Professional Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

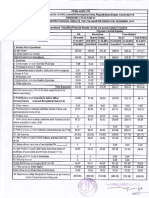

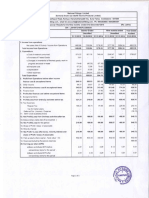

WINDSOR MACHINES LIMITED.

Regd. Office - 102/103, Dev Milan Co.Op. Housing Society, Next to Tip Top Plaza, LBS Road, Thane (W) - 400 604.

website: www.windsormachines.com, email: contact@windsormachines.com, CIN No.L99999MH1963PLC012642

STANDALONE UN- AUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED ON DECEMBER 31, 2014

PART I

` in Lacs

Sr.

No

Particulars

3 months ended

Preceding 3

on 31.12.2014 months ended on

30.09.2014

(Un-audited)

1

Income from operations

a) Net Sales/Income from operations

(Net of excise duty)

b) Other Operating Income

Total Income from operations (net)

9 Months ended on Corresponding 9 Previous Accounting

Year ended on

31.12.2014

Months in the

31.03.2014

previous year

ended on

31.12.2013

(Un-Audited)

(Un-Audited)

(Audited)

6,002.58

5,339.67

5,995.72

16,290.31

110.74

6,113.32

67.76

51.97

276.17

206.77

309.51

5,407.43

6,047.69

16,566.48

16,595.14

23,852.55

3,952.57

3,764.44

11,624.02

11,035.89

15,514.70

16388.37

23,543.04

Expenses

a) Cost of raw materials consumed

b) Changes in inventories of finished

goods, work-in-progress & stock in trade

c) Employee benefits expense

d) Depreciation and amortisation expense

e) Other expenses

(Un-audited)

Corresponding 3

months in the

previous year

ended on

31.12.2013

(Un-Audited)

Total expenses

Profit (+)/Loss (-) from Operations before other income,

finance costs & Exceptional items ( 1 - 2 )

3,868.63

(185.78)

(391.23)

64.29

(959.19)

(327.32)

113.59

842.11

763.14

699.74

2,334.24

2,003.93

115.36

96.41

63.66

314.45

189.18

253.19

989.89

5,630.21

782.45

903.30

2,626.15

2,260.72

3,067.36

5,203.34

5,495.43

15,939.67

15,162.40

21,660.72

483.11

204.09

552.26

626.81

1,432.74

2,191.83

2,711.88

Other Income

92.62

67.22

55.12

190.72

147.02

590.85

Profit (+)/ Loss (-) from ordinary activities before finance

costs & Exceptional Items ( 3+4 )

575.73

271.31

607.38

817.53

1,579.76

2,782.68

Finance Cost

161.69

12.45

32.73

194.26

102.13

133.06

Profit(+)/Loss(-) from ordinary activities after finance costs

but before Exceptional items ( 5-6 )

414.04

258.86

574.65

623.27

1,477.63

2,649.62

Exceptional Items

Profit(+)/Loss(-) from Ordinary Activities before tax ( 7+8 )

414.04

258.86

574.65

623.27

1,477.63

2,649.62

10

Tax expense (Refer note No. 3)

Current Tax

Deferred Tax

127.03

104.48

225.41

Net Profit(+)/Loss(-) from Ordinary Activities after tax (9-10)

287.01

574.65

397.86

11

12

Extraordinary item

13

Net Profit(+)/Loss after Taxes and Extraordinary items (1112)

14

154.38

690.88

1,477.63

1,958.74

287.01

154.38

574.65

397.86

1,477.63

1,958.74

1,298.64

1,298.64

1,298.64

1,298.64

1,298.64

1,298.64

0.44

0.24

0.89

0.61

2.28

Paid-up Equity Share Capital

(Face value of Rs.2/- each) .

15

Reserves & Surplus (excluding Revaluation Reserves)

16

Earning Per Share (EPS) (In `)

- Basic and diluted EPS before & after

extraordinary items for the period, for the year to

date and for the previous year (not annualized)

See accompanying note to the financial results

Page 1

3,940.99

3.02

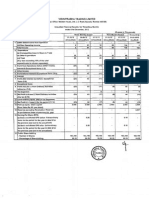

WINDSOR MACHINES LIMITED.

