Professional Documents

Culture Documents

Results Update For All Companies - Jun 2015 PDF

Uploaded by

Randora LkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Update For All Companies - Jun 2015 PDF

Uploaded by

Randora LkCopyright:

Available Formats

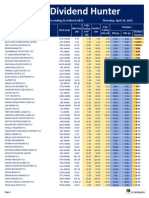

Results Update

June 2015

Monday, August 24, 2015

Quarter Earnings LKR 'mn

Company

Mkt Price

Stock Code

LKR

Qtr

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

4 Qtr Trailing

ROE

PER (x) PBV (x)

Banking, Finance & Insurance

ABANS FINANCE PLC

ALLIANCE FINANCE COMPANY PLC

AMANA BANK PLC

AMANA TAKAFUL PLC

AMW CAPITAL LEASING PLC

ARPICO FINANCE COMPANY PLC

ASIA ASSET FINANCE LIMITED

ASIA CAPITAL PLC

ASIAN ALLIANCE INSURANCE PLC

ASSOCIATED MOTOR FINANCE COMPANY PLC

AIA INSURANCE LANKA PLC

BIMPUTH LANKA INVESTMENTS PLC

CAPITAL ALLIANCE FINANCE PLC

CENTRAL FINANCE COMPANY PLC

CEYLINCO INSURANCE PLC

CHILAW FINANCE LIMITED

CITIZENS DEVELOPMENT BUSINESS FINANCE PLC

COMMERCIAL BANK OF CEYLON PLC

COMMERCIAL CREDIT PLC

COMMERCIAL LEASING & FINANCE

DFCC BANK

ENTRUST SECURITIES LIMITED

FIRST CAPITAL HOLDINGS PLC

GEORGE STEWART FINANCE

HATTON NATIONAL BANK PLC

HNB ASSURANCE PLC

JANASHAKTHI INSURANCE COMPANY PLC

LANKA ORIX FINANCE PLC

LANKA ORIX LEASING COMPANY PLC

LANKA VENTURES PLC

LB FINANCE PLC

MERCANTILE INVESTMENTS PLC

MERCHANT BANK OF SRI LANKA PLC

MULTI FINANCE PLC

NANDA INVESTMENTS AND FINANCE LIMITED

NATION LANKA FINANCE PLC

NATIONAL DEVELOPMENT BANK PLC

NATIONS TRUST BANK PLC

PAN ASIA BANKING CORPORATION PLC

PEOPLE'S LEASING COMPANY PLC

SANASA DEVELOPMENT BANK PLC

Page 1

AFSL.N0000

ALLI.N0000

ABL.N0000

ATL.N0000

AMCL.N0000

ARPI.N0000

AAF.N0000

ACAP.N0000

AAIC.N0000

AMF.N0000

CTCE.N0000

BLI.N0000

CALF.N0000

CFIN.N0000

CINS.N0000

CFL.N0000

CDB.N0000

COMB.N0000

COCR.N0000

CLC.N0000

DFCC.N0000

ESL.N0000

CFVF.N0000

GSF.N0000

HNB.N0000

HASU.N0000

JINS.N0000

LOFC.N0000

LOLC.N0000

LVEN.N0000

LFIN.N0000

MERC.N0000

MBSL.N0000

MFL.N0000

NIFL.N0000

CSF.N0000

NDB.N0000

NTB.N0000

PABC.N0000

PLC.N0000

SDB.N0000

42.80

916.00

5.00

1.30

22.40

210.00

1.80

8.90

19.70

467.70

279.80

96.90

14.90

275.00

1,550.10

23.80

110.00

175.00

66.10

4.20

194.10

39.90

41.00

24.00

227.40

82.00

20.10

4.40

114.00

51.60

129.70

2,200.00

18.50

24.30

9.30

3.00

255.30

104.10

28.00

26.00

165.10

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

2Q-Dec

1Q-Mar

2Q-Dec

26

120

48

-29

69

81

35

-88

52

111

74

135

4

1,026

178

8

217

2,646

622

406

622

93

170

18

2,386

64

94

364

1,851

68

776

149

95

4

54

36

575

765

274

1,110

208

4

33

-86

16

50

-4

13

-127

89

34

68

11

-2

844

89

7

158

2,216

491

275

1,123

82

209

3

2,550

54

191

231

926

51

449

89

-41

9

2

-55

843

608

90

783

153

494%

259%

156%

-280%

38%

2336%

166%

31%

-41%

224%

10%

1087%

345%

22%

100%

24%

38%

19%

27%

48%

-45%

14%

-19%

528%

-6%

18%

-51%

58%

100%

35%

73%

67%

329%

-58%

2758%

165%

-32%

26%

204%

42%

36%

12

220

23

-51

66

40

25

-89

200

65

-2

125

2

875

378

5

242

2,536

711

371

825

-91

-91

15

1,915

16

106

295

1,633

0

629

198

-151

42

166

-132

869

493

177

1,125

205

122%

-46%

106%

43%

5%

101%

42%

2%

-74%

71%

4022%

8%

97%

17%

-53%

68%

-10%

4%

-13%

9%

-25%

202%

286%

26%

25%

312%

-11%

23%

13%

18137%

23%

-25%

163%

-91%

-68%

127%

-34%

55%

55%

-1%

1%

26

120

71

-80

135

81

35

-88

253

111

72

135

4

1,026

556

8

217

5,182

622

406

622

93

170

18

4,301

80

201

364

1,851

68

776

149

-56

4

54

36

1,444

1,258

451

1,110

414

4

33

-135

49

98

-4

13

-127

339

34

146

11

-2

844

375

7

158

4,517

491

275

1,123

82

209

3

3,647

108

347

231

926

51

449

89

-94

9

2

-55

2,034

1,157

176

783

210

494%

259%

152%

-262%

38%

2336%

166%

31%

-25%

224%

-51%

1087%

345%

22%

48%

24%

38%

15%

27%

48%

-45%

14%

-19%

528%

18%

-26%

-42%

58%

100%

35%

73%

67%

40%

-58%

2758%

165%

-29%

9%

156%

42%

97%

2.52

14.95

184.66 1,075.50

0.10

4.06

-0.06

1.00

12.96

63.97

40.74 131.02

0.16

1.57

-2.56

2.75

1.78

6.49

53.40 195.90

9.06 161.87

6.36

18.98

0.37

8.62

36.38 241.08

103.33 754.72

0.63

16.10

14.16

78.57

13.59

81.00

7.46

20.67

0.27

1.68

14.57 174.64

7.04

38.59

9.06

23.98

-2.21

13.43

25.86 171.44

7.78

45.18

2.52

12.15

0.58

3.00

13.31

64.25

4.41

30.99

18.11

63.16

229.91 2,592.32

0.14

17.49

-0.07

14.97

2.17

7.75

0.57

-0.91

21.46 173.67

11.44

63.78

2.34

17.58

2.80

14.22

17.59 122.78

17% 17.0x

17% 5.0x

2% 49.9x

-6% N/A

20% 1.7x

31% 5.2x

10% 11.5x

-93% N/A

27% 11.1x

27% 8.8x

6% 30.9x

34% 15.2x

4% 39.9x

15% 7.6x

14% 15.0x

4% 37.5x

18% 7.8x

17% 12.9x

36% 8.9x

16% 15.5x

8% 13.3x

18% 5.7x

38% 4.5x

-16% N/A

15% 8.8x

17% 10.5x

21% 8.0x

19% 7.6x

21% 8.6x

14% 11.7x

29% 7.2x

9% 9.6x

1% 131.1x

0% N/A

28% 4.3x

N/A 5.2x

12% 11.9x

18% 9.1x

13% 12.0x

20% 9.3x

14% 9.4x

2.9x

0.9x

1.2x

1.3x

0.4x

1.6x

1.1x

3.2x

3.0x

2.4x

1.7x

5.1x

1.7x

1.1x

2.1x

1.5x

1.4x

2.2x

3.2x

2.5x

1.1x

1.0x

1.7x

1.8x

1.3x

1.8x

1.7x

1.5x

1.8x

1.7x

2.1x

0.8x

1.1x

1.6x

1.2x

-3.3x

1.5x

1.6x

1.6x

1.8x

1.3x

FC RESEARCH

Quarter Earnings LKR 'mn

Company

SAMPATH BANK PLC

SENKADAGALA FINANCE PLC

SEYLAN BANK PLC

SINGER FINANCE (LANKA) PLC

SINHAPUTHRA FINANCE PLC

SMB LEASING PLC

SOFTLOGIC CAPITAL LIMITED

SOFTLOGIC FINANCE PLC

SWARNAMAHAL FINANCIAL SERVICES PLC

THE FINANCE COMPANY PLC

THE HOUSING DEVELOPMENT FINANCE CORP:

