Professional Documents

Culture Documents

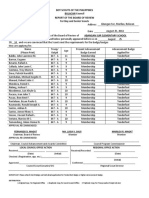

Emergency Loan

Uploaded by

Mark Gil Andales LavadoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emergency Loan

Uploaded by

Mark Gil Andales LavadoCopyright:

Available Formats

Form No.

EL-2011-10-001

Date Revised: 2011-10-13

EMERGENCY LOAN APPLICATION

IMPORTANT: Before applying for Emergency Loan, please secure tentative computation of your proceeds.

Name of Applicant

Last Name

Birth Date

Cell Phone No.

First Name

BP No.

Middle Name

E-Card/UMID Card No.

E-Card/UMID Bank Account No.

Mailing/Residential Address

Email Address

Present Office

Telephone No.

TYPE OF LOAN:

New Renewal

I undertake to pay the loan principal, interest and other charges due in thirty six (36) monthly amortizations.

TERMS AND CONDITIONS

1. Loanable Amount: Twenty Thousand Pesos (P20, 000.00)

2. Term and Interest Rate: PAYABLE IN THREE (3) YEARS OR THIRTY-SIX (36) EQUAL MONTHLY

INSTALLMENTS AT SIX PERCENT 6% PER ANNUM COMPUTED IN ADVANCE.

3. THE INITIAL PAYMENT FOR THE LOAN SHALL COMMENCE THREE (3) MONTHS AFTER THE

DRAWDOWN OF THE LOAN SUCH THAT THE FIRST MONTHLY AMORTIZATION SHALL BE DUE

ON OR BEFORE THE 10TH DAY OF THE 3RD MONTH AFTER THE DRAWDOWN OF THE LOAN

AND EVERY MONTH THEREAFTER UNTIL THE LOAN IS PAID.

4. Loan Redemption Insurance: Loan Redemption Insurance (LRI) of 1.2% of the gross loan amount shall be

deducted from the proceeds of the loan.

5. Surcharge/penalty for unpaid amortizations: When the account incurs arrears equivalent to six (6) months of

amortization, the outstanding balance becomes due and demandable and charged with interest of twelve

percent (12%) per annum computed monthly and a penalty of six percent (6%) per annum compounded

monthly.

6. Loan Pre-Termination

The borrower may pre-terminate the loan anytime during its term subject to the full payment of the outstanding

balance.

7. Maturity of the Loan

The loan shall mature at the end of the payment term of thirty-six (36) months or upon retirement, separation,

permanent disability or death of the borrower if any of these events occur before the expiration of the said term

of the loan. In which case, the entire principal amount of the loan including all interest and other charges

payable, shall be due and payable without need of demand or further notice.

8. Deduction from the Loan Proceeds

The following shall be deducted from the loan proceeds:

a.

Loan Redemption Insurance (LRI) premium equivalent to 1.2% of the loan amount

b.

Outstanding balance of the previous emergency loan including surcharges, if any.

9. Loan Cancellation

Once the emergency loan is approved and the loan proceeds have been credited in the eCard or other mode of

disbursement, the borrower has no more option to cancel the loan but only to pre-terminate it by paying the full

amount of the outstanding balance including accrued interests, if any, without any right to demand the

reimbursement of service fee and such other fees that might have been deducted under such loan.

10. Event / Consequence of Default

Failure of the borrower to pay six (6) monthly installments shall consider him/her in default. In such case, the

outstanding balance of the loan shall be due and payable without need of demand or further notice, all of which

the borrower expressly waives.

11. Availment of Loan

Availment of the loan shall be as prescribed.

12. Authority to Apply Payment

In case of maturity of this loan and it remains outstanding either in whole or in part, both for principal and

interest, the GSIS is authorized to collect, deduct or withhold from whatever benefits that may be due the

Borrower, his/her heirs, beneficiaries, assignees or successors-in-interest, the amount equivalent to the

outstanding balance of this loan, inclusive of interest, penalties and surcharges. Such authorization shall remain

effective until full payment of the loan or any other outstanding obligation of the Borrower to the GSIS.

It is expressly understood that any unpaid balance or outstanding obligation of the Borrower to the GSIS, by

virtue of this loan and/or other obligation, shall constitute a lien over any benefits/claims that may be due the

Borrower.

Should such benefits/claims from the GSIS be insufficient to cover the remaining balance, GSIS shall not be

prevented from filing the necessary civil and administrative action(s) for recovery either against the borrower or

his estate.

