Professional Documents

Culture Documents

Minimizing Bussing Costs When Assigning Students to Schools

Uploaded by

Naresh HariyaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Minimizing Bussing Costs When Assigning Students to Schools

Uploaded by

Naresh HariyaniCopyright:

Available Formats

hil61217_ch04_case.

qxd

5/12/04

17:11

Page 7

ADDITIONAL CASES

CASE 4.2

NEW FRONTIERS

Rob Richman, president of AmeriBank, takes off his glasses,

rubs his eyes in exhaustion, and squints at the clock in his

study. It reads 3 A.M. For the last several hours, Rob has been

poring over AmeriBanks financial statements from the last

three quarters of operation. AmeriBank, a medium-sized bank

with branches throughout the United States, is headed for dire

economic straits. The bank, which provides transaction, savings, and investment and loan services, has been experiencing

a steady decline in its net income over the past year, and trends

show that the decline will continue. The bank is simply losing customers to nonbank and foreign bank competitors.

AmeriBank is not alone in its struggle to stay out of the

red. From his daily industry readings, Rob knows that many

American banks have been suffering significant losses because of increasing competition from nonbank and foreign

bank competitors offering services typically in the domain

of American banks. Because the nonbank and foreign bank

competitors specialize in particular services, they are able

to better capture the market for those services by offering

less expensive, more efficient, more convenient services. For

example, large corporations now turn to foreign banks and

commercial paper offerings for loans, and affluent Americans now turn to money-market funds for investment. Banks

face the daunting challenge of distinguishing themselves

from nonbank and foreign bank competitors.

Rob has concluded that one strategy for distinguishing

AmeriBank from its competitors is to improve services that

nonbank and foreign bank competitors do not readily provide: transaction services. He has decided that a more convenient transaction method must logically succeed the automatic teller machine, and he believes that electronic

banking over the Internet allows this convenient transaction

method. Over the Internet, customers are able to perform

transactions on their desktop computers either at home or at

work. The explosion of the Internet means that many potential customers understand and use the World Wide Web.

He therefore feels that if AmeriBank offers Web banking (as

the practice of Internet banking is commonly called), the

bank will attract many new customers.

Before Rob undertakes the project to make Web banking possible, however, he needs to understand the market for

Web banking and the services AmeriBank should provide

over the Internet. For example, should the bank only allow

customers to access account balances and historical transaction information over the Internet, or should the bank develop a strategy to allow customers to make deposits and

withdrawals over the Internet? Should the bank try to recapture a portion of the investment market by continuously

running stock prices and allowing customers to make stock

transactions over the Internet for a minimal fee?

Because AmeriBank is not in the business of performing surveys, Rob has decided to outsource the survey project to a professional survey company. He has opened the

project up for bidding by several survey companies and will

award the project to the company which is willing to perform the survey for the least cost.

Sophisticated Surveys is one of three survey companies

competing for the project. Rob provided each survey company with a list of survey requirements to ensure that

AmeriBank receives the needed information for planning the

Web banking project.

Because different age groups require different services, AmeriBank is interested in surveying four different

age groups. The first group encompasses customers who

are 18 to 25 years old. The bank assumes that this age

group has limited yearly income and performs minimal

transactions. The second group encompasses customers

who are 26 to 40 years old. This age group has significant

sources of income, performs many transactions, requires

numerous loans for new houses and cars, and invests in

various securities. The third group encompasses customers

who are 41 to 50 years old. These customers typically have

the same level of income and perform the same number of

transactions as the second age group, but the bank assumes

that these customers are less likely to use Web banking since

they have not become as comfortable with the explosion of

computers or the Internet. Finally, the fourth group encompasses customers who are 51 years of age and over.

These customers commonly crave security and require continuous information on retirement funds. The banks believes

that it is highly unlikely that customers in this age group

will use Web banking, but the bank desires to learn the needs

7

hil61217_ch04_case.qxd

5/12/04

17:11

Page 8

ADDITIONAL CASES

of this age group for the future. AmeriBank wants to interview 2,000 customers with at least 20 percent from the first

age group, at least 27.5 percent from the second age group,

at least 15 percent from the third age group, and at least 15

percent from the fourth age group.