TRADE FINANCE & INVESTMENTS PLC

UNION ASSURANCE PLC

UNION BANK OF COLOMBO PLC

VALLIBEL FINANCE PLC

Mkt Price

Stock Code

LKR

SAMP.N0000

SFCL.N0000

SEYB.N0000

SFIN.N0000

SFL.N0000

SEMB.N0000

SCAP.N0000

CRL.N0000

SFS.N0000

TFC.N0000

HDFC.N0000

TFIL.N0000

UAL.N0000

UBC.N0000

VFIN.N0000

273.70

60.00

106.30

26.00

19.50

1.20

7.50

57.70

1.90

14.50

73.40

27.00

178.40

24.00

69.00

Qtr

2Q-Dec

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

2Q-Dec

2Q-Dec

1Q-Mar

Banking, Finance & Insurance Sector Earnings

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

1,628

227

1,052

112

20

19

43

55

13

-373

141

58

93

36

96

1,543

100

684

74

16

15

7

5

-352

-627

83

53

91

9

66

6%

127%

54%

52%

24%

30%

565%

954%

104%

40%

70%

8%

3%

302%

45%

1,578

100

664

111

50

18

122

63

-11

-347

136

44

1,322

32

120

3%

128%

58%

1%

-59%

8%

-65%

-13%

224%

-8%

4%

32%

-93%

14%

-20%

3,206

227

1,715

112

20

37

43

55

13

-373

276

58

1,416

68

96

2,818

100

1,211

74

16

30

7

5

-352

-627

185

53

214

28

66

18,741

14,297

31%

17,999

6

307

135

2

82

-168

4

24

2

156

131

0

13

-172

5

8

184%

97%

4%

531%

527%

3%

-1%

221%

13

160

279

5

81

-218

10

23

-51%

92%

-52%

-53%

1%

23%

-55%

3%

394

142

177%

354

11% Sector Multiples

144

391

313

550

102

3,019

51

22

1,755

43

-2

70

45

12

-1

1,299

43

-145

231

299

218

2,511

33

20

1,846

33

-9

38

20

-21

-8

976

238%

369%

36%

84%

-53%

20%

54%

13%

-5%

28%

81%

86%

130%

157%

90%

33%

95

295

-134

601

136

2,490

42

78

2,057

62

-2

79

49

-91

4

1,158

14%

127%

42%

52%

24%

22%

565%

954%

104%

40%

49%

8%

560%

146%

45%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

32.80

8.75

10.68

2.58

1.97

0.05

0.73

5.24

-0.21

-9.94

7.93

3.35

28.06

0.07

9.69

210.80

41.02

74.88

13.73

16.12

0.60

5.32

37.94

-2.10

-70.15

48.86

17.34

82.19

14.89

36.75

4 Qtr Trailing

ROE

PER (x) PBV (x)

