Professional Documents

Culture Documents

Free Markets and Online Auctions

Uploaded by

NuhtimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Free Markets and Online Auctions

Uploaded by

NuhtimCopyright:

Available Formats

Business Strategy Review, 2001, Volume 12 Issue 2, pp 59-68

Case Study

FreeMarkets and Online

Auctions

Jamie Anderson and Mark Frohlich

Before last years dot-com meltdown, one

of the most hyped areas was large

industry-based business-to-business

(B2B) marketplaces. Most of these have

either failed or are struggling. Instead, the

growth today is in less ambitious online

auctions where individual firms,

increasingly having to focus on costs, seek

suppliers of the products or services they

need. FreeMarkets, growing fast though

still unprofitable, is the leader in this

growing field. This case discusses the

problems and potential not only for

FreeMarkets itself but also for the buying

and selling companies which use it.

Since last years dot-com meltdown, the number of

pure play business-to business (B2B) e-commerce startups has declined dramatically amidst industry

uncertainty, unsustainable business models, and the

evaporation of venture capital funding. Organisations

such as Forrester and the Gartner Group estimate that

fewer than half of the B2B e-marketplaces in existence

in late 1999 will survive beyond 2001. Industry-based

mega-exchanges, such as the automotive industrys

widely-publicized Covisint, are only stumbling along:

complex issues relating to regulation and lack of co-

ordination amongst participants have slowed

implementation. The corporate world has gradually

realised that integrated e-procurement and the

development of industry exchanges might be a much

longer and more difficult road to bottom-line savings

than originally anticipated.

In this broad environment of uncertainty on the future

of B2B, some companies have chosen to develop their

own e-marketplaces: Walmart, for example, with its

RetailLink. Another approach is the B2B online

auction. Public and private sector use of online

auctions is growing exponentially, with buyers and

sellers using systems from vendors like FreeMarkets,

Ariba and CommerceOne.

This article discusses the growth of FreeMarkets, the

worlds largest B2B online auction provider and

arguably the most successful B2B online marketplace.

It explores the companys business model, and the

ways in which online auctions can affect B2B

procurement. In particular, it draws on the

FreeMarkets experience to provide lessons for vendors

of online B2B e-commerce services, and buyers and

sellers participating in online auction events.

The Emergence of FreeMarkets

Since 1995, FreeMarkets has created over 11,500

online auctions for over US$16.6bn worth of purchase

orders. FreeMarkets estimates that its clients save

between 2% and 25% on their purchases, with average

savings across all categories of 15% in 2000. Total client

savings since 1995 are estimated to be more than $3.2bn.

London Business School

60 Jamie Anderson and Mark Frohlich

FreeMarkets has more than 110 clients (buyers),

including United Technologies, General Motors,

Alcoa, Royal Bank of Scotland, Emerson, Nestl and

Visteon. In many cases, FreeMarkets works to

consolidate purchases across several divisions within

the organisation to provide maximum leverage. More

than 11,000 suppliers from over 55 countries have

participated in FreeMarkets auctions.

Example: Corrugated paper packaging

To consolidate business among the most

competitive, high-quality, service-oriented

suppliers, a large global corporation placed its

requirements for corrugated paper packaging

up for bid through the FreeMarkets B2B emarketplace. Purchases were aggregated across

five facilities to create a more attractive bidding

opportunity for suppliers.

Supply category: corrugated paper packaging

Historic cost: $3.9m

Buyer: five US locations of a global corporation

Suppliers: 14 US suppliers

Pricing format: downward auction

e-Sourcing solution: FreeMarkets FullSourceTM

Number of Bids: 115

Benefits

Grouped request for quotations (RFQ) from

five facilities

Introduced new qualified suppliers

Achieved 12% savings ($468,000) in a

supply market operating at near capacity

The companys B2B e-marketplace handles direct

materials (incorporated into end-products), indirect

materials (used to support operations) and services in

over 175 product and service categories. Examples

include injection-moulded plastic parts, metal

fabrications, chemicals, printed circuit boards,

corrugated packaging, coal, capital equipment, and

construction services.

FreeMarkets believes that a fair and efficient

marketplace must cross borders. The company has

established operations on four continents to provide

Business Strategy Review

local support to its customers in various regions and

to help buyers and suppliers who wish to trade in

these markets.

The Buying Process

FreeMarkets online auction process follows a series

of steps. The company first works with the client to

identify products and services that might be purchased

through its B2B e-marketplace. Once an appropriate

purchase has been identified, FreeMarkets begins the

market-making process. The company helps the buyer

prepare and distribute a detailed Request for

Quotation (RFQ), identifies qualified global suppliers,

and prepares suppliers to bid. Finally, FreeMarkets

conducts a real-time, online auction through its B2B

e-marketplace.

