Professional Documents

Culture Documents

Major Changes

Uploaded by

Bhava Nath DahalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Major Changes

Uploaded by

Bhava Nath DahalCopyright:

Available Formats

Amendments by Finance Ordinance 2072/73

Amendments by Finance Ordinance, 2072/73

1.

Special Provision for taxpayer submitting Presumptive Tax (Clause 21): Replaced

Small taxpayer who submit presumptive tax return whose business is completely destroyed

by earthquake in district receiving relief material and certified by District Natural District

Rescue Committee, shall be relieved from income tax and house rent tax on filing tax return

for F/Y 2071-72 along with such certification. Excise duty renewal fees shall also be waived

for F/Y 2072-73 for such taxpayer.

2.

Special Provisions for waiver of outstanding tax (Clause 22): Replaced

Out of outstanding Hotel Tax, Entertainment tax, contractual tax which were replaced by

Income tax according to Income tax Act 2058, VAT according to Value Added tax 2052 and

outstanding tax as record (nut) upto Ashad end 2060 under Sales Tax Act, NRs 20,000 per

record (nut) and penalties and interest on it shall be waived.

Income Tax Act, 2058

1.

Provision related to tax amount (Section 4): Inserted

Subsection (4) Gha: Not registered in VAT (condition for tax to be paid equal to the amount

at the rate in Schedule-1 Section 1(7).

Subsection 4(Ka): Notwithstanding anything written in subsection (2) tax payment in any

fiscal year on basis of transaction for resident natural person pursuant to Section 3(Ka) shall

be equal to the amount calculated using rate mentioned in Subsection 17 Section 1 of

Schedule in following cases:

(a) the person only has income from business having source in Nepal for the fiscal year

(b) has not claimed medical tax credit pursuant to section 51

(c) has not claimed advance tax deduction pursuant to Section 93

(d) business transaction is between 20 lacs and 50 lacs annually

(e) not registered in VAT

(f) has not earned income as physician, engineer, auditor, law professional, athlete, actor,

consultant and other consultancy and expert service

2.

Exemptions (Section 11(3)): Inserted

Tax shall be levied on following rates to any person having income from Special Industries

and Information Technology Industry:

Ka1) 70% of the rate to be levied on Special Industry, agro-based industry, tourism related

industry providing year around direct employment to at least 100 nepali nationals.

3ka) Concession at the following rates shall be provided on dividend distributed by Industries

established in Special Economic Zone:

Nga) On dividend distributed by Special Industry, agro-based industry, tourism related

industry which capitalizes its accumulated profit for expansion of industry,100% concession

of dividend tax on such capitalization.

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

3.

Donation (Section 12): Inserted

12 Kha) Contribution made to Prime minister Disaster Relief Fund and reconstruction

Fund established by GoN: Contribution made to Prime minister Disaster Relief Fund and

reconstruction Fund established by GoN by any person during any income year shall be

allowed for deduction while assessing taxable income.

4.

Repair and maintenance (Section 16): Inserted:

(2) Notwithstanding anything contained in subsection 1, amount to be deducted according to

this section at the end of income year shall not exceed 7% of depreciable base but

(Kha) This provision shall not apply on repair and maintenance expenses incurred on assets

in district selected by GoN as earthquake affected area upto F/Y 2073/74 on option of

taxpayer.

5.

Characterization of Compensation payment (Section 31): Inserted

Following restrictive phrase has been added to Section 31(Kha)

(2) Compensation received for death of natural person shall not be included in income.

7.

Tax withheld at Source (Section 88): Inserted

(Ka5) tax shall be withheld at the rate of 1.5% for person involved in business of providing

vehicle for rent and is registered in VAT.

8.

Deposition of Withholding Tax (Section 90): Inserted

Subsection 4(Ka) has been added after Subsection (4): Notwithstanding anything contained

in subsection (4) {withheld tax to be deposited within 25 days} tax withheld shall be deposited

within Ashad end of current year for non-business house rent income of natural person and

tax withheld should be deposited at time of paying advance tax instalment according to

Chapter 17 for person involved in transaction in Section 4(4Ka)

9.

