Professional Documents

Culture Documents

1 s2.0 S016517659900230X Main

Uploaded by

Eugenio MartinezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 s2.0 S016517659900230X Main

Uploaded by

Eugenio MartinezCopyright:

Available Formats

Economics Letters 66 (2000) 199202

www.elsevier.com / locate / econbase

Corruption and inflation

Fahim A. Al-Marhubi*

Sultan Qaboos University, College of Commerce and Economics, P.O. Box 20, Post Code 123, Al-Khoudh, Oman

Received 18 September 1998; accepted 20 April 1999

Abstract

This paper analyzes the relationship between corruption and inflation. Using alternative indicators of

corruption, I find a significant positive association between corruption and inflation, even after controlling for a

variety of other determinants of the latter. 2000 Elsevier Science S.A. All rights reserved.

Keywords: Inflation; Corruption

JEL classification: E31; E62

1. Introduction

During the last decade there has been considerable research on the macroeconomic consequences of

corruption. Most of the academic literature on this subject has studied the effects of corruption on

static efficiency, investment, and economic growth. Missing from recent discussions of corruption is

any systematic analysis of the effects of corruption on inflation. This is surprising given the recent

explosion of interest in the political-economy determinants of inflation.

There are a number of reasons why inflation and corruption may be linked. First, according to the

theory of optimal taxation, governments may have a motive for creating inflation, so as to generate

seigniorage. Tax evasion and tax collection costs may make it optimal for the government to rely on

the inflation tax as a source of government revenue. Clearly, tax evasion and tax collection costs are

likely to be greater in countries that are more corrupt. Second, businesses are likely to respond to

corruption by going underground, thereby increasing reliance on the inflation tax. Third, corruption

may also lead to capital flight, which shrinks taxable assets and income of those most able to meet

government revenue requirements. Finally, by reducing revenues and increasing public spending,

corruption may also contribute to larger fiscal deficits, which may have inflationary consequences for

countries with less developed financial markets.

*Tel.: 1 968-51-58-18; fax: 1 968-51-40-43.

E-mail address: faaam@gto.net.om (F.A. Al-Marhubi)

0165-1765 / 00 / $ see front matter 2000 Elsevier Science S.A. All rights reserved.

PII: S0165-1765( 99 )00230-X

200

F. A. Al-Marhubi / Economics Letters 66 (2000) 199 202

The impact of corruption on inflation is ultimately an empirical question. Drawing on the political

economy approach to inflation, this paper provides evidence on the extent to which corruption

explains cross-country inflation differentials.1

2. Methodology and data description

The significance of the inflation-corruption link is evaluated using the positive political-economy

approach to inflation. This conceptual framework analyzes the underlying incentives and constraints

faced by policy-makers in their strategic decisions regarding monetary policy. This literature has

provided some important insights into the effectiveness of different pre-commitment devices in

containing inflationary forces and the institutional and political factors that contribute to the

development of inflationary pressures. Variables that have received the most attention in this literature

are used as control variables. These include indicators of central bank independence and political

instability, the level of economic development, and openness of the economy.2 Dummy variables for

Asia and Latin America are included to capture other elements determining inflation that are not

captured in the analysis.

The analysis is based on cross-country data consisting of 41 countries for which data is available on

four alternative indices of corruption. Ideally, measures of corruption would consist of objective

evaluations that are comparable across countries and over time. Ideal measures such as these do not as

yet exist. In their absence, indicators have been developed that are based on foreign businessmen and

international correspondents perceptions of corruption.3 The first two indicators are from Transparency International and are based on perceptions drawn mostly from people in multinational firms

and institutions for the years 198892 and 198085, respectively. The third index is the Business

International (BI) measure of corruption based on perceptions drawn from BI overseas correspondents

in the years 198083. This indicator is taken from Mauro (1995). The last indicator is Mauros (1995)

bureaucratic efficiency index. All indices range from 10 (no corruption) to 0 (maximum corruption).

All remaining variables are averaged over the period 198095, except where otherwise noted.

Inflation is measured as the logarithm of the average annual percentage change in the GDP deflator.

The level of economic development is measured by per capita real GDP. Openness is measured by the

ratio of imports and exports to GDP. All data were obtained from the World Development Indicators

1997 on CD-ROM. The index of central bank dependence is the turnover of central bank governors

compiled by Cukierman et al. (1992).

