Professional Documents

Culture Documents

Stock Market Commentary For July 2015

Uploaded by

Edward C LaneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Market Commentary For July 2015

Uploaded by

Edward C LaneCopyright:

Available Formats

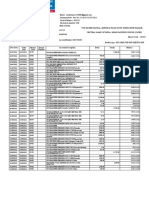

July 8, 2015

L a n e A s s e t M a n age m e n t

Stock Market Commentary

Market Recap for June and Early July 2015

In the end of the day, I believe the S&P will be driven by corporate earnings,

U.S. equities were brought low in June and early July as concerns about Greece

expectations for adjustments to the Fed funds rate (coming later in the year

and a collapse of the Chinese market weighed on investors despite some decent

economic news for the U.S. during the month:

a 3-month high in construction spending,

steady job creation for May and June though average hourly earnings remained weak,

the largest gain in 6 months for private sector employment for May,

job openings in the JOLTS survey just below the series high established in

2001,

pending home sales at their highest level since 2006, and

auto sales at their best pace since 2005.

International stocks significantly underperformed the U.S. with Europe and

in my opinion and just possibly next year), and increasing strength in the dollar (driven not only by anticipation of increase in the Fed funds rate, but also

by accommodative monetary policy in Europe, Japan and elsewhere).

For international equities, the torrid pace earlier in the year has been

brought down to earth. Even with a settlement on the Greek debt, Im thinking the broad index will be kept in moderate territory for the balance of the

year on account of a variety of pressures around the globe, especially in Asia.

In any event, while I dont believe we are on the precipice of a major market

decline at the moment, we are at a place where it would not take much of an

event to present challenging decisions about taking risk off the table.

emerging markets taking a beating, China especially. Investment grade corporate bonds also weakened as interest rates rose during the month (but declined

since my last report).

Oil (and energy stocks) fell especially hard, perhaps on account of the possible

influx of Iranian oil if an agreement is reached and, in any event, a slowing economy in China.

Market Outlook

Although the annualized return for the S&P this year is well below my expectations, a catch-up could happen depending on emerging corporate earnings and a

settlement with Greece. Accordingly, Im going to keep my outlook unchanged.

While the second quarter could be another challenging time, I expect the third

and fourth quarters to pick up steam as long as any increase in the Fed funds

rate turns out to be less impactful than some folks expect (which I think is the

Feds game plan as the FOMC continues to telegraph its intentions well in advance).

The charts on the following pages use mostly exchange-traded funds (ETFs) rather than market indexes since indexes cannot be invested in directly nor do they reflect the total return

that comes from reinvested dividends. The ETFs are chosen to be as close as possible to the performance of the indexes while representing a realistic investment opportunity. Prospectuses for these ETFs can be found with an internet search on their symbol. Past performance is no guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 2

Stock Market Commentary

2015 PREDICTIONS (UPDATED)

As the year unfolds, Ill offer updates to my 2015 predictions. Heres where I

about 3.4% YTD, about 6.7% annualized and about 1.25 percentage points ahead of

SPY (4% last month). With VEUs recent decline, the broad index is now right on tar-

come out after three months. Revisions/comments are shown in blue italics.

get with my expected result for the year.

U.S. Equities

The standout so far this year is Japan where the related ETF has soared over 14% so

As I believe the primary drivers of stock market returns in 2015 will be corporate earnings and modest, if any, movement on the federal funds rate, my expectation for the S&P 500 for 2015 is for a total return of 8-10% (measured by

far this year, almost 17% on a hedged basis. While India is marginally ahead of the

broad index, high flying China has come back to earth with, by one measure, a 25%

decline from its recent peak.

SPY) with risk to the downside on account of international considerations. On

Bonds and Other Income Securities:

a sector basis, I expect healthcare, technology, consumer discretionary and

The 10-year Treasury yield surprised everyone in 2014, especially after its rapid

small cap stocks to outperform. There may be a rebound in energy, but Im

increase in 2013. The yield currently rests at about 2% and I believe it will end

not prepared to go there now.

the year near 2.5%. Total return for 7-15 year U.S. government bond funds in

The S&P 500 (SPY) lost ground in June and early July as the Greek debt crisis con-

2014 was a bit over 9% while investment grade corporate (IGC) bonds funds re-

tinued unresolved. As of this writing, total YTD return is now about 2.2%, or about

4.2% on an annualized basis below my target for the year. Healthcare, consumer

discretionary, tech and small cap stocks are all well ahead of the broad index.

