Professional Documents

Culture Documents

Avian Influenza

Uploaded by

gtg414gOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Avian Influenza

Uploaded by

gtg414gCopyright:

Available Formats

EG15-05

May 12, 2015

Egg Sector Update: Special Report on Avian Influenza

Avian influenza (AI) is passed freely among migratory birds, often with little or no health consequence

for the infected animal. Because migratory birds generally suffer few adverse health effects from an AI

infection, they are able to serve as the primary vehicle for the virus to spread over long distances and

into domesticated poultry flocks, which have immune systems that are often ill-equipped to handle

many strains of the virus. In some respects, AI might be considered an ever-present danger for

domesticated fowl, though in actuality each outbreak plays out in very sporadic and often unpredictable

ways. Sometimes the virus disappears almost as quickly as it appears while other times the effects are

felt over multiple years. Typically this depends on the level of pathogenicity of the AI subtype in

question, although geographic and seasonal considerations generally come into play as well. In recent

years, the H5N1 and H7N9 subtypes of AI have done the most damage to domesticated poultry and egg

farming operations, predominantly in Southeast Asia but also in many other parts of the world,

including North America. At the present time, it is the H5N2 subtype that has a choke-hold on US

poultry and egg operations, particularly in the Upper Midwest.

Unlike the H5N1 and H7N9 subtypes, H5N2 is yet to demonstrate a serious threat to human health,

which is critical when examining this outbreak from a demand perspective; however, some health

officials have warned that the potential is still there for this strain of the virus to mutate in such a way

that humans are at risk of infection. While AI popped up on the West Coast as far back as December, it

was still considered little more than a nuisance until about two months ago when it started hitting

commercial turkey operations in the central US. AI was discovered in various flocks in Kansas,

Missouri, and Arkansas, raising fears the virus was about to spread into and through the Southeast,

where broiler production is most heavily concentrated. Officials were able to keep the virus contained

in those states, but AI popped up in Minnesota around that same time and quickly spilled over into Iowa

and other surrounding states. Health and veterinary officials in that part of the country have had little

success in preventing the virus from spreading, and the rate at which new cases have been reported over

the past couple of weeks suggests the outbreak is hardly slowing down.

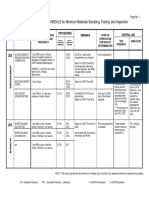

Initially it was the US turkey industry that felt the brunt of the outbreak, and the losses in that sector are

certainly consequential, but its the table egg laying sector thats now faced with the most staggering

losses. Below (next page) is a table that reflects the most current tally of affected animals from the

Animal and Plant Health Inspection Service (APHIS) division of the United States Department of

Agriculture (USDA). APHIS breaks down the losses by geographic location, flock type (commercial or

backyard), species grouping, AI subtype, confirmation date, and flock size. For the purpose of this

report, Informa has isolated only the losses falling under the species grouping labeled Chickens.

While APHIS does not differentiate the specific type of chicken in its reporting, other information

sources available to the public suggest that the overwhelming majority all the chickens that have been

infected are table egg laying hens as opposed to broilers.

775 Ridge Lake Boulevard, Suite 400 ~ Memphis, Tennessee 38120-9403 ~ Telephone 901.202.4600 ~ Fax 901.766.4402

http://www.informaecon.com

Egg Sector Update

EG15-04

May 12, 2015

State

County

Iowa

Wright

Iowa

Sioux

Iowa

Sioux

Iowa

Wright

Iowa

Sioux

Iowa

Sioux

Iowa

Osceola

Iowa

Wright

Minnesota

Nicollet

Iowa

Madison

Iowa

Sioux

Iowa

Kossuth

Iowa

Clay

Iowa

Buena Vista

Iowa

Buena Vista

Minnesota

Stearns

Iowa

Sioux

Iowa

Osceola

Iowa

O'Brien

Iowa

O'Brien

Iowa

Sioux

Wisconsin

Jefferson

Minnesota

Clay

Iowa

Osceola

Wisconsin

Jefferson

California

Kings

Washington

Okanogan

Source: USDA/APHIS

Page 2

Flyway

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Mississippi

Pacific

Pacific

Flock Type

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Commercial

Backyard

Species

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

Chickens

AI Subtype

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA/AM-H5N2

EA-H5N8

EA/AM-H5N2

Conf. Date

8-May-15

8-May-15

8-May-15

7-May-15

7-May-15

7-May-15

7-May-15

5-May-15

5-May-15

4-May-15

1-May-15

1-May-15

1-May-15

1-May-15

30-Apr-15

29-Apr-15

28-Apr-15

28-Apr-15

28-Apr-15

28-Apr-15

27-Apr-15

24-Apr-15

23-Apr-15

20-Apr-15

11-Apr-15

12-Feb-15

3-Feb-15

Total:

Flock Size

pending

581,300

100,000

2,800,000

pending

1,000,000

100,000

1,031,200

pending

1,795,900

165,200

18,800

93,000

5,700,000

40,800

202,500

3,660,000

258,000

98,000

240,000

1,700,000

1,031,000

175,000

3,800,000

200,000

112,900

40

24,903,640

As the table indicates, just short of 25 million chickens almost all table egg laying hens have been

lost in this outbreak in just the past month alone in Iowa, Minnesota, and Wisconsin. There are multiple

pending cases, most likely situations in which the mortality rate is elevated and AI is suspected but

additional testing is still needed, which could easily push that total to more than 30 million by midweek.

Coupled with the losses experienced in the turkey sector between 5.5 and 6.0 million birds based on

recent counts its now safe to say that the current AI outbreak has moved into unprecedented territory.

The last time anything similar happened in the US was 1983 when a total of 17 million birds,

predominantly in the Northeast, of all species were lost. Arguably the 2003-04 outbreak would still be

considered more significant than the present one from a global perspective as the animal death loss

totaled in excess of 100 million while the effects on human health were also devastating.

That 2003-04 outbreak that rocked Southeast Asia was difficult to contain given the lack of modernity

in production systems there. Whats making the current spread of H5N2 through the Midwest so

troublesome and confounding to many health officials working to contain and eradicate it is that the

US poultry and egg sector is supposedly the world leader in housing technology and biosecurity

measures. The advanced housing systems in place here in the US are supposed to limit the flocks

exposure to outside elements and specifically other animals that transmit infectious diseases such as

rodents or migratory birds while making containment easier should contamination occur. In the

Midwest, containment has been an elusive concept, which suggests the possibility of widespread lapses

in biosecurity measures but may also indicate just how potent the H5N2 subtype is and how remarkably

capable it is in moving from place to place. This naturally leads into a question of just how many more

birds may be at risk given the difficulty containing AI up to this point.

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 3

Below is a snapshot of key Midwest states and breakdown of how many table egg layers can be found

in each and what that means in terms of share of total inventories on the national stage. Iowa is

suffering the biggest losses, and its the state with the most layers in the US by a fairly wide margin.

Reiterating the point from above about current pending cases, the number of table egg layers lost to

H5N2 in Iowa, Minnesota, and Wisconsin is likely to exceed 30 million by midweek. According to

USDA/NASS, there were slightly more than 70 million layers on hand, on average, in those three states

in 2014. You can add an additional 40-45 million hens possibly at risk in Illinois, Indiana, and

Michigan, which is only notable as a backyard poultry flock in Indiana is likely to test positive for the

H5N8 subtype of AI very soon following a weekend discovery. This subtype has been present in other

areas as part of this broader outbreak, although it hasnt been moving with anywhere near the intensity

and ferocity of the H5N2 subtype. As health officials continue to warn, however, adaptations and

mutations can and do happen, meaning complacency is not an option regardless of the subtype. One

other consideration if AI spears to be heading east is the fact that theres another 50+ million table egg

laying hens in Ohio and Pennsylvania combined.