13. CHOICE OF LOAN AMORTIZATION SCHEDULE FOR PENSIONERS (CLASP) EFFECTIVE JUNE 1, 2011, RETIRING GSIS

MEMBERS WHO WILL AVAIL OF A RETIREMENT SCHEME WITH AN IMMEDIATE PENSION BENEFIT AS PROVIDED UNDER RA

660, PD 1146 AD RA 8291 MAY AVAIL OF THE CHOICE OF LOAN AMORTIZATION SCHEDULE FOR PENSIONERS (CLASP)

WHERE THE MEMBER-RETIREE MAY CHOOSE TO SETTLE HIS/HER OUTSTANDING BALANCE OF THE LOAN IN WHOLE

(100%) OR A PERCENTAGE THEREOF (75%, 50% OR 25%) WHICH SHALL BE DEDUCTED FROM HIS/HER RETIREMENT

PROCEEDS. FOR THOSE WHO CHOOSE TO PAY A PERCENTAGE OF THE OUTSTANDING BALANCE OF THE LOAN (75%, 50%

OR 25%), THE REMAINING UNPAID BALANCE SHALL BE RESTRUCTURED AS A LOAN WITH A RATE OF 10% PER ANNUM

COMPOUNDED ANNUALLY, PAYABLE OVER A MAXIMUM PERIOD OF THREE (3) YEARS.

14. RECOVERY OF AMOUNT/S CREDITED IN THE eCARD.

GSIS shall have the right to recover by any legal means, any amount in the eCard account credited thereon by

the GSIS due to fraud, misrepresentation or error on account of any transaction which the member may have

with the GSIS.

15. Attorneys Fees

Should the GSIS be compelled to refer the Loan or any portion thereof to an Attorney-at-Law for collection or to

enforce any right hereunder against the Borrower or avail of any remedy under the law or this Agreement, the

Borrower shall pay an amount equivalent to twenty five (25%) percent of all amounts outstanding and unpaid as

and for attorneys fees and litigation expenses.

16. Venue

Any legal action, suit, or proceeding arising out or relating to this Agreement, shall be brought or instituted in the

appropriate courts in the City of Pasay or such other venue at the exclusive option of GSIS. In the event the

borrower initiates any legal action arising from or under this agreement, for whatever causes, the borrower

agrees to initiate such action only in the City where the principal office of GSIS is located.

17. Transfer/Change of Office

The Borrower shall immediately inform the GSIS of his transfer to any government office/agency and in case

the borrower opted to pay through monthly payment via salary deduction, this application shall be sufficient

authority for GSIS to effect collection through salary deduction from his new office/agency.

18. Notices

All notices required under this Agreement or for its enforcement shall be sent to the Office Address indicated in

the Personal Data portion of this loan application. The notices sent to the said office address shall be valid and

serve as sufficient notice to the Borrower for all legal intents and purposes.

I confirm that I have read and fully understood the EMERGENCY LOAN Terms and Conditions and undertake to

comply with them.

______________________________________

SIGNATURE OF MEMBER/BORROWER

TIN: _______________________________

___________________________

Date Signed

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Breaking of Rocks/weatheringDocument10 pagesBreaking of Rocks/weatheringpatokgayangNo ratings yet

- Case Study Royal Bank of CanadaDocument10 pagesCase Study Royal Bank of Canadandgharat100% (1)

- Customer equity value and lifetime revenue importanceDocument10 pagesCustomer equity value and lifetime revenue importanceSniper ShaikhNo ratings yet

- PAS 27 Separate Financial StatementsDocument16 pagesPAS 27 Separate Financial Statementsrena chavez100% (1)

- DESIGNER BASKETS Vs Air Sea TransportDocument1 pageDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNo ratings yet

- Fabric Test ReportDocument4 pagesFabric Test ReportHasan MustafaNo ratings yet

- Wu Flyer MatesolDocument1 pageWu Flyer MatesolMark Gil Andales LavadoNo ratings yet

- 1 PDFDocument2 pages1 PDFMark Gil Andales LavadoNo ratings yet

- Child Protection Policy As Perceived by Public Elementary School Teachers of Marilao NorthDocument1 pageChild Protection Policy As Perceived by Public Elementary School Teachers of Marilao NorthMark Gil Andales LavadoNo ratings yet

- Biological Interaction: Organisms Community WorldDocument6 pagesBiological Interaction: Organisms Community WorldMark Gil Andales LavadoNo ratings yet

- 2nd Periodical Test 2016 FSSPES 2Document14 pages2nd Periodical Test 2016 FSSPES 2Mark Gil Andales LavadoNo ratings yet

