Professional Documents

Culture Documents

BIR RR 13 - 18 Matrix

Uploaded by

ErmawooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR RR 13 - 18 Matrix

Uploaded by

ErmawooCopyright:

Available Formats

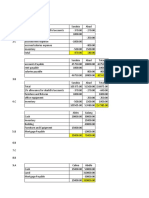

Before Payment

PROTEST (Protest Against Assessment)

COMPROMISE

After Payment

Refund

Tax Credit

ASSESSMENT

Section 228 of the 1997 Tax Code

Procedural Steps Governing Administrative Protests

RR 13-18

Due Process Requirement in the Issuance of a Deficiency Tax Assessment

Condition: If after review, there exists sufficient basis to assess the taxpayer for any

deficiency tax or taxes

BIR shall issue to the taxpayer PAN (Preliminary Assessment Notice) for the proposed assessment.

Showing in detail, the facts and the law, RRs, or jurisprudence on which the proposed assessment is based

Exceptions to PAN*

(i)

W hen the findingfor any deficiency tax is the result of mathematical error in thecomputation

appearing on the face of the tax return filed by the taxpayer; or

of

the

tax

(ii)

W hen a discrepancy has been determined between the tax withheld and theamount actually remitted by the

withholding agent; or

(iii)

W hen a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a taxable

period was determined to have carried over and automatically applied the same amount claimed against the estimated tax

liabilities for the taxable quarter or quarters of the succeeding taxable year; or

(iv)

W hen the excise tax due on excisable articles has not been paid; or

(v)

W hen an article locally purchased or imported by an exempt person, such as, butnot limited to, vehicles,

capital equipment, machineries and spare parts, has been sold, traded or transferred to non-exempt persons.

*In the above-cited cases, a FLD/FAN shall be issued outright.

15 DAYS from receipt of PAN

Response NO

Taxpayer IN DEFAULT

Response YES

That he/it disagrees with the findings of deficiency tax or

taxes.

BIR shall issue a Formal Letter of Demand and Final

Assessment Notice (FLD/FAN), calling for payment of

the taxpayer's deficiency tax liability, inclusive of the

applicable penalties.

Within 15 DAYS from filing/submission of the

taxpayers response BIR shall issue FLD/FAN calling

for payment of the taxpayer's deficiency tax

liability, inclusive of the applicable penalties.

FLD/FAN shall be issued by the Commissioner or his duly authorized representative.

Shall state the facts, the law, rules and regulations, or jurisprudence on which the assessment is based; otherwise, the

assessment shall be void.

Disputed Assessment

Within 30 DAYS from receipt of FLD/FAN

Taxpayer may PROTEST Administratively against

Otherwise, the assessment shall become final,

FLD/FAN,

executory and demandable.

he/it may file a written request for reconsideration or

No request for reconsideration or reinvestigation shall be

reinvestigation

granted.

(i) Request for reconsideration refers to a plea of re-evaluation of an assessment on the basis of existing records

without need of additional evidence. It may involve both a question of fact or of law or both.

(ii) Request for reinvestigation refers to a plea of re-evaluation of an assessment on the basis of newly discovered or

additional evidence that a taxpayer intends to present in the reinvestigation. It may also involve a question of fact or of law

or both.

Protest shall states (i) the nature of protest whether reconsideration or reinvestigation, specifying newly discovered or additional

evidence he intends to present if it is a request for reinvestigation, (ii) date of the assessment notice, and (iii) the applicable law,

rules and regulations, or jurisprudence on which his protest is based, otherwise, his protest shall be considered void and

without force and effect.

Partial Dispute Taxpayer shall pay the deficiency tax or taxes attributable to the undisputed issues, in which case, a

collection letter shall be issued to the taxpayer calling for payment of the said deficiency tax, inclusive of the applicable surcharge

and/or interest. The assessment attributable to the undisputed issue or issues shall become final, executory and demandable.

Failure to state the facts, the applicable law, RRs, or jurisprudence in support of his protest = undisputed issue

Taxpayer shall state the facts, the applicable law, rules and regulations, or jurisprudence on which his protest is

based, otherwise, his protest shall be void and without force and effect.

For REQUEST for REINVESTIGATION

Within 60 DAYS from FILING of PROTEST

Taxpayer shall submit all relevant supporting

Otherwise, the assessment shall become final.

documents

Final - shall mean the taxpayer is barred from disputing

the correctness of the issued assessment by introduction

of newly discovered or additional evidence, and the FDDA

shall consequently be denied.

