Professional Documents

Culture Documents

Derivatives Daily

Uploaded by

bbaalluuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Daily

Uploaded by

bbaalluuCopyright:

Available Formats

Feb 18, 2014

Key Parameters

Current

Previous

Cash Closing

6073.20

6048.35

Jan Future Closing

6091.20

6058.00

Traded Vol. (Cntrcts)

167030

227135

Open Interest ( in Lk.)

162.54

162.05

0.49

-4.51

Change in OI (Lk.)

CoC %

11.95

4.85

6123.85

6091.70

Traded Vol. (Cntrcts)

11584

11851

Open Interest ( in Lk.)

18.90

17.38

Volatility (HV) %

15.71

15.98

Feb Future Closing

PCR OI

1.09

1.07

PCR Vol

1.05

1.04

Call IV (Avg)

14.47

14.71

Put IV (Avg)

17.36

17.17

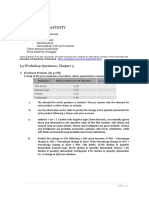

Put

3.84

2.34

3.13

2.17

0.01

0.62

0.16

0.87

0.12

13.00

2.65

2.60

4.13

0.78

1.09

0.39

0.01

4.01

10

0.00

OpenInterestinLk.

15

Call

NiftyChangeinOption Open Interest

ason170214

0.67

6500

6400

6300

6200

6100

6000

5900

5800

5700

5600

5500

5400

5350

10

Nifty Most Active Call

Strike

Close

6100

6200

6300

6000

6400

6150

No.Of Lots

50.1

15.75

3.55

114.4

1.05

29.45

465769

318621

193293

134631

70551

47737

OI

OI Chng

4849950

6561100

4875450

3077100

2940650

1041150

66800

233700

-217150

-259700

-62100

275250

Nifty fut opened on positive note. The market remained ranged

bounded with stock specific momentum, but recovered in late

afternoon session. Nifty Fut consololidated in nerrow range for major

part of the day and surged in last half an hour of trade to close the

session at days high, gaining 33

points.

Nifty Feb contract premium increased

to 18 points to cash.

India VIX (volatility index) decreased

by

4.98% to 15.83

Banknifty Feb Fut closed at 10342.4,

up

by 105 points and shed 0.42L

shares in OI shows unwinding of some short positions.

Nifty call side shed total 3L in OI, 5800, 5900, 6000 and 6100 strike

of some short positions, while 6200,

shed OI of 18L shows unsinding

and above strike add OI shows addition of some short positions.

Nifty Feb Put side add total 14L in OI, 6200,6100 and 6000 strike add

OI of 13L shares, shows addition of some long positions, while 5900

and 5700 shed OI shows unwinding

of short positions.

call observed to 6200 strike and put

Maximum OI build up in Nifty Feb

side at 6000 strike price followed

by 5900 strike price.

Stock Futures OI increased by 1.45Cr. Shares, about 1.88% of total OI

with increase in average CoC (cost of Carry) shows addition of some

long positions.

Finance and Pharma stocks led the

Among sectoral indices, Power,

recovery in the market, while Telecom, Realty and Metals stocks

closed negative.

Major

Gainers:

TATAPOWER,

DRREDDY,

ICICIBANK,

HEROMOTOCO, IDFC and LUPIN

in frontline.

Major Losers: NMDC, COALINDIA,

DLF, HINDALCO, RELIANCE,

BHEL, and BANKBARODA in frontline

Market Outlook

Nifty fut expected to open flat to negative following mixed global market

cues. Nifty fut may open around 6090 level as indicated by SGXNifty.

Nifty fut may trade widely in the range

of 6040 6130 with higher degree

of swinging action. Nifty fut Resistance at 6110 6125 and support at

6055-6040. As stated earlier, If Nifty Fut sustained above 6080,

possiblity of rally up to 6130 and 6180, on the other side, failing to hold

again up to 5990 and 5965 may not

6040 level, possiblity Nifty fut to drag

be niglacted..

Nifty Most Active Put

Strike

Close

No.Of Lots

OI

OI Chng

6000

27.1

411729

10015300

1299800

6100

61.15

270931

3965500

383500

Most Active Call ( by no. of contracts)

Symbol

TATAMOTORS

RELIANCE

TCS

RELIANCE

ICICIBANK

DLF

MCDOWELL-N

AXISBANK

M&M

INFY

Strike

Pri.

