Professional Documents

Culture Documents

Perfection of A Security Interest in Fixtures

Uploaded by

Julian Williams©™Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perfection of A Security Interest in Fixtures

Uploaded by

Julian Williams©™Copyright:

Available Formats

8/24/2015

Perfection of a Security Interest in Fixtures

Perfection of a Security Interest in Fixtures

By Paul Hodnefield, Corporation Service Company

Article 9 of the Uniform Commercial Code (UCC) offers lenders three different methods to perfect a

security interest in fixtures. It is important for lenders to understand the characteristics of each,

because the choice of perfection method affects both the priority and duration of the security interest.

This article explains the UCC fixture perfection options and the effect each has on priority and lapse

dates.

The first perfection method is the fixture filing. A fixture filing is a UCC financing statement filed in

the county real estate records where the related real property is located. It must satisfy the same

sufficiency requirements as state-level UCC filings. In addition, the record must indicate that it is to be

filed in real estate records, indicate that it covers fixtures, describe the real property to which it

relates, and, if the debtor does not have a recorded interest, identify the record owner of the property.

Once filed, a fixture filing takes priority over later recorded real estate interests in fixtures. If filed to

perfect a purchase-money security interest, the fixture filing can take priority over earlier recorded

interests as well.

A fixture filing is effective for five years from the date of recording. The effectiveness can be extended

for additional five-year periods by filing continuation statements.

When continuing a fixture filing, lenders must beware of a common trap. Some county recording

offices confuse real estate recording rules with those applicable to UCC records. Consequently, these

offices may claim fixture filings do not lapse and might even reject continuation statements.

Rest assured, the five-year effective period for fixture filings is uniform nationwide. The lender must

always submit a continuation statement to continue a fixture filing. Failure to do so will cause the

fixture filing to lapse, regardless of what the recording office says.

Another method for perfecting a security interest in fixtures is by filing a state-level financing

statement that includes fixtures within the collateral description. This method is really nothing more

than a normal UCC filing in the central index where the debtor is located. The financing statement

merely needs to satisfy the basic requirements for sufficiency of a financing statement.

Just like a fixture filing, the state-level UCC record is effective for five years from the date of filing.

The effectiveness can be continued for additional five-year periods as necessary.

The state-level UCC record has one important limitation. The general UCC rules apply for determining

priority in relation to competing interests filed at the state-level and certain lien claims. However, a

security interest perfected by a state-level UCC filing is subordinate to any interest recorded in the real

estate records, including fixture filings.

Finally, a security interest in fixtures may also be perfected by recording a record of mortgage. The

term record of mortgage is defined to include most records that could create a real estate interest in

fixtures. It is first and foremost a real estate record, but can be effective for UCC purposes if it meets

the content requirements for a fixture filing.

Unlike the five-year effectiveness given to UCC records, a record of mortgage is effective until either

satisfied or it lapses by its own terms. It is not necessary or effective for the lender to file a UCC

continuation statement.

The priority rules for a record of mortgage are the same as for a fixture filing. Once recorded, the

record of mortgage will take priority over later recorded real estate interests that cover fixtures.

data:text/html;charset=utf-8,%3Cp%20class%3D%22MsoNormal%22%20style%3D%22color%3A%20rgb(0%2C%200%2C%200)%3B%20font-family

1/2

8/24/2015

Perfection of a Security Interest in Fixtures

A lender is not limited to just one method of perfection for fixtures. Although generally not necessary,

all three methods can be used for the same transaction. A lender will commonly rely on a record of

mortgage to perfect its security interest in both the real property and fixtures. Some lenders also like

to record a fixture filing as belt and suspenders insurance.

A fixture filing alone is often used when the security interest covers fixtures, but not the rest of the

related real property. Lenders also use fixture filings to perfect purchase-money security interests

when financing goods that will become fixtures on the debtors property.

