Professional Documents

Culture Documents

Prop 1

Uploaded by

nicholas.phillips0 ratings0% found this document useful (0 votes)

113 views1 pageProp1 Bond Issue

Original Title

Prop1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProp1 Bond Issue

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

113 views1 pageProp 1

Uploaded by

nicholas.phillipsProp1 Bond Issue

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

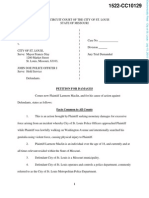

Proposition 1 City of St.

Louis August 4th election:

Shall the following be adopted: Proposition to issue bonds of the City of St. Louis, Missouri in

an amount not to exceed One Hundred Eighty Million Dollars ($180,000,000) for the purpose of

funding a portion of the cost of acquiring certain real property for, and purchasing, replacing,

improving, and maintaining the buildings, vehicles, and equipment of, the City, the St. Louis

Police Department, Fire Department, and

Emergency Medical Services, and other City departments and for maintaining the safety and

security of the jails and improving public safety; for funding a portion of the costs of

reconstructing, repairing and improving streets, bridges, and sidewalks; for funding a portion of

the costs of infrastructure development and of demolition and abatement of various abandoned or

condemned buildings owned by or under the control of the City of St. Louis or its related

agencies; for funding a portion of the cost of city owned building stabilization and preservation;

for funding a portion of the costs of home repair programs; for funding ward capital

improvements; for funding a portion of the cost of paying for economic development and site

development infrastructure, and for paying incidental costs of such work and of issuing the

Bonds.

Yes for the Proposition

No against the Proposition

The City wants to borrow $180 million to make significant repairs, improvements, and

reconstruction, equipment upgrades in addition to upgrades of public safety equipment, vehicles,

condemned and abandoned property demolition and abatement, and numerous other projects.

Specific projects include municipal court improvements, replacement of fire trucks, a secure and

centralized 911 center, corrections department updates, city building improvements, and home

repair programs. In addition the citys wards would get $10 million for aldermen to share and

spread throughout the citys neighborhoods.

The $180 million bond would be funded through a property tax increase. For example, a

homeowner with a property tax bill based on $80,000 (home and vehicle) will pay approximately

$28 more in annual property tax. Someone with a current property tax bill based on $140,000

would pay an additional $50 each year. A property tax bill based on $275,000 would have a $97

annual increase. The City last passed a general obligation bond in 1999.

Proponents say that it is time to reinvest in St. Louis. These improvements are long overdue and

much needed to continue delivery of critical services, maintain the Citys financial health, and

save millions of dollars in annual maintenance. They also say that repairs are particularly needed

around the old Pruitt-Igo housing complex in north St. Louis since the City wants to have that

site approved by the federal government for the National Geospatial-Intelligence Agencys

Western headquarters.

Opponents say added ward money, home repairs and demolition programs, work against the

central purpose of the bond issue, which is to repair the citys roads, streets and bridges and to

upgrade equipment for police and firefighter equipment.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Charmin HeistDocument2 pagesCharmin Heistnicholas.phillipsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Aug15 Sample Ballot1Document1 pageAug15 Sample Ballot1nicholas.phillipsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- City of Westland Police & Fire Ret. Sys. v. StumpfDocument108 pagesCity of Westland Police & Fire Ret. Sys. v. Stumpfnicholas.phillipsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Panouzis PleaDocument13 pagesPanouzis Pleanicholas.phillipsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Abdullah V STLCDocument10 pagesAbdullah V STLCnicholas.phillipsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Paternity Test CaseDocument19 pagesPaternity Test Casenicholas.phillips0% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Frazier V Jilly'sDocument10 pagesFrazier V Jilly'snicholas.phillips100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Metropolitan Taxicab Commission: St. Louis, MissouriDocument1 pageMetropolitan Taxicab Commission: St. Louis, Missourinicholas.phillipsNo ratings yet

- Bond Issue BreakdownDocument1 pageBond Issue Breakdownnicholas.phillipsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- USA V John David BerrettDocument16 pagesUSA V John David Berrettnicholas.phillipsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Maclin SuitDocument5 pagesMaclin Suitnicholas.phillipsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Micro-Businesses - June 12, 2015Document3 pagesMicro-Businesses - June 12, 2015nicholas.phillipsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TinkerDocument1 pageTinkernicholas.phillipsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Terry Swopes Sentencing MemoDocument6 pagesTerry Swopes Sentencing Memonicholas.phillips100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Board of Adjustment Appeal Decision Re ST Louis Swap MeetDocument4 pagesBoard of Adjustment Appeal Decision Re ST Louis Swap Meetnicholas.phillipsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Uber Ad in Post DispatchDocument1 pageUber Ad in Post Dispatchnicholas.phillipsNo ratings yet

