Professional Documents

Culture Documents

Humanities-The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector-Ashima Mangla

Uploaded by

BESTJournalsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Humanities-The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector-Ashima Mangla

Uploaded by

BESTJournalsCopyright:

Available Formats

BEST: International Journal of Humanities, Arts,

Medicine and Sciences (BEST: IJHAMS)

ISSN 2348-0521

Vol. 3, Issue 7, Jul 2015, 11-20

BEST Journals

THE OPPORTUNITIES AND CHALLENGES OF FOREIGN

DIRECT INVESTMENT IN INDIAN RETAIL SECTOR

ASHIMA MANGLA

Assistant Professor, Economics SGGS College, Chandigarh, India

ABSTRACT

FDI plays an important role in the long term development of a country by enhancing the competitiveness of

domestic economy through transfer of capital, up gradation of technology, developing managerial skills and capabilities in

various sectors, strengthening infrastructure, raising productivity and generating new employment opportunities. India is

being looked up by many foreign nations as the scope of investment due to rise in purchasing power, growing

consumerism and brand proliferation. Allowing FDI in the retail sector proves good as it leads to improvements in supply

chain technologies, elimination of the exploitative system of middlemen and informational externalities to local players

that could benefit consumers and suppliers. Competition is best for consumers as it gives them variety and better quality at

reduced prices. Opposition have raised concerns about employment losses, promotion of unhealthy competition among

organized domestic retailers from the market and distortion of urban cultural development. However, the Indian

government must take timely and prudent actions to safeguard the health of the Indian retail sector and to stabilize

themselves against competition from the giant players of the global economy.

This research paper focuses on the overview of the Indian retail sector along with the opportunities of expansion

of FDI in India and the major challenges that it faces.

KEYWORDS: Domestic Economy, Indian Retail Sector

INTRODUCTION

Retail Sector is one of the most important pillars of Indian economy and it is growing at a phenomenal pace.

The increasing disposable incomes among the Indian middle class, increased urbanization, credit availability, improvement

in infrastructure and increasing young population have been cited as the main reasons for such attractive optimism. Foreign

investors are also very keen to invest in Indian Retail Sector. Foreign Direct Investment (FDI) in the Indian retail sector

plays an integral role in the economic growth of the country.

India, being a signatory to World Trade Organizations General Agreement on Trade in Services, had to open up

the retail trade sector to foreign investment. There were initial reservations towards opening up of retail sector due to fear

of job losses, procurement from international market, competition and loss of entrepreneurial opportunities.

However, the government in a series of moves has opened up the retail sector to Foreign Direct Investment (FDI).

The Government cap over FDI in retail has been a personification of the dilemma that confronts policy makers

about whether opening up FDI in retail would be a boon or bane for the sector.

REVIEW OF LITERATURE

A study conducted by Mukherjee and Patel (2005) found that foreign retailers are working with small

manufacturers and are providing them technologies like packaging technologies and bar coding. Sourcing from India has

12

Ashima Mangla

increased with the advent of foreign retailers and they also bring in an efficient supply-chain management system.

Joint ventures with foreign retailers are helping the Indian industry to get access to finance and global best practices.

Prof. Kore Chandrakant (2011) examines the changing habits of Indian consumers, impact of FDI on consumers,

suppliers and present retailers. It raises the concern regarding the employment opportunities citing the example of

Wal-Mart, the worlds largest retailer which has the capability of wiping out immediate competition and sustaining losses

for few years, an estimated eight million people in the unorganized sector will be displaced.

Moghe (2012) critically analyzed the decision of Indian government to open retail sector for FDI in single-brand

and multi-brand category and it's likely to have an adverse impact on various components of Indian economy.

Vaidehi and Alekhya (2012) studied the positive and negative effects of FDI on Indian economy. It can be

concluded that to keep pace with the forecast of Indian GDP, government should encourage foreign investment.

Jain and Sukhlecha (2012) studied FDI in multi-brand retail and tried to establish the need of the retail community

to invite FDI in multi-brand retailing.

Kumar (2013) examined the decision of government to allow 51 percent FDI in multi brand retail. India came

under serious flake due to many reasons, loss of employment being one of them.

Mahadevaswamy and Nalini (2013) analyzed the perceptions of the common man about foreign direct investment

(FDI) in multi-brand retailing (MBR).

Jain (2013) examined that retailing is the interface between the producer and the individual consumer buying for

personal consumption. As such, retailing is the last link that connects the individual consumer with the manufacturing and

distribution chain. Indian retail industry is one of the sunrise sectors with huge growth potential.

