Professional Documents

Culture Documents

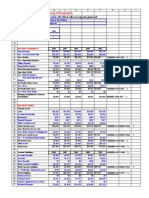

Depreciation Auto Calculation Sheet

Uploaded by

sachin2727Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Auto Calculation Sheet

Uploaded by

sachin2727Copyright:

Available Formats

CAREFULLY READ ALL THE INSTRUCTION BEFORE USING THIS SHEET

Note :

1

2

3

To add more assets in sheet : Insert the rows under corresponding group and just copy the formula from previous row (along with Name, DOP etc), change the name of Assets, DOP, Cost, Dep. upto 31.03.2014, etc. Do not

change the formula in sheet

Assets of which life has been expired although depreciation charged till 31.03.2014 was lesser than 95% of Original Cost, difference has to be adjusted with Retained earning. Deferred tax assets has also to be created for same

amount.

Alternatively, you can debit in Profit & Loss account (just like depreciation).

Short depreciation due to expiry of useful life of assets : Same could be adjusted with retained earning. In case adjusted with retained earning, simultaneously provision for deferred tax has also to be created. Deferred Tax Assets

to be created @ 30.90% or 32.445% or 33.99% (depending upon taxable income/loss of the company by crediting Reserve & Surplus A/c (in short Reserve & Surplus A/c should be debited by "Net" amount of "Amount to be

Adjusted and Deferred Tax provision"). In below given case : R&S A/c Dr. 10386/-, Deferred Tax A/c Dr. 4645/- and Fixed Assets A/c Cr. 15031/-. Rate assumed 30.90%. This has to be reviewed yearly and has to be again

adjusted as and when assets is sold or discarded or revalued.

It is highly suggested / recommended that instead of adjusting with retained earning, transfer the same in P/L A/c in the form of depreciation and calculate the deferred tax as usual as earlier.

Assets against which depreciation till 31.03.2014 has been claimed more them 95% of Original Cost of Assets : Excess Depreciation (Already charged) not to be adjusted anywhere (neither from Reserve & Surplus nor from

Current Year Depreciation).

Salvage Value of Assets covered under Note No. 4 will be WDV as on 01.04.2014. Salvage Value not to be maintained @5% of Original Cost for these assets. Law restrict us to keep the salvage value 5% for higher side and not

for lower side.

Date of purchase, Original Cost, WDV, accumulated depreciation are dummy figures, just to explain the working. Do not cross verify the figures for actual depreciation till 31.03.2014 considering details as per sheet and do not

send query for the same.

Be very careful for depreciation in the last year (example : if remaining life year is 2.46 years, in such a case 3rd (third) year for depreciation of that assets, as same has to be calculated as balancing figure of total depreciable

amount under whole life "less" depreciation claimed till the year immediately previous year for which deprecation to be calculated.

10

Calculation sheet is also very effective in those cases in which remaining life of assets is less than 1 year.

11

Use 3rd Sheet for Assets purchased after 31.03.2014

NAME OF THE COMPANY..

DEPRECIATION CHART FOR F. Y. 2014-15

FOR ASSETS EXISTING AS ON 31.03.2014

Date of

Purchase /

Put to use

(A) Land

-

Particular

Land

Original Cost

Dep charged

(Rs)

upto 31.03.2014

WDV as on

01.04.2014

Life as per

Life Used till Remaining

Co. Act,

Salvaged value

31/03/2014

Life

2013

Depreciable

amount over

whole life

Excess Dep.

(Already

charged)

0.00%

Rate of

Dep.