Zacks reports an expected decline in YoY earnings for Q2 of 6.7% on 6% lower

revenue (+0.5 and 0.3%, resp., ex-energy). About 2/3rds of the S&P 500 will be reporting in July. If earnings come in better than expected, I may yet achieve my estimated outcome of 8-10% for the year.

International Equities

turned a bit over 8%. For 2015, I expect total return for IGC bonds between 6%

and 8%, still better than current yield. I believe the best opportunities for income investing will come from preferred stocks, REITs and established, long

term dividend paying common stocks.

The 10-year Treasury yield dropped back a bit in June and early July to 2.27%, down

from 2.41% reported last month, and up about 10 b.p. for the year so far. Investment

grade corporate bonds (LQD) gained a little ground since last months report with

the weakness in Treasury yields and now sit with a 0.9% decline YTD, about 3% below

the S&P and well below my 2015 forecast. Preferred stocks (PFF) added strength in

My estimate for total return from international equities, as measured by the

June relative to bonds while dividend-paying corporate stocks fell back a bit. REITs

Vanguard All-world (ex U.S.) fund,VEU, is 2-3% less than SPY which, given the

had another volatile month, ending up roughly in the same place as LQD.

above estimate, is 5-8% for VEU. I believe the international equity returns will

be very region specific with India and China leading the way and commodityproducing regions lagging. Europe is a wild card as the broader economy

struggles while the ECB may come to the rescue. Id keep an eye on Germany

as Europes bellwether country.

I continue to believe that the FOMC will go slow with any Fed funds rate increase.

Current betting seems to be on a September increase, and that could turn out to be

the case if the next few employment reports meet or beat expectations. With the

third reading for Q1 GDP being 0.2%, corporate earnings being not particularly stellar, core PCE below the Feds target of 2% at 1.24%, and no real growth showing in

VEU came off its pedestal in June and early July owing to the Greek debt crisis and

hours worked or the average hourly wage, I think well need to see solid improve-

a major selloff in emerging markets, especially China. As of this writing, VEU is up

ment in the coming months before the Fed decides to pull the trigger.

L a n e A s s e t M a n age m e n t

Page 3

S&P 500 Total Return

SPY rode another rollercoaster in June, ultimately falling 2% for the month with further deterioration in

early July. The 50-day moving average trend weakened and has now turned negative with the current Greek

saga. Momentum has continued to weaken. Generally good news on the economic front (see page 1) has

been insufficient to overcome concerns about the Greek default and potential removal from the Eurozone.

As of this writing, the YTD total return of the S&P 500 index proxy SPY is roughly 2.2%, down from 2.5% reported last

month, or about 4.2% annualized, down from 6% last month and a lower trajectory than the 7.4% gain over the last 12 months (these percentages are volatile and highly dependent on the starting and ending points). While I believe this downward trend is steeper than will materialize

by year-end, Ill let my strategy be guided by the reality.

Speaking strictly from the technical perspective shown in the chart below, the large cap domestic index has fallen below the trend begun in

early 2014, fulfilling the downside risk I noted last month. With the trend reversal referred to above and the weakness in the momentum, the

risk remains to the downside. On the other hand, if the spike in volume plays out as it has in the past, this downward action may be short-lived.

I dont believe this would be a good time to go beyond ones strategic long term allocation to equities, and having some cash in reserve may be

appropriate for those with limited risk tolerance.

SPY is an exchange-traded fund designed to match the experience of the S&P 500 index adjusted for dividend reinvestment. Its prospectus can be found online. Past performance is no

guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 4

Margin Debt

Margin debt came off its peak in May (data is one month old when it becomes available). Im not sure if the absolute level

means much OTHER THAN the implication that at a very high level, a mild correction in the S&P could trigger margin calls

and a flood of selling, exacerbating a downturn in the market.