Rob wants to ensure that the survey includes a mix of customers who know the Internet well and those that have less exposure to the Internet. To ensure that AmeriBank obtains the correct mix, he wants to interview at least 15 percent of customers

from the Silicon Valley where Internet use is high, at least

35 percent of customers from big cities where Internet use

is medium, and at least 20 percent of customers from small

towns where Internet use is low.

Sophisticated Surveys has performed an initial analysis

of these survey requirements to determine the cost of surveying different populations. The costs per person surveyed

are listed in the following table:

Age Group

Region

Silicon Valley

Big cities

Small towns

18 to 25

26 to 40

41 to 50

51 and over

$4.75

$5.25

$6.50

$6.50

$5.75

$7.50

$6.50

$6.25

$7.50

$5.00

$6.25

$7.25

Sophisticated Surveys explores the following options

cumulatively.

(a) Formulate a linear programming model to minimize costs

while meeting all survey constraints imposed by AmeriBank.

(b) If the profit margin for Sophisticated Surveys is 15 percent of

cost, what bid will they submit?

(c) After submitting its bid, Sophisticated Surveys is informed that

it has the lowest cost but that AmeriBank does not like the solution. Specifically, Rob feels that the selected survey population is not representative enough of the banking customer population. Rob wants at least 50 people of each age group

surveyed in each region. What is the new bid made by

Sophisticated Surveys?

(d) Rob feels that Sophisticated Survey oversampled the 18- to 25year-old population and the Silicon Valley population. He imposes a new constraint that no more than 600 individuals can

be surveyed from the 18- to 25-year-old population and no more

than 650 individuals can be surveyed from the Silicon Valley

population. What is the new bid?

(e) When Sophisticated Surveys calculated the cost of reaching

and surveying particular individuals, the company thought that

reaching individuals in young populations would be easiest. In

a recently completed survey, however, Sophisticated Surveys

learned that this assumption was wrong. The new costs for surveying the 18- to 25-year-old population are listed below.

CASE 4.3

Region survey cost per person

Silicon Valley

Big cities

Small towns

$6.50

$6.75

$7.00

Given the new costs, what is the new bid?

(f) To ensure the desired sampling of individuals, Rob imposes

even stricter requirements. He fixes the exact percentage of

people that should be surveyed from each population. The requirements are listed below:

Population percentage

of people surveyed

18

26

41

51

to 25

to 40

to 50

and over

25%

35%

20%

20%

Silicon Valley

Big cities

Small towns

20%

50%

30%

By how much would these new requirements increase the cost of

surveying for Sophisticated Surveys? Given the 15 percent profit

margin, what would Sophisticated Surveys bid?

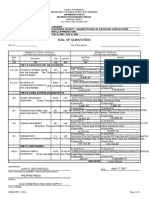

ASSIGNING STUDENTS TO SCHOOLS

The Springfield school board has made the decision to close

one of its middle schools (sixth, seventh, and eighth grades)

at the end of this school year and reassign all of next years

middle school students to the three remaining middle

schools. The school district provides bussing for all middle

school students who must travel more than approximately a

mile, so the school board wants a plan for reassigning the

students that will minimize the total bussing cost. The

hil61217_ch04_case.qxd

5/12/04

17:11

Page 9

CASE 4.3

ASSIGNING STUDENTS TO SCHOOLS

annual cost per student of bussing from each of the six residential areas of the city to each of the schools is shown in

the following table (along with other basic data for next

No. of

Area Students

1

2

3

4

5

6

450

600

550

350

500

450

year), where 0 indicates that bussing is not needed and a

dash indicates an infeasible assignment.

Percentage Percentage Percentage

Bussing Cost per Student

in 6th

in 7th

in 8th

Grade

Grade

Grade

School 1 School 2 School 3

32

37

30

28

39

34

38

28

32

40

34

28

30

35

38

32

27

38

School capacity:

The school board also has imposed the restriction that

each grade must constitute between 30 and 36 percent of

each schools population. The above table shows the percentage of each areas middle school population for next

year that falls into each of the three grades. The school attendance zone boundaries can be drawn so as to split any

given area among more than one school, but assume that the

percentages shown in the table will continue to hold for any

partial assignment of an area to a school.

You have been hired as an operations research consultant to assist the school board in determining how many students in each area should be assigned to each school.

(a) Formulate a linear programming model for this problem.

(b) Solve the model.

(c) What is your resulting recommendation to the school board?

After seeing your recommendation, the school board expresses concern about all the splitting of residential areas

among multiple schools. They indicate that they would like

to keep each neighborhood together.