Because of the priority limitations, lenders generally should not rely solely on a state-level UCC filing

to perfect a security interest in fixtures. Most commonly, the state-level UCC filing covers fixtures

simply as part of a blanket lien. When fixtures have significant value, the prudent lender will make a

fixture filing to preserve its priority with respect to real estate interests.

data:text/html;charset=utf-8,%3Cp%20class%3D%22MsoNormal%22%20style%3D%22color%3A%20rgb(0%2C%200%2C%200)%3B%20font-family

2/2

You might also like

- International Law Admiralty Maritime Process Are You Lost at SeaDocument63 pagesInternational Law Admiralty Maritime Process Are You Lost at Seaanon-77290291% (35)

- Knowledge of Self - A Collection of Wisdom On The Science of Everything in LiFe - ExcerptsDocument33 pagesKnowledge of Self - A Collection of Wisdom On The Science of Everything in LiFe - ExcerptsAllahUniversal91% (78)

- Advanced Trial HandbookDocument27 pagesAdvanced Trial HandbookJulian Williams©™No ratings yet

- Your Strawman (Legal Fiction)Document31 pagesYour Strawman (Legal Fiction)Karl_23100% (4)

- The Laws of Cosmic AwarenessDocument104 pagesThe Laws of Cosmic Awarenesswho moved my cheese?100% (5)

- How To Find Out Who You AreDocument18 pagesHow To Find Out Who You AreJulian Williams©™100% (2)

- Drafting Affidavits - A Lay Persons GuideDocument25 pagesDrafting Affidavits - A Lay Persons Guidesabiont100% (8)

- How To Achieve SuperhealthDocument24 pagesHow To Achieve SuperhealthJulian Williams©™No ratings yet

- Court Survival GuideDocument53 pagesCourt Survival GuideextemporaneousNo ratings yet

- Milk Elizabeth NobleDocument13 pagesMilk Elizabeth NobleJulian Williams©™No ratings yet

- Notice of Intent To Preserve Interest CC880-330Document1 pageNotice of Intent To Preserve Interest CC880-330Gregg P. MillerNo ratings yet

- Understanding Certificate of TitleDocument15 pagesUnderstanding Certificate of Titlehoward almunidNo ratings yet

- Lawrence On Negotiable InstrumentsDocument10 pagesLawrence On Negotiable InstrumentsDeontosNo ratings yet

- Lawrence On Negotiable InstrumentsDocument10 pagesLawrence On Negotiable InstrumentsDeontosNo ratings yet

- Acc 4 Value BillofexchangeDocument2 pagesAcc 4 Value BillofexchangeChad Lange100% (1)

- The Kings Popes and Parasites in American HistoryDocument24 pagesThe Kings Popes and Parasites in American HistoryTiger Dimension-El100% (1)

- DTCC & CEDE Sample-LanguageDocument3 pagesDTCC & CEDE Sample-LanguageAnonymous nYwWYS3ntV100% (1)

- Go FigureDocument1 pageGo FigureA. CampbellNo ratings yet

- Department of The TreasuryDocument1 pageDepartment of The TreasuryShevis Singleton Sr.No ratings yet

- Sec Form DDocument5 pagesSec Form DPando DailyNo ratings yet

- How To Increase Your ConsciousnessDocument11 pagesHow To Increase Your ConsciousnessJulian Williams©™No ratings yet

- Application Form For World Passport, World Birth Card, World Birth Certificate, & World Identity CardDocument4 pagesApplication Form For World Passport, World Birth Card, World Birth Certificate, & World Identity CardRamon MartinezNo ratings yet

- Affidavit of Penalty of PurjuryDocument3 pagesAffidavit of Penalty of PurjuryYarod ELNo ratings yet

- Bought Into The SystemDocument7 pagesBought Into The SystemJulian Williams©™No ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsAnna CabreraNo ratings yet

- Letters - Allodium - The Lawful PathDocument4 pagesLetters - Allodium - The Lawful PathJulian Williams©™100% (3)

- Legal KnowledgeDocument37 pagesLegal Knowledgeanil kumarNo ratings yet

- US Internal Revenue Service: p1212 - 1997Document15 pagesUS Internal Revenue Service: p1212 - 1997IRSNo ratings yet