FreeMarkets e-sourcing solutions are customised to

meet the goals of each e-market. Over 160 million

possible combinations of bidding formats, display

formats and other parameters are available. The

following lists some of the possible formats:

Downward: allows bids in decreasing increments

Upward: allows bids in increasing increments

Index: allows bidding above/below a published index

Multicurrency: converts bids in different currencies

to a single currency

Net present value: converts different multi-year bids

into one current value

Rank order: allows bidders to see their ranks only,

not all bids

Transformational: converts different types of bids into

one format

Although suppliers can see the bid prices on bid day,

all supplier identities are kept confidential. The bidding

event has a scheduled opening and closing time. As

long as suppliers continue to place bids in a lot, the

lot stays open. The lot closes when no new marketleading bids are submitted. An online auction bid

history graph is shown at Figure 1.

Because price is not the only factor, clients do not

normally make award decisions on bid day. In the days

and weeks that follow the bidding event, buyers

examine bid results, review supplier information (such

as supplier capability, quality certifications, and

FreeMarkets and Online Auctions 61

manufacturing processes), and sometimes conduct a

buyer audit before making a final decision. The client

does not have to select the lowest bidder, and may well

stay with an existing supplier who is price competitive

but may not have submitted the lowest price.

Recently, FreeMarkets has started to license use of its

software for auctions hosted by the purchasing

departments, business units or divisions of individual

companies. Under a three-year agreement announced

in February 2001, United Technologies Corporation

(UTC), a global provider of high technology products

and support services to the building systems and

aerospace industries, became the first company to

license FreeMarkets QuicksourceTM auction software.

UTC will not use FreeMarkets consultancy or marketmaking services, but will run its own auctions using

QuicksourceTM. Buyer-driven marketplaces operate

from the buyers desktop, branded with the client

organisations look and feel, and are able to support a

range of sourcing needs. The service gives

organisations the ability to create their own e-markets,

hosted and supported by FreeMarkets.

Another service provided by FreeMarkets is asset

recovery for surplus assets through its online Asset

Exchange. This represents only a small share of total

revenue.

FreeMarkets at a Glance

June 2001

Founded 1995

$16.6bn traded volume

$3.2bn savings generated

15% average saving for customers

Over 9,300 online markets hosted

Over 150,000 suppliers

100 clients (buying companies)

Over 165 categories

Nearly 1,000 employees

Over 30 languages

Initial Public Offering: December 10, 1999

IPO Price per Share: $48

Price Per Share June 2001: $16

Figure 1

FreeMarkets Bid History Graph: Microprocessor Auction

Summer 2001

62 Jamie Anderson and Mark Frohlich

The FreeMarkets Value Proposition

FreeMarkets believes that its B2B e-Marketplace

delivers the following:

Volume: FreeMarkets sees volume as an important

metric for any marketplace. Volume is seen to drive

both performance and efficiency.

Independence: FreeMarkets argues that only an

independent e-marketplace can provide a truly level

playing field. The FreeMarkets B2B e-marketplace is

fully independent and neutral. FreeMarkets does not

promote the interest of any buying or selling

organisation.

Integration: The company believes that an e-market

solution has to be flexible enough to integrate with

other technology solutions but powerful enough to

stand alone. FreeMarkets has designed its sourcing

software to work as seamlessly as possible with a range

of e-commerce solutions.

Market efficiency: The company also asserts that an

efficient market will bring the right buyers and sellers

together, facilitate transactions, and create a win-win

process that encourages even greater participation.

Measurable ROI: FreeMarkets aims to deliver fast,

measurable results in the form of procurement

savings, reductions in project cycle times and

administration costs.

Figure 2

Savings and fees

(a) A US based diversified manufacturer

Cumulative Identified Savings & Fees

$45,000,0000

$35,000,0000

$25,000,0000

Identified Savings

Fees & Expenses

$15,000,0000

$5,000,0000

Ju

l

r

Ap

Ja

n

ct

O

Ju

l

r

Ap

Ja

n

$(5,000,0000)

(b) Consumer electronics manufacturer: savings by product

Commodity Savings %

General Freight

Thermoforming (Plastic)

Compression Moulding (Plastic)

Component Manufacturing (Electrical)

Blow Moulding (Plastic)

9.0%

15.9%

16.6%

17.8%

Stamping

21.2%

Forging

21.5%

Machining

Injection Moulding (Plastic)

Printed Circuit Bare Boards

Business Strategy Review

0.0%

24.0%

27.8%

28.4%

FreeMarkets and Online Auctions 63

savings for a consumer electronics manufacturer.

Example: Printed Circuit Boards

A global diversified manufacturing firm faced

the difficult challenge of consolidating millions

of dollars of printed circuit board (PCB)

purchases across 14 global divisions. The

company wanted to consolidate its supply base

and standardise data to understand future

buying patterns.

Supply category: printed circuit boards

Historic cost: $36.1m

Buyer: global diversified manufacturer

Suppliers: 43 ISO9000 certified suppliers

Pricing format: downward auction

Sourcing solution: FreeMarkets FullSourceTM

Number of bids: 755

Benefits

Obtained buy-in from 14 divisions to

participate in a corporate-wide event.

