Professional Documents

Culture Documents

India Govt Crack Down On Domestic Money Laundering

Uploaded by

AndyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Govt Crack Down On Domestic Money Laundering

Uploaded by

AndyCopyright:

Available Formats

Government plans to crack down on domestic money laundering, issues answers to FAQs - The ...

1 of 5

http://economictimes.indiatimes.com/news/economy/finance/government-plans-to-crack-down-o...

You are here: ET Home News Economy Finance

Search for News, Stock Quotes & NAV's

Government plans to crack down on domestic money

laundering, issues answers to FAQs

Post a Comment

By ET Bureau | 7 Jul, 2015, 01.01AM IST

NEW DELHI: India said it was cracking down on attempts to launder black money locally

and told people with unaccounted assets abroad that it will become increasingly difficult to

conceal these, urging them to make use of a window that shuts on September 30.

The government will start receiving financial information from the US later this year and

another 94 countries, including some that have beneficial tax regimes, by 2018, the finance

ministry said in answers to frequently asked questions issued on Monday. The FAQs follow

elaborations to India's stringent black money law that were issued on Friday.

The warning about action against local money laundering was tweeted by Revenue

Secretary Shaktikanta Das.

According to the finmin FAQ sheet, it won't help if a person

has left the country and is no longer resident if the violation

took place at that time.

"Entry operators converting domestic black money to

white... coordinated action taken to track down these

transactions. Good progress," Revenue Secretary

ET SPECIAL: Love visual aspect of news? Enjoy

this exclusive slideshows treat!

Shaktikanta Das tweeted on Monday.

According to the finance ministry FAQ sheet, it won't help if a person has left the country and is no

longer resident if the violation took place at that time. This suggests that even non-resident Indians will

be covered by the law if they have any assets acquired with unaccounted Indian income.

The finance ministry's 32 FAQs explained the provisions of the one-time compliance window, which

07/Jul/2015 8:03 AM

Government plans to crack down on domestic money laundering, issues answers to FAQs - The ...

2 of 5

http://economictimes.indiatimes.com/news/economy/finance/government-plans-to-crack-down-o...

allows those holding unaccounted assets overseas to pay tax and penalty to escape the harsh

provisions of the law. Those declaring assets by September 30 will have to pay 30% tax and 30% penalty

by December 31.

The law provides for stiff penalties and imprisonment of up to 10 years for those who break the law

enacted by the Narendra Modi government in line with its poll promise to root out black money.

The law provides for stiff penalties and imprisonment of up to 10 years for those who break the law

enacted by the Narendra Modi government in line with its poll promise to root out black money.

No Relief For Graft Proceeds

Those declaring unaccounted wealth under the scheme will not be charged under the Prevention of Money Laundering Act (PMLA). But

there will be no protection from the black money law if it's later discovered that the assets declared are the proceeds of corruption. Even

closed bank accounts have to be declared and the value of assets will be taken as the sum total of all deposits into the account.

Assets acquired when a person was non-resident from income not taxable in India need not be disclosed under the Black Money

(Undisclosed Foreign Income &Assets) and Imposition of Tax Act, 2015, that came into force on July 1.

"The possibility of discovery of an undisclosed asset may arise at any time in the future," the ministry said, listing the details of the

Automatic Exchange of Information (AEOI) that will kick in soon, making it clear that the government will also know the identities of asset

beneficiaries.

"Those settled abroad or planning to settle abroad need to be careful as they remain accountable for any undisclosed foreign assets

which they acquired from their income chargeable to tax in India in the year in which they were ordinarily resident of India," said Kuldip

Kumar, partner, PricewaterhouseCoopers.

US-India To Share Information Soon

The US and India will shortly start sharing information under the Foreign Account Tax Compliance Act.

"India is expected to start receiving information through AEOI route under FATCA from USA later in the year 2015," the finance ministry

said, adding that another 58 jurisdictions will start sharing information under AEOI by 2017 and 36 more by 2018. The information under

07/Jul/2015 8:03 AM

Government plans to crack down on domestic money laundering, issues answers to FAQs - The ...

3 of 5

http://economictimes.indiatimes.com/news/economy/finance/government-plans-to-crack-down-o...

AEOI will include information of beneficial owners of the asset, the FAQ said.

It detailed the tax liability on a hypothetical example of a $100,000 asset acquired in 1975 that comes to the notice of tax authorities in

2020. If the asset is valued at $5 million in 2020, $6 million will be levied in tax and prosecution started under the Act.

07/Jul/2015 8:03 AM

Government plans to crack down on domestic money laundering, issues answers to FAQs - The ...

4 of 5

http://economictimes.indiatimes.com/news/economy/finance/government-plans-to-crack-down-o...

The law applies to assets held by the person in his name or in respect of which he is a beneficial owner, implying that the person need

not directly hold the asset. If he derives benefit from an undisclosed asset overseas then he can disclose the same through this window.

The disclosure is required even if the asset has been sold.

"The declaration may be made if the foreign asset was acquired out of undisclosed income even if the same has been disposed of and is

not held by the declarant on the date of declaration," the FAQ said.

Declare All Assets

An asset acquired by a resident from income earned overseas and tax paid in that country but not declared in India will also be covered

under the law. "It is an undisclosed asset and acquired from income chargeable to tax in India" and therefore should be declared, the

ministry said. Such a person will be covered even if he may no longer be a resident.