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 4

It has come up a few times in this report that health officials seem almost baffled as to why current

containment efforts appear to be falling short, and Informa mentioned at the outset that AI has long had

a reputation of being sporadic and unpredictable. With that in mind, hazarding a guess as to the

ultimate damage to US egg industry could very well be an exercise in futility at this point. Informa will

simply do its best based on the current understanding, limited as it is, of this AI outbreak and what has

been generally observed in past ones, taking geographic, seasonal, and biosecurity factors into

consideration. Death losses should soon exceed 30 million table egg layers. The speed at which the

outbreak is moving makes a hard stop to its spread seem highly unlikely. There are at least another 3040 million hens under at least a moderate threat level with another 40-50 million hens that carry a

limited risk of getting infected near-term. Health and veterinary officials have had some time now to

assess the situation and should be able to use their recent lack of success as a way of developing a better

plan of action. On top of that, the approach of summer and arrival of hotter, dryer weather is supposed

to make it more difficult for AI to survive even over shorter journeys. There should still be a few more

cases pop up in the coming weeks, but Informa expects the losses to start tapering off soon. An

additional 10-15 million hens are expected to be lost on top of whats already confirmed and pending

additional testing. That would put total layer inventory losses at around 40-45 million. The graphic

below illustrates death loss trends with the current and projected impact from AI and indicates what the

effect on overall layer inventories will be going forward.

Exceptional profitability throughout the US egg industry last year was fueling an aggressive

expansionary push by many producers, even with uncertainty around the implementation of Proposition

2 in California. Breeding hen inventories reached an all-time high earlier this year, and the replacement

stock from those layers was expected to push the overall table egg laying flock to at least 310-315

million during the second half of 2015. Mounting death losses due to AI will derail that surge in layer

inventories, pushing the flock back down into the 260-270 million range by late summer. Assuming the

virus just fades naturally and/or US egg industry gets much better equipped at handling it, layer

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 5

inventories will be poised for a V-shaped recovery later this year and should keep growing rapidly

through next year. Given the extensive damage done to inventories in the coming months, it will still

take a year or more in a rebuilding effort to get table egg layer numbers back above the 300-million

mark. All these missing layers represent lost egg production as well, which will put a squeeze on shell

egg and egg product supplies for a while to come.

Unlike the US broiler and turkey sectors, the US egg industry has maintained a healthy export program

during this unfolding AI mess. Shipments of US broiler meat were down 11% from year prior levels

during the January-March time period while turkey meat shipments were down 5.8% from year-ago

during that same time period. As the chart above reflects, total US table egg exports during the first

three months of 2015 registered at 1.19 billion eggs (shell egg equivalent), which represented a 20%

increase from year-ago. Export gains during that time period were led by Canada (+16%) and Mexico

(+84%), with the latter a particularly aggressive buyer of US eggs, importing 455 million during the

January-March time period. Mexico is the top consumer of eggs in the world on a per capita basis, and

they have stepped up purchases of US eggs considerably the past 2-3 years due to persistent production

shortfalls related to an outbreak of the H7N3 subtype of AI. Export business has been booming lately,

but Informa sees shipments declining sharply relative to year-ago levels through the balance of 2015, if

for no other reason than a drastic reduction in production capabilities will leave significantly fewer eggs

available to export. Sharp price increases in the near-term will also make eggs cost-prohibitive for some

foreign buyers. A slowdown on the export side will help to some degree with domestic availability,

although it pales in comparison the squeeze that will result from lost production. The recent growth

trajectory of the US egg industry was about to put per capita availability of table eggs in the US at a

three-decade high, but catastrophic losses from AI should easily prevent that from happening.

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 6

Per capita availability of table eggs in the US is charted below on an annual basis since the early 1990s

and includes Informas outlook for both 2015 and 2016 as well. Egg supplies are broken down into the

shell egg and further-processed components. Egg product supplies were record large on a per capita

basis in 2014 and were poised to increase an additional 4%-5%, at least, this year before AI struck.

Based on the geography of farms that have been impacted by the virus and how prices across the entire

egg segment are responding, it appears that the most of the negative impact has been on operations that

supply eggs for the processing segment of the industry as opposed to the shell egg side of the business.

Regardless, both sectors are poised to incur massive supply losses this year, and per capita availability

of all table eggs is projected at 240.5 (shell egg equivalent) overall in 2015. That would represent the

smallest per capita supply total since 1998. Informa sees a decent 3%-4% recovery in per capita

supplies next year, but the industry needs to get to a point where it seems theyre putting AI behind

them before we can feel very confident about that outlook.

Supply losses are going to be deep and painful, notably for buyers and ultimately consumers that will be

forced to pay higher prices for eggs, shell or processed. It will also be very painful and costly for the

suppliers of these shell and processed eggs that have lost so many millions of birds. Egg producers

unaffected by the outbreak will enjoy surging sales at exceptional price points, creating one of the

biggest windfalls of all-time. This all assumes that demand largely holds together, which is hardly a

guarantee when dealing with an animal health issue that is at least tangentially related to human health

and may wind up being more directly related going forward. As the chart below (next page) indicates,

shell egg demand went through a relative soft patch through much of 2010 and early 2011, and this is

often attributed to a salmonella outbreak when nearly 2,000 human illnesses were reported.

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 7

Demand has held together relatively well this time around despite heightened coverage of the AI

outbreak in mainstream press. Informa doesnt see that changing much so long as the virus behavior

remains fairly consistent in terms of being lethal only for birds. If that leap into the human population is

made and illness and even death becomes widespread, demand could wind up unraveling just as fast

as the supply side has as losses have mounted. Assuming demand holds together reasonably well,

however, spot prices across the entire complex are poised to be incredibly strong for at least the next

few months until some supply relief is finally made available. Buyers should be prepared for a volatile,

unpredictable, and likely uncomfortable ride over the next several months. Informa has shifted its price

outlook for all key markets sharply higher in lieu of recent developments, and there is likely

considerable upside risk beyond what the outlook suggests.

Due to the pressing and explosive nature of the AI situation, Informa believed it necessary to devote as

much commentary as possible to the topic. Attached to the end of this report is the regular set of tables

and charts that provide updates on the extended set of supply variables and prices that are typically

discussed in greater detail. Due to the constantly evolving nature of this AI outbreak, Informa

encourages readers to reach out to Mark Jordan, Director of Poultry Egg Services, directly at (901) 2024412 to stay abreast of developments.

MWJ

This copyrighted material is intended for the use of clients of Informa Economics, Inc., only and may not be reproduced or electronically

transmitted to other companies or individuals, whole or in part, without the prior written permission of Informa Economics, Inc. The information

contained herein is believed to be reliable and the views expressed within this document reflect judgments at this time and are subject to change

without notice. Informa Economics, Inc., does not guarantee that the information contained herein is accurate or complete and it should not be

relied upon as such.