Standardised data on over 1,000 PCB

designs across 19 divisions

Introduced several qualified suppliers from

Asian countries

Consolidated supply base from 58 to 9

Ultimate saving around $10m

Global reach: Finally, the company believes that an

efficient marketplace has to be global. Buyers and

suppliers from over 55 countries have participated in

the FreeMarkets B2B e-marketplace, supported by

FreeMarkets 19 offices in 13 countries across Asia,

Europe and the Americas.

To participate in a FreeMarkets online market,

suppliers must provide a detailed capability profile,

review the RFQ, prepare a bidding strategy, and

complete FreeMarkets BidWare R training.

Revenue Model

FreeMarkets generates revenue from its service

agreements with clients (buyers). These typically

provide for fixed monthly fees (eg $75,000 $100,000

per month for the two-three months of a project life

cycle) performance incentive payments based on

volume, savings or both, and sales commissions. The

company expects incentive payments to become its

main revenue source in the long term.

Monthly fees received by the company are for the use

of technologies, supplier and supply market

information, market making and market operations

staff, and facilities. Negotiated monthly fees vary by

client, and reflect both the anticipated auction volume

and the staffing, expertise and technology that

FreeMarkets expects to commit to provide the services

requested.

Revenue from the licensing and support of the

QuicksourceTM auction software is expected to grow

substantially in the medium to long-term, as other

companies follow United Technologies.

FreeMarkets agreements can provide for sales

commissions to be paid by suppliers. But this approach

has been strongly resisted by the companys supplier

base. Most of the service agreements signed by

FreeMarkets since early 1999 have not included

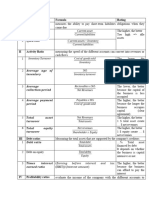

Table 1

FreeMarkets Financial Performance, 1996-2000

In addition, Freemarkets argues that its clients benefit

from the depth of information it provides about both

auctions and suppliers, and from the competition

introduced by bringing in new suppliers from around

the world. On the supply side, sellers can gain access

to a global scale, as well as from the cost savings

generated by free registration and participation,

detailed standardised RFQs, and a much faster

bidding process.

Calendar years, $m

Revenue

Direct costs

Indirect costs

Operating loss*

Figure 2 compares the cumulative savings and fees

for a diversified manufacturer and the commodity

2000

1999

1998

1997

1996

83.3

20.9

7.8

1.7

0.4

(48.9)

(12.2)

(4.3)

(1.1)

(0.5)

34.4

8.7

3.5

0.6

(0.1)

(101.1)

(31.4)

(3.5)

(1.7)

(1.3)

(66.7)

(22.7)

(1.1)

(1.4)

*Excluding goodwill amortization, interest and other income

Summer 2001

64 Jamie Anderson and Mark Frohlich

supplier-paid commissions, and the company expects

to eventually abandon this approach altogether.

Table 2

FreeMarkets Financial Performance, 1st Qtr 2001

1Q01

Financial Performance

FreeMarkets is still not profitable (Table 1) and its

share price collapsed along with those of other

dot.coms last year (Figure 3). However, on release of

its first quarter results for 2001, it declared that it

expected to break even by the first quarter of 2002.

In the words of FreeMarkets' Chairman and CEO,

Glen Meakem:

We look forward to building on the

momentum we have gained to extend our global

leadership position even further in the months

aheadAlthough demand for e-sourcing

solutions softened during the quarter due to the

weakening economy, our customers continued

to leverage our technologies, market

information and services to generate savings

and efficiencies for their organizations

Table 2 shows figures for the first quarter of 2001.

FreeMarkets Senior Vice President and Chief Financial

Officer Joan Hooper said:

Previous qtr

1Q00

Revenue ($m)

33.0

34.5 (-4.3%)

10.8 (+205%)

Volume ($bn)

2.6

3.5 (-43%)

1.3 (+92%)

Gross margin

51%

50%

41%

Net loss ($m)*

9.3

10.4

Net loss per share ($)* 0.24

0.27

*Excluding stock-based expense and non-cash acquisition costs

We are pleased with our bottom-line

performance for the first quarter. While our

revenues fell slightly short of our expectations

due to longer sales cycles driven by a softening

economy, we are very encouraged by the deals

we signed late in the quarter, which should

enable us to achieve sequential revenue growth

of 10% to 15% in the second quarter.

The Future

In mid-2001, FreeMarkets is positioning itself to

remain the premier global provider of online

purchasing and procurement.

Figure 3

FreeMarkets' Share Price Performance and Trading Volume December 1999 - June 2001 (US cents)

Business Strategy Review

FreeMarkets and Online Auctions 65

Examples: Online Markets for Services

Tax preparation services: A major client

identified savings of close to 50% on a

contract for tax preparation services

Telecommunications services: More than

$4m worth of telecoms services including

fixed and mobile service in Italy, wiring and

hardware installation have been bid

through the FreeMarkets online auction

marketplace, saving over 30%.