Payment of Income Tax by installment (Section 94): Inserted

Subsection 1(ka) has been added after subsection 1

1(ka) Pesron paying tax on basis of transaction shall pay tax in two installment:

Due date for deposition

Amount to be deposited

Upto Poush end

Tax amount at prescribed rate on transaction upto

Poush 20

Tax amount at prescribed rate on actual transaction upto

Ashad 20 minus tax paid on Poush end

End of Ashad

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

Changes to Schedule -1

Of Income Tax Act, 2058

Tax Rates

1.

Social Security tax applicable under Section 1- Inserted

Social security tax not to be levied on income pension income

1.

Presumptive tax applicable under section 4.13 of this Act- Amended

Following shall be the presumptive tax applicable under Section 4.13 of this Act.

a. NRs. 3,000 for minibus, mini-truck, truck and bus

b. NRs. 2,400 for Car, Jeep, Van and Microbus

c. NRs. 1,550 for Three-wheeler, Auto-rickshaw and tempo

d. NRs. 1,000 for Tractor and Power Tiller

2.

Medical Insurance: Inserted

Notwithstanding anything mentioned in this section, if any payment is made to resident

insurance company by any natural person, then such payment or NRs. 20,000 whichever is

lower shall be allowed for deduction while calculating taxable income according to this

section.

3.

Tax at following rates shall be levied on transaction pursuant to Section 4 (4ka):

a. For person involved in transaction of gas, cigarette along with goods traded with additional

3% commission or price 0.5% of transaction amount

b. For person involved in business except for business mentioned in (a), 1.5% of transaction

amount

c. For person involved in service business, 2% of transaction amount

Value Added Tax Act, 2052

1.

Provision for Bank Guarantee (Section 8)-Amended

(Ka1) Industry exporting more than 40% (previously more than 60%) of the total sales of

last 12 months shall be availed with the facility of importing the raw material required for

such export by furnishing bank guarantee during such tax payable on such import.

(Ka5) Person availing the import under bank guarantee shall not be able to claim refund of

excess tax if the sales during any month exceeds 40%.-Deleted

2.

Exemption for small entrepreneur (Section 9): Amended

Provided that any person other than presumptive tax payer as per Section 4 (4) of Income Tax

Act, 2052 may voluntarily apply for the registration. (Previously anyone could apply for

voluntary registration.

3.

Registration (Section 10): Deleted

Subsection 2(a) Person involved in business of brick production and transaction, wine

distributors, Wine shop, software, trekking, rafting, ultra-light flight, paragliding, tourist

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

vehicle, stone crushing, slate and stone industry are required to be register under VAT within

30 days of operation of the business.

Subsection 2(b) Person conducting business of hardware, sanitary , furniture , furnishing,

automobiles, motor parts, electronics, marble, educational consultancy, Disco The que,

catering service, health club, party palace, parking service, dry cleaners using machinery

equipment , restaurant with bar, and color lab, boutique, tailoring business along with suiting

and shirting, education institution or medical institutions or business of preparing uniform for

other organizations and ice-cream industry in a metropolis, sub metropolis or a municipality

or place specified by IRD are required to be register under VAT within 30 days of operation

of the business.

4.

Special provision for Temporary Registration (Section 10 Kha): Inserted

(1) Joint venture business established by two or more persons for specified time period should

be registered for temporary purpose.

(2) Joint venture established pursuant to Subsection (1) should be deregistered after expiry of

the specified time period.

Excise Act, 2052

1.

Restriction on Sales and Distribution (Section 4 Gha): Inserted

(2) Except for hotel and restaurant business, person involved in transaction of tobacco and alcoholic

product within metropolitan, sub metropolitan, municipality and area specified by department shall

be restricted to do such business only.

However, departmental stores can conduct such transaction through separate sales room for alcoholic

substance.

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

A.

Tax rates for Natural Person

A.1

Income Tax rate for Individual

S.N. Particulars

2069

70NRs.

2070

2071

71NRs. 72NRs.

2072

73NRs.

1.

160,000

200,000

250,000

250,000

1%

1%

1%

1%

Next NRs. 100,000

15%

15%

15%

15%

Balance Amount

25%

25%

25%

25%

10%

10%

10%

10%

Basic Tax Exemption limit to individual

-Tax Rates

Social Security Tax (except for income from

pension)

Additional tax:

If taxable income is more than NRs. 2,500,000

(40% tax on tax amount calculated under the

slab of 25% tax rate beyond 25 lacs)

A.2 Income Tax rate for Couple

S.N. Particulars

1.

Basic Tax Exemption limit to individual

-Tax Rates

Social Security Tax (except for income from

pension)

2070

2071

71NRs. 72NRs.