Regd. Office - 102/103, Dev Milan Co.Op. Housing Society, Next to Tip Top Plaza, LBS Road, Thane (W) - 400 604.

website: www.windsormachines.com, email: contact@windsormachines.com, CIN No.L99999MH1963PLC012642

STANDALONE UN- AUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED ON DECEMBER 31, 2014

PART II

Particulars

3 months ended

Preceding 3

on 31.12.2014 months ended on

30.09.2014

STANDALONE

Corresponding 3 9 Months ended on Corresponding 9 Previous Accounting

months in the

Year ended on

31.12.2014

Months in the

previous year

31.03.2014

previous year

ended on

ended on

31.12.2013

31.12.2013

(Un-Audited)

(Un-Audited)

(Un-Audited)

(Audited)

(Un-audited)

(Un-audited)

Particulars of Shareholding

1 Public shareholding:

- Number of Shares

27,431,800

27,431,800

26,966,128

27,431,800

26,966,128

27,431,800

- Percentage of shareholding

42.25%

42.25%

41.53%

42.25%

41.53%

42.25%

2 Promoters and promoter group shareholding:

a) Pledged/Encumbered

- Number of Shares

19,479,539

19,479,539

19,479,539

19,479,539

19,479,539

19,479,539

- Percentage of shares (as a % of the total

51.95%

51.95%

51.31%

51.95%

51.31%

51.95%

shareholding of promoter and promoter group)

30.00%

30.00%

30.00%

30.00%

30.00%

30.00%

- Percentage of shares (as a % of the total share

capital of the company)

b) Non-encumbered

- Number of Shares

18,020,461

18,020,461

18,486,133

18,020,461

18,486,133

18,020,461

- Percentage of shares (as a % of the total

48.05%

48.05%

48.69%

48.05%

48.69%

48.05%

shareholding of promoter and promoter group)

- Percentage of shares (as a % of the total share

27.75%

27.75%

28.47%

27.75%

28.47%

27.75%

capital of the company)

B INVESTOR COMPLAINTS

3 months ended Dec 31, 2014

Pending at the beginning of the quarter

NIL

Received during the quarter

11

Disposed of during the quarter

11

Remaining unresolved at the end of the quarter

NIL

NOTE :

1. The above financial results were reviewed and recommended by the Audit Committee and were approved by the Board of Directors at its meeting held on February 14, 2015. The

Statutory Auditors have carried out a limited review of stand alone financial results.

A

2. Segment Information for the quarter ended December 31, 2014 under Clause 41 of the Listing Agreement.

PRIMARY SEGMENT INFORMATION (BUSINESS SEGMENTS)

` in Lacs

STANDALONE

Sr.No

Particulars

3 months ended

Preceding 3

on 31.12.2014 months ended on

30.09.2014

(Un-audited)

(i)

(ii)

Segment Revenue

-Extrusion Machinery Division

-Injection Moulding Machinery

Total Segment Revenue

Segment Results

-Extrusion Machinery Division

-Injection Moulding Machinery

Total Segment Results

Unallocated Corporate Expenses net of unallocated income

Profit / (Loss)before interest etc., Extra - ordinary items and

taxation

Finance cost

Profit / (Loss) before taxation and Extra - Ordinary items

Tax Expenses.

Current Tax

Deferred tax.

Net Profit/ (Loss) from Ordinary Activities after tax.

Extraordinary items.

(iii)

3,101.64

3,011.68

6,113.32

(Un-audited)

2,329.04

3,078.39

5,407.43

Corresponding 3

months in the

previous year

ended on

31.12.2013

(Un-Audited)

9 Months ended on Corresponding 9 Previous Accounting

31.12.2014

Months in the

Year ended on

previous year

31.03.2014

ended on

31.12.2013

(Un-Audited)

(Audited)

(Un-Audited)

2,784.44

3,263.25

6,047.69

7,707.60

8,858.88

16,566.48

8,438.18

8,156.96

16,595.14

12,239.56

11,612.99

23,852.55

348.94

201.71

550.65

298.98

(65.68)

233.30

381.77

188.96

570.73

639.23

83.93

723.16

1,133.10

323.70

1,456.80

1,858.10

773.67

2,631.77

25.08

38.01

36.65

94.37

122.96

150.91

575.73

161.69

271.31

12.45

607.38

32.73

817.53

194.26

1,579.76

102.13

2,782.68

133.06

414.04

258.86

574.65

623.27

1,477.63

2,649.62

127.03

287.01

-

104.48

154.38

-

574.65

-

225.41

397.86

-

1,477.63

-

690.88

1,958.74

-

Net Profit / (Loss) after taxation & extra - ordinary items.

