Professional Documents

Culture Documents

69 70

Uploaded by

Janus Mari0 ratings0% found this document useful (0 votes)

20 views1 pagesdsddddd

Original Title

69-70

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsdsddddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 page69 70

Uploaded by

Janus Marisdsddddd

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

# 70

Dioscoro C. Ty v First National Surety & Assurance Co., Inc.

G.R. No. L-16138 April 29, 1961

Facts:

Ty, a mechanic foreman in Caloocan, bought 18 availed an insurance policies at 8 pesos each. A fire broke out, and Ty

fought his way out of the factory. His hand was broken by a heavy object in the process. His injuries

caused temporary total disability on his left hand. He wanted to claim an indemnity valuing 650 pesos for the loss

of hand by means of amputation even if he only suffered from broken fingers. The insurance companies sued him in court

and they won. Ty then appealed to the Supreme Court.

Issue: Can he collect the sums even if there was no amputation?

Held: No. The Plaintiff cannot go beyond the clear and express conditions of the insurance policies, all of which define

partial disability as loss of either hand by amputation through the bones of the wrist.

Note that the disability of plaintiff's hand was merely temporary, having been caused by fracture of the index, the middle

and the fourth fingers of the left hand agreement contained in the insurance policies is the law between the parties.

The insurance policies clearly define loss of hand as amputation of the bones on the wrist. The injury was only a

temporary total disability of plaintiff's left hand." This wasnt covered by the policies.

#69

Ulpiano Santa Ana vs. Commercial Union Assurance Company, et al.,

GR. NO. L- 32889 November 20, 1930

Facts:

In 1923, Sta. Ana built his house in Pasig and insured it against fire for (1) P3, 000 to Phoenix Assurance Company and

(2) P6, 000 to Guardian Assurance limited, for a period of one year.

In 1925, Santa Ana mortgaged this house to Garcia for P5, 000, for a "period of two years, the contract being drawn up as

a retro sale for the sum of P5, 000. The 2 policies were endorsed to Garcia. In December 1925, Santa Ana reinsured said

house with the defendant companies, the Globe and Rutgers Fire Insurance Company of New York, and the Commercial

Union Assurance Company Limited London, through their common agent duly authorized to represent them in the

Philippine Islands, the Pacific Commercial Company which was to be effective for one year.On September 20, 1926,

Santa Ana lookout another insurance policy on the house in question for P6,00 in the Filipinas Campania de Segurros,

which issued the one year policy upon receiving from Sta. Ana premium thereon. Twelve hours before the expiration of the

policies issued by the Phoenix Assurance Company and the Guardian Assurance Company, Limited for P3, 000 and P6,

000 respectively, the entire house was burned. Santa Ana gave notice in due time of the loss to each and every one of the

companies in which he had insured the house and demanded payment of the respective policies. The insurance

companies refused payment on the ground that claim of 21,000 filed by him was fraudulent, being in excess of real value

of the insured property; that none said companies had been informed of the existence of the other policies in the other

companies, and that the fire was intentional.

Issue: Can the insured Santa Ana claim against the insurance companies?

Held: No. without arguing the issue of whether or not other insurance upon the same property must be given in writing or

whether a verbal notice is sufficient to render an issuance valid which requires such notice, whether oral or written, the SC

held that in the absolute absence of such notice when it one of the conditions specified in the fire insurance policy, the

policy is null and void, plaintiff cannot recover from the defendants insurance companies. The Supreme Court upheld the

finding of the trial court that the policies provide that no other insurance should be admitted upon the property thereby

assured without the consent of said companies.

You might also like

- Notarial PetitiondfdfdfdDocument3 pagesNotarial PetitiondfdfdfdJanus MariNo ratings yet

- Notice: Republic of The Philippines Supreme CourtDocument6 pagesNotice: Republic of The Philippines Supreme CourtJanus MariNo ratings yet

- SPECIAL POWER OF ATTORNEY SampleDocument2 pagesSPECIAL POWER OF ATTORNEY SampleJanus MariNo ratings yet

- Oath of OfficeDocument2 pagesOath of OfficeJanus MariNo ratings yet

- Legal Ethics 2005 2014 Bar QADocument62 pagesLegal Ethics 2005 2014 Bar QAJanus Mari100% (1)

- Masterlist CPA Firms APRIL 30 2018.outputDocument1,602 pagesMasterlist CPA Firms APRIL 30 2018.outputJanus MariNo ratings yet

- Case Digest On Atienza V. Brillantes: Manzano Vs SanchezDocument3 pagesCase Digest On Atienza V. Brillantes: Manzano Vs SanchezJanus MariNo ratings yet

- USC v. CADocument1 pageUSC v. CAJanus MariNo ratings yet

- Legal Ethics Bar Qs 2014Document15 pagesLegal Ethics Bar Qs 2014Janus MariNo ratings yet

- 2012 Legal Ethics Bar Question and AsnwerDocument18 pages2012 Legal Ethics Bar Question and AsnwerJanus Mari100% (2)