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 8

EGG PRODUCTION DURING MONTH, TABLE EGG TYPE, MILLION EGGS

YEAR

2012

2013

2014

2015

2016

% change 14/13

% change 15/14

% change 16/15

14 cumulative

15 cumulative

16 cumulative

% cum chg 14/13

% cum chg 15/14

% cum chg 16/15

JAN

FEB

MAR

APR

MAY

JUN

JUL

6,912

6,361

6,934

6,690

6,852

6,622

6,832

7,160

6,437

7,198

6,954

7,124

6,878

7,085

7,321

6,579

7,354

7,160

7,336

7,091

7,404

7,428

6,612

7,417

6,983

6,842

6,361

6,430

6,193

6,931

6,753

6,972

6,801

7,104

6,844

2.2%

2.2%

2.2%

3.0%

3.0%

3.1%

4.5%

1.5%

0.5%

0.9% -2.5% -6.7% -10.3% -13.2%

-7.9% -6.3% -6.6% -3.3%

1.9%

6.9% 10.5%

7,321 13,900 21,254 28,414 35,750 42,841 50,245

7,428 14,040 21,457 28,440 35,282 41,643 48,073

6,844 13,037 19,968 26,721 33,693 40,494 47,598

2.2%

2.2%

2.2%

2.4%

2.5%

2.6%

2.9%

1.5%

1.0%

1.0%

0.1% -1.3% -2.8% -4.3%

-7.9% -7.1% -6.9% -6.0% -4.5% -2.8% -1.0%

TABLE EGG LAYERS, 1st OF MONTH, MILLION HENS

YEAR

2012

2013

2014

2015

2016

% change 14/13

% change 15/14

% change 16/15

JAN

290.1

298.6

304.3

308.2

281.7

1.9%

1.3%

-8.6%

FEB

289.1

298.8

302.3

304.6

281.0

1.2%

0.8%

-7.7%

MAR

290.3

300.6

303.0

304.7

283.0

0.8%

0.6%

-7.1%

APR

291.1

300.2

304.4

303.1

285.1

1.4%

-0.4%

-5.9%

MAY

289.3

296.0

304.3

289.7

285.6

2.8%

-4.8%

-1.4%

JAN

23.9

24.0

24.1

24.2

24.3

0.7%

0.5%

0.3%

FEB

22.0

21.5

21.7

21.7

22.0

1.2%

-0.2%

1.2%

MAR

23.9

24.0

24.2

24.4

24.4

1.0%

0.7%

0.0%

APR

23.1

23.3

23.5

23.6

23.7

0.9%

0.2%

0.4%

MAY

23.7

24.0

24.2

24.2

24.3

0.6%

0.2%

0.5%

JUN

23.0

23.2

23.4

23.4

23.5

1.0%

0.1%

0.5%

JUL

23.8

23.8

24.3

24.2

24.3

2.1%

-0.6%

0.5%

EGG-TYPE CHICKS HATCHED DURING MONTH, MILLION CHICKS

YEAR

2012

2013

2014

2015

2016

% change 14/13

% change 15/14

% change 16/15

14 cumulative

15 cumulative

16 cumulative

% cum chg 14/13

% cum chg 15/14

% cum chg 16/15

JAN

41.3

43.8

44.5

44.2

46.9

1.4%

-0.6%

6.1%

44.5

44.2

46.9

1.4%

-0.6%

6.1%

FEB

40.5

42.2

41.0

43.1

44.7

-3.0%

5.1%

3.7%

85.4

87.3

91.6

-0.7%

2.1%

4.9%

MAR

43.1

43.6

44.2

50.4

49.2

1.5%

14.0%

-2.4%

129.7

137.7

140.7

0.0%

6.2%

2.2%

APR

43.2

46.0

45.7

50.0

49.8

-0.7%

9.4%

-0.3%

175.4

187.7

190.6

-0.2%

7.0%

1.5%

MAY

44.6

50.2

49.1

50.6

51.9

-2.0%

3.0%

2.5%

224.5

238.3

242.4

-0.6%

6.1%

1.8%

JUN

38.8

42.3

44.0

44.8

45.6

4.2%

1.7%

1.9%

268.5

283.0

288.1

0.2%

5.4%

1.8%

JUL

36.0

39.9

42.3

42.2

43.1

5.9%

-0.1%

2.1%

310.8

325.3

331.2

0.9%

4.7%

1.8%

JAN

4.6

7.0

20.8

22.1

39.4

10.2

FEB

(5.1)

4.7

36.9

37.1

31.5

10.3

MAR

2.4

11.2

36.8

70.8

41.2

14.0

APR

(3.1)

(0.3)

46.4

29.6

26.2

10.1

MAY

(16.1)

7.5

28.0

37.9

24.6

(0.4)

JUN

(6.1)

(4.5)

27.8

40.6

23.8

(0.1)

JUL

(1.9)

10.3

37.5

46.9

30.9

7.2

DEC

301.7

306.1

310.1

280.9

310.2

1.3%

-9.4%

10.4%

AVG

291.5

299.6

304.8

284.7

291.9

1.7%

-6.6%

2.5%

Informa forecast in bold.

AUG

SEP

OCT

NOV

23.9

23.1

23.9

23.4

24.0

23.4

24.2

23.6

24.2

23.3

24.3

23.9

24.2

23.5

24.3

23.8

24.4

23.6

24.5

23.9

0.9% -0.6%

0.1%

1.3%

0.2%

0.9%

0.3% -0.3%

0.5%

0.4%

0.5%

0.5%

DEC

TOTAL

24.2

281.6

24.3

283.3

24.7

285.8

24.6

286.2

24.8

287.6

1.5%

0.9%

-0.2%

0.1%

0.5%

0.5%

Informa forecast in bold.

AUG

SEP

OCT

NOV

42.3

38.3

37.9

36.5

38.8

42.2

42.5

41.8

39.8

43.7

44.5

36.5

43.5

44.4

44.5

41.6

45.0

45.6

45.2

42.4

2.6%

3.7%

4.6% -12.7%

9.2%

1.5%

0.1% 13.9%

3.6%

2.6%

1.6%

1.8%

350.6

394.4

438.8

475.4

368.8

413.2

457.7

499.3

376.2

421.8

467.0

509.4

1.1%

1.4%

1.7%

0.4%

5.2%

4.8%

4.3%

5.0%

2.0%

2.1%

2.0%

2.0%

DEC

TOTAL

41.0

483.4

41.1

514.5

43.0

518.3

44.2

543.4

43.7

553.1

4.5%

0.8%

2.8%

4.8%

-1.1%

1.8%

518.3

543.4

553.1

0.8%

4.8%

1.8%

AVERAGE EGG INDUSTRY MARGINS, CENTS/DOZEN (Informa calc.)

YEAR

2012

2013

2014

2015

2016

10-14 average

Informa forecast in bold.

SEP

OCT

NOV

DEC

TOTAL

6,727

7,046

7,022

7,263

82,183

7,028

7,300

7,172

7,422

84,944

7,126

7,433

7,353

7,633

87,184

6,363

6,670

6,628

6,934

81,144

7,064

7,405

7,352

7,683

84,318

1.4%

1.8%

2.5%

2.8%

2.6%

-10.7% -10.3% -9.9% -9.2%

-6.9%

11.0% 11.0% 10.9% 10.8%

3.9%

64,765 72,198 79,551 87,184

60,912 67,582 74,210 81,144

61,878 69,283 76,635 84,318

2.7%

2.6%

2.6%

2.6%

-5.9% -6.4% -6.7% -6.9%

1.6%

2.5%

3.3%

3.9%

Informa forecast in bold.

JUN

JUL

AUG

SEP

OCT

NOV

289.1

287.5

287.8

290.6

292.9

297.8

297.2

296.7

298.0

300.9

299.3

303.0

302.9

303.1

305.2

305.6

306.4

306.2

275.8

267.3

264.3

269.8

271.9

276.4

287.7

290.2

293.9

298.3

300.5

305.1

1.9%

2.1%

2.4%

1.6%

2.4%

1.1%

-9.0% -11.8% -13.4% -11.7% -11.3% -9.7%

4.3%

8.6% 11.2% 10.5% 10.5% 10.4%

TABLE EGG PRODUCTION PER LAYER DURING MONTH (Informa calc.)

YEAR

2012

2013

2014

2015

2016

% change 14/13

% change 15/14

% change 16/15

AUG

6,922

7,186

7,394

6,476

7,216

2.9%

-12.4%

11.4%

57,639

54,549

54,814

2.9%

-5.4%

0.5%

AUG

12.8

18.6

32.9

54.0

35.5

16.4

Informa forecast in bold.

SEP

OCT

NOV

13.5

9.7

19.2

19.0

21.3

41.7

33.5

34.7

53.0

52.5

53.3

61.3

35.0

35.4

49.0

13.9

14.5

31.4

DEC

15.4

48.4

84.7

75.5

64.3

39.3

AVG

3.8

15.4

39.4

48.5

36.4

13.9

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 9

Informa Economics

EGG & EGG PRODUCT PRICE FORECASTS

low end of reported range

2013

JFM

Eggs (cents/dozen)

Table Eggs, Midwest, Large, A

UB NE Shell Eggs, Large, White

UB MW Shell Eggs, Large, White

UB National Breaking Stock

2013

AMJ

2013

JAS

2013

OND

2014

JFM

2014

AMJ

2014

JAS

2014

OND

2015

JFM

2015

AMJ

2015

JAS

Informa forecast in bold.