Security guard services: FreeMarkets helped

a global 1000 client save more than 14%

on a contract for security guard services.

Transportation: Contracts for more than

$31m worth of transportation, including

less-than-truckload transportation and

ocean freight, have been bid through the

FreeMarkets online auction marketplace.

Relocation services: FreeMarkets has bid out

over $93m worth of relocation services and

identified annual savings of more than 20%

Hotel services: a major client saved more

than 20% off contract hotel-room rates.

Office furniture and installation: Office

furniture and installation services worth

nearly $9m have been purchased through

the FreeMarkets online auction marketplace.

Average savings on these purchases

exceeded 31%.

According to Glen Meakem, Chairman and CEO

Demand for sourcing solutions that deliver

large and immediate returns on investment is

extremely strong, and FreeMarkets is uniquely

positioned to capitalise on this market

opportunity Our portfolio of sourcing

solutions provides professional buyers with the

technology, information and services they need

to make better business decisions.

According to Ed Smith, Director of Group Purchasing

Operations at London-based Royal Bank group, and

a FreeMarkets client:

We see a strong future for FreeMarkets. Royal

Bank has 99 different integration activities to

complete by the end of 2001, and the FreeMarkets

auction process helps us manage our time more

effectively. True market price is another benefit.

Prices are not based on historic data but what the

market will bear, coupled with the element of cost

breakdown from bids so we are able to check how

robust bids are before awarding. FreeMarkets also

does a lot of work to ensure supplier integrity. At

the moment we just have a toe in water, 60 70m worth of work through FreeMarkets in the

next 12 months, but our total spend is well over

2bn per year.

FreeMarkets intends to expand its client base in 2001-2

to include additional global corporations, government

agencies and medium-sized companies from around

the world, supported by additional international

offices. FreeMarkets also plans to continue to

expand its e-marketplace to include more direct and

indirect materials and services, where its online

auctions and other services can provide significant

savings for clients.

Online Auctions: Lessons for Vendors,

Buyers and Sellers

FreeMarkets believes that its B2B e-marketplace

benefits all participants. It enables buyers to find

qualified suppliers, quality goods and services. It also

enables competitive pricing. Suppliers have better

access to new customers. Transactions flow freely in

a secure, transparent environment with fair and equal

access for all. The companys e-marketplace is

independent and neutral, and does not promote the

interest of any buying or selling organisation. It brings

buyers and sellers together, and facilitates frictionless

transactions. Unlike B2B exchanges, it does not involve

huge upfront investment in terms of capital,

organisation or time.

Lessons for vendors

For other vendors of B2B solutions, the FreeMarkets

story provides a number of lessons. First, any online B2B

e-commerce offering must obviously provide a clear value

proposition to customers over existing business

processes, and provide clear savings and/or efficiencies

in project cycle time and total transaction costs.

Technology for the e-marketplace must be easy to

implement, the most attractive solutions for both

customers and suppliers being those which minimise

the changes an enterprise must make when it does

Summer 2001

66 Jamie Anderson and Mark Frohlich

business online. But technology is not the key here, as

software solutions for in-house auctions are becoming

readily available. Elements such as the market-making

expertise surrounding the technology, breadth of

supplier base, and the ability of vendors to confirm

the integrity of geographically-dispersed suppliers are

what buyers are willing to pay for. And this is another

lesson from FreeMarkets buyers will pay if the

benefits are clear.

Experience has shown that business models based on

advertising revenue or supplier commissions to support

B2B exchanges or industry-specific e-commerce sites

are usually unsustainable. Despite this, a recent review

of leading B2B online marketplaces revealed that only

two out of 23 vendors levied substantial fees on buyers

(Kerrigan et al 2001). The FreeMarkets case suggests

that vendors should develop a fee structure that is

closely linked to the value-added provided to their

clients, and this might certainly mean basing a portion

of fees on project outcomes.

Another important metric is critical mass of both

buyers and suppliers, with transaction fees depending

on the number and scope of auctions hosted. With

more than 110 buyers and 11,000 suppliers from over

55 countries, FreeMarkets has emerged as one of the

strongest e-marketplaces in terms of active members.

FreeMarketss experience with its QuickTrade solution

also shows that vendors can make money by providing

proprietary auction software and support to large

customers.

One aspect that FreeMarkets and other online auction

providers need to address should they wish to provide

a full spectrum of procurement services is relationship

management. Vendors in the e-marketplace need to

develop non-auction or tailored auction offerings to

facilitate transactions where established buyer-supplier

relationships are important in negotiating long-term

contracts, volume pricing agreements or collaborative

product development.

While FreeMarkets is not yet profitable, it is likely to

be one of the few B2B e-marketplace start-ups (that

does not have a major industry sponsor) to survive

the current round of online marketplace

consolidation. In mid-2001, FreeMarkets is still

recruiting amidst significant downsizing by other

technology companies.