3. Empirical results

Table 1 contains the results obtained from OLS estimation. Most of the coefficients have the

expected signs, even though not all are statistically significant. All indicators of corruption enter the

1

To my knowledge, this is the first systematic cross-country analysis that relates indicators of corruption to inflation.

For models that argue for the inclusion of these variables and empirical evidence, see Lane (1997), Romer (1993),

Cukierman (1992), and Cukierman et al. (1992).

3

Indicators based on perceptions, however, have significant drawbacks. See, for example, Bardhan (1997) and Tanzi

(1998).

2

F. A. Al-Marhubi / Economics Letters 66 (2000) 199 202

201

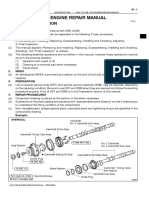

Table 1

Dependent variable: logarithm of average annual inflation (198095)a

Constant

Openness

Per capita real GDP

Turnover of central

bank governors

Asia

Latin America

Corruption 1

(1)

(2)

(3)

(4)

3.32**

(2.97)

2 2.78E-03*

(2.01)

2 0.06

(0.37)

3.44**

(4.86)

2 1.22**

(4.22)

0.19

(0.45)

2 0.17**

(2.87)

3.08**

(3.06)

2 2.75E-03*

(2.23)

2 3.44E-03

(0.02)

3.41**

(5.30)

2 1.25**

(4.39)

0.19

(0.44)

3.38**

(3.29)

2 2.96E-03*

(2.47)

7.75E-03

(0.05)

3.86**

(5.75)

2 1.38**

(4.21)

0.05

(0.10)

3.78**

(4.07)

2 2.16E-03

(1.95)

2 4.45E-03

(0.03)

3.34**

(5.64)

2 1.23**

(5.01)

0.28

(0.83)

2 0.21**

(2.86)

Corruption 2

2 0.22**

(2.82)

Corruption 3

Corruption 4

Adjusted R 2

Observations

0.68

41

0.70

41

0.70

41

2 0.26**

(3.67)

0.72

41

a

Figures in parentheses are heteroscedastic-consistent t statistics.

* and ** denote significance at 5 and 1%, respectively.

inflation equations with negative and significant coefficient estimates, suggesting that, other things

given, countries with more corruption experienced higher inflation.4 The prediction that more open

economies and countries with more independent central banks will have lower inflation is also borne

out by the regression results. Finally, the significantly negative estimates on the Asian dummy suggest

that there are other variables determining inflation that are not fully captured in the analysis.

4. Conclusions

Corruption has been blamed for many poor macroeconomic outcomes such as low investment and

slow growth. This paper has extended the list of negative consequences of corruption and argued that

it is also partly responsible for high inflation. The empirical evidence presented suggests that higher

corruption is associated with higher inflation. The relationship is robust to the inclusion of other

determinants of inflation, including the degree of central bank independence, political instability, and

other structural characteristics. From a policy perspective, the main implication of this finding is that

reforming economic and political institutions to strengthen the rule of law and reduce corruption

should be part of the agenda for any meaningful policy reform.

4

The inflationcorruption link is robust to the inclusion of political instability, taken from Barro (1991).

202

F. A. Al-Marhubi / Economics Letters 66 (2000) 199 202

References

Bardhan, P., 1997. Corruption and development: a review of issues. Journal of Economic Literature XXXV, 13201346.

Barro, R., 1991. Economic growth in a cross section of countries. Quarterly Journal of Economics 106, 407443.

Cukierman, A., 1992. In: Central Bank Strategy, Credibility and Independence: Theory and Evidence, Cambridge University

Press, Cambridge.

Cukierman, A., Edwards, S., Tabellini, G., 1992. Seigniorage and political instability. American Economic Review 82,

537555.

Lane, P., 1997. Inflation in open economies. Journal of International Economies 42, 327347.

Mauro, P., 1995. Corruption and growth. Quarterly Journal of Economics, 110, 681, 712.

Romer, D., 1993. Openness and inflation, Quarterly Journal of Economics CVIII, 869903.

Tanzi, V., 1998. Corruption around the world: causes, consequences, scope, and cures. IMF Working Paper WP/ 98 / 63, 139.