On the basis of the charts below, while we are in the territory where theres added risk of a self-reinforcing correction. Given

that this data is one month old, I expect to see an additional decline in both the S&P and margin debt in next months report. It would be good to see the margin debt on a slow downward trajectory, but it will take several months of data to know thats happening.

Meanwhile, these charts illustrate the added reisk inherent in the market today.

L a n e A s s e t M a n age m e n t

Page 5

Portfolio Protection

This chart has been prepared to assist investors in making a decision about portfolio protection, in particular, protecting against a major market sell-off such as occurred in 2000 and 2008. The chart shows, since January 1980, the weekly value of SPY (the ETF proxy for the S&P 500 index on a total return basis). The red line is

a 50-week moving average (50WMA) and the green line, called a Chandelier Exit, is a form of a trailing stop-loss (see www.stockcharts.com). The red arrows show

when the weekly price has fallen below the 50 WMA. This is often accompanied by the Chandelier Exit falling below the 50 WMA.

To me, events such as these would be an important signal that it would be timely to reduce equity exposure, perhaps significantly so if the 50WMA also had an inflection point and began a downward slope. In the last 36+ years, this has happened 8 times; 6 if you exclude 1998 and 2011 when the 50WMA did not turn negative. Since its the major negative market sell-offs that are to be avoided (and reversals to be taken take advantage of), this is the kind of evidence I would be looking

for to protect the equity portion of a portfolio. While its true there can be false or short-lived signals, as there were in 1984, 1990, and, if you like, in early 1998 and

2011, taking steps to protect assets at the wrong moment is, I believe, a small price to pay, especially since we dont know how wrong the moment is at the time

it occurs.

The point I want to make at this time is that for the S&P 500 to have another red arrow event of the type that occurred in 2000 and 2008, the current price would

need to fall about 2.6% vs. 6% last month (see the magnified insert for 2015) and the 50-week moving average trend would need to turn south. As the margin for

safety has narrowed and the price momentum is fading, we have taken a step in the direction of raising an alert. While this analysis would not necessarily work for

other securities, the action of the S&P 500 would be enough for me to react across the board. Also, if such an event were to happen, Id probably go to cash rather

than, say, the investment grade bonds or preferred stocks, depending on the interest rate outlook at the time.

Past performance is no guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 6

All-world (ex U.S.)

International equities, represented here by VEU, experienced another volatile month owing to wavering

negotiations on Greek debt repayment and major deterioration in emerging markets, especially South

Korea,Taiwan and China (where the A-shares have fallen over 25% since my positive outlook last month

giving good reason to stay on ones toes when investing in international markets).

The technical outlook for international equities looks bleak. During June, price broke below the recent trend line, the 50-day

moving average has turned south, momentum has collapsed and, now, price has broken through the line of support around $48.50. Surely, much

of this action is related to the Greek and China situations which I think will prove temporary. That said, unless an investor is prepared to

wait it out or has low sensitivity to volatility, I would avoid trying to catch a falling knife here.

On an individual country basis, about the only one of the majors I find holding up is India. At some point, especially if the pace of this decline

continues, there will be some opportunities to capture an oversold position in one or more of the beat up countries or regions. At that point,

be sure that the fundamental outlook favors an entry point.

VEU is a Vanguard exchange-traded fund designed to match the experience of the FTSE All-world (ex U.S.) Index. Its prospectus can be found online. As of 12/31/14, VEU was allocated as

follows: approximately 19% Emerging Markets, 46% Europe, 28% Pacific and about 7% Canada. Past performance is no guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 7

Asset Allocation and Relative Performance

Asset allocation is the mechanism investors use to enhance gains and reduce volatility over the long term. One useful tool Ive

found for establishing and revising asset allocation comes from observing the relative performance of major asset sectors (and

within sectors, as well). The charts below show the relative performance of the S&P 500 (SPY) to an investment grade corporate

bond index (LQD) on the left, and to the Vanguard All-world (ex U.S.) index fund (VEU) on the right.

On the left, the relative strength of U.S. equities over investment grade corporate bonds stagnated in June with early July showing equity weakness on account of the Greek situation. Importantly, the broad trend of relative outperformance of equities remained in the channel established at the beginning of 2014, albeit with a fair amount of volatility. I expect this relationship to continue.