Business Strategy Review

FreeMarkets future success will depend upon its

ability to continue to build its global customer and

supplier base and to provide sustained value-added.

The companys combination of transaction, licensing

and professional service fees provides an attractive

example for B2B marketplaces struggling to devise

sustainable revenue models.

Lessons for buyers

FreeMarkets and other online auction providers claim

that the primary benefit for buyers is the cost and time

savings they realise by creating a frictionless and

transparent market. This benefit is coupled with

secondary benefits of access to a global supplier

network and extensive market data including

information on suppliers' manufacturing processes,

quality assurance practice, market focus, and facilities.

But, while online auctions such as FreeMarkets offer

many benefits for buyers, there are also constraints.

While the auction approach may certainly work for

commodity products such as paper, office products or

microchips, there might be dangers if buyers expect

to be able to apply this model to more critical or

complex direct inputs.

Even if an online auction company provides extensive

vetting and pre-qualification of suppliers, do buyers

really benefit by changing suppliers for every product

run or project? Indeed, the internet-based auction

model seems to go against the strategic partnership

approach that many companies have adopted as they

have outsourced extensive parts of their value chains.

FreeMarkets and other online auction providers have

discovered that buyers who move to a lower cost

bidder often return to existing (and higher cost)

suppliers after experiencing realignment challenges.

It is notable that leading new economy companies such

as Cisco and Dell have avoided subjecting their suppliers

to this kind of competition, being more concerned to

maintain strong and dependable relationships than to

squeeze their suppliers to the line on each transaction.

It is in no-ones best interests to force your suppliers

out of business by applying hyper-competition.

Important strategic considerations include:

Can this product/service be readily sourced from

multiple suppliers?

What are the potential or hidden costs of changing

my existing supplier?

FreeMarkets and Online Auctions 67

Are supplier transfer costs acceptable?

What are the risks associated with alienating core

suppliers?

Before entering the online auction space, buyers should

first assess whether an e-marketplace is the best option

for the purchases they expect to make, compared to

other methods on or off the Internet.

Lessons for suppliers

There are also lessons for sellers. In situations where

suppliers are drawn into an auction by an existing

customer, they should recognise that they often do not

have to provide the lowest price to extend previous

contracts. Price is certainly important, but issues

relating to dependability, quality and established

relationships can often result in an existing supplier

who is competitive but not the cheapest bidder winning

the final tender. As mentioned above, and with the

possible exception of commodity-type products and

services, a buyer is unlikely to change supplier for every

procurement project.

Although online auctions might be applicable for

interchangeable commodities, this is not always the

case for more complex products and services. Among

those who will experience far less pressure to

participate in online auctions are: suppliers with

unique or specialised products that do not lend

themselves to direct comparison; those with products

that are not susceptible to substitution (due to a limited

supplier base); those with significant patent or

copyright protection; and suppliers with hybrid

product and service offerings.

In situations where there are a limited number of

suppliers providing highly customised products or

services, sellers should be in a strong position. But in

the absence of a reasoned strategy, costly mistakes are

possible. In one case, a large organisation invited the

only three qualified suppliers of a critical component

to participate in an online auction, making a 28%

saving over historic cost. The suppliers to their auction

have now set a much lower price for their products,

creating a dangerous precedent for their industry. A

wiser strategy would have been for all of the suppliers

to refuse to participate not through collusion but

through a shared desire to retain healthy profits in a

unique market where they have a significant amount

of bargaining power.

A Page from FreeMarkets' Website

Summer 2001

68 Jamie Anderson and Mark Frohlich

More and more companies are refusing to

participate in auctions, particularly in fragmented

industries with multiple buyers who possess a

relatively weak bargaining position. Important

strategic considerations for suppliers include:

What is the competitive situation in my industry?

What is the relative bargaining power of buyers/

suppliers?

Which competing sellers are likely to be involved

in the auction?

Does the auction provide an opportunity for

suppliers to differentiate their products/services?

How have auctions affected suppliers prices in this

industry to date?

A final lesson for sellers relates to cost and acceptable

profit margin as the auction process provides an easy

outlet for an undisciplined bidder to lose his or her

shirt. Sellers should enter an online auction process

with a pre-determined strategy, and a definite

withdrawal point. It is not unknown for emotion to

get the better of reason (particularly if the CEO is

present for the auction event) and for a company to

bid itself below break-even. Unscrupulous bidders

who do not intend to pursue a tender might drive

down the bid price early and then withdraw, using

the auction process as a competitive tool against

other suppliers.

Conclusion

Online auctions will increase over the coming years.

They remove much of the friction surrounding the

traditional tendering process, offer the potential

advantages of wider breadth of suppliers, and can

provide an effective solution for buyers to establish

Business Strategy Review

true market prices for their inputs. For suppliers, emarketplaces can provide access to previously

unattainable accounts and unprecedented

participation in global markets. And unlike other eprocurement solutions such as industry exchanges and

B2B e-commerce portals, online auctions are relatively

quick and easy to implement.