- Cover PageDocument1 pageCover PageJanus MariNo ratings yet

- Legal Ethics 2005 2014 Bar QA DraftDocument86 pagesLegal Ethics 2005 2014 Bar QA DraftJanus Mari67% (3)

- Siguion Reyna, Montecillo & Ongsiako For Petitioner. Morales & Joyas Law Office For Private RespondentDocument3 pagesSiguion Reyna, Montecillo & Ongsiako For Petitioner. Morales & Joyas Law Office For Private RespondentJanus MariNo ratings yet

- Corporation LawDocument36 pagesCorporation LawJanus Mari100% (1)

- Corporations and Other Juridical EntitiesDocument6 pagesCorporations and Other Juridical EntitiesJanus MariNo ratings yet

- MinutesDocument1 pageMinutesJanus MariNo ratings yet

- Bank CertificateDocument2 pagesBank CertificateJanus MariNo ratings yet

- Cadalin vs. POEA G.R. No. L-104776, Dec. 5, 1994Document1 pageCadalin vs. POEA G.R. No. L-104776, Dec. 5, 1994Janus MariNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lexical Test 1Document7 pagesLexical Test 1CEC CVP's English ClubNo ratings yet

- 1a Makaleb Crowley My NotesDocument1 page1a Makaleb Crowley My Notesapi-426853793No ratings yet

- Trans PenaDocument3 pagesTrans Penavivi putriNo ratings yet

- Claude BalbastreDocument4 pagesClaude BalbastreDiana GhiusNo ratings yet

- FIS V Plus ETADocument14 pagesFIS V Plus ETAHOANG KHANH SONNo ratings yet

- BK 291Document108 pagesBK 291Santi Jonas LopezNo ratings yet

- Case DigestDocument14 pagesCase DigestMerxeilles Santos100% (5)

- EXTFILE134991159Document24 pagesEXTFILE134991159Narciso JuniorNo ratings yet

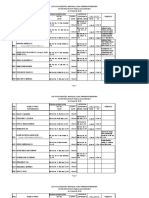

- Bid Opening and EvaluationDocument64 pagesBid Opening and EvaluationDavid Sabai100% (3)

- Pak301 Long QsDocument6 pagesPak301 Long QsAijaz khanNo ratings yet

- Evelyn de Luna vs. Sofronio Abrigo, G.R. No. L-57455, January 18, 1990Document5 pagesEvelyn de Luna vs. Sofronio Abrigo, G.R. No. L-57455, January 18, 1990Lou Ann AncaoNo ratings yet

- Persons and Family Relationship Assign CasesDocument6 pagesPersons and Family Relationship Assign Casessheridan DienteNo ratings yet

- Choose A Plan - ScribdDocument1 pageChoose A Plan - ScribdUltraJohn95No ratings yet

- BanksDocument16 pagesBanksjofer63No ratings yet

- Intellectual PropertyDocument6 pagesIntellectual PropertyFe EsperanzaNo ratings yet

- Charles Steward Mott Foundation LetterDocument2 pagesCharles Steward Mott Foundation LetterDave BondyNo ratings yet

- FD Valve: Product No. 054110110Document1 pageFD Valve: Product No. 054110110Marcelo PereiraNo ratings yet

- Tushnet & Bugaric, What Is ConstitutionalismDocument27 pagesTushnet & Bugaric, What Is Constitutionalismdummy accountNo ratings yet

- Sigmagold Inti Perkasa TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesSigmagold Inti Perkasa TBK.: Company Report: January 2019 As of 31 January 2019ElusNo ratings yet

- SLB Bydt Jar W4 - 00523 H - 6698873 - 01Document59 pagesSLB Bydt Jar W4 - 00523 H - 6698873 - 01Hector BarriosNo ratings yet

- Principles and Practices of Working As A CCTV Operator in The Private Security Industry Specimen Examination Paper 1Document4 pagesPrinciples and Practices of Working As A CCTV Operator in The Private Security Industry Specimen Examination Paper 1Sekgathe MatauNo ratings yet

- Scratch Your BrainDocument22 pagesScratch Your BrainTrancemissionNo ratings yet

- 2021 Fourth Quarter Non-Life Industry ReportDocument62 pages2021 Fourth Quarter Non-Life Industry ReportPropensity MuyamboNo ratings yet

- Revised AIS Rule Vol I Rule 23Document7 pagesRevised AIS Rule Vol I Rule 23Shyam MishraNo ratings yet

- Class Xi Third Periodical Exam Subject - Business Studies 2021-22Document8 pagesClass Xi Third Periodical Exam Subject - Business Studies 2021-22Satish agggarwalNo ratings yet

- On August 31 2015 The Rijo Equipment Repair Corp S Post ClosingDocument1 pageOn August 31 2015 The Rijo Equipment Repair Corp S Post ClosingMiroslav GegoskiNo ratings yet

- ASME B31.8 - 2003 (A)Document192 pagesASME B31.8 - 2003 (A)luigiNo ratings yet

- Flow Chart For Installation of Rooftop Solar PV System Under Net Metering ArrangementDocument1 pageFlow Chart For Installation of Rooftop Solar PV System Under Net Metering Arrangementjai parkashNo ratings yet