390

820

2200

840

1000

150

2400

1150

920

3700

SBICAP Securities Limited

Closing

Pri

6.75

8.65

20.9

3.15

26.15

1.45

24.15

11.6

22.3

23.25

No.of Lots

2845

2760

2683

2662

2439

2104

2091

1670

1593

1568

Change

in OI

232000

166250

4500

217000

-78250

188000

11125

-16000

-22750

-250

5900

5800

5700

5600

11.05

4.3

1.95

1.05

265133

163777

98066

43100

5780150

5083300

3584100

2028200

Most Active Put ( by no. of contracts)

Strike

Closing

Symbol

No.Of Lots

Pri

Pri.

MCDOWELL-N

2300

41.45

2349

TATAMOTORS

380

4.55

2324

TATASTEEL

RELIANCE

TCS

ICICIBANK

DLF

AXISBANK

INFY

RCOM

-401150

265300

-584850

-78250

Change in

OI

370

800

2150

980

140

1100

3600

6.05

5.8

23.45

8.95

3.15

16.45

14.6

1818

1775

1747

1545

1522

1232

1128

11625

88000

170000

15500

5250

61000

132000

-10000

22125

120

4.05

980

-234000

Price

%

Chg

OI Chng

OI %

Chg

3.95

Capital_Goods

2.83

Textile

2.30

Cement

2.18

Fertilisers

2.09

Pharma

1.95

Media

1.49

Automobile

34.35

3.93

104000

0.37

TATACOMM

M&M

932.1

3.14

141750

7.05

CROMPGREAV

JPPOWER

14.05

2.93

260000

1.00

RCOM

505.95

2.72

984000

7.55

1.06

ADANIPORTS

1.76

1.30

Telecom

Scrip

ADANIPOWER

AUROPHARMA

Realty

1.30

1.14

Others

0.32

Power

Negative Trend

Positive Trend

Scrip

Index

0.19

Finance

0.72

0.05

Oil_Gas

Technology

0.11

FMCG

0.70

0.36

Infrastructure

Metals

0.51

Banking

%chnginOI

SectorwiseChanginOIPositionon170214

5

4

4

3

3

2

2

1

1

0

1

1

151.35

2.58

44000

Derivative Strategy

Price

%

Chg

OI Chng

OI %

Chg

280.85

-9.55

180000

3.55

118.5

-3.85

880000

10.24

118.45

-3.15

2238000

4.98

SAIL

58.35

-1.40

440000

1.66

ASHOKLEY

15.45

-0.30

1530000

3.55

Payoff Profile

Rcom Buy 1 lot of 120 Put @ 3.8 - 3.9

Rcom Sell 1 lot of 115 Put @ 1.8 - 1.9

Initial Margin : aprox Rs.37044

Max Profit Rs.6000

Max loss Rs.4000

BEP : 118

Future Calls

Options Calls

Buy ZEEL Fut @ 260 SL 257 Trgt 266

Buy M&M 920 CE @ 22 SL 20 Trgt 26

Sell CROMPGREAV Fut @ 119 SL 122.5 Trgt 114

Buy ICICIBANK 1000 CE@ 25 SL 22 Trgt 29

Buy TATASTEEL 370 CE @ 10.5 SL 7.9 Trgt 14

SBICAP Securities Limited

Name

Designation

Alpesh Porwal

SVP & Head (Retail)

Ashu Bagri

Dy. Head - Technical Analyst

Jaldeep Vaishnav

Derivatives Analyst

Regd. Office: SBICAP Securities Limited

191, Maker Towers 'F', Cuffe Parade, Mumbai 400 005. I Tel.: 91-22-30273300 (Board) Fax: (022) 30273420

nd

Corporate Office: SBICAP Securities Limited

Floor, Mafatlal Chamber, N. M. Joshi Marg, Lower Parel (East), Mumbai-13. I Tel.: 91-22-42273300 / 3301 (Board)

For any information contact us:

Toll Free: 1800-22-33-45 I 1800-209-93-45

E-mail: helpdesk@sbicapsec.com I Web: www.sbicapsec.com

I, Jaldeep S.Vaishnav, PGDBA (Finance), Derivatives Analyst and the author of this report, hereby certify that all of the views expressed in this research report accurately reflect

my personal views about any and all of the subject issuer(s) or securities. This report has been prepared based upon information available to the public and sources, believed to be

reliable. I also certify that no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

SBICAP Securities Limited (SSL),a full service Stock Broking Company and a member of National Stock Exchange of India Ltd. (NSE) and Bombay Stock Exchange Ltd. (BSE).

