Professional Documents

Culture Documents

Financial Statement Analysis

Uploaded by

daregumacalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement Analysis

Uploaded by

daregumacalCopyright:

Available Formats

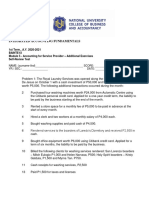

LOPEZ HOLDING CORPORATION

Horizontal Analysis-Comparative Statement of Financial Position

December 31, 2014

2014

Increase (Decrease)

2013 Amount Percent

ASSETS

Current Assets

Cash and cash equivalent

Short Term Investment

Inventories

Other current assets

Total current assets

Non- Current Assets

Property, plant & equipment

Goodwill

Intangible Assets

Deferred Income Tax

Prepaid Pension Benefit

Other Long Term Assets

106,526

53,433

2,675

13,405

32,740

102,25

3

118,938

96,286

22,652

19.05%

53,971

2,064

(367)

(62)

(114)

6,400

0.68%

3.00%

11.18%

Total Non-Current Asset

232,198

54,338

2,126

114

50,825

203,68

9

305,94

2

Equity

28,509

12.28%

32,782

9.68%

41.60%

100.00%

76.62%

1334.88%

25.44%

Total Assets

46,681

5,335

15,218

39,292

57,225

338,724

Liabilities & Shareholder's

Liabilities

Current Liabilities

Short Term Debts

Accouts Payable

Taxes Payable

Other Current Liabilities

Total current Liabilities

Non-Current Liabilities

Long Term Debt

Deferred Taxes Liabilities

Accrued Liabilities

Pensions and other Benefit Liabilities

Minority Interest

Other Long Term Liabilities

Total Non-Current Liabilities

Total Liabilities

Shareholder's Equity

Paid-up Capital

Retained Earnings

Accumulated other comprehensive income

(6,752)

2,660

1,813

6,552

14.46%

49.86%

11.91%

16.68%

4,273

4.01%

21,126

31,654

928

2,021

55,729

12,338

217

28,999

41,554

8,788

31,654

711

(26,978)

14,175

143,157

3,179

137,471

2,835

5,686

344

3.97%

10.82%

87,276

7,092

240,704

296,433

75,907

7,393

223,606

265,160

11,369

(301)

17,098

31,273

13.03%

4.24%

7.10%

10.55%

54

44,174

-1,937

31

40,112

639

23

4,062

(2,576)

42.59%

9.20%

132.99%

Total Shareholder's Equity

Total Liabilities & shareholder's Equity

42,291

338,724

40,782

305,942

1,509

32,782

3.57%

9.68%

LOPEZ HOLDING CORPORATION

Horizontal Analysis-Comparative Income Statements

December 31, 2014

Increase (Decrease)

2014

Revenue

2013 Amount

Percent

100,654

93,308

7,346

7.30%

Cost of Revenue

63,507

64,371

(864)

1.36%

Gross Profit

37,147

28,937

8,210

22.10%

13,586

11,593

1,993

14.67%

3,376

5,698

(2,322)

68.78%

Total Operating Expenses

16,962

17,291

(329)

1.94%

Operating Income

20,185

11,646

8,539

42.30%

526

-804

1,330

252.85%

20,711

10,842

9,869

47.65%

4,378

3,383

995

22.73%

16,333

7,459

8,874

54.33%

-573

-5,516

4,943

862.65%

-12,000

1,943

(13,943)