16% 8.3x

21% 6.9x

14% 10.0x

19% 10.1x

12% 9.9x

9% 22.2x

14% 10.3x

14% 11.0x

N/A N/A

N/A N/A

16% 9.3x

19% 8.1x

34% 6.4x

0% 366.7x

26% 7.1x

4% Sector Multiples

1.3x

1.5x

1.4x

1.9x

1.2x

2.0x

1.4x

1.5x

-0.9x

-0.2x

1.5x

1.6x

2.2x

1.6x

1.9x

10.6x

1.6x

60.8x

12.0x

8.3x

20.2x

7.7x

N/A

9.8x

10.8x

0.8x

1.5x

1.0x

2.3x

1.0x

0.9x

2.2x

2.1x

17.7x

1.1x

Chemicals & Pharmaceuticals

CHEMANEX PLC

CIC HOLDINGS PLC

HAYCARB PLC

INDUSTRIAL ASPHALTS (CEYLON) PLC

J.L. MORISON SONS & JONES (CEYLON) PLC

LANKEM CEYLON PLC

MULLER AND PHIPPS (CEYLON) PLC

UNION CHEMICALS LANKA PLC

CHMX.N0000

CIC.N0000

HAYC.N0000

ASPH.N0000

MORI.N0000

LCEY.N0000

MULL.N0000

UCAR.N0000

84.70

115.90

186.10

330.00

330.00

120.80

1.50

521.10

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

Chemicals & Pharmaceuticals Sector Earnings

6

307

135

2

82

-168

4

47

2

156

131

0

13

-172

5

24

184%

97%

4%

531%

527%

3%

-1%

97%

1.39

9.63

22.51

16.30

43.12

-19.58

0.15

48.37

103.85

77.38

193.80

144.42

320.46

141.81

0.68

252.91

1%

12%

12%

11%

13%

-14%

22%

19%

Beverage, Food and Tobacco

BAIRAHA FARMS PLC

CARGILLS (CEYLON) PLC

CEYLON BEVERAGE HOLDINGS PLC

CEYLON COLD STORES PLC

CEYLON TEA SERVICES PLC

CEYLON TOBACCO COMPANY PLC

RENUKA SHAW WALLACE PLC

CONVENIENCE FOODS (LANKA )PLC

DISTILLERIES COMPANY OF SRI LANKA PLC

HARISCHANDRA MILLS PLC

HVA FOODS PLC

KEELLS FOOD PRODUCTS PLC

KOTMALE HOLDINGS PLC

LANKA MILK FOODS (CWE) PLC

LUCKY LANKA MILK PROCESSING COMPANY LIMITED

NESTLE LANKA PLC

Page 2

BFL.N0000

CARG.N0000

BREW.N0000

CCS.N0000

CTEA.N0000

CTC.N0000

COCO.N0000

SOY.N0000

DIST.N0000

HARI.N0000

HVA.N0000

KFP.N0000

LAMB.N0000

LMF.N0000

LLMP.N0000

NEST.N0000

184.30

182.00

840.00

419.80

674.00

978.10

26.80

498.20

302.40

2,300.00

9.00

179.80

60.10

164.00

3.80

2,118.00

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

52%

32%

334%

-9%

-25%

21%

20%

-71%

-15%

-31%

29%

-11%

-8%

113%

-121%

12%

144

391

313

550

102

5,509

51

22

1,755

43

-2

70

45

12

-1

2,458

43

-145

231

299

218

4,537

33

20

1,846

33

-9

38

20

-21

-8

2,079

238%

369%

36%

84%

-53%

21%

54%

13%

-5%

28%

81%

86%

130%

157%

90%

18%

16.29 129.70

4.96

57.43

35.43 203.28

18.69 112.19

34.90 433.90

51.20

46.00

2.59

30.45

60.09 217.07

24.37 209.51

184.52 1,164.96

-0.05

7.64

11.53

62.45

4.50

33.13

1.61 313.33

-0.03

3.08

77.54

65.33

13% 11.3x

9% 36.7x

17% 23.7x

17% 22.5x

8% 19.3x

111% 19.1x

8% 10.4x

28% 8.3x

12% 12.4x

16% 12.5x

-1% N/A

18% 15.6x

14% 13.4x

1% 101.8x

-1% N/A

119% 27.3x

1.4x

3.2x

4.1x

3.7x

1.6x

21.3x

0.9x

2.3x

1.4x

2.0x

1.2x

2.9x

1.8x

0.5x

1.2x

32.4x

FC RESEARCH

Quarter Earnings LKR 'mn

Company

RAIGAM WAYAMBA SALTERNS PLC

RENUKA AGRI FOODS PLC

TEA SMALLHOLDER FACTORIES PLC

THE LION BREWERY CEYLON PLC

THREE ACRE FARMS PLC

Mkt Price

Stock Code

LKR

RWSL.N0000

RAL.N0000

TSML.N0000

LION.N0000

TAFL.N0000

2.90

4.40

39.30

660.70

128.10

Qtr

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

Beverage, Food and Tobacco Sector Earnings

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

5

37

0

579

107

8

55

19

488

-15

-32%

-33%

-102%

19%

823%

8

16

-2

-324

79

8,542

6,640

29%

6,697

600

182

-15

-140

545

-52

-12

282

10%

453%

-20%

-150%

660

135

-330

44

627

762

-18%

508

-14

-196

567

-162

178

370

222

-14

523

415

116

2,178

573

84

420

162

-116

891

-12

-63

1,347

-134

104

-164

173

23

367

247

61

2,143

420

41

747

147

52

493

-17%

-211%

-58%

-21%

71%

325%

28%

-158%

43%

68%

91%

2%

36%

106%

-44%

11%

-324%

81%

-29

313

608

223

-138

556

216

-255

887

772

100

5,222

359

313

1,384

98

-126

903

6,199

5,992

3%

11,406

196

-26

-94

302

-25

-13

-4

-42

285

-2

-116

337

-25

6

-8

-58

-31%

-1078%

19%

-10%

0%

-313%

48%

27%

1,100

104

-145

504

-6

-10

-8

70

-35%

132%

86%

279%

36%

5

37

0

579

186

8

55

19

488

54

-32%

-33%

-102%

19%

244%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

0.13

0.48

0.54

16.37

12.75

3.01

4.25

30.09

106.32

53.93

4 Qtr Trailing

ROE

4%

11%

2%

15%

24%

28% Sector Multiples

PER (x) PBV (x)

23.1x

9.2x

72.4x

40.4x

10.0x

1.0x

1.0x

1.3x

6.2x

2.4x

20.4x

3.9x

10.6x

22.9x

N/A

23.7x

1.6x

1.1x

0.9x

1.3x

16.8x

2.5x

N/A

N/A

33.9x

29.5x

5.7x

21.2x

18.0x

N/A

9.9x

25.0x

31.6x

15.0x

9.6x

19.2x

12.5x

15.7x

N/A

8.5x

1.2x

0.5x

1.8x

0.6x

2.6x

1.7x

1.5x

0.4x

0.9x

2.6x

1.6x

1.6x

1.7x

1.7x

1.2x

1.5x

1.0x

0.8x

18.8x

1.4x

12.5x

19.4x

N/A

17.5x

N/A

N/A

N/A

45.2x

1.6x

1.3x

0.7x

1.3x

2.3x

1.3x

2.0x

0.7x

Construction & Engineering

ACCESS ENGINEERING PLC

COLOMBO DOCKYARD PLC

LANKEM DEVELOPMENTS PLC

MTD WALKERS PLC

AEL.N0000

DOCK.N0000

LDEV.N0000

KAPI.N0000

25.80

168.00

6.70

63.60

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

Construction & Engineering Sector Earnings

-9%

35%

96%

-416%

600

317

-15

-140

545

79

-12

282

10%

299%

-20%

-150%

2.43

7.34

-8.20

2.68

16.62

154.09

7.73

47.16

15%

5%

-106%

6%

23% Sector Multiples

Diversified Holdings

ADAM INVESTMENTS LIMITED

BROWNS INVESTMENTS PLC

CARSONS CUMBERBATCH PLC

THE COLOMBO FORT LAND & BUILDING COM: PLC

DUNAMIS CAPITAL PLC

C T HOLDINGS PLC

EXPOLANKA HOLDINGS PLC

FREE LANKA CAPITAL HOLDINGS PLC

HAYLEYS PLC

HEMAS HOLDINGS PLC

FINLAYS COLOMBO PLC

JOHN KEELLS HOLDINGS PLC

RICHARD PIERIS AND COMPANY PLC

SOFTLOGIC HOLDINGS PLC

AITKEN SPENCE PLC

SUNSHINE HOLDINGS PLC

TAPROBANE HOLDINGS

VALLIBEL ONE PLC

AINV.N0000

BIL.N0000

CARS.N0000

CFLB.N0000

CSEC.N0000

CTHR.N0000

EXPO.N0000

FLCH.N0000

HAYL.N0000

HHL.N0000

JFIN.N0000

JKH.N0000

RICH.N0000

SHL.N0000

SPEN.N0000

SUN.N0000

TAP.N0000

VONE.N0000

2.70

1.70

400.00

26.10

31.80

163.60

8.60

1.50

360.00

91.60

274.00

189.50

8.60

16.70

99.90

59.00

5.10

25.60

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Diversified Holdings Sector Earnings