You might also like

- 395a PDFDocument4 pages395a PDFEugenio MartinezNo ratings yet

- Otro Oaxaca PDFDocument6 pagesOtro Oaxaca PDFEugenio MartinezNo ratings yet

- 1 s2.0 S000039 Main PDFDocument25 pages1 s2.0 S000039 Main PDFEugenio MartinezNo ratings yet

- Rnoti p670 PDFDocument3 pagesRnoti p670 PDFEugenio MartinezNo ratings yet

- Grej797282.ww1 Default PDFDocument2 pagesGrej797282.ww1 Default PDFEugenio MartinezNo ratings yet

- Statins PDFDocument7 pagesStatins PDFEugenio MartinezNo ratings yet

- Jama 1991 PDFDocument9 pagesJama 1991 PDFEugenio MartinezNo ratings yet

- Nirenberg PDFDocument3 pagesNirenberg PDFEugenio MartinezNo ratings yet

- NashIPEL PDFDocument7 pagesNashIPEL PDFEugenio MartinezNo ratings yet

- 10 2307@2234627 PDFDocument21 pages10 2307@2234627 PDFEugenio MartinezNo ratings yet

- 522420a PDFDocument1 page522420a PDFEugenio MartinezNo ratings yet

- WatsonPalgraveNash2007 PDFDocument9 pagesWatsonPalgraveNash2007 PDFEugenio MartinezNo ratings yet

- Games and Economic Behavior Volume 14 Issue 2 1996 (Doi 10.1006/game.1996.0053) Roger B. Myerson - John Nash's Contribution To Economics PDFDocument9 pagesGames and Economic Behavior Volume 14 Issue 2 1996 (Doi 10.1006/game.1996.0053) Roger B. Myerson - John Nash's Contribution To Economics PDFEugenio MartinezNo ratings yet

- John Nash - Lecture Game Theory PDFDocument31 pagesJohn Nash - Lecture Game Theory PDFTsongmingNo ratings yet

- Abelprisen Pressebrosjyre2015 O4 PDFDocument11 pagesAbelprisen Pressebrosjyre2015 O4 PDFEugenio MartinezNo ratings yet

- Jnash PDFDocument3 pagesJnash PDFEugenio MartinezNo ratings yet

- A Numerical Algorithm With Preference Statements To Evaluate The Performance of ScientistsDocument22 pagesA Numerical Algorithm With Preference Statements To Evaluate The Performance of ScientistsEugenio MartinezNo ratings yet

- A Numerical Algorithm With Preference Statements To Evaluate The Performance of ScientistsDocument22 pagesA Numerical Algorithm With Preference Statements To Evaluate The Performance of ScientistsEugenio MartinezNo ratings yet

- JSciRes2292-5113006 141210 PDFDocument10 pagesJSciRes2292-5113006 141210 PDFEugenio MartinezNo ratings yet

- JSciRes1128-5125773 141417 PDFDocument7 pagesJSciRes1128-5125773 141417 PDFEugenio MartinezNo ratings yet

- Is208syl 11f PDFDocument13 pagesIs208syl 11f PDFEugenio MartinezNo ratings yet

- Beyond Traditional Citations: Leap On Clouds To Capture Virtual Metrics!Document2 pagesBeyond Traditional Citations: Leap On Clouds To Capture Virtual Metrics!Eugenio MartinezNo ratings yet

- Media Documents 2010 10 syl891InformScholComm PDFDocument14 pagesMedia Documents 2010 10 syl891InformScholComm PDFEugenio MartinezNo ratings yet

- Beyond Publication Bias: T. D. Stanley Hendrix CollegeDocument38 pagesBeyond Publication Bias: T. D. Stanley Hendrix CollegeEugenio MartinezNo ratings yet

- JSciRes1111-5127109 141431 PDFDocument11 pagesJSciRes1111-5127109 141431 PDFEugenio MartinezNo ratings yet

- 14 PDFDocument16 pages14 PDFEugenio MartinezNo ratings yet

- Is208syl 11f PDFDocument13 pagesIs208syl 11f PDFEugenio MartinezNo ratings yet

- JSciRes3115-5093617 140856 PDFDocument7 pagesJSciRes3115-5093617 140856 PDFEugenio MartinezNo ratings yet