RESEARCH METHODOLOGY

This paper is based on secondary data and information collected from various books, journals, government

publications, newspapers etc., and research is descriptive in nature. Data is presented in the form of tables and analyzed in

the form of charts. Internet searching has also been done for this purpose.

MEANING OF RETAIL SECTOR

In 2004, The High Court of Delhi defined the term retail as a sale for final consumption i.e. a sale to the ultimate

consumer. A retailer purchases goods or products in large quantities form manufacturers directly or through wholesaler and

then sells smaller quantities to the consumers for a profit. Thus retailing can be said to be the interface between the

producer and the individual consumer who purchases goods for personal consumption.

The retail industry is mainly divided into two types- Organized and Unorganized Retailing.

Organized Retailing: Refers to trading activities undertaken by licensed retailers, who are registered for sales

tax, income tax, etc. These include the corporate-backed hypermarkets, supermarkets and retail chains.

Unorganized Retailing: On the other hand, refers to the traditional formats of low-cost retailing, for example, the

local kirana shops, paan/beedi shops, owner manned general stores, convenience stores and pavement vendors,

etc. The Indian retail sector is highly fragmented with 97 per cent of its business being run by the unorganized

retailers.

The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector

13

Overview of Retail Sector in India

Retailing is one of the prime movers of an Indian economy. In India, retailing is the second largest industry

accounting for about 14 to 15% of its GDP and around 8 % of the employment. Nearly 40 million people earn their

livelihood from retailing business and majority of them are small traders, kirana shop owners etc. In 2010, the Indian retail

market was valued at $435 billion and attracted the largest number of new retailers. According to study conducted by

Indian Council for Research on International Economic Relations (ICRIER), total retail business in India will grow at

13% annually, from $ 322 billion in 2006-2007 to $ 590 billion in 2011- 2012 and further to $ 1 trillion by 2016-2017.

Figure 1

Retailing in India is gradually becoming the next boom industry. The whole concept of shopping has changed in

terms of format and consumer buying behavior, bringing a revolution in shopping. Contrary to traditional retailing, modern

retail has entered Indian markets as sprawling shopping centers, multi-storied malls offering shopping, entertainment and

food all under one roof. India has a large proportion of young population that provides a conducive environment for this

sector. The per capita income in India has doubled between 2000-01 and 2009-10 resulting in improved purchasing power.

The customer mind set is gradually shifting from low price to better convenience, high value and a better shopping

experience. Quick and easy loans, EMIs, loan through credit cards, have made purchasing very easy for Indian consumers.

There is high brand consciousness among the youth. All these factors are contributing to the growth of retail sector in

India.

The retail trade sector of India occupies important place in the socio-economic growth of the country.

As a consequence, the opening up of the retail sector to foreign direct investment (FDI) is inevitable. International

experience also shows that there has been impressive growth in retail and wholesale trade after China approved 100% FDI

in retail. Thailand has experienced tremendous growth in the agro-processing industry.

FDI in Indian Retail Sector

FDI refers to capital inflows from abroad that are invested to enhance the production capacity of the economy.

FDI in Indias retail business can be made through any of routes like joint ventures, franchising, cash and carry operations,

and non-store formats.

The question is why foreign investors are so keen on throwing away huge sums to a poor nation and why is India

so reluctant to divert from a closed economy. The reason is that India has one of the largest consumer markets of the

14

Ashima Mangla

world and a huge population that likes to spend irrespective of its financial constraints. India is ranked as the third most

attractive nation for retail investment among 30 emerging markets, which is next to China and Kuwait. There can be two

types of FDI in the retail sector.

FDI in Single Brand Retail

Single brand implies that foreign companies would be allowed to sell goods internationally under a single brand,

like Reebok, Nokia and Adidas. FDI in Single brand retail implies that a retail store with foreign investment can sell only

one brand.

FDI in Multi Brand Retail

FDI in Multi Brand retail implies that a retail store with a foreign investment can sell multiple brands under one

roof. Opening up FDI in multi-brand retail will mean that global retailers including Wal-Mart, Marks & Spencer,

Carrefour and Tesco can open stores offering a range of household items and grocery directly to consumers in the same

way as kirana store does.

Current Position of FDI in Indian Retail

As a part of the economic liberalization process set in place by the Industrial Policy of 1991, the government of

India has opened up the retail sector to FDI in a phased manner.

In1995 World Trade Organizations (WTO) General Agreement on Trade in Services (GATS), which included

both wholesale and retail trade in services, came into effect.