The FAQs also advise declaration of all assets even if their fair value is nil. For instance, if a house acquired in a foreign country from

undisclosed income is sold and the proceeds deposited in a bank account then both should be declared.

The law will apply even on inherited assets acquired from unexplained sources of investment. If an asset has been disclosed under the

Schedule FA (foreign assets) of the income-tax return, then the black money law will apply on it since it is from undisclosed income.

"Schedule FA of the return does not mean that the source of investment in the asset has been explained," it said.

Stay on top of business news with The Economic Times App. Download it Now!

Live Market

News

Other Times Group news

sites

Times of India |

Portfolio

Mobile

Live TV

Newsletter

Commodities

Speed

QnA

Blogs

Living and entertainment

Hot on the Web

Services

Timescity | iDiva | Bollywood

Zoom | Healthmeup | Luxpresso

Daily Horoscope | Weather in

Delhi

Book print ads | Online shopping | Free SMS | Website

design | CRM | Tenders

Alerts

07/Jul/2015 8:03 AM

Government plans to crack down on domestic money laundering, issues answers to FAQs - The ...

5 of 5

| Mumbai Mirror

Times Now | Indiatimes

|

| Lifehacker

Gizmodo | Eisamay | IGN India

NavGujarat Samay

Technology | Guylife | Online

Songs | Travel Guides | Hotel

Reviews | Cricbuzz.com

Networking

http://economictimes.indiatimes.com/news/economy/finance/government-plans-to-crack-down-o...

Mumbai Map | Horoscope

Hotels in Delhi | Xiaomi Mobile

Phones

Matrimonial | Ringtones | Astrology | Jobs | Property | Buy car | Bikes in

India

Used Cars | Online Deals | Restaurants in Delhi | Movie Show Timings in

Mumbai

Remit to India | Buy Mobiles | Listen Songs

itimes | Dating & Chat | Email

MensXP.com

About us / Advertise with us / Terms of Use and Grievance Redressal Policy / Privacy Policy / Feedback / Sitemap / Code of Ethics

Copyright 2015 Times Internet Limited. All rights reserved.

07/Jul/2015 8:03 AM

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Cs8792 Cns Unit 1Document35 pagesCs8792 Cns Unit 1Manikandan JNo ratings yet

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDocument75 pagesInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspNo ratings yet

- Wind Energy in MalaysiaDocument17 pagesWind Energy in MalaysiaJia Le ChowNo ratings yet

- Unit Process 009Document15 pagesUnit Process 009Talha ImtiazNo ratings yet

- Jerome4 Sample Chap08Document58 pagesJerome4 Sample Chap08Basil Babym100% (7)

- Accomplishment ReportDocument1 pageAccomplishment ReportMaria MiguelNo ratings yet

- 004-PA-16 Technosheet ICP2 LRDocument2 pages004-PA-16 Technosheet ICP2 LRHossam MostafaNo ratings yet

- Phase 1: API Lifecycle (2 Days)Document3 pagesPhase 1: API Lifecycle (2 Days)DevendraNo ratings yet

- Maths PDFDocument3 pagesMaths PDFChristina HemsworthNo ratings yet

- Financial Derivatives: Prof. Scott JoslinDocument44 pagesFinancial Derivatives: Prof. Scott JoslinarnavNo ratings yet

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocument2 pagesSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNo ratings yet

- HealthInsuranceCertificate-Group CPGDHAB303500662021Document2 pagesHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNo ratings yet

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaNo ratings yet

- Hayashi Q Econometica 82Document16 pagesHayashi Q Econometica 82Franco VenesiaNo ratings yet

- Everlube 620 CTDSDocument2 pagesEverlube 620 CTDSchristianNo ratings yet

- NOP PortalDocument87 pagesNOP PortalCarlos RicoNo ratings yet

- Squirrel Cage Induction Motor Preventive MaintenaceDocument6 pagesSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekNo ratings yet

- Lactobacillus Acidophilus - Wikipedia, The Free EncyclopediaDocument5 pagesLactobacillus Acidophilus - Wikipedia, The Free Encyclopediahlkjhlkjhlhkj100% (1)

- PVAI VPO - Membership FormDocument8 pagesPVAI VPO - Membership FormRajeevSangamNo ratings yet

- 1 PBDocument14 pages1 PBSaepul HayatNo ratings yet

- Activity Description Predecessor Time (Days) Activity Description Predecessor ADocument4 pagesActivity Description Predecessor Time (Days) Activity Description Predecessor AAlvin LuisaNo ratings yet

- Job Description For QAQC EngineerDocument2 pagesJob Description For QAQC EngineerSafriza ZaidiNo ratings yet

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationDocument27 pagesAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfNo ratings yet

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Document16 pagesOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- 18PGHR11 - MDI - Aditya JainDocument4 pages18PGHR11 - MDI - Aditya JainSamanway BhowmikNo ratings yet

- General Field Definitions PlusDocument9 pagesGeneral Field Definitions PlusOscar Alberto ZambranoNo ratings yet

- Experiment On Heat Transfer Through Fins Having Different NotchesDocument4 pagesExperiment On Heat Transfer Through Fins Having Different NotcheskrantiNo ratings yet

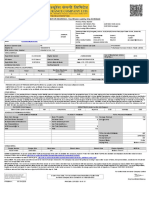

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNo ratings yet

- Unit 2Document97 pagesUnit 2MOHAN RuttalaNo ratings yet