SSL is a wholly owned subsidiary of SBI Capital Markets Limited (SBICAP), which is engaged into the investment banking activities and is registered with the Securities and

Exchange Board of India as a Category I Merchant Banker. SBICAP (Singapore) Limited, a fellow subsidiary of SSL, incorporated in Singapore is regulated by the Monetary

Authority of Singapore as a holder of a capital markets services license and an exempt financial adviser in Singapore. SBICAP (Singapore) Limiteds services are available only to

accredited investors (other than individuals), and institutional investors in Singapore as defined in section 4A of the Securities and Futures Act (Cap. 289) of Singapore. SBICAP

(Singapore) is a wholly owned subsidiary of SBICAP. SBICAP (UK) Limited, a fellow subsidiary of SSL, incorporated in United Kingdom is authorised and regulated by the

Financial Services Authority. [SBICAP, SBICAP (Singapore) Limited, SBICAP (UK) Limited and SSL are collectively referred to as SBICAP Entities].

Recipients of this report should assume that SBICAP Entities (and/or its Affiliates) is seeking (or may seek or will seek) Investment Banking, advisory, project finance or other

businesses and may receive commission, brokerage, fees or other compensation from the company or companies that are the subject of this material/ report. SSL (and/or its

Affiliates) and its officers, directors and employees, including the analysts and others involved in the preparation/issuance of this material and their dependant(s), may on the date

of this report/from time to time, have long/short positions in, act as principal in, and buy or sell the securities or derivatives thereof of companies mentioned herein.

SSLs sales people, dealers, traders and other professionals may provide oral or written market commentary or trading strategies to its clients that reflect opinion that are contrary

to the opinions expressed herein, and its proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. SSL may have earlier issued or may issue in future reports on the companies covered herein with recommendations/ information inconsistent or different from those made

in this report. In reviewing this document, you should be aware that any or all of the foregoing, among other things, may give rise to potential conflicts of interest.

Please ensure that you have read Risk Disclosure Document for Capital Market and Derivatives Segments as prescribed by Securities and Exchange Board of India before

investing in Indian Securities Market.

The projections and forecasts described in this report should be carefully evaluated as these

1.

Are based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies.

2.

Can be expected that some of the estimates on which these were based, will not materialize or will vary significantly from actual results, and such variances may increase

over time.

3.

Are not prepared with a view towards compliance with published guidelines or generally accepted accounting principles. No independent accountants have expressed an

opinion or any other form of assurance on these.

4.

Should not be regarded, by mere inclusion in this report, as a representation or warranty by or on behalf of SSL the authors of this report, or any other person, that these

or their underlying assumptions will be achieved.

This report is for information purposes only and SBICAP Entities accept no liabilities for any loss or damage of any kind arising out of the use of this report. Though disseminated to

clients simultaneously, not all clients may receive this report at the same time. SSL will not treat recipients as clients by virtue of their receiving this report. It should not be

construed as an offer to sell or solicitation of an offer to buy, purchase or subscribe to any securities this report shall not form the basis of or be relied upon in connection with any

contract or commitment, whatsoever. This report does not solicit any action based on the material contained herein.

It does not constitute a personal recommendation and does not take into account the specific investment objectives, financial situation/circumstances and the particular needs of

any specific person who may receive this document. The securities discussed in this report may not be suitable for all the investors. SSL does not provide tax advice to its clients

and you should independently evaluate the suitability of this report and all investors are strongly advised to seek professional consultation regarding any potential investment.

Nothing in this report is intended by SBICAP Entities to be construed as legal, accounting or tax advice.

Certain transactions including those involving futures, options, and other derivatives as well as non-investment grade securities give rise to substantial risk and are not suitable for

all investors. Foreign currency denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value or price of or income derived

from the investment. Investors in securities such as ADRs, the value of which are influenced by foreign currencies effectively assume currency risk.

SBICAP Securities Limited

The price, value and income of the investments referred to in this report may fluctuate and investors may realize losses on any investments. Past performance is not a guide for

future performance. Actual results may differ materially from those set forth in projections. SSL has reviewed the report and, the current or historical information included here is

believed to be reliable, the accuracy and completeness of which is not guaranteed. SSL endeavors to update on a reasonable basis the information discussed in this

document/material/ report, but regulatory compliance or other reasons may prevent it from doing so.