(d) Adjust your recommendation as well as you can to enable each

area to be assigned to just one school. (Adding this restriction

may force you to fudge on some other constraints.) How much

does this increase the total bussing cost? (This line of analysis

will be pursued more rigorously in Case 11.4.)

The school board is considering eliminating some

bussing to reduce costs. Option 1 is to eliminate bussing only

$300

$600

$200

0

$500

0

$400

$300

$500

$300

$700

$500

$200

$400

0

900

1,100

1,000

for students traveling 1 to 1.5 miles, where the cost per student is given in the table as $200. Option 2 is to also eliminate bussing for students traveling 1.5 to 2 miles, where the

estimated cost per student is $300.

(e) Revise the model from part (a) to fit Option 1, and solve. Compare these results with those from part (c), including the reduction in total bussing cost.

(f) Repeat part (e) for Option 2.

The school board now needs to choose among the three

alternative bussing plans (the current one or Option 1 or Option 2). One important factor is bussing costs. However, the

school board also wants to place equal weight on a second

factor: the inconvenience and safety problems caused by

forcing students to travel by foot or bicycle a substantial distance (more than a mile, and especially more than 1.5 miles).

Therefore, they want to choose a plan that provides the best

trade-off between these two factors.

(g) Use your results from parts (c), (e), and ( f ) to summarize the

key information related to these two factors that the school

board needs to make this decision.

(h) Which decision do you think should be made? Why?

Note: A data file for this case is included on the CD-ROM

for your convenience. Also note that this case will be continued in later chapters (Cases 6.3 and 11.4), so we suggest

that you save your analysis, including your basic model.

You might also like

- New Frontiers Case Study Analysis orDocument15 pagesNew Frontiers Case Study Analysis orKaushik Mandal90% (10)

- Shaking Tables Around The WorldDocument15 pagesShaking Tables Around The Worlddjani_ip100% (1)

- RBC CaseAnswers Group13Document4 pagesRBC CaseAnswers Group13Shikha Gupta100% (1)

- Hil61217 ch04 CaseDocument3 pagesHil61217 ch04 CaseRupam JainNo ratings yet

- Q1 2016 Net Lease Bank Ground Lease ReportDocument3 pagesQ1 2016 Net Lease Bank Ground Lease ReportnetleaseNo ratings yet

- Backbase Omni Channel Banking Report 2Document52 pagesBackbase Omni Channel Banking Report 2Kıvanç AkdenizNo ratings yet

- Online BankingDocument68 pagesOnline BankingArvind Sanu MisraNo ratings yet

- Economics Higher Level Paper 3: Instructions To CandidatesDocument20 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres LopezNo ratings yet

- Problem Statement of or Assignment of Group-DDocument5 pagesProblem Statement of or Assignment of Group-DSusanta HotaNo ratings yet

- Ejercicio de GamsDocument15 pagesEjercicio de GamsclaudiamogoNo ratings yet

- New Frontiers Case Study Analysis orDocument8 pagesNew Frontiers Case Study Analysis orMaunilShethNo ratings yet

- AmeriBank Survey Services CustomersDocument6 pagesAmeriBank Survey Services CustomersAishwarya ChintaNo ratings yet

- Banking Sector-An Overview: Syed Asad Raza HBLDocument39 pagesBanking Sector-An Overview: Syed Asad Raza HBL007tahir007No ratings yet

- Online or Offline? The Rise of Peer To Peer Lending in MicrofinanceDocument11 pagesOnline or Offline? The Rise of Peer To Peer Lending in MicrofinanceNgọc Minh Đỗ NguyễnNo ratings yet

- Feb Hit 36 BvilleDocument1 pageFeb Hit 36 BvillePrice LangNo ratings yet

- Electronic Banking Is An Umbrella Term For The Process by Which A Customer May Perform BankingDocument15 pagesElectronic Banking Is An Umbrella Term For The Process by Which A Customer May Perform BankingDrNeeraj N. RanaNo ratings yet

- RBC CaseAnswers Group13Document4 pagesRBC CaseAnswers Group13Jayesh KukretiNo ratings yet

- Slide - 1: (Click) (Click) (Click) (Click)Document3 pagesSlide - 1: (Click) (Click) (Click) (Click)shuvojitNo ratings yet