52%

-163%

-7%

-173%

229%

-33%

3%

95%

-41%

-46%

16%

-58%

60%

-73%

-70%

66%

8%

-1%

-42

-196

567

-162

178

370

222

-14

523

415

216

2,178

573

84

420

162

-116

891

N/A

-63

1,347

-134

104

-164

173

23

367

247

143

2,143

420

41

747

147

52

493

N/A

-211%

-58%

-21%

71%

325%

28%

-158%

43%

68%

51%

2%

36%

106%

-44%

11%

-324%

81%

-0.18

-0.04

11.80

0.89

5.57

7.73

0.48

-0.76

36.50

3.66

8.68

12.61

0.90

0.87

8.01

3.76

-0.08

3.00

2.29

3.71

227.15

43.47

12.36

96.62

5.56

4.15

388.78

35.16

168.99

121.84

5.16

9.77

85.26

40.44

4.88

32.89

-8%

-1%

5%

2%

45%

8%

9%

-18%

9%

10%

5%

10%

17%

9%

9%

9%

-2%

9%

-46% Sector Multiples

Hotels and Travels

AITKEN SPENCE HOTEL HOLDINGS PLC

AMAYA LEISURE PLC

ANILANA HOTELS AND PROPERTIES LIMITED

ASIAN HOTELS & PROPERTIES PLC

BERUWALA RESORTS

BROWNS BEACH HOTELS PLC

BANSEI ROYAL RESORTS HIKKADUWA LIMITED

CEYLON HOTELS CORPORATION PLC

Page 3

AHUN.N0000

CONN.N0000

ALHP.N0000

AHPL.N0000

BERU.N0000

BBH.N0000

BRR.N0000

CHOT.N0000

80.00

78.50

4.80

68.00

1.80

36.00

10.60

25.00

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

-82%

-125%

35%

-40%

-287%

-31%

51%

-160%

196

-26

-94

302

-25

-13

-4

-42

285

-2

-116

337

-25

6

-8

-58

-31%

-1078%

19%

-10%

0%

-313%

48%

27%

6.38

4.04

-0.97

3.89

-0.11

-0.27

-0.53

0.55

50.26

62.38

6.73

51.99

0.79

27.29

5.36

35.03

13%

6%

-14%

7%

-14%

-1%

-10%

2%

FC RESEARCH

Quarter Earnings LKR 'mn

Company

CITRUS LEISURE PLC

DOLPHIN HOTELS PLC

EDEN HOTEL LANKA PLC

GALADARI HOTELS (LANKA) PLC

HIKKADUWA BEACH RESORT LIMITED

HOTEL DEVELOPERS (LANKA) PLC

HOTEL SERVICES (CEYLON) PLC

HOTEL SIGIRIYA PLC

HUNAS FALLS HOTELS PLC

JOHN KEELLS HOTELS PLC

KALPITIYA BEACH RESORT LIMITED

KANDY HOTELS COMPANY (1938) PLC

MAHAWELI REACH HOTELS PLC

MARAWILA RESORTS PLC

PALM GARDEN HOTELS PLC

PEGASUS HOTELS OF CEYLON PLC

RAMBODA FALLS

RENUKA CITY HOTEL PLC

ROYAL PALMS BEACH HOTELS PLC

SERENDIB HOTELS PLC

SIGIRIYA VILLAGE HOTELS PLC

TAJ LANKA HOTELS PLC

TANGERINE BEACH HOTELS PLC

THE FORTRESS RESORTS PLC

THE LIGHTHOUSE HOTEL PLC

THE NUWARA ELIYA HOTELS COMPANY PLC

TRANS ASIA HOTELS PLC

WASKADUWA BEACH RESORT LIMITED

Mkt Price

Stock Code

LKR

REEF.N0000

STAF.N0000

EDEN.N0000

GHLL.N0000

CITH.N0000

HDEV.N0000

SERV.N0000

HSIG.N0000

HUNA.N0000

KHL.N0000

CITK.N0000

KHC.N0000

MRH.N0000

MARA.N0000

PALM.N0000

PEG.N0000

RFL.N0000

RENU.N0000

RPBH.N0000

SHOT.N0000

SIGV.N0000

TAJ.N0000

TANG.N0000

RHTL.N0000

LHL.N0000

NEH.N0000

TRAN.N0000

CITW.N0000

13.00

54.50

21.40

13.00

15.20

94.80

17.20

106.40

60.00

16.70

3.50

8.60

24.00

3.10

47.00

40.20

29.70

389.90

38.00

39.20

64.10

31.00

85.60

16.50

62.10

1,440.70

93.00

6.40

Qtr

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Hotels and Travels Sector Earnings

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

-129

29

-111

-3

-1

-104

54

5

-7

131

-17

2

-17

-18

-60

20

4

69

-4

-20

-2

-38

-15

0

0

23

-32

-87

-37

16

-124

10

-6

42

21

-3

1

129

-29

30

-13

-29

-100

19

1

61

-17

-1

-3

-85

-17

16

6

41

65

-4

-243%

86%

10%

-135%

81%

-350%

155%

277%

-738%

2%

41%

-93%

-30%

39%

40%

1%

203%

12%

78%

-2690%

45%

55%

14%

-99%

-94%

-43%

-150%

-2236%

-96

71

5

66

51

-23

78

34

0

965

-26

39

33

-3

-40

17

15

69

38

139

-19

19

37

101

73

86

207

-184

-36

408

-109%

3,361

-9

35

35

51

5

4

-118%

653%

770%

-155

36

18

62

59

4%

-100

88

296

121

57

208

84

261

60

47

67

5%

14%

100%

23%

209%

69

655

2

-35

163

771

519

49%

853

-34%

-59%

-2326%

-105%

-102%

-357%

-31%

-86%

-2647%

-86%

34%

-95%

-151%

-434%

-49%

12%

-75%

0%

-110%

-114%

91%

-295%

-140%

-100%

-99%

-73%

-116%

53%

-129

29

-111

63

-1

-104

54

5

-7

131

-17

2

-17

-18

-60

20

4

69

-4

-20

-2

-38

-15

0

0

23

-32

-87

-37

16

-124

100

-6

42

21

-3

1

129

-29

30

-13

-29

-100

19

1

61

-17

-1

-3

-85

-17

16

6

41

65

-4

-243%

86%

10%

-37%

81%

-350%

155%

277%

-738%

2%

41%

-93%

-30%

39%

40%

1%

203%

12%

78%

-2690%

45%

55%

14%

-99%

-94%

-43%

-150%

-2236%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

-3.89

28.08

5.35

41.73

-4.90

41.84

0.35

17.97

1.23

19.79

0.05

6.60

1.34

8.33

11.73

51.26

-0.93

58.73

1.27

14.07

-0.59

8.03

0.20

10.65

1.05

20.91

-0.31

3.53

-5.82

75.65

3.16

48.59

1.48

13.91

59.46 637.62

0.72

34.65

1.64

18.74

-1.19

67.81

-0.96

11.17

2.47 129.77

1.68

12.66

2.69

51.64

125.70 1,464.67

2.44

27.78

-2.85

7.64

4 Qtr Trailing

ROE

PER (x) PBV (x)

-14% N/A

13% 10.2x

-12% N/A

2% 37.1x

6% 12.4x

1% 1861.8x

16% 12.8x

23% 9.1x

-2% N/A

9% 13.1x

-7% N/A

2% 42.3x

5% 22.8x

-9% N/A

-8% N/A

6% 12.7x

11% 20.1x

9% 6.6x

2% 52.7x

9% 24.0x

-2% N/A

-9% N/A

2% 34.7x

13% 9.8x

5% 23.0x

9% 11.5x

9% 38.2x

-37% N/A

-101% Sector Multiples

0.5x

1.3x

0.5x

0.7x

0.8x

14.4x

2.1x

2.1x

1.0x

1.2x

0.4x

0.8x

1.1x

0.9x

0.6x

0.8x

2.1x

0.6x

1.1x

2.1x

0.9x

2.8x

0.7x

1.3x

1.2x

1.0x

3.3x

0.8x

54.1x

2.4x

N/A

32.6x

30.8x

0.8x

1.9x

1.1x

46.2x

1.2x

20.9x

16.8x

13.8x

46.0x

19.0x

2.5x

3.9x

1.3x

1.1x

2.5x

18.5x

2.5x

Footwear & Textiles

CEYLON LEATHER PRODUCTS PLC

HAYLEYS MGT KNITTING MILLS PLC

ODEL PLC

CLPL.N0000

MGT.N0000

ODEL.N0000

82.00

19.00

21.80

1Q-Mar

1Q-Mar

1Q-Mar

Footwear & Textiles Sector Earnings

94%

-3%

99%

-9

35

35

51

5

4

-118%

653%

770%

-1.16

0.58

0.71

99.17

10.27

19.55

-1%

6%

4%

161% Sector Multiples

Healthcare

ASIRI SURGICAL HOSPITAL PLC

ASIRI HOSPITAL HOLDINGS PLC

CEYLON HOSPITALS PLC (DURDANS)

NAWALOKA HOSPITALS PLC

THE LANKA HOSPITAL CORPORATION PLC

Healthcare Sector Earnings

Page 4

AMSL.N0000

ASIR.N0000

CHL.N0000

NHL.N0000

LHCL.N0000

15.40

22.40

107.00

3.10

52.70

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

27%

-55%

7444%

262%

28%

88

296

121

57

371

-10% Sector Multiples

84

261

60

47

212

5%

14%

100%

23%

76%

0.74

1.33

7.73

0.07

2.78

6.23

5.78

82.87

2.80

21.20

12%

23%

9%

2%

13%

FC RESEARCH

Quarter Earnings LKR 'mn

Company

Mkt Price

Stock Code

LKR

Qtr

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

4 Qtr Trailing

ROE

PER (x) PBV (x)