This report/document has been prepared by SSL based upon information available to the public and sources, believed to be reliable. No representation or warranty, express or

implied is made that it is accurate or complete.

The opinions expressed in this report are subject to change without notice and have no obligation to tell the clients when opinions or information in this report change. This report

has not been approved and will not or may not be reviewed or approved by any statutory or regulatory authority in India, United Kingdom or Singapore or by any Stock Exchange in

India, United Kingdom or Singapore. This report may not be all inclusive and may not contain all the information that the recipient may consider material.

This report does not constitute or purport to constitute investment advice in publicly accessible media and should not be reproduced, transmitted or published by the recipient. The

report is for the use and consumption of the recipient only. This report or any portion hereof may not be printed, sold or distributed without the written consent of SBICAP Entities.

The securities described herein may not be eligible for sale in all jurisdictions or to all categories of investors. The countries in which the companies mentioned in this report are

organized may have restrictions on investments, voting rights or dealings in securities by nationals of other countries. Distributing /taking/sending/dispatching/transmitting this

document in certain foreign jurisdictions may be restricted by law, and persons into whose possession this document comes should inform themselves about, and observe, any

such restrictions. Failure to comply with this restriction may constitute a violation of any foreign jurisdiction laws. Neither SBICAP Entities nor its directors, employees, agents or

representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in

connection with the use of the information. Further, no representation or warranty, expressed or implied, is made or given by or on behalf of SBICAP Entities, nor any person who

controls it or any director, officer, employee, advisor or agent of it, or affiliate of any such person or such persons as to the accuracy, authenticity, completeness or fairness of the

information or opinions contained in this report and SBICAP Entities or such persons do not accept any responsibility or liability for any such information or opinions and therefore,

any liability or responsibility is expressly disclaimed.

Legal Entity Disclosure

Singapore: This report may be distributed in Singapore by SBICAP (Singapore) Limited (Registration No. 201026168R), a holder of a capital markets services license and an

exempt financial adviser in Singapore and solely to persons who qualify as institutional investors or accredited investors (other than individuals) as defined in section 4A(1) of the

Securities and Futures Act, Chapter 289 of Singapore (the SFA) and is not intended to be distributed directly or indirectly to any other class of person. Persons in Singapore

should contact SBICAP (Singapore) Limited in respect of any matters arising from, or in connection with this report.

United Kingdom: This marketing communication is being solely issued to and directed at persons (i) fall within one of the categories of Investment Professionals as defined in

Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the Financial Promotion Order), (ii) fall within any of the categories

of persons described in Article 49 of the Financial Promotion Order (High net worth companies, unincorporated associations etc.) or (iii) any other person to whom it may

otherwise lawfully be made available (together Relevant Persons) by SSL. The materials are exempt from the general restriction on the communication of invitations or

inducements to enter into investment activity on the basis that they are only being made to Relevant Persons and have therefore not been approved by an authorised person as

would otherwise be required by section 21 of the Financial Services and Markets Act 2000 (FSMA).

This report is issued and distributed by SBICAP Entities without any liability / undertaking / commitment on the part of itselves or SBI Capital Markets Limited or State Bank of India

or any other entity in the State Bank Group. Further, in case of any commitment on behalf of State Bank of India or SBI Capital Markets Limited or any entity in the State Bank

Group, such commitment is valid only when separately confirmed by that entity.

SBICAP Securities Limited

You might also like

- Technical Report 19th October 2011Document5 pagesTechnical Report 19th October 2011Angel BrokingNo ratings yet

- Technical Report 24th October 2011Document5 pagesTechnical Report 24th October 2011Angel BrokingNo ratings yet

- Technical Report 17th February 2012Document5 pagesTechnical Report 17th February 2012Angel BrokingNo ratings yet

- Daringderivatives-Nov11 11Document3 pagesDaringderivatives-Nov11 11Shahid IbrahimNo ratings yet

- Technical Report 14th December 2011Document5 pagesTechnical Report 14th December 2011Angel BrokingNo ratings yet

- Technical Report 23rd December 2011Document5 pagesTechnical Report 23rd December 2011Angel BrokingNo ratings yet

- Technical Report 25th January 2012Document5 pagesTechnical Report 25th January 2012Angel BrokingNo ratings yet