Dep for the

Year 2014-15

Adjusted

with

Retained

Earning

WDV as on 31st

Mar 2015

29,847,589

29,847,589

41,823,746

4,865,265

36,958,481

60.00

2.51

57.49

2,091,187

39,732,559

4.87%

1,801,067

35,157,414

(C) Office Equipments

26-Apr-2011 Air Conditioner

29-May-2011 Fire Extinguisher

15-Oct-2011

Fire Extinguisher

18-Jul-2011

Generator

9-Aug-2011

Lift/Escalators

15-Mar-2009 Panels

27-Nov-2008 Pump/Meters

1-Apr-2011

Transformers

19-Jun-2006

Mobile

20-Aug-2005 Computer

7-Jul-2006

Computer

12-Dec-2011 Computer

19-Mar-2014 Computer

690,800

34,760

46,820

3,218,760

2,284,120

713,864

216,126

557,404

29,374

2,028,420

635,000

100,000

180,000

248,614

12,458

34,257

349,872

434,858

358,478

74,258

212,487

12,874

2,002,710

622,480

68,379

2,560

442,186

22,302

12,563

2,868,888

1,849,262

355,386

141,868

344,917

16,500

25,710

12,520

31,621

177,440

5.00

5.00

5.00

10.00

10.00

10.00

10.00

10.00

5.00

3.00

3.00

3.00

3.00

2.93

2.84

2.46

2.70

2.64

5.05

5.34

3.00

7.79

8.62

7.74

2.30

0.03

2.07

2.16

2.54

7.30

7.36

4.95

4.66

7.00

(2.79)

(5.62)

(4.74)

0.70

2.97

34,540

1,738

2,341

160,938

114,206

35,693

10,806

27,870

1,469

101,421

31,750

5,000

9,000

656,260

33,022

44,479

3,057,822

2,169,914

678,171

205,320

529,534

27,905

1,926,999

603,250

95,000

171,000

75,711

19,230

-

70.85%

69.34%

48.40%

32.62%

31.51%

37.12%

42.47%

30.19%

0.00%

0.00%

0.00%

92.86%

63.39%

313,273

15,463

6,080

935,853

582,764

131,926

60,248

104,131

26,621

112,477

15,031

-

128,913

6,839

6,483

1,933,035

1,266,498

223,460

81,620

240,786

1,469

25,710

12,520

5,000

64,963

(D) Furniture and Fixtures

25-Apr-2011 Electricals Equipments & Fittings

17-Jun-2011

Furniture & Fixtures

2,092,276

3,458,745

942,877

1,348,758

1,149,399

2,109,987

10.00

10.00

2.93

2.79

7.07

7.21

104,614

172,937

1,987,662

3,285,808

28.77%

29.31%

330,638

618,494

818,761

1,491,493

(E) Vehicles

21-Jan-2010

10-Aug-2011

Motor Cycle

Car

72,734

1,413,428

51,868

766,180

20,866

647,248

10.00

8.00

4.19

2.64

5.81

5.36

3,637

70,671

69,097

1,342,757

25.98%

33.85%

5,420

219,106

15,446

428,142

Total Assets

89,443,966

12,409,233

77,034,733

2,979,818

56,616,559

94,941

5,263,561

15,031

71,756,142

(B) Buildings

26-Sep-2011 Building

29,847,589

###

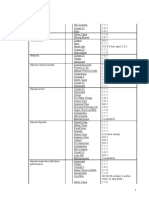

CAREFULLY READ ALL THE INSTRUCTION BEFORE USING THIS SHEET

Note :

1

2

3

To add more assets in sheet : Insert the rows under corresponding group and just copy the formula from previous row (along with Name, DOP etc), change the name of Assets, DOP, Cost, Dep. upto 31.03.2014, etc. Do not

change the formula in sheet

Assets of which life has been expired although depreciation charged till 31.03.2014 was lesser than 95% of Original Cost, difference has to be adjusted with Retained earning. Deferred tax assets has also to be created for same

amount.

Alternatively, you can debit in Profit & Loss account (just like depreciation).

Short depreciation due to expiry of useful life of assets : Same could be adjusted with retained earning. In case adjusted with retained earning, simultaneously provision for deferred tax has also to be created. Deferred Tax Assets

to be created @ 30.90% or 32.445% or 33.99% (depending upon taxable income/loss of the company by crediting Reserve & Surplus A/c (in short Reserve & Surplus A/c should be debited by "Net" amount of "Amount to be

Adjusted and Deferred Tax provision"). In below given case : R&S A/c Dr. 10386/-, Deferred Tax A/c Dr. 4645/- and Fixed Assets A/c Cr. 15031/-. Rate assumed 30.90%. This has to be reviewed yearly and has to be again

adjusted as and when assets is sold or discarded or revalued.