Information Technology

E-CHANNELLING PLC

ECL.N0000

13.30

1Q-Mar

Information Technology Sector Earnings

20

28

-29%

26

-24%

20

28

20

28

-29%

26

-24% Sector Multiples

-9

197

143

24

15

-103

1

65

25

-4

540

351

-5

32

56

127

50

57

-163%

-64%

-59%

622%

-54%

-284%

-100%

30%

-57%

-8

4

-59

-14

-45

-86

44

59

8

357

1,205

-70%

-97

66

14

-9

-9

25

22

13

1

2

-29

21

709

98

3

22

5

51

63

-15

-11

31

23

14

3

-12

4

22

675

94

3

19

1

29%

-78%

39%

20%

-19%

-4%

-5%

-68%

120%

-900%

-2%

5%

3%

17%

15%

332%

116

14

6

0

26

321

115

-4

81

-3

23

750

97

60

29

4

956

965

-1%

1,634

15

264

31

-24

54

6

56

13

31

17

-26

40

-2

63

21%

763%

82%

7%

35%

349%

-11%

42

435

36

-28

15

12

131

-29%

0.88

0.95

93%

15.0x

14.0x

N/A

5.5x

N/A

13.7x

12.3x

6.6x

14.4x

N/A

19.3x

11.0x

22.5x

0.8x

0.7x

0.7x

0.5x

0.6x

0.6x

1.7x

0.7x

0.7x

16.2x

0.7x

9.8x

15.6x

N/A

N/A

4.6x

4.8x

12.0x

N/A

8.8x

N/A

12.7x

7.2x

14.5x

8.8x

21.7x

17.7x

0.8x

0.6x

2.3x

1.9x

0.8x

0.8x

2.2x

1.9x

1.5x

8.1x

0.8x

0.8x

1.7x

2.1x

0.5x

1.2x

10.7x

0.9x

Investment Trusts

ASCOT HOLDINGS PLC

CEYLON GUARDIAN INVESTMENT TRUST PLC

CEYLON INVESTMENT PLC

COLOMBO FORT INVESTMENTS PLC

COLOMBO INVESTMENT TRUST PLC

ENVIRONMENTAL RESOURCES INVESTMENTS PLC

GUARDIAN CAPITAL PARTNERS PLC

RENUKA HOLDINGS PLC

LEE HEDGES PLC

ASCO.N0000

GUAR.N0000

CINV.N0000

CFI.N0000

CIT.N0000

GREG.N0000

WAPO.N0000

RHL.N0000

SHAW.N0000

38.60

193.20

96.20

95.70

125.00

13.40

42.80

30.80

479.60

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Investment Trusts Sector Earnings