287.01

154.38

574.65

397.86

1,477.63

1,958.74

Capital Employed

(Segment Assets Less Segment Liabilities)

-Extrusion Machinery Division

830.48

136.85

369.64

830.48

369.64

1,137.99

-Injection Moulding Machinery

2,237.50

1,624.61

1,709.49

2,237.50

1,709.49

2,364.64

Total capital employed in segments

3,067.98

1,761.46

2,079.13

3,067.98

2,079.13

3,502.63

Unallocated Corporate assets less corporate liabilities

3,746.14

3,697.47

3,406.69

3,746.14

3,406.69

2,282.47

Total Capital employed.

6,814.12

5,458.93

5,485.82

6,814.12

5,485.82

5,785.10

The segment revenue and total assets include the revenue and assets respectively, which are identifiable with each segment and amounts allocated to the segments on a reasonable

basis.

Page 2

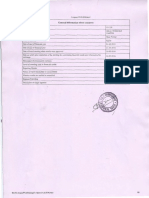

WINDSOR MACHINES LIMITED.

Regd. Office - 102/103, Dev Milan Co.Op. Housing Society, Next to Tip Top Plaza, LBS Road, Thane (W) - 400 604.

website: www.windsormachines.com, email: contact@windsormachines.com, CIN No.L99999MH1963PLC012642

STANDALONE UN- AUDITED FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED ON DECEMBER 31, 2014

3. The Company has filed a Miscellaneous application before the Hble Board for Industrial and Financial Reconstruction (BIFR)-New Delhi on May 20, 2013 for granting tax

reliefs/concessions under the Income Tax Act, 1961 as per the Sanctioned Scheme of BIFR. The Miscellaneous application is pending for disposal, hence provisions of Income Tax

(including MAT) has not been made.

4. The management of the Company has identified tangible fixed assets and their major components and has reviewed / determined their remaining useful lives. The tangible fixed

assets for which useful life is different than the one prescribed in the Schedule II are (1) Testing and Inspection Equipment < ` 5000 & (2) Testing and Inspection Equipment > ` 5000,

and there Useful Life are estimated as 1 Year and 3 Years respetively. Accordingly, the depreciation on tangible fixed assets is provided for as per the provisions of Schedule II to the

Companies Act, 2013. In respect of assets where the remaining useful life is Nil, ` 73.38 Lacs their carrying amount (net of tax effect) after retaining the residual value as on April1,

2014 as determined by the management has been adjusted against the opening balance of retained earnings as on that date. This being a technical matter has been relied upon by

the auditors.

5. The Consolidated accounts will be published for the year ended March 31, 2015 in accordance with the relavant provision of law. For the nine months ended December 31, 2014,

Wintech B.V., wholly own subsidiary, has incurred losses of Euro 1.17 Millions (Rs. 91.5 Millions) as per its unaudited account for that period.

6. Pursuant to the requirements of Clause 41 of the listing agreement the statutory Auditors of the company have carried out a Limited Review of the unaudited quarterly & nine

months results of the company for the quarter and nine months ended on December 31, 2014.

7. Previous period figures have been regrouped / reclassified, wherever necessary, to make them comparable with current period figures.

By Order of the Board

For, Windsor Machines Limited

Place: :Mumbai

Date: February 14, 2015

K.C Gupte

Executive Director

Page 3

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument6 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Document6 pagesStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document23 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For December 31, 2015 (Result)Document2 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ITC LimitedDocument7 pagesITC LimitedlovemethewayiamNo ratings yet

- Balance Sheet 2016Document30 pagesBalance Sheet 2016Aakash AgrawalNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Reference Form 2016Document270 pagesReference Form 2016MillsRINo ratings yet

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Reference Form 2015Document271 pagesReference Form 2015MillsRINo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- BEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Document3 pagesBEML Limited: (A Govt. of India Mini Ratna Company Under Ministry of Defence)Kapil SharmaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document23 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document7 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document6 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNo ratings yet