250,000 300,000

2072

73NRs.

300,000

1%

1%

1%

1%

Next NRs. 100,000

15%

15%

15%

15%

Balance Amount

25%

25%

25%

25%

10%

10%

10%

10%

Additional tax:

If taxable income is more than NRs. 2,500,000

(40% tax on tax amount calculated under the

slab of 25% tax rate beyond 25 lacs)

2069

70NRs.

200,000

Note:Compensation received for death of natural person shall not be included in income

A.3

Special provisions applicable for individual and couple

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

A.3

Special provisions applicable for individual and couple

S.N. Particulars

1.

Resident natural Person having pension income included in the

taxable income shall be entitled to deduct from taxable income

2.

2069-70 NRs.

Lower of 25%

of basic exemption

limit or pension

income

50% of basic

exemption limit

10%

2070-71 NRs.

Lower of 25%

of basic exemption

limit or pension

income

50% of basic

exemption limit

10%

2071-72 NRs.

Lower of 25%

of basic exemption

limit or pension

income

50% of basic

exemption limit

10%

2072-73 NRs.

Lower of 25%

of basic exemption

limit or pension

income

50% of basic

exemption limit

10%

75% deduction

allowed

Paid Premium

amount or NRs

20,000 whichever

is lower

Taxable

75% deduction

allowed

Paid Premium

amount or NRs

20,000 whichever

is lower

Taxable

75% deduction

allowed

Paid Premium

amount or NRs

20,000 whichever

is lower

Taxable

Up to NRs.50,000

Up to NRs.50,000

75% deduction

allowed

Paid Premium

amount or NRs

20,000 whichever

is lower

Paid Premium

amount or NRs

20,000 whichever

is lower

Up to NRs.50,000

5.

Incapacitated resident natural person shall be entitled to get

deduction from taxable income

Tax rebate has been provided to the women who have

remuneration income only.(Not opting for couple status)

Foreign Allowance for Nepalese staff working in diplomatic

sector

Life insurance premium deduction on taxable income

6.

Medical Insurance Premium deduction on taxable income

7.

Remote allowance reduction for 5 class of remote area

Up to NRs.50,000

specified by IRD

Tax rate applicable to natural person conducting special

20%

industries during the whole income year, where applicable rate

is 25%

Tax rate applicable to income earned by natural person from

15%

export, where applicable rate is 25%

Non-resident natural person

25%

3.

4.

8.

9.

9.

20%

20%

20%

15%

15%

15%

25%

25%

25%

*Medical tax credit is available to resident natural persons as deduction from tax liabilities. The limit prescribed is Rs.750 or 15% of Approved medical expense or actual

approved medical expense incurred whichever is lower. Any unutilized expenses can be carried forward to next year.

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

B.

Corporate Tax Rates for Entity

B.1

For financial institution

S.N. Particulars

1.

2

B.2

Bank, Financial Institutions, or General Insurance Business

Co-operative Society established under Co-operative Act,

2048 conducting other than those tax exempt transactions

206970

NRs.

30%

20%

207071NRs.

207172NRs.

30%

20%

30%

20%

207273

NRs.

30%

20%

Special Industries

S.N. Particulars

1.

3

4

206970NRs. 207071NRs.

Special Industry, Entity engaged in the

construction of road, bridge, tunnel, ropeway, or flying bridge,

operation of any trolley bus, or train

Projects (building of public infrastructure, own operate and

transfer to HMG), Power Generation, transmission, or

distribution

Any Entity operating as special Industry in whole year as per

Section11 of Income Tax Act 2058

Special industry and IT industry providing direct employment

to 300 or more Nepali citizens

Special Industry Providing direct employment to 1200 or

more Nepali Citizen

Special industry providing direct employment to 100 or more

Nepali citizen

including women, dalits and disabled in the proportion of 33%

Special industry operating in following regions have

following tax rates for first 10 years:

a. Remote Regions

BRSNeupane&Co.

CharteredAccountants

20%

20%

207172

NRs.

