Professional Documents

Culture Documents

Managerial Accounting Chapter 5 by Garrison

Uploaded by

Joshua HinesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting Chapter 5 by Garrison

Uploaded by

Joshua HinesCopyright:

Available Formats

VARIABLE COSTING: A TOOL

FOR MANAGEMENT

Two general approaches are used for valuing inventories and cost of goods sold. One

approach, called absorption costing, is generally used for external reporting purposes. The

other approach, called variable costing, is preferred by some managers for internal decision

making and must be used when an income statement is prepared in the contribution format.

Absorption costing

also called the full cost method

treats all costs of production as product costs, regardless of whether they are

variable or fixed

is not well suited for CVP computations since no distinction is made between variable

and fixed costs, absorption costing

the cost of a unit of product consists of direct materials, direct labor, and both

variable and fixed overhead

Variable and fixed selling and administrative expenses are treated as period costs

and are deducted from revenue as incurred.

Variable costing

also called direct costing or marginal costing

treats only those costs of production that vary with output as product costs.

is in accordance with the contribution approach income statement and supports CVP

analysis because of its emphasis on separating variable and fixed costs.

The cost of a unit of product consists of direct materials, direct labor, and variable

overhead.

Fixed manufacturing overhead, and both variable and fixed selling and administrative

expenses are treated as period costs and deducted from revenue as incurred.

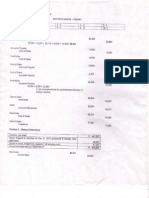

Unit Cost Computations

Mitsubishi Company produces 25,000 units of a single product. Variable manufacturing

costs total $10 per unit. Variable selling and administrative expenses are $3 per unit. Fixed

manufacturing overhead for the year is $150,000 and fixed selling and administrative

expenses for the year are $100,000.

To determine the unit product cost:

VARIABLE COSTING: A TOOL

FOR MANAGEMENT

The unit product costs under absorption and variable costing would be $16 and $10,

respectively. Under absorption costing, all production costs, variable and fixed, are included

when determining unit product cost. Under variable costing, only the variable production

costs are included in product costs.

Income Comparison of Absorption and Variable Costing

We need some additional information to allow us to prepare income statements for

Mitsubushi Company:

20,000 units were sold during the year.

The selling price per unit is $30.

There is no beginning inventory.

To compute for the Absorption costing income statement:

Mitsubishi sold only 20,000 of the 25,000 units produced, leaving 5,000 units in ending

inventory. At a sales price of $30 per unit, sales revenue for the 20,000 units sold is

$600,000. At a unit product cost of $16, cost of goods sold for the 20,000 units sold is

$320,000. Subtracting cost of goods sold from sales, we find the gross margin of $280,000.

After subtracting selling and administrative expenses from the gross margin, we see that net

operating income is $120,000.

Fixed manufacturing overhead deferred in inventory, as a result of the 5,000 unsold units at

$6 of fixed overhead per unit, is $30,000.

To compute for the Variable Costing income statement:

VARIABLE COSTING: A TOOL

FOR MANAGEMENT

In a contribution format income statement, first, we subtract all variable expenses from

sales to get contribution margin. At a product cost of $10 per unit, the variable cost of

goods sold for 20,000 units is $200,000. The next variable expense is the variable selling

and administrative expense. After computing contribution margin, we subtract fixed

expenses to get the $90,000 net operating income. Note that all $150,000 of fixed

manufacturing overhead is expensed in the current period.

Under absorption costing, $120,000 of fixed manufacturing overhead is included in cost of

goods sold and $30,000 is deferred in ending inventory as an asset on the balance sheet.

Under variable costing, the entire $150,000 of fixed manufacturing overhead is treated as a

period expense.

The variable costing ending inventory is $30,000 less than absorption costing, thus

explaining the difference in net operating income between the two methods.

Comparing the two methods:

The difference in net operating income between the two methods ($30,000) can also be

reconciled by multiplying the number of units in ending inventory (5,000 units) by the fixed

manufacturing overhead per unit ($6) that is deferred in ending inventory under absorption

costing.

Practically speaking, absorption costing is required for external reports. Since top executives

are typically evaluated based on earnings reported to shareholders in external reports, they

may feel that decisions should be based on absorption costing data.