2015 2016 2016 2016

OND JFM AMJ JAS

2016

OND

CURRENT

PRICE

119

133

131

66

103

116

113

65

112

125

123

78

136

149

147

90

133

149

147

85

132

141

140

102

122

135

134

82

158

167

170

99

149

153

150

76

129

137

134

93

145

160

158

106

159

172

172

108

134

144

142

80

114

123

121

84

122

136

134

90

142

153

154

99

5/11/2015

117

139

139

104

56

51

87

60

66

76

73

77

76

76

88

66

71

91

59

93

121

65

76

124

65

82

101

67

63

62

76

78

73

93

85

86

84

91

85

83

67

65

72

72

70

78

76

78

77

81

76

78

91

75

94

UB Dried Whole Eggs

UB Dried Albumen

UB Dried Yolk

273

482

242

277

604

201

311

728

195

323

816

173

308

901

152

396

1309

153

393

1424

151

383

1199

159

330

840

187

378

801

236

399

846

254

401

725

252

338

600

217

346

642

210

367

703

222

374

648

226

375

745

235

UB Frozen

UB Frozen

UB Frozen

UB Frozen

73

68

108

105

78

84

94

91

91

94

93

90

95

107

87

84

90

113

80

77

118

140

83

80

110

144

83

80

104

125

85

82

79

83

92

89

98

95

116

113

117

113

111

108

119

107

103

100

89

84

94

91

95

87

98

95

105

96

99

95

105

93

97

94

105

89

110

107

Egg Products (cents/lb)

UB Raw Liquid Whole Eggs

UB Raw Liquid Whites

UB Raw Liquid Yolks

Whole Eggs

Whites

Sugar Yolk

Salted Yolk

TABLE EGG TYPE LAYERS, PULLETS ADDED, AND LAYERS CULLED / REMOVED (million birds)

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

JFM

AMJ

JAS

OND

2010

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

285.2 282.8 284.1 285.7 282.0 282.4 283.6 282.2 284.9 280.9 280.9 285.8 284.0 283.4 283.6 282.5

20.7 23.0 24.0 21.9 23.2 24.1 22.7 20.6 23.2 22.6 23.3 24.0 67.7 69.2 66.5 69.9

23.1 21.7 22.3 25.7 22.8 22.9 24.0 17.9 27.2 22.6 18.4 23.0 67.1 71.4 69.2 64.0

8.1% 7.7% 7.9% 9.0% 8.1% 8.1% 8.5% 6.3% 9.6% 8.0% 6.6% 8.1% 7.9% 8.4% 8.1% 7.5%

2011

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

286.8 283.2 282.2 284.7 281.5 278.6 281.6 281.6 284.6 285.0 287.9 290.4 284.1 281.6 282.6 287.8

22.0 22.3 26.2 21.8 23.8 23.1 22.2 22.1 23.8 22.4 21.1 24.4 70.5 68.8 68.1 67.8

25.6 23.3 23.7 25.0 26.8 20.1 22.3 19.1 23.4 19.5 18.7 24.6 72.7 71.8 64.7 62.7

8.9% 8.2% 8.4% 8.8% 9.5% 7.2% 7.9% 6.8% 8.2% 6.8% 6.5% 8.5% 8.5% 8.5% 7.6% 7.3%

2012

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

290.1 289.1 290.3 291.1 289.3 289.1 287.5 287.8 290.6 292.9 297.8 301.7 289.9 289.8 288.7 297.5

22.9 23.9 24.3 22.3 26.5 24.9 20.3 26.5 23.0 23.3 24.0 21.9 71.1 73.7 69.8 69.2

23.9 22.7 23.6 24.1 26.8 26.4 20.0 23.7 20.8 18.4 20.0 25.1 70.1 77.3 64.5 63.5

8.2% 7.8% 8.1% 8.3% 9.3% 9.1% 7.0% 8.2% 7.2% 6.3% 6.7% 8.3% 8.1% 8.9% 7.4% 7.1%

2013

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

298.6 298.8 300.6 300.2 296.0 297.2 296.7 298.0 300.9 299.3 303.0 306.1 299.3 297.8 298.5 302.8

25.0 23.5 25.2 23.0 25.6 23.3 23.9 21.8 24.2 26.4 23.9 23.7 73.7 71.8 69.8 74.0

24.8 21.7 25.5 27.2 24.5 23.7 22.6 18.9 25.8 22.7 20.8 25.5 72.0 75.3 67.3 68.9

8.3% 7.3% 8.5% 9.0% 8.3% 8.0% 7.6% 6.3% 8.6% 7.6% 6.9% 8.3% 8.0% 8.4% 7.5% 7.6%

2014

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

304.3 302.3 303.0 304.4 304.3 302.9 303.1 305.2 305.6 306.4 306.2 310.1 303.2 303.9 304.6 307.6

22.8 24.5 24.2 24.2 24.6 23.2 25.6 25.0 23.3 24.9 23.6 23.7 71.6 72.0 74.0 72.2

24.8 23.9 22.8 24.4 25.9 23.1 23.5 24.7 22.5 25.1 19.8 25.6 71.5 73.3 70.6 70.4

8.1% 7.9% 7.5% 8.0% 8.5% 7.6% 7.7% 8.1% 7.4% 8.2% 6.5% 8.2% 7.9% 8.0% 7.7% 7.6%

2015

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

308.2 304.6 304.7 303.1 289.7 275.8 267.3 264.3 269.8 271.9 276.4 280.9 305.8 289.5 267.1 276.4

23.9 23.3 25.1 21.9 26.7 25.0 24.7 26.6 26.1 26.2 25.2 25.7 72.3 73.6 77.4 77.1

27.4 23.2 26.8 35.3 40.6 33.5 27.7 21.1 24.1 21.7 20.7 24.9 77.4 109.4 72.8 67.3

8.9% 7.6% 8.8% 11.7% 14.0% 12.1% 10.4% 8.0% 8.9% 8.0% 7.5% 8.9% 8.4% 12.6% 9.1% 8.1%

2016

TABLE EGG LAYERS, 1st OF MONTH

PULLETS ADDED DURING MONTH

LAYERS CULLED / REMOVED

% OF LAYERS CULLED / REMOVED

281.7 281.0 283.0 285.1 285.6 287.7 290.2 293.9 298.3 300.5 305.1 310.2 281.9 286.1 294.2 305.3

25.4 25.6 27.3 24.7 27.8 26.1 25.5 26.6 26.3 26.9 25.7 26.1 78.3 78.6 78.4 78.8

26.1 23.7 25.1 24.2 25.7 23.6 21.8 22.3 24.2 22.3 20.7 22.9 74.9 73.5 68.2 65.9

9.3% 8.4% 8.9% 8.5% 9.0% 8.2% 7.5% 7.6% 8.1% 7.4% 6.8% 7.4% 8.9% 8.6% 7.7% 7.2%

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 10

EGGS PROCESSED UNDER FEDERAL INSPECTION

Million Eggs Broken, Weekly

2012

2013

2014

Week Ended

Weekly

Weekly

Weekly

495

512

496

1/10/2015

479

494

504

1/17/2015

475

480

487

1/24/2015

456

466

498

1/31/2015

472

489

486

2/7/2015

470

494

485

2/14/2015

455

489

485

2/21/2015

463

489

494

2/28/2015

472

488

499

3/7/2015

455

483

506

3/14/2015

452

491

502

3/21/2015

448

482

501

3/28/2015

469

513

523

4/4/2015

490

525

503

4/11/2015

499

517

529

4/18/2015

494

516

534

4/25/2015

522

507

555

5/2/2015

510

501

552

5/9/2015

507

495

547

5/16/2015

492

512

551

5/23/2015

472

510

529

5/30/2015

512

549

550

6/6/2015

507

547

567

6/13/2015

509

532

564

6/20/2015

491

513

569

6/27/2015

467

496

515

7/4/2015

512

539

554

7/11/2015

495

541

535

7/18/2015

496

529

547

7/25/2015

488

550

532

8/1/2015

536

535

541

8/8/2015

541

541

541

8/15/2015

548

529

541

8/22/2015

537

525

536

8/29/2015

512

503

527

9/5/2015

497

523

570

9/12/2015

494

521

552

9/19/2015

505

514

550

9/26/2015

522

518

547

10/3/2015

508

525

530

10/10/2015

499

519

551

10/17/2015

493

524

551

10/24/2015

478

506

542

10/31/2015

512

508

554

11/7/2015

506

494

531

11/14/2015

456

488

519

11/21/2015

500

454

464

11/28/2015

507

503

529

12/5/2015

493

491

494

12/12/2015

500

491

526

12/19/2015

520

451

484

12/26/2015

468

477

484

1/2/2016

Source: USDA/AMS Weekly Processed Eggs Report

Informa forecast in bold.