116.19%

3,760

1,943

1,817

48.32%

Operating Expenses

Research & Development

Sales, General, administrative expenses

Other Operating expenses

Other Income

Income Before Taxes

Provision for Income Taxes

Net Income From continuing operation

Net Income From discontinuing operation

Other

Net Income

LOPEZ HOLDING CORPORATION

Vertical Analysis-Comparative Income Statements

December 31, 2014

2014

2013

2014

2013

100,654

93,308

100.00%

100.00%

Cost of Revenue

63,507

64,371

63.09%

68.99%

Gross Profit

37,147

28,937

36.91%

31.01%

0.00%

0.00%

Revenue

Operating Expenses

Sales, General, administrative expenses

13,586

11,593

13.50%

12.42%

3,376

5,698

3.35%

6.11%

Total Operating Expenses

16,962

17,291

16.85%

18.53%

Operating Income

20,185

11,646

20.05%

12.48%

526

-804

0.52%

0.86%

20,711

10,842

20.58%

11.62%

4,378

3,383

4.35%

3.63%

16,333

7,459

16.23%

7.99%

-573

-5,516

0.57%

5.91%

-12,000

1,943

11.92%

2.08%

3,760

1,943

3.74%

2.08%

Other Operating expenses

Other Income

Income Before Taxes

Provision for Income Taxes

Net Income From continuing operation

Net Income From discontinuing operation

Other

Net Income

LOPEZ HOLDING CORPORATION

Vertical Analysis-Comparative Statement of Financial Position

December 31, 2014

Current Assets

Cash and cash equivalent

Short Term Investment

Inventories

Other current assets

Total current assets

Non- Current Assets

Property, plant & equipment

Goodwill

Intangible Assets

Deferred Income Tax

Prepaid Pension Benefit

Other Long Term Assets

Total Non-Current Asset

Total Assets

ASSETS

2014

46,681

5,335

15,218

39,292

106,526

2013

53,433

2,675

13,405

32,740

102,253

2014

13.78%

1.58%

4.49%

11.60%

31.45%

2013

17.47%

0.87%

4.38%

10.70%

33.42%

118,938

96,286

35.11%

31.47%

54,338

15.93%

2,126

0.61%

114

57,225

50,825

16.89%

232,198 203,689

68.55%

338,724 305,942 100.00%

Liabilities & Shareholder's Equity

17.76%

0.69%

0.04%

16.61%

66.58%

100.00%

Liabilities

Current Liabilities

Short Term Debts

Accouts Payable

Taxes Payable

Other Current Liabilities

Total current Liabilities

Non-Current Liabilities

Long Term Debt

Deferred Taxes Liabilities

Accrued Liabilities

Pensions and other Benefit Liabilities

Minority Interest

Other Long Term Liabilities

Total Non-Current Liabilities

Total Liabilities

Shareholder's Equity

Paid-up Capital

Retained Earnings

Accumulated other comprehensive income

53,971

2,064

21,126

31,654

928

2,021

55,729

12,338

217

28,999

41,554

6.24%

9.35%

0.27%

0.60%

16.45%

4.03%

0.07%

9.48%

13.58%

143,157

3,179

137,471

2,835

42.26%

0.94%

44.93%

0.93%

87,276

7,092

240,704

296,433

75,907

7,393

223,606

265,160

25.77%

2.09%

71.06%

87.51%

24.81%

2.42%

73.09%

86.67%

54

44,174

-1,937

31

40,112

639

0.02%

13.04%

0.57%

0.01%

13.11%

0.21%

Total Shareholder's Equity

Total Liabilities & shareholder's Equity

42,291

338,724

40,782

305,942

Financial Ratios

Profitability

1. Gross Profit Ratio

2014

37,147/100,654

=36.91%

2013

28,937/93,308 =31.01%

2. Operating Ratio

2014

20,185/100,654

=20.05%

2013

11,646/93,308 =12.48%

3. Return on Revenue

2014

3,760/100,654 =3.74%

2013

1,943/93,308 =2.08%

Liquidity

1. Working Capital

2014

106,526-55,729

2013

102,253-41,554

2. Current Ratio

2014

106,526/55,729

2013

102,253/41,554

3. Asset Turnover

2014

100,654/322,333

2013

93,308/305,942

=50,797

=60,699

=1.91 : 1

=2.46 : 1

=31 times

=.3 times

Solvency

1. Debt Ratio

2014

2013

2. Equity Ratio

2014

2013

296,433/338,724

265,160/305,942

=87.51%

=86.67%

42,291/338,724

40,782/305,942

=12.49%

=13.33%

12.49%

100.00%

13.33%

100.00%

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Assignment in SOCIAL DIMENTION of EducationDocument3 pagesAssignment in SOCIAL DIMENTION of Educationdaregumacal54% (13)

- Semenar Topic MeDocument23 pagesSemenar Topic MedaregumacalNo ratings yet

- 6 - Plane Mirrors LessonDocument23 pages6 - Plane Mirrors LessondaregumacalNo ratings yet

- Case CorpDocument4 pagesCase CorpdaregumacalNo ratings yet

- Xiv. Duties of Directors and Controlling StockholdersDocument1 pageXiv. Duties of Directors and Controlling StockholdersdaregumacalNo ratings yet