It is highly suggested / recommended that instead of adjusting with retained earning, transfer the same in P/L A/c in the form of depreciation and calculate the deferred tax as usual as earlier.

Assets against which depreciation till 31.03.2014 has been claimed more them 95% of Original Cost of Assets : Excess Depreciation (Already charged) not to be adjusted anywhere (neither from Reserve & Surplus nor from

Current Year Depreciation).

Salvage Value of Assets covered under Note No. 4 will be WDV as on 01.04.2014. Salvage Value not to be maintained @5% of Original Cost for these assets. Law restrict us to keep the salvage value 5% for higher side and not

for lower side.

Date of purchase, Original Cost, WDV, accumulated depreciation are dummy figures, just to explain the working. Do not cross verify the figures for actual depreciation till 31.03.2014 considering details as per sheet and do not

send query for the same.

Be very careful for depreciation in the last year (example : if remaining life year is 2.46 years, in such a case 3rd (third) year for depreciation of that assets, as same has to be calculated as balancing figure of total depreciable

amount under whole life "less" depreciation claimed till the year immediately previous year for which deprecation to be calculated.

10

Calculation sheet is also very effective in those cases in which remaining life of assets is less than 1 year.

11

Use 3rd Sheet for Assets purchased after 31.03.2014

NAME OF THE COMPANY..

DEPRECIATION CHART FOR F. Y. 2014-15

FOR ASSETS EXISTING AS ON 31.03.2014

Date of

Purchase /

Put to use

Particular

Original Cost

Dep charged

(Rs)

upto 31.03.2014

WDV as on

01.04.2014

Life as per

Life Used till Remaining

Co. Act,

Salvaged value

31/03/2014

Life

2013

Depreciable

amount over

whole life

Excess Dep.

(Already

charged)

Rate of

Dep.

Dep for the

Year 2014-15

Adjusted

with

Retained

Earning

WDV as on 31st

Mar 2015

(A) Land

Land

60.00

114.33

(54.33)

0.00%

2,868,888

-

5.00

5.00

5.00

10.00

10.00

10.00

10.00

10.00

5.00

3.00

3.00

3.00

114.33

114.33

114.33

2.70

114.33

114.33

114.33

114.33

114.33

114.33

114.33

114.33

(109.33)

(109.33)

(109.33)

7.30

(104.33)

(104.33)

(104.33)

(104.33)

(109.33)

(111.33)

(111.33)

(111.33)

160,938

-

3,057,822

-

0.00%

0.00%

0.00%

32.62%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

935,853

-

1,933,035

-

###

(B) Buildings

Building

(C) Office Equipments

Air Conditioner

Fire Extinguisher

Fire Extinguisher

18-Jul-2011

Generator

Lift/Escalators

Panels

Pump/Meters

Transformers

Mobile

Computer

Computer

Computer

(D) Furniture and Fixtures

3,218,760

349,872

Electricals Equipments & Fittings

Furniture & Fixtures

10.00

10.00

114.33

114.33

(104.33)

(104.33)

0.00%

0.00%

Motor Cycle

Car

10.00

8.00

114.33

114.33

(104.33)

(106.33)

0.00%

0.00%

160,938

3,057,822

935,853

1,933,035

(E) Vehicles

Total Assets

3,218,760

349,872

2,868,888

NAME OF THE COMPANY..

DEPRECIATION CHART FOR F. Y. 2014-15

FOR ASSETS PURCHASED AFTER 31.03.2014

Date of

Purchase /

Put to use

(A) Land

-

Life as per

Co. Act, Salvaged value

2013

Depreciable

amount over

whole life

0.00%

60.00

#DIV/0!

42094

#DIV/0!

#DIV/0!