2015

2012

2013

2014

2015

2015/2014

Weekly

Cumulative Cumulative Cumulative Cumulative % of last year

565

495

512

496

565

113.91%

543

974

1,006

1,000

1,108

110.84%

524

1,449

1,486

1,486

1,632

109.83%

532

1,905

1,952

1,984

2,164

109.09%

530

2,377

2,441

2,470

2,694

109.07%

520

2,847

2,935

2,956

3,214

108.74%

510

3,302

3,424

3,441

3,724

108.23%

513

3,765

3,913

3,936

4,237

107.67%

496

4,237

4,401

4,435

4,733

106.74%

487

4,693

4,884

4,941

5,221

105.67%

494

5,145

5,375

5,442

5,715

105.01%

496

5,593

5,857

5,943

6,210

104.50%

506

6,062

6,370

6,467

6,716

103.86%

524

6,552

6,895

6,970

7,241

103.89%

521

7,050

7,412

7,498

7,762

103.52%

526

7,544

7,928

8,033

8,288

103.18%

512

8,066

8,436

8,587

8,800

102.47%

8,576

8,937

9,139

495

9,295

101.70%

9,083

9,432

9,686

488

9,783

101.00%

9,575

9,944

10,236

490

10,273

100.35%

10,047

10,454

10,765

468

10,740

99.77%

10,559

11,003

11,316

496

11,236

99.29%

11,067

11,550

11,882

508

11,744

98.83%

11,576

12,082

12,446

505

12,249

98.41%

12,067

12,596

13,015

510

12,759

98.03%

12,533

13,092

13,531

469

13,228

97.76%

13,045

13,631

14,085

504

13,732

97.49%

13,541

14,172

14,619

487

14,219

97.26%

14,037

14,701

15,166

499

14,718

97.04%

14,525

15,251

15,698

486

15,204

96.85%

15,061

15,786

16,239

469

15,673

96.52%

15,601

16,327

16,780

469

16,142

96.20%

16,149

16,857

17,320

468

16,610

95.90%

16,686

17,381

17,857

463

17,074

95.61%

17,198

17,884

18,384

483

17,557

95.50%

17,695

18,407

18,954

523

18,080

95.39%

18,189

18,928

19,506

506

18,586

95.29%

18,695

19,442

20,056

506

19,092

95.19%

19,216

19,960

20,603

504

19,596

95.11%

19,724

20,485

21,133

480

20,076

95.00%

20,222

21,004

21,684

500

20,576

94.89%

20,716

21,528

22,235

500

21,075

94.78%

21,193

22,033

22,777

491

21,566

94.68%

21,705

22,542

23,331

473

22,039

94.46%

22,211

23,036

23,861

452

22,491

94.26%

22,667

23,524

24,380

440

22,932

94.06%

23,167

23,978

24,844

393

23,324

93.88%

23,673

24,481

25,373

484

23,809

93.83%

24,167

24,972

25,867

452

24,261

93.79%

24,666

25,463

26,393

482

24,743

93.75%

25,186

25,914

26,877

444

25,187

93.71%

25,654

26,392

27,362

446

25,633

93.68%

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 11

SHELL EGGS BROKEN AND EGG PRODUCT PRODUCTION

YEAR

JAN

FEB

M AR

APR

MAY

SHELL EGGS BROKEN, MILLION EGGS

2,040

1,988

2,057

2,028

2,181

2012

2,075

1,935

2,099

2,142

2,095

2013

2,112

1,917

2,191

2,234

2,345

2014

2,388

2,068

2,171

2015

2,025

1,940

2016

2,099

2,122

2,356

2,111

2,205

1.7%

-0.9%

4.4%

4.3% 11.9%

% change 14/13

13.1%

7.9%

-0.9%

-9.3% -17.3%

% change 15/14

2.6%

8.5%

4.2% 13.6%

% change 16/15 -12.1%

2,112

4,029

6,220

8,454 10,799

14 cumulative

2,388

4,457

6,628

8,653 10,593

15 cumulative

2,099

4,220

6,577

8,688 10,893

16 cumulative

EDIBLE LIQUID WHOLE EGG PRODUCTION, MILLION POUNDS

134.4

129.0

137.7

127.4

136.3

2012

135.4

128.3

140.9

137.2

131.3

2013

130.3

117.5

136.5

138.0

147.4

2014

150.3

132.1

145.9

2015

123.3

116.9

2016

130.0

130.6

149.1

128.4

131.9

-3.8%

-8.4%

-3.1%

0.6% 12.3%

% change 14/13

15.4% 12.4%

6.9% -10.7% -20.7%

% change 15/14

-1.1%

2.2%

4.2% 12.9%

% change 16/15 -13.5%

130.3

247.8

384.3

522.4

669.8

14 cumulative

150.3

282.4

428.3

551.6

668.4

15 cumulative

130.0

260.7

409.7

538.1

670.0

16 cumulative

EDIBLE LIQUID WHITE PRODUCTION, M ILLION POUNDS

58.0

57.4

57.1

60.7

64.6

2012

56.6

53.5

56.3

62.9

63.8

2013

66.2

60.0

66.8

69.8

71.1

2014

72.4

60.3

59.6

2015

63.6

61.9

2016

62.9

64.4

69.0

65.4

69.9

16.9% 12.1% 18.8% 11.0% 11.5%

% change 14/13

9.3%

0.5% -10.8%

-9.0% -12.9%

% change 15/14

6.9% 15.7%

3.0% 13.0%

% change 16/15 -13.1%

66.2

126.2

193.0

262.8

333.9

14 cumulative

72.4

132.7

192.3

255.8

317.7

15 cumulative

62.9

127.3

196.3

261.7

331.7

16 cumulative

EDIBLE LIQUID YOLK PRODUCTION, MILLION POUNDS

30.1

29.3

29.2

30.2

34.1

2012

29.8

27.0

28.9

31.6

32.6

2013

32.8

30.4

33.9

33.4

34.9

2014

35.3

30.5

29.5

2015

32.5

31.8

2016

33.6

34.5

37.1

34.2

36.9

10.2% 12.6% 17.1%

5.6%

7.1%

% change 14/13

7.6%

0.3% -12.8%

-2.7%

-8.8%

% change 15/14

-5.0% 13.3% 25.7%

5.4% 15.8%

% change 16/15

32.8

63.2

97.1

130.4

165.3

14 cumulative

35.3

65.8

95.3

127.8

159.6

15 cumulative

33.6

68.1

105.2

139.4

176.3

16 cumulative

TOTAL EDIBLE LIQUID PRODUCTION, M ILLION POUNDS

222.5

215.8

224.0

218.4

235.0

2012

221.8

208.7

226.1

231.7

227.7

2013

229.3

207.8

237.2

241.2

253.4

2014

258.0

222.8

235.1

219.3

210.6

2015