- Memo - Conditional Use Process ReformsDocument3 pagesMemo - Conditional Use Process Reformsnicholas.phillipsNo ratings yet

- Business License Code Reforms - June 12, 2015Document12 pagesBusiness License Code Reforms - June 12, 2015nicholas.phillipsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Home-Based Business OccupationsDocument4 pagesHome-Based Business Occupationsnicholas.phillipsNo ratings yet

- McSpadden V City of FergusonDocument54 pagesMcSpadden V City of Fergusonnicholas.phillipsNo ratings yet

- Zorich V St. Louis CountyDocument24 pagesZorich V St. Louis Countynicholas.phillipsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- F.M Project (Tooba)Document25 pagesF.M Project (Tooba)tooba kanwalNo ratings yet

- Best of LUCK ..!Document1 pageBest of LUCK ..!Wajid HussainNo ratings yet

- What Is The Implication of The Global Crisis To Financial ManagersDocument2 pagesWhat Is The Implication of The Global Crisis To Financial ManagersYenelyn Apistar CambarijanNo ratings yet

- Pas 20 - Acctg For Govt Grants & Disclosure of Govt AssistanceDocument12 pagesPas 20 - Acctg For Govt Grants & Disclosure of Govt AssistanceGraciasNo ratings yet

- UBP Corporate Card Application - Employee - New FillableDocument5 pagesUBP Corporate Card Application - Employee - New FillableAdam Albert DomendenNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Ruma GhoshDocument26 pagesRuma GhoshhritamgemsNo ratings yet

- Paper12 SolutionDocument21 pagesPaper12 SolutionTW ALWINNo ratings yet

- Birch Paper CompanyDocument1 pageBirch Paper CompanySwami R RNo ratings yet

- LNG Contract StructureDocument31 pagesLNG Contract Structurevenancio-20100% (4)

- Documents To Check Before Buying A HouseDocument13 pagesDocuments To Check Before Buying A Housenshetty22869No ratings yet

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- Topic 4: Recording in JournalDocument3 pagesTopic 4: Recording in JournalJuan FrivaldoNo ratings yet

- Lorenzo V Posadas (Digest)Document2 pagesLorenzo V Posadas (Digest)StBernard15No ratings yet

- Westside BillDocument3 pagesWestside BillVamsee309No ratings yet

- Mock Prelim - Intermediate AcctDocument9 pagesMock Prelim - Intermediate AcctNikki LabialNo ratings yet

- Wise Transaction Disclosure 1698248770342Document2 pagesWise Transaction Disclosure 1698248770342ALJANE QUILICOLNo ratings yet

- BVFADocument212 pagesBVFAYan Shen TanNo ratings yet

- Political Economy Annotated BibliographyDocument3 pagesPolitical Economy Annotated BibliographyAndrew S. Terrell100% (1)

- Halina Mountain Resort (B)Document5 pagesHalina Mountain Resort (B)SuzetTe OlmedoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Chapter 3 Problems - FinmgtDocument11 pagesChapter 3 Problems - FinmgtLaisa Vinia TaypenNo ratings yet

- CBK Power LTD Vs Cir CDDocument3 pagesCBK Power LTD Vs Cir CDJennylyn Biltz AlbanoNo ratings yet

- Bank of The Philippine Islands Green Finance FrameworkDocument7 pagesBank of The Philippine Islands Green Finance FrameworkMarilyn CailaoNo ratings yet

- Grant ProcedureDocument4 pagesGrant ProcedurerahulNo ratings yet

- ATP Case Digest 2Document7 pagesATP Case Digest 2Tay Wasnot TusNo ratings yet

- Developing An Effective Business Case For A Warehouse Management SystemDocument16 pagesDeveloping An Effective Business Case For A Warehouse Management SystemJovan ĆetkovićNo ratings yet

- Ifrs Objective Final 2020 Preview VersionDocument42 pagesIfrs Objective Final 2020 Preview VersionMuhammad Haroon KhanNo ratings yet

- State Investment Vs CA and MoulicDocument10 pagesState Investment Vs CA and MoulicArlyn R. RetardoNo ratings yet

- Reading 20 Discounted Dividend ValuationDocument55 pagesReading 20 Discounted Dividend Valuationdhanh.bdn.hsv.neuNo ratings yet

- NCERT Solutions For Class 11th: CH 1 Introduction To Accounting AccountancyDocument36 pagesNCERT Solutions For Class 11th: CH 1 Introduction To Accounting Accountancydinesh100% (1)

- The Financial Risk Manager (FRM®) CertificationDocument2 pagesThe Financial Risk Manager (FRM®) CertificationRonaldoNo ratings yet

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Waste: One Woman’s Fight Against America’s Dirty SecretFrom EverandWaste: One Woman’s Fight Against America’s Dirty SecretRating: 5 out of 5 stars5/5 (1)