In 1997 FDI in cash and carry (wholesale) was allowed up to 100% under the government approval route.

In 2006 FDI in single brand retail was permitted to the extent of 51% and FDI in cash and carry was brought

under automatic route.

In 2011, 100% FDI in single-brand retail was permitted with government approval and 51% FDI in multi-brand

was allowed with a few conditions. The recommendations of FDI policy in multi brand retail are:

o

At least 50% of total FDI is to be invested in back- end infrastructure.

At least 30% of their goods and products will be procured from local companies a industries.

At least $100 million FDI in multi brand retail sector is required.

Retail outlets can be set up in cities having a population of at least 1 million.

FDI in multi-brand retail is restricted to protect the traditional mom and pop retailers. This policy restricts global

low-cost multi-brand retailers from catering directly to Indian consumers.

Some of the Key Players in Indian Retail Sector

Major domestic players in India are - Pantaloon Retail Ltd., Shoppers Stop Ltd., Spencer's Retail, Lifestyle

Retail, Landmark group venture, Bharti Retail, Tata Trent, Globus, Aditya Birla, More and Reliance retail.

Major foreign players who have entered the segment in India are.

Carrefour which opened its first cash and carry store in India in New Delhi.

Germany based Metro cash and carry which opened six wholesale centers in the country.

The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector

15

Wal-Mart in a JV with 'Bharti Retail', owner of easy day store - plans to invest about US $ 2.5 billion over the

next five years to add about 10 million sq. ft. of retails space in the country.

British retailer Tesco PIC (TSCO) in 2008 signed an agreement with Trent Ltd. (TRENT) the retail arm.

Marks & Spencers have a JV with Reliance retail.

Sources of FDI in India

India has broadened the sources of FDI in the period of reforms. There were more than 130 countries investing in

India in 2011 as compared to 15 countries in 1991.

Table 1: Major Sources of FDI (In %) in India (From April 2000 to April 2011)

Mauritius Singapore

USA

UK

Netherlands Japan Cyprus Germany France

UAE

41.56%

9.84%

7.17%

5%

4.32%

4.15%

3.75%

2.30%

1.87%

1.44%

Source: Complied & computed from the various issues of Economic Survey, RBI Bulletin, Ministry of Commerce

The data in Table-1 presents the major investing countries in India during 2000-2011. Mauritius is the largest

investor in India with 41.56% of total FDI during the period. This dominance of Mauritius is because of the Double

Taxation Treaty i.e., DTAA- Double Taxation Avoidance Agreement between the two countries, which favors routing of

investment through this country. This DTAA has been made out with Singapore also. Singapore is the second largest

investing country in India. While comparing the investment made by both Mauritius and Singapore, we find that there is a

huge difference between FDI inflows to India from Mauritius and Singapore. The other major countries are U.S.A with a

relative share of 7.17% followed by UK, Netherlands, Japan, Cyprus, Germany, France and UAE.

Source: Complied & computed from the various issues of Economic Survey,

RBI Bulletin, Ministry of Commerce

Figure 2

Thus, it is understood that only these ten countries account for 81.4% of the total FDI inflows in India during

2000-2011.

Distribution of FDI within India

FDI inflows in India are concentrated around five cities namely, Mumbai, New Delhi, Bangalore, Ahmedabad,

and Chennai.

16

Ashima Mangla

Source: Compiled and computed from the various issues of SIA Bulletin,

Ministry of Commerce, GOI

Figure 3

Within the country, there has been significant debate on whether opening up of FDI in retail sector will create

problems or provide opportunities. Although there is no clear answer yet, lets look at some of the advantages and

disadvantages of allowing FDI in retail sector.

Advantages of FDI in Retail

Overall Growth of the Country: FDI is one of the major sources of investments for a developing country like

India wherein it expects huge investments from multinational companies to improve the countries growth rate,

create jobs, share their expertise, back-end infrastructure and research & development in the country.

Availability of Large Varieties at Reduced Prices: Entry of the multi-national corporations will promise

intensive competition between the different companies offering their brands in a particular product market.

When the manufacturing companies will take efforts to increase their market share, competition among them will

be activated. Such a competition will result in the availability of many varieties, reduced prices, and convenient

distribution of the marketing offers.

Improvement in Supply Chain Systems: Improvement of supply chain and distribution efficiencies, coupled

with capacity building and introduction of modern technology will help to reduce the wastages. As much as 40%

of India's fruits and vegetables rot due to lack of processing facilities. The foreign retail houses like Wal-Mart and

Carrefour can bring better managerial practices and IT-Friendly techniques to cut wastages and set up integrated

supply chains to gradually replace present disorganized retail market.

