Professional Documents

Culture Documents

Finance

Uploaded by

Anonymous LkoKGdFCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance

Uploaded by

Anonymous LkoKGdFCopyright:

Available Formats

DEFINITION OF 'INVESTMENT PRODUCT'

A product purchased with the expectation of earning a favorable return. Investment

products can be income-producing, as with fixed-interest earning products, or more

speculative in nature, as with stocks and options. A wide variety of investment

products exist, including, but not limited to, stocks, options, futures, bonds, mutual

funds, certificates of deposit, money market investments, ETFs and annuities.

INVESTOPEDIA EXPLAINS 'INVESTMENT PRODUCT'

Investment products are available for individual and institutional investors, and are

purchased in an attempt to generate a profit. Some investment products, such as

certain types of bonds, provide a fixed interest payment in addition to a return of

the initial investment at the time of maturity. Other types of investment products,

such as stocks, entail greater risk and while earnings (and profits) are anticipated,

they are not guaranteed. An investor who diversifies will have a variety of

investment products in his or her portfolio to manage risk.

List of investment products

The list contains the following information:

Investment products' offering documents that have been authorized by the

SFC for issuance under the Securities and Futures Ordinance (SFO) or for

registration under theCompanies Ordinance (CO); and

Particulars of exemptions granted by the SFC for shares or debentures offered

on or after 1 July 2004 under the relevant provisions of the CO.

Please note that where unlisted shares or debentures are concerned, information is

available only for products offered on or after 1 July 2004.

Click below to view the lists by product type:

Unlisted products

Unit trusts and mutual funds

Investment-linked assurance schemes

Structured investment products

Mandatory provident funds

Pooled retirement funds

Unlisted shares and debentures

Investment-linked deposits

Paper gold schemes

Listed products

Exchange-traded funds

Real estate investment trusts

Closed-end funds

Listed shares and debentures

DEFINITION OF 'TREASURY BILL - T-BILL'

A short-term debt obligation backed by the U.S. government with a maturity of less

than one year. T-bills are sold in denominations of $1,000 up to a maximum

purchase of $5 million and commonly have maturities of one month (four weeks),

three months (13 weeks) or six months (26 weeks).

T-bills are issued through a competitive bidding process at a discount from par,

which means that rather than paying fixed interest payments like conventional

bonds, the appreciation of the bond provides the return to the holder.

INVESTOPEDIA EXPLAINS 'TREASURY BILL - T-BILL'

For example, let's say you buy a 13-week T-bill priced at $9,800. Essentially, the

U.S. government (and its nearly bulletproof credit rating) writes you an IOU for

$10,000 that it agrees to pay back in three months. You will not receive regular

payments as you would with a coupon bond, for example. Instead, the appreciation

- and, therefore, the value to you - comes from the difference between the

discounted value you originally paid and the amount you receive back ($10,000). In

this case, the T-bill pays a 2.04% interest rate ($200/$9,800 = 2.04%) over a threemonth period.

His bright future begins with the right plan.

When it comes to your childs college education, only the best will do. Help give him

the bright future he deserves with Philam Lifes Bright Future Invest.

College Education Fund with High Earning Potential

You can start building your childs education fund for as low as P20,000 a

year.

You can grow your money through Philam Lifes investment funds. These

funds offer high earning potential to help you send your child to his dream

university.

Flexible Investment Features

You can select the Philam Life investment fund/s that will suit your unique

financial needs.

You can choose how long you want to pay. You have the option to pay for 3

years, 5 years, 10 years or until your child is 17 years old.*

You can add to your childs education fund whenever you have extra cash.

Guaranteed Life Protection

You can increase your protection through optional benefits that can financially

protect against unexpected events such as accidents and disability.

*These are target premium payment periods only and are not guaranteed.

Attachable Benefits

We enhance your protection and security with our add-on benefits.

You can secure your childs bright future even more by adding these benefits to your

basic Bright Future Invest plan:

Accident and Health (A&H)

In case of death, dismemberment or total and permanent disability, Accident and

Health (A&H) Benefit provides you with additional protection coverage. You also

have an option to add Medical Reimbursement and Weekly Income benefits on top

of your plan.

Waiver of Premium / Waiver of Premium Plus (WP/WP+)

In case you become totally and permanently disabled, you and your family will not

have to worry about paying for your premiums when you have a Waiver of Premium

(WP) Benefit. You can have more peace of mind by availing our Waiver of Premium

Plus (WP+) Benefit. Not only will your premium payments be waived, you and your

family will also receive an annual disability income equivalent to the waived

premium.