Despite these advantages, both buyers and sellers

should also acknowledge that electronic B2B auctions

have limitations. For buyers, online auctions are

primarily a tactical tool to get the best price for

commodity products and services from non-strategic

suppliers. For sellers, auctions are a necessary evil in

competitive markets involving high levels of

commoditization and/or consolidation amongst

buyers, but should be approached cautiously in

industries where suppliers are few.

The shakeout in B2B e-marketplaces is likely to

continue. Those vendors who survive will be those

who, like FreeMarkets, can deliver a clear value

proposition to clients and can support this value

proposition with a sustainable path to profitability.

Jamie Anderson is a Programme Director and

researcher within the Centre for Management

Development, and Mark Frohlich is an Assistant

Professor of Operations and Technology

Management and the Deloitte Consulting eBusiness Fellow, both at London Business School

Reference

Kerrigan, Ryan, Eric V. Roegner, Bennis D. Swinford

and Craig Zawada (2001) B2Basics McKinsey

Quarterly, Number 1, 45-53.

You might also like

- Ndividual Ssignment AnagementDocument5 pagesNdividual Ssignment AnagementJoel Christian MascariñaNo ratings yet

- Free Job Hunt Guide v1.1 PDFDocument78 pagesFree Job Hunt Guide v1.1 PDFBogdan LupuNo ratings yet

- Additional Exercice S Data ScienceDocument3 pagesAdditional Exercice S Data ScienceFrankNo ratings yet

- Ebay Case StudyDocument7 pagesEbay Case Studyrajdeeplaha0% (1)

- Free Markets Online AnalysisDocument5 pagesFree Markets Online AnalysispjkutumbeNo ratings yet

- Corporate Planning and StrategyDocument22 pagesCorporate Planning and StrategyjoNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasDevia SuswodijoyoNo ratings yet

- MBF Question Paper in Two SetsDocument6 pagesMBF Question Paper in Two Setsracingvicky05100% (2)

- Fama Efficient Capital Markets PDFDocument2 pagesFama Efficient Capital Markets PDFCatherineNo ratings yet

- Ewen Chias Fast Track Cash Review The Easiest Way To Make Massive Cash Onlinenuvxq PDFDocument1 pageEwen Chias Fast Track Cash Review The Easiest Way To Make Massive Cash Onlinenuvxq PDFugandavalley75No ratings yet

- Inspera Online Exams 2022 - EMFSS - FAQs - v1.1 - May22Document14 pagesInspera Online Exams 2022 - EMFSS - FAQs - v1.1 - May22Ahmad Diaa El DinNo ratings yet

- G. Edward Griffin: A Second Look at The Federal ReserveDocument11 pagesG. Edward Griffin: A Second Look at The Federal ReserveKirsten NicoleNo ratings yet

- Contest Promotion PDFDocument55 pagesContest Promotion PDFTuan Ahamed CassimNo ratings yet

- Facebook $3000 A Month Ebook NewDocument5 pagesFacebook $3000 A Month Ebook NewGautam AggarwalNo ratings yet

- Itin Online Pre Application Training 11 22 2019 2Document90 pagesItin Online Pre Application Training 11 22 2019 2Joeren GonzalesNo ratings yet

- Homeasy A Home Service AppDocument4 pagesHomeasy A Home Service AppInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Social Media Marketing - An Effective Solution For Non-Profit OrganizationsDocument7 pagesSocial Media Marketing - An Effective Solution For Non-Profit OrganizationsLathaNo ratings yet

- MoneyDocument19 pagesMoneyapi-344737172No ratings yet

- Make Money Online With BrowsingDocument15 pagesMake Money Online With BrowsingkimNo ratings yet

- 8 Free Online Courses For TechDocument2 pages8 Free Online Courses For Techmercina87No ratings yet

- Hi My Ass Proxy Free List - Google SearchDocument2 pagesHi My Ass Proxy Free List - Google Searchgetcash freeNo ratings yet

- Free Course and Programming GuideDocument51 pagesFree Course and Programming GuideAd AdNo ratings yet

- Onlyfans Hack 2021 REAL Onlyfans Free Premium Account Generator #8cP0ADocument2 pagesOnlyfans Hack 2021 REAL Onlyfans Free Premium Account Generator #8cP0ANaruto Uzumaki100% (1)

- Jail Breaking and Unlocking Is LEGAL As Confirmed by The US Federal Court of Appeal 2011-09-29Document19 pagesJail Breaking and Unlocking Is LEGAL As Confirmed by The US Federal Court of Appeal 2011-09-29andreass_9No ratings yet

- Cecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyDocument74 pagesCecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyammendNo ratings yet

- TEA Application Guide and Form EN March 2020 Filled PDFDocument20 pagesTEA Application Guide and Form EN March 2020 Filled PDFFaraz SofiyanNo ratings yet