On the right, the outperformance of international equities deteriorated in May and more so in June and early July with a net YTD difference of

about 1%, down from 4% last month. Both momentum and the trend channel favor domestic equities, while the 50-day moving average trend

has just recently reversed in favor of domestic. Given the Greek- and Asian-caused market turmoil, I expect domestic equities to continue their

outperformance, albeit with the likelihood of high volatility.

SPY, VEU, and LQD are exchange-traded funds designed to match the experience of the S&P 500, (with dividends), the FTSE All-world (ex US) index, and the iBoxx Investment Grade

Corporate Bond Index, respectively. Their prospectuses can be found online. Past performance is no guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 8

Income Investing

Investment grade corporate bonds (LQD) weakened further in June, and now are underwater by about 1% for the

year. On a technical basis, the trend extended its decline after becoming negative for the first time in about 2

years in April. The key to the action in LQD is the direction and magnitude of the 10-year U.S Treasury yield with

which it has an almost perfect negative correlation. If you can forecast the 10-year rate, you can forecast LQD.

Since my forecast is for a modest increase in the 10-year yield from its current level of about 2.27%, I expect LQD

to resume its downward course despite the changing momentum shown below. Time will tell.

While we wait to see how the bond picture unfolds, preferred stocks gained about 0.3% in June and early July relative to LQD., bringing their

YTD outperformance to about 2.7% Unlike LQD, preferred stocks have been largely uncorrelated with the 10-year Treasury yield (not exactly

what I would have expected, but there you have it). Although momentum is beginning to weaken, if Im right about the 10-year Treasury yield

increasing from here, I expect preferred stocks will continue to outperform the investment grade corporate bonds.

LQD is an ETF designed to match the experience of the iBoxx Investment Grade Corporate Bond Index. Prospectuses can be found online. TLT seeks to track the investment results of an

index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. PFF seeks to track the investment results of the S&P U.S. Preferred Stock Index (TM) which

measures the performance of a select group of preferred stocks. Past performance is no guarantee of future results.

L a n e A s s e t M a n age m e n t

Page 9

Interest Rates

Shown below are the 2-year and 10-year Treasury yields for the last two years. The 2-year yield might be taken as a proxy

for the markets opinion about what will ensue for the Fed funds rate. The 10-year yield is a reflection of not only domestic attitudes about changes in the Fed funds rate, but also reflects the global interest rate environment and the developing strength or weakness in the U.S. dollar. The correlation between the two is high over longer periods, but not so much

over the last year or so until recently.

As you can see, the trend in the 2-year has been gradually positive since the beginning of 2014, but dropped back a bit in June, probably on account of the mild FOMC report. The U.S. 10-year Treasury rate is now about 2.3% (at this writing, not far from my year-end forecast of 2.5%),

down from 2.4% last month. While a number of factors are involved, I think the appearance of a dovish Fed along with turmoil in Europe making the U.S. a safe haven, combine to keep the lid on U.S. rates. Moreover, I expect this scenario will persist for a while.

Page 10

L an e A ss et M an ag em ent

Disclosures

Edward Lane is a CERTIFIED FINANCIAL PLANNER. Lane Asset Management is a Registered Investment Advisor with the States of NY, CT and

NJ. Advisory services are only offered to clients or prospective clients

where Lane Asset Management and its representatives are properly licensed or exempted. No advice may be rendered by Lane Asset Management unless a client service agreement is in place.

and related exchanged-traded and closed-end funds are selected based on his opinion

as to their usefulness in providing the viewer a comprehensive summary of market

conditions for the featured period. Chart annotations arent predictive of any future

market action rather they only demonstrate the authors opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but its

accuracy cannot be guaranteed. The information contained herein (including historical

prices or values) has been obtained from sources that Lane Asset Management (LAM)

considers to be reliable; however, LAM makes no representation as to, or accepts any

responsibility or liability for, the accuracy or completeness of the information con-