2016

226.5

229.5

255.2

228.1

238.6

3.4%

-0.4%

4.9%

4.1% 11.3%

% change 14/13

12.5%

7.2%

-0.9%

-9.1% -16.9%

% change 15/14

3.0%

8.6%

4.0% 13.3%

% change 16/15 -12.2%

229.3

437.2

674.4

915.6 1,169.1

14 cumulative

258.0

480.8

715.9

935.2 1,145.7

15 cumulative

226.5

456.0

711.2

939.3 1,177.9

16 cumulative

DRIED EGG PRODUCTION, MILLION POUNDS

13.7

11.6

10.0

12.5

15.1

2012

13.9

11.1

9.3

13.2

13.1

2013

13.7

11.2

11.2

11.8

12.4

2014

12.9

10.8

9.6

11.8

2015

13.3

2016

13.7

11.8

11.1

12.0

13.9

-1.1%

0.5% 20.9% -10.7%

-5.0%

% change 14/13

-5.8%

-3.5% -14.5%

-0.2%

7.1%

% change 15/14

5.6%

9.6% 15.4%

2.1%

4.8%

% change 16/15

13.7

24.9

36.2

48.0

60.4

14 cumulative

12.9

23.7

33.3

45.1

58.4

15 cumulative

13.7

25.5

36.6

48.6

62.6

16 cumulative

Source: USDA/NASS M onthly Egg Products Report

JUN

JUL

AUG

2,144

2,202

2,351

2,208

2,414

6.8%

-6.1%

9.3%

13,150

12,802

13,307

2,069

2,256

2,382

2,180

2,157

5.6%

-8.5%

-1.1%

15,532

14,981

15,463

2,348

2,232

2,375

2,031

2,439

6.4%

-14.5%

20.1%

17,907

17,012

17,902

Informa forecast in bold.

SEP

OCT

NOV

25,372

25,609

27,146

25,332

26,866

6.0%

-6.7%

6.1%

138.5

146.7

143.2

132.6

145.7

-2.4%

-7.4%

9.8%

813.0

801.0

815.7

135.6

150.5

143.9

147.2

137.3

145.3

141.7

147.6

141.2

143.6

130.9

138.3

141.4

149.0

149.4

155.3

145.6

143.0

130.0

125.0

135.7

131.1

120.4

132.0

128.2

150.2

146.9

135.8

139.7

138.8

-0.2%

0.9%

5.8%

8.1% 11.2%

3.4%

-8.1% -16.1%

-9.2% -15.6% -17.3%

-7.7%

-1.4% 20.1%

8.3%

3.6% 16.1%

5.2%

954.4 1,103.4 1,252.7 1,408.1 1,553.6 1,696.6

931.0 1,056.1 1,191.8 1,322.8 1,443.2 1,575.2

943.9 1,094.1 1,241.0 1,376.8 1,516.6 1,655.4

1,663.1

1,663.1

1,696.6

1,575.2

1,655.4

2.0%

-7.2%

5.1%

62.5

61.0

72.9

70.2

75.1

19.5%

-3.7%

6.9%

406.9

387.9

406.7

56.1

65.1

73.6

66.8

65.3

13.1%

-9.2%

-2.4%

480.5

454.8

472.0

67.4

61.5

71.4

60.5

72.2

16.1%

-15.3%

19.4%

551.9

515.2

544.2

59.3

62.0

72.4

66.4

70.8

16.7%

-8.3%

6.6%

624.3

581.7

615.0

58.5

68.4

69.8

61.0

63.1

2.1%

-12.6%

3.5%

694.1

642.6

678.1

52.3

61.6

61.2

57.3

65.6

-0.6%

-6.4%

14.5%

755.3

699.9

743.7

57.6

57.4

66.4

62.3

63.6

15.8%

-6.3%

2.1%

821.7

762.2

807.2

711.6

730.1

821.7

762.2

807.2

12.6%

-7.2%

5.9%

31.7

31.0

36.3

35.5

39.4

17.1%

-2.3%

11.0%

201.7

195.1

215.7

28.5

32.9

37.3

34.3

34.6

13.2%

-8.0%

0.7%

239.0

229.4

250.3

33.4

30.1

35.2

31.2

38.1

16.8%

-11.2%

22.0%

274.1

260.7

288.3

30.6

30.0

35.1

34.5

37.6

17.2%

-1.9%

9.0%

309.3

295.1

325.9

31.4

34.1

33.5

32.6

34.2

-2.0%

-2.4%

4.9%

342.7

327.8

360.2

26.5

30.7

29.8

30.2

35.4

-2.8%

1.4%

16.9%

372.6

358.0

395.5

28.6

27.6

33.1

32.5

34.0

19.6%

-1.7%

4.5%

405.6

390.5

429.5

363.7

366.4

405.6

390.5

429.5

10.7%

-3.7%

10.0%

232.8

220.2

251.3

233.7

237.2

216.1

231.5

238.8

239.8

239.2

233.2

246.1

223.2

223.3

252.4

252.3

255.6

256.9

258.5

236.6

242.5

238.3

231.1

216.7

236.6

224.7

207.9

226.7

260.2

228.0

260.5

255.3

233.2

240.7

236.3

5.7%

5.2%

6.8% 10.2%

5.0%

6.0%

8.6%

-5.6%

-8.4% -15.2%

-7.9% -13.1% -12.1%

-6.5%

9.2%

-1.4% 20.2%

7.9%

3.8% 15.8%

4.3%

1,421.5 1,673.8 1,929.4 2,186.3 2,444.8 2,681.5 2,924.0

1,384.1 1,615.2 1,832.0 2,068.5 2,293.2 2,501.2 2,727.9

1,438.1 1,666.1 1,926.6 2,181.9 2,415.1 2,655.8 2,892.1

2,738.5

2,759.6

2,924.0

2,727.9

2,892.1

6.0%

-6.7%

6.0%

13.1

15.0

14.3

14.6

14.2

-4.6%

1.7%

-2.4%

89.1

87.3

91.4

15.0

13.6

14.6

13.1

14.3

6.9%

-10.3%

9.7%

103.6

100.3

105.8

11.3

12.5

13.9

12.9

13.0

11.4%

-7.6%

1.2%

117.5

113.2

118.8

2,199

2,264

2,423

2,094

2,167

7.0%

-13.6%

3.5%

22,694

21,301

22,439

12.2

12.2

11.7

11.5

11.5

-4.7%

-1.4%

-0.4%

129.2

124.7

130.2

2,008

2,066

2,191

1,928

2,233

6.1%

-12.0%

15.8%

24,885

23,230

24,671

TOTAL

2,147

2,068

2,261

2,102

2,195

9.3%

-7.0%

4.4%

27,146

25,332

26,866

14.3

12.3

14.3

14.3

14.6

16.5%

-0.4%

2.5%

74.7

72.7

77.2

2,162

2,175

2,364

2,196

2,369

8.7%

-7.1%

7.9%

20,271

19,208

20,271

DEC

11.2

9.2

8.2

9.8

10.4

-10.7%

19.4%

5.6%

137.4

134.5

140.6

11.3

10.1

11.0

11.5

11.3

9.6%

4.1%

-1.7%

148.4

146.0

151.9

151.2

145.5

148.4

146.0

151.9

2.0%

-1.6%

4.0%

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 12

DRIED EGG STOCKS, END OF MONTH, MILLION POUNDS

YEAR

JAN

FEB

M AR

APR

WHOLE EGGS, PLAIN PLUS FREE FLOWING

4.9

4.9

4.1

4.0

2013

3.4

3.4

2.5

2.0

2014

3.3

2.7

2.1

2.3

2015

2016

5.6

5.2

4.2

3.8

-30%

-31%

-38%

-51%

% change 14/13

-5%

-21%

-18%

14%

% change 15/14

71%

95%

100%

68%

% change 16/15

ALBUMEN (PLAIN WHITE)

