Professional Documents

Culture Documents

Examiners' Report

Uploaded by

ALIEVALIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Examiners' Report

Uploaded by

ALIEVALICopyright:

Available Formats

Examiners’ report

F3 Financial Accounting

December 2007

The following questions were chosen from the December 2007 F3 INT examination to provide illustrations of

areas in which students can improve their exam performance.

Example 1

Jill and John are in partnership sharing profits in the ratio 3:2. During the financial year the partnership earned

$28,650 profit. Jill is paid a salary of $5,000 and partners were charged interest on drawings amounting to

$200 for Jill and $350 for John. Jill’s current account had a credit balance of $15,614 at the beginning of the

year.

What is the net increase in Jill’s current account during the year?

A $19,320

B $34,934

C $19,720

D $14,480

The correct answer to this question is A ($19,320) see working 1 at end of report.

Almost as many students selected B as the answer, as those who correctly selected A.

This demonstrates that candidates are still not reading the requirements of the question properly. The question

asks for the net increase in the account, not the closing balance. Candidates who selected B performed all the

calculations correctly, but missed out on the marks due to simply not reading the requirement. This is basic exam

technique. It is imperative that candidates answer the question asked, not the one they presume will be asked,

or the one they would have liked to be asked.

Example 2

Which of the following provides advice to the International Accounting Standards Board (IASB) as well as

informing the IASB of the implications of proposed standards for users and preparers of financial statements?

A The Standards Advisory Council

B The International Financial Reporting Interpretations Committee

The answer to this question is A (The Standards Advisory Council).

There was roughly an even split between candidates giving each of the two answers. This suggests that the

regulatory framework and the role of accounting bodies is perceived as an area which is peripheral to the syllabus

and so is not given adequate attention by students in their preparation for exams. It should be noted that this

area is seen to be an important aspect of the F3 syllabus. Due to the nature and structure of the examination,

questions will be set every sitting across the breadth of the syllabus, and so students should revise across the

whole of the syllabus.

Worryingly, some students answered C or D to this question. If an answer to a question is to be guessed, it is

worth checking whether the question offers A, B, C and D as options before putting pen to paper.

Examiners’ report – F3 December 2007 1

Example 3

Samantha has extracted a trial balance and created a suspense account with a credit balance of $759 to make it

balance.

Samantha found the following:

1. A sales invoice for $4,569 has not been entered in the accounting records

2. A payment of $1,512 has been posted correctly to the payables control account but no other entry

has been made.

3. A credit sale of $131 has only been credited to the sales account.

What is the remaining balance on the suspense account after these errors have been corrected?

A $3,810 debit

B $2,140 credit

C $890 credit

D $622 debit

The answer to this question is D ($622 debit) see working 2 at end of report.

Only 41% of students who answered this question selected the correct answer. The most popular incorrect

answer was B. Therefore the majority of students recognised that error 1 had no effect on the suspense account,

which is encouraging. The error rate on this question though, reflects a lack of understanding of error correction

and double entry. This is an area which is tested in numerous questions in each examination, and should be

mastered prior to attempting the F3 examination.

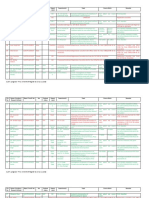

Workings for answers:

1.

Jill John Total

$ $ $

Net profit 28,650

Interest on drawings (200) (350) 550

Salary 5,000 (5,000)

24,200

Profit share 3:2 14,520 9,680

Total 19,320 9,330

2.

Suspense account

$ $

B/f 759

(2) Cash 1,512 (3) Receivables 131

Balance c/d 622

1,512 1,512

Examiners’ report – F3 December 2007 2

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Start Up Guide - How To Become A Truck Dispatcher eDocument12 pagesStart Up Guide - How To Become A Truck Dispatcher eDragan LovricNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Are To Many People Going To CollegeDocument2 pagesAre To Many People Going To Collegektrout919No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Trifles DiscussionDocument11 pagesTrifles Discussionapi-242602081No ratings yet

- Legal Medicine (Medical Jurisprudence To A Law Student)Document14 pagesLegal Medicine (Medical Jurisprudence To A Law Student)Look ArtNo ratings yet

- Acca ExercisesDocument10 pagesAcca ExercisesAmir AmirliNo ratings yet

- Led TV in The Classroom Its Acceptability and Effectiveness in The PhilippinesDocument24 pagesLed TV in The Classroom Its Acceptability and Effectiveness in The PhilippinesGlobal Research and Development Services100% (3)

- Verbal Reasoning Test1 QuestionsDocument3 pagesVerbal Reasoning Test1 QuestionsALIEVALI100% (1)

- Verbal Reasoning Test1 QuestionsDocument3 pagesVerbal Reasoning Test1 QuestionsALIEVALI100% (1)

- Guide To Research in Music Education PDFDocument201 pagesGuide To Research in Music Education PDFjorge etayo0% (1)

- Present Yourself SB L2-1Document14 pagesPresent Yourself SB L2-1Hanan HabashiNo ratings yet

- IASB-conceptual FrameworkDocument26 pagesIASB-conceptual Frameworkrhima_No ratings yet

- Bank Recons.Document12 pagesBank Recons.ALIEVALI100% (1)