Mediguard

Mediguard provides daily hospital income and additional benefits (optional) for long

term hospitalization, intensive care unit confinement, and surgery.

You might also like

- Variable Annuities: What You Should KnowDocument10 pagesVariable Annuities: What You Should Knowwink-winkNo ratings yet

- Tax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingFrom EverandTax Free Wealth: Learn the strategies and loopholes of the wealthy on lowering taxes by leveraging Cash Value Life Insurance, 1031 Real Estate Exchanges, 401k & IRA InvestingNo ratings yet

- What Is The Money MarketDocument22 pagesWhat Is The Money MarketMuhammad HasnainNo ratings yet

- Investing for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.From EverandInvesting for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.Rating: 5 out of 5 stars5/5 (89)

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011592No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122943No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276122886No ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276011208No ratings yet

- Investments AssignmentDocument4 pagesInvestments Assignmentapi-276122905No ratings yet

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketFrom EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketNo ratings yet

- Financial SectorsDocument22 pagesFinancial SectorsSaurav SinghNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-288241922No ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276122961No ratings yet

- Philam Life ProductsDocument3 pagesPhilam Life Productsbeia21No ratings yet

- Introduction to Index Funds and ETF's - Passive Investing for BeginnersFrom EverandIntroduction to Index Funds and ETF's - Passive Investing for BeginnersRating: 4.5 out of 5 stars4.5/5 (7)

- Fin MarDocument11 pagesFin MarYes ChannelNo ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276123292No ratings yet

- SEC Guide To Variable AnnuitiesDocument28 pagesSEC Guide To Variable AnnuitiesAlex SongNo ratings yet

- Stock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersFrom EverandStock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- Investment ProjectDocument28 pagesInvestment ProjectYashiNo ratings yet

- Investments AssignmentDocument6 pagesInvestments Assignmentapi-276231812No ratings yet

- Investment NotesDocument59 pagesInvestment NotesAbhilasha RoyNo ratings yet

- BONDSDocument5 pagesBONDSKyrbe Krystel AbalaNo ratings yet

- Unit 1Document52 pagesUnit 1vijay SNo ratings yet

- Investments AssignmentDocument5 pagesInvestments Assignmentapi-276011473No ratings yet

- What Is Investment Definition?Document6 pagesWhat Is Investment Definition?Simohamed BennaniNo ratings yet

- Investment and Portfolio ManagementDocument36 pagesInvestment and Portfolio ManagementMiguel MartinezNo ratings yet

- Financial Economics NotesDocument56 pagesFinancial Economics NotesNa-Ri LeeNo ratings yet

- Investment Banking Individual AssignmentDocument3 pagesInvestment Banking Individual AssignmentSolita JessyNo ratings yet

- Financial DictnaryDocument3 pagesFinancial Dictnaryraghavan001No ratings yet

- Financial TermsDocument5 pagesFinancial TermsDavide PinnaNo ratings yet

- Investing For BeginnersDocument10 pagesInvesting For BeginnersAnonymous YkDJkSqNo ratings yet

- IapmDocument8 pagesIapmjohn doeNo ratings yet

- Financial Services Management: CHAPTER - 1 (Introduction To Investment)Document26 pagesFinancial Services Management: CHAPTER - 1 (Introduction To Investment)RobinvarshneyNo ratings yet

- Insurance As An Investment StrategyDocument33 pagesInsurance As An Investment StrategySimran khandareNo ratings yet

- Investment IntroductionDocument25 pagesInvestment IntroductionKumarNo ratings yet

- 27 Things You Must Know About VulDocument9 pages27 Things You Must Know About VulTina LlorcaNo ratings yet

- Value Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementFrom EverandValue Investing: A Comprehensive Beginner Investor's Guide to Finding Undervalued Stock, Value Investing Strategy and Risk ManagementNo ratings yet

- Stocks and BondsDocument20 pagesStocks and BondsChristian CorchilNo ratings yet

- Heading DescriptionDocument4 pagesHeading DescriptionSri Ram SahooNo ratings yet

- Variable Universal Life - ExplanationDocument5 pagesVariable Universal Life - ExplanationGerald MesinaNo ratings yet

- InvestmentDocument92 pagesInvestmentkabhaattNo ratings yet

- Vignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies AssignmentDocument5 pagesVignana Jyothi Institute of Management Operations and Management OF Banks and Insurance Companies Assignmentsri kavyaNo ratings yet

- Chapter 14 - Student Worksheet #3 - Common Forms of InvestmentsDocument5 pagesChapter 14 - Student Worksheet #3 - Common Forms of InvestmentskailynNo ratings yet