- RBC QuestionsDocument3 pagesRBC QuestionsShikha GuptaNo ratings yet

- Internet Banking in Us 12Document8 pagesInternet Banking in Us 12Flaviub23No ratings yet

- AmeriBank Case Study Analysis of Web Banking Survey RequirementsDocument15 pagesAmeriBank Case Study Analysis of Web Banking Survey RequirementsMaria MercadoNo ratings yet

- Accenture The Everyday Bank A New Vision For The Digital AgeDocument16 pagesAccenture The Everyday Bank A New Vision For The Digital AgeГлеб КоэнNo ratings yet

- 11 Chapter-05Document9 pages11 Chapter-05Manoj ValaNo ratings yet

- Dissertation Online BankingDocument4 pagesDissertation Online BankingWhereToBuyResumePaperNorman100% (1)

- E Banking ProjectDocument123 pagesE Banking ProjectRezwan Bobby100% (1)

- The Financial Performance of Pure Play Internet Banks: Robert DeyoungDocument16 pagesThe Financial Performance of Pure Play Internet Banks: Robert DeyoungFlaviub23No ratings yet

- The Current State and Future of Mobile Banking in EuropeDocument16 pagesThe Current State and Future of Mobile Banking in EuropepaulojooliveiraNo ratings yet

- Lists of FiguresDocument2 pagesLists of FiguresNefin Faisol HadiNo ratings yet

- Internet Banking: Developments and Prospects: Karen Furst, William W. Lang, and Daniel E. NolleDocument60 pagesInternet Banking: Developments and Prospects: Karen Furst, William W. Lang, and Daniel E. NolleSauarbh MalaviyaNo ratings yet

- Retail BankingDocument6 pagesRetail Bankingtejasvgahlot05No ratings yet

- Americas Alternative Finance ReportDocument80 pagesAmericas Alternative Finance ReportCrowdfundInsider100% (1)

- Electronic Banking - The Next Revolution in Financial AccessDocument7 pagesElectronic Banking - The Next Revolution in Financial Accesspiyush_iascaNo ratings yet

- Knowledge and Awareness Level of Online Sellers On Electronic Banking ServicesDocument31 pagesKnowledge and Awareness Level of Online Sellers On Electronic Banking Servicesagosto.demate.claro.cuizon100% (1)

- The Impact of Online On The Financial Performance of Private BanksDocument16 pagesThe Impact of Online On The Financial Performance of Private BanksRaj RomeroNo ratings yet

- Banking SectorDocument7 pagesBanking SectoradilkidwaiNo ratings yet

- Term Paper On Mobile BankingDocument4 pagesTerm Paper On Mobile Bankingc5qdk8jn100% (1)

- Next Wave of Online Banking Requires Secure, Robust PlatformsDocument4 pagesNext Wave of Online Banking Requires Secure, Robust PlatformskarthikeyanabiramiNo ratings yet

- Self Check Exercises: Exercise 6.2Document11 pagesSelf Check Exercises: Exercise 6.2Bhargav D.S.No ratings yet

- MEANING AND EVOLUTION OF RETAIL BANKINGDocument70 pagesMEANING AND EVOLUTION OF RETAIL BANKINGReshma Radhakrishnan0% (1)

- Meaning of Retail: Banking Regulation Act 1949Document22 pagesMeaning of Retail: Banking Regulation Act 1949chinu1303No ratings yet

- Journal of Internet Banking and CommerceDocument8 pagesJournal of Internet Banking and CommerceSyalom DatzmeNo ratings yet

- Getting Ready To Create A Marketing Plan?: Situation AnalysisDocument15 pagesGetting Ready To Create A Marketing Plan?: Situation Analysisjoefrey BalumaNo ratings yet

- SWOT AnalysisDocument5 pagesSWOT AnalysisMir S. SauhridNo ratings yet

- Project 2Document137 pagesProject 2Ankit SrivastavaNo ratings yet

- The Place of Internet BankingDocument4 pagesThe Place of Internet BankingFlaviub23No ratings yet

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- ProjectDocument136 pagesProjectRam NandgaonkarNo ratings yet

- ProjectDocument136 pagesProjectNeha GuptaNo ratings yet

- Final Project On E BankingDocument71 pagesFinal Project On E BankingTarun Dhiman0% (2)