- Emergency Solutions Grant Programs ApplicationDocument127 pagesEmergency Solutions Grant Programs ApplicationThe Anniston StarNo ratings yet

- New O Penin G: Concept MoneyDocument14 pagesNew O Penin G: Concept MoneyYudhisthir HaldarNo ratings yet

- Pinterest Accounts To Follow About Free Money NowDocument3 pagesPinterest Accounts To Follow About Free Money NowambiochudpNo ratings yet

- Free BTC Autopilot Method 2019Document5 pagesFree BTC Autopilot Method 2019ToxiclandNo ratings yet

- Money Market MarketwalaDocument57 pagesMoney Market MarketwalaUtkarsh NegiNo ratings yet

- IOS Application Security Part 24 - Jailbreak Detection and EvasionDocument5 pagesIOS Application Security Part 24 - Jailbreak Detection and EvasionSto StrategyNo ratings yet

- The Best Grant Programs For You - Sclolsrships Small Business and HousingDocument7 pagesThe Best Grant Programs For You - Sclolsrships Small Business and HousingSamFrazer0% (1)

- Os Projct ReportDocument16 pagesOs Projct ReportJoeyNo ratings yet

- Local Online Marketing For Attorneys Package PageDocument4 pagesLocal Online Marketing For Attorneys Package PageSyed Umayr Ali HashmiNo ratings yet

- US Small Business Administration Disaster Loan Information For August StormDocument2 pagesUS Small Business Administration Disaster Loan Information For August StormKaren WallNo ratings yet

- Bus IessDocument45 pagesBus IessBernadette Mausisa100% (1)

- How To Start A Blog That Makes Money (Lessons Learned)Document20 pagesHow To Start A Blog That Makes Money (Lessons Learned)Edward AngelesNo ratings yet

- AV GainfulEmploymentPolicyFocus One Pager v1Document3 pagesAV GainfulEmploymentPolicyFocus One Pager v1Arnold VenturesNo ratings yet

- There's A Lot To Learn About MoneyDocument8 pagesThere's A Lot To Learn About MoneyWickedadonisNo ratings yet

- Charitable Fund Raising Ohio by Professional Solicitors ReportDocument91 pagesCharitable Fund Raising Ohio by Professional Solicitors ReportMike DeWineNo ratings yet

- I CPA ProfitsDocument20 pagesI CPA ProfitsJeremy ThomsonNo ratings yet

- U.S.-Based Wholesale Vehicle Auction Giant, Auto Auction Mall, Establishes Local Presence in Lagos, NigeriaDocument2 pagesU.S.-Based Wholesale Vehicle Auction Giant, Auto Auction Mall, Establishes Local Presence in Lagos, NigeriaPR.com100% (1)

- All Courses OnlineDocument45 pagesAll Courses OnlineYo_amaranthNo ratings yet

- Android Vs IphoneDocument15 pagesAndroid Vs IphoneShannon AthaideNo ratings yet

- Debt or Equity-Which One Is Better For Your Business?: Name-Avani Shah Roll No-Pgdmrba019Document2 pagesDebt or Equity-Which One Is Better For Your Business?: Name-Avani Shah Roll No-Pgdmrba019avani shahNo ratings yet

- How To Monetize Your WebsiteDocument1 pageHow To Monetize Your WebsiteVicky ManghaniNo ratings yet

- How To Make Money OnlineDocument2 pagesHow To Make Money OnlinepavanmetriNo ratings yet

- Rural Development's Broad Base of Economic Development Programs by Vernita DoreDocument40 pagesRural Development's Broad Base of Economic Development Programs by Vernita DoreNational Environmental Justice Conference and Training ProgramNo ratings yet

- Consular InformationDocument18 pagesConsular InformationPraveen SankisaNo ratings yet

- Email PaymentsDocument9 pagesEmail PaymentsFlaviub23No ratings yet

- Online Job Searching:Workbook: WWW - Library.pima - Gov 520-791-4010Document22 pagesOnline Job Searching:Workbook: WWW - Library.pima - Gov 520-791-4010TanveerNo ratings yet

- Cleaning Product Business PlanDocument4 pagesCleaning Product Business PlanSantosh Arakeri0% (1)

- Principles of Finance For Small BusinessDocument24 pagesPrinciples of Finance For Small BusinessSenelwa AnayaNo ratings yet

- Facebook Code BookDocument151 pagesFacebook Code BookAlsheDupurNo ratings yet

- Land, Tenure and Housing Issues For Conflict-Displaced Populations in GeorgiaDocument84 pagesLand, Tenure and Housing Issues For Conflict-Displaced Populations in GeorgiaUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- AA - The Motley Fool Money GuideDocument422 pagesAA - The Motley Fool Money GuideAlina ArdeleanNo ratings yet

- Success on the internet: How to earn a million dollars in seven monthsFrom EverandSuccess on the internet: How to earn a million dollars in seven monthsNo ratings yet