- Technical Report 18th January 2012Document5 pagesTechnical Report 18th January 2012Angel BrokingNo ratings yet

- Technical Report 15th March 2012Document5 pagesTechnical Report 15th March 2012Angel BrokingNo ratings yet

- Technical Report 17th April 2012Document5 pagesTechnical Report 17th April 2012Angel BrokingNo ratings yet

- Technical Report 4th November 2011Document5 pagesTechnical Report 4th November 2011Angel BrokingNo ratings yet

- Technical Report 3rd January 2012Document5 pagesTechnical Report 3rd January 2012Angel BrokingNo ratings yet

- Nifty Futures Turn To DiscountDocument3 pagesNifty Futures Turn To DiscountSakha SabkaNo ratings yet

- Technical Report 18th October 2011Document5 pagesTechnical Report 18th October 2011Angel BrokingNo ratings yet

- Technical Report 14th October 2011Document5 pagesTechnical Report 14th October 2011Angel BrokingNo ratings yet

- Technical Report 13th March 2012Document5 pagesTechnical Report 13th March 2012Angel BrokingNo ratings yet

- Technical Report 9th March 2012Document5 pagesTechnical Report 9th March 2012Angel BrokingNo ratings yet

- Daringderivatives-Jan10 13Document3 pagesDaringderivatives-Jan10 13balaji_resourceNo ratings yet

- Technical Report 16th April 2012Document5 pagesTechnical Report 16th April 2012Angel BrokingNo ratings yet

- Technical Report 24th February 2012Document5 pagesTechnical Report 24th February 2012Angel BrokingNo ratings yet

- Technical Report 15th February 2012Document5 pagesTechnical Report 15th February 2012Angel BrokingNo ratings yet

- Technical Report 4th January 2012Document5 pagesTechnical Report 4th January 2012Angel BrokingNo ratings yet

- Technical Report 29th December 2011Document5 pagesTechnical Report 29th December 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Document5 pagesDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingNo ratings yet

- Technical Report 23rd February 2012Document5 pagesTechnical Report 23rd February 2012Angel BrokingNo ratings yet

- Technical Report 20th December 2011Document5 pagesTechnical Report 20th December 2011Angel BrokingNo ratings yet

- Daily Equtiy News Letter 11jan 2013Document7 pagesDaily Equtiy News Letter 11jan 2013Theequicom AdvisoryNo ratings yet

- Technical Report 19th September 2011Document3 pagesTechnical Report 19th September 2011Angel BrokingNo ratings yet

- Technical Report 19th January 2012Document5 pagesTechnical Report 19th January 2012Angel BrokingNo ratings yet

- Technical Report 7th February 2012Document5 pagesTechnical Report 7th February 2012Angel BrokingNo ratings yet

- Technical Report 20th April 2012Document5 pagesTechnical Report 20th April 2012Angel BrokingNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartKavitha RavikumarNo ratings yet

- Daily Option News LetterDocument7 pagesDaily Option News Letterapi-234732356No ratings yet

- Technical Report 27th December 2011Document5 pagesTechnical Report 27th December 2011Angel BrokingNo ratings yet

- Technical Report 20th September 2011Document3 pagesTechnical Report 20th September 2011Angel BrokingNo ratings yet

- Technical Report 25th July 2011Document3 pagesTechnical Report 25th July 2011Angel BrokingNo ratings yet

- Technical Report 9th February 2012Document5 pagesTechnical Report 9th February 2012Angel BrokingNo ratings yet

- Technical Report 21st December 2011Document5 pagesTechnical Report 21st December 2011Angel BrokingNo ratings yet

- Technical Report 23rd January 2012Document5 pagesTechnical Report 23rd January 2012Angel BrokingNo ratings yet

- Daringderivatives-Aug29 11Document3 pagesDaringderivatives-Aug29 11ansfaridNo ratings yet

- Technical Report 22nd August 2011Document3 pagesTechnical Report 22nd August 2011Angel BrokingNo ratings yet

- Bulls Say Happy Weekend: Punter's CallDocument5 pagesBulls Say Happy Weekend: Punter's CallGauriGanNo ratings yet

- Technical Report 23rd April 2012Document5 pagesTechnical Report 23rd April 2012Angel BrokingNo ratings yet

- Technical Report 1st March 2012Document5 pagesTechnical Report 1st March 2012Angel BrokingNo ratings yet