- Innovations in Small Dollar Payments: Peter Burns Anne Stanley October 2001Document9 pagesInnovations in Small Dollar Payments: Peter Burns Anne Stanley October 2001Flaviub23No ratings yet

- Insights e Commerce in Asia Bracing For Digital DisruptionDocument28 pagesInsights e Commerce in Asia Bracing For Digital DisruptionJasjivan AhluwaliaNo ratings yet

- MajorDocument20 pagesMajorfarhat khanNo ratings yet

- RETAIL BANKING MEANING AND IMPACT OF WEBDocument17 pagesRETAIL BANKING MEANING AND IMPACT OF WEBVivek YesodharanNo ratings yet

- Random Variables, Sampling, Hypothesis TestingDocument6 pagesRandom Variables, Sampling, Hypothesis Testingvarunsmith0% (11)

- Embracing the E-commerce Revolution in Asia and the PacificFrom EverandEmbracing the E-commerce Revolution in Asia and the PacificNo ratings yet

- Behind the Startup: How Venture Capital Shapes Work, Innovation, and InequalityFrom EverandBehind the Startup: How Venture Capital Shapes Work, Innovation, and InequalityNo ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- Road Map for Developing an Online Platform to Trade Nonperforming Loans in Asia and the PacificFrom EverandRoad Map for Developing an Online Platform to Trade Nonperforming Loans in Asia and the PacificNo ratings yet

- 12 Sources of Project FundsDocument15 pages12 Sources of Project FundsNaresh HariyaniNo ratings yet

- MMII IntrosessionDocument30 pagesMMII IntrosessionNaresh HariyaniNo ratings yet

- 3 - Project Risk AnalysisDocument23 pages3 - Project Risk AnalysisNaresh HariyaniNo ratings yet

- Designing and Managing Integrated Marketing CommunicationsDocument35 pagesDesigning and Managing Integrated Marketing CommunicationsNaresh HariyaniNo ratings yet

- Service RecoveryDocument30 pagesService RecoveryNaresh HariyaniNo ratings yet

- CB A&bDocument8 pagesCB A&bNaresh HariyaniNo ratings yet

- ConsiderationDocument1 pageConsiderationNaresh HariyaniNo ratings yet

- Name/roll No:: Case StudyDocument1 pageName/roll No:: Case StudyNaresh HariyaniNo ratings yet

- Tax Calculation With Three Tax BracketsDocument5 pagesTax Calculation With Three Tax BracketsNaresh HariyaniNo ratings yet

- 2 - Teaching NotesDocument6 pages2 - Teaching NotesNaresh HariyaniNo ratings yet

- Nature of Information Search & Customer ChoiceDocument9 pagesNature of Information Search & Customer ChoiceNaresh HariyaniNo ratings yet

- FM I Course Outline PGDM 2014-16Document7 pagesFM I Course Outline PGDM 2014-16Naresh HariyaniNo ratings yet

- Ambulance Deployment and Shift Scheduling: An Integrated ApproachDocument13 pagesAmbulance Deployment and Shift Scheduling: An Integrated ApproachNaresh HariyaniNo ratings yet

- CH 11Document51 pagesCH 11Naresh HariyaniNo ratings yet

- MidtermDocument1 pageMidtermNaresh HariyaniNo ratings yet

- CH 12 FinDocument49 pagesCH 12 FinNaresh HariyaniNo ratings yet

- CH 2 PPTDocument31 pagesCH 2 PPTNaresh HariyaniNo ratings yet

- MMII IntrosessionDocument30 pagesMMII IntrosessionNaresh HariyaniNo ratings yet

- CH 7 PPTDocument53 pagesCH 7 PPTNaresh HariyaniNo ratings yet

- CH 10Document72 pagesCH 10Naresh HariyaniNo ratings yet

- CH 10Document72 pagesCH 10Naresh HariyaniNo ratings yet

- CH 3 PPTDocument43 pagesCH 3 PPTNaresh HariyaniNo ratings yet

- CH 1 PPTDocument39 pagesCH 1 PPTNaresh HariyaniNo ratings yet

- CH 08Document65 pagesCH 08Naresh HariyaniNo ratings yet

- CH 6 PPTDocument39 pagesCH 6 PPTNaresh HariyaniNo ratings yet

- CH 4 PPTDocument59 pagesCH 4 PPTUtsav DubeyNo ratings yet

- CH 5 PPTDocument32 pagesCH 5 PPTUtsav DubeyNo ratings yet

- CH 6 PPTDocument39 pagesCH 6 PPTNaresh HariyaniNo ratings yet

- QuestionnaireDocument2 pagesQuestionnaireNaresh HariyaniNo ratings yet

- Case - Academic PerformanceDocument1 pageCase - Academic PerformanceAbhay SrivastavaNo ratings yet

