Professional Documents

Culture Documents

DBS Bank

Uploaded by

Mayank DixitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBS Bank

Uploaded by

Mayank DixitCopyright:

Available Formats

DBS Bank

Global: DBS Bank Ltd was incorporated in Singapore by Government of

Singapore in June 1968. DBS Bank is the largest bank in South East

Asia by assets and among the larger banks in Asia. It has marketdominant positions in consumer banking, treasury and markets, asset

management, securities brokerage, equity and debt fund-raising in

Singapore and Hong Kong. The bank's strong capital position, as well as

"AA-" and "Aa1" credit ratings that are among the highest in the AsiaPacific region, earned it Global Finance's "Safest Bank in Asia" accolade for

six consecutive years, from 2009 to 2014. With operations in 17 markets,

the bank has a regional network spanning more than 250 branches and

over 1,100 ATMs across 50 cities.

India: DBS entered India through a representative office in 1994 and set up its

first branch in 1995. Headquartered in the commercial capital of Mumbai,

DBS operates via a network of 12 bank branches across India in

Bangalore, Chennai, Cuddalore, Calcutta, Kolhapur, Moradabad, Bombay,

Nashik, New Delhi, Pune, Salem and Surat. DBS India had a 37.5% stake

in DBS Cholamandalam Finance, a non-bank financial institution, in April

2009, it transferred its shares to the parent company Tubes Investments

of India Limited, thus terminating its shared holder agreement

in Cholamandalam DBS .

Product: The DBS Group has 3 products for Indian region:

1. Personal Banking

2. Wealth Management (DBS Treasures)

3. Business Banking (SME Banking and Corporate Banking)

Personal Banking:

Banking- Savings Account, Fixed deposits

NRI Banking- NRE & NRO Accounts, Foreign Currency Non Resident Fixed

Deposits, Remittances

Investment Banking- Equity Fund, Money Market Funds, Investment

Grade Bonds, Yield Enhancement Notes, Fixed Income Funds

Life Insurance- Endowment Savings - Aviva Dhan Samruddhi, Term

Protection - Aviva LifeShield Advantage, Term Protection - Aviva LifeShield

Platinum, Protection - Aviva Wealth Builder, Aviva Next Innings Pension

Plan, Education - Aviva Young Scholar Secure, Protection - Aviva Life Shield

Plus, Retirement - Aviva New Family Income Builder and Protection - Aviva

Live Smart

General Insurance- Travel Shield - Single Trip

DBS Group has a strategic tie up with Aviva Life Insurance for Life

insurance products and they had tied up with Royal Sundaram for General

insurance products.

Current Focus- The bank will continue to focus on small and medium

enterprises (SME) in India and the retail banking wasnt a part of its larger

plans right now (serve only high-end retail). Bank is set to make a foray

into asset-based lending this year. DBS will sell mortgages (housing loans)

and loan against property (LAP) as it seeks to consolidate its consumer

banking business and turn it around in the next calendar year. The bank

may also venture into auto loans and even unsecured offerings such as

credit cards and personal loans in coming years.

Marketing: Not much detail available

DBS Bank serves up Chilli Paneer to drive brand awareness

DBS Bank India has launched a new online campaign titled Chilli Paneer

in an attempt to engage with consumers and build brand awareness few

months ago. The innovative campaign, conceptualised by 4nought4 (a

digital agency of Cartwheel Creative Consultancy), revolves around the

banks values, purpose, relationship and connectivity. The film is being

unveiled in four parts and can be watched on www.chillipaneerfilm.com.

The campaign was spread across four weeks and supported by

print, radio and outdoor on-ground activities.

Concern Person - Sheran Mehra, Head, Group Strategic Marketing &

Communications at DBS Bank India

DBS-TISS tap entrepreneurs to meet social objective

DBS Bank India launched a CSR initiative in association with TISS to

financially support social entrepreneurs in 2012, It aids 17 social

enterprise ventures across Singapore (four), China (four) and India (nine),

with an annual budget of SG$500,000 (Rs 20 cr).