- JSciRes3115-5093617 140856 PDFDocument7 pagesJSciRes3115-5093617 140856 PDFEugenio MartinezNo ratings yet

- JSciRes3261-5033664 135856 PDFDocument7 pagesJSciRes3261-5033664 135856 PDFEugenio MartinezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Jaap Rousseau: Master ExtraodinaireDocument4 pagesJaap Rousseau: Master ExtraodinaireKeithBeavonNo ratings yet

- CP ON PUD (1) ADocument20 pagesCP ON PUD (1) ADeekshitha DanthuluriNo ratings yet

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Compro Russindo Group Tahun 2018 UpdateDocument44 pagesCompro Russindo Group Tahun 2018 UpdateElyza Farah FadhillahNo ratings yet

- Consent 1095 1107Document3 pagesConsent 1095 1107Pervil BolanteNo ratings yet

- Write a composition on tax evasionDocument7 pagesWrite a composition on tax evasionLii JaaNo ratings yet

- Abbreviations (Kısaltmalar)Document4 pagesAbbreviations (Kısaltmalar)ozguncrl1No ratings yet

- 14 Jet Mykles - Heaven Sent 5 - GenesisDocument124 pages14 Jet Mykles - Heaven Sent 5 - Genesiskeikey2050% (2)

- The Five Laws of Light - Suburban ArrowsDocument206 pagesThe Five Laws of Light - Suburban Arrowsjorge_calvo_20No ratings yet

- CH 19Document56 pagesCH 19Ahmed El KhateebNo ratings yet

- MW Scenario Handbook V 12 ADocument121 pagesMW Scenario Handbook V 12 AWilliam HamiltonNo ratings yet

- Obtaining Workplace InformationDocument4 pagesObtaining Workplace InformationJessica CarismaNo ratings yet

- Compound SentenceDocument31 pagesCompound Sentencerosemarie ricoNo ratings yet

- Amway Health CareDocument7 pagesAmway Health CareChowduru Venkat Sasidhar SharmaNo ratings yet

- Consumer Behavior Paper PLDTDocument6 pagesConsumer Behavior Paper PLDTAngeline Santiago100% (2)

- Ethnic Conflicts and PeacekeepingDocument2 pagesEthnic Conflicts and PeacekeepingAmna KhanNo ratings yet

- 11th AccountancyDocument13 pages11th AccountancyNarendar KumarNo ratings yet

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocument43 pagesLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNo ratings yet

- Set up pfSense transparent Web proxy with multi-WAN failoverDocument8 pagesSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithNo ratings yet

- Political Philosophy and Political Science: Complex RelationshipsDocument15 pagesPolitical Philosophy and Political Science: Complex RelationshipsVane ValienteNo ratings yet

- Strategies To Promote ConcordanceDocument4 pagesStrategies To Promote ConcordanceDem BertoNo ratings yet

- Classification of Boreal Forest Ecosystem Goods and Services in FinlandDocument197 pagesClassification of Boreal Forest Ecosystem Goods and Services in FinlandSivamani SelvarajuNo ratings yet

- Mundane AstrologyDocument93 pagesMundane Astrologynikhil mehra100% (5)

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- Bpoc Creation Ex-OrderDocument4 pagesBpoc Creation Ex-OrderGalileo Tampus Roma Jr.100% (7)

- Settlement of Piled Foundations Using Equivalent Raft ApproachDocument17 pagesSettlement of Piled Foundations Using Equivalent Raft ApproachSebastian DraghiciNo ratings yet

- AFRICAN SYSTEMS OF KINSHIP AND MARRIAGEDocument34 pagesAFRICAN SYSTEMS OF KINSHIP AND MARRIAGEjudassantos100% (2)

- Chronic Pancreatitis - Management - UpToDateDocument22 pagesChronic Pancreatitis - Management - UpToDateJose Miranda ChavezNo ratings yet

- Online Statement of Marks For: B.A. (CBCS) PART 1 SEM 1 (Semester - 1) Examination: Oct-2020Document1 pageOnline Statement of Marks For: B.A. (CBCS) PART 1 SEM 1 (Semester - 1) Examination: Oct-2020Omkar ShewaleNo ratings yet

- Revolutionizing Via RoboticsDocument7 pagesRevolutionizing Via RoboticsSiddhi DoshiNo ratings yet