20%

20%

20%

20%

20%

20%

20%

20%

20%

90% of the

applicable tax

rate (i.e. 18%)

80% of the

applicable tax

rate (i.e. 16%)

80% of the

applicable tax

rate (i.e. 16%)

90% of the

applicable tax

rate (i.e. 18%)

80% of the

applicable tax

rate (i.e. 16%)

80% of the

applicable tax

rate (i.e. 16%)

90% of the

applicable tax

rate (i.e. 18%)

80% of the

applicable tax

rate (i.e. 16%)

80% of the

applicable tax

rate (i.e. 16%)

90% of the

applicable tax

rate (i.e. 18%)

80% of the

applicable tax

rate (i.e. 16%)

80% of the

applicable tax

rate (i.e. 16%)

207273

NRs.

20%

Amendments by Finance Ordinance 2072/73

B.3

b. Underdeveloped Regions

10% of the

applicable tax

rate (i.e. 2%)

10% of the

applicable tax

rate (i.e. 2%)

10% of the

applicable tax

rate (i.e. 2%)

10% of the

applicable tax

rate (i.e. 2%)

c. Undeveloped Regions

20% of the

applicable tax

rate (i.e. 4%)

20% of the

applicable tax

rate (i.e. 4%)

20% of the

applicable tax

rate (i.e. 4%)

20% of the

applicable tax

rate (i.e. 4%)

30% of the

applicable tax

rate (i.e. 6%)

20%

30% of the

applicable tax

rate (i.e. 6%)

20%

30% of the

applicable tax

rate (i.e. 6%)

20%

30% of the

applicable tax

rate (i.e. 6%)

70% of

applicable rate

(i.e. 14%)

206970NRs.

30%

207071NRs.

30%

207172NRs.

30%

207273 NRs.

30%

30%

30%

30%

30%

25%

20%

25%

20%

25%

20%

25%

20%

2069-70 NRs.

2070-71 NRs.

2071-72 NRs.

2072-73 NRs.

Tax exempt

Tax exempt

Special Industry, agro-based industry, tourism related

industry providing year around direct employment to at

least 100 nepali nationals.

General Provisions for entity

S.N. Particulars

1.

Entities producing cigarette, bidi, cigar, tobacco, khaini,

liquor, beer

2

Entity engaged in petroleum operations under the Nepal

Petroleum Act, 1983

3

Other firms, companies

4

Taxable income of an entity having source in Nepal earned

from export

B.4

Concession tax rate for entity

S.N. Particulars

1.

Industries established in Special Economic Zone situated in

mountainous districts and hilly districts prescribed by Nepal

Government

-For first 10 years

Tax exempt

Tax exempt

-After such period

BRSNeupane&Co.

CharteredAccountants

Amendments by Finance Ordinance 2072/73

50% of the

applicable tax

rate

2

Industries established in Special Economic Zone situated in

other regions

Tax exempt

-For first 5 years

50% of the

applicable tax

-After such period

rate

Income from Foreign technology and management service 50% of the

fee and royalty of Foreign investor in Special Economic Zone applicable tax

rate (i.e. 7.5%)

Tax exempt

for

first 7 years

and 50% of

applicable rate

on subsequent

3 years

Tax exempt

for

Tax exempt

for

first 7 years

and 50% of

applicable rate

on subsequent

3 years

Tax exempt

for

Brandy based on fruits, cider and wine

manufacturers in undeveloped area

Entities (Manufacturing, Tourism, Hydro

electricity production, distribution and transmission, IT

industry established within IT Park, biotech park and

technology park as specified in the Gazette) listed in

Securities Market

Person involved in exploration & extraction of petroleum and Tax exempt for

natural gases, will start its operation within Chaitra end 2075 first 7 years and

50%

of

applicable rate

on subsequent 3

years

Person having license to generate, transmit and distribute Tax exempt for

electricity will be allowed if the commercial electricity

BRSNeupane&Co.

CharteredAccountants

50% of the

applicable tax

rate

Tax exempt

50% of the

applicable tax

rate

50% of the

applicable tax

rate (i.e.

7.5%)

50% tax

rebate on

applicable tax

rate

40% tax

rebate

on applicable

tax rate for

period of 10

years

90% of the

applicable tax

rate

(i.e.

22.5%)

IT industry established within IT Park, biotech park and

technology park as specified in the Gazette

50% of the

applicable tax

rate

Tax exempt

50% of the

applicable tax

rate

50% of the

applicable tax

rate (i.e.