-21%

4670%

344%

264%

133%

-19%

-99%

11%

190%

-9

197

143

24

15

-103

1

65

25

-4

540

351

-5

32

56

127

50

57

-163%

-64%

-59%

622%

-54%

-284%

-100%

30%

-57%

-1.36

14.09

7.84

14.58

8.71

-0.41

2.22

2.80

21.31

49.52

273.71

132.52

202.51

216.96

22.56

24.99

44.71

668.17

-3%

5%

6%

7%

4%

-2%

9%

6%

3%

467% Sector Multiples

Land and Property

C T LAND DEVELOPMENT PLC

CARGO BOAT DEVELOPMENT COMPANY PLC

CITY HOUSING & REAL ESTATE CO. PLC

COLOMBO LAND & DEVELOPMENT COMPANY PLC

COMMERCIAL DEVELOPMENT COMPANY PLC

EQUITY ONE PLC

EQUITY TWO PLC

SERENDIB ENGINEERING GROUP PLC

MILLENNIUM HOUSING DEVELOPERS PLC

KELSEY DEVELOPMENTS PLC

ON'ALLY HOLDINGS PLC

OVERSEAS REALTY (CEYLON) PLC

PROPERTY DEVELOPMENT PLC

SERENDIB LAND PLC

SEYLAN DEVELOPMENTS PLC

YORK ARCADE HOLDINGS PLC

CTLD.N0000

CABO.N0000

CHOU.N0000

CLND.N0000

COMD.N0000

EQIT.N0000

ETWO.N0000

IDL.N0000

MHDL.N0000

KDL.N0000

ONAL.N0000

OSEA.N0000

PDL.N0000

SLND.N0000

CSD.N0000

YORK.N0000

51.40

131.30

18.80

27.80

105.00

46.40

58.60

12.70

8.40

60.30

64.90

24.50

90.00

1,713.00

15.00

17.10

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

1Q-Mar

2Q-Dec

1Q-Mar

Land and Property Sector Earnings

-43%

-1%

-248%

-3985%

-3%

-93%

-89%

122%

-97%

-905%

-9%

-5%

1%

-94%

-23%

34%

66

14

-9

-9

50

22

13

1

2

-29

21

1,459

194

3

51

5

51

63

-15

-21

52

23

14

3

-12

4

22

1,394

191

3

49

1

29%

-78%

39%

58%

-4%

-4%

-5%

-68%

120%

-900%

-2%

5%

2%

17%

5%

332%

5.23

8.42

-1.68

-0.18

22.78

9.57

4.87

-0.50

0.96

-3.66

5.10

3.41

6.23

193.94

0.69

0.97

60.95

226.24

8.08

14.53

128.62

56.04

26.85

6.64

5.48

7.42

76.81

30.52

52.56

826.15

28.80

14.31

-41% Sector Multiples

9%

4%

-21%

-1%

18%

17%

18%

-8%

17%

-49%

7%

11%

12%

23%

2%

7%

Manufacturing

ABANS ELECTRICALS PLC

ACL CABLES PLC

ACL PLASTICS PLC

ACME PRINTING & PACKAGING PLC

AGSTAR FERTILIZERS LIMITED

ALUFAB PLC

ALUMEX PLC

Page 5

ABAN.N0000

ACL.N0000

APLA.N0000

ACME.N0000

AGST.N0000

ALUF.N0000

ALUM.N0000

153.00

120.00

158.30

9.60

7.00

56.50

18.60

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

-63%

-39%

-12%

13%

266%

-52%

-57%

15

264

31

-24

54

6

56

13

31

17

-26

40

-2

63

21%

763%

82%

7%

35%

349%

-11%

17.32

18.45

24.22

-5.34

0.71

0.41

1.57

142.90

127.82

196.67

16.14

7.92

22.71

5.58

12% 8.8x

14% 6.5x

12% 6.5x

-33% N/A

9% 9.9x

2% 136.5x

28% 11.8x

1.1x

0.9x

0.8x

0.6x

0.9x

2.5x

3.3x

FC RESEARCH

Quarter Earnings LKR 'mn

Company

BLUE DIAMONDS JEWELLERY WORLDWIDE PLC

BOGALA GRAPHITE LANKA PLC

CENTRAL INDUSTRIES PLC

CEYLON GRAIN ELEVATORS PLC

CHEVRON LUBRICANTS LANKA PLC

DANKOTUWA PORCELAIN PLC

DIPPED PRODUCTS PLC

HAYLEYS FIBRE PLC

KELANI CABLES PLC

KELANI TYRES PLC

LANKA ALUMINIUM INDUSTRIES PLC

LANKA CERAMIC PLC

LANKA FLOORTILES PLC

LANKA WALLTILES PLC

LAXAPANA BATTERIES PLC

PIRAMAL GLASS CEYLON PLC

PRINTCARE PLC

REGNIS(LANKA) PLC

RICHARD PIERIS EXPORTS PLC

ROYAL CERAMICS LANKA PLC

SAMSON INTERNATIONAL PLC

SINGER INDUSTRIES (CEYLON) PLC

SIERRA CABLES PLC

SWADESHI INDUSTRIAL WORKS PLC

SWISSTEK (CEYLON) PLC

TEXTURED JERSEY LANKA PLC

TOKYO CEMENT COMPANY (LANKA) PLC

Mkt Price

Stock Code

LKR

Qtr

BLUE.N0000

1.30

1Q-Mar

BOGA.N0000

32.20

2Q-Dec

CIND.N0000

113.70 1Q-Mar

GRAN.N0000

85.00

2Q-Dec

LLUB.N0000

404.40

2Q-Dec

DPL.N0000

11.80

1Q-Mar

DIPD.N0000

139.80 1Q-Mar

HEXP.N0000

44.30

1Q-Mar

KCAB.N0000

120.00 1Q-Mar

TYRE.N0000

83.00

1Q-Mar

LALU.N0000

103.20 1Q-Mar

CERA.N0000

132.00 1Q-Mar

TILE.N0000

117.00 1Q-Mar

LWL.N0000

118.00 1Q-Mar

LITE.N0000

7.30

1Q-Mar

GLAS.N0000

7.00

1Q-Mar

CARE.N0000

43.00

1Q-Mar

REG.N0000

205.00

2Q-Dec

REXP.N0000

220.10 1Q-Mar

RCL.N0000

127.50 1Q-Mar

SIL.N0000

118.10 1Q-Mar

SINI.N0000

199.90

2Q-Dec

SIRA.N0000

4.70

1Q-Mar

SWAD.N0000 13,500.00 1Q-Mar

PARQ.N0000

57.10

1Q-Mar

TJL.N0000

32.30

1Q-Mar

TKYO.N0000

55.60

1Q-Mar

Manufacturing Sector Earnings

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

-22

-19

34

155

797

-20

132

-6

70

164

15

128

196

180

8

147

90

81

105

562

21

-1

65

-1

27

206

466

-12

11

13

31

675

5

231

3

25

141

11

85

121

132

4

86

62

24

72

161

24

-3

11

1

21

164

524

-79%

-278%

158%

394%

18%

-528%

-43%

-333%

176%

16%

38%

50%

62%

36%

99%

70%

44%

238%

46%

249%

-13%

64%

477%

-165%

28%

26%

-11%

-22

11

36

168

743

-111

260

2

175

165

20

129

307

375

4

209

40

73

40

853

-18

10

-59

22

87

512

425

3%

-275%

-4%

-8%

7%

82%

-49%

-433%

-60%

-1%

-23%

-1%

-36%

-52%

105%

-30%

124%

11%

160%

-34%

219%

-112%

209%

-104%

-69%

-60%

10%

-22

-8

34

323

1,540

-20

132

-6

70

164

15

128

196

180

8

147

90

154

105

562

21

9

65

-1

27

206

466

-12

41

13

25

1,439

5

231

3

25

141

11

85

121

132

4

86

62

58

72

161

24

2

11

1

21

164

524

3,983

2,759

44%

5,097

57

228

15

63

15

351

128

30

15

36

9

193

-55%

655%

0%

73%

61%

82%

-45

263

-26

107

7

539

226%

-13%

157%

-41%

121%

-35%

729

411

77%

845

-14% Sector Multiples

24

20

375

44

50

31

1,127

27

-51%

-35%

-67%

62%

-1

-1

564

-3

-79%

-120%

158%

1219%

7%

-528%

-43%

-333%

176%

16%

38%

50%

62%

36%

99%

70%

44%

167%

46%

249%

-13%

358%

477%

-165%

28%

26%

-11%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

-0.16

0.91

0.54

5.52

15.31 116.15

6.33

52.91

23.73

51.16

-1.51

12.55

16.93 131.12

-0.72

57.08

17.71 126.79

9.18

39.49

10.91

64.92

21.06 140.20

17.26

81.10

19.99 122.24

0.47

4.07

0.53

3.97

3.38

31.31

22.26

95.36

26.91

48.43

22.89 110.36

4.22 117.01

2.78 259.82

0.58

2.82

97.44 1,096.23

8.68

39.95

2.08

10.98

5.13

31.27

4 Qtr Trailing

ROE

PER (x) PBV (x)

-18% N/A

10% 59.1x

13% 7.4x

12% 13.4x

46% 17.0x

-12% N/A

13% 8.3x

-1% N/A

14% 6.8x

23% 9.0x

17% 9.5x

15% 6.3x

21% 6.8x

16% 5.9x

12% 15.5x

13% 13.3x

11% 12.7x

23% 9.2x

56% 8.2x

21% 5.6x

4% 28.0x

1% 71.8x

21% 8.1x

9% 138.5x

22% 6.6x

19% 15.5x

16% 10.8x

-22% Sector Multiples

1.4x

5.8x

1.0x

1.6x

7.9x

0.9x

1.1x

0.8x

0.9x

2.1x

1.6x

0.9x

1.4x

1.0x

1.8x

1.8x

1.4x

2.1x

4.5x

1.2x

1.0x

0.8x

1.7x

12.3x

1.4x

2.9x

1.8x

10.8x

1.9x

9.1x

8.4x

15.4x

6.5x

22.5x

5.3x

0.6x

0.7x

1.9x

1.4x

1.1x

0.7x

9.0x

1.0x

Motors

COLONIAL MOTORS PLC

DIESEL & MOTOR ENGINEERING PLC

LANKA ASHOK LEYLAND PLC

SATHOSA MOTORS PLC

THE AUTODROME PLC

UNITED MOTORS LANKA PLC

COLO.N0000

DIMO.N0000

ASHO.N0000

SMOT.N0000

AUTO.N0000

UML.N0000

142.60

749.70

1,411.60

309.80

872.10

111.80

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Motors Sector Earnings

57

228

15

63

15

351

128

30

15

36

9

193

-55%

655%

0%

73%

61%

82%

15.60 250.18

89.48 1,046.50

91.76 758.11

47.74 214.46

38.81 824.22

21.12 159.79

6%

9%

12%

22%

5%

13%

Oil Palms

SELINSING PLC

SHALIMAR (MALAY) PLC

THE BUKIT DARAH PLC

THE GOOD HOPE PLC

Page 6

SELI.N0000

SHAL.N0000

BUKI.N0000

GOOD.N0000

1,500.00

2,275.00

670.00

1,601.00

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2724%

2163%

-33%

1471%

24

20

375

44

50

31

1,127

27

-51%

-35%

-67%

62%

11.68 1,100.70

7.97 822.25

14.10 274.67

10.82 887.18

1% 128.4x

1% 285.3x

5% 47.5x

1% 148.0x

1.4x

2.8x

2.4x

1.8x

FC RESEARCH

Quarter Earnings LKR 'mn

Company

THE INDO MALAY PLC

Mkt Price

Stock Code

LKR

INDO.N0000

1,659.00

Qtr

1Q-Mar

Oil Palms Sector Earnings

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

14

20

-34%

-5

355%

14

20

477

1,255

-62%

554

-90

38

-76

29

52

-46

-49

0

30

-29

-183

-32

-32

-96

22

16

10

-6

131

6

80

57

32

88

81

23

29

42

-20

-214

60

90

24

24

59

40

71

231

-1577%

-52%

-232%

-8%

-41%

-157%

-310%

-100%

-30%

-51%

15%

-152%

-135%

-499%

-8%

-74%

-76%

-108%

-43%

-271

95

-102

-39

138

-81

31

-43

64

10

-7

-33

-59

-95

-37

9

61

-23

-1

-313

805

-139%

-385

75

-4

171

326

-6

53

186

119

-69

-11

1,202

329

-6

21

150

40

209%

61%

-86%

-1%

4%

157%

24%

195%

19

0

-1,066

369

-4

21

8

-1

920

1,655

-44%

-655

241% Sector Multiples

25

6

53

6

9

33

15

67

6

-29

-23%

-62%

-21%

-8%

130%

26

5

21

7

-513

-2%

18%

153%

-12%

102%

98

92

7%

-455

122% Sector Multiples

-34%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

6.13

842.58

4 Qtr Trailing

ROE

PER (x) PBV (x)