- Fss Patulo Elementary SchoolDocument4 pagesFss Patulo Elementary SchoolMark Gil Andales LavadoNo ratings yet

- 2016 Ipcrf Template For Elementary Teachers I III EditedDocument11 pages2016 Ipcrf Template For Elementary Teachers I III EditedMark Gil Andales LavadoNo ratings yet

- Advancement Form For TroopDocument1 pageAdvancement Form For TroopMark Gil Andales LavadoNo ratings yet

- Feeding With InstrumentDocument130 pagesFeeding With InstrumentMark Gil Andales LavadoNo ratings yet

- Is There A Significant Difference in The Kindergarten Pupils' Auditory Attention Span When They Are Grouped According To Their Profile?Document8 pagesIs There A Significant Difference in The Kindergarten Pupils' Auditory Attention Span When They Are Grouped According To Their Profile?Mark Gil Andales LavadoNo ratings yet

- Eddis 1 Science 5Document25 pagesEddis 1 Science 5Mark Gil Andales LavadoNo ratings yet

- 01sun Pre Assess WsDocument1 page01sun Pre Assess WsMark Gil Andales LavadoNo ratings yet

- WeatherDocument2 pagesWeatherMark Gil Andales LavadoNo ratings yet

- Table of SpecificationDocument4 pagesTable of SpecificationMark Gil Andales LavadoNo ratings yet

- Marketing Strategies of BSNLDocument5 pagesMarketing Strategies of BSNLRanjeet Pandit50% (2)

- Operation Management DocumentDocument7 pagesOperation Management DocumentYogesh KumarNo ratings yet

- 2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerDocument20 pages2performant Terms of Services, Privacy Policy and Data Processing Appendix As Joint ControllerGabitaGabitaNo ratings yet

- Water Crisis Collection: Payment1 Payment2 Payment3Document8 pagesWater Crisis Collection: Payment1 Payment2 Payment3Raghotham AcharyaNo ratings yet

- Management Accounting Tutorial QuestionsDocument2 pagesManagement Accounting Tutorial Questionskanasai1992No ratings yet

- Silicon Valley Community Foundation 2008 990Document481 pagesSilicon Valley Community Foundation 2008 990TheSceneOfTheCrimeNo ratings yet

- Project On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078Document147 pagesProject On Logistics Management: Name: Suresh Marimuthu Roll No.: 520964937 LC Code: 3078awaisjinnahNo ratings yet

- Pizza BillDocument2 pagesPizza BillManjunatha APNo ratings yet

- ThelerougecandycompanyDocument4 pagesThelerougecandycompanyAreeba.SulemanNo ratings yet

- Resume PDFDocument1 pageResume PDFAlejandro LopezNo ratings yet

- Interviews Will Be Held at Academic Block, Room No. M-2 Iba Main Campus, University Road, KarachiDocument46 pagesInterviews Will Be Held at Academic Block, Room No. M-2 Iba Main Campus, University Road, KarachichikoofaizanNo ratings yet

- Evaluation of Print and Digital AdvertisementsDocument23 pagesEvaluation of Print and Digital AdvertisementsAshish KumarNo ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- Segmenting Global MarketsDocument12 pagesSegmenting Global MarketsJenny YadvNo ratings yet

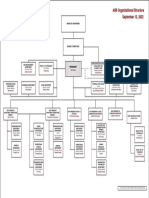

- AIIB Organizational StructureDocument1 pageAIIB Organizational StructureHenintsoa RaNo ratings yet

- Accounting principles, concepts and processesDocument339 pagesAccounting principles, concepts and processesdeepshrm100% (1)

- Aavin Summer Internship ReportDocument45 pagesAavin Summer Internship Reportmo25% (4)

- Frequently Asked Questions Transition From UL 508C To UL 61800-5-1Document6 pagesFrequently Asked Questions Transition From UL 508C To UL 61800-5-1nomeacueroNo ratings yet

- Lambo v. NLRCDocument17 pagesLambo v. NLRCPatrisha AlmasaNo ratings yet

- Maintainance Contract FormatDocument3 pagesMaintainance Contract Formatnauaf101No ratings yet

- Merritt's BakeryDocument1 pageMerritt's BakeryNardine Farag0% (1)

- Simple Service InvoiceDocument2 pagesSimple Service InvoiceFaisalNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Agency v4Document59 pagesAgency v4Roxanne Daphne Ocsan LapaanNo ratings yet

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocument8 pagesKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)