5.8

5.3

4.2

3.2

2013

2.2

2.1

1.8

1.7

2014

5.8

6.1

5.2

5.1

2015

2016

6.0

5.8

5.2

4.7

-63%

-60%

-57%

-46%

% change 14/13

167%

188%

185%

198%

% change 15/14

3%

-5%

0%

-10%

% change 16/15

YOLK, PLAIN PLUS FREE FLOWING

5.3

5.2

4.5

5.1

2013

7.7

7.7

7.9

8.0

2014

3.4

3.8

2.5

2.1

2015

2016

3.0

3.1

2.8

2.8

43%

48%

76%

55%

% change 14/13

-55%

-50%

-68%

-73%

% change 15/14

-13%

-19%

11%

31%

% change 16/15

Source: USDA/AMS Monthly Dried Egg Report

M AY

JUN

JUL

AUG

DEC

3.5

1.8

2.4

3.7

-49%

36%

58%

3.0

2.5

2.8

4.4

-17%

11%

57%

3.3

4.5

3.4

5.3

34%

-24%

55%

4.5

6.0

3.9

6.1

34%

-35%

56%

4.8

5.9

3.9

6.0

23%

-34%

55%

3.6

5.8

3.5

5.3

59%

-40%

53%

2.2

4.7

2.8

4.3

112%

-40%

51%

2.5

3.6

2.8

4.2

43%

-23%

50%

3.2

1.7

4.5

4.6

-46%

161%

3%

2.9

1.9

3.8

4.7

-35%

99%

25%

3.0

2.7

4.2

5.2

-9%

58%

22%

3.2

3.9

4.7

5.8

20%

23%

23%

3.2

4.5

4.9

6.0

40%

9%

23%

3.0

4.7

4.8

5.9

56%

2%

23%

2.8

5.1

4.6

5.8

82%

-8%

25%

2.4

5.3

4.6

5.7

116%

-13%

24%

5.4

7.8

2.3

2.9

43%

-71%

28%

6.0

7.7

2.6

3.3

28%

-67%

27%

6.8

7.6

2.7

3.4

11%

-65%

28%

6.8

6.3

2.4

3.0

-8%

-62%

27%

8.3

5.4

2.3

2.8

-35%

-58%

24%

9.0

4.9

2.0

2.7

-45%

-59%

30%

8.7

4.1

2.0

2.6

-53%

-50%

28%

7.9

3.7

2.0

2.5

-54%

-45%

25%

FROZEN EGG STOCKS, END OF MONTH, MILLION POUNDS

YEAR

JAN

FEB

M AR

APR

FROZEN EGGS, TOTAL

29.7

28.6

27.1

29.3

2013

34.7

34.6

29.0

27.4

2014

34.7

35.6

32.1

2015

32.4

2016

38.5

38.5

35.0

35.2

17%

21%

7%

-7%

% change 14/13

0%

3%

10%

18%

% change 15/14

11%

8%

9%

9%

% change 16/15

FROZEN EGGS, UNCLASSIFIED

15.7

15.5

15.1

15.3

2013

16.0

16.3

12.6

13.1

2014

17.1

17.1

15.5

2015

15.8

2016

18.9

19.1

17.2

17.7

2%

5%

-16%

-15%

% change 14/13

6%

5%

23%

21%

% change 15/14

11%

12%

11%

12%

% change 16/15

FROZEN EGGS, WHOLE & MIXED

8.3

8.0

6.3

8.6

2013

12.4

12.2

10.4

9.3

2014

11.2

12.8

10.6

2015

10.8

2016

12.9

12.8

11.0

11.2

50%

52%

66%

8%

% change 14/13

-10%

6%

2%

17%

% change 15/14

15%

-1%

4%

3%

% change 16/15

FROZEN EGGS, WHITE

3.2

2.9

3.4

3.1

2013

4.1

4.5

4.1

3.4

2014

4.9

4.2

5.0

2015

4.4

2016

4.5

4.3

4.5

4.1

27%

53%

22%

12%

% change 14/13

20%

-5%

21%

30%

% change 15/14

-8%

0%

-11%

-9%

% change 16/15

FROZEN EGGS, YOLK

2.5

2.2

2.4

2.3

2013

2.2

1.7

1.9

1.6

2014

1.5

1.4

0.9

2015

1.3

2016

2.2

2.3

2.3

2.2

-12%

-23%

-21%

-30%

% change 14/13

-32%

-18%

-50%

-23%

% change 15/14

48%

65%

139%

77%

% change 16/15

Source: USDA/NASS M onthly Cold Storage Report

Informa forecast in bold.

SEP

OCT

NOV

M AY

JUN

JUL

AUG

Informa forecast in bold.