Advantages of Variable Costing and the Contribution Approach

The advantages of variable costing and the contribution approach include:

The data required for CVP analysis can be taken directly from a contribution format

income statement.

Profits move in the same direction as sales, assuming other things remain the same.

Managers often assume that unit product costs are variable costs. Under variable

costing, this assumption is true.

Fixed costs appear explicitly on a contribution format income statement; thus, the

impact of fixed costs on profits is emphasized.

VARIABLE COSTING: A TOOL

FOR MANAGEMENT

Variable costing data make it easier to estimate the profitability of products,

customers, and other business segments.

Variable costing ties in with cost control methods, such as standard costs and flexible

budgeting.

Variable costing net operating income is closer to net cash flow than absorption

costing net operating income.

You might also like

- Duo PLC Produces Two Products A and B Each HasDocument2 pagesDuo PLC Produces Two Products A and B Each HasAmit Pandey50% (2)

- Absorption Costing Vs Variable CostingDocument2 pagesAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Business Plan Pizza ShopDocument11 pagesBusiness Plan Pizza ShopPaulaBrinzeaNo ratings yet

- OB Myers-Briggs Type IndicatorDocument9 pagesOB Myers-Briggs Type IndicatorJoshua Hines100% (1)

- The One That Got Away ChordsDocument9 pagesThe One That Got Away ChordsJoshua HinesNo ratings yet

- Zambia in FiguresDocument24 pagesZambia in FiguresChola Mukanga100% (1)

- XYZ Corporation Business PlanDocument14 pagesXYZ Corporation Business PlanKris Rugene DelimaNo ratings yet

- Financial MarketsDocument49 pagesFinancial MarketsNew OldNo ratings yet

- Managerial Accounting by Garrison Appendix 12B34 MASDocument29 pagesManagerial Accounting by Garrison Appendix 12B34 MASJoshua Hines0% (1)

- EntrepreneurshipDocument191 pagesEntrepreneurshipWacks Venzon50% (2)

- Purpose of AuditDocument5 pagesPurpose of Auditannisa radiNo ratings yet

- Divorce UnconstitutionalDocument27 pagesDivorce UnconstitutionalJoshua HinesNo ratings yet

- Questionnaire Consumer Perception On Online ShoppingDocument5 pagesQuestionnaire Consumer Perception On Online Shoppingrkpreethi75% (8)

- ACCT 311 - Chapter 5 Notes - Part 1Document4 pagesACCT 311 - Chapter 5 Notes - Part 1SummerNo ratings yet

- Prologue: Managerial Accounting and The Business EnvironmentDocument156 pagesPrologue: Managerial Accounting and The Business EnvironmentMarcus MonocayNo ratings yet

- All Intermediate ChapterDocument278 pagesAll Intermediate ChapterNigus AyeleNo ratings yet

- Case Study (WACC)Document17 pagesCase Study (WACC)Joshua Hines100% (1)

- Global Delivery Model: We Are Where Our Customers AreDocument2 pagesGlobal Delivery Model: We Are Where Our Customers AreKhiet PhamNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Project Change ManagementDocument15 pagesProject Change ManagementTaskia FiraNo ratings yet

- 1 Day KaizenDocument1 page1 Day KaizenpandaprasadNo ratings yet

- FA GP5 Assignment 1Document4 pagesFA GP5 Assignment 1saurabhNo ratings yet

- Chapter EightDocument38 pagesChapter EightLauren Campbell100% (4)

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Cost Analysis and Control Hyundai Motors India Limited (HMIL) 2014Document94 pagesCost Analysis and Control Hyundai Motors India Limited (HMIL) 2014ravikumarreddyt100% (2)

- Job Interview QuestionsDocument5 pagesJob Interview QuestionsJoshua HinesNo ratings yet

- Assignment 1Document5 pagesAssignment 1kamrulkawserNo ratings yet

- 2014 Bep Analysis ExercisesDocument5 pages2014 Bep Analysis ExercisesaimeeNo ratings yet

- Chapter Review Guide QuestionsDocument1 pageChapter Review Guide QuestionsRick RanteNo ratings yet

- CHAPTER-6 FORECASTING TECHNIQUES - Formatted PDFDocument55 pagesCHAPTER-6 FORECASTING TECHNIQUES - Formatted PDFsamsungloverNo ratings yet