60-day period for the submission of all relevant supporting documents N/A to requests for reconsideration

BY THE DULY REP

DENIED, in whole or in part

Fails to ACT

Within 30 DAYS

Within 30 DAYS from

RECON: WITHIN 180 DAYS from filing of protest

from receipt of

receipt of decision,

REINVESTIGATION: 180 days from date of submission

decision, APPEAL

OR

elevate (Admin Appeal)

of the required documents within sixty 60 days from the

to CTA

thru RECONSIDERATION date of filing

Within 30 DAYS from the

Await the final decision of

to Commissioner

expiration of 180-day

the REP on the disputed

>Request for reinvestigation

period, APPEAL to CTA ,

assessment

NOT ALLOWED and

>Only issues raised in the

decision of the Rep s/b

entertained by the Comm.

OR

Protest/ADMIN Appeal_ BY THE COMM

DENIED, in whole or in part

Fails to ACT 180 DAYS from Filing of the Protest

Within 30 days from receipt

Otherwise,

Within 30 DAYS from the

Await the final decision of

of decision, APPEAL to

the assessment shall

expiration of 180-day

the Comm. on the

CTA

become final,

period, APPEAL to CTA ,

disputed assessment and

executory and

appeal such final decision

demandable

OR

to the CTA within 30 days

after the receipt of a copy

of such decision.

In

case

of

inaction

*Mutually

exclusive

and the resort to

MR of the Commissioners denial shall

one bars the application of the other.

not toll the thirty (30)-day period to

appeal to the CTA.

Final Decision on a Disputed Assessment (FDDA) shall state

(a) the facts, the applicable law, rules and regulations, or jurisprudence on which such decision is based, otherwise, the decision

shall be void, in which case, the same shall not be considered a decision on a disputed assessment; and

(b) that the same is his final decision.

Modes of Service of notice (PAN/FLD/FAN/FDDA) like the rules on service of summons

Personal service. If not practicable, the notice shall be served by substituted service or by mail.

Disinterested witnesses refers to persons of legal age other than employees of the BIR.

Service to the tax agent/practitioner, who is appointed by the taxpayer under circumstances prescribed in the pertinent

regulations on accreditation of tax agents, shall be deemed service to the taxpayer.

You might also like

- Notes in SEC Circulars and IssuancesDocument13 pagesNotes in SEC Circulars and IssuancesJeremae Ann CeriacoNo ratings yet

- AC19 MODULE 5 - UpdatedDocument14 pagesAC19 MODULE 5 - UpdatedMaricar PinedaNo ratings yet

- Chapter 2 - CISDocument40 pagesChapter 2 - CISMaeNeth GullanNo ratings yet

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidNo ratings yet

- MODULE 6 - Audit PlanningDocument9 pagesMODULE 6 - Audit PlanningRufina B VerdeNo ratings yet

- Taxation: 8. Special Economic Zone ActDocument6 pagesTaxation: 8. Special Economic Zone ActMayann UrbanoNo ratings yet

- MODADV3 Handouts 1 of 2Document23 pagesMODADV3 Handouts 1 of 2Dennis ChuaNo ratings yet

- 7084 Multiple Choice Small Entities Lecture Notes and SolutionDocument4 pages7084 Multiple Choice Small Entities Lecture Notes and SolutionpompomNo ratings yet

- Commission On Audit:: Government Accounting Manual (Gam) Pointers CA51027Document4 pagesCommission On Audit:: Government Accounting Manual (Gam) Pointers CA51027Carl Dhaniel Garcia SalenNo ratings yet

- Income Taxation: 2. Personal Income Tax: Non-Resident Citizen (1999)Document8 pagesIncome Taxation: 2. Personal Income Tax: Non-Resident Citizen (1999)Anonymous oWQuKcUNo ratings yet

- Taxation Law II Prelim Exam 2021Document2 pagesTaxation Law II Prelim Exam 2021Aure ReidNo ratings yet

- Polytechnic University of The Philippines: ST NDDocument10 pagesPolytechnic University of The Philippines: ST NDShania BuenaventuraNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- Tax BT Introduction To VATDocument5 pagesTax BT Introduction To VATJoshua Phillip TorcedoNo ratings yet

- Batas Pambansa BLG 22Document19 pagesBatas Pambansa BLG 22Samn Pistola CadleyNo ratings yet

