key management personnel (as defined in AASB 124 Related Party

Disclosures) of PanAust are set out in the following tables.

The key management personnel of PanAust includes the directors as per pages 1 to 3 above and the senior executives

listed in the following table, and in Part C of this Remuneration Report, who have authority and responsibility for planning,

directing and controlling the activities of the entity, and are also the highest paid executives of the Company and the

Group:

Year ended 31 December 2007

Name

Non-executive directors

R. Bryan Chairman

N.P. Withnall

A.E. Daley

G.A. Handley

Sub-total non-executive directors

Managing director

G. Stafford

Other senior executives

F. Hess

J. Walsh

D. Hairsine

A. Bell

R. Usher

R. Allen (from 23 April 2007)

D. Brost (from 3 August 2007)

P. Scarr (from 5 February 2007)

R. Child (resigned effective 30 June 2007)

Total key management personnel compensation

Short-term employee

benefits

Retirement

benefits

Sharebased

payments

Cash

salary and Short Term

fees

Incentive

$

$

Superannuation

$

Long Term

Incentive

$

Total

$

143,353

74,329

83,565

12,831

314,078

6,687

53,991

60,678

143,353

81,016

83,565

66,822

374,756

449,397

87,673

38,760

63,215

639,045

266,175

217,502

205,956

191,254

220,848

154,342

76,428

140,017

188,077

2,424,074

46,767

35,069

35,069

46,917

22,795

35,069

35,069

35,069

379,497

18,033

29,764

14,870

8,311

33,798

204,214

28,620

23,480

23,029

52,582

60,111

23,029

8,662

23,480

306,208

341,562

294,084

293,818

305,623

303,754

212,440

128,470

232,364

188,077

3,313,993

The value for Long Term Incentives presented in the table above is calculated in accordance with AASB 2 Share-based

Payment and represents options and share rights that have been expensed during the current year. Refer to the tables on

pages 17 and 19 for full details of the fair $A value at the grant date of all options and share rights issued by the Company

to the Managing Director and other senior executives in previous, this or future reporting periods and the number of

options and share rights issued to these executives during the reporting period.

Short-term employee

benefits

Year ended 31 December 2006

Retirement

benefits

Cash

salary and Short Term

Superfees

Incentive annuation

$

$

$

Name

Non-executive directors

R. Bryan Chairman

N.P. Withnall

A.E. Daley

G.A. Handley

Sub-total non-executive directors

Managing director

Gary Stafford

Other senior executives

F. Hess

J. Walsh

D. Hairsine

A. Bell (from 27 March 2006)

R. Usher (from 5 September 2006)

R. Child (resigned effective 30 June 2007)

Total key management personnel compensation

-14-

Sharebased

payments

Long Term

Incentive

$

Total

$

80,603

40,302

40,718

161,623

7,254

3,627

3,665

12,834

27,380

87,857

43,929

44,383

12,834

189,003

359,737

38,688

30,488

125,450

554,363

216,696

176,166

168,829

123,753

57,307

297,632

1,561,743

11,824

15,048

15,048

11,824

15,424

107,856

15,846

23,192

11,138

108,044

50,642

19,715

195,807

228,520

207,060

207,069

197,357

77,022

313,056

1,973,450

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

B Details of remuneration (audited) (continued)

Amounts of remuneration (continued)

Long-term benefits provided for during the year

Long service leave /

Long service leave /

termination benefits 2007 termination benefits 2006

$

$

Name

Managing director

G. Stafford

Other senior executives

F. Hess

J. Walsh

D. Hairsine

A. Bell

D. Brost

P. Scarr

R. Child (resigned effective 30 June 2007)

Total key management personnel compensation

177,321

375,707

11,180

10,864

10,385

4,292

467

1,017

8,398

223,924

3,677

7,136

6,618

791

4,875

398,804

Long service leave and termination benefits represent amounts provided for long service leave and termination

entitlements during the year ended 31 December 2007. Termination benefits are those as referred to under Part C Service

Agreements (audited) of this Remuneration Report. Termination benefits payable when the Managing Director leaves the

employment of the Company (other than for gross misconduct) are included in the table.