Improved Standard of Living: Consumers in the organized retail will have the opportunity to choose between a

numbers of internationally famous brands with pleasant shopping environment, huge space for product display,

maintenance of hygiene and better customer care. FDI can account for a higher standard of living by bringing in

high-quality foreign items of luxury that were previously banned in India. As a result, the high class of India

wont have to import these goods and generate a cash outflow.

Improved Technology and Logistics: Improved technology in the sphere of processing, grading, handling and

packaging of goods and further technical developments in areas like electronic weighing, billing, barcode

scanning etc. could be a direct consequence of foreign companies opening retail shops in India,.

Further, transportation facilities can get a boost, in the form of increased number of refrigerated vans which can

help to bring down wastage of goods.

The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector

17

Benefits for the Farmers: Though India is the second largest producer of fruits and vegetables, it has a very

limited integrated cold-chain infrastructure. Lack of adequate storage facilities causes heavy losses to farmers,

in terms of wastage in quality and quantity of produce. With liberalization, there could be a complete overhaul of

the supply chain infrastructure. Extensive backward integration by multinational retailers, coupled with their

technical and operational expertise, can hopefully remedy such structural flaws. Also, farmers can benefit with the

farm-to fork ventures with retailers which helps- (i) to cut down intermediaries (ii) to give better prices to

farmers, and (iii) provide stability and economics of scale.

Better Employment Opportunities: Huge investments in the retail sector will see gainful employment

opportunities in agro processing, sorting, marketing, logistics, and front end retail. At least 10 million jobs are

likely to be created in the next three years in the retail sector.

Impact on Real-Estate Development: Retail is closely dependent on real estate as any retailer will require

substantial spaces for setting up business. Real estate in India has gone through a revamp due to the demand of

high-end retail malls and peoples changing perception towards an enjoyable shopping experience. Thus real

estate can get a further facelift in India and receive more investment with the opening up of FDI in multi-brand

retail.

Disadvantages of FDI in Retail

Displacement of Traditional Retailers: FDI in retail will have an adverse impact on the traditional unorganized

retail which is currently more dominant. India has 1.2 crore shops employing over 4 crore people and 95% of

these are small shops run by self-employed people. FDI in Retail involves traditional retailers going out of

business. They wouldn't be able to compete because of the international competition. International experience of

USA and Europe shows that supermarkets invariably displace small retailers.

Increase in Real Estate Prices: It is obvious that the foreign companies which enter into India to open up their

malls and stores will certainly look for places in the heart of cities. There shall be a war for place, initiated among

such companies. It will result in increase in the cost of real estate that will eventually affect the interest of the

ordinary people who desire to own their houses within the cities.

Creation of Monopoly in the Long-Term: The foreign companies, which shall be permitted through FDI in

retail, will initially spend huge sum of money to chase the domestic companies out of business. The foreign giants

will offer the products in the beginning at subsidized rates in order to capture a large market share. They can

sustain for a longer period even in loss, but the same is not possible for domestic companies. Once, the domestic

companies are suppressed fully and sent out of the market, the foreign companies will play like monopoly. This

will only result in the exploitation of the interest of final consumers.

Adverse Impact on Farmers: FDI in retail will leave the farmers at the mercy of the multi-nationals as they will

fix the price of the products being procured from them. The giant retailers would have far greater bargaining

power vis--vis the farmers. As against the mandis that operate today, where several traders have to compete

with each other in order to buy the farmers produce, there will be a single buyer in the case of the MNCs. This

will make the farmers dependent on the MNCs and vulnerable to exploitation. The farmers may not be able to sell

their entire product which is currently being undertaken by the government agencies.

18

Ashima Mangla

Less Choice and Distortion of Culture: Fragmented markets give larger options to consumers. Consolidated

markets make the consumer captive. Certain Indian brands may start losing their importance. As the similar kind

of product will be available in a foreign brand, consumers will long to buy foreign brand product. The culture of

the people in India will slowly be changed, which is not for good. The youth shall easily imbibe negative aspects

of foreign culture and lifestyles and develop inappropriate consumption pattern, which is not suited to Indian

cultural environment.

Creates Unemployment: Jobs in the manufacturing sector will be lost because structured international retail

makes purchases internationally and not from domestic sources. Moreover, the middlemen who have been

working in this industry will be thrown out of their jobs as the foreign retailers will be directly procuring from the

main supplier.