7.5%)

50% tax rebate 50% tax rebate 50% tax

on applicable

on applicable

rebate on

tax rate

tax rate

applicable tax

rate

40% tax rebate 40% tax rebate 40% tax

rebate

on applicable

on applicable

on applicable

tax rate for

tax rate for

tax rate for

period of 10

period of 10

period of 10

years

years

years

90% of the 90% of the 90% of the

applicable tax applicable tax applicable tax

rate (i.e. 22.5%) rate (i.e. 22.5%) rate

(i.e.

22.5%)

50% of the

applicable tax

rate

Tax exempt

50% of the

applicable tax

rate

50% of the

applicable tax

rate (i.e. 7.5%)

Tax exempt for

first 7 years and

50%

of

applicable rate

on subsequent 3

years

Tax exempt for

Amendments by Finance Ordinance 2072/73

10

11

12

13

14

generation, generation and transmission, generation and first 7 years and

distribution or generation, transmission, distribution 50%

of

commences before Chaitra end 2075

applicable rate

on subsequent 3

years

Hydroelectricity project initiating construction within 07 Tax exempt for

Bhadra, 2071 if started commercial production within Chaitra first 10 years

2075

Income earned by manufacturing industries

25%

through export sales

concession on

applicable rate

Income earned from Road, Bridge, Airport, tunnel way 40%

construction and operation or from tram and trolleybus concession on

operation

applicable rate

Royalty income earned from export of

25%

intellectual assets

concession on

applicable rate

Income earned from disposal of intellectual property

50%

concession on

applicable rate

Special industry with capital investment of more than 1 N/A

billion and (1 Arab) providing direct employment to more

than 500 Nepali throughout the year.

first 7 years and

50%

of

applicable rate

on subsequent 3

years

Tax exempt for

first 10 years

25%

concession on

applicable rate

40%

concession on

applicable rate

25%

concession on

applicable rate

50%

concession on

applicable rate

N/A

if the capital requirement is met by increasing present

capacity by 25%

BRSNeupane&Co.

CharteredAccountants

10

first 7 years

and 50% of

applicable rate

on subsequent

3 years

Tax exempt

for

first 10 years

25%

concession on

applicable rate

40%

concession on

applicable rate

25%

concession on

applicable rate

50%

concession on

applicable rate

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

first 7 years

and 50% of

applicable rate

on subsequent

3 years

Tax exempt

for

first 10 years

25%

concession on

applicable rate

40%

concession on

applicable rate

25%

concession on

applicable rate

50%

concession on

applicable rate

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

on

increased

income

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

on

increased

income

Amendments by Finance Ordinance 2072/73

15

Industry related to the tourism sector and Airways industry N/A

involved in international flights investing more than 2 billion

N/A

if the capital requirement is met by increasing present

capacity by 25%

16

Special Industry, agro-based industry and tourism related industry

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

on

increased

income

-

Full

tax

exemption for

first 5 years

and 50% of

applicable tax

rate for next 3

years

on

increased

income

100%

concession of

dividend tax

on

such

capitalization

2072-73 NRs.

5% on

turnover

2% on

turnover

if accumulated profit is capitalized for expansion of industry

B.5

Rate for non-resident person

S.N. Particulars

1.

Non-Residents Providing Shipping, Air

Transport or Telecommunication Services

2

Non-Residents Providing Shipping, Air

Transport or Telecommunication Services

within the Nepal

3

Repatriation of income by Foreign Permanent Establishment

4

Natural person with transaction between 20 to 50 lacs

annually and not registered in VAT and other provisions

mentioned in Section 4(Ka)

BRSNeupane&Co.

CharteredAccountants

2069-70 NRs.

5% on

turnover

2% on

turnover

2070-71 NRs.

5% on turnover

2071-72 NRs.

5% on turnover

2% on turnover

2% on turnover

5%

25% of profit

5%

25% of profit

5%

25% of profit

11

5%

Amendments by Finance Ordinance 2072/73

-For person involved in transaction of gas, cigarette

0.5% on

turnover

along with goods traded with additional 3% commission

or price

-For person involved in business except for business

mentioned above

- For person involved in service business

1.5% of

turnover

2% of

turnover

(minimum of

NRs. 5,000 in

each case)

B.6

TDS rates

Section

Type of Payment

87(1)

Income from employment

88(1)

88(3)

88(1)

2070-71 NRs.

2071-72 NRs.

2072-73 NRs.