1% 270.6x

-14% Sector Multiples

69.3x

2.0x

2.2x

Plantations

AGALAWATTE PLANTATIONS PLC

AITKEN SPENCE PLANTATION MANAGEMENTS PLC

BALANGODA PLANTATIONS PLC

BOGAWANTALAWA TEA ESTATES PLC

ELPITIYA PLANTATIONS PLC

HAPUGASTENNE PLANTATIONS PLC

HORANA PLANTATIONS PLC

KAHAWATTE PLANTATIONS PLC

KEGALLE PLANTATIONS PLC

KELANI VALLEY PLANTATIONS PLC

KOTAGALA PLANTATIONS PLC

MADULSIMA PLANTATIONS PLC

MALWATTE VALLEY PLANTATIONS PLC

MASKELIYA PLANTATIONS PLC

METROPOLITAN RESOURCE HOLDINGS PLC

NAMUNUKULA PLANTATIONS PLC

TALAWAKELLE TEA ESTATES PLC

UDAPUSSELLAWA PLANTATIONS PLC

WATAWALA PLANTATIONS PLC

AGAL.N0000

ASPM.N0000

BALA.N0000

BOPL.N0000

ELPL.N0000

HAPU.N0000

HOPL.N0000

KAHA.N0000

KGAL.N0000

KVAL.N0000

KOTA.N0000

MADU.N0000

MAL.N0000

MASK.N0000

MPRH.N0000

NAMU.N0000

TPL.N0000

UDPL.N0000

WATA.N0000

23.40

45.50

20.50

11.50

21.30

31.70

23.00

33.90

83.00

69.90

24.50

9.80

3.80

10.60

29.60

69.30

36.70

28.10

24.70

2Q-Dec

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

2Q-Dec

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

Plantations Sector Earnings

67%

-59%

26%

174%

-62%

42%

-259%

100%

-53%

-389%

-2694%

5%

47%

-1%

159%

72%

-84%

74%

11061%

-361

38

-178

29

52

-127

-49

-43

30

-29

-183

-65

-91

-96

22

16

10

-29

131

-51

80

80

32

88

99

23

57

42

-20

-214

47

104

24

24

59

40

94

231

-601%

-52%

-321%

-8%

-41%

-229%

-310%

-175%

-30%

-51%

15%

-239%

-188%

-499%

-8%

-74%

-76%

-131%

-43%

-21.64

10.94

-15.22

1.01

4.44

-0.92

-0.43

0.07

8.60

0.23

-11.10

-9.01

-0.48

-5.64

2.86

4.98

7.36

-1.88

1.30

26.93

102.12

103.39

13.41

44.14

42.77

54.45

13.29

145.34

77.40

55.04

52.08

12.35

21.00

47.08

93.03

69.45

37.52

18.69

-80% N/A

11% 4.2x

-15% N/A

7% 11.4x

10% 4.8x

-2% N/A

-1% N/A

1% 476.3x

6% 9.7x

0% 305.2x

-20% N/A

-17% N/A

-4% N/A

-27% N/A

6% 10.3x

5% 13.9x

11% 5.0x

-5% N/A

7% 19.0x

19% Sector Multiples

0.9x

0.4x

0.2x

0.9x

0.5x

0.7x

0.4x

2.6x

0.6x

0.9x

0.4x

0.2x

0.3x

0.5x

0.6x

0.7x

0.5x

0.7x

1.3x

N/A

0.7x

35.6x

10.2x

25.2x

11.3x

N/A

9.2x

8.7x

11.7x

1.2x

1.2x

1.2x

2.2x

0.8x

1.7x

3.1x

3.3x

13.3x

1.5x

8.8x

11.5x

27.2x

16.7x

N/A

1.2x

2.4x

1.7x

1.2x

-0.9x

N/A

1.8x

Power and Energy

HEMAS POWER PLC

F L C HYDRO POWER PLC

LANKA IOC PLC

LAUGFS GAS PLC

MACKWOODS ENERGY

PANASIAN POWER PLC

VALLIBEL POWER ERATHNA PLC

VIDULLANKA PLC

HPWR.N0000

HPFL.N0000

LIOC.N0000

LGL.N0000

MEL.N0000

PAP.N0000

VPEL.N0000

VLL.N0000

23.90

7.60

40.20

42.20

6.00

3.70

9.80

10.70

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Power and Energy Sector Earnings

299%

-1961%

116%

-12%

-45%

155%

2157%

10138%

75

-4

171

326

-6

53

186

119

-69

-11

1,202

329

-6

21

150

40

209%

61%

-86%

-1%

4%

157%

24%

195%

0.67

0.75

1.60

3.73

-0.06

0.40

1.13

0.92

19.67

6.60

34.36

19.25

7.42

2.22

3.12

3.28

3%

11%

5%

19%

-1%

18%

36%

28%

Services

ASIA SIYAKA COMMODITIES LIMITED

CEYLON TEA BROKERS PLC

JOHN KEELLS PLC

LAKE HOUSE PRINTERS AND PUBLISHERS PLC

MERCANTILE SHIPPING COMPANY PLC

Services Sector Earnings

Page 7

ASIY.N0000

CTBL.N0000

JKL.N0000

LPRT.N0000

MSL.N0000

3.50

4.60

91.00

120.00

107.20

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

25

6

53

6

9

33

15

67

6

-29

-23%

-62%

-21%

-8%

130%

0.40

0.40

3.35

7.20

-196.08

2.85

1.91

53.95

101.64

-118.04

14%

21%

6%

7%

N/A

FC RESEARCH

Quarter Earnings LKR 'mn

Company

Mkt Price

Stock Code

LKR

Qtr

Cum. Earnings LKR 'mn

1QFY16

1QFY15

YoY%

3QFY14

QoQ%

YTD FY16

YTD FY15

YoY%

2Q2015

2Q2014

YoY%

4Q2014

QoQ%

YTD 2015

YTD 2014

YoY%

1H2015

1H2014

YoY%

1H2014

HoH%

YTD 2015

YTD 2014

YoY%

4 Qtr

NAVPS

Trailing

LKR

EPS LKR

4 Qtr Trailing

ROE

PER (x) PBV (x)