Only the value showing for R. Child was paid out during the year (this related to outstanding long service leave).

Termination benefits accrued from 1996 to 2006 for the Managing Director were first recognised as salaries and

employment benefits in the income statements in the year ended 31 December 2006. The figures for the year ended 31

December 2007 reflect the amount accrued during the current year only.

Termination benefits for other senior executives are payable only upon termination of employment by the Company (other

than for gross misconduct). The termination benefit is not payable if the senior executive resigns. On that basis, the

amounts accrued as at 31 December 2006 have been reversed in 2007 and the amounts are not included in the above

table.

C

Service agreements (audited)

The Managing Director and the other senior executives are employed under service agreements. Each of these

agreements provides for the provision of performance-related cash bonuses and participation, when eligible, in the EOP

and SRP. Other major provisions of the agreements relating to remuneration are set out below. The current service

agreements may be terminated by either party with three months' notice, subject to termination payments as detailed

below.

G. Stafford, Managing Director

Commencement date 7 March 1996;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$570,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, other than for gross misconduct, equal to one months salary for each year of

service to a maximum of 12 months.

F. Hess, Managing Director - Phu Bia Mining Limited

Commencement date 17 October 2005;

Base salary, inclusive of superannuation, for the year ending Monday, 31 December 2007 of A$320,000, to be

reviewed annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

J. Walsh, General Manager Corporate Development

Commencement date 1 July 2004;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$280,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

-15-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

C Service agreements (audited) (continued)

D. Hairsine, Chief Financial Officer

Commencement date 27 September 2004;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$280,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

A. Bell, General Manager Human Resources

Commencement date 27 March 2006;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$245,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

R. Usher, General Manager Phu Kham Operations

Commencement date 5 September 2006; and

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$260,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

R. Allen, General Manager Country Affairs

Commencement date 23 April 2007;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$250,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

D. Brost, General Manager Geology

Commencement date 3 August 2007;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$230,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

P. Scarr, Company Secretary & General Counsel

Commencement date 5 February 2007;

Base salary, inclusive of superannuation, for the year ended 31 December 2007 of A$230,000, to be reviewed

annually by the Remuneration Committee; and

Payment of a termination benefit, upon termination by the Company other than for gross misconduct, equal to one

months salary for each year of service to a maximum of 6 months.

-16-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

D Share-based compensation (audited)

Options

The terms and conditions of each grant of options affecting remuneration in the previous, this or future reporting periods

are as follows:

Grant date

Date vested and exercisable

30-Jun-04

13-Oct-05

13-Oct-05

13-Jun-07

13-Oct-08

50% after 13 April 2006 50%

after 13 October 2006

1-Dec-05

15-Mar-06

27-Mar-06

50% after 15 September 2006

50% after 15 March 2007

50% after 27 September 2006

50% after 27 March 2007

24-May-06

4-Sep-06

23-Mar-07

29-May-07

5-Oct-07

22-Feb-08

Note (i)

Expiry date

50% after 13 March 2007

50% after 13 September 2007

1 April 2010

1 April 2010

8 October 2010

31 December 2010

31 December 2010

Exercise price

Fair value per

Unissued shares

A$ cents

option at grant date

under option

A$ cents

12.00

4.00

18.00

5.70

-

13-Oct-08

18.00

5.70

5,500,000

13-Oct-08

18.00

5.70

15-Mar-09

18.00

6.28

27-Mar-09

18.00

4.85

600,000

13-Apr-09

32.00

8.25

2,000,000

13-Sep-09

32.00

8.60

1,000,000

29-Feb-12

29-Feb-12

7-Oct-12

31-Dec-12

31-Dec-12

40.00

40.00

83.00

90.00

90.00

8.10

8.10

16.50

25.90

-

4,550,000

3,500,000

750,000

2,310,000

4,400,000

Note (i) - 4,400,000 options under the EOP to be issued to the Managing Director in 2008 subject to shareholder approval.