- Managerial Accounting Hilton 6e Chapter 4 Solution PDFDocument68 pagesManagerial Accounting Hilton 6e Chapter 4 Solution PDFNoor QamarNo ratings yet

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Waiting Line ModelsDocument30 pagesWaiting Line ModelsPinky GuptaNo ratings yet

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- The Purpose of Cost SheetDocument5 pagesThe Purpose of Cost SheetRishabh SinghNo ratings yet

- Management Accounting Practice QuestionsDocument6 pagesManagement Accounting Practice QuestionsSayantan NandyNo ratings yet

- 6e Brewer CH03 B EOCDocument10 pages6e Brewer CH03 B EOCLiyanCenNo ratings yet

- Study Guide SampleDocument154 pagesStudy Guide SampleBryan Seow0% (1)

- Managerial Accounting - Ch.1Document2 pagesManagerial Accounting - Ch.1Ammar HussainNo ratings yet

- Day 7 Chap 3 Rev. FI5 Ex PR PDFDocument5 pagesDay 7 Chap 3 Rev. FI5 Ex PR PDFJames Erick LermaNo ratings yet

- Short-Run Decision Making and CVP AnalysisDocument43 pagesShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Allocation and ApportionmentDocument11 pagesAllocation and ApportionmentpRiNcE DuDhAtRa100% (2)

- Standard Costing and Variance Analysis: Multimedia Slides By: Gail A. Mestas, Macc, New Mexico State UniversityDocument99 pagesStandard Costing and Variance Analysis: Multimedia Slides By: Gail A. Mestas, Macc, New Mexico State Universityzidan92No ratings yet

- Programmazione e Controllo Esercizi Capitolo 9Document32 pagesProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariNo ratings yet

- Lecture 2 BEP Numericals AnswersDocument16 pagesLecture 2 BEP Numericals AnswersSanyam GoelNo ratings yet

- Exercise 7 - Standard CostingDocument3 pagesExercise 7 - Standard CostingSports savageNo ratings yet

- SMChap 007Document86 pagesSMChap 007Huishan Zheng100% (5)

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- MA Tutorial 2Document6 pagesMA Tutorial 2Jia WenNo ratings yet

- Solution Manual For Book CP 4Document107 pagesSolution Manual For Book CP 4SkfNo ratings yet

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Topic 2 Support Department Cost AllocationDocument27 pagesTopic 2 Support Department Cost Allocationluckystar251095No ratings yet

- Chapter V: Relevant Information and Decision MakingDocument37 pagesChapter V: Relevant Information and Decision MakingBereket DesalegnNo ratings yet

- Macro Environment of The Mobile IndustryDocument2 pagesMacro Environment of The Mobile IndustryAbhinandanMalhotraNo ratings yet

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Chapter 6 Financial Estimates and ProjectionsDocument15 pagesChapter 6 Financial Estimates and ProjectionsKusum Bhandari33% (3)

- Income Tax Guide UgandaDocument13 pagesIncome Tax Guide UgandaMoses LubangakeneNo ratings yet

- Mgt402 - 14midterm Solved PapersDocument125 pagesMgt402 - 14midterm Solved Papersfari kh100% (1)

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Process Costing Assignment SolutionDocument16 pagesProcess Costing Assignment SolutionMudassirMehdiNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Shukrullah Assignment No 2Document4 pagesShukrullah Assignment No 2Shukrullah JanNo ratings yet

- CHAPTER FOUR Process CostingDocument10 pagesCHAPTER FOUR Process Costingzewdie100% (1)

- Cost AccountingDocument21 pagesCost Accountingabdullah_0o0No ratings yet

- Finals Reviewer Cost AccDocument12 pagesFinals Reviewer Cost AccLuna KimNo ratings yet

- ABC Sample ProblemsDocument16 pagesABC Sample ProblemsrsalicsicNo ratings yet

- Chap 018Document43 pagesChap 018josephselo100% (1)

- Chapter 10 Activity Based CostingDocument10 pagesChapter 10 Activity Based CostingRuby P. MadejaNo ratings yet

- Chapter 05 TestbankDocument81 pagesChapter 05 TestbankNihal Navneet100% (2)