- Technical Report 27th January 2012Document5 pagesTechnical Report 27th January 2012Angel BrokingNo ratings yet

- Technical Report 23rd November 2011Document5 pagesTechnical Report 23rd November 2011Angel BrokingNo ratings yet

- Technical Report 19th March 2012Document5 pagesTechnical Report 19th March 2012Angel BrokingNo ratings yet

- Technical Report 2nd January 2012Document5 pagesTechnical Report 2nd January 2012Angel BrokingNo ratings yet

- Positive Momentum Continues: Punter's CallDocument3 pagesPositive Momentum Continues: Punter's CallDivakar MamidiNo ratings yet

- Technical Report 28th March 2012Document5 pagesTechnical Report 28th March 2012Angel BrokingNo ratings yet

- Technical Report 26th April 2012Document5 pagesTechnical Report 26th April 2012Angel BrokingNo ratings yet

- Stock To Watch:: Nifty ChartDocument3 pagesStock To Watch:: Nifty ChartbidyuttezuNo ratings yet

- Technical Report 12th March 2012Document5 pagesTechnical Report 12th March 2012Angel BrokingNo ratings yet

- Technical Report 7th December 2011Document5 pagesTechnical Report 7th December 2011Angel BrokingNo ratings yet

- Technical Teport 2nd February 2012Document5 pagesTechnical Teport 2nd February 2012Angel BrokingNo ratings yet

- Technical Report 8th December 2011Document5 pagesTechnical Report 8th December 2011Angel BrokingNo ratings yet

- Technical Report 21st February 2012Document5 pagesTechnical Report 21st February 2012Angel BrokingNo ratings yet

- Technical Report 27th April 2012Document5 pagesTechnical Report 27th April 2012Angel BrokingNo ratings yet

- The Investment Industry for IT Practitioners: An Introductory GuideFrom EverandThe Investment Industry for IT Practitioners: An Introductory GuideNo ratings yet

- Sensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (34869) / Nifty (10305) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34869) / Nifty (10305) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (34732) / Nifty (10244) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34732) / Nifty (10244) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38071) / Nifty (11203) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38071) / Nifty (11203) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartDocument5 pagesSensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartbbaalluuNo ratings yet

- Sensex (34911) / Nifty (10311) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34911) / Nifty (10311) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38615) / Nifty (11408) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38615) / Nifty (11408) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38370) / Nifty (11308) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38370) / Nifty (11308) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38528) / Nifty (11385) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38528) / Nifty (11385) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Rollover Report July 2020 - Aug 2020Document7 pagesRollover Report July 2020 - Aug 2020bbaalluuNo ratings yet

- Sensex (38615) / Nifty (11408) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38615) / Nifty (11408) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38528) / Nifty (11385) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38528) / Nifty (11385) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37877) / Nifty (11178) : Nifty Finally Gives Up Around 11350Document3 pagesSensex (37877) / Nifty (11178) : Nifty Finally Gives Up Around 11350bbaalluuNo ratings yet

- Technical & Derivatives Report Highlights July 2020Document5 pagesTechnical & Derivatives Report Highlights July 2020bbaalluuNo ratings yet

- Technical & Derivatives Report SummaryDocument5 pagesTechnical & Derivatives Report SummarybbaalluuNo ratings yet

- Technical Report Highlights Midcap Rally and Dollar Index ReboundDocument5 pagesTechnical Report Highlights Midcap Rally and Dollar Index ReboundbbaalluuNo ratings yet

- Technical & Derivatives Report Highlights Bank Nifty StrengthDocument5 pagesTechnical & Derivatives Report Highlights Bank Nifty StrengthbbaalluuNo ratings yet

- Sensex (38435) / Nifty (11372) : Benchmark Consolidates, Midcaps Continues Their Dream RunDocument3 pagesSensex (38435) / Nifty (11372) : Benchmark Consolidates, Midcaps Continues Their Dream RunbbaalluuNo ratings yet

- Sensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartDocument5 pagesSensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartbbaalluuNo ratings yet

- Nifty Ends Higher Despite ChecksDocument3 pagesNifty Ends Higher Despite ChecksbbaalluuNo ratings yet

- Technical & Derivatives Report InsightsDocument5 pagesTechnical & Derivatives Report InsightsbbaalluuNo ratings yet

- Technical and Derivatives Review |July 18, 2020Document3 pagesTechnical and Derivatives Review |July 18, 2020bbaalluuNo ratings yet