- Held: 1. The Right of ExclusiveDocument1 pageHeld: 1. The Right of ExclusivedaregumacalNo ratings yet

- Journal Entries, T Account, Trial BalanceDocument3 pagesJournal Entries, T Account, Trial BalancedaregumacalNo ratings yet

- Corporation Code of The Philippines ReviewerDocument3 pagesCorporation Code of The Philippines Reviewerdaregumacal100% (1)

- LiteratureDocument20 pagesLiteraturedaregumacal100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- VAT in IndiaDocument2 pagesVAT in IndiagundujumpuNo ratings yet

- Compendium On Local Property Taxes & Other Taxes in The NCRDocument35 pagesCompendium On Local Property Taxes & Other Taxes in The NCRBo DistNo ratings yet

- Payslip TemplateDocument1 pagePayslip TemplatemashipooNo ratings yet

- Statement of Receipts and ExpendituresDocument1 pageStatement of Receipts and ExpendituresNorma CanoyNo ratings yet

- Schedule of Fees & Charges November 2021 (English)Document1 pageSchedule of Fees & Charges November 2021 (English)Tabish JazbiNo ratings yet

- gst523 1 Fill 15eDocument3 pagesgst523 1 Fill 15eJeff MNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pragyakta SinghNo ratings yet

- Invoice 23Document1 pageInvoice 23kuldeep singhNo ratings yet

- Final ExaminationDocument3 pagesFinal ExaminationFrancis Dave MabborangNo ratings yet

- Tax - Midterm NTC 2017Document12 pagesTax - Midterm NTC 2017Red YuNo ratings yet

- SCC Welcome PDFDocument4 pagesSCC Welcome PDFfibiro9231No ratings yet

- JPMCStatementDocument4 pagesJPMCStatementesteysi775No ratings yet

- EastWest Consumer LendingDocument4 pagesEastWest Consumer LendingCrestNo ratings yet

- TE Ch13Document10 pagesTE Ch131anthonyanthony7No ratings yet

- V3 Bachelor of Law and Sharia KUCCPS4Document1 pageV3 Bachelor of Law and Sharia KUCCPS4AllanNo ratings yet

- Cta CaseDocument10 pagesCta Caselucial_68No ratings yet

- SARS Tax ClearenceDocument1 pageSARS Tax ClearenceLelo MkhizeNo ratings yet

- IDFCFIRSTBankstatement 10110872462 213022617Document2 pagesIDFCFIRSTBankstatement 10110872462 213022617SATISH SNEHINo ratings yet

- 03042019224419ghl3mz627ub0c5pdyw Estatement 032019 1858 PDFDocument4 pages03042019224419ghl3mz627ub0c5pdyw Estatement 032019 1858 PDFSachinNo ratings yet

- Invoice: Billing DetailsDocument1 pageInvoice: Billing DetailsAlina IkaNo ratings yet

- Charge SlipDocument2 pagesCharge SlipSunny GuptaNo ratings yet

- Taxation Solution 2018 MarchDocument11 pagesTaxation Solution 2018 MarchNg GraceNo ratings yet

- StatementDocument99 pagesStatementmdarsalankhan.hseNo ratings yet

- TSB Statement Maris KalvansDocument1 pageTSB Statement Maris Kalvansanastasiya DubininaNo ratings yet

- Kerala State Electricity Board Limited: Demand Cum Disconnection NoticeDocument2 pagesKerala State Electricity Board Limited: Demand Cum Disconnection NoticeAskar AsaruNo ratings yet

- Profit Sharing Agreement SampleDocument4 pagesProfit Sharing Agreement SampleCatherine LopezNo ratings yet

- ACTIVITY 06 Accounting For A Service Provider Additional ExercisesDocument3 pagesACTIVITY 06 Accounting For A Service Provider Additional Exercises이시연No ratings yet

- 6018-P1-SPK-AKUNTANSI-Data Mentah SoalDocument20 pages6018-P1-SPK-AKUNTANSI-Data Mentah Soaliqbal kamilNo ratings yet

- It 000129964508 2022 11Document1 pageIt 000129964508 2022 11SkjhkjhkjhNo ratings yet

- A Guide To Your Statements of Account Received During The Enhanced Community QuarantineDocument6 pagesA Guide To Your Statements of Account Received During The Enhanced Community QuarantineNotes CraftNo ratings yet