720,000

400,000

-

5.00

5.00

5.00

10.00

10.00

10.00

10.00

10.00

5.00

3.00

3.00

3.00

36,000

20,000

-

684,000

380,000

-

45.07%

45.07%

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

340

166

42094

42094

42094

42094

42094

42094

42094

42094

42094

42094

302,291

81,994

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

417,709

318,006

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

10.00

10.00

#DIV/0!

#DIV/0!

42094

42094

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Motor Cycle

Car

10.00

8.00

#DIV/0!

#DIV/0!

42094

42094

#DIV/0!

#DIV/0!

#DIV/0!

#DIV/0!

Total Assets

1,120,500

56,000

1,064,000

#DIV/0!

#DIV/0!

Particular

Land

Original Cost

(Rs)

500

Rate of

Dep.

Used during Dep for the

the year

Year 2014-15

-

WDV as on 31st

Mar 2015

500

(B) Buildings

Building

(C) Office Equipments

25-Apr-2014 Air Conditioner

16-Oct-2014 Fire Extinguisher

Fire Extinguisher

Generator

Lift/Escalators

Panels

Pump/Meters

Transformers

Mobile

Computer

Computer

Computer

(D) Furniture and Fixtures

Electricals Equipments & Fittings

Furniture & Fixtures

(E) Vehicles

You might also like

- Buckwold 21e - Ch10 Selected SolutionDocument15 pagesBuckwold 21e - Ch10 Selected SolutionLucyNo ratings yet

- Understanding Financial Statements - Making More Authoritative BCDocument6 pagesUnderstanding Financial Statements - Making More Authoritative BCLakshmi Narasimha MoorthyNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- 1 Heinz Case StudyDocument8 pages1 Heinz Case Studysachin2727100% (2)

- Macrs TableDocument4 pagesMacrs TableLvarsha NihanthNo ratings yet

- 10 Column WorksheetDocument41 pages10 Column WorksheetRachel Jane TanNo ratings yet

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- QTM - Soap Battle CaseDocument7 pagesQTM - Soap Battle CaseAshish Babaria100% (1)

- Leaflet CycleManager Ep CycleManager ErDocument7 pagesLeaflet CycleManager Ep CycleManager ErValeska ArdilesNo ratings yet

- Adjustment Entries and TreatmentDocument35 pagesAdjustment Entries and TreatmentPRACHI DASNo ratings yet

- 2020 Cma P1 A5 PpeDocument35 pages2020 Cma P1 A5 PpeLhenNo ratings yet

- How To Calculate Your Taxable Profits: Helpsheet 222Document14 pagesHow To Calculate Your Taxable Profits: Helpsheet 222subtle69No ratings yet

- Depreciation of Non Current AssetsDocument27 pagesDepreciation of Non Current Assetskimuli FreddieNo ratings yet

- DepreciationDocument9 pagesDepreciationmannyop496No ratings yet

- Assets Fair ValueDocument10 pagesAssets Fair ValueArulmani MurugesanNo ratings yet

- DepreciationDocument6 pagesDepreciationSYOUSUF45No ratings yet

- FA Material2Document12 pagesFA Material2Mohan Reddy KothapetaNo ratings yet

- Inac CompiDocument6 pagesInac CompiRovee PagaduanNo ratings yet

- Accounting Grade 12 For LessonDocument8 pagesAccounting Grade 12 For LessonKgothatso ArnanzaNo ratings yet

- Depreciation: ConceptDocument6 pagesDepreciation: ConceptEdna OrdanezaNo ratings yet

- DepreciationDocument16 pagesDepreciationYashi GuptaNo ratings yet

- Accounting Concept: Fair Value Matching PrincipleDocument13 pagesAccounting Concept: Fair Value Matching PrincipleJohn ArthurNo ratings yet

- Guidelines Tax Related DeclarationsDocument16 pagesGuidelines Tax Related DeclarationsRaghul MuthuNo ratings yet

- ACCT604 Week 6 Lecture SlidesDocument26 pagesACCT604 Week 6 Lecture SlidesBuddika PrasannaNo ratings yet

- Adj 1Document4 pagesAdj 1Alisha KhanNo ratings yet

- Accounting Standard 22Document12 pagesAccounting Standard 22Rupesh MoreNo ratings yet