Stores & Supplies

COLOMBO PHARMACY COMPANY PLC

E B CREASY & COMPANY PLC

GESTETNER OF CEYLON PLC

HUNTERS & COMPANY LIMITED

PHAR.N0000

EBCR.N0000

GEST.N0000

HUNT.N0000

640.70

1,150.00

153.50

433.30

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

Stores & Supplies Sector Earnings

9

9

-3

27

1

-85

5

-35

1120%

111%

-158%

177%

62

87

5

51

42

-115

137%

204

1,907

1,797

1,657

2,421

15%

-26%

1,982

1,602

3,704

4,078

-9%

3,584

36

56

2

0

363

-9

1

126

30

7

-2

117

-26

-7

-72%

88%

-73%

113%

211%

65%

120%

240

73

715

-7

254

221

-9

450

245

84%

1,488

-86%

-89%

-165%

-46%

9

9

-3

27

1

-85

5

-35

1120%

111%

-158%

177%

95.19 861.97

54.07 1,210.26

16.11

77.60

30.08 992.60

11%

4%

21%

3%

-79% Sector Multiples

6.7x

21.3x

9.5x

14.4x

0.7x

1.0x

2.0x

0.4x

14.0x

0.7x

13.5x

13.2x

2.0x

1.3x

13.3x

1.6x

6.8x

10.6x

1.4x

N/A

16.7x

8.2x

N/A

0.5x

1.2x

0.7x

6.9x

3.1x

0.9x

1.7x

9.4x

1.2x

16.0x

1.8x

Telecommunications

DIALOG AXIATA PLC

SRI LANKA TELECOM PLC

DIAL.N0000

SLTL.N0000

11.70

46.90

2Q-Dec

2Q-Dec

Telecommunications Sector Earnings

-4%

12%

3,888

3,477

2,926

2,968

33%

17%

0.87

3.56

5.85

36.35

15%

10%

3% Sector Multiples

Trading

BROWN & COMPANY PLC

C. W. MACKIE PLC

CEYLON & FOREIGN TRADES PLC

RADIANT GEMS INTERNATIONAL PLC

SINGER SRI LANKA PLC

EASTERN MERCHANTS PLC

TESS AGRO PLC

Trading Sector Earnings

BRWN.N0000

CWM.N0000

CFT.N0000

RGEM.N0000

SINS.N0000

EMER.N0000

TESS.N0000

118.20

61.70

7.50

40.00

145.00

10.90

1.80

1Q-Mar

1Q-Mar

1Q-Mar

1Q-Mar

2Q-Dec

1Q-Mar

1Q-Mar

-85%

-24%

-100%

105%

43%

-104%

116%

36

56

2

0

617

-9

1

126

30

7

-2

247

-26

-7

-72%

88%

-73%

113%

150%

65%

120%

17.42

5.83

5.18

-5.34

8.66

1.34

-0.11

221.87

49.61

11.24

5.77

46.16

12.21

1.06

-70% Sector Multiples

Market Valuations

8%

12%

46%

-92%

19%

11%

-10%

Market Earnings - June 2015

46,731

42,196

11%

52,923

-12%

No. of Companies that released results

268

Market Earnings - March 2015

52,733

52,312

1%

55,121

-4%

No. of Companies that released results

276

Page 8

FC RESEARCH

First Capital Equities (Pvt) Ltd

347 1/1, Dr. Colvin R. De Silva Mawatha,

Colombo 2

Sales Desk:

+94 11 2145 000

Fax:

+94 11 2145 050

HEAD OFFICE

BRANCHES

347 1/1,

Matara

Negombo

Dr. Colvin R. De Silva Mawatha,

No. 24, Mezzanine Floor,

No.72A, 2/1,

Colombo 2

E.H. Cooray Building,

Old Chilaw Road,

Anagarika Dharmapala Mw,

Negombo

Sales Desk:

+94 11 2145 000

Matara

Fax:

+94 11 2145 050

Tel:

+94 41 2237 636

Tel:

Jaliya Wijeratne

+94 71 5329 602

Negombo

SALES

+94 31 2233 299

BRANCHES

CEO

Colombo

Priyanka Anuruddha

+94 76 6910 035

Priyantha Wijesiri

+94 76 6910 036

Damian Le Grand

+94 77 7383 237

Nishantha Mudalige

+94 76 6910 041

Matara

Isuru Jayawardana

+94 76 7084 953

Sumeda Jayawardana

+94 76 6910 038

Anushka Buddhika

+94 77 9553 613

Gamini Hettiarachchi

+94 76 6910 039

Thushara Abeyratne

+94 76 6910 037

Nishani Prasangi

+94 76 6910 033

Ishanka Wickramanayaka

+94 77 7611 200

RESEARCH

Dimantha Mathew

+94 11 2145 016

Amanda Lokugamage

+94 11 2145 015

Reshan Wediwardana

+94 11 2145 017

Michelle Weerasinghe

+94 11 2145 018

FIRST CAPITAL GROUP

HEAD OFFICE

BRANCHES

No. 2, Deal Place,

Matara

Kurunegala

Kandy

Colombo 3

No. 24, Mezzanine Floor,

No. 6, 1st Floor,

No.213-215,

Tel:

E.H. Cooray Building,

Union Assurance Building,

Peradeniya Road,

Anagarika Dharmapala Mawatha,

Rajapihilla Mawatha,

Kandy

Matara

Kurunegala

+94 11 2576 878

Tel:

+94 41 2222 988

Tel:

+94 37 2222 930

Tel:

+94 81 2236 010

Disclaimer:

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be correct.

Although all reasonable care has been taken to ensure the contents of the Review are accurate, First Capital Equities (Pvt) Ltd and/or its Directors, employees, are not

responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt) Ltd may act as a Broker in the investments which are the subject of this document or

related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is based, before its publication. First

Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise interested in the investments referred to in this

document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are inaccurate and unreliable. You hereby waive

irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with respect to the Review and agree to indemnify and hold

First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and employees harmless to the fullest extent allowed by law regarding all matters related to your

use of this Review. No part of this document may be reproduced, distributed or published in whole or in part by any means to any other person for any purpose without prior

permission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- Portersfiveforcestrategy 131215101901 Phpapp01Document9 pagesPortersfiveforcestrategy 131215101901 Phpapp01Ahmed Jan DahriNo ratings yet

- LeveragesDocument50 pagesLeveragesPrem KishanNo ratings yet

- 4 - Problem SolvingDocument8 pages4 - Problem SolvingKlenida DashoNo ratings yet

- Business CorrespondentDocument22 pagesBusiness CorrespondentdivyangNo ratings yet

- Chapter 4 - Working Capital and Cash Flow ManagementDocument13 pagesChapter 4 - Working Capital and Cash Flow ManagementAnna Mae SanchezNo ratings yet

- JFA Constitution 2012Document13 pagesJFA Constitution 2012Nikki TorralbaNo ratings yet

- Portfolio Management IIFLDocument49 pagesPortfolio Management IIFLabhaysinghzone100% (3)

- Dupire Local VolatilityDocument15 pagesDupire Local VolatilityJohn MclaughlinNo ratings yet

- AccountingDocument339 pagesAccountingShaik Basha100% (3)

- Corporate Level StrategiesDocument26 pagesCorporate Level StrategiesIrin I.gNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SahamDocument2 pagesSahamStenly LumendekNo ratings yet

- Currency FuturesDocument11 pagesCurrency FuturesAakash ChhariaNo ratings yet

- Test QuestionsDocument24 pagesTest Questionsjmp8888No ratings yet

- Wyoming Entrepreneur-Business Plan TemplateDocument13 pagesWyoming Entrepreneur-Business Plan TemplateBrooke TillmanNo ratings yet

- Ugba 101b Test 2 2008Document12 pagesUgba 101b Test 2 2008Minji KimNo ratings yet

- Title Xii Close Corporation: Salazar, Sopoco, Sta Ana, Suyosa, Tan, Umali, Uy, VelascoDocument9 pagesTitle Xii Close Corporation: Salazar, Sopoco, Sta Ana, Suyosa, Tan, Umali, Uy, VelascoArvin CruzNo ratings yet

- 1.4 An Overview of The Capital Allocation Process: Self-TestDocument1 page1.4 An Overview of The Capital Allocation Process: Self-Testadrien_ducaillouNo ratings yet

- Ias 12Document32 pagesIas 12Cat ValentineNo ratings yet

- VolatilityDocument21 pagesVolatilityRajput JaysinhNo ratings yet