- Investment: An Investment Is An Asset or Item Acquired With The GoalDocument17 pagesInvestment: An Investment Is An Asset or Item Acquired With The GoalBCom 2 B RPD CollegeNo ratings yet

- Non Bank Financial Institutions NotesDocument3 pagesNon Bank Financial Institutions NotesAmarachi UdoyeNo ratings yet

- Debentures - Meaning, Types, Features, Accounting ExamplesDocument6 pagesDebentures - Meaning, Types, Features, Accounting Examplesfarhadcse30No ratings yet

- New Issue SecuritiesDocument21 pagesNew Issue SecuritiesJOYCE-ANNE MARAGGUNNo ratings yet

- Investing, Purchaing Power, & Frictional CostsDocument12 pagesInvesting, Purchaing Power, & Frictional Costss2mcpaul100% (1)

- Guidelines Use of The Word AnzacDocument28 pagesGuidelines Use of The Word AnzacMichael SmithNo ratings yet

- QuizDocument11 pagesQuizDanica RamosNo ratings yet

- Ficha Tecnica 320D3 GCDocument12 pagesFicha Tecnica 320D3 GCanahdezj88No ratings yet

- EW160 AlarmsDocument12 pagesEW160 AlarmsIgor MaricNo ratings yet

- IEEE Conference Template ExampleDocument14 pagesIEEE Conference Template ExampleEmilyNo ratings yet

- Residential BuildingDocument5 pagesResidential Buildingkamaldeep singhNo ratings yet

- Computer System Architecture: Pamantasan NG CabuyaoDocument12 pagesComputer System Architecture: Pamantasan NG CabuyaoBien MedinaNo ratings yet

- Is.14785.2000 - Coast Down Test PDFDocument12 pagesIs.14785.2000 - Coast Down Test PDFVenkata NarayanaNo ratings yet

- Historical DocumentsDocument82 pagesHistorical Documentsmanavjha29No ratings yet

- Data Sheet: Elcometer 108 Hydraulic Adhesion TestersDocument3 pagesData Sheet: Elcometer 108 Hydraulic Adhesion TesterstilanfernandoNo ratings yet

- Liga NG Mga Barangay: Resolution No. 30Document2 pagesLiga NG Mga Barangay: Resolution No. 30Rey PerezNo ratings yet

- Sales Manager Latin AmericaDocument3 pagesSales Manager Latin Americaapi-76934736No ratings yet

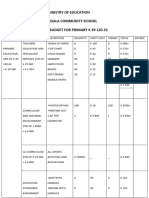

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Nat Law 2 - CasesDocument12 pagesNat Law 2 - CasesLylo BesaresNo ratings yet

- Health Informatics SDocument4 pagesHealth Informatics SnourhanNo ratings yet

- Management in English Language Teaching SummaryDocument2 pagesManagement in English Language Teaching SummaryCarolina Lara50% (2)

- Pilot'S Operating Handbook: Robinson Helicopter CoDocument200 pagesPilot'S Operating Handbook: Robinson Helicopter CoJoseph BensonNo ratings yet

- ECO 101 Assignment - Introduction To EconomicsDocument5 pagesECO 101 Assignment - Introduction To EconomicsTabitha WatsaiNo ratings yet

- FBW Manual-Jan 2012-Revised and Corrected CS2Document68 pagesFBW Manual-Jan 2012-Revised and Corrected CS2Dinesh CandassamyNo ratings yet

- Product Guide TrioDocument32 pagesProduct Guide Triomarcosandia1974No ratings yet

- United States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Document2 pagesUnited States v. Manuel Sosa, 959 F.2d 232, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- Stock Prediction SynopsisDocument3 pagesStock Prediction SynopsisPiyushPurohitNo ratings yet

- Pega AcademyDocument10 pagesPega AcademySasidharNo ratings yet

- Bisleri 2.0Document59 pagesBisleri 2.0Dr Amit Rangnekar100% (4)

- PE Range Moulded Case Current Transformers: Energy DivisionDocument7 pagesPE Range Moulded Case Current Transformers: Energy DivisionUlfran MedinaNo ratings yet

- Copeland PresentationDocument26 pagesCopeland Presentationjai soniNo ratings yet

- Managerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Document40 pagesManagerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Uzma Khan100% (1)

- UCAT SJT Cheat SheetDocument3 pagesUCAT SJT Cheat Sheetmatthewgao78No ratings yet

- In Partial Fulfillment of The Requirements For The Award of The Degree ofDocument66 pagesIn Partial Fulfillment of The Requirements For The Award of The Degree ofcicil josyNo ratings yet

- UBITX V6 MainDocument15 pagesUBITX V6 MainEngaf ProcurementNo ratings yet