- Fully Depreciated AssetDocument2 pagesFully Depreciated AssethieutlbkreportNo ratings yet

- Afm Mod 2Document4 pagesAfm Mod 2Manas MohapatraNo ratings yet

- What Is Depreciation?Document4 pagesWhat Is Depreciation?Muhammad BilalNo ratings yet

- ACC 111 Chapter 4 Lecture NotesDocument5 pagesACC 111 Chapter 4 Lecture NotesLoriNo ratings yet

- DepreciationDocument7 pagesDepreciationSoumendra RoyNo ratings yet

- Dep and InventoryDocument129 pagesDep and InventoryShruti VermaNo ratings yet

- Units of Production Method of DepreciationDocument3 pagesUnits of Production Method of DepreciationPraneeth SaiNo ratings yet

- Accounting Standard 6 - DepreciationDocument34 pagesAccounting Standard 6 - DepreciationSarthak Gupta100% (2)

- Depreciation AccountingDocument9 pagesDepreciation Accountingu1909030No ratings yet

- Ikk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Document8 pagesIkk Ichigan Inc. Notes To Financial Statements For The Years Ended December 31, 2010 and 2009 (Amounts in Philippine Peso)Dondie EsguerraNo ratings yet

- What Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodDocument23 pagesWhat Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodShamarat RahmanNo ratings yet

- Quiz Theory AccountingDocument8 pagesQuiz Theory Accountingjucia wantaNo ratings yet

- Depreciate An Asset in One YearDocument10 pagesDepreciate An Asset in One Yearbalucbe35No ratings yet

- Planning & EstateDocument5 pagesPlanning & Estatebhaw_shNo ratings yet

- Fa Unit 3Document11 pagesFa Unit 3VTNo ratings yet

- DepreciationDocument28 pagesDepreciationREHANRAJNo ratings yet

- Amodia - Notes (SIM 3)Document2 pagesAmodia - Notes (SIM 3)CLUVER AEDRIAN AMODIANo ratings yet

- Depreciation: Depreciation Is A Term Used inDocument10 pagesDepreciation: Depreciation Is A Term Used inalbertNo ratings yet

- Chapter 6: Accounting Adjustments IIDocument9 pagesChapter 6: Accounting Adjustments IIetextbooks lkNo ratings yet

- Chapter 6 Income Statement & Statement of Changes in EquityDocument7 pagesChapter 6 Income Statement & Statement of Changes in EquitykajsdkjqwelNo ratings yet

- Major ObjectiveDocument2 pagesMajor ObjectivepalvinderNo ratings yet

- DepreciationDocument10 pagesDepreciationJAS 0313No ratings yet

- Chapter 3 HW SolutionsDocument41 pagesChapter 3 HW SolutionsemailericNo ratings yet

- Problem Based On Accounting StandardDocument4 pagesProblem Based On Accounting StandardBhagwat BalotNo ratings yet

- FAR560 - Interim ReportingDocument18 pagesFAR560 - Interim ReportingSiti AqilahNo ratings yet

- Notes On Depreciation Class-11Document5 pagesNotes On Depreciation Class-11Suresh Kumar100% (1)

- DepreciationDocument10 pagesDepreciationApril Patrizia AtienzaNo ratings yet

- M3FARDocument6 pagesM3FARchibiNo ratings yet

- Depreciation 140513051242 Phpapp02Document22 pagesDepreciation 140513051242 Phpapp020612001No ratings yet

- DepreciationDocument52 pagesDepreciationPiyush Malhotra50% (2)

- Debits and Credits QuizDocument6 pagesDebits and Credits QuizQuyền Nguyễn Khánh HàNo ratings yet

- Accounting Concept: C I D C CDocument9 pagesAccounting Concept: C I D C CRana FahadNo ratings yet

- ACC - ACF1200 Topic 3 SOLUTIONS To Questions For Self-StudyDocument3 pagesACC - ACF1200 Topic 3 SOLUTIONS To Questions For Self-StudyChuangjia MaNo ratings yet