Options granted under the EOP carry no dividend or voting rights.

Details of options over ordinary shares in the Company provided as remuneration to the Managing Director and each of

the senior executives of the Company are set out below. When exercisable, each option is convertible into one ordinary

share of PanAust. Further information on the options is set out in note 40 to the financial statements.

Name

Managing Director

G. Stafford

Other senior executives

F. Hess

J. Walsh

A. Bell

R. Usher

R. Allen

D. Brost

P. Scarr

Number of options granted during the year

2008

2007

2006

Number of options vested

during the year

2007

2006

4,400,000

3,500,000

2,000,000

2,000,000

660,000

330,000

660,000

660,000

800,000

1,300,000

650,000

500,000

750,000

1,300,000

2,000,000

1,000,000

-

1,000,000

1,000,000

-

2,000,000

1,000,000

-

In the table above, the grant of options in 2008 represents options granted since the end of the financial year up to the

date of this report. The options to be issued to the Managing Director in 2008 are subject to shareholder approval.

In 2007, the Company commenced issuing options with a three year non-vesting period and subject to TSR performance

conditions (see page 12) as part of key senior executive remuneration.

-17-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

D Share-based compensation (audited) (continued)

From 1 July 2004 until 31 December 2006, options granted as part of senior executives' remuneration were valued using

the Single Barrier option pricing model, which takes account of factors including option exercise price, share price hurdles,

current level and volatility of the underlying share price, risk-free interest rate, expected dividends on the underlying share,

current market price of the underlying share and expected life of the option.

Fair value of options

The fair value attributed to options in the table on page 17 was calculated using a model with the following inputs:

Dividend yield

Expected volatility

Risk-free interest rate

Staff turnover

Dec

2007

Dec

2006

Dec

2005

June

2005

June

2004

Nil

40%

6.50%

16.70%

Nil

30-50%

5.75%

-

Nil

40-55%

4.99%

-

Nil

40-55%

4.99%

-

Nil

74%

5.34%

-

Shares issued on exercise of options

Details of ordinary shares in the Company issued as a result of the exercise of options to the Managing Director of

PanAust and other senior executives of the Group are set out below.

Name

Managing Director

G. Stafford

G. Stafford

G. Stafford (indirect)

Other senior executives

J. Walsh

J. Walsh

D. Hairsine

D. Hairsine

A. Bell

R. Child (ex-employee)

R. Child (ex-employee)

J. Adams (ex-employee)

S. Milroy (ex-employee)

S. Milroy (ex-employee)

S. Milroy (ex-employee)

T. Olsen (ex-employee)

Date of exercise of

options

Number of ordinary shares

Exercise price issued on exercise of options

A$ cents

during the year

2007

2006

29 May 2007

20 October 2006

31 March 2006

12.00

4.70

4.00

4,000,000

-

1,000,000

3,000,000

1 May 2007

26 June 2006

21 September 2007

30 June 2006

2 April 2007

13 March 2007

8 October 2007

1 May 2007

29 May 2007

14 June 2007

27 January 2006

2 February 2006

12.00

12.00

12.00

12.00

18.00

12.00

18.00

18.00

12.00

18.00

9.74

17.00

1,000,000

1,000,000

1,400,000

2,000,000

750,000

1,000,000

2,000,000

750,000

-

1,000,000

1,000,000

1,000,000

2,000,000

-18-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

D Share-based compensation (audited) (continued)

Share Rights Plan

The terms and conditions of each grant of share rights to senior executives in the previous, this or future reporting periods

are as follows:

Grant Date

Expiry Date

Number

Granted

A$ Exercise

Price Cents

Performance

Hurdle

A$ Fair Value per share

right at grant date

2-Apr-07

25-Feb-08

31-Mar-17

31-Dec-17

2,025,000

1,885,000

Nil

Nil

TSR

TSR

15.9 cents

44.1 cents

Details of share rights issued under the SRP provided as remuneration to senior executives of the Company are set out

below. When exercised, each share right is convertible into one ordinary share of PanAust.