- How To Achieve Ultimate SuccessDocument36 pagesHow To Achieve Ultimate SuccessJulian Williams©™No ratings yet

- Instructions For Mailing Liquidation To Sec of TreasuryDocument1 pageInstructions For Mailing Liquidation To Sec of TreasuryFreeman LawyerNo ratings yet

- Florida Residential Landlord-Tenant LawDocument19 pagesFlorida Residential Landlord-Tenant LawRio2005No ratings yet

- Surety Bonds Explained for Contractors and LawyersDocument20 pagesSurety Bonds Explained for Contractors and Lawyershelenmckane67% (6)

- Banker's Confirmation Request Form: Personal BankingDocument1 pageBanker's Confirmation Request Form: Personal BankingArsalan HafeezNo ratings yet

- How To Achieve and Increase Personal PowerDocument22 pagesHow To Achieve and Increase Personal PowerJulian Williams©™No ratings yet

- Ye Must Be Born AgainDocument16 pagesYe Must Be Born AgaindeweyNo ratings yet

- Form of Protest Which May in Terms of Section Ninety-Eight ofDocument3 pagesForm of Protest Which May in Terms of Section Ninety-Eight ofJohn KronnickNo ratings yet

- Ucc 4Document66 pagesUcc 4Glenn Augenstein67% (3)

- POADocument3 pagesPOA2910inlandNo ratings yet

- The Right Way to Legally Challenge Government DemandsDocument12 pagesThe Right Way to Legally Challenge Government DemandsJulian Williams©™No ratings yet

- IRS clarification requestDocument7 pagesIRS clarification requestfisherre2000No ratings yet

- OFFICIAL NOTICE/DEMAND by An American Sovereign!: For The Record at LawDocument2 pagesOFFICIAL NOTICE/DEMAND by An American Sovereign!: For The Record at LawDantes KebreauNo ratings yet

- Buck Act PDFDocument3 pagesBuck Act PDFJulian Williams©™100% (1)

- Vaccination NoticeDocument2 pagesVaccination NoticeJulian Williams©™100% (2)

- 2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesDocument2 pages2A-505. Cancellation and Termination and Effect of Cancellation, Termination, Rescission, or Fraud On Rights and RemediesSheldon JungleNo ratings yet

- Fidelity Foreign Tax Certification Form GuideDocument2 pagesFidelity Foreign Tax Certification Form GuidemiscribeNo ratings yet

- Declaration of Abandonment of Declared Homestead: Recording Requested By: and When Recorded, Mail ToDocument1 pageDeclaration of Abandonment of Declared Homestead: Recording Requested By: and When Recorded, Mail TohramcorpNo ratings yet

- The Stamp Act 1899Document47 pagesThe Stamp Act 1899bakhtiarahmed7362No ratings yet

- Bond (Finance) : IssuanceDocument66 pagesBond (Finance) : IssuanceAnonymous 83chWz2voNo ratings yet

- Harbor Funds Letter InstructionDocument1 pageHarbor Funds Letter Instructioncsmith9100% (1)

- LienDocument2 pagesLienBharat PrajapatiNo ratings yet

- California Foreign Corp RegistrationDocument4 pagesCalifornia Foreign Corp Registrationthemoneycenter100% (1)

- Fall 2017 Security InterestDocument89 pagesFall 2017 Security InterestSarah EunJu LeeNo ratings yet

- Introductory Freedom GuideDocument20 pagesIntroductory Freedom GuideJulian Williams©™No ratings yet

- 15 US Code 1692e Restricts Misleading Debt Collection PracticesDocument4 pages15 US Code 1692e Restricts Misleading Debt Collection PracticesJunius EdwardNo ratings yet

- Acts of Congress Held UnconstitutionalDocument33 pagesActs of Congress Held UnconstitutionalJulian Williams©™No ratings yet

- Agricultural Land Reform Code of the Philippines (RA 3844Document26 pagesAgricultural Land Reform Code of the Philippines (RA 3844RogelineNo ratings yet