- MOS GameDocument13 pagesMOS GameNuhtimNo ratings yet

- Essel Group PresentationDocument38 pagesEssel Group PresentationSai Krishna KodaliNo ratings yet

- Love LetterDocument1 pageLove LetterNuhtimNo ratings yet

- Core CompetenceDocument11 pagesCore CompetenceNuhtimNo ratings yet

- Chapter 19 - Marketing ManagementDocument34 pagesChapter 19 - Marketing ManagementNuhtimNo ratings yet

- IP Protection of Intangible AssetsDocument3 pagesIP Protection of Intangible AssetsNuhtimNo ratings yet

- Power' Crisis: Mithun Ganesh S (1511102) MANISH KUMAR (1511101)Document7 pagesPower' Crisis: Mithun Ganesh S (1511102) MANISH KUMAR (1511101)NuhtimNo ratings yet

- RICOH Printer Setup GuideDocument2 pagesRICOH Printer Setup GuideNuhtimNo ratings yet

- State Wise Poultry in India 2003: ScopeDocument5 pagesState Wise Poultry in India 2003: ScopeNuhtimNo ratings yet

- Ce2Document4 pagesCe2NuhtimNo ratings yet

- Entry Form For Best Writing On CinemaDocument3 pagesEntry Form For Best Writing On CinemaNuhtimNo ratings yet

- Adaptive Car Security SystemDocument4 pagesAdaptive Car Security SystemNuhtimNo ratings yet

- Hplabs InternsposterDocument2 pagesHplabs InternsposterNuhtimNo ratings yet

- Coinjoos Presents "Expro Online Quiz Set 1": RulesDocument8 pagesCoinjoos Presents "Expro Online Quiz Set 1": RulesNuhtimNo ratings yet

- Recent Rulings in Income Tax ActDocument91 pagesRecent Rulings in Income Tax ActKarthik Chandrashekar100% (1)

- Valu TraderDocument16 pagesValu TraderRichard SuttmeierNo ratings yet

- Customer SatisfactionDocument88 pagesCustomer Satisfactionmd jabir hussain73% (11)

- International Business ManagementDocument23 pagesInternational Business Managementsunny100% (1)

- Uniform Valuation Standards Way ForwardDocument38 pagesUniform Valuation Standards Way ForwardttkarthikeyanNo ratings yet

- Investment Contract Template 1Document3 pagesInvestment Contract Template 1Jyka BonitaNo ratings yet

- Practice QuestionsDocument10 pagesPractice Questionsaba brohaNo ratings yet

- The Ansoff Growth MatrixDocument2 pagesThe Ansoff Growth Matrixebonycat1209No ratings yet

- Apti 9Document4 pagesApti 9Shikha AryaNo ratings yet

- Assignment On WB, IMF & WTODocument18 pagesAssignment On WB, IMF & WTOdead_fahad100% (1)

- Raj UCO SynopsisDocument9 pagesRaj UCO SynopsisRaj Kamal100% (1)

- FT Annual - Report - 2016Document120 pagesFT Annual - Report - 2016Meruţ ŞtefanNo ratings yet

- Corporate Restructuring - Reconfiguring The FirmDocument10 pagesCorporate Restructuring - Reconfiguring The FirmShashank VihariNo ratings yet

- Dell ComputersDocument8 pagesDell ComputersDebashish Bagg100% (1)

- Entrepreneurship Toolkit - Baker Library - Harvard Business SchoolDocument4 pagesEntrepreneurship Toolkit - Baker Library - Harvard Business SchoolcmkkaranNo ratings yet

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- Portfolio RevisionDocument14 pagesPortfolio RevisionchitkarashellyNo ratings yet

- Accounting Module Fixed 1Document70 pagesAccounting Module Fixed 1Ferry SetiabudiNo ratings yet

- Bonnie'S Buds: Financial Worksheet MAY 21. 2012 Account Titles Unadjusted Trial BalanceDocument13 pagesBonnie'S Buds: Financial Worksheet MAY 21. 2012 Account Titles Unadjusted Trial BalanceMary Clare VinluanNo ratings yet

- Total Number of Rooms 50.63Document4 pagesTotal Number of Rooms 50.63hanuman2467% (3)

- A Study On Financial Performance of Axis Bank in Comparison of HDFC Bank and Icici BankDocument99 pagesA Study On Financial Performance of Axis Bank in Comparison of HDFC Bank and Icici Bankjenish modiNo ratings yet

- SP Complete NotesDocument18 pagesSP Complete NotesKrushna ShirsatNo ratings yet

- Company Background: Problem StatementDocument14 pagesCompany Background: Problem Statementsaleh_399No ratings yet

- Flipkart Case StudyDocument6 pagesFlipkart Case Studyrushikesh kakadeNo ratings yet

- Research Project On Red BullDocument58 pagesResearch Project On Red Bullnaagesh7No ratings yet

- Personal Finance 6th Edition Madura Solution ManualDocument46 pagesPersonal Finance 6th Edition Madura Solution Manualbrenda100% (22)