- Price Discrimination On Anand City TheatersDocument51 pagesPrice Discrimination On Anand City TheatersTusshar R Gadhiya NewNo ratings yet

- Developing and Managing An Advertising ProgrammeDocument3 pagesDeveloping and Managing An Advertising ProgrammemierameaNo ratings yet

- Bankers Trust Case StudyDocument19 pagesBankers Trust Case StudySedeqha PopalNo ratings yet

- Ebs Global CRMDocument57 pagesEbs Global CRMNagendra ManralNo ratings yet

- Demand (Economics)Document5 pagesDemand (Economics)Manoj KNo ratings yet

- How Philip Morris Built Marlboro Into A Global Brand For Young AdultsDocument11 pagesHow Philip Morris Built Marlboro Into A Global Brand For Young AdultsIrvandy Farwezy HamzahNo ratings yet

- What Is A PEST AnalysisDocument13 pagesWhat Is A PEST AnalysistusharNo ratings yet

- Merger and Acquisition FinalsDocument3 pagesMerger and Acquisition FinalsLeevya GeethanjaliNo ratings yet

- Microsoft PowerPoint - ICT December Study Notes - ICT-MENTORSHIP-M4-PDF.11Document35 pagesMicrosoft PowerPoint - ICT December Study Notes - ICT-MENTORSHIP-M4-PDF.11romaric0% (1)

- Final Presentationon SharekhanDocument15 pagesFinal Presentationon SharekhanRajat SharmaNo ratings yet

- 0812 Daniel Camacho Capital Markets FinalDocument20 pages0812 Daniel Camacho Capital Markets FinalJonathan AguilarNo ratings yet

- Different Types of Sales JobsDocument3 pagesDifferent Types of Sales Jobssachin patidarNo ratings yet

- NSU Final Exam Corporate Finance ProblemsDocument3 pagesNSU Final Exam Corporate Finance ProblemsFariha FarjanaNo ratings yet

- Eco Plastic Case StudyDocument3 pagesEco Plastic Case StudyQistina100% (2)

- Lev Leviev Vs de BeersDocument19 pagesLev Leviev Vs de BeersainiakbarNo ratings yet

- Final Marchant BankingDocument42 pagesFinal Marchant BankingSupriya PatekarNo ratings yet

- Natalie Jaeger Resume 1Document1 pageNatalie Jaeger Resume 1api-384851446No ratings yet

- Cash Grants ProposalsDocument41 pagesCash Grants ProposalsMuhammad AbdullahNo ratings yet

- Panera Bread's unique position and success in the restaurant industryDocument4 pagesPanera Bread's unique position and success in the restaurant industryAbdul Basit100% (1)

- Financial Education and Investor AwarenessDocument9 pagesFinancial Education and Investor Awarenessgethu.akiNo ratings yet

- Chapter 7, Lesson 1: Place: Distribution DesignDocument22 pagesChapter 7, Lesson 1: Place: Distribution DesignSophie Kesche ScheniderNo ratings yet

- Marketing Case StudyDocument2 pagesMarketing Case StudySandesh KandelNo ratings yet

- Demand For MoneyDocument4 pagesDemand For MoneyHadhi MubarakNo ratings yet

- 20 SWOT Analysis Questions To Ask YourselfDocument3 pages20 SWOT Analysis Questions To Ask YourselfJulie LimNo ratings yet

- Report EntrepreneurshipDocument38 pagesReport EntrepreneurshipHarfizzie FatehNo ratings yet

- Transport Logistics Trendbook 2019 en PDFDocument40 pagesTransport Logistics Trendbook 2019 en PDFNavin JollyNo ratings yet

- L3. Elasticity - CH 3, Questions (Teacher)Document5 pagesL3. Elasticity - CH 3, Questions (Teacher)shikha ramdanyNo ratings yet

- Candlestick Patterns: Daily ChartDocument30 pagesCandlestick Patterns: Daily Chartzulfikar Salim0% (2)

- Ifmr - PGP Batch 18 - Management Accounting Quiz 3 A. Choose The Correct Answer (1.25 Marks Each)Document2 pagesIfmr - PGP Batch 18 - Management Accounting Quiz 3 A. Choose The Correct Answer (1.25 Marks Each)Anu AmruthNo ratings yet

- Procurement Strategies and StructuresDocument52 pagesProcurement Strategies and StructuresKalkidan100% (1)