Final or

Advance

Final (if

employment

tax only)

Advance

As per section

1 and 2 of

Schedule 2

Payment of natural resource, royalty, service fee,

15%

commission, sales bonus, retirement payments and other

return except other rate stated in this table

5%

Payment of interest having source in Nepal to natural

person not involved in any business activity by resident

Bank, financial institutions or debenture issuing entity, or

listed company on deposit, bond, debenture or government

bond

Other Interest payment:

As per section

1 and 2 of

Schedule 2

15%

As per section

1 and 2 of

Schedule 2

15%

5%

5%

Final

-Tax exempt entity as per Section 2(Dha)

15%

15%

15%

Final

-Others

15%

15%

15%

Advance

BRSNeupane&Co.

CharteredAccountants

12

Amendments by Finance Ordinance 2072/73

88(1)

88(1)

(1)

88(2)

Ga

88(1)

(2)

88(1)

(3)

88 (1)

(4)

88(1)

(5)

88(1)

(5)

88 Ka

(5)

88(1)

(6)

88(2)

(ka)

88(2)

Kha

88 (4)

Ka

88 (4)

Ka 1

88(4)

Kha

Meeting allowances, periodic/part time teaching to natural

person

Retirement payment made by government of Nepal or

retirement payment from approved retirement fund after

reduction higher of NRs. 500,000.00 or 50% of total

payment

Gain on payment from unapproved retirement fund

15%

15%

15%

Final

5%

5%

5%

Final (except

for regular

pension)

5%

5%

5%

Final

Commission paid by resident employer company to nonresident person

Lease rental payment

5%

5%

5%

Final

10%

10%

10%

Final

Service fee paid to VAT registered service provider person

and Service provider entity of Vat exempt goods

1.5%

1.5%

1.5%

Rent for the lease of land or a building and associated

fittings and fixtures, having source in Nepal, and that is

received by an individual other than in conducting

business

Rent having source in Nepal

10%

10%

10%

Final (Vat

exempt good

added this

year)

Final

10%

10%

10%

Advance

Payment of rent on vehicle hire for person involved in

business of providing vehicle on hire

Payment of return to natural person by

mutual fund

Dividend

1.5%

5%

5%

5%

Final

5%

5%

5%

Final

Gain on investment (life) insurance

5%

5%

5%

Final

Payment made by natural person other than conducting

business activity or other payments other than rent

Payment for setting exam paper, for checking answer

paper and for a writing up in newspaper

Interest to resident bank or financial institutions

Nil

Nil

Nil

N/A

Nil

Nil

Nil

N/A

Nil

Nil

Nil

N/A

BRSNeupane&Co.

CharteredAccountants

13

Amendments by Finance Ordinance 2072/73

88(4)

Ga

88(4)

Gha

88(4)

Chha

Tax exempt payments

Nil

Nil

Nil

N/A

Inter-regional/interchange fee payable to the bank issuing

credit card

Payment to Mutual fund for:

Nil

Nil

Nil

N/A

Nil

Nil

Nil

Nil

Nil

Nil

25%

25%

25%

Advance

1.5%

1.5%

1.5%

Advance

5%

5%

5%

Final

1.5%

1.5%

1.5%

Final

Aspernotice

ofIRD

10%

Aspernotice

ofIRD

10%

Aspernotice

ofIRD

10%

Final

5%

Nil

10%

5%

Nil

10%

5%

Nil

10%

10%

Nil

15%

10%

Nil

15%

10%

Nil

15%

-Interest

88 Ka

89(1)

89 (3)

Ka

89 (3)

Kha

89 (3)

Ga

95 Ka

(1)

95 Ka

(2)Ka

95 Ka

(2)Kha

95 Ka

(3)

-Dividend

Windfall gain (except for payment up to NRs 5 lacs

relating to national and international level awards for

literature, art, culture, sports, journalism, science,

technology and public administration)

Payment of a contractual amount in excess of Rs.

50,000.00 (the same payment under same contract within

last 10 days to be considered)

Contract payments made by resident person to nonresident persons for repair of aircraft or other contracts

Payment of insurance premium made by resident person

to non-resident insurance company

Other contract payments made by resident person to nonresident persons

Gain on transaction in commodity future market

Gain on disposal of interest of a listed entity:

- Resident Natural Person

- Mutual fund

- Others.

Gain on disposal of interest of a unlisted entity:

- Resident Natural Person

- Mutual fund

- Others.