Investing involves risk including loss of principal. Investing in interna-

tained herein or any decision made or action taken by you or any third party in reli-

tional and emerging markets may entail additional risks such as currency

ance upon the data. Some results are derived using historical estimations from available

fluctuation and political instability. Investing in small-cap stocks includes

data. Investment recommendations may change without notice and readers are urged

specific risks such as greater volatility and potentially less liquidity.

to check with tax advisors before making any investment decisions. Opinions ex-

Small-cap stocks may be subject to higher degree of risk than more es-

pressed in these reports may change without prior notice. This memorandum is based

tablished companies securities. The illiquidity of the small-cap market

on information available to the public. No representation is made that it is accurate or

may adversely affect the value of these investments.

complete. This memorandum is not an offer to buy or sell or a solicitation of an offer

Investors should consider the investment objectives, risks, and charges

to buy or sell the securities mentioned. The investments discussed or recommended in

and expenses of mutual funds and exchange-traded funds carefully for a

this report may be unsuitable for investors depending on their specific investment ob-

full background on the possibility that a more suitable securities trans-

jectives and financial position. The price or value of the investments to which this re-

action may exist. The prospectus contains this and other information. A

port relates, either directly or indirectly, may fall or rise against the interest of inves-

prospectus for all funds is available from Lane Asset Management or

tors. All prices and yields contained in this report are subject to change without notice.

your financial advisor and should be read carefully before investing.

This information is intended for illustrative purposes only. PAST PERFORMANCE

Note that indexes cannot be invested in directly and their performance

DOES NOT GUARANTEE FUTURE RESULTS.

may or may not correspond to securities intended to represent these

Periodically, I will prepare a Commentary focusing on a specific investment issue.

sectors.

Please let me know if there is one of interest to you. As always, I appreciate your feed-

Investors should carefully review their financial situation, making sure

back and look forward to addressing any questions you may have. You can find me at :

their cash flow needs for the next 3-5 years are secure with a margin

for error. Beyond that, the degree of risk taken in a portfolio should be

commensurate with ones overall risk tolerance and financial objectives.

www.LaneAssetManagement.com

Edward.Lane@LaneAssetManagement.com

Edward Lane, CFP

The charts and comments are only the authors view of market activity

Lane Asset Management

and arent recommendations to buy or sell any security. Market sectors

Kingston, NY

Reprints and quotations are encouraged with attribution.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 2023 WSO IB Working Conditions SurveyDocument46 pages2023 WSO IB Working Conditions SurveyHaiyun ChenNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Taxation CPALE by WMGDocument19 pagesTaxation CPALE by WMGJona Celle Castillo100% (1)

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNo ratings yet

- Garnishee OrderDocument15 pagesGarnishee OrderH B CHIRAG 1950311100% (1)

- Forbes USA - 24 January 2017Document116 pagesForbes USA - 24 January 2017Carlos PanaoNo ratings yet

- 5 Must Have Clauses in Property Sale AgreementDocument3 pages5 Must Have Clauses in Property Sale AgreementRajat KatyalNo ratings yet

- Ratio Analysis ItcDocument41 pagesRatio Analysis ItcPrit Ranjan Jha86% (7)

- VP Director Finance Securitization in USA Resume Timothy LoganDocument3 pagesVP Director Finance Securitization in USA Resume Timothy LoganTimothyLoganNo ratings yet

- CORPORATE LAW REVIEWER (Ladia)Document12 pagesCORPORATE LAW REVIEWER (Ladia)Neil Davis BulanNo ratings yet

- Cost & Management Accounting: Cia-IiiDocument9 pagesCost & Management Accounting: Cia-IiiARYAN GARG 19212016No ratings yet

- Market Outlook - September 30, 2023Document11 pagesMarket Outlook - September 30, 2023Edward C LaneNo ratings yet

- Saving Social SecurityDocument39 pagesSaving Social SecurityEdward C LaneNo ratings yet

- LAM Stock Market in Focus August 2022Document14 pagesLAM Stock Market in Focus August 2022Edward C LaneNo ratings yet

- LAM Commentary Q1 2017Document11 pagesLAM Commentary Q1 2017Edward C LaneNo ratings yet

- Lane Asset Management Market Commentary For Q3 2017Document15 pagesLane Asset Management Market Commentary For Q3 2017Edward C LaneNo ratings yet