Name

Senior executives

J. Walsh

D. Hairsine

A. Bell

F. Hess

R. Usher

R. Allen

Number of share rights granted during the

year

2008

2007

2006

420,000

420,000

550,000

330,000

165,000

650,000

325,000

400,000

650,000

Number of share rights

vested during the year

2007

2006

-

16,130

14,663

-

Shares vested in 2006 represented shares issued under the Employee Share Plan, which has since been replaced by the

SRP. The grant of share rights in 2008 in the table above, represents options granted since the end of the financial year

up to the date of this report.

No share rights were issued to the Managing Director.

Fair value of share rights

The fair value attributed to share rights in the table above was calculated using a model with the following inputs:

Dec

2007

Dividend yield

Expected volatility

Risk-free interest rate

Staff turnover

E

Nil

40%

6.50%

16.70%

Additional information - unaudited

This section of the remuneration report details matters required to be reported by the Corporations Act which have not

been dealt with elsewhere in this report.

Details of remuneration of the Managing Director and other senior executives

For each cash bonus and grant of options and share rights included in the tables on pages 17 - 19, the percentage of the

available bonus or grant that was paid, or that vested, in the financial year, and the percentage that was forfeited because

the person did not meet the service and performance criteria is set out below. No part of the bonuses is payable in future

years. The options and share rights vest after three years, provided the vesting conditions are met. No options or share

rights will vest if the conditions are not satisfied, hence the minimum value of the option or share right yet to vest is nil.

The maximum value of the options or share rights yet to vest is calculated by taking the fair value of the options and share

rights as at the grant date (refer to tables on page 17 and 19) and deducting that component of the fair value of options

and share rights which has already been expensed.

-19-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Remuneration report (continued)

E

Additional information - unaudited (continued)

Cash bonus

Name

G. Stafford (EOP)

F. Hess (EOP)

F. Hess (SRP)

J. Walsh (EOP)

D. Hairsine (SRP)

A. Bell (EOP)

A. Bell (SRP)

R.Usher (EOP)

R. Allen (SRP)

D. Brost (EOP)

P. Scarr (EOP)

Paid

%

100

100

Forfeited

%

-

100

100

100

100

100

100

100

Year

granted

2007

2007

2007

2007

2007

2007

2007

2007

2007

2007

2007

Options and Share Rights

Financial

years in Minimum

which total value

grant may of grant

Vested Forfeited

vest

yet to vest

%

%

$

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

2010

Nil

Maximum

total value

of grant

yet to vest

$

184,517

42,175

41,405

68,535

67,283

34,267

33,641

26,360

67,283

90,015

68,535

Share-based compensation: Options and Share Rights

Further details relating to options and share rights are set out below.

Name

G. Stafford

F. Hess

J. Walsh

D. Hairsine

A. Bell

R. Usher

R. Allen

D. Brost

P. Scarr

A

B

C

D

E

Remuneration

consisting of

options and Value at grant

Value at

Value at lapse

Total of

share rights

date

exercise date

date

columns B-D

$

$

$

$

9.9%

63,215

63,215

8.4%

28,620

28,620

8.0%

23,480

23,480

7.8%

23,029

23,029

17.2%

52,582

52,582

19.8%

60,111

60,111

10.8%

23,029

23,029

6.7%

8,662

8,662

10.1%

23,480

23,480

A = The percentage of the value of remuneration consisting of options and share rights, based on the value of options and

share rights expensed during the current year.