You might also like

- Online Assignment Process FlowDocument6 pagesOnline Assignment Process FlowMayank DixitNo ratings yet

- Revenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRDocument1 pageRevenue 142 Cr. 108 Cr. Profit (Before Tax) 10.23 Cr. 12.39 Cr. Profit (After Tax) 6.75 Cr. 8.12 CRMayank DixitNo ratings yet

- Business Opportunities & Procurement News: Subscription FormDocument2 pagesBusiness Opportunities & Procurement News: Subscription FormMayank DixitNo ratings yet

- Directorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PDocument62 pagesDirectorate General of Hydrocarbons (Under Ministry of Petroleum & Natural Gas) Plot No. 2, OIDB Bhawan, Sector 73, Noida - 201 301 U.PMayank DixitNo ratings yet

- Elecrama ExhDocument44 pagesElecrama ExhMayank Dixit100% (1)

- Signature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanDocument1 pageSignature Not Verified: Digitally Signed by KRISHNA KANTA Sharma Date: 2016.03.01 11:22:34 PST Location: RajasthanMayank DixitNo ratings yet

- Tender Document: National Innovation Foundation-IndiaDocument7 pagesTender Document: National Innovation Foundation-IndiaMayank DixitNo ratings yet

- Brahmana Thread 1Document4 pagesBrahmana Thread 1Mayank DixitNo ratings yet

- Importance of Garbhadhana Samskara - 0Document5 pagesImportance of Garbhadhana Samskara - 0Mayank DixitNo ratings yet

- Duties of The Sannyasi - 1Document10 pagesDuties of The Sannyasi - 1Mayank DixitNo ratings yet

- Arcana As Yoga - 0Document7 pagesArcana As Yoga - 0Mayank DixitNo ratings yet

- Duties of The Brahmacari - 0Document4 pagesDuties of The Brahmacari - 0Mayank DixitNo ratings yet

- Guide To Ritual ImpurityDocument13 pagesGuide To Ritual ImpurityMayank DixitNo ratings yet

- Procedure To Do Anushtan/Invocation: Frankinscence (Guggal)Document5 pagesProcedure To Do Anushtan/Invocation: Frankinscence (Guggal)Mayank DixitNo ratings yet

- Choosing Rudraksha by TherapyDocument2 pagesChoosing Rudraksha by TherapyMayank DixitNo ratings yet

- Shiva Shadakshara StotramDocument2 pagesShiva Shadakshara StotramMayank DixitNo ratings yet

- Sodarshan Chakra KriyaDocument10 pagesSodarshan Chakra KriyaMayank Dixit100% (1)

- Ganesha Pancharatnam: Mudakaratta ModakamDocument13 pagesGanesha Pancharatnam: Mudakaratta ModakamMayank DixitNo ratings yet

- Beej Mantra For All PlanetsDocument2 pagesBeej Mantra For All PlanetsMayank Dixit0% (1)

- Puja MaterialsDocument1 pagePuja MaterialsMayank DixitNo ratings yet

- Lord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriDocument1 pageLord Venkatesvara & Tirupati Notes: Appearance of Visnu On VenkatadriMayank DixitNo ratings yet

- Ganesha Chaturthi Puja Vidhi NewDocument21 pagesGanesha Chaturthi Puja Vidhi NewMayank Dixit100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Carrier RAC - Consumer Offers - Apr 2023 - For RelianceDocument20 pagesCarrier RAC - Consumer Offers - Apr 2023 - For RelianceHara HinisNo ratings yet

- Bata Case Study - Growing Your Brand OnlineDocument44 pagesBata Case Study - Growing Your Brand OnlineICT AUTHORITYNo ratings yet

- Trial 4G Trial Fast Power Increase For Big Package UeDocument2 pagesTrial 4G Trial Fast Power Increase For Big Package UeDanang Bayuaji100% (1)