Challenges in Retail Business in India

There are several challenges that Indian retail sector has to face.

Real Estate Issues: Due to high cost of real estate in most cities, it is difficult to find suitable properties in central

locations for retail. Most of the retail outlets in India have outlets that are less than 500 square feet in area.

This is very small by International Standards.

Lack of Capital Availability: Capital availability for business is another challenge faced by this sector.

Due to the absence of 'industry status' organized retail in India faces difficulties in procurement of organized

finance and fiscal incentives.

Inefficient Supply Chain Management: Indian retailing is still dominated by the unorganized sector and there is

still a lack of efficient supply chain management. India must concentrate on improving the supply chain

management, which in turn would bring down inventory cost, which can then be passed on to the consumer in the

form of low pricing.

Human Resource Problems: There is a shortage of skilled manpower in the organized retail sector of India.

The Indian retailers have difficulty in finding trained persons and also have to pay more in order to retain them.

This again brings down the Indian retailers profit levels.

Frauds in Retail: It is one of the primary challenges the companies would have to face. Frauds, including vendor

frauds, thefts, shoplifting and inaccuracy in supervision and administration are the challenges that are difficult to

handle. This is so even after the use of security techniques, such as CCTVs and POS systems.

Challenges with Infrastructure and Logistics: The lack of proper infrastructure and distribution channels in the

country results in inefficient processes. Infrastructure does not have a strong base in India. Transportation,

including railway systems, has to be more efficient. Highways have to meet global standards. Airport capacities

and power supply have to be enhanced. Warehouse facilities and timely distribution are other areas of challeng.

POLICY RECOMMENDATIONS

However, if FDI in retail is liberalized by considering the following suggestions, it is expected to bring in more of

benefits than threats to the country.

The Opportunities and Challenges of Foreign Direct Investment in Indian Retail Sector

19

FDI should be initially allowed in less sensitive sectors and also in the sectors wherein the domestic companies

are established strongly.

FDI in retail should be liberalized in a phased manner like the case with China.

Entry of foreign players must be gradual with social safeguards so that the effects of labor dislocation can be

minimized.

Adequate attention should be paid to procuring, staff recruitment, investments in warehouse, cold storage,

infrastructure, competition and retail formats so that not only does the money comes in, but also it's a win-win

situation for the current national retailer as well as mom and pop stores which account for 70% of the retail

business even after the arrival of national retailers from the corporate giants like the Tata, Reliance, Future Group

and the Birla's.

The government should take initiatives to improve the manufacturing sector. If the manufacturing is strengthened,

the displaced employees of the retail industry could be well accommodated there.

A National Commission should be set up to study the problems of the retail sector which should also evolve a

clear set of conditions on foreign retailers on procurement of farm produce, domestically manufactured

merchandise and imported goods. These conditions must state minimum space, size and other details like

construction and storage standards.

CONCLUSIONS

It is obvious that India, being a member of WTO, has to allow FDI in multi-brand retail also. India could only

delay the permission to FDI but not to disallow it. So India should find out suitable ways so that it can enjoy more of the

benefits than threats. The entry of foreign capital into multi-brand retailing needs to be anchored in such a way that it must

result in backward linkages of production and increase domestic retailing as well as exports. It can be stipulated that a

percentage of FDI should be spent towards building up of back end infrastructure, logistics or agro processing units and at

least 50% of the jobs in the retail outlet should be reserved for rural youth.

Thus, the priority step would be accordance of industry status to retail sector. Uniform regulatory structure need to

be set up with respect to taxes and duties as regards modern retail sector. Exclusive national policy pertaining to this sector

should be formulated. Along with existing legal and regulatory framework, strong enforcement mechanism is necessary to

ensure that big retailers do not dislocate small retailers by unfair means.

REFERENCES

1.

Manikyam K.R. and Rao K.S. (2013). Foreign direct investment in Indian retailing An analysis. International

journal of multidisciplinary educational research, Vol. 2(1).

2.

Gill H.S. and Komal (2014). Impact of Multi Brand Foreign Direct Investment in Retail Sector in India. Pacific

Business Review International, Volume 6(12).

3.

Vaidehi and Alekhya (2012). Role of FDI in Retailing. Asia Pacific Journal of Marketing & Management Review,

Vol. 1(2).

4.

Moghe, D. (2012). Critical Study of Foreign Direct Investment in Indian Retail Sector with Special Reference to

Multi Brand Retail Sector. Journal of Research in Commerce and Management, Vol. 1(3), 29-39.