- Kundalini AwakeningDocument3 pagesKundalini AwakeningJulian Williams©™No ratings yet

- P.D SharmaDocument612 pagesP.D SharmaSiddhant Soni83% (18)

- Questions For Authorities & Bureaucrats PDFDocument2 pagesQuestions For Authorities & Bureaucrats PDF19simon85No ratings yet

- Sav 1851Document5 pagesSav 1851MichaelNo ratings yet

- Amended NoteDocument6 pagesAmended NoteForeclosure FraudNo ratings yet

- Right of Way Agreement SummaryDocument2 pagesRight of Way Agreement SummaryRamil F. De JesusNo ratings yet

- Attorney License Fraud Attorney'S License??? Ain'T No Such Thing!!!Document14 pagesAttorney License Fraud Attorney'S License??? Ain'T No Such Thing!!!Julio VargasNo ratings yet

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsFrom EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNo ratings yet

- SEO-Optimized Purchase Money Mortgage TitleDocument6 pagesSEO-Optimized Purchase Money Mortgage TitleJames Bradley StoddartNo ratings yet

- By Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Document11 pagesBy Bakampa Brian Baryaguma : Real Property, 5 Ed, Stevens & Sons LTD, p.913)Real TrekstarNo ratings yet

- Birth Certificate - What It IsDocument3 pagesBirth Certificate - What It IsAngela WigleyNo ratings yet

- Termination Procedure For ContractDocument9 pagesTermination Procedure For ContractKarthikNo ratings yet

- Is Government A Solution To AnythingDocument5 pagesIs Government A Solution To AnythingJulian Williams©™No ratings yet

- Methods and Modes of Terminating ContractsDocument83 pagesMethods and Modes of Terminating ContractsNusrat ShatyNo ratings yet

- Controlling QuestionDocument1 pageControlling QuestioniamsomedudeNo ratings yet

- Deed of Donation NewDocument1 pageDeed of Donation NewCristina MaquintoNo ratings yet

- Law of ContractsDocument102 pagesLaw of Contractsrajjuneja100% (5)

- The Nature of FreedomDocument5 pagesThe Nature of FreedomJulian Williams©™No ratings yet

- Regalian Doctrine and Native Title in Philippine Land LawDocument15 pagesRegalian Doctrine and Native Title in Philippine Land Lawzazzasim100% (1)

- Ignacio Frias Chua Vs Cfi of NegrosDocument6 pagesIgnacio Frias Chua Vs Cfi of NegrosYvon BaguioNo ratings yet

- Clogging the Equity of Redemption: An Outmoded ConceptDocument18 pagesClogging the Equity of Redemption: An Outmoded Conceptadvopreethi100% (1)

- Obli 1st Exam Syllabus For ReviewDocument6 pagesObli 1st Exam Syllabus For ReviewNikita DaceraNo ratings yet

- Disqualification of Justice, Judge, or Magistrate JudgeDocument4 pagesDisqualification of Justice, Judge, or Magistrate JudgeMarquise JenkinsNo ratings yet

- Property - Case Digest - Co-OwnershipDocument9 pagesProperty - Case Digest - Co-OwnershipGoodyNo ratings yet

- EXHIBIT 013 - Without United StatesDocument4 pagesEXHIBIT 013 - Without United StatesJesse Garcia100% (2)

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Document17 pagesGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508No ratings yet

- Private Car Package PolicyDocument16 pagesPrivate Car Package PolicyAwadhesh YadavNo ratings yet

- Sales Sample Q Sans F 09Document17 pagesSales Sample Q Sans F 09Tay Mon100% (1)

- From Freedom To Serfdom Rev - 19Document498 pagesFrom Freedom To Serfdom Rev - 19ronwestNo ratings yet

- CBS and Postal DepartmentDocument49 pagesCBS and Postal DepartmentK V Sridharan General Secretary P3 NFPENo ratings yet

- PDF 20200812 131130 142277012701921Document4 pagesPDF 20200812 131130 142277012701921Lee LienNo ratings yet