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For March 31, 2016 (Result)Document10 pagesRevised Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- BHL Fin Res 2011 12 q1 MillionDocument2 pagesBHL Fin Res 2011 12 q1 Millionacrule07No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Form-25 Fitness RenewalDocument3 pagesForm-25 Fitness Renewalbalaji stationersNo ratings yet

- EIU Collibra Transforming Data Into Action-The Business Outlook For Data Governance 0Document16 pagesEIU Collibra Transforming Data Into Action-The Business Outlook For Data Governance 0Mario Alejandro Charlin SteinNo ratings yet

- Tax Alert - Revised Commercial Code of Ethiopia - FinalDocument1 pageTax Alert - Revised Commercial Code of Ethiopia - FinalBooruuNo ratings yet

- Chap 012Document14 pagesChap 012HassaanAhmadNo ratings yet

- Corporate Identity ManualDocument54 pagesCorporate Identity ManualAleksandra Ruzic67% (3)

- Halmore - PL 25923 - BOP 1 (Non COA 12)Document10 pagesHalmore - PL 25923 - BOP 1 (Non COA 12)Humayun NawazNo ratings yet

- OR2 Review 2013 PDFDocument17 pagesOR2 Review 2013 PDFhshshdhdNo ratings yet

- Credit Application 2023Document1 pageCredit Application 2023Jean Pierre PerrierNo ratings yet

- AccountingDocument336 pagesAccountingVenkat GV100% (2)

- Social Cost Benefit AnalysisDocument13 pagesSocial Cost Benefit AnalysisMohammad Nayamat Ali Rubel100% (1)

- Regional Sales Account Manager in Scottsdale Phoenix AZ Resume Frank BortelDocument2 pagesRegional Sales Account Manager in Scottsdale Phoenix AZ Resume Frank BortelFrankBortelNo ratings yet

- Internal Control Policy Manual SCHOOLSDocument23 pagesInternal Control Policy Manual SCHOOLSmaryann lumactaoNo ratings yet

- Report PBCDocument5 pagesReport PBCTOP No LimitNo ratings yet

- BS 2898Document16 pagesBS 2898jiwani87No ratings yet

- Corporation: Basic Concepts in Establishing OneDocument26 pagesCorporation: Basic Concepts in Establishing OnearctikmarkNo ratings yet

- Magnetic Sponsoring by Mike DillardDocument116 pagesMagnetic Sponsoring by Mike DillardChristine Stevie Grey100% (10)

- Advertising (MNT Dew)Document10 pagesAdvertising (MNT Dew)Yash GopalkaNo ratings yet

- Bar Frauds & FormsDocument41 pagesBar Frauds & FormsOm Singh100% (6)

- CV Asif Hamid Sales ExecutiveDocument4 pagesCV Asif Hamid Sales Executivelubnaasifhamid100% (1)

- Intermediate Accounting Exam 3Document2 pagesIntermediate Accounting Exam 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- OD223976402654163000Document4 pagesOD223976402654163000Aditya JaiswalNo ratings yet

- Conf 92EC AgendaBook 21821Document384 pagesConf 92EC AgendaBook 21821Tushar ChaudhariNo ratings yet

- 01-Sithind001b - Updated To Sit07v2.3Document13 pages01-Sithind001b - Updated To Sit07v2.3Samuel Fetor YaoNo ratings yet

- 9708 s04 QP 4Document4 pages9708 s04 QP 4Diksha KoossoolNo ratings yet

- House of TataDocument36 pagesHouse of TataHarsh Bhardwaj0% (1)

- 300 - PEI - Jun 2019 - DigiDocument24 pages300 - PEI - Jun 2019 - Digimick ryanNo ratings yet

- BWI 6th Synthesis Report v3.2 FINAL enDocument5 pagesBWI 6th Synthesis Report v3.2 FINAL enJulio Best Setiyawan100% (1)

- Term Paper On FDIDocument42 pagesTerm Paper On FDITarikul Islam Shoeb67% (3)

- Chapter 3Document62 pagesChapter 3K60 Cù Thảo LyNo ratings yet

- Aki Insurance Industry Report 2009Document40 pagesAki Insurance Industry Report 2009cimcim0812No ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet