Professional Documents

Culture Documents

Financial Results For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results For June 30, 2015 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

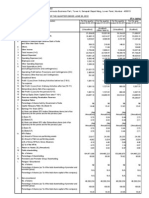

RITESH INTERNATIONAL LIMITED

REGD.OFF: 356, INDUSTRIAL AREA A, LUDHIANA-141003

CIN: L15142PB1981PLC004736 Website: www.riteshinternationalltd.in

E-mail: riteshinternational@gmail. com

Contact No.-0161-5059126

STATEMENT OF UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30TH JUNE, 2015

(Rs. In Lacs)

S.No

PARTICULARS

30.06.2015

(Unaudited)

Year Ended

31.03.2015

(Audited)

30.06.2014

(Unaudited)

Income from operations

(a) Net Sales/Income from Operations (Net of Excise Duty)

(b) Other Operating Income

696.26

29.79

517.53

43.61

727.04

17.69

2,720.61

160.87

Total Income from operations (Net)

726.05

561.14

744.73

2,881.48

618.69

2,298.74

-

Expenses

a) Cost of material consumed

b) Purchases of stock-in-trade

c)changes in inventories of finished goods, work in progress and

stock-in-trade

d) Employee benefits expense

e) Depreciation and amortisation expense

f) Other Expenses

Total Expenses

Quarter Ended

31.03.2015

(Audited)

Profit/ (loss) from operations before Other Income, finance costs and

Exceptional Items (1-2)

494.26

501.90

-

30.61

(77.97)

35.77

7.67

144.11

44.87

(21.60)

138.31

35.04

18.63

184.66

(1.61)

151.22

34.54

628.72

(33.04)

712.42

585.51

855.41

3,080.18

13.63

(24.37)

(110.68)

(198.70)

Other Income

1.57

22.47

Profit/ (loss) from ordinary activities before finance costs and

Exceptional Items (3+4)

15.20

(1.90)

(108.66)

(158.21)

Finance Costs

13.01

11.64

14.92

53.33

Profit/(loss) from ordinary activities after finace costs but before

Exceptional Items (5-6)

2.19

(13.54)

(123.58)

(211.54)

Exceptional Items

(0.05)

0.97

Profit/(Loss) from Ordinary Activities before tax (7+8)

2.14

(12.57)

10 Tax Expense

11 Net Profit/(Loss) from Ordinary Activities after tax (9-10)

12 Extraordinary items (net of tax expenses)

13 Net Profit/(Loss) for the period (11+-12)

14 Paid up Equity Share Capital (Face Value of Rs. 10/- each)

2.14

2.14

855.28

2.02

1.15

(122.43)

16ii Earning Per Share (after extraordinary items)

(of Rs. 10/- each)(not annualised):

a) Basic

b) Diluted

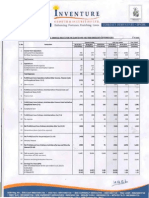

PART-II

A PARTICULARS OF SHAREHOLDING

1 Public Shareholding

- Number of Shares (in lacs)

- Percentage of share holding

2

Promoters and promoter group Shareholding

a) Pledged/Encumbered

Number of shares (in lacs)

- Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

- Percentage of shares (as a% of the total share capital of the

company)

b) Non-encumbered

Number of shares (in lacs)

- Percentage of shares (as a% of the total shareholding of

promoter and promoter group)

- Percentage of shares (as a % of the total share capital of the

company)

Particulars

(1.32)

(212.86)

(12.57)

(122.43)

(212.86)

(348.87)

(348.87)

(361.44)

(122.43)

(561.73)

855.28

855.28

855.28

212.71

15 Reserves (excluding revaluation reserves)

16i Earning Per Share (before extraordinary items)

(of Rs. 10/- each)(not annualised):

a) Basic

b) Diluted

40.49

0.03

0.03

(0.15)

(0.15)

(1.43)

(1.43)

(2.49)

(2.49)

0.03

0.03

(4.23)

(4.23)

(1.43)

(1.43)

(6.57)

(6.57)

43.41

50.75

43.56

50.93

44.14

51.61

43.56

50.93

42.12

41.96

41.39

41.96

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

42.12

100.00

41.96

100.00

41.39

100.00

41.96

100.00

49.25

49.07

48.39

49.07

Quarter ended 30th June, 2015

Investor Complaints

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

1

2

3

NIL

2

2

NIL

Notes

The Company deals in non-edible oils segment which is the primary reportable segment.

Other Operating Income represent the sale of textiles items, as approved by the shareholders in the AGM,

Above Unaudited results have been reviewed by the Audit Committee and were considered and approved by the Board

of Directors at their meeting held on 14.08.2015

FOR: RITESH INTERNATIONAL LIMITED

Place : Ludhiana

Date : 14.08.2015

Rajiv Arora

Chairman-cum- Managing Director

DIN: 00079838

1108/1 Tagore Nagar, Civil Lines, Ludhiana

You might also like

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Registered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Document1 pageRegistered Office: Plot No. 11, Block D-1, MIDC, Chinchwad, Pune 411 019 Unaudited Financial Results (Provisional) For The Quarter Ended 30th June, 2007Jatin GuptaNo ratings yet

- Avt Naturals (Qtly 2011 06 30) PDFDocument1 pageAvt Naturals (Qtly 2011 06 30) PDFKarl_23No ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- India BullsDocument2 pagesIndia Bullsrajesh_d84No ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- Corporate Centre, Mumbai - 400 021: State Bank of IndiaDocument1 pageCorporate Centre, Mumbai - 400 021: State Bank of IndiajoshijaysoftNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Financial Results For March 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For March 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document11 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Part - I - Standalone Balance Sheet As at 31 March, 2016: ST STDocument2 pagesPart - I - Standalone Balance Sheet As at 31 March, 2016: ST STDeepak AryaNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Document1 pageUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- June 2015Document2 pagesJune 2015Aarush VermaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Security AnalysisDocument60 pagesSecurity AnalysisShezad Lalani [LUC]No ratings yet

- Lanka Walltiles PLC 2019 2020Document176 pagesLanka Walltiles PLC 2019 2020lahiruNo ratings yet

- EDP Module 7Document10 pagesEDP Module 7Mehul_Singh_7900No ratings yet

- Shareholder Demand LetterDocument3 pagesShareholder Demand LetterParalegal JGGCNo ratings yet

- Muhammad Luthfi Mahendra - 2001036085 - Tugas 5Document5 pagesMuhammad Luthfi Mahendra - 2001036085 - Tugas 5luthfi mahendraNo ratings yet

- Final TestDocument85 pagesFinal TestRobin MehtaNo ratings yet

- 62697bos050121interp2c RemovedDocument38 pages62697bos050121interp2c RemovedKartikNo ratings yet

- Beat The Market - Ed ThorpDocument229 pagesBeat The Market - Ed Thorprychang901100% (9)

- 01 Merger and Acquisition QADocument5 pages01 Merger and Acquisition QApijiyo78No ratings yet

- Problem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Document2 pagesProblem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Katrina Dela Cruz100% (1)

- Acc AssignmentDocument5 pagesAcc AssignmentBlen tesfayeNo ratings yet

- Ingles Tecnico I - OracionesDocument3 pagesIngles Tecnico I - OracionesJuan CuadrosNo ratings yet

- Audit of EquityDocument76 pagesAudit of Equitydar •No ratings yet

- Lincoln Phil Life Insurance Co V. CADocument3 pagesLincoln Phil Life Insurance Co V. CASha SantosNo ratings yet

- Answer KeyDocument5 pagesAnswer KeyYhancie Mae TorresNo ratings yet

- Advance Accounting Chapter 8Document52 pagesAdvance Accounting Chapter 8febrythiodorNo ratings yet

- Financial Management NotesDocument202 pagesFinancial Management NotesSandeep KulshresthaNo ratings yet

- Check BOLDED Answers PleaseDocument5 pagesCheck BOLDED Answers Pleasemohitgaba19No ratings yet

- Shareholders Equity With AnswersDocument4 pagesShareholders Equity With AnswersJillian Faye Doria100% (3)

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- Sec-Ogc Opinion No. 14-10: Sebastian Liganor Galinato & AlamisDocument4 pagesSec-Ogc Opinion No. 14-10: Sebastian Liganor Galinato & AlamisFrances EsteronNo ratings yet

- Accounting For DividendsDocument6 pagesAccounting For DividendsAgatha Apolinario100% (1)

- Parcor Chap 6 DoneDocument10 pagesParcor Chap 6 DoneJohn Carlo CastilloNo ratings yet

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- Sir Answer P 11-1A S.D 11-4ADocument5 pagesSir Answer P 11-1A S.D 11-4AInez ChristabelNo ratings yet

- Fap CombinedDocument77 pagesFap CombinedKevin MehtaNo ratings yet

- Finance Satyam AnalysisDocument12 pagesFinance Satyam AnalysisNeha AgarwalNo ratings yet

- Accounting 3 & 4 - 07 Fundamentals of Acctg 2Document10 pagesAccounting 3 & 4 - 07 Fundamentals of Acctg 2Kristine Salvador CayetanoNo ratings yet

- Everon Vs Birla ShlokaDocument6 pagesEveron Vs Birla Shlokasrscribd10No ratings yet

- rev-mat-2-IA Print PDFDocument31 pagesrev-mat-2-IA Print PDFAyaka FujiharaNo ratings yet