- AccountDocument13 pagesAccountPrabodh TirkeyNo ratings yet

- 01.finance FundamentalsDocument5 pages01.finance Fundamentalsdevilcaeser2010No ratings yet

- CH13MANDocument50 pagesCH13MANEmranul Islam ShovonNo ratings yet

- Uniply IndustriesDocument3 pagesUniply Industriessachin2727100% (1)

- AnnualReport 20220712115723815Document168 pagesAnnualReport 20220712115723815sachin2727No ratings yet

- Fine Organics - Niche Products, Niche ValuationsDocument26 pagesFine Organics - Niche Products, Niche Valuationssachin2727No ratings yet

- Segment Percentage of Revenue Percentage of Profit: Share Price ChartDocument3 pagesSegment Percentage of Revenue Percentage of Profit: Share Price Chartsachin2727No ratings yet

- q4 Financials ZeeDocument1 pageq4 Financials Zeesachin2727No ratings yet

- Investing Under UncerDocument43 pagesInvesting Under Uncersachin2727No ratings yet

- Mens Wearhouse 10 K Annual ReportDocument128 pagesMens Wearhouse 10 K Annual Reportsachin2727No ratings yet

- 7 MGMT of Working CapitalDocument108 pages7 MGMT of Working Capitalsachin2727No ratings yet

- 1 Corporate Finance Assignment 2Document6 pages1 Corporate Finance Assignment 2sachin2727No ratings yet

- 1 Corporate Finance Assignment 2Document6 pages1 Corporate Finance Assignment 2sachin2727No ratings yet

- Finance HWDocument10 pagesFinance HWsachin2727No ratings yet

- Mens Wearhouse 10 K Annual ReportDocument128 pagesMens Wearhouse 10 K Annual Reportsachin2727No ratings yet

- Financial Assign 4Document1 pageFinancial Assign 4sachin2727No ratings yet

- CaseDocument7 pagesCasesachin2727No ratings yet

- 1 Module 2 SLP QuestionDocument3 pages1 Module 2 SLP Questionsachin2727No ratings yet

- ICICI D Muhurat Picks 2015Document9 pagesICICI D Muhurat Picks 2015sachin2727No ratings yet

- Accounting 141 Budgeting For A ManufacturerDocument18 pagesAccounting 141 Budgeting For A Manufacturersachin27270% (2)

- 52 Techniques For Finding FraudDocument2 pages52 Techniques For Finding Fraudsachin2727No ratings yet

- 1 Usd-EuroDocument1 page1 Usd-Eurosachin2727No ratings yet

- Case 1 Please Answer ALL Question Below. Show Step by Step AnswerDocument7 pagesCase 1 Please Answer ALL Question Below. Show Step by Step Answersachin2727No ratings yet

- Apple Ratio FileDocument3 pagesApple Ratio Filesachin2727No ratings yet

- Wacc NTDocument41 pagesWacc NTsachin2727No ratings yet

- LLLKLKLDocument1 pageLLLKLKLsachin2727No ratings yet

- 1 Acc-ExamDocument10 pages1 Acc-Examsachin2727No ratings yet

- Proof of Cash AssignmentDocument2 pagesProof of Cash Assignmentsachin2727No ratings yet

- Mid TermDocument28 pagesMid Termsachin2727No ratings yet

- Use of TemplateDocument13 pagesUse of Templatesachin2727No ratings yet

- Bank Transfer ProblemDocument1 pageBank Transfer Problemsachin2727No ratings yet

- +chapter 6 Binomial CoefficientsDocument34 pages+chapter 6 Binomial CoefficientsArash RastiNo ratings yet

- 14 WosDocument6 pages14 WosATUL KURZEKARNo ratings yet

- Diesel Rotary UPS Configurations V1 - 00 - Jan2008Document10 pagesDiesel Rotary UPS Configurations V1 - 00 - Jan2008Karim SenhajiNo ratings yet

- Manual de Taller sk350 PDFDocument31 pagesManual de Taller sk350 PDFLeo Perez100% (1)