- Intro To CmaDocument21 pagesIntro To CmaRima PrajapatiNo ratings yet

- BACT 302 BUDGETING, STD COST, VAR ANAL.-videoXDocument66 pagesBACT 302 BUDGETING, STD COST, VAR ANAL.-videoXLetsah BrightNo ratings yet

- Variable Costing: A Tool For ManagementDocument9 pagesVariable Costing: A Tool For ManagementNica JeonNo ratings yet

- Chapter 3 AkmenDocument28 pagesChapter 3 AkmenRomi AlfikriNo ratings yet

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Explain The Difference Between Variable and Absorption CostingDocument8 pagesExplain The Difference Between Variable and Absorption CostingJc QuismundoNo ratings yet

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- Faber Drive When Im With You ChordsDocument3 pagesFaber Drive When Im With You ChordsJoshua HinesNo ratings yet

- Case 8 Philips in ChinaDocument1 pageCase 8 Philips in ChinaJoshua Hines0% (2)

- Managerial Accounting Chapter 3 by GarrisonDocument3 pagesManagerial Accounting Chapter 3 by GarrisonJoshua HinesNo ratings yet

- How The Budget Process WorksDocument8 pagesHow The Budget Process WorksJoshua HinesNo ratings yet

- Leadership Manual 2011Document67 pagesLeadership Manual 2011Joshua HinesNo ratings yet

- Chapter 5 - Inventories and Related ExpensesDocument13 pagesChapter 5 - Inventories and Related ExpensesJoshua HinesNo ratings yet

- Demand in A Perfectly Competitive MarketDocument4 pagesDemand in A Perfectly Competitive MarketCrisielyn BuyanNo ratings yet

- Lecture 33434434313545Document10 pagesLecture 33434434313545Christelle Marie Aquino Beroña100% (3)

- Bulletin - 2014 2015 - Final6 18 14print6Document656 pagesBulletin - 2014 2015 - Final6 18 14print6Ali Amer Pantas OmarNo ratings yet

- Design Technology Project Booklet - Ver - 8Document8 pagesDesign Technology Project Booklet - Ver - 8Joanna OlszańskaNo ratings yet

- Material Requirements PlanningDocument151 pagesMaterial Requirements PlanningVinod Kumar PatelNo ratings yet

- Volkswagen of America - HoutDocument12 pagesVolkswagen of America - HoutRahul kumarNo ratings yet

- 1577168581final Exam Routine - Mor ShiftDocument19 pages1577168581final Exam Routine - Mor ShiftNafiz Iqbal MugdhoNo ratings yet

- Association of Differently Abled Person in The Province of AntiqueDocument2 pagesAssociation of Differently Abled Person in The Province of AntiqueLucifer MorningstarNo ratings yet

- REBUTTAL REPORT OF DR. ROBERT McCORMICK IN SUPPORT OF ANTITRUST PLAINTIFFS' MOTION FOR CLASS CERTIFICATIONDocument199 pagesREBUTTAL REPORT OF DR. ROBERT McCORMICK IN SUPPORT OF ANTITRUST PLAINTIFFS' MOTION FOR CLASS CERTIFICATIONInsideSportsLawNo ratings yet

- Test 11Document4 pagesTest 11Enrique GarciaNo ratings yet

- CBOK 2015 Stakeholder Overview For Institutes - June 2014Document10 pagesCBOK 2015 Stakeholder Overview For Institutes - June 2014danielaNo ratings yet

- LoanDocument1 pageLoansuriya bhaiNo ratings yet

- CurriculumVitae 1Document2 pagesCurriculumVitae 1Adams S. Bol-NabaNo ratings yet

- ORR TemplateDocument13 pagesORR TemplateDel Valle MauroNo ratings yet

- Oneott Intertainment LTD.: Comments Date DeclarationDocument1 pageOneott Intertainment LTD.: Comments Date Declarationrajrajeshwari kulkarniNo ratings yet

- Quality Preliminary ReportDocument16 pagesQuality Preliminary ReportNilabh OholNo ratings yet

- Food Services PresentationDocument30 pagesFood Services PresentationGanesh MundheNo ratings yet

- Aqeeq-Far East - Special DirectDocument2 pagesAqeeq-Far East - Special DirectRyan DarmawanNo ratings yet