- Is It Time To Eliminate Federal Corporate Income TaxesDocument30 pagesIs It Time To Eliminate Federal Corporate Income TaxesEdward C LaneNo ratings yet

- Lane Asset Management Stock Market Commentary For January 2017Document9 pagesLane Asset Management Stock Market Commentary For January 2017Edward C LaneNo ratings yet

- Lane Asset Management Stock Market Commentary September 2015Document10 pagesLane Asset Management Stock Market Commentary September 2015Edward C LaneNo ratings yet

- Lane Asset Management Commentary For November 2016Document14 pagesLane Asset Management Commentary For November 2016Edward C LaneNo ratings yet

- Lane Asset Management Stock Market and Economic Commentary February 2016Document11 pagesLane Asset Management Stock Market and Economic Commentary February 2016Edward C LaneNo ratings yet

- Stock Market Commentary For June 2015Document10 pagesStock Market Commentary For June 2015Edward C LaneNo ratings yet

- Stock Market Commentary June 2016Document10 pagesStock Market Commentary June 2016Edward C LaneNo ratings yet

- Stock Market Commentary February 2015Document9 pagesStock Market Commentary February 2015Edward C LaneNo ratings yet

- Lane Asset Management 2014 Review and 2015 Fearless ForecastDocument16 pagesLane Asset Management 2014 Review and 2015 Fearless ForecastEdward C LaneNo ratings yet

- Stock Market Commentary For October 2014Document8 pagesStock Market Commentary For October 2014Edward C LaneNo ratings yet

- Stock Market Commentary November 2014Document7 pagesStock Market Commentary November 2014Edward C LaneNo ratings yet

- Lane Asset Management Stock Market Commentary May 2014Document7 pagesLane Asset Management Stock Market Commentary May 2014Edward C LaneNo ratings yet

- Chapter 04Document26 pagesChapter 04蓝依旎No ratings yet

- Capital Budgeting Cash Flows1Document37 pagesCapital Budgeting Cash Flows1Mofdy MinaNo ratings yet

- Borrowing Powers of CompanyDocument37 pagesBorrowing Powers of CompanyRohan NambiarNo ratings yet

- TCS Result Analysis 2023Document4 pagesTCS Result Analysis 2023vinay_814585077No ratings yet

- Share Based Payments ExercisesDocument5 pagesShare Based Payments ExercisesayhanacruzNo ratings yet

- International Journals Call For Paper HTTP://WWW - Iiste.org/journalsDocument12 pagesInternational Journals Call For Paper HTTP://WWW - Iiste.org/journalsAlexander DeckerNo ratings yet

- Offer Shift PRODDocument5 pagesOffer Shift PRODyuygNo ratings yet

- Chapter 5 IntAcct Sum21-DropboxDocument68 pagesChapter 5 IntAcct Sum21-DropboxPhuong Anh NguyenNo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- Audit 2 l2 Test of ControlsDocument45 pagesAudit 2 l2 Test of ControlsGen AbulkhairNo ratings yet

- Exchange Rate Exposure and Its Determinants Evidence From Indian FirmsDocument16 pagesExchange Rate Exposure and Its Determinants Evidence From Indian Firmsswapnil tyagiNo ratings yet

- Chapter 9 Cooperative BLAWDocument16 pagesChapter 9 Cooperative BLAWnovi bag-ayNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- The Implementation of Customer Due Diligence Princinple For Electronic Money As Preventive Measures of Terrorism Financing in Bank XDocument221 pagesThe Implementation of Customer Due Diligence Princinple For Electronic Money As Preventive Measures of Terrorism Financing in Bank XOddy Ramadhika SusmoyoNo ratings yet

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- Accounting ReviewDocument14 pagesAccounting ReviewMelessa Pescador100% (1)

- Chapter - 1Document69 pagesChapter - 1111induNo ratings yet

- Asset Accounting Year End CloseDocument16 pagesAsset Accounting Year End ClosePriya MadhuNo ratings yet

- Regional ImbalanceDocument20 pagesRegional Imbalancesujeet_kumar_nandan7984100% (8)

- 578 ATC 2022 v3Document1 page578 ATC 2022 v3TYO WIBOWONo ratings yet