- In Truth To Mollusca According To New Studies by J RutherfordDocument4 pagesIn Truth To Mollusca According To New Studies by J RutherfordbalaiNo ratings yet

- Study of Mosquito Larvicidal Effects of (Bitter Gourd) Extracts As NanopowderDocument3 pagesStudy of Mosquito Larvicidal Effects of (Bitter Gourd) Extracts As NanopowderAnonymous AkoNo ratings yet

- Vol07 1 PDFDocument275 pagesVol07 1 PDFRurintana Nalendra WarnaNo ratings yet

- Iloilo City Regulation Ordinance 2006-010Document4 pagesIloilo City Regulation Ordinance 2006-010Iloilo City CouncilNo ratings yet

- The Sea DevilDocument6 pagesThe Sea DevilRevthi SankerNo ratings yet

- InTech-Batteries Charging Systems For Electric and Plug in Hybrid Electric VehiclesDocument20 pagesInTech-Batteries Charging Systems For Electric and Plug in Hybrid Electric VehiclesM VetriselviNo ratings yet

- 520L0586 MMF044Document48 pages520L0586 MMF044vendas servicosNo ratings yet

- Column c4 From 3rd FloorDocument1 pageColumn c4 From 3rd Floor1man1bookNo ratings yet

- EY Enhanced Oil RecoveryDocument24 pagesEY Enhanced Oil RecoveryDario Pederiva100% (1)

- Modern Views Catalogue/Sotheby's BenefitDocument36 pagesModern Views Catalogue/Sotheby's BenefitStudio AdjayeNo ratings yet

- Class 28: Outline: Hour 1: Displacement Current Maxwell's Equations Hour 2: Electromagnetic WavesDocument33 pagesClass 28: Outline: Hour 1: Displacement Current Maxwell's Equations Hour 2: Electromagnetic Wavesakirank1No ratings yet

- Afectiuni Si SimptomeDocument22 pagesAfectiuni Si SimptomeIOANA_ROX_DRNo ratings yet

- Scuba Diving - Technical Terms MK IDocument107 pagesScuba Diving - Technical Terms MK IJoachim MikkelsenNo ratings yet

- Vintage Tavern - PrintInspectionDocument4 pagesVintage Tavern - PrintInspectionBryce AirgoodNo ratings yet

- Faujifood Pakistan PortfolioDocument21 pagesFaujifood Pakistan PortfolioPradeep AbeynayakeNo ratings yet

- Chinese ArchitectureDocument31 pagesChinese Architecturenusantara knowledge100% (2)

- Calculate Cable Size and Voltage Drop Electrical Notes Articles PDFDocument10 pagesCalculate Cable Size and Voltage Drop Electrical Notes Articles PDFRavi SharmaNo ratings yet

- Sew Gear ReducerDocument772 pagesSew Gear Reducerrahimi mohamadNo ratings yet

- Mwangi, Thyne, Rao - 2013 - Extensive Experimental Wettability Study in Sandstone and Carbonate-Oil-Brine Systems Part 1 - Screening ToDocument7 pagesMwangi, Thyne, Rao - 2013 - Extensive Experimental Wettability Study in Sandstone and Carbonate-Oil-Brine Systems Part 1 - Screening ToMateo AponteNo ratings yet

- Solid Mens ModuleDocument158 pagesSolid Mens ModuleAzha Clarice VillanuevaNo ratings yet

- Extrahepatic Biliary Tract Pathology - Cholidolithiasis, Cholidocholithiasis, Cholecystitis and CholangitisDocument60 pagesExtrahepatic Biliary Tract Pathology - Cholidolithiasis, Cholidocholithiasis, Cholecystitis and CholangitisDarien LiewNo ratings yet

- Wjec Biology SpectificaionDocument93 pagesWjec Biology SpectificaionLucy EvrettNo ratings yet

- Theology of Work and Practical ImplicationsDocument28 pagesTheology of Work and Practical ImplicationsVinicius CardosoNo ratings yet

- Chapter 3 FinalizedDocument11 pagesChapter 3 Finalizedpeter vanderNo ratings yet