- 2012 08 NIRC Remedies TablesDocument8 pages2012 08 NIRC Remedies TablesJaime Dadbod NolascoNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- ObliCon - Quiz Part 1 of 4Document2 pagesObliCon - Quiz Part 1 of 4Mi MingkaiNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Income Taxation-FinalsDocument14 pagesIncome Taxation-FinalsTheaNo ratings yet

- Questions and Suggested AnswersDocument1 pageQuestions and Suggested AnswersjustinebetteNo ratings yet

- Acrev 422 AfarDocument19 pagesAcrev 422 AfarAira Mugal OwarNo ratings yet

- Revenue Memorandum Circular No. 35-06: June 21, 2006Document17 pagesRevenue Memorandum Circular No. 35-06: June 21, 2006Kitty ReyesNo ratings yet

- Taxation Sia/Tabag TAX.2814-Community Tax MAY 2020: Lecture Notes A. IndividualsDocument1 pageTaxation Sia/Tabag TAX.2814-Community Tax MAY 2020: Lecture Notes A. IndividualsMay Grethel Joy PeranteNo ratings yet

- Accounting For PayrollDocument15 pagesAccounting For PayrollDenise Aubrey GallardoNo ratings yet

- Audit of Acquisition and Payment Cycle PDFDocument36 pagesAudit of Acquisition and Payment Cycle PDFZi VillarNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Income TaxationDocument38 pagesIncome TaxationElson TalotaloNo ratings yet

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Utopia Obligations ReviewerDocument122 pagesUtopia Obligations ReviewerGracey CasianoNo ratings yet

- Philippine Standards On AuditingDocument51 pagesPhilippine Standards On AuditingStephannieArreolaNo ratings yet

- General Provisions: The Law On PartnershipDocument38 pagesGeneral Provisions: The Law On PartnershipJoe P PokaranNo ratings yet

- 1995Document17 pages1995Gelo MVNo ratings yet

- Ra 9520Document2 pagesRa 9520kat perezNo ratings yet

- Afar Concept Review Notes Part 1Document13 pagesAfar Concept Review Notes Part 1Alexis SosingNo ratings yet

- Acc 61 1stsem Sy2021 Gutierrez, FerdinandDocument6 pagesAcc 61 1stsem Sy2021 Gutierrez, FerdinandrnNo ratings yet

- CPALE TOS Eff May 2019Document25 pagesCPALE TOS Eff May 2019Dale Abrams Dimataga75% (4)

- Midterm Mockboard ACCOUNTING 601-Integrated Course in TaxationDocument12 pagesMidterm Mockboard ACCOUNTING 601-Integrated Course in TaxationhyasNo ratings yet

- Foreign Currency Deposit Act of The PhilippinesDocument14 pagesForeign Currency Deposit Act of The PhilippinestheaNo ratings yet

- Rodriguez Zyra-Denelle 06 JournalDocument12 pagesRodriguez Zyra-Denelle 06 JournalDaena NicodemusNo ratings yet

- Bouncing Checks Law: Batas Pambansa Bilang No. 22Document8 pagesBouncing Checks Law: Batas Pambansa Bilang No. 22Chara etangNo ratings yet

- Part I: Concept of Tax AdministrationDocument22 pagesPart I: Concept of Tax AdministrationShiela Marie Sta AnaNo ratings yet

- FAR 2 Finals Cheat SheetDocument8 pagesFAR 2 Finals Cheat SheetILOVE MATURED FANSNo ratings yet

- Notes ReceivableDocument9 pagesNotes ReceivableJAPNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Study Notes 4 PAPS 1013Document6 pagesStudy Notes 4 PAPS 1013Francis Ysabella BalagtasNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoicesppNo ratings yet

- SalesDocument89 pagesSalesjelviee15No ratings yet

- Preferential TaxationDocument8 pagesPreferential TaxationAngelica Nicole TamayoNo ratings yet

- Manual On Financial Manager of Barangays Module 3Document11 pagesManual On Financial Manager of Barangays Module 3vicsNo ratings yet

- Law003 Ease of Doing Business Act QuestionsDocument5 pagesLaw003 Ease of Doing Business Act Questionskgandamarket.jeasselNo ratings yet

- Chap 011Document36 pagesChap 011Angel TumamaoNo ratings yet

- RMC 130-2016Document2 pagesRMC 130-2016Earl John PajaroNo ratings yet

- Bases Conversion and Development - RA 7227 PDFDocument17 pagesBases Conversion and Development - RA 7227 PDFRain Rivera RamasNo ratings yet