- Corp p05Document2 pagesCorp p05Mark ReinhardtNo ratings yet

- 1031 Drawdown Settlement OptionDocument1 page1031 Drawdown Settlement OptionMikeDouglas0% (1)

- AP 301 SOA RequestDocument1 pageAP 301 SOA RequestJason HenryNo ratings yet

- Maritime Law - Lamens TermsDocument5 pagesMaritime Law - Lamens TermsbiscuitheadNo ratings yet

- 5 Usc Part IiiDocument4 pages5 Usc Part IiiMike SiscoNo ratings yet

- MRC Constitution 96 eDocument13 pagesMRC Constitution 96 eMounir BelhadNo ratings yet

- The Seven Deadly SinsDocument2 pagesThe Seven Deadly SinsShirley BriagasNo ratings yet

- BIR Revised Deed of Sale 2MDocument2 pagesBIR Revised Deed of Sale 2MLeulaDianneCantosNo ratings yet

- Lecture Notes Lecture Semester 2 Easements and Covenants Ho 2016Document64 pagesLecture Notes Lecture Semester 2 Easements and Covenants Ho 2016YugenndraNaiduNo ratings yet

- Court Approves Increase in Size of Land Subdivision in Estate CaseDocument4 pagesCourt Approves Increase in Size of Land Subdivision in Estate CaseKeej DalonosNo ratings yet

- LTD Cases For Discussion - 09112020Document11 pagesLTD Cases For Discussion - 09112020Arnel MangilimanNo ratings yet

- Daep, April Dawn - FexampropertyDocument5 pagesDaep, April Dawn - FexampropertyApril Dawn DaepNo ratings yet

- Week3-EsP1Document19 pagesWeek3-EsP1Angeline BugayaoNo ratings yet

- Estates of Deceased PeopleDocument2 pagesEstates of Deceased PeoplePepa JuarezNo ratings yet

- Science 3 Week 2 Quarter 3Document8 pagesScience 3 Week 2 Quarter 3Mirasol Lumod SalaumNo ratings yet

- NEM P&P Cardbacks - Singles ISO With BleedDocument165 pagesNEM P&P Cardbacks - Singles ISO With BleedWilliam ElrichNo ratings yet

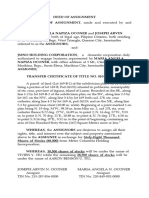

- Deed of AssignmentDocument2 pagesDeed of Assignmentpatricia anne dela cruzNo ratings yet

- اقتصاديات التعليم في ضوء إدارة الجودةDocument55 pagesاقتصاديات التعليم في ضوء إدارة الجودةوليد الرميزانNo ratings yet

- Ramirez G.R. No. L-27952Document3 pagesRamirez G.R. No. L-27952Mae TrabajoNo ratings yet

- Gratis Ebook Seri Balita Cerdas Alam Semesta PDFDocument30 pagesGratis Ebook Seri Balita Cerdas Alam Semesta PDFSukses Kelas 9No ratings yet

- Trust ActDocument67 pagesTrust ActPallavi UNo ratings yet

- Basabo ManagerDocument2 pagesBasabo Managersaddam hossainNo ratings yet

- Ashrae 55 2010Document44 pagesAshrae 55 2010GutikjhonNo ratings yet

- Eipr Report1Document15 pagesEipr Report1Akshay AsNo ratings yet

- De Gala Vs Gonzales Compared From Garcia Vs LacuestaDocument10 pagesDe Gala Vs Gonzales Compared From Garcia Vs LacuestaGerald GarcianoNo ratings yet

- Section 6 Analysis: Exceptions to Property TransferDocument11 pagesSection 6 Analysis: Exceptions to Property TransferrishabhNo ratings yet

- Rewpdf18 20110504Document29 pagesRewpdf18 20110504rscottcoNo ratings yet

- Contract of Lease for Land Between Abdukahal and VTLCDocument3 pagesContract of Lease for Land Between Abdukahal and VTLCEnrryson SebastianNo ratings yet