B = The value at grant date calculated in accordance with AASB 2 Share-based Payment of options and share rights

granted during the year as part of remuneration that has been expensed during the current year.

C = The value at exercise date of options that were granted as part of remuneration and were exercised during the year,

being the intrinsic value of the options at that date.

D = The value at lapse date of options that were granted as part of remuneration and that lapsed during the year.

Risk management products

The Company's securities trading policy applies to debt securities and financial products issued or created over its share

rights or options by third parties and associated products which executives or directors may procure to limit the risk of a

holding in the Company.

-20-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

Corporate governance statement

In recognising the need for the highest standard of corporate behaviour and accountability, the Directors of PanAust

support, and have adhered to, principles of corporate governance appropriate for a company such as PanAust. The

Companys corporate governance statement is contained after the auditor's independence declaration in this financial

report.

Auditor's independence declaration

A copy of the auditor's independence declaration as required under section 307C of the Corporations Act 2001 is set out

on page {T#}

Rounding of amounts

The Company is of a kind referred to in Class Order 98/100, issued by the Australian Securities and Investments

Commission, relating to the ''rounding off'' of amounts in the directors' report. Amounts in the directors' report have been

rounded off in accordance with that Class Order to the nearest thousand dollars, or in certain cases, to the nearest dollar.

Auditor

PricewaterhouseCoopers continues in office in accordance with section 327 of the Corporations Act 2001.

This report is made in accordance with a resolution of directors.

R. Bryan

Chairman

G. Stafford

Managing Director

Brisbane

20 March 2008

-21-

Pan Australian Resources Limited

Directors' report

31 December 2007

(continued)

-22-

Pan Australian Resources Limited

Corporate governance statement

31 December 2007

Corporate governance statement

Introduction

PanAust is committed to best practice corporate governance practices. This commitment is founded on a culture of

integrity rather than a tick a box mentality.

In August 2007, the ASX Corporate Governance Council issued a revised edition of the Corporate Governance Principles

and Recommendations (the Recommendations). Whilst the changes in reporting requirements are not formally required

to be complied with until 1 January 2008, PanAust has elected to transition to the revised principles and recommendations

at the earliest stage practical.

In accordance with Listing Rule 4.10, this statement discloses the extent to which the Company has followed the

Recommendations. The relevant Recommendations are considered under each of the corporate governance principles

identified by the ASX Corporate Governance Council. Where a Recommendation has not been followed, the Company is

obligated to disclose the reasons why the Recommendation has not been followed. This is referred to as if not, why not

reporting. Unless otherwise stated, the Company has adhered to the Recommendation for the full period of this report.

It should be noted that Corporate Governance Principles and Recommendations are largely recommendations (the main

exception to this being the requirement for PanAust to have an Audit Committee). It is recognised that not all of the

Recommendations will be suitable for all companies at all times in their corporate development. In this regard, the Board

recognises that the Companys corporate governance practices must continue to evolve and develop as the Company

grows.

Principle 1 Lay solid foundations for management and oversight

The Company has established the functions reserved to the Board and those delegated to senior executives. During

2007, the Board re-visited the responsibilities of the Board and management and their enunciation in a new Board Charter

in accordance with the Recommendations. At the time of this report, the new Board Charter is in the process of being

finalised. The responsibilities of the Board include:

to appoint and remove the Managing Director on the basis of performance and approve key appointments reporting to

the Managing Director;

assess the performance of the Board, each Committee and each non-executive director so as to ensure their

effectiveness;

review and approve managements proposed strategy and performance objectives;

oversee the Company, including its control and accountability systems;

make recommendations to the shareholders as to the appointment and removal of non-executive directors based on

performance;

review key executive performance and remuneration policy;

review and monitor development of succession plans for key senior management, including the Managing Director and

the Chief Financial Officer;

review, ratify and monitor systems of risk management and internal control, codes of conduct, and legal compliance;

approve and monitor the progress of major capital expenditure, capital management, and acquisitions and divestitures;