20

Ashima Mangla

5.

Singh and Dave (2013). FDI in multi brand retail: An empirical study of consumers in NCR Region (India).

International Journal of Indian Culture and Business Management, Vol. 7(1).

6.

Muley S. S. (2014). Indian retail industry - An overview. Excel Journal of Engineering Technology and

Management Science, Vol. 1(6).

7.

Nasir Z. Qureshi & Amin (2007). FDI in Indian retail sector: Prospects and hurdles. Indian Journal of Commerce,

Vol. 60(4).

8.

Gupta S.K. and Batra A. (2011). FDI in retail sector in India A boon or bane. International Journal of Research

in IT & Management, Vol. 1(8).

9.

Soundararaj J.J. (2012). 100% FDI in single-brand retail of India- A boon or a bane? International Journal of

Multidisciplinary Management Studies, Vol. 2(5).

10. Mixed reactions to FDI in Indian retail trade. The Indian Express, September 16, 2005.

11. Pushing for retail FDI. The Hindu Business Line, August 04, 2005.

12. Vijay, Tarun (2004). Debate: Should FDI be allowed in retail branding? The Financial Express.

13. Bulbul Singh and Suvidha Kamra (2011). FDI in Indian retail sector: Problems and Prospects. International

Journal of Research in Commerce & Management, Vol. 1(1), 98-105.

14. Ritu (2014). Foreign direct investment in Indian retail sector - Aspects of Indian economy. Asian Journal of

Multidimensional Research, Vol. 3(12).

15. Naruka J.S. (2014). Foreign direct investment and Indian retail sector- Aspects of Indian economy. International

journal of engineering and management Research, vol. 4(3).

16. Meenakshi S.P., Venkata Subrahmanyam C.V., Ravichandran K. (2013). Problems and prospects of FDI in Indian

retail sector. International Journal of Humanities and Social Science Invention, vol. 2(7).

17. Ritika and Dangi N. (2013). FDI in retail sector: Opportunities and challenges. Innovative Journal of Business and

Management, vol. 2(5).

18. Bhattacharyya R. (2012). The Opportunities and Challenges of FDI in Retail in India. IOSR Journal of

Humanities and Social Science, vol. 5(5).

19. Aarti Garg and Anju Bala (2014). Foreign direct investment in India: A study on retail sector. The International

Journal of Humanities & Social Studies, Vol 2(5).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Interchip InterconnectionsDocument6 pagesInterchip InterconnectionsBESTJournalsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Introducing A New Cryptographic Scheme: Ak CipherDocument6 pagesIntroducing A New Cryptographic Scheme: Ak CipherBESTJournalsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Compatible Role of Sea Weed Extracts and Carbendazim On The Biological Activities of PaddyDocument10 pagesCompatible Role of Sea Weed Extracts and Carbendazim On The Biological Activities of PaddyBESTJournalsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- An Approach To The Problem Solving of Sensitivity Determining of Electronic CircuitryDocument12 pagesAn Approach To The Problem Solving of Sensitivity Determining of Electronic CircuitryBESTJournalsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Political Empowerment of Women Through Panchayats (A Study On Coastal Districts of Andhra Pradesh)Document6 pagesPolitical Empowerment of Women Through Panchayats (A Study On Coastal Districts of Andhra Pradesh)BESTJournalsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ANALYSIS OF EFFECTS OF ENDOSULFAN USING FCMsDocument6 pagesANALYSIS OF EFFECTS OF ENDOSULFAN USING FCMsBESTJournalsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Strategies of Escalating Employee Satisfaction Among The Employees of Ankur Chemicals, Gandhidham, GujaratDocument10 pagesStrategies of Escalating Employee Satisfaction Among The Employees of Ankur Chemicals, Gandhidham, GujaratBESTJournalsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Liquidity Risk Management in Islamic and Conventional Banks in Sri Lanka: A Comparative StudyDocument17 pagesLiquidity Risk Management in Islamic and Conventional Banks in Sri Lanka: A Comparative StudyBESTJournalsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Humanities - A COMPARATIVE STUDY - Dr. MUKESH KUMAR PANTH PDFDocument10 pagesHumanities - A COMPARATIVE STUDY - Dr. MUKESH KUMAR PANTH PDFBESTJournalsNo ratings yet