- ANA StandardsDocument1 pageANA Standardsointeriano100% (1)

- Examiners' ReportDocument3 pagesExaminers' ReportALIEVALINo ratings yet

- Iunie 2008Document3 pagesIunie 2008Nicolae CaminschiNo ratings yet

- Customs Code of The Republic of AzerbaijanDocument147 pagesCustoms Code of The Republic of AzerbaijanALIEVALINo ratings yet

- Sa Stein AccaDocument4 pagesSa Stein AccaALIEVALINo ratings yet

- Fresh BeginningsDocument3 pagesFresh BeginningsALIEVALINo ratings yet

- Examiner's ReportDocument3 pagesExaminer's ReportALIEVALINo ratings yet

- SDT BigDocument2 pagesSDT BigALIEVALINo ratings yet

- FCR BigDocument2 pagesFCR BigALIEVALINo ratings yet

- Verbal Reasoning Test3 QuestionsDocument9 pagesVerbal Reasoning Test3 QuestionsALIEVALI50% (2)

- Verbal Reasoning Test3 SolutionsDocument10 pagesVerbal Reasoning Test3 SolutionsALIEVALI100% (1)

- Verbal Reasoning Test2 QuestionsDocument12 pagesVerbal Reasoning Test2 QuestionsALIEVALI100% (1)

- Verbal Reasoning Test2 SolutionsDocument12 pagesVerbal Reasoning Test2 SolutionsALIEVALINo ratings yet

- Verbal Reasoning Test2 SolutionsDocument12 pagesVerbal Reasoning Test2 SolutionsALIEVALINo ratings yet

- Verbal Reasoning Test1 SolutionsDocument3 pagesVerbal Reasoning Test1 SolutionsALIEVALI100% (1)

- Verbal Reasoning Test1 SolutionsDocument3 pagesVerbal Reasoning Test1 SolutionsALIEVALI100% (1)

- Verbal Reasoning Test2 QuestionsDocument12 pagesVerbal Reasoning Test2 QuestionsALIEVALI100% (1)

- Pilot PapersDocument320 pagesPilot Papersrasced67% (3)

- Admission FormDocument1 pageAdmission FormYasin AhmedNo ratings yet

- 2012S1 Itsy 1400 5420Document5 pages2012S1 Itsy 1400 5420Christine LogueNo ratings yet

- Jean Piaget's Cognitive Theories of DevelopmentDocument44 pagesJean Piaget's Cognitive Theories of DevelopmentDominic RiveraNo ratings yet

- Teacher Leadership and Student AchievementDocument2 pagesTeacher Leadership and Student Achievementapi-622508187No ratings yet

- T19 Participatory Planning MethodsDocument3 pagesT19 Participatory Planning MethodsNaveed UllahNo ratings yet

- 2010 11catalogDocument313 pages2010 11catalogJustin PennNo ratings yet

- Intro To Emails, Letters, Memos Teacher's Notes + Answers (Languagedownload - Ir) PDFDocument1 pageIntro To Emails, Letters, Memos Teacher's Notes + Answers (Languagedownload - Ir) PDFjcarloscar1981No ratings yet

- Conducting An Effective Business Impact AnalysisDocument5 pagesConducting An Effective Business Impact AnalysisDésiré NgaryadjiNo ratings yet

- Humanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFDocument8 pagesHumanities-A STUDY ON CURRICULUM DEVELOPMENT-Kashefa Peerzada PDFBESTJournalsNo ratings yet

- Study Guide: IGCSE and AS/A2 Level 2017 - 2018Document45 pagesStudy Guide: IGCSE and AS/A2 Level 2017 - 2018Shakila ShakiNo ratings yet

- Ste Computer Science II q2m5 Smnhs 1Document26 pagesSte Computer Science II q2m5 Smnhs 1mariannepm1312No ratings yet

- Correction and Repair in Language TeachingDocument3 pagesCorrection and Repair in Language TeachingAwg Zainal AbidinNo ratings yet

- Amanda Lesson PlanDocument7 pagesAmanda Lesson Planapi-2830820140% (1)

- Chapter 4 OrganizingDocument17 pagesChapter 4 OrganizingKenjie GarqueNo ratings yet

- Women's Activism in Latin America and The CaribbeanDocument159 pagesWomen's Activism in Latin America and The CaribbeanLindaNo ratings yet

- Ph.D. Enrolment Register As On 22.11.2016Document35 pagesPh.D. Enrolment Register As On 22.11.2016ragvshahNo ratings yet

- Recomandare DaviDocument2 pagesRecomandare DaviTeodora TatuNo ratings yet

- Lesson-Plan-Voc Adjs Appearance Adjs PersonalityDocument2 pagesLesson-Plan-Voc Adjs Appearance Adjs PersonalityHamza MolyNo ratings yet

- English Literature's Evolving Role in Malaysian Secondary EducationDocument3 pagesEnglish Literature's Evolving Role in Malaysian Secondary Educationanbu100% (1)

- Process of Development: CurriculumDocument16 pagesProcess of Development: CurriculumShivNo ratings yet

- Michael Rubel ResumeDocument1 pageMichael Rubel Resumeapi-207919284No ratings yet

- Community and Environmental HealthDocument26 pagesCommunity and Environmental HealthMary Grace AgueteNo ratings yet