Capital Gain on Disposal of Non-business chargeable

assets (land / and building) of a natural person:

- Owned for less than 5 years

- Owned for more than 5 years but less than 10 years

Advance

Advance

Advance

Advance

5%

2.5%

5%

2.5%

BRSNeupane&Co.

CharteredAccountants

Advance

14

5%

2.5%

Amendments by Finance Ordinance 2072/73

C.

Presumptive Tax

S.N. Particulars

1.

Small and low income entrepreneurs having net income

less than NRs 2 Lac income and transactions less than

NRs 20 Lac transactions:

- Metropolis /Sub metropolis

- Municipality

- Others

2

Public Vehicle Owner

-Mini-bus, Mini-truck, Truck and Bus

-Car, Jeep, Van, Micro Bus

-Three Wheeler, Auto Rickshaw, Tempo

-Tractor and Power Tiller

2069-70 NRs.

2070-71 NRs.

2072-73 NRs.

3500

2000

1250

3500

2000

1250

5000

2500

1500

5000

2500

1500

1500

1200

850

750

1500

1200

850

750

1500

1200

850

750

3000

2400

1550

1000

BRSNeupane&Co.

CharteredAccountants

2071-72 NRs.

15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Exact Trigonometry Table For All AnglesDocument4 pagesExact Trigonometry Table For All AnglesBhava Nath DahalNo ratings yet

- Breaking Classical Rules - One Third Angle in Trigonometry (New Method For Cubic Equation)Document19 pagesBreaking Classical Rules - One Third Angle in Trigonometry (New Method For Cubic Equation)Bhava Nath Dahal100% (1)

- Exact Trigonometric Ratios For All Angles (Precise-Rewritten Method)Document4 pagesExact Trigonometric Ratios For All Angles (Precise-Rewritten Method)Bhava Nath DahalNo ratings yet

- Annex 9 - D 19 RepatriationDocument1 pageAnnex 9 - D 19 RepatriationBhava Nath DahalNo ratings yet

- Exact Trigonometry Table For All AnglesDocument4 pagesExact Trigonometry Table For All AnglesBhava Nath DahalNo ratings yet

- VAT Exempt ItemsDocument17 pagesVAT Exempt ItemsBhava Nath Dahal0% (1)

- Exact Trigonometry Table For All AnglesDocument4 pagesExact Trigonometry Table For All AnglesBhava Nath DahalNo ratings yet

- Quarterly Economic Bulletin 2011 01 (Mid January) NewDocument104 pagesQuarterly Economic Bulletin 2011 01 (Mid January) NewBhava Nath DahalNo ratings yet

- Long-Term Contract To BE PRINTDocument236 pagesLong-Term Contract To BE PRINTBhava Nath DahalNo ratings yet

- Jyoti Sham (Hindu Astrology)Document30 pagesJyoti Sham (Hindu Astrology)Bhava Nath DahalNo ratings yet

- IRD Bulletine 3Document12 pagesIRD Bulletine 3Bhava Nath DahalNo ratings yet

- Annual Report 2067.68Document65 pagesAnnual Report 2067.68Bhava Nath DahalNo ratings yet

- s/ ;'wf/ / ;'zf;g aLr cGt;{DaGwDocument12 pagess/ ;'wf/ / ;'zf;g aLr cGt;{DaGwBhava Nath DahalNo ratings yet

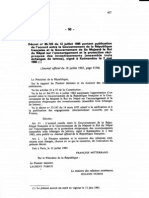

- Nepal France (French)Document9 pagesNepal France (French)Bhava Nath DahalNo ratings yet

- Directives - Unified Directives 2068 PDFDocument277 pagesDirectives - Unified Directives 2068 PDFBhava Nath DahalNo ratings yet

- Nepal - Germani (Eng and GR)Document7 pagesNepal - Germani (Eng and GR)Bhava Nath DahalNo ratings yet

- Opening Time of BidDocument2 pagesOpening Time of BidBhava Nath DahalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CH 14 Answer KeyDocument12 pagesCH 14 Answer KeyRodolfo HandalNo ratings yet

- Funding A Pension Plan If Each Individual Retires at Age 65Document1 pageFunding A Pension Plan If Each Individual Retires at Age 65M Bilal SaleemNo ratings yet

- CEB 311 - Stochastic Vs Deterministic Models - Pros N ConsDocument19 pagesCEB 311 - Stochastic Vs Deterministic Models - Pros N Consakawunggabriel23No ratings yet