- Predictive Analytics Using Big Data: A SurveyDocument8 pagesPredictive Analytics Using Big Data: A SurveyBESTJournalsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Interpretation of 16o (D, ) 14n-Reaction's Mechanism at e D 1.876 - 40 MevDocument16 pagesInterpretation of 16o (D, ) 14n-Reaction's Mechanism at e D 1.876 - 40 MevBESTJournalsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Impact of Employer Brandon Employee Satisfaction, With Special Reference To It IndustryDocument8 pagesImpact of Employer Brandon Employee Satisfaction, With Special Reference To It IndustryBESTJournalsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Adoption of Last Planner System Using Engineer's Day-Wise Card in Civil Projects For Career AdvancementDocument8 pagesAdoption of Last Planner System Using Engineer's Day-Wise Card in Civil Projects For Career AdvancementBESTJournalsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Objectively Structured Clinical Evaluation (Osce) Versus Conventional Examination Method Used For Dental Postgraduate Student in PracticalDocument9 pagesObjectively Structured Clinical Evaluation (Osce) Versus Conventional Examination Method Used For Dental Postgraduate Student in PracticalBESTJournalsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Modeling of Transient Temperature Change in Finned Tube Heat ExchangerDocument6 pagesModeling of Transient Temperature Change in Finned Tube Heat ExchangerBESTJournalsNo ratings yet

- Geometry Associated With The Generalization of ConvexityDocument6 pagesGeometry Associated With The Generalization of ConvexityBESTJournalsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Geometry Associated With The Generalization of ConvexityDocument6 pagesGeometry Associated With The Generalization of ConvexityBESTJournalsNo ratings yet

- A Study of Consumer Behavior Pattern For Select Eye-Care Facilities in Vashi and Koparkhairne, Navi MumbaiDocument14 pagesA Study of Consumer Behavior Pattern For Select Eye-Care Facilities in Vashi and Koparkhairne, Navi MumbaiBESTJournalsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Selected Intervention Strategy On Thrombophlebitis Among Patients With Intravenous CannulaDocument6 pagesSelected Intervention Strategy On Thrombophlebitis Among Patients With Intravenous CannulaBESTJournalsNo ratings yet

- Humanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFDocument8 pagesHumanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFBESTJournalsNo ratings yet

- Seasoning The Heart of Students Through The Department of Service Learning (Outreach) at Loyola College (Autonomous), Chennai - A Case StudyDocument10 pagesSeasoning The Heart of Students Through The Department of Service Learning (Outreach) at Loyola College (Autonomous), Chennai - A Case StudyBESTJournalsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Way To Improve One's Academic PerformanceDocument7 pagesA Way To Improve One's Academic PerformanceBESTJournalsNo ratings yet

- Humanities - Occupational Mobility - DR - Falak Butool PDFDocument6 pagesHumanities - Occupational Mobility - DR - Falak Butool PDFBESTJournalsNo ratings yet

- Humanities-Historiographic Metafiction-DR. PARNEET PDFDocument4 pagesHumanities-Historiographic Metafiction-DR. PARNEET PDFBESTJournalsNo ratings yet

- Humanities-The OBESITY LEVEL - DR - Gunathevan ElumalaiDocument6 pagesHumanities-The OBESITY LEVEL - DR - Gunathevan ElumalaiBESTJournalsNo ratings yet

- Humanities - Occupational Mobility - DR - Falak Butool PDFDocument6 pagesHumanities - Occupational Mobility - DR - Falak Butool PDFBESTJournalsNo ratings yet

- Humanities - A COMPARATIVE STUDY - Dr. MUKESH KUMAR PANTH PDFDocument10 pagesHumanities - A COMPARATIVE STUDY - Dr. MUKESH KUMAR PANTH PDFBESTJournalsNo ratings yet

- Humanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFDocument8 pagesHumanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFBESTJournalsNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Humanities-ELECTRICAL CONDUCTIVITY - DR - Atulkumar H. Patel PDFDocument6 pagesHumanities-ELECTRICAL CONDUCTIVITY - DR - Atulkumar H. Patel PDFBESTJournalsNo ratings yet

- Management - Synthesis of Octa-Nazar A. HusseinDocument6 pagesManagement - Synthesis of Octa-Nazar A. HusseinBESTJournalsNo ratings yet

- Biometric Security ConcernsDocument27 pagesBiometric Security ConcernsprinceuchenduNo ratings yet

- The Bible Does Not Condemn Premarital SexDocument16 pagesThe Bible Does Not Condemn Premarital SexKeith502100% (3)

- Software Project Management PDFDocument125 pagesSoftware Project Management PDFUmirNo ratings yet