SEP

OCT

NOV

DEC

28.9

28.3

33.9

36.3

-2%

20%

7%

30.6

30.1

36.4

40.1

-1%

21%

10%

26.1

31.5

36.2

39.2

20%

15%

8%

30.1

29.8

35.7

38.4

-1%

20%

7%

33.6

31.1

36.6

39.0

-7%

17%

7%

33.8

32.0

36.7

39.2

-6%

15%

7%

29.8

30.3

33.7

36.4

2%

11%

8%

30.4

30.7

35.4

37.9

1%

15%

7%

15.4

13.4

16.7

18.8

-13%

25%

13%

15.9

14.4

18.7

20.6

-9%

29%

10%

12.6

15.2

17.4

19.3

20%

14%

11%

13.3

13.9

16.6

18.4

4%

20%

11%

14.9

14.8

16.7

18.6

0%

13%

11%

14.8

15.8

16.5

18.3

6%

5%

11%

12.2

14.2

15.6

17.1

16%

10%

10%

13.2

15.5

17.0

18.4

18%

10%

8%

8.1

10.2

11.5

11.6

26%

13%

1%

7.8

10.6

11.7

12.2

36%

10%

4%

8.3

10.6

12.8

13.2

28%

21%

4%

11.5

10.6

13.1

13.4

-8%

24%

3%

11.8

10.4

13.4

13.5

-12%

29%

0%

12.5

10.2

13.8

14.0

-19%

36%

2%

11.6

10.7

12.4

13.1

-8%

16%

6%

11.7

10.1

12.9

13.5

-13%

27%

5%

3.1

3.5

4.2

3.6

13%

22%

-15%

4.1

3.6

4.3

4.6

-13%

20%

7%

3.5

3.9

4.0

4.1

12%

3%

2%

3.7

3.6

4.3

4.5

-2%

18%

5%

5.1

4.1

4.7

4.9

-19%

14%

5%

4.9

4.5

4.7

4.9

-9%

4%

5%

4.1

4.0

3.9

4.2

-2%

-2%

7%

3.5

3.6

3.4

3.7

3%

-5%

9%

2.4

1.3

1.5

2.3

-45%

14%

53%

2.8

1.5

1.7

2.6

-47%

15%

54%

1.7

1.8

2.1

2.5

3%

17%

21%

1.6

1.8

1.8

2.1

7%

1%

19%

1.7

1.8

1.7

2.0

4%

-3%

16%

1.6

1.5

1.7

2.0

-4%

14%

14%

1.8

1.5

1.9

2.1

-20%

27%

12%

2.0

1.5

2.1

2.3

-25%

43%

10%

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 13

US EXPORTS AND IMPORTS OF SHELL EGGS AND EGG PRODUCTS

YEAR

JAN

FEB

MAR

APR

M AY

JUN

JUL

TOTAL US EGG EXPORTS, SHELL EGG EQUIVALENT, MILLION EGGS

246

237

272

292

296

303

283

2012

235

258

313

370

455

403

375

2013

321

339

336

348

375

362

373

2014

405

380

408

2015

326

367

338

322

2016

287

295

332

332

370

337

325

36%

31%

7%

-6%

-17%

-10%

0%

% change 14/13

26%

12%

21%

-6%

-2%

-7%

-14%

% change 15/14

-29%

-22%

-18%

2%

1%

0%

1%

% change 16/15

321

660

996

1,344

1,719

2,081

2,454

14 cumulative

405

784

1,192

1,518

1,885

2,222

2,544

15 cumulative

287

582

915

1,247

1,617

1,954

2,279

16 cumulative

US SHELL EGG EXPORTS, M ILLION EGGS

130

114

118

123

144

147

141

2012

134

134

158

223

292

213

211

2013

148

172

171

191

239

191

254

2014

242

241

268

2015

195

237

201

212

2016

164

162

188

189

232

192

205

11%

28%

8%

-14%

-18%

-10%

20%

% change 14/13

63%

40%

57%

2%

-1%

5%

-17%

% change 15/14

-32%

-33%

-30%

-3%

-2%

-4%

-3%

% change 16/15

148

321

491

682

921

1,112

1,367

14 cumulative

242

483

750

946

1,182

1,383

1,595

15 cumulative

164

325

513

702

935

1,127

1,332

16 cumulative

US EGG PRODUCT EXPORTS, SHELL EGG EQUIVALENT, MILLION EGGS

115

124

155

169

152

156

142

2012

102

124

156

147

163

190

164

2013

173

167

166

157

136

170

119

2014

163

139

140

2015

131

130

137

110

2016

124

133

145

143

137

145

121

70%

35%

6%

7%

-16%

-11%

-27%

% change 14/13

-6%

-17%

-16%

-16%

-5%

-20%

-8%

% change 15/14

-24%

-4%

3%

9%

6%

6%

10%

% change 16/15

173

339

505

662

798

968

1,087

14 cumulative

163

301

441

573

702

839

949

15 cumulative

124

257

401

544

682

827

947

16 cumulative

TOTAL US EGG IM PORTS, SHELL EGG EQUIVALENT, M ILLION EGGS

20

25

28

16

17

24

17

2012

18

16

16

20

18

15

16

2013

12

22

21

32

28

38

36

2014

30

25

34

2015

51

47

50

54

2016

33

35

39

44

42

44

46

-35%

43%

34%

59%

56%

148%

129%

% change 14/13

155%

11%

63%

57%

67%

33%

49%

% change 15/14

9%

39%

15%

-13%

-12%

-12%

-14%

% change 16/15

12

34

55

87

116

154

189

14 cumulative

30

55

89

140

187

237

291

15 cumulative

33

68

106

150

192

236

282

16 cumulative

US SHELL EGG IM PORTS, MILLION EGGS

5

3

2

4

4

5

4

2012

4

2

1

4

3

4

3

2013

3

2

3

18

18

16

16

2014

12

9

13

2015

19

19

17

18

2016

11

7

7

17

17

16

16

-24%

3%

119%

322%

449%

325%

454%

% change 14/13

338%

400%

342%

1%

7%

5%

16%

% change 15/14

-9%

-21%

-43%

-8%

-9%

-3%

-11%

% change 16/15

3

4

7

26

43

59

75

14 cumulative

12

21

34

52

71

87

106

15 cumulative

11

18

25

42

59

75

92

16 cumulative

US EGG PRODUCT IM PORTS, SHELL EGG EQUIVALENT, M ILLION EGGS

15

22

26

12

13

20

14

2012

15

14

14

16

15

11

13

2013

9

21

18

14

11

22

20

2014

19

16

21

2015

32

28

34

35

2016

22

28

31

27

24

28

30

-38%

48%

26%

-12%

-28%

91%

57%

% change 14/13

101%

-22%

17%

129%

164%

54%

76%

% change 15/14

20%

73%

50%

-17%

-14%

-16%

-15%

% change 16/15

9

30

48

62

73

94

115

14 cumulative

19

35

56

88

116

150

185

15 cumulative

22

50

81

108

133

161

191

16 cumulative

Source: USDA/ERS M onthly International Trade Statistics

AUG

Informa forecast in bold.

SEP

OCT

NOV

DEC

TOTAL

287

417

398

360

359

-4%

-10%

0%

2,852

2,904

2,638

404

341

406

380

380

19%

-6%

0%

3,259

3,284

3,019

400

377

453

390

387

20%

-14%

-1%

3,711

3,674

3,406

290

470

426

348

359

-9%

-18%

3%

4,137

4,022

3,764

308

445

607

392

399

36%

-35%

2%

4,744

4,415

4,164

3,619

4,459

4,744

4,415

4,164

6.4%

-7.0%

-5.7%

140

247

248

230

223

0%

-7%

-3%

1,614

1,825

1,555

241

233

242

256

247

4%

6%

-3%

1,856

2,081

1,802

217

240

301

260

251

25%

-13%

-4%

2,157

2,342

2,052

148

225

291

227

220

29%

-22%

-3%

2,447

2,569

2,273

196

218

428

273

266

97%

-36%

-2%

2,876

2,842

2,539

1,860

2,527

2,876

2,842

2,539

13.8%

-1.2%

-10.7%

147

170

150

130

136

-12%

-14%

5%

1,238

1,079

1,084

163

108

165

124

133

53%

-25%

7%

1,403

1,203

1,217

183

138

152

129

136

10%

-15%

5%

1,555

1,332

1,353

141

245

135

121

138

-45%

-10%

14%

1,690

1,453

1,492

112

227

179

119

133

-21%

-33%

11%

1,869

1,573

1,625

1,759

1,933

1,869

1,573

1,625

-3.3%

-15.8%

3.3%

19

20

41

52

47

111%

26%

-10%

231

343

330

16

16

47

45

40

197%

-5%

-11%

278

388

370

12

19

48

40

37

148%

-16%

-9%

326

429

407

12

15

39

39

36

161%

0%

-8%

365

468

443

13

14

29

39

34

110%

37%

-14%

394

507

477

221

203

394

507

477

94.4%

28.7%

-6.0%

2

2

13

13

12

472%

6%

-12%

87

119

103

3

3

16

12

12

521%

-23%

-2%

104

132

116

1

3

13

10

9

311%

-20%

-11%

116

142

125

3

3

11

13

12

285%

19%

-3%

127

154

137

3

2

12

14

12

584%

20%

-15%

139

168

149

39

33

139

168

149

319.3%

21.4%

-11.6%

17

17

29

39

36

65%

35%

-9%

143

224

226

13

13

31

33

28

133%

5%

-14%

174

257

254

11

16

35

30

28

117%

-14%

-8%

209

287

282

9

12

29

27

24

133%

-8%

-10%

238

313

306

10

12

17

25

22

43%

48%

-13%

255

339

328

182

170

255

339

328

50.5%

32.7%

-3.2%

Copyright 2015 by Informa Economics, Inc.

Egg Sector Update

EG15-04

May 12, 2015

Page 14

EGG SUPPLIES IN THE US

Informa forecast in bold.

AUG

SEP

OCT

NOV

YEAR

JAN

FEB

MAR

APR

MAY

JUN

JUL

TABLE EGG-TYPE CONSUMPTION IN THE US, SHELL EGG EQUIVALENT, MILLION EGGS

6,679

6,199

6,809

6,464

6,509

6,210

6,598

6,746

6,426

6,760

6,783

2012

6,896

6,255

7,034

6,655

6,712

6,493

6,723

6,697

6,630

6,991

6,825

2013

6,969

6,267

7,136

6,884

6,995

6,706

6,915

6,950

6,739

7,000

7,023

2014

7,004

6,238

7,194

2015

6,709

6,553

6,076

6,091

6,128

6,021

6,344

6,383

2016

6,337

5,965

6,757

6,514

6,637

6,431

6,744

6,852

6,721

7,091

7,101

1%

0%

1%

3%

4%

3%

3%

4%

2%

0%

3%

% change 14/13

1%

0%

1%

-3%

-6%

-9%

-12%

-12%

-11%

-9%

-9%

% change 15/14

-10%

-4%

-6%

-3%

1%

6%

11%

12%

12%

12%

11%

% change 16/15

6,969 13,236 20,372 27,256 34,251 40,957 47,873 54,822 61,561 68,561 75,584

14 cumulative

7,004 13,242 20,436 27,145 33,698 39,774 45,865 51,993 58,014 64,358 70,742

15 cumulative

6,337 12,302 19,059 25,573 32,209 38,640 45,384 52,236 58,957 66,048 73,149

16 cumulative

SHELL EGG CONSUMPTION IN THE US, M ILLION EGGS

4,747

4,262

4,761

4,542

4,531

4,336

4,625