- NOMINATE BENEFICIARIES RAILWAY PENSIONDocument2 pagesNOMINATE BENEFICIARIES RAILWAY PENSIONMurliNo ratings yet

- Labour Law QuestionsDocument45 pagesLabour Law QuestionsPalash Sahu100% (1)

- Industrial Relations and Labour Legislation PDF Converted 221685018974060Document6 pagesIndustrial Relations and Labour Legislation PDF Converted 221685018974060Aadil ReshiNo ratings yet

- IRR RA 11916 (Increasing Pension)Document8 pagesIRR RA 11916 (Increasing Pension)Jane Marie Javier100% (1)

- Table B.1 Expenditure Program by Object 2010-2012Document4 pagesTable B.1 Expenditure Program by Object 2010-2012Burtonium PartosaNo ratings yet

- Mabugay Otamias vs. Republic.Document8 pagesMabugay Otamias vs. Republic.Graziella AndayaNo ratings yet

- Charles Schwab - Asset InventoryDocument8 pagesCharles Schwab - Asset InventoryBruno IankowskiNo ratings yet

- Helix Bond - Privilidge - Wealth PDFDocument12 pagesHelix Bond - Privilidge - Wealth PDFhyenadogNo ratings yet

- Sample MCQ For Unit 2Document8 pagesSample MCQ For Unit 2varunendra pandey100% (1)

- Literature Review Aging and HomelessnessDocument20 pagesLiterature Review Aging and Homelessnesshazel jacaNo ratings yet

- Regular Income TaxDocument11 pagesRegular Income Taxwhat ever100% (4)

- Taxguru - In-Accounting Requirement For Employee Benefit Plans - AS 15 Amp IndAS 19Document4 pagesTaxguru - In-Accounting Requirement For Employee Benefit Plans - AS 15 Amp IndAS 19Neel VoraNo ratings yet

- Bangladesh Television (BTV) : HR Policies and Benefit AnalysisDocument19 pagesBangladesh Television (BTV) : HR Policies and Benefit AnalysisRafeeah HasanNo ratings yet

- Form 16Document6 pagesForm 16CSKNo ratings yet

- 284 Tanisha NairDocument24 pages284 Tanisha NairGourav YadavNo ratings yet

- Risk Management and InsuranceDocument25 pagesRisk Management and InsuranceGayathry Rajendran RCBS0% (1)

- Population Dynamics (CSEC Geography)Document25 pagesPopulation Dynamics (CSEC Geography)Kym Singh100% (2)

- Compensation Management Practices in Banking Sector of Bangladesh A Case Study On Dhaka Bank Ltd.Document44 pagesCompensation Management Practices in Banking Sector of Bangladesh A Case Study On Dhaka Bank Ltd.Zahirul Islam94% (31)

- Tax Planning With Example, Compensation MGMTDocument40 pagesTax Planning With Example, Compensation MGMTrashmi_shantikumarNo ratings yet

- GPP - Consolidate retirement savings with a single pension accountDocument3 pagesGPP - Consolidate retirement savings with a single pension accountvikas pallaNo ratings yet

- Looking Back To Look Ahead: The Life Trajectory Among Indigenous People Retired Teachers in The PhilippinesDocument10 pagesLooking Back To Look Ahead: The Life Trajectory Among Indigenous People Retired Teachers in The PhilippinesLee Hock SengNo ratings yet

- PRB Reading MaterialDocument77 pagesPRB Reading MaterialGK TiwariNo ratings yet

- Customer Satisfaction On ICICI PrudentialDocument63 pagesCustomer Satisfaction On ICICI Prudentialmss_singh_sikarwar100% (8)

- Role of Human Resources in The Payment of SalariesDocument6 pagesRole of Human Resources in The Payment of SalariesZdh Patrick Nunez100% (3)

- Tamil Nadu Govt Employee Pension Interest RateDocument2 pagesTamil Nadu Govt Employee Pension Interest RateMani BaluNo ratings yet

- (Sffis: The 8tel. 735 9807 AccountancyDocument18 pages(Sffis: The 8tel. 735 9807 AccountancyCharry RamosNo ratings yet

- Macquarie Pension Manager II Application Form - Collins, Patrick - 19122019 PDFDocument42 pagesMacquarie Pension Manager II Application Form - Collins, Patrick - 19122019 PDFSandy Oriño - MoncanoNo ratings yet