- CPA Review School of The Philippines ManilaDocument4 pagesCPA Review School of The Philippines ManilaSophia PerezNo ratings yet

- Republic Act No 9679 PAG IBIGDocument17 pagesRepublic Act No 9679 PAG IBIGJnot VictoriknoxNo ratings yet

- SE Gov ActgDocument16 pagesSE Gov ActgCristel TannaganNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument76 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledFrancis Coronel Jr.No ratings yet

- RR No. 18-2013 (Digest)Document3 pagesRR No. 18-2013 (Digest)Alisa FitzpatrickNo ratings yet

- Rev Regs No. 12-99 (As Amended) - 08012014Document27 pagesRev Regs No. 12-99 (As Amended) - 08012014Jacob DalisayNo ratings yet

- Civil Law Last Minute Tips FEUDocument18 pagesCivil Law Last Minute Tips FEUKaren SupapoNo ratings yet

- CM TaxationDocument55 pagesCM TaxationErmawooNo ratings yet

- PAO Code of Conduct FinalDocument7 pagesPAO Code of Conduct FinalceejayeNo ratings yet

- CM Taxation 2Document56 pagesCM Taxation 2ErmawooNo ratings yet

- Labor Law Bar Questions 2016Document6 pagesLabor Law Bar Questions 2016Ruth Hazel Galang0% (1)

- Magic Areas in Political Law: 2017 Bar ExaminationDocument41 pagesMagic Areas in Political Law: 2017 Bar ExaminationHassanal AbdurahimNo ratings yet

- Pao Law IrrDocument10 pagesPao Law IrrzhanleriNo ratings yet

- Congress of The Philippines: (Republic Act No. 9406)Document10 pagesCongress of The Philippines: (Republic Act No. 9406)mcris101No ratings yet

- Affirmations For The Nervous Pretty Law SlaveDocument3 pagesAffirmations For The Nervous Pretty Law SlaveErmawooNo ratings yet

- Labor Addendum Bar QA (2012-2015)Document83 pagesLabor Addendum Bar QA (2012-2015)jesusjoelarzagaNo ratings yet

- Response From Philippines Commission On Human RightsDocument15 pagesResponse From Philippines Commission On Human RightsErmawooNo ratings yet

- Unfair CC CollectionDocument2 pagesUnfair CC CollectionErmawooNo ratings yet

- Cases in Tax ReviewDocument173 pagesCases in Tax ReviewErmawooNo ratings yet

- Intercon Vs AmarillaDocument11 pagesIntercon Vs AmarillaErmawooNo ratings yet

- List Rules JARDocument6 pagesList Rules JARErmawooNo ratings yet

- 30 Things You Should Start DoingDocument6 pages30 Things You Should Start DoingErmawooNo ratings yet

- Tax Review OutlineDocument18 pagesTax Review OutlineMyn Mirafuentes Sta AnaNo ratings yet

- CM TaxationDocument32 pagesCM TaxationErmawooNo ratings yet

- 1st Set Digested Cases Taxation Law 1Document53 pages1st Set Digested Cases Taxation Law 1ErmawooNo ratings yet

- Taxation Law Mamalateo PDFDocument99 pagesTaxation Law Mamalateo PDFErmawooNo ratings yet

- RPC - Book II. by TitleDocument4 pagesRPC - Book II. by TitleErmawooNo ratings yet

- BIR RR 13 - 18 MatrixDocument2 pagesBIR RR 13 - 18 MatrixErmawooNo ratings yet

- Magna Carta For Public School Teachers (Philippines)Document6 pagesMagna Carta For Public School Teachers (Philippines)muniesang0% (1)

- RR 12-99 Full TextDocument5 pagesRR 12-99 Full TextErmawoo100% (2)

- Bar TechniquesDocument11 pagesBar TechniquesolpotNo ratings yet

- Sample Notarial & Holographic - Last Will and TestamentDocument4 pagesSample Notarial & Holographic - Last Will and TestamentErmawooNo ratings yet

- 1st Set Tax CasesDocument309 pages1st Set Tax CasesolofuzyatotzNo ratings yet

- Multi-Media Approach To Teaching-LearningDocument8 pagesMulti-Media Approach To Teaching-LearningswethashakiNo ratings yet

- IELTS Material Writing 1Document112 pagesIELTS Material Writing 1Lê hoàng anhNo ratings yet