- Not For Profit Governance WeilDocument224 pagesNot For Profit Governance WeillkjhmnvbNo ratings yet

- Improving Self-Esteem - 08 - Developing Balanced Core BeliefsDocument12 pagesImproving Self-Esteem - 08 - Developing Balanced Core BeliefsJag KaleyNo ratings yet

- ThesisDocument58 pagesThesisTirtha Roy BiswasNo ratings yet

- REVISION For END COURSE TEST - Criticial ThinkingDocument14 pagesREVISION For END COURSE TEST - Criticial Thinkingmai đặngNo ratings yet

- Fortune 2010Document14 pagesFortune 2010Stefan JenkinsNo ratings yet

- Aroma TherapyDocument89 pagesAroma TherapyHemanth Kumar G0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Eugène Burnouf: Legends of Indian Buddhism (1911)Document136 pagesEugène Burnouf: Legends of Indian Buddhism (1911)Levente Bakos100% (1)

- Habanera Botolena & Carinosa (Gas-A)Document8 pagesHabanera Botolena & Carinosa (Gas-A)christian100% (4)

- Report On Soap StudyDocument25 pagesReport On Soap StudyAbhishek JaiswalNo ratings yet

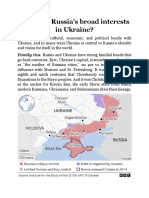

- What Are RussiaDocument3 pagesWhat Are RussiaMuhammad SufyanNo ratings yet

- (Paper-2) 20th Century Indian Writing: Saadat Hasan Manto: Toba Tek SinghDocument18 pages(Paper-2) 20th Century Indian Writing: Saadat Hasan Manto: Toba Tek SinghApexa Kerai67% (3)

- Answers To Case Studies 1a - 2dDocument9 pagesAnswers To Case Studies 1a - 2dOgnen GaleskiNo ratings yet

- Second Grading EappDocument2 pagesSecond Grading EappConnieRoseRamos100% (2)

- Confidential Recommendation Letter SampleDocument1 pageConfidential Recommendation Letter SamplearcanerkNo ratings yet

- Strategi Pencegahan Kecelakaan Di PT VALE Indonesia Presentation To FPP Workshop - APKPI - 12102019Document35 pagesStrategi Pencegahan Kecelakaan Di PT VALE Indonesia Presentation To FPP Workshop - APKPI - 12102019Eko Maulia MahardikaNo ratings yet

- Storey Publishing Fall 2017 CatalogDocument108 pagesStorey Publishing Fall 2017 CatalogStorey PublishingNo ratings yet

- Analysis of Low-Frequency Passive Seismic Attributes in Maroun Oil Field, IranDocument16 pagesAnalysis of Low-Frequency Passive Seismic Attributes in Maroun Oil Field, IranFakhrur NoviantoNo ratings yet

- 3er Grado - DMPA 05 - ACTIVIDAD DE COMPRENSION LECTORA - UNIT 2 - CORRECCIONDocument11 pages3er Grado - DMPA 05 - ACTIVIDAD DE COMPRENSION LECTORA - UNIT 2 - CORRECCIONANDERSON BRUCE MATIAS DE LA SOTANo ratings yet

- Public Administration 2000 - CSS ForumsDocument3 pagesPublic Administration 2000 - CSS ForumsMansoor Ali KhanNo ratings yet

- Vocabulary Task Harry PotterDocument3 pagesVocabulary Task Harry PotterBest FriendsNo ratings yet

- Units 6-10 Review TestDocument20 pagesUnits 6-10 Review TestCristian Patricio Torres Rojas86% (14)

- QuotesDocument12 pagesQuotesflowerkmNo ratings yet

- WWW - Ib.academy: Study GuideDocument122 pagesWWW - Ib.academy: Study GuideHendrikEspinozaLoyola100% (2)

- A Global StudyDocument57 pagesA Global StudyRoynal PasaribuNo ratings yet

- Amtek Auto Analysis AnuragDocument4 pagesAmtek Auto Analysis AnuraganuragNo ratings yet

- Tugas, MO - REVIEW JURNAL JIT - Ikomang Aditya Prawira Nugraha (1902612010304)Document12 pagesTugas, MO - REVIEW JURNAL JIT - Ikomang Aditya Prawira Nugraha (1902612010304)MamanxNo ratings yet

- VestibuleDocument17 pagesVestibuleDeepti MangalNo ratings yet

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterFrom EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterRating: 3.5 out of 5 stars3.5/5 (487)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedRating: 2.5 out of 5 stars2.5/5 (5)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)