- Financial Job Guide For NewbiesDocument27 pagesFinancial Job Guide For NewbiesArissa Lai100% (1)

- GiGE Responder DSDocument2 pagesGiGE Responder DSQiandra kamilahNo ratings yet

- Mobile ComputingDocument7 pagesMobile ComputingNISHA 1022No ratings yet

- Star TopologyDocument8 pagesStar TopologyAbigail ParungaoNo ratings yet

- 2011 Flex Enrolment GuideDocument40 pages2011 Flex Enrolment GuideparamvikramNo ratings yet

- Virtual Network Interface: Loopback InterfacesDocument2 pagesVirtual Network Interface: Loopback InterfacesIslam AhmedNo ratings yet

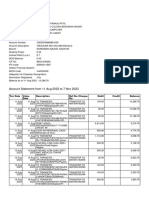

- Account Statement 190521 180721Document1 pageAccount Statement 190521 180721Swaroop MNo ratings yet

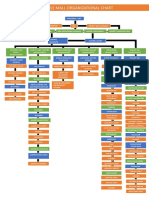

- Organizational ChartDocument2 pagesOrganizational Chartsheila roxasNo ratings yet

- Financial AccDocument9 pagesFinancial AccSirius BlackNo ratings yet

- (Campus of Open Learning) University of Delhi Delhi-110007Document1 page(Campus of Open Learning) University of Delhi Delhi-110007om parkash barakNo ratings yet

- Chapter 3 Solutions Comm 305Document77 pagesChapter 3 Solutions Comm 305mike100% (1)

- Diagrama de Conexion INTERNETDocument2 pagesDiagrama de Conexion INTERNETbraulio lopezNo ratings yet

- Punjab Car Hire - Self Driven Car in Punjab IndiaDocument11 pagesPunjab Car Hire - Self Driven Car in Punjab IndiaSumanNo ratings yet

- Digital Marketing QuizDocument2 pagesDigital Marketing QuizpankajnidhiNo ratings yet

- JsoDocument11 pagesJsovenkat yeluriNo ratings yet

- Brendan Dawes: Unknown Threats Detected and Stopped Over Time by Trend Micro. Created With Real DataDocument12 pagesBrendan Dawes: Unknown Threats Detected and Stopped Over Time by Trend Micro. Created With Real DatamarahlhalatNo ratings yet

- Panasonic Malaysia - Authorized Online Retailers: Kuala LumpurDocument3 pagesPanasonic Malaysia - Authorized Online Retailers: Kuala Lumpurبُنِي كفاحNo ratings yet

- Sagawa ExpressDocument14 pagesSagawa ExpressFauzul MuhammadNo ratings yet

- HLR9820 System OverviewDocument29 pagesHLR9820 System OverviewAnas AnsariNo ratings yet

- SFMS - GuidelinesDocument116 pagesSFMS - GuidelinesRajnish ShastriNo ratings yet

- 3GPP TS 38.304Document28 pages3GPP TS 38.304holapaquitoNo ratings yet

- Uec Bi T2 LJDJM KG UcDocument10 pagesUec Bi T2 LJDJM KG Ucpatilrasika289No ratings yet

- Digital Smart Telemedicine: Clini C INA Bag?Document2 pagesDigital Smart Telemedicine: Clini C INA Bag?Vedang PrabhuNo ratings yet

- Working Capital CashDocument6 pagesWorking Capital CashNiña Rhocel YangcoNo ratings yet

- CLASS TY. BMS E-COMMERCE AND DIGITAL MARKETING PPTVDocument47 pagesCLASS TY. BMS E-COMMERCE AND DIGITAL MARKETING PPTVIts UnknownNo ratings yet

- Chantera LeeDocument2 pagesChantera Leeapi-393982288No ratings yet

- Banking Law Notes From Dean Abella's Lectures AY 2018-2019: New Central Bank ActDocument14 pagesBanking Law Notes From Dean Abella's Lectures AY 2018-2019: New Central Bank ActDeanne ViNo ratings yet