- Java Edition Data Values - Official Minecraft WikiDocument140 pagesJava Edition Data Values - Official Minecraft WikiCristian Rene SuárezNo ratings yet

- PEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)Document13 pagesPEA Comp Study - Estate Planning For Private Equity Fund Managers (ITaback, JWaxenberg 10 - 10)lbaker2009No ratings yet

- Teal Motor Co. Vs CFIDocument6 pagesTeal Motor Co. Vs CFIJL A H-DimaculanganNo ratings yet

- List of Bird Sanctuaries in India (State-Wise)Document6 pagesList of Bird Sanctuaries in India (State-Wise)VISHRUTH.S. GOWDANo ratings yet

- Activity Based Costing TestbanksDocument18 pagesActivity Based Costing TestbanksCharlene MinaNo ratings yet

- 2 Calculation ProblemsDocument4 pages2 Calculation ProblemsFathia IbrahimNo ratings yet

- Schermer 1984Document25 pagesSchermer 1984Pedro VeraNo ratings yet

- LMSTC Questionnaire EFFECTIVENESS IN THE IMPLEMENTATION OF LUCENA MANPOWER SKILLS TRAINING CENTER BASIS FOR PROGRAM ENHANCEMENTDocument3 pagesLMSTC Questionnaire EFFECTIVENESS IN THE IMPLEMENTATION OF LUCENA MANPOWER SKILLS TRAINING CENTER BASIS FOR PROGRAM ENHANCEMENTCriselda Cabangon DavidNo ratings yet

- MikoritkDocument6 pagesMikoritkChris Jonathan Showip RouteNo ratings yet

- ABHIGYAN 2020 E-InvitationDocument2 pagesABHIGYAN 2020 E-Invitationchirag sabhayaNo ratings yet

- Southern California International Gateway Final Environmental Impact ReportDocument40 pagesSouthern California International Gateway Final Environmental Impact ReportLong Beach PostNo ratings yet

- MSDS Formic AcidDocument3 pagesMSDS Formic AcidChirag DobariyaNo ratings yet

- Matrices and Vectors. - . in A Nutshell: AT Patera, M Yano October 9, 2014Document19 pagesMatrices and Vectors. - . in A Nutshell: AT Patera, M Yano October 9, 2014navigareeNo ratings yet

- Preliminary Examination The Contemporary WorldDocument2 pagesPreliminary Examination The Contemporary WorldJane M100% (1)

- Listening Tests 81112Document13 pagesListening Tests 81112luprof tpNo ratings yet

- Limestone Standards PDFDocument2 pagesLimestone Standards PDFJacqueline BerueteNo ratings yet

- NCDC-2 Physical Health Inventory Form A4Document6 pagesNCDC-2 Physical Health Inventory Form A4knock medinaNo ratings yet

- 4BT3 9-G2 PDFDocument5 pages4BT3 9-G2 PDFNv Thái100% (1)

- Pds Hempel's Maestro Water Borne Primer 28830 En-GbDocument2 pagesPds Hempel's Maestro Water Borne Primer 28830 En-GbKalaiyazhagan ElangeeranNo ratings yet

- Edtpa Lesson 3Document3 pagesEdtpa Lesson 3api-299319227No ratings yet

- S P99 41000099DisplayVendorListDocument31 pagesS P99 41000099DisplayVendorListMazen Sanad100% (1)

- Walton Finance Way Strategy (MO)Document12 pagesWalton Finance Way Strategy (MO)AshokNo ratings yet

- Tutorial 3 MFRS8 Q PDFDocument3 pagesTutorial 3 MFRS8 Q PDFKelvin LeongNo ratings yet

- Routine Maintenance For External Water Tank Pump and Circulation Pump On FID Tower and Rack 2017-014Document5 pagesRoutine Maintenance For External Water Tank Pump and Circulation Pump On FID Tower and Rack 2017-014CONVIERTE PDF JPG WORDNo ratings yet

- Chemistry II EM Basic Learning MaterialDocument40 pagesChemistry II EM Basic Learning MaterialMAHINDRA BALLANo ratings yet

- History of Old English GrammarDocument9 pagesHistory of Old English GrammarAla CzerwinskaNo ratings yet

- Lecture 1 Electrolyte ImbalanceDocument15 pagesLecture 1 Electrolyte ImbalanceSajib Chandra RoyNo ratings yet

- NOV23 Nomura Class 6Document54 pagesNOV23 Nomura Class 6JAYA BHARATHA REDDYNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Bookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesFrom EverandBookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesNo ratings yet