- Finance Manager Reporting Planning in Los Angeles, CA ResumeDocument2 pagesFinance Manager Reporting Planning in Los Angeles, CA ResumeRCTBLPONo ratings yet

- Role of Agriculture in Economic DevelopmentDocument9 pagesRole of Agriculture in Economic DevelopmentFrank Macharia100% (1)

- Example Accounting Ledgers ACC406Document5 pagesExample Accounting Ledgers ACC406AinaAteerahNo ratings yet

- Method Statement-Site CleaningDocument6 pagesMethod Statement-Site Cleaningprisma integrated100% (1)

- Vietnam Trade MissionDocument2 pagesVietnam Trade MissionXuân NguyễnNo ratings yet

- Dana Molded Products Webcast/Onsite Auction BrochureDocument5 pagesDana Molded Products Webcast/Onsite Auction BrochureHilco IndustrialNo ratings yet

- PPDA User Guide for Procurement and Disposal PlanningDocument21 pagesPPDA User Guide for Procurement and Disposal PlanningThoboloMaunNo ratings yet

- Conforming Vs Nonconforming Material Control SystemDocument5 pagesConforming Vs Nonconforming Material Control SystemManu ElaNo ratings yet

- López Quispe Alejandro MagnoDocument91 pagesLópez Quispe Alejandro MagnoAssasin WildNo ratings yet

- CCS NewsletterDocument2 pagesCCS NewsletterCindy Mitchell KirbyNo ratings yet

- Project Report SSIDocument140 pagesProject Report SSIharsh358No ratings yet

- Fair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDDocument3 pagesFair & Lovely Born: 1978 History: The Fairness Cream Brand Was Developed by Hindustan Lever LTDNarendra KumarNo ratings yet

- MTNL Mumbai PlansDocument3 pagesMTNL Mumbai PlansTravel HelpdeskNo ratings yet

- Ali BabaDocument1 pageAli BabaRahhal AjbilouNo ratings yet

- Dgcis Report Kolkata PDFDocument12 pagesDgcis Report Kolkata PDFABCDNo ratings yet

- 8 Top Questions You Should Prepare For Bank InterviewsDocument10 pages8 Top Questions You Should Prepare For Bank InterviewsAbdulgafoor NellogiNo ratings yet

- Microeconomia: Preferenze Lessicografiche (Dimostrazioni Delle Proprietà)Document3 pagesMicroeconomia: Preferenze Lessicografiche (Dimostrazioni Delle Proprietà)maslsl daimondNo ratings yet

- Budget Review of NepalDocument10 pagesBudget Review of NepalBasanta BhetwalNo ratings yet

- HANDLING | BE DESCHI PROFILEDocument37 pagesHANDLING | BE DESCHI PROFILECarlos ContrerasNo ratings yet

- OCI DiscussionDocument6 pagesOCI DiscussionMichelle VinoyaNo ratings yet

- Commercial Transactions ProjectDocument25 pagesCommercial Transactions ProjectNishtha ojhaNo ratings yet

- Liberal: 3.0 ObjectivesDocument11 pagesLiberal: 3.0 ObjectivesShivam SinghNo ratings yet

- RubricsDocument2 pagesRubricsScarlette Beauty EnriquezNo ratings yet

- Cleared OTC Interest Rate Swaps: Security. Neutrality. TransparencyDocument22 pagesCleared OTC Interest Rate Swaps: Security. Neutrality. TransparencyAbhijit SenapatiNo ratings yet

- International Market SegmentationDocument9 pagesInternational Market SegmentationYashodara Ranawaka ArachchigeNo ratings yet

- Careem Analytics Test - Data Set #1Document648 pagesCareem Analytics Test - Data Set #1Amrata MenonNo ratings yet

- 2.kristian Agung PrasetyoDocument32 pages2.kristian Agung PrasetyoIin Mochamad SolihinNo ratings yet

- 17FG0045 BoqDocument2 pages